CHAPTER 3 SOLUTIONS

CHAPTER 3

Cost-Volume-Profit Analysis and Pricing Decisions

Learning Objectives

1. Calculate the breakeven point in units and sales dollars. (Unit 3.1)

2. Calculate the level of activity required to meet a target income. (Unit 3.2)

3. Determine the effects of changes in sales price, cost, and volume on operating income. (Unit 3.2)

4. Define operating leverage and explain the risks associated with the tradeoff between variable and fixed costs. (Unit 3.2)

5. Calculate the multi-product breakeven point and level of activity required to meet a target income. (Unit 3.3)

6. Define markup and explain cost-plus pricing. (Unit 3.4)

7. Explain target costing and calculate a target cost. (Unit 3.4)

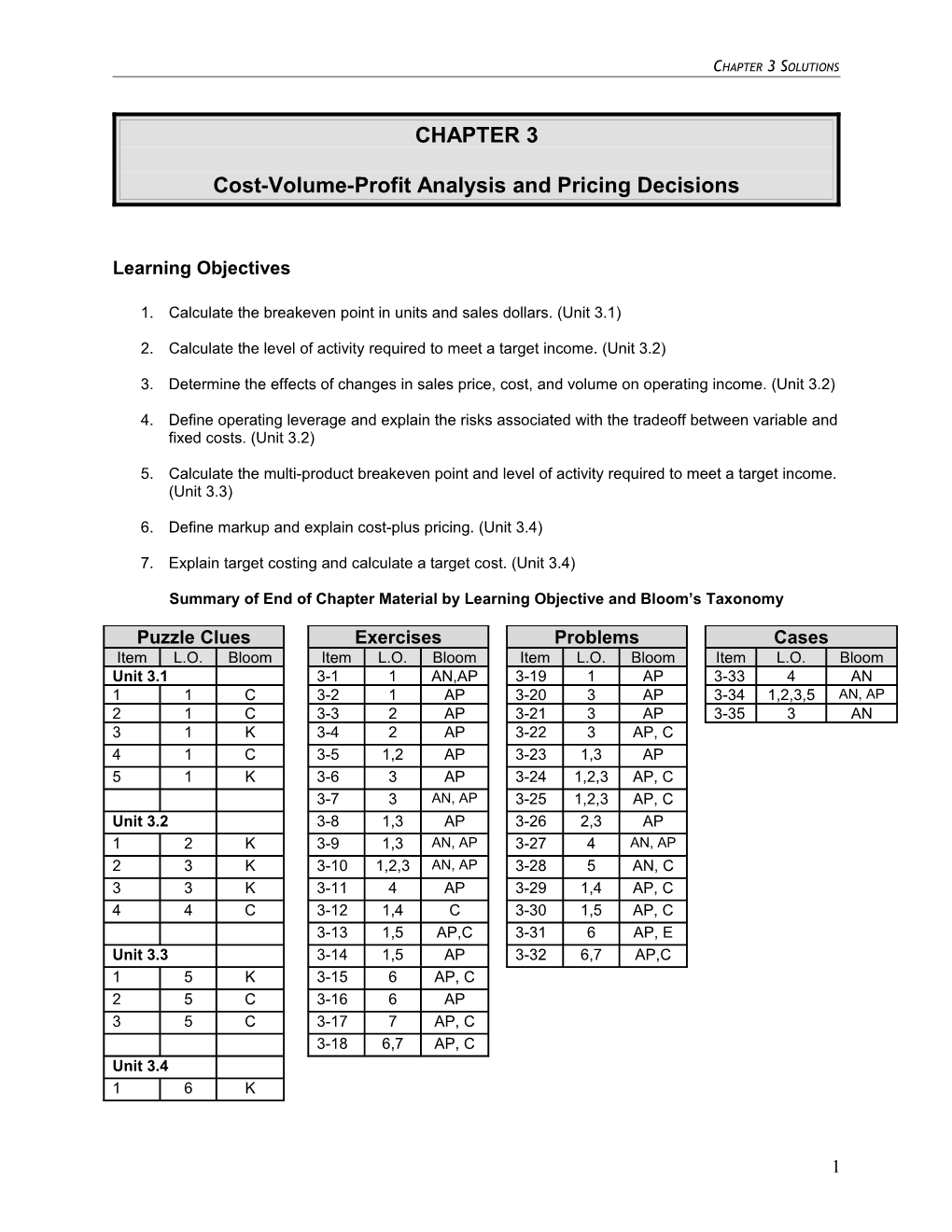

Summary of End of Chapter Material by Learning Objective and Bloom’s Taxonomy

Puzzle Clues Exercises Problems Cases Item L.O. Bloom Item L.O. Bloom Item L.O. Bloom Item L.O. Bloom Unit 3.1 3-1 1 AN,AP 3-19 1 AP 3-33 4 AN 1 1 C 3-2 1 AP 3-20 3 AP 3-34 1,2,3,5 AN, AP 2 1 C 3-3 2 AP 3-21 3 AP 3-35 3 AN 3 1 K 3-4 2 AP 3-22 3 AP, C 4 1 C 3-5 1,2 AP 3-23 1,3 AP 5 1 K 3-6 3 AP 3-24 1,2,3 AP, C 3-7 3 AN, AP 3-25 1,2,3 AP, C Unit 3.2 3-8 1,3 AP 3-26 2,3 AP 1 2 K 3-9 1,3 AN, AP 3-27 4 AN, AP 2 3 K 3-10 1,2,3 AN, AP 3-28 5 AN, C 3 3 K 3-11 4 AP 3-29 1,4 AP, C 4 4 C 3-12 1,4 C 3-30 1,5 AP, C 3-13 1,5 AP,C 3-31 6 AP, E Unit 3.3 3-14 1,5 AP 3-32 6,7 AP,C 1 5 K 3-15 6 AP, C 2 5 C 3-16 6 AP 3 5 C 3-17 7 AP, C 3-18 6,7 AP, C Unit 3.4 1 6 K

1 CHAPTER 3 SOLUTIONS

2 6 K 3 6 C 4 7 K

2 CHAPTER 3 SOLUTIONS

SOLUTIONS TO PUZZLE CLUES

Unit 3.1

1. A company breaks even when total revenues equal total costs. No income or loss is generated. LO: 1, Bloom: C, Unit: 3-1, Difficulty: Easy, Min: 2, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

2. If variable costs per unit increase, all other things equal, then the breakeven point will increase. More products/services must be sold to cover the increase in costs. LO: 1, Bloom: C, Unit: 3-1, Difficulty: Difficult, Min: 2, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

3. Let x equal the number of units needed to break even. Solve for x in the following equation: SPx – VCx – FC = $0. Breakeven in dollars can be calculated as the sales price per unit times the number of units required to breakeven. LO: 1, Bloom: K, Unit: 3-1, Difficulty: Moderate, Min: 2, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

4. In order to reduce the breakeven point, a company must reduce variable costs per unit, reduce fixed expenses in total or increase the selling price per unit. LO: 1, Bloom: C, Unit: 3-1, Difficulty: Moderate, Min: 2, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

5. Margin of safety is the difference between a company’s current level of sales and breakeven sales. It can be calculated in units or in sales dollars. LO: 1, Bloom: K, Unit: 3-1, Difficulty: Easy, Min: 2, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Unit 3.2

1. Let x equal the number of units needed to achieve the target income. Solve for x in the following equation: SPx – VCx – FC = target income. Total sales to achieve this level of target income can be calculated as the sales price per unit times the number of units required to achieve the target income. LO: 2, Bloom: K, Unit: 3-2, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

3 CHAPTER 3 SOLUTIONS

2. CVP analysis allows managers to predict the financial implications of their decisions. While the expected financial outcome is not the only piece of information managers should use, it is a very important piece of information that can prevent managers from making very costly decisions that might put the company in a financial bind. LO: 3, Bloom: K, Unit: 3-2, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

3. The assumptions are: All costs can be easily and accurately separated into fixed and variable categories. A linear relationship exists between variable costs and sales activity over the relevant range of interest. Total fixed expenses and variable costs per unit remain constant across all sales volume levels. Inventory is sold during the same period it is purchased or produced. Even with these assumptions, managers find CVP to be a useful tool for decision making. LO: 3, Bloom: K, Unit: 3-2, Difficulty: Easy, Min: 4, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

4. Operating leverage is the change in operating income relative to a change in sales, and is calculated as contribution margin divided by operating income. If a company’s degree of operating leverage is 2, then an increase in sales of 15% would increase operating income by 30%. Operating leverage is directly related to the cost structure of a company. High fixed costs relative to variable costs indicates a relatively high degree of operating leverage and risk for the company. LO: 4, Bloom: C, Unit: 3-2, Difficulty: Moderate, Min: 4, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Unit 3.3

1. The sales mix is the relative sales of all of a company’s products or services. LO: 5, Bloom: K, Unit: 3-3, Difficulty: Easy, Min: 2, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

4 CHAPTER 3 SOLUTIONS

2. Holding the sales mix constant for n products, the breakeven point and target operating income can be calculated using the modified profit formula: CM1 + CM2 + … CMn – fixed expenses = operating income LO: 5, Bloom: C, Unit: 3-3, Difficulty: Moderate, Min: 2, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

3. The sales mix will remain constant. LO: 5, Bloom: C, Unit: 3-3, Difficulty: Moderate, Min: 2, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Unit 3.4

1. The markup of a product is the difference between the selling price and the cost. The markup percentage is markup cost. The gross margin percentage is gross margin sales. As a dollar amount, the markup on cost of goods sold and gross profit are the same. LO: 6, Bloom: K, Unit: 3-4, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

2. Cost-plus pricing is a method of determining price by adding a predetermined markup to the cost of the product. A flaw of cost-plus pricing is that this price doesn’t reflect the value of the product to the customer. It is solely based on the return to the seller. LO: 6, Bloom: K, Unit: 3-4, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

3. Once company managers have calculated a price using cost-plus pricing, that price must be compared to competitors’ prices. Customers will pay the lowest price for similar products, all other things equal. So if the cost-plus price is higher than competitors’ prices, company managers will need to reduce the price or find a way to differentiate the product so customers are willing to pay more. LO: 6, Bloom: C, Unit: 3-4, Difficulty: Moderate, Min: 3, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

4. Target costing is a pricing strategy that computes the desired markup and maximum cost that can be incurred to deliver a product or service at the market price. If the company cannot redesign the product to meet a target cost, then the company must either accept a smaller markup or not sell the product. LO: 7, Bloom: K, Unit: 3-4, Difficulty: Easy, Min: 3, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

5 CHAPTER 3 SOLUTIONS

SOLUTIONS TO EXERCISES

Exercise 3-1

a. $30x – $18x – $150,000 = $0 $12x = $150,000 x = 12,500 hats to breakeven 12,500 hats $30 per hat = $375,000 breakeven sales dollars

$30-18 b. Contribution margin ratio = = 4 $30 Variable cost ratio = $1 - .4 = .60

c. Managers could increase the selling price or purchase the hats from another distributor at a lower cost. LO: 1, Bloom: AN, AP, Unit: 3-1, Difficulty: Easy, Min: 8, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-2

a. $.80 - $.45 = $.35 $.35 b. Contribution margin ratio = .4375 $.80 c. $.80x – $.45x – $175,000 = $0 $.35x = $175,000 x = 500,000 bars to breakeven 500,000 bars $.80 per bar = $400,000 to breakeven

d. The breakeven point will increase to

$175,000 = 700000 bars $.80 = $560,000 $.25 LO: 1, Bloom: AP, Unit: 3-1, Difficulty: Moderate, Min: 10, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-3

6 CHAPTER 3 SOLUTIONS

a. $25x – $15x – $12,000 = $30,000 $10x = $42,000 x = 4,200 baskets b. Marissa can raise the selling price, reduce variable cost per basket, or reduce fixed expenses. Holding two of these inputs constant, we can solve for the third. Remember that sales volume of 4,000 units is known.

Raise the selling price (SP):

(SP 4,000 units) – ($15 4,000 units) - $12,000 = $30,000 (SP 4,000 units) = $102,000 SP = $25.50

7 CHAPTER 3 SOLUTIONS

Reduce variable cost per basket (VC)

($25 4,000 units) – (VC 4,000 units) - $12,000 = $30,000 $58,000 = (VC 4,000 units) $14.50 = VC

Reduce fixed expenses (FC)

($25 4,000 units) – ($15 4,000 units) - FC = $30,000 FC = $10,000

Various combinations of these changes would also work.

Alternate Solution:

CM/unit × 4,000 baskets = $42,000 CM/unit = $10.50

The contribution margin on each basket needs to be $10.50, so Marissa could raise prices to $25.50 ($15.00 + $10.50) or reduce variable costs to $14.50 ($25.00 - $10.50). Alternatively, holding sales price and variable costs constant, fixed expenses could be reduced to $10,000: ($10 × 4,000 baskets) - $10,000 = $30,000.

LO: 2, Bloom: AP, Unit: 3-2, Difficulty: Difficult, Min: 15, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-4

$12,000x – $8,200x – $6,840,000 = $3420000 1-25 $3,800x = $11,400,000 x = 3,000 freezers

8 CHAPTER 3 SOLUTIONS

LO: 2, Bloom: AP, Unit: 3-2, Difficulty: Easy, Min: 5, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-5

a. $12x – $3x – $432,000a = $0 $9x = $432,000 x = 48,000 frisbees to breakeven 48,000 frisbees $12 = $576,000 to breakeven

a$36,000 per month × 12 months per year

b. $9x = $432,000 + $18,000 x = 50,000 frisbees

c. $16,200 1-4 = $27,000

d. $9x = $432,000 + $27,000 x = 51,000 frisbees

LO: 1,2, Bloom: AP, Unit: 3-1,3-2, Difficulty: Moderate, Min: 10, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-6

$390,000 = 65 a. Contribution margin ratio = $600,000

Variable cost ratio = 1 - .65 = .35

b. Margin of safety = Current sales – Breakeven sales

$292,500 Breakeven sales = .65 = $450,000

9 CHAPTER 3 SOLUTIONS

Margin of safety = $600,000 – $450,000 = $150,000

c. Net operating income would increase by the change in contribution margin: $100,000 .65 = $65,000

d. new variable cost = $17.50 1.16 = $20.30

new price = $50 1.1 = $55

$600,000 current unit sales = 50 = 12,000

new unit sales = 12,000 .98 = 11,760

operating income = [($55.00 – $20.30) 11,760] – $292,500 = $115,572

LO: 3, Bloom: AP, Unit: 3-2, Difficulty: Difficult, Min: 15, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

10 CHAPTER 3 SOLUTIONS

Exercise 3-7

a. Operating income would increase by the change in contribution margin:

$30-$12 contribution margin ratio = $30 = .60

change in operating income = $39,000 .60 = $23,400

b. operating income last year = (32,000 $18.00) - $360,000 = $216,000

new price = $30.00 .95 = $28.50

new fixed expenses = $360,000 + $50,000 = $410,000

new unit sales = 32,000 1.3 = 41,600 units

projected income = [($28.50 – $12.00) 41,600] – $410,000 = $276,400

Clarkson should implement the price reduction because the estimated operating income is larger than the current operating income. LO: 3, Bloom: AP, AN, Unit: 3-2, Difficulty: Difficult, Min: 15, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-8

a. B: $25,000 x 60% = $15,000

11 CHAPTER 3 SOLUTIONS

b. C

c. D: TC – VC = FC = $170,000 – ($150,000 × .60) = $80,000

d. A: The additional 1,000 units × the $8 contribution margin per unit ($20 × .4) provide $8,000 in additional contribution margin, while the advertising campaign increases costs by $6,000. The net result is a $2,000 increase in operating income.

[($20 .4) 1,000] - $6,000 = $2,000

e. C: At breakeven, CM = FC. Using the contribution margin ratio to find the contribution margin per unit,

[(.32 $50) x] = $200,000 x = 12,500 units

LO: 1,3, Bloom: AP, Unit: 3-2, Difficulty: Difficult, Min: 20, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-9

a. annual fixed expenses = $120,000 12 months = $1,440,000

contribution margin ratio = 1 – .4 = .60

$1,440,000 breakeven = .60 = $2,400,000

b. Operating income will increase by the increase in contribution margin

Additional units sold = 100,000 .15 = 15,000

12 CHAPTER 3 SOLUTIONS

Additional contribution margin = 15,000 additional units ($40 .60) = $360,000

c. new variable cost: .45 $40 = $18 per unit new fixed expenses: $1,440,000 + ($10,000 12 months) = $1,560,000 new sales price: $40 1.1 = $44 per unit

Sales – VC – FC = 0 $44x - $18x - $1,560,000 = 0 $26x = $1,560,000 x = 60,000 blankets 60,000 blankets $44 = $2,640,000

d. new variable cost: .45 $40 = $18 per unit new fixed expenses: $1,440,000 + ($10,000 12 months) = $1,560,000 new sales price: $40 1.1 = $44 per unit new contribution margin: $44 – $18 = $26 per blanket new sales volume: 100,000 .95 = 95,000 blankets

Sales – VC – FC = Operating Income ($26 95,000) – $1,560,000 = $910,000

e. From part d, operating income = $910,000

With a sales price of $40 per blanket and sales volume of 100,000 blankets, operating income is:

[($40 – $18) 100,000] – $1,560,000 = $640,000

Matoaka is better off to raise the sales price to $44 and sell fewer blankets. LO: 1,3, Bloom: AP, Unit: 3-1, 3-2, Difficulty: Difficult, Min: 20, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-10

13 CHAPTER 3 SOLUTIONS a. ($3.00 – $1.75)x – $25,000 = $0 $1.25x = $25,000 x = 20,000 hamburgers

14 CHAPTER 3 SOLUTIONS

b. ($3.00 – $1.75)x – $25,000 = $6,000 $1.25x = $25,000 + $6,000 x = 24,800 hamburgers

c.

$80,000

$70,000

$60,000

$50,000 Sales $40,000 Costs $30,000

$20,000

$10,000

$0 0 5,000 10,000 15,000 20,000 25,000

d. It is unlikely that Wimpee’s can sell the 24,800 hamburgers required to earn the desired $6,000 in operating income. Instead, Wimpee could try to reduce variable costs per unit and/or fixed expenses. Alternatively, Wimpee could increase the selling price, but that might further reduce the number of hamburgers sold. LO: 1,2,3, Bloom: AP, AN, Unit: 3-1, 3-2, Difficulty: Moderate, Min: 15, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

15 CHAPTER 3 SOLUTIONS

Exercise 3-11

Sales $50,000 Variable expenses COGS $26,00 0 Selling 1,600 Administrative 7,200 Total variable expenses 34,800 Contribution margin 15,200 Fixed expenses Selling 6,400 Administrative 4,800 Total fixed expenses 11,200 Operating income $ 4,000

a. Contribution Margin Operating leverage = Operating Income $15,200 = $4,000 = 3.8

b. Increase in operating income = 3.8 x 10% = 38%, or $1,520

LO: 4, Bloom: AP, Unit: 3-2, Difficulty: Moderate, Min: 15, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-12

a. Warner’s breakeven point would decrease. Reducing fixed expenses lowers the breakeven point.

b. Warner’s margin of safety would increase. The margin of safety is current sales minus breakeven sales. When the breakeven point decreases, all other things equal, the margin of safety increases.

16 CHAPTER 3 SOLUTIONS

c. Warner’s degree of operating leverage would decrease because the level of fixed expenses relative to variable costs decreased. LO: 1,4, Bloom: C, Unit: 3-1, 3-2, Difficulty: Moderate, Min: 10, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

17 CHAPTER 3 SOLUTIONS

Exercise 3-13

a. Abado’s sales mix is 60,000 math tests and 20,000 reading tests, or a sales mix of 3 to 1.

$360,000 Breakeven point = 6(3x) 18x = 10,000

reading tests = x = 10,000; math tests = 3x = 30,000

reading test sales: 10,000 tests × $36 per test = $360,000 math test sales: 30,000 tests × $20 per test = 600,000 breakeven sales = $960,000

b. Math Testing Reading Testing Total Company Total Per Unit Total Per Unit Sales $1,200,000 $20 $1,200,000 $20 $2,400,000 Variable costs 840,000 14 1,080,000 18 1,920,000 Contribution margin $ 360,000 $ 6 $ 120,000 $ 2 480,000 Fixed expenses 360,000 Operating income $ 120,000

18 CHAPTER 3 SOLUTIONS

c. Abado’s sales mix is now 60,000 math tests and 60,000 reading tests, or a sales mix of 1 to 1.

$360,000 Breakeven point = 6x+ 2 x

= 45,000

reading tests = x = 45,000; math tests = x = 45,000

reading test sales: 45,000 tests × $20 per test = $ 900,000 math test sales: 45,000 tests × $20 per test = 900,000 breakeven sales = $1,800,000

Since the breakeven sales revenue has increased and the expected operating income has decreased, Abado should not make the change.

LO: 1,5, Bloom: AP, C, Unit: 3-1,3-3, Difficulty: Difficult, Min: 20, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-14

a. Kitchenware’s sales mix is 14,000 plastic pitchers and 42,000 glass pitchers, or a sales mix of 1 to 3.

($30 – $15)x + ($45 – $24)3x – $982,800 = 0 $15x + $63x = $982,800 x = 12,600

plastic pitchers = x = 12,600; glass pitchers = 3x = 37,800

b. ($30 – $13)x + ($45 – $24)3x – $982,800 = 0 $17x + $63x = $982,800 x = 12,285

plastic pitchers = x = 12,285; glass pitchers = 3x = 36,855

LO: 1,5, Bloom: AP, Unit: 3-1,3-3, Difficulty: Moderate, Min: 10, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

19 CHAPTER 3 SOLUTIONS

20 CHAPTER 3 SOLUTIONS

Exercise 3-15

a. Cost = $249 × .75 = $186.75

b. $249 $166 Markup = 166 = 50%

c. .75(sales price) = $166 sales price = $221.33

LO: 6, Bloom: AP, C, Unit: 3-4, Difficulty: Easy, Min: 8, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-16

$216,000 a. = 67% $324,000

b. Total cost = $324,000 + $126,000 = $450,000

$90,000 markup percentage = = 20% $450,000

$216,000 c. = 40% $540,000

d. Use the gross margin percentage

x $42 = .4 x x -$42 = .4x .6x = $42 x = $70 LO: 6, Bloom: AP, C, Unit: 3-4, Difficulty: Moderate, Min: 15, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

21 CHAPTER 3 SOLUTIONS

22 CHAPTER 3 SOLUTIONS

Exercise 3-17

a. $36 x .6 = x .6x = $36 – x 1.6x = $36 x = $22.50

b. Justin should try to value engineer the product to reduce the unit price by $1.50 to reach the target price of $22.50.

LO: 7, Bloom: AP, C, Unit: 3-4, Difficulty: Easy, Min: 8, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Exercise 3-18

a. cost of original pet bed = $45 – $15 = $30 per bed $15 markup percentage = = 50% markup on cost of goods sold $30 price of high-end bed = $58 × 1.5 = $87 per bed

$15 b. current gross margin = = 1/3; cost of goods sold = 2/3 $45 high-end bed target cost of goods sold = 2/3 × $78 = $52 per bed

c. Pet Designs could redesign the high-end bed to reduce the cost to produce the bed; accept a lower gross margin percentage; or, not make the bed

LO: 6, 7, Bloom: AP, C, Unit: 3-4, Difficulty: Moderate, Min: 8, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

23 CHAPTER 3 SOLUTIONS

SOLUTIONS TO PROBLEMS

Problem 3-19

a. Using the sales revenue of $10,000 and sales price of $5.00 per unit, $10,000 determine that The Robinson Company sold 2,000 units ( ). $5.00

Per Unit Sales $10,000 $5.00 Less variable expenses Cost of goods sold $3,00 1.50 0 Operating costs 1,000 0.50 Total variable expenses 4,000 2.00 Contribution margin 6,000 $3.00 Less fixed operating expenses 1,500 Operating income $ 4,500

$6,000 contribution margin per unit = 2,000 units = $3.00 per unit

$1,500 breakeven point = $3.00 = 500 units

breakeven sales = 500 units × $5.00 = $2,500

b. Margin of safety = 2,000 units – 500 units = 1,500 units

Margin of safety = 1,500 units × $5.00 = $7,500

24 CHAPTER 3 SOLUTIONS

LO: 1, Bloom: AP, Unit: 3-1, Difficulty: Moderate, Min: 15, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

25 CHAPTER 3 SOLUTIONS

Problem 3-20

$600,000 a. current sales volume: = 50,000 units $12 new sales volume: 50,000 × .95 = 47,500 units new sales price: $12.00 × 1.10 = $13.20

Total Per unit Sales $627,000 $13.20 Less variable expenses 332,500 7.00 Contribution margin 294,500 $ 6.20 Less fixed expenses 175,000 Operating income $119,500

b. new sales price: $12.00 × 1.10 = $13.20 per unit new variable cost per unit: $7.00 × 1.05 = $7.35 per unit

Total Per unit Sales $660,000 $13.20 Less variable expenses 367,500 7.35 Contribution margin 292,500 $ 5.85 Less fixed expenses 175,000 Operating income $117,500

c. new sales price: $12.00 × .90 = $10.80 new sales volume: 50,000 × 1.20 = 60,000 units

Total Per unit Sales $648,000 $10.80 Less variable expenses 420,000 7.00 Contribution margin 228,000 $ 3.80 Less fixed expenses 175,000 Operating income $ 53,000

26 CHAPTER 3 SOLUTIONS

d. new fixed expenses: $175,000 + $20,000 = $195,000

Total Per unit Sales $600,000 $12.00 Less variable expenses 350,000 7.00 Contribution margin 250,000 $ 5.00 Less fixed expenses 195,000 Operating income $ 55,000

e. new sales price: $12.00 × 1.10 = $13.20 new variable cost per unit: $7.00 × 1.10 = $7.70 new fixed expenses: $175,000 + $25,000 = $200,000 new sales volume: 50,000 × .90 = 45,000 units

Total Per unit Sales $594,000 $13.20 Less variable expenses 346,500 7.70 Contribution margin 247,500 $ 5.50 Less fixed expenses 200,000 Operating income $ 47,500

LO: 3, Bloom: AP, Unit: 3-2, Difficulty: Difficult, Min: 20-25, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Problem 3-21

a. Using the sales revenue of $2,000,000 and sales price of $20.00 per $2,000,000 unit, determine that SND, Inc. sold 100,000 units ( ). $20.00 new sales volume: 100,000 × .90 = 90,000 units

Total Per unit Sales $1,800,000 $20.00 Less variable expenses 1,125,000 12.50 Contribution margin 675,000 $ 7.50 Less fixed expenses 400,000 Operating income $ 275,000

27 CHAPTER 3 SOLUTIONS

b. new sales price: $20.00 × 1.05 = 21.00

Total Per unit Sales $2,100,000 $21.00 Less variable expenses 1,250,000 12.50 Contribution margin 850,000 $ 8.50 Less fixed expenses 400,000 Operating income $ 450,000 c. new variable cost per unit: $12.50 + $1.50 = $14.00

Total Per unit Sales $2,000,000 $20.00 Less variable expenses 1,400,000 14.00 Contribution margin 600,000 $ 6.00 Less fixed expenses 400,000 Operating income $ 200,000 d. new sales volume: 100,000 + 5,000 = 105,000 units new sales price: $18

Total Per unit Sales $1,890,000 $18.00 Less variable expenses 1,312,500 12.50 Contribution margin 577,500 $ 5.50 Less fixed expenses 400,000 Operating income $ 177,500 e. new sales volume: 100,000 × 1.15 = 115,000 units new fixed expenses: $400,000 + $75,000 = $475,000

Total Per unit Sales $2,300,000 $20.00 Less variable expenses 1,437,500 12.50 Contribution margin 862,500 $ 7.50 Less fixed expenses 475,000

28 CHAPTER 3 SOLUTIONS

Operating income $ 387,500 f. new variable cost per unit: $12.50 + $2.00 = $14.50 new sales price: $20.00 + $1.50 = $21.50 new sales volume: 100,000 – 2,500 = 97,500 units new fixed expenses: $400,000 + $20,000 = $420,000

Total Per unit Sales $2,096,250 $21.50 Less variable expenses 1,413,750 14.50 Contribution margin 682,500 $ 7.00 Less fixed expenses 420,000 Operating income $ 262,500

LO: 3, Bloom: AP, Unit: 3-2, Difficulty: Difficult, Min: 25-30, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Problem 3-22

a. Using the sales revenue of $1,050,000 and sales price of $20.00 per unit from Exhibit 3-1, determine that Universal Sports Exchange sold $1,050,000 52,500 units ( ). $20.00

new cost of jersey = $ 15.30 current cost of jersey = $ 14.80 cost increase = $ 0.50 jerseys sold × 52,500 decrease in operating income = $26,250

29 CHAPTER 3 SOLUTIONS b. Alternative 1: new sales price: $20.00 + $0.50 = $20.50 new commission: $20.50 × .06 = $1.23 per jersey new fixed expenses: $168,000 + $5,000 = $173,000 maintain current sales volume of 52,500 jerseys

Total Per unit Sales $1,076,250 $20.50 Less variable expenses Cost of goods sold 803,250 15.30 Commission 64,575 1.23 Contribution margin 208,425 $ 3.97 Less fixed expenses 173,000 Operating income $ 35,425

Alternative 2: sales price remains $20.00 per jersey new fixed expenses: $168,000 + $22,000= $190,000 new sales volume: 52,500 × 1.10 = 57,750 jerseys new commission: $20.00 × .04 = $0.80 per jersey

Total Per unit Sales $1,155,000 $20.00 Less variable expenses Cost of goods sold 883,575 15.30 Commission 46,200 0.80 Contribution margin 225,225 $ 3.90 Less fixed expenses 190,000 Operating income $ 35,225 c. Under this plan, the commission increased by $0.03 per jersey, or $1,575. d. The two plans’ operating incomes differ by only $200, so there is not an overwhelming monetary advantage of one over the other. However, under plan 2, the company gains access to a large database of potential customers. The database could provide long- term benefits of additional sales in future periods.

30 CHAPTER 3 SOLUTIONS

If the sales team could be motivated to work hard enough to achieve the new sales volume with the smaller commission, Universal managers should seriously consider option 2.

LO: 3, Bloom: AP, C, Unit: 3-2, Difficulty: Difficult, Min: 20-25, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Problem 3-23

a. Calculate total fixed expenses using the breakeven formula:

Fixed Expenses = 20,000 $18.00 - $5.40

Fixed Expenses = 20,000 $12.60

Fixed Expenses = 20,000 × $12.60

Fixed Expenses = $252,000

Use the 40% tax rate and $15,120 net income given in the problem to $15,120 calculate operating income of $25,200 ( ). Add this amount .60 to the $252,000 fixed expenses to calculate contribution margin of $277,200.

Total Per unit Sales $396,000 $18.00 Variable expenses 118,800 5.40 Contribution margin 277,200 $ 12.60 Less fixed expenses 252,000 Operating income 25,200 Income tax (40%) 10,080 Net income $ 15,120

b. new sales price: $21.00

31 CHAPTER 3 SOLUTIONS

$5.40 new variable cost per unit: $5.40 + = $7.20 3 new fixed expenses: $252,000 + $30,900 = $282,900 $282,900 Breakeven point in units = $21.00 - $7.20

$282,900 = 20,500 T-shirts $13.80

c. new sales price: $21.00 $5.40 new variable cost per unit: $5.40 + = $7.20 3 new fixed expenses: $252,000 + $30,900 = $282,900 $28,980 target operating income of $48,300 ( ) .6

$282,900 $48,300 Breakeven point in units = $21.00 - $7.20

$331,200 = 24,000 T-shirts $13.80

LO: 1, 3, Bloom: AP, Unit: 3-1, 3-2, Difficulty: Difficult, Min: 20-25, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Problem 3-24

a. At the breakeven point, contribution margin equals fixed expenses.

($18.00 - $13.00) × 15,000 hats = $75,000

b. $14,000 net income with a 30% tax rate yields $20,000 in operating $14,000 income ( ). Using the profit equation: .7

$18.00x - $13.00x - $75,000 = $20,000 $5.00x = $95,000

32 CHAPTER 3 SOLUTIONS x = 19,000 hats

33 CHAPTER 3 SOLUTIONS

Or approach the question as a target income question:

$75,000 $20,000 = 19,000 hats ($18.00 - $13.00) c. Margin of Safety = 19,000 hats – 15,000 hats = 4,000 hats 4,000 hats × $18.00 = $72,000 d. $17,500 net income with a 30% tax rate yields $25,000 in operating $17,500 income ( ). Using the profit equation: .7

$18.00x - $13.00x - $75,000 = $25,000 $5.00x = $100,000 x = 20,000 hats

Or:

$75,000 $25,000 = 20,000 hats ($18.00 - $13.00) e. new variable cost = $14.00 per hat new contribution margin = $4.00 per hat

$18.00x – $14.00x – $75,000 = 0 $4.00x = $75,000 x = 18,750 hats

Or:

$75,000 = 18,750 hats ($18.00 - $14.00)

34 CHAPTER 3 SOLUTIONS

f. seek a new supplier at a lower cost per hat raise prices to increase contribution margin do nothing and accept the lower level of income

g. new sales price: $20 new volume: 19,000 × .95 = 18,050 hats

Operating Income [($20.00 - $14.00) × 18,050 hats] - $75,000 = $33,300

Net Income $33,300 × .7 = $23,310

LO: 1,2,3, Bloom: AP, C, Unit: 3-1, 3-2, Difficulty: Moderate, Min: 30-40, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Problem 3-25

a. $36.00x - $16.00x - $450,000 = 0 $20.00x = $450,000 x = 22,500 units

Or:

$450,000 = 22,500 hats ($36.00 - $16.00)

b. Maximum operating income: ($36.00 × 25,000) - ($16.00 × 25,000) - $450,000 = $50,000

Maximum net income: $50,000 × .06 = $30,000

c. $75,000 net income with a 40% tax rate yields $125,000 in operating $75,000 income ( ). Using the profit equation: .6 $36.00x - $16.00x - $450,000 = $125,000 $20.00x = $575,000

35 CHAPTER 3 SOLUTIONS

x = 28,750 units Or:

$450,000 $125,000 = 28,750 hats ($36.00 - $16.00)

d. $75,000 net income with a 40% tax rate yields $125,000 in operating $75,000 income ( ). Using the profit equation: .6

(SP × 25,000) - ($16.00 × 25,000) - $450,000 = $125,000 (SP × 25,000) - ($400,000) = $575,000 $975,000 SP - $16.00 = 25,000 SP - $16.00 = $23.00 SP = $39.00

e. The project manager needs to look for ways to reduce the costs to produce the product or look for ways to expand capacity beyond the current limit of 25,000 units.

LO: 1,2,3, Bloom: AP, C, Unit: 3-1, 3-2, Difficulty: Moderate, Min: 25-30, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Problem 3-26

a. new variable cost of goods sold: $12.00 × 1.15 = $13.80 per unit new total variable costs: $13.80 + $10.60 + $3.00 = $27.40 per unit new contribution margin: $40.00 - $27.40 = $12.60 per unit new fixed expenses: $7,800,000 + $1,550,000 + $3,250,000 + $150,000 = $12,750,000 $1,800,000 net income with a 40% tax rate yields $3,000,000 in $1,800,000 operating income ( ). Using the profit equation: .6

$40.00x – $27.40x – $12,750,000 = $3,000,000 $12.60x = $15,750,000

36 CHAPTER 3 SOLUTIONS x = 1,250,000 units

37 CHAPTER 3 SOLUTIONS

Or:

$12,750,000 $3,000,000 = 1,250,000 hats ($40.00 - $27.40)

sales revenue required = 1,250,000 hats × $40.00 = $50,000,000

b. $14.40 current contribution margin ratio = = 36% $40.00 SP $27.40 new contribution margin ratio = = 36% SP SP - $27.40 = .36SP .64SP = $27.40 SP = $42.8125, rounded to $42.82

LO: 2, 3, Bloom: AP, Unit: 3-2, Difficulty: Moderate, Min: 15, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Problem 3-27

a. Contribution Margin Degree of operating leverage = Operating Income

$9,000,000 $5,000,000 = $2,000,000 = 2

b. 5% sales increase × 2 degree of operating leverage =10% increase new operating income = $2,000,000 × 1.10 = $2,200,000

c. Moving employees from a fixed salary to a commission based on sales will increase variable costs and decrease contribution margin. This will cause the degree of operating leverage to decrease.

LO: 4, Bloom: AP, AN, Unit: 3-2, Difficulty: Easy, Min: 12, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

38 CHAPTER 3 SOLUTIONS

Problem 3-28

a. When the sales mix changes, the effect on the breakeven point and operating income depends on the contribution margin ratios of the product lines involved. If coffee-making equipment has a higher contribution margin ratio than whole coffee beans, all other things equal, the breakeven point will decrease and operating income will increase as a result of the new sales mix. If whole coffee beans have the higher contribution margin of the two, the opposite will be true.

b. Yes, this is a desirable change in the sales mix. A higher percentage of a dollar from equipment sales than a dollar from whole coffee bean sales will be retained to cover fixed expenses and provide operating income.

c. No. There are a variety of products within the equipment and accessories line, and they all probably have different contribution margin ratios. For example, the contribution margin ratio on a high- end expresso machine is likely different from the contribution margin ratio of an insulated coffee mug.

LO: 5, Bloom: AN, C, Unit: 3-3, Difficulty: Moderate, Min: 20-25, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Problem 3-29

a. molded briefcase contribution margin: $40.00 - $27.40 = $12.60 leather briefcase contribution margin: $90.00 - $36.00 = $54.00 fixed expenses: $12,750,000 + $300,000 = $13,050,000

Let x = number of leather briefcases sold

$54.00x + $12.60(4x) - $13,050,000 = 0 $104.40x = $13,050,000 x = 125,000 leather briefcases 4x = 500,000 molded briefcases

39 CHAPTER 3 SOLUTIONS

b. new leather sales price: $66.00 new leather contribution margin: $66.00 - $36.00 = $30.00 new fixed expenses: $12,750,000 + $177,600 = $12,927,600 new sales mix: 1 molded briefcase for every 3 leather briefcases

Let x = number of molded briefcases sold

$12.60x + $30.00(3x) - $12,927,600 = 0 $102.6x = $12,927,600 x = 126,000 molded briefcases 3x = 378,000 leather briefcases

c. The biggest risk of introducing the leather briefcase is the potential cannibalization of molded briefcase sales. While we have calculated breakeven points, managers also need to consider expected operating income under various scenarios.

LO: 1,4, Bloom: AP, C, Unit: 3-1, 3-2, Difficulty: Difficult, Min: 20-25, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Problem 3-30

a. sales mix: 4:6 or 1:1.5

Let x = number of XL-709s sold

($10.00 - $6.00)x + ($25.00 - $17.00)(1.5x) - $200,000 = 0 $4.00x + $8.00(1.5x) = $200,000 16x = $200,000 x = 12,500 XL-709s 1.5x = 18,750 CD-918s

b. new XL-709 contribution margin: $14.00 - $6.00 = $8.00

Let x = number of XL-709s sold

($14.00 - $6.00)x + ($25.00 - $17.00)(1.5x) - $200,000 = 0 $8.00x + $8.00(1.5x) = $200,000 20x = $200,000 x = 10,000 XL-709s

40 CHAPTER 3 SOLUTIONS

1.5x = 15,000 CD-918s

41 CHAPTER 3 SOLUTIONS

c. new sales mix: 4:8 or 1:2 new fixed expense = $200,000 + $60,000 = $260,000

Let x = number of XL-709s sold

($10.00 - $6.00)x + ($25.00 - $17.00)(2x) - $260,000 = 0 $4.00x + $8.00(2x) = $260,000 20x = $260,000 x = 13,000 XL-709s 2x = 26,000 CD-918s

d. Operating income if the company advertises XL-709:

[($14 - $6) × 50,000)] + [($25 - $17) × 60,000)] - $260,000 = $620,000

Operating income if the company advertises CD-918:

[($10 - $6) × 40,000)] + [($25 - $17) × 80,000)] - $260,000 = $540,000

The company should advertise product XL-709 since it expects to earn $80,000 more in operating income than if it advertised CD-918.

LO: 1,5, Bloom: AP, C, Unit: 3-1, 3-3, Difficulty: Difficult, Min: 25-30, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

42 CHAPTER 3 SOLUTIONS

Problem 3-31

a. Sales Variable Fixed Operating Price Demand Revenue Cost expense Income $200 40,657 $ 8,131,400 $2,439,420 $350,000 $5,341,980 $190 44,486 $ 8,452,340 $2,669,160 $350,000 $5,433,180 $180 48,675 $ 8,761,500 $2,920,500 $350,000 $5,491,000

$170 53,259 $ 9,054,030 $3,195,540 $350,000 $5,508,490 $160 58,275 $ 9,324,000 $3,496,500 $350,000 $5,477,500 $150 63,763 $ 9,564,450 $3,825,780 $350,000 $5,388,670 $140 69,768 $ 9,767,520 $4,186,080 $350,000 $5,231,440 $130 76,338 $ 9,923,940 $4,580,280 $350,000 $4,993,660 $120 83,527 $10,023,240 $5,011,620 $350,000 $4,661,620 $110 91,393 $10,053,230 $5,483,580 $350,000 $4,219,650 $100 100,000 $10,000,000 $6,000,000 $350,000 $3,650,000

A price of $170 generates the highest operating income.

$170 $60 b. = 183.33% $60

$200 $60 c. at $200: = 233.33% $60 $100 $60 at $100: = 66.67% $60

d. Cost-plus pricing does not take demand schedules into consideration when setting prices. Management must combine their knowledge of demand with desired markups to determine the best price to set.

LO: 6, Bloom: AP, E, Unit: 3-4, Difficulty: Moderate, Min: 20-25, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

43 CHAPTER 3 SOLUTIONS

Problem 3-32

a. The minimum price Gail should quote is $30.00 per plate plus any other variable costs of serving the meal.

b. $30.00 × 1.6 = $48 per plate

$45.00 $30.00 $15 c. = 50% $30.00 $30

d. If Gail met the lower price of $45.00 per plate and won the bid, she would cover her variable costs and generate contribution margin to cover her fixed expenses and provide operating profit. She would also receive “free” advertising and have the potential for generating future sales that she would not have otherwise made.

On the downside, if the mayor chooses to use Gail again, he may expect the same level of markup concession. Future customers may also expect this same menu at $45.00 per plate. LO: 6, 7, Bloom: AP, C, Unit: 3-4, Difficulty: Easy, Min: 15-20, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

SOLUTIONS TO CASES

Case 3-33

a. Tiffany’s fixed expenses are a much higher percentage of sales than Blue Nile. It has relatively more fixed expenses associated with building occupancy and salaries than Blue Nile.

b. While Blue Nile’s gross margin percentage is 37.2 points below Tiffany’s, its operating expense percentage is 29.5 points lower as well. Therefore the difference in operating income is 7.7 points. Blue Nile would hope to make up the difference in sales volume.

44 CHAPTER 3 SOLUTIONS

c. Tiffany, because it is likely to have higher fixed expenses relative variable costs due primarily to building space.

d. A move toward lower-margin products will decrease the contribution margin.

e. Amazon.com’s cost structure is most like Blue Nile. Both are online retailers with little investment in buildings. LO: 4, Bloom: AN, Unit: 3-2, Difficulty: Moderate, Min: 20-25, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

Case 3-34

a. Operating income includes fixed expenses which do not change with changes in volume. By using operating income per mascot, Blake is treating these fixed expenses as variable costs. For decision making, Blake needs to use contribution margin per unit.

45 CHAPTER 3 SOLUTIONS

b. Use the high-low method to calculate the cost formula for each cost. Then use the cost formulas to create the contribution format income statement.

Cost Behavior Cost formula Cost of goods sold Variable y = $10x Rent Fixed y = $1,500 Wages Mixed y = $500 + $3x Shipping Variable y = $1.25x Utilities Fixed y = $750 Advertising Mixed y = $500 + .25x Insurance Fixed y = $400

Total Per unit Sales $37,500 $25.00 Less variable costs Cost of goods sold 15,000 10.00 Wages 4,500 3.00 Shipping 1,875 1.25 Advertising 375 0.25 Total variable costs 21,750 14.50 Contribution margin 15,750 $10.50 Less fixed expenses Rent 1,500 Wages 500 Utilities 750 Advertising 500 Insurance 400 Total fixed expenses 3,650 Operating income $12,100 c. Sales revenue – Variable costs – Fixed expenses = Operating profit ($25.00 × 500) - ($14.50 × 500) - $3,650 = $1,600

46 CHAPTER 3 SOLUTIONS

d. $25.00x - $14.50x -$3,650 = $3,700 $10.50x = $7,350 x = 700 mascots

Or

$3,650 $3,700 = 700 mascots $10.50

To break even:

$25.00x - $14.50x -$3,650 = $0 $10.50x = $3,650 x = 347.6 mascots, rounded to 348

Or

$3,650 = 347.6 mascots, rounded to 348 $10.50 e. Option 1 new fixed expenses: $3,650 + $1,200 = $4,850 new sales volume: 960 mascots

($25.00 × 960) - ($14.50 × 960) - $4,850 = Operating income $24,000 - $13,920 - $4,850 = $5,230

Option 2 new sales price: $25.00 × .90 = $22.50 new sales volume: 1,000 mascots

($22.50 × 1,000) - ($14.50× 1,000) - $3,650 = Operating income $22,500 - $14,500 - $3,650 = $4,350 Blake should implement option 1 to earn the highest operating income.

47 CHAPTER 3 SOLUTIONS

Blake would be indifferent between the two plans at the point where they generate the same operating income.

($25.00 - $14.50)x - $4,850 = ($22.50 - $14.50)x - $3,650 $10.50x - $4,850 = $8.00x - $3,650 $2.50x = $1,200 x = 480 mascots

f. new variable cost of goods sold: $10.00 × 1.2 = $12.00 new variable cost per unit: $12.00 + $3.00 + $1.25 + $0.25 = $16.50 $12.00 $10.00 new sales price: $25.00 + = $26.00 2 new contribution margin: $26.00 - $16.50 = $9.50 new sales volume: 1,200 × .95 = 1,140

new projection with price increase [($26.00 - $16.50) × 1,140] - $3,650 = $7,180

new projection without price increase [($25.00 - $16.50) × 1,200] - $3,650 = $6,550

Blake is better off increasing the price by $1.00 even though it reduces the sale volume.

g. new sales mix: 1 blanket for every 3 mascots blanket variable cost: $32.00 + $3.00 + $1.25 + $0.25 = $36.50 blanket contribution margin: $55.00 - $36.50 = $18.50 new fixed expenses = $3,650 + $350 = $4,000 Let x = number of blankets sold

($55.00 - $36.50)x + ($25.00 - $14.50)(3x) - $4,000 = 0 $18.50x + $10.50(3x) = $4,000 $50.00x = $4,000 x = 80 blankets 3x = 240 mascots

LO: 1,2,3,5, Bloom: AN, AP, Unit: 3-1, 3-2, 3-3, Difficulty: Difficult, Min: 35-40, AACSB: Analytic, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

48 CHAPTER 3 SOLUTIONS

Case 3-35

a. Among the ethical issues in the case are: Jeff presented a long-term contract proposal that apparently was not within normal operating guidelines, since it required special approval. Jeff withheld critical information about the contract and the quality of the cartons. Jeff created a conflict of interest by entering into a contract with his brother. Jeff was influenced by the promise of attending the Super Bowl with his brother if he signed the contract. Jeff knowingly purchased lower-quality cartons to get a lower cost so that managers would look favorably on his performance and reward him with a promotion. The company has collected damages from freight carriers under the pretense that the carrier caused the damage when it was due to the lower-quality cartons. Jeff continued to withhold information when confronted by Dan about the lower-quality cartons.

b. Jeff and Dan have several possible action steps at this point. Jeff should inform Dan of his actions in obtaining the contract, including the conflict of interest with his brother and the fact that he knowingly purchased lower-quality cartons to inflate his performance evaluation. Dan should contact the carriers and offer to reimburse the claims that have been paid to date. Dan should stop using the lower-quality cartons immediately to prevent future damage claims by customers. Dan should investigate cancelling the remaining portion of the long-term contract. Dan should purchase cartons of the correct quality.

c. In this situation, the costs of ethical decision making include: The cost of damage claims The cost of inferior cartons if they can’t be returned or if the contract cannot be voided

49 CHAPTER 3 SOLUTIONS

In this situation, the benefits of ethical decision making include: Repairing the company’s reputation Building trust with freight carriers, customers, and employees Building relationships with stakeholders Demonstrating to employees that ethical decision making is valued

The costs of not making the appropriate decision include: Continued damage to company reputation from damaged goods Implicit approval of unethical behavior Increased unethical behavior, as conflicts of interest are viewed by employees as a normal part of doing business Increased unethical behavior as employees see that managers do not address unethical behavior

LO: 3, Bloom: AN, Unit: 3-2, Difficulty: Moderate, Min: 20-25, AACSB: Ethics, AICPA FN: Decision Modeling, AICPA PC: Problem Solving and Decision Making, IMA: Decision Analysis

50