Module 10: Merchandizing in Retailing

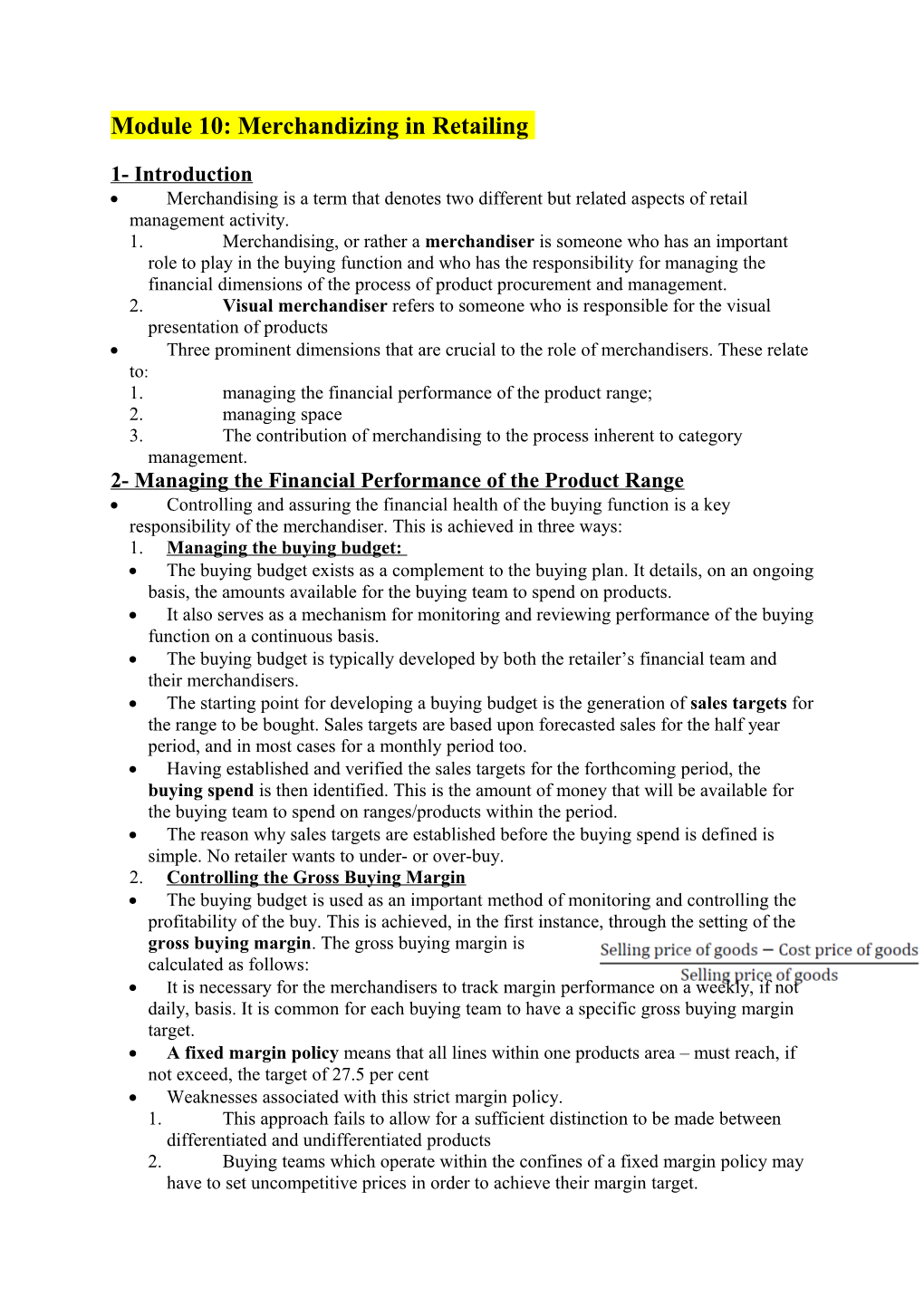

1- Introduction Merchandising is a term that denotes two different but related aspects of retail management activity. 1. Merchandising, or rather a merchandiser is someone who has an important role to play in the buying function and who has the responsibility for managing the financial dimensions of the process of product procurement and management. 2. Visual merchandiser refers to someone who is responsible for the visual presentation of products Three prominent dimensions that are crucial to the role of merchandisers. These relate to: 1. managing the financial performance of the product range; 2. managing space 3. The contribution of merchandising to the process inherent to category management. 2- Managing the Financial Performance of the Product Range Controlling and assuring the financial health of the buying function is a key responsibility of the merchandiser. This is achieved in three ways: 1. Managing the buying budget: The buying budget exists as a complement to the buying plan. It details, on an ongoing basis, the amounts available for the buying team to spend on products. It also serves as a mechanism for monitoring and reviewing performance of the buying function on a continuous basis. The buying budget is typically developed by both the retailer’s financial team and their merchandisers. The starting point for developing a buying budget is the generation of sales targets for the range to be bought. Sales targets are based upon forecasted sales for the half year period, and in most cases for a monthly period too. Having established and verified the sales targets for the forthcoming period, the buying spend is then identified. This is the amount of money that will be available for the buying team to spend on ranges/products within the period. The reason why sales targets are established before the buying spend is defined is simple. No retailer wants to under- or over-buy. 2. Controlling the Gross Buying Margin The buying budget is used as an important method of monitoring and controlling the profitability of the buy. This is achieved, in the first instance, through the setting of the gross buying margin. The gross buying margin is calculated as follows: It is necessary for the merchandisers to track margin performance on a weekly, if not daily, basis. It is common for each buying team to have a specific gross buying margin target. A fixed margin policy means that all lines within one products area – must reach, if not exceed, the target of 27.5 per cent Weaknesses associated with this strict margin policy. 1. This approach fails to allow for a sufficient distinction to be made between differentiated and undifferentiated products 2. Buying teams which operate within the confines of a fixed margin policy may have to set uncompetitive prices in order to achieve their margin target. Flexible margin policy: means that merchandisers and buyers have the discretion to set variable margins at product level provided that the overall buying margins are achieved. This flexibility allows the merchandiser to distinguish between differentiated and undifferentiated products

The achievement of a gross margin is no guarantee of profitability, nor does it promise an acceptable return on equity The fixation with gross margins fails to take full account of the impact of market- based pricing upon retail performance, assumes that all items have a similar cost structure Direct product profitability therefore seeks to provide a specific indication of a particular product’s contribution to the retailer’s profitability It is the balance between the gross margin of a product and its direct product costs. These direct product costs arise as part of the process of managing the movement of the product from the supplier to the final customer. As such, these costs are typically derived from four key areas – warehousing, transportation, in-store stocking and merchandising – as well as from the head office Difficulties associated with applying direct product profitability principles is complex and expensive Criticized: encouraging more of a product rather than a customer need orientation among buying teams The net buying margin is the difference between the gross margin and the costs associated with the buying process. Again, it is common for the merchandiser to= establish a net buying margin in order to monitor and control the costs associated with the buying process and to assure an acceptable net buying margin level. The net buying margin does not take into account the costs associated with retail operations Acting on Performance Target Information Measurement should serve to provide a direction for taking action if the target performance, and particularly under-performance, requires it. If the range is under- performing, the merchandiser may advise the following: 1. Reconfiguration of the product mix: identifying the reasons for the poor performance of certain products As a result, they may choose to alter the balance of the buy. 2. Reviewing the product pricing and margin mix: In certain circumstances it may be necessary to reduce the retail price of under- performing lines. For those retailers that enjoy a powerful position within the supply chain, it may be that this is not at the expense of margin, since any price reduction will be absorbed by the suppliers. Where this is not possible, it is vital that the merchandiser accurately calculates the volume of sales that would be required at the new, lower selling price in order to maintain margin performance 3. Redefining the sales and profit forecast. This may be the only course of action available to buyers in situations where there is no obvious action that can be undertaken 4. Gross margin under-performance: Under-performance with respect to gross margin does not necessarily require remedial action. 3. Managing the Open to Buy The proportion of spend and the timing of the buying commitment will depend upon the sector within which the retailer operates, as well as the type of product being bought and the amount of money that is available for the buy. Open to buy is the process which allows for the ongoing process of buying Open to buy as the difference between the planned purchases for a season or period and the values of goods that had already been committed by the retailer. 1. Merchandiser accurately monitors the level of stock committed and received by the business and the levels which are committed but have not as yet been received. 2. keep an eye upon consumer demand on stock throughput so that they can reorder best- selling lines 3. It allows for the replenishment of high-demand lines as these emerge, as well as the purchase of newly launched products which may very quickly generate high demands

The open to buy budget = the required stock holding (which is the sum of all products that are required in order to cover size/colour options in order to meet customer demand and assure a strong merchandise presentation) + the estimated sales for the period + mark-down allowances - current stock holdings and stock currently on order. Open to buy assists the buying team in two important ways. 1. It serves as an important planning and control device. Balances stock levels with sales demand. As such, it helps prevent an over- or an under-bought situation. This minimizes the volume of lost sales as a result of an out-of-stock situation, controls the amount spent on goods within the financial limitations of the periodic merchandise budget. Reduce the number of mark-downs, increase sales and therefore protect, if not enhance, the gross margin targets that have been set. Allows the retailer to retain funds in order to reorder fast-selling lines, 2. It acts as an important diagnostic tool in the valuation of merchandising activities. Allows the retailer to identify planning errors, such as in relation to inaccurate sales forecasts. It helps identify buying errors with respect to a failure in recognizing emerging fashion trends, and allows the retailer to take prompt corrective action 4- Management of Space Stock Allocation: Retailer must develop a set of stock allocation principles that will ensure that the correct type and amount of stock is allocated to the various and varying stores at a rate that matches local demand. The most common stock allocation methodology that is used by retailers is that of store grading. Store grading requires that the store network is divided into subsets or clusters. The number of clusters is dependent upon the number of stores in the network and the differences that exist between and among these stores. The grading that a store receives directly determines the breadth and the depth of products that are subsequently allocated to them Successful retailers, while broadly adopting the rigidity implied by the grading system identified above, will also allow merchandisers the freedom to allocate, albeit on a restricted basis, product lines to outlets regardless of their classification status Store gradings may change in response to changes in consumer buying patterns and changes in the competitive environment. The Drivers of Space Management Merchandising team should ensure that the stock is presented in a manner that is attractive to the consumer, is cost efficient and maximizes the profit potential of the space available Management of space is influenced by a variety of key drivers. Firstly, the nature of the sector within which the retailer operates There has been a general shift in the retail sector towards the minimization of stock holding, especially at store level, in order to reduce financing, administration, handling and storage costs. As a result of this policy, retailers are now seeking to convert stockroom space into selling space and hold stock higher up in the supply chain Key principles of space management: 1. Sufficient space is allocated across the product assortment in order to meet 2. Forecasts with respect to sales, volume and profit targets; 3. The best-selling and the most profitable lines are allocated space which maximizes their contribution potential; 4. Customer service levels are met through maximum product availability; 5. Displays are not undermined between replenishment cycles. Space management decisions are taken at three levels: strategic, tactical and operational. Strategic level: concerned with the number, location and design of locations require significant capital investment, long-term commitment. the merchandising team will have little involvement in space management decisions at this stage Tactical space management decisions are store based, and relate to issues of store design, layout, and allocation of space and location to key product categories, identifies how the retailer’s market positioning, sales and profitability targets, the expectations of customers, and format conventions should impact upon the space allocation decisions. A merchandising team is likely to be closely involved in tactical space management decisions. The operational level of space management: the influence of a merchandising team higher. Decisions are micro-level in nature and are concerned with the amount of space that is given over to specific products and brands, Approches: 1. Productivity ratios Allocate space and a particular location to a product based upon the sales or profit that it is expected to generate “the ‘share-of-shelf = share-of-market rule” This approach fails to recognize the relationship between the velocity of sales and their visual appeal. Furthermore, the fastest-selling lines may not in fact be the most profitable. The market possibilities of newly launched products may be undermined by virtue of their lack of sales history, 2. The balanced stock model approach seeks to balance issues of sales participation and profitability contribution with considerations relevant to the demand for the product, its characteristics and the associated display requirements. A planogram: is a pictorial representation of a stock display that brings together the numerical and visual dimensions of developing a stock layout plan in a way that ought to maximize sales and profitability, while still maintaining the visual integrity of the offer. A number of factors impact upon space allocation: External factors: the nature of the relationship with a supplier: if the product category is dominated, in market share terms, by a small number of powerful manufacturer brands, any decision on the allocation and location of space to these products will be determined by the demands of the supplier. Internal factors: product attributes and their visual appeal. (fragile product or of a non-standard shape, these features alone may determine the space allocation decisions) The composition of the product range may also determine the allocation. Merchandise Allocation and the Product Life Cycle Introducing a product, or a range of products, the amount of space that is allocated will be dependent upon the importance of the product to the retailer in terms of the product’s exclusivity, its relevance to the retailer’s market positioning, the likely customer demand, If the launch of the product or product range has been successful, and demand enables it to enter into the growth stage, then it is expected that the product will enjoy a greater space allocation, At the maturity stage, it is common for retailers to aim to maximize cash flow and to maintain market penetration. At this stage, it may be possible to move these products to secondary locations without undermining sales levels, the overall space allocation will be reduced When the decline stage: the amount of stock ought to have reduced and therefore the space that is allocated will also decline markedly 4- The Contribution of Merchandising to Category Management Process of adopting category management is the establishment of a group of products as a category, which have similar demand patterns, are reasonable substitutes for one another and can be viewed from a marketing viewpoint as a sensible strategic business unit on which to base a marketing plan Category management team: led by a category manager, comprises 1- buyers, 2- merchandisers, 3- marketing promotions specialists, 4- product designers, 5- technologists, 6- logistics specialists 7- those responsible for the presentation of the category in the stores. 8- Specialist employed by their most important suppliers Note: Small number of supplier should be involved, for two reasons: 1. The rivalry between and among suppliers would be detrimental to the collaborative principles of category management. 2. Large number of participants would be difficult to coordinate and manage and, as a result, would undermine the category management approach. Main reasons for the development of an inclusive category team structure 1. It helps to create a clear focus upon the needs of the customer 2. It encourages retailers and suppliers to consider themselves as partners that collaborate in order to profitably satisfy the needs of consumers 3. Improvements which can improve the overall profitability of the procurement process. Adopting a Category Management Approach (three stage process) 1. Category definition stage: involves defining, from the prospective of the consumer, which products will constitute and contribute to the category. 2. Category planning stage, which involves determining the performance measures for the category, identifying the category’s product mix, and formulating a marketing strategy to support the category. 3. Category implementation stage: involves the assignment of responsibilities to supply chain partners in terms of managing, controlling and monitoring category performance. Stage 1: Analysis of Consumer Demand Trends within the Category To define the broad parameters of the category in terms of its scope and coverage This is achieved by considering the range of products that customers may need in order to solve a particular problem or satisfy a particular need. A review of internal sales data is crucial The merchandiser is then able to establish patterns of demand and identify product sales trends External factors: the form of competitor reports The inclusion of primary consumer research is also vital (to outline customers’ attitudes and behaviors) Competent understanding of customers’ need requirements and what motivates their decision to purchase one product Stage 2: Reviewing the Category Mix Options The merchandiser will seek to identify all of the products that the customer may expect to be included within a particular category. For each product type, brands that complement the retailer’s market positioning will be considered Next step is the evaluation of each product depending on a number of factors: 1- the sector within which the retailer operates, 2- their market positioning, 3- the product expectations of their customers, 4- the nature of the particular category. Then, it is necessary for the merchandiser to collaborate with the relevant manufacturers and suppliers. It is at this stage that the importance of excellent retailer–supplier relations becomes apparent. Stage 3: Assembling the Category Merchandiser should recommend to the category management team the make-up of the category in terms of its overall coverage and structure The category management teams can then begin to identify the specific products to be included in the category. This process usually commences with the identification of all possible product options within a subcategory. The products that are finally selected for inclusion are chosen on the basis that these: 1. collectively satisfy the product requirements of the majority of customers 2. present the customer with an impression of sufficient and reasonable choice; 3. share similar characteristics to be reasonable substitutes for each other; 4. are likely to have patterns; 5. Satisfy the business’s requirements in terms of profitability and sales levels. 5- The Dimensions of Visual Merchandise Management Visual merchandising is concerned with the creation of a store environment which 1- consistently represents the values of the retailer and their brand to consumers 2- Satisfies the needs and expectations that the consumer has of the retailer. Visual Merchandising and Consumer Behavior The assumptions are: 1- The environmental context within which customers shop can have a significant impact upon their purchasing behavior. 2- Significant and worthwhile proportions of customers’ decisions are unplanned and are made at the point of purchase within the store. Two-thirds of purchase decisions are actually made within the store. A study classified purchasing decisions into four categories, as follows: 1- Specifically planned – the customer knows which product and brand they want before entering the store and does not deviate from this position when buying. 2- Generally planned – the customer knows which product they want, but has no specific brand in mind when they shop. 3- Substitute purchase – the customer purchases a different product from their declared intention. 4- Unplanned purchase – the customer buys a purchase without prior intention. The Key Business Objectives of Visual Merchandising 1.1- attract customers’ attention; 1.2- encourage customers to increase the time and money they spend in store; 1.3- differentiate the retailer from the competition; 1.4- reinforce the messages integral to the company’s marketing communications strategy Schimp (1990) maintained that the role of visual merchandising is to: 1.4.1. create awareness among consumers about a product, and provide relevant information about it; 1.4.2. remind customers about the benefits of a product and of its availability; 1.4.3. encourage a customer to buy a particular product or brand; 1.4.4. maximize the utilization of space, while making the buying experience easy for consumers; 1.4.5. reinforce the retailer’s communications campaign; 1.4.6. assist the customer in locating, evaluating and selecting a product Within this context, Harris and Walters (1992) identified that visual merchandising should serve to: 1. reinforce the marketing positioning of the company within the competitive environment; 2. encourage interest and comparison among customers, and prompt the customer to make a purchase; 3. coordinate the merchandise into a coherent proposition, which provides an integrated communications message Factors Affecting Layout and Display Cost factors include the cost of layout and display and the cost of fixtures and fittings used in layout and display. The gondolas in the superstore are ‘permanent’ fixtures Stock security: valuable merchandise can be displayed in secure display boxes or, in the case of high-priced grocery items, under electronic surveillance, visual surveillance and/or the control of staff One of the main purposes of layout and display is to facilitate sales, so pay points have to be visible and sufficient for the number of customers anticipated at peak times

Layout and Display Starts at the Entrance The visual impact of the store begins before customers enter it. is important to intercept customers as they walk along a street, The fascia of the store presents a ‘summarized image’ of the store brand using a recognizable logo, font, signage and colors. Lighting is a further element of store-front design The store entrance is designed both to communicate the image of the store and to facilitate the start of the shopping experience The Principles of Store Layout The layout that the retailer adopts is dependent upon a number of factors, and these include: 1. the sector in which the retailer operates 2. the architecture of the store itself; 3. the market positioning of the retailer There are four principle store layout formats 1. The grid layout: used primarily by food retailers, Involves the organization of gondola fixtures on a row-after-row basis Merchandise rows are separated by aisles which allow for customer movement The selling areas are usually classified as ‘hot spots’, where promotional lines are displayed Advantages: 1- Maximize the use of space. 2- Expose customers to as much merchandise as possible. Disadvantages: 1- some customers can feel frustrated by the manipulation that the grid layout provides. 2- Inflexible and a monotonous experience for shoppers. 2. The free-flow layout. This layout is used within fashion stores and involves the presentation of merchandise fixtures on a more random basis This approach enables the customers to move easily between fixtures and allows them to browse as they select free-flow layout allows for a less intensive use of space, is cost intensive, and, if the merchandise is not presented in a coordinated manner, then the overall effect may be of confusion 3. Boutique layouts are similar to the free-flow layout, but departments or sections are laid out to produce the feeling of a ‘shop in a shop’. This approach is often adopted by brands within department stores That it does not provide for an economical use of selling space.

4. The controlled flow layout: IKEA: This involves the creation of a layout which tightly controls the movement of customers through the store by creating a one-way racetrack system from which the customer cannot deviate. Customers can feel frustrated by the lack of freedom of movement that this approach involves. The design and layout of e-tail stores: Navigability is the most important component. e-tail free-flow layouts were more useful for finding products, were more entertaining and engaged people for a longer time. Two other essential components of e-tail design are interactivity (between retailer and customer, and customer and customer) and web atmospherics (visuals, audio, offers, reviews and so on). Methods of In-Store Display Window displays have been found to be a crucially important marketing communications device The display of merchandise takes two forms.1- Standard merchandise displays are used for the presentation of products en masse. 2- Special merchandise displays are used to showcase specific products Standard Merchandise Displays Use shelving, or it may be in the form of a hanging fixture. The organization of display would have internal logic, such as in terms of price, size, color or use. The organizational logic that retailers use is usually based upon an understanding of how the customer actually selects the product Special Merchandise Displays For merchandise that a retailer wants to highlight or promote in particular, there are a number of display options available: 1. Event displays: Merchandise that has some connection to an event, holiday or festival is displayed together 2. Table-top displays. These involve the presentation of merchandise on table tops with the aim of encouraging customers to interact with the product range 3. Hot spots. These are displays of promotional merchandise presented in areas of high customer density. Often, 4. Lifestyle displays. These sorts of displays utilize props that are associated with a particular lifestyle in order to create an association between the product range and a lifestyle image. 5. Brand displays. These present the goods that are included in a brand range collectively in order to showcase to customers the breadth of the range.