1

BA 9210- STRATEGIC MANAGEMENT

UNIT – 2: COMPETITIVE ADVANTAGE

Environmental Scanning Environmental scanning plays a key role in strategy formulation by analyzing the strengths and weaknesses and opportunities and threats in the environment. Environmental scanning is defined as, “Monitoring, evaluating, and disseminate of information from external and internal environments to managers in organizations so that long term health of the organization will be ensured and strategic shocks can be avoided”.

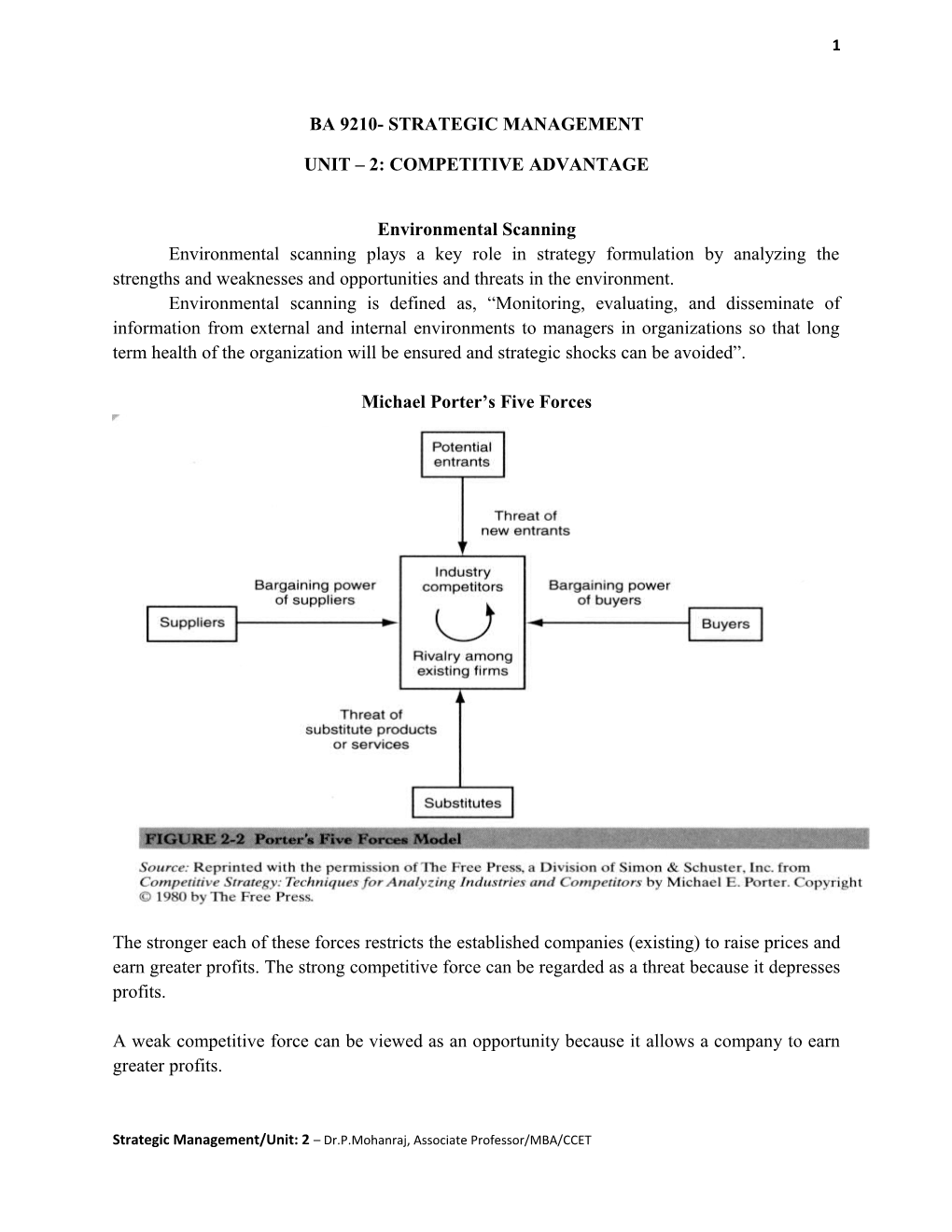

Michael Porter’s Five Forces

The stronger each of these forces restricts the established companies (existing) to raise prices and earn greater profits. The strong competitive force can be regarded as a threat because it depresses profits.

A weak competitive force can be viewed as an opportunity because it allows a company to earn greater profits.

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 2

The task facing managers is to recognize how changes in the five forces give rise to new opportunities and threats and to formulate appropriate strategic responses.

1. Threat of Potential entrants (New entrants) The Entry of potential competitors to an industry is a threat to the profitability of established players. The new entrants bring in new capacity, substantial resources and aggressiveness to gain market share. The established companies try to discourage potential competitors from entering to an industry by raising height of barriers. Barriers of new entrants a. Economies of scale The cost advantage that arises with increased out of a product Reduction in cost per unit resulting from increased production Economies of scale are obtained through cost reduction, mass production, discount of bulk purchase of raw materials and advertising. It is a less threat to established companies. b. Product differentiation c. Cost advantage – due to their access of raw materials, Cheaper funds, superior production technique, patents, secret processes, etc., d. Capital requirements – for infrastructure facilities, inventories, etc., e. Access to Distribution channels – Large retailers give preference to established firms f. Govt. Policy – The Govt. can limit entry into an industry through licensing requirements, air and water pollution standards and safety regulations, etc.,

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 3

g. Brand Identity – Building a favourable brand image is tough for new comers.

2. Bargaining power of suppliers Suppliers enjoy bargaining power by raising the price or reduce the quality of purchased goods and services and thereby reduce the profitability of the company.

Supplier is powerful, under following conditions: Few companies selling to many The product is differentiated, unique Substitutes are not easily available (electricity0 Supplier can threaten with forwarding integration and compete directly with the existing firms. Purchasing firms buys a small quantity of the supplier’s goods and it is unimportant to the supplier.

3. Bargaining power of buyers Buyers are threat when the force the companies to - Charge low price - Demand higher quality - Demand better service According to Porter the buyers are powerful in the following circumstances o Suppliers are more in numbers o Buyers buy in large quantity o More numbers of alternative suppliers – o Cost of changing supplier is not much o Supplier depends buyer for big order o Purchased item is not important o Buyer can able to produce the product o Buyer uses the threat of vertical integration as a measure for forcing down prices.

4. Substitute product Substitutes are those products, which satisfy similar needs though appear to be different.

According to Porter, Substitute products limit the potential returns of any industry by placing a ceiling on price, firms in the industry can charge. The existence of close substitutes is a threat, by limiting the price and profitability of a company.

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 4

5. Rivalry among existing players - When the intensity of rivalry is weak among established players within an industry, companies can raise prices and earn greater profits. - If the rivalry is strong among the players, price competition and price war will be possible and it will reduce the profit margin.

Reasons for strong rivalry among established companies: o Industry competitive structure o Demand conditions o The height of exit barriers in the industry.

Strategic Groups An Industry consists of number of firms, which are differ from each other with respect to products , the distribution channels they use, the market segments they serve, the quality of their products, technological leadership, customer service, pricing policy, advertising policy, and promotions.

Within an industry, A strategic group refers to ‘a set of business units, which ‘pursue similar strategies with similar resources’.

A strategic group is a concept used in strategic management that groups companies within an industry that have similar business models or similar combinations of strategies. For example, the fast-food industry can be portrayed as consisting of several strategic groups.

The strategies followed by companies in one strategic group will be different from the strategy pursued by other strategic group. In a strategic group, each member company almost follows the same basic strategy as other companies in the group.

Characteristics of Strategic group companies - A company’s close competitors are members of the same strategic group - Strategic groups follows similar strategies - Companies are viewed by customers as substitutes for each other - Members of the strategic group mainly threaten a company’s profitability - Competitive forces are vary among different strategic groups within the same industry

Types of Strategic groups a. Proprietary group – Heavy spending on R&D and they adopt high-risk and high-return strategy. It makes high cost products.

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 5

b. Generic group – It spends less on R&D and follows low risk, low-return strategy. It makes low cost products.

Strategic Groups in Pharma Industry

HIgh Proprietary Group Merck Pfizer Eli Lilly

Price Charged Generic group • Dr.Reddy’s Labs •Ranbaxy •Marion Labs

Low

R&D spending Low HIgh

Strategic Types It is a strategic orientation which is a combination of structure, culture and process consistent with that strategy. The different strategic orientation is the reason behind the varying behaviour of firms facing similar environment.

Miles and Snow have classified the strategic types 1. Defender – these companies have a limited product line and they focus on efficiency of existing operations. 2. Prospectors – Broad product line and focus on product innovation and market opportunities. 3. Analyzers – It operates stable and variable markets. In stable markets these companies emphasize efficiency and in variable markets it emphasizes innovation, creativity, etc. 4. Reactors – The firms do not have a consistent strategy to pursue. There is an absence of well-integrated strategy structure culture relationship

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 6

Competitive changes during industry evolution The competitive forces changes/ acts upon the various stages of industries and give rise to opportunities and threats for an industry. The Industry life cycle model is used for analyzing the effects of industry evolution on competitive forces. Based on the industry life cycle model, the industry environment could be identified as follows: - Embryonic industry environment - Growth industry environment - Shakeout environment - Mature industry environment and - Decline industry environment

Stages of Industry life cycle

Demand

Growth Shakeout Maturity Decline

Time

1. Embryonic industry environment - It is just beginning to develop - Growth is very slow at this stage - Buyers are unfamiliar with the product - Prices are high since economies of scales are not achieved - Distribution channels are not developed fully Entry barrier is based on technological know-how Rivalry is based on firm’s ability to educate customers, develop distribution channel and to improve product designs, etc.

2. Growth industries - Consumers are familiar with the product

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 7

- New customers enter the market and demand expands rapidly - Prices fall due to scales of economy - Distribution channel grow Entry barriers are low Threat from potential competitors is the highest at this stage Less competitive pressure for new entrants High demand generates adequate revenue

3. Industry Shakeout - Demand is saturated and not from first time buyers but from replacement demand - Rivalry between companies is very strong - Price cutting and price war starts from excess capacity

4. Maturity industries - The market is saturated and demand is confined (restricted) to replacement demand - Growth is very little or nothing - Barrier to entry increases - Threat of entry of potential competitors decreases - Fight for market share, price reduction and focusing cost minimization - Existing firms left with brand loyalty and cost minimization – it is the barrier to entry in mature industries

5. Declining Industries - Negative growth due to technological substitutions, Social changes, international competition and demographic factors. - Rivalry among firms will be keen in declining stage - Demand for product is very low

Globalization and Industry Structure

In conventional economic system, national markets are separate entities separated by trade barriers and barriers of distance, time and culture.

With globalization, markets are moving towards a huge global market place. The tastes and preferences of customers of different countries are converging on common global norm. - Products like coco-cola, Pepsi, Sony walkman and McDonald hamburgers are globally accepted.

The intense rivalry forces of all firms to maximize their efficiency, quality, innovative power and customer satisfaction.

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 8

With hyper competition, the rate of innovation has increased significantly.

Companies try to outperform their competitors by pioneering new products, processes and new ways of doing business.

Previously protected national markets face the threat of new entrants and intense rivalry. After regulation of Indian economy the industrial sector has witnesses’ enormous changes.

The banking sector reforms also contributed to changes in the economic conditions of India. Merger, acquisition and joint venture with MNCs take place in large number. Ultimately intense competition is felt in the industrial scene. A vibrant stock market has emerged.

National Context and Competitive advantage (Competitive advantage of Nations)

In spite of globalization of markets and production, successful companies in certain industries are found in specific countries Japan has most successful consumer electronics companies in the world Germany has many successful chemical and engineering companies in the world United states has many of the world’s successful companies in computer and biotechnology It shows that national context (back-round) has an important bearing on the competitive position of the companies in the global market. According to Michael Porter, the Nation’s competitive position in an industry depends on factor conditions, Industry rivalry, demand conditions, and related and supporting industries. These four national characteristics create an environment that is conducive (favourable) to creating globally competitive firms in particular industries. The four national characteristics are interrelated as shown in the following diagram. This diagram popularly known as the Porter’s diamond. These four factors are called the diamond determinants.

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 9

Porter’s Diamond: The Determinants of Competitive Advantage

Intensity of Rivalry

National Factor Local demand Competitive Conditions conditions Advantage

Competitiveness of related and supporting industries

The determinants of National competitive advantage 1. Firm strategy, structure and Intensity of Rivalry – The conditions in the nation determining how firms are created, organized and managed and the nature of domestic competition. Among domestic companies force them to be efficient 2. Factor conditions – The special factors or inputs of production such as natural resources, raw materials, labour, etc., that a nation is especially endowed with. Right mix of basic & Advanced factors of production Economists consider the cost and quality of factors of production as the major reason for the competitive advantage of some countries with respect to certain industries.

Factors of production include basic factors such as labor, capital, raw material, land and advanced factors such as technological know-how, managerial talent and physical infrastructure 3. Local Demand conditions – Demand conditions force the local industry to be efficient. The nature and size of the buyer’s needs in the domestic market. 4. Competitiveness of related and supporting industries – The existence of related and supporting industries to the ones in which a nation excel. The Low cost & High quality inputs supplied by related/ supporting industries helps to compete internationally

The competitive advantages U.S enjoys in bio-technology due to technological know- how, low venture capital to fund risky start-ups in industries.

Competitive Advantage

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 10

Meaning of Competitive advantage: The term can be defined to mean “anything that a firm does especially well when compared with rival firms”.

“ When two or more firms compete within the same market, one firms possesses a competitive advantage over its rivals when it earns a persistently (constantly) higher rate of profit (or has the potential to earn a persistently higher rate of profit)” - R. M. Grant, 2000

An advantage that a firm has over its competitors, allowing it to generate greater sales or margins and/or retain more customers than its competition. There can be many types of competitive advantages including the firm's cost structure, product offerings, distribution network and customer support

A company has a competitive advantage over its rivals (Competitors) when its profitability is greater than the average profitability of all companies in its industry. It has a sustained competitive advantage when it is able to maintain above average profitability over a number of years.

Low cost & Differentiation – Competitive Advantage There are two main types of competitive advantages: comparative advantage and differential advantage. These are the two ways of attaining competitive advantage a. Comparative advantage or Cost advantage is a firm's ability to produce a good or service at a lower cost than its competitors, which gives the firm the ability sell its goods or services at a lower price than its competition or to generate a larger margin on sales. b. Differential advantage, is created when a firm's products or services differ from its competitors and are seen as better than a competitor's products by customers. The constituents of the DQE approach, Design, Quality, Environment, can enhance a company’s differentiation advantage.

A firm can achieve a higher rate of profit over a competitor in two ways: - By establishing low cost advantage: e.g. provide products or services similar to those of its competitors but at a lower cost - By establishing a differentiation advantage: e.g. provide a unique product for which the customer is willing to pay a premium.

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 11

The two aforementioned sources of competitive advantage define ways of positioning the company to its market (“positioning school”).

Competitive advantages - Strategies a. Cost Leadership Strategy The goal of Cost Leadership Strategy is to offer products or services at the lowest cost in the industry. The challenge of this strategy is to earn a suitable profit for the company, rather than operating at a loss and draining profitability from all market players. Companies such as Walmart succeed with this strategy by featuring low prices on key items on which customers are price-aware, while selling other merchandise at less aggressive discounts. Products are to be created at the lowest cost in the industry. An example is to use space in stores for sales and not for storing excess product.

b. Differentiation Strategy The goal of Differentiation Strategy is to provide a variety of products, services, or features to consumers that competitors are not yet offering or are unable to offer. This gives a direct advantage to the company which is able to provide a unique product or service that none of its competitors is able to offer. An example is Dell which launched mass-customizations on computers to fit consumers' needs. This allows the company to make its first product to be the star of its sales.

c. Innovation Strategy The goal of Innovation Strategy is to leapfrog other market players via the introduction of completely new or notably better products or services. This strategy is typical of technology start-up companies which often intend to "disrupt" the existing marketplace, obsolete the current market entries with a breakthrough product offering. It is harder for more established companies to pursue this strategy because their product offering has achieved market acceptance. Apple has been a notable example of using this strategy with its introduction of iPod personal

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 12

music players, and iPad tablets. Many companies invest heavily in their research and development department to achieve such statuses with their innovations.

d. Operational Effectiveness Strategy The goal of Operational Effectiveness as a strategy is to perform internal business activities better than competitors, making the company easier or more pleasurable to do business with than other market choices. It improves the characteristics of the company while lowering the time it takes to get the products on the market with a great start. State Farm Insurance pursues this strategy by promoting their agents as "good neighbors" who actively help customers.

GENERIC BUILDING BLOCKS OF COMPETITIVE ADVANTAGE

Efficiency, Quality, Innovation and Customer responsiveness are 4 basic ways (Building blocks) for lowering costs and achieving differentiation. - These four factors are inter-related – Superior quality leads to superior efficiency and innovation will increase efficiency, quality and customer responsiveness. a. Efficiency Efficiency on production here by lower the cost of inputs (Land, Capital, raw materials, etc.) to produce given/ more output with in time and quality to attain competitive advantage. The employee’s productivity also important to attain efficiency.

Generic Building blocks of Competitive Advantage

Superior Quality

Superior Competitive Superior Customer Efficiency Advantage Service (Low cost & Differentiation)

Superior Innovation

b. Quality Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 13

Quality of goods and services indicates the reliability of doing the job, which the product is intended for. High quality products create a reputation and brand name. Indirectly, it reduces waste of time on rework, defective work, etc. In general high quality increases, reliability and productivity. c. Innovation Innovation means new way of doing things. It results in new knowledge, new product development, new production process, management system, etc,. Innovation offers something unique, which the competitors may not have and can charge high price. d. Customer responsiveness Providing the product/services what the customers are exactly in need/ desires. Unique customer responsiveness is determined by time of delivery, value for money, customization of products, quality, design and prompt after sales service.

Distinctive Competencies Distinctive competencies are firm specific strengths that allow a company to differentiate its product and achieve substantially lower costs than its rivals and thus gain a competitive advantage - Efficiency, Quality, Innovation and Customer responsiveness.

Distinctive competencies are those capabilities which are superior to those of other competitions. Three conditions of distinctive competencies; - Value : Contribute to customers’ perceived value - Unique : It should be unique compared to competitors - Extendibility: Capable of developing new products

Sources of Distinctive competencies - Distinctive competencies arise from two sources namely, 1. Resources and 2.Capabilities

1. Resources Resources are financial, physical, social or human, technological and organizational factors that allow a company to create value for its customers. It may be tangible (Land, buildings, plants, machineries, etc.,) or intangible (brand name, patents, know-how, R&D, etc.)

Barney’s VRIO framework to evaluate firm’s key resources 1. Value – Capable of providing competitive advantage 2. Rareness - Not easily available 3. Imitability - Costly for others to imitate 4. Organisation - Proper usage of resources/ exploitation

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 14

2. Capabilities Capabilities refer to a company’s skills at co-ordinating its resources and putting them to purposeful/productive use.

The distinction between resources and capabilities is critical to understanding what generates a distinctive competency. A company may have valuable resources, but unless it has the capability to use those resources effectively, it may not be able to create a distinctive competency.

Core Competence It is a fundamental enduring strength, which is a key to competitive advantage. It may be a competency in technology, process, engineering capability or expertise, which is difficult for competitors to imitate. Ex.: Honda’s core competence in designing and manufacturing engines/ Sony has a core competence in miniaturization. Measures of core-competence Able to serve wide variety of markets Significant contribution to customer benefits through end products Difficult for the competitors to imitate.

Durability of Competitive advantage It refers to the rate at which the firm’s capabilities and resources depreciate or become obsolete. Durability depends on three factors Barrier to imitation – If it is difficult for competitors to copy a company’s distinctive competencies, greater will be the durability of competitive advantage. Capability of competitors – Strength of capabilities of competitors will decides Dynamism of industry – Dynamic industries are characterized by high rate of innovation and fast change. In such industries, product life cycle will be short and competitive advantage will not last for a long time.

Sustained Competitive Advantage A firm can have a source of competitive advantage for only a certain period because the rival firms imitate and copy the successful firms’ strategies leading to the original firm losing its source of competitive advantage over the longer term. Hence, it is imperative (essential) for firms to develop and nurture (develop) sustained competitive advantage. This can be done by

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET 15

. Continually adapting to the changing external business landscape and matching internal strengths and capabilities by channeling resources and competencies in a fluid manner. . By formulating, implementing, and evaluating strategies in an effective manner which make use of the factors described above.

Avoiding failures and sustaining competitive advantage When a company loses its competitive advantage, its profitability falls. The company does not necessarily fail; it may just have average or below average profitability and can remain in this mode for considerable time although its resource and capital base is shrinking. A failing company is one whose profitability is new substantially lower than the average profitability of its competitors, it has lost the ability to attract and generate resources so that its profit margins and invested capital are shrinking rapidly.

Reasons for failure Inertia (lethargy, inactive) – Companies find difficult to change its strategies according to changing market conditions. This due to established decision making and management process.

Prior strategic commitments – The commitments which are already made in terms of huge investments, directions and facilities.

Too much of inner directedness – Over confidence on their selling ability and paying no attention on new product development.

Steps to avoid failure Focus on the building blocks of competitive advantage Institute continuous improvement and learning Track Best Industrial Practice and Benchmarking Overcome Inertia

Strategic Management/Unit: 2 – Dr.P.Mohanraj, Associate Professor/MBA/CCET