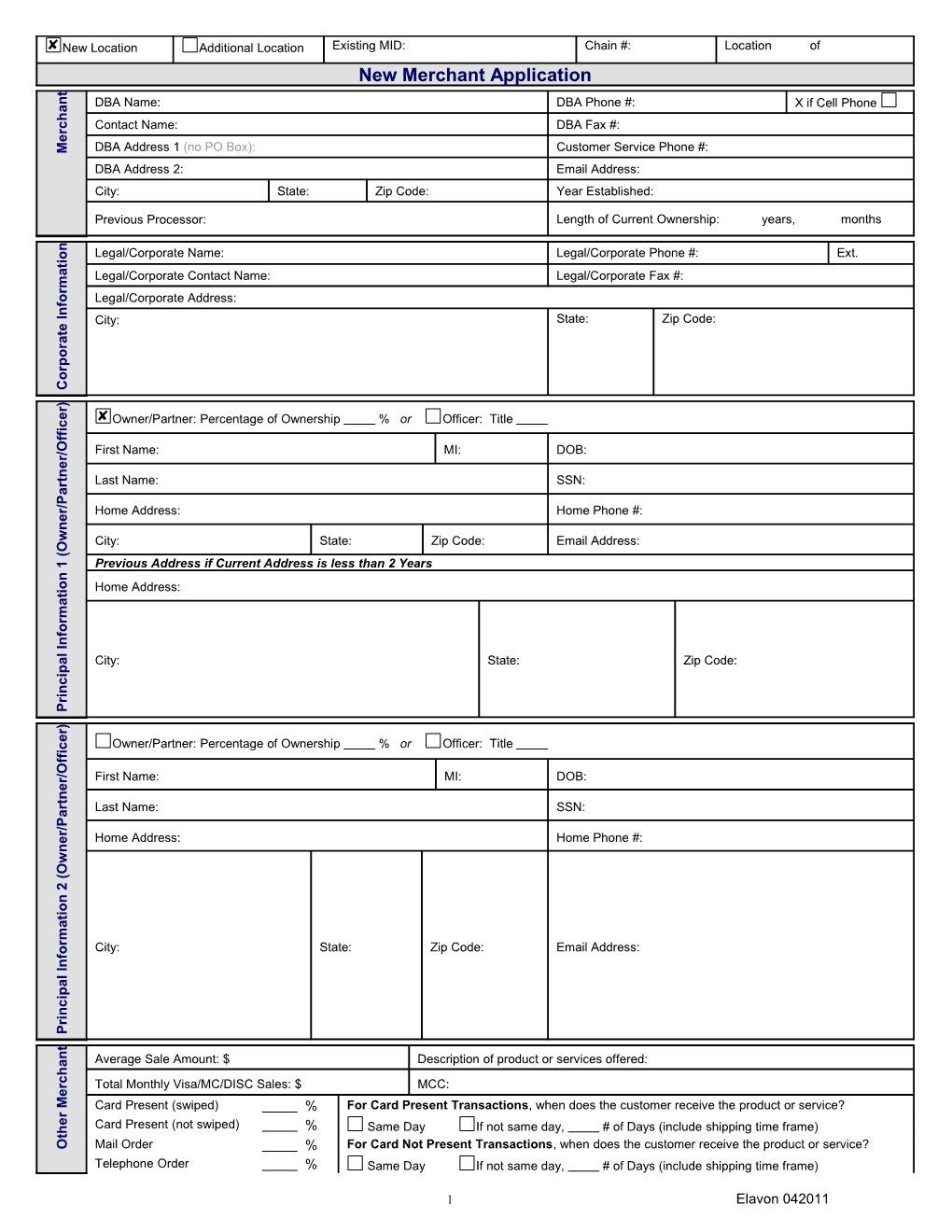

New Location Additional Location Existing MID: Chain #: Location of New Merchant Application t n DBA Name: DBA Phone #: X if Cell Phone a h c Contact Name: DBA Fax #: r e DBA Address 1 (no PO Box): Customer Service Phone #: M DBA Address 2: Email Address: City: State: Zip Code: Year Established:

Previous Processor: Length of Current Ownership: years, months n

o Legal/Corporate Name: Legal/Corporate Phone #: Ext. i t a Legal/Corporate Contact Name: Legal/Corporate Fax #: m r

o Legal/Corporate Address: f n I

City: State: Zip Code: e t a r o p r o C ) r e Owner/Partner: Percentage of Ownership % or Officer: Title c i f f O

/ First Name: MI: DOB: r e n t Last Name: SSN: r a P / r Home Address: Home Phone #: e n w City: State: Zip Code: Email Address: O (

1 Previous Address if Current Address is less than 2 Years n o

i Home Address: t a m r o f n I l a City: State: Zip Code: p i c n i r P ) r e

c Owner/Partner: Percentage of Ownership % or Officer: Title i f f O /

r First Name: MI: DOB: e n t r Last Name: SSN: a P / r

e Home Address: Home Phone #: n w O (

2 n o i t a m r City: State: Zip Code: Email Address: o f n I l a p i c n i r P t n Average Sale Amount: $ Description of product or services offered: a h c r Total Monthly Visa/MC/DISC Sales: $ MCC: e

M Card Present (swiped) For Card Present Transactions, when does the customer receive the product or service? % r e Card Present (not swiped) % Same Day If not same day, # of Days (include shipping time frame) h t

O Mail Order % For Card Not Present Transactions, when does the customer receive the product or service? Telephone Order % Same Day If not same day, # of Days (include shipping time frame)

1 Elavon 042011 Internet % For Internet Transactions: List the product web site: Total = 100% “Contact Us” email address: Do you operate seasonally: Yes No If yes, please check months closed: January February March April May June July August September October November December k (Checking Accounts only) n a

B Deposit Bank Name: ABA/Routing #: DDA Account #:

Billing Bank Name (if different): ABA/Routing #: DDA Account #: y d

Please check each card you wish to accept. r r

o Retail Lodging Pay at Pump a Note: acceptance of card types not selected will result in discount downgrades. g C e

All Visa/MasterCard/Discover Cards (JCB, DI, CUP) t Restaurant Supermarket a C

Visa Credit Visa Debit g

MasterCard Credit MasterCard Debit Discover (JCB, DI, CUP) n i MO/TO / Internet ARU c i r P s

AUTH FEE (charged on all V/MC & Discover auths) $ Other Authorizations: Per Auth e One Time Fee Type: e F TIERED Rate Per Item WEX $ Application Fee $100 Qualified % $ Other: $ Installation/Training $00 Mid-Qual % $ Other: $ Wireless Set-Up Fee $ Non-Qual % $ Voice Authorizations: Rush Shipment $ Opt. Check Card Sprmkt QPS/Small Tkt ARU $0.75 Other: $ n o % $ Operator Assisted $0.90 Monthly Fee Type: i t a Opt. Rewards Tier % $ AVS $0.90 Support Fee $10 m r Opt. Commercial Card Tier % $ Bank Referral $4.00 Statement Fee $0 o f

n PIN Debit: Per Item Electronic Statement

I INT Differential Plus or g Rate n VISA - Qual % $ Paper Statement i (Plus network switch fee) c $ i Statement Mailing Fee r MasterCard – Qual % $ Mont. pricing=S / Auth pricing=Assoc (For paper statements only) $5 P Discover – Qual % $ Per Auth Minimum Discount $25 Non-Qual % $ INT Plus/Assoc Other: $ Mont. pricing=ICDIF/Auth $ INT PLUS % $ pricing=Assoc Per Occurrence Fee Type: Above Rates are for all Card Acceptance types selected. Chargeback Fee $35 Return Item (NSF) Fee $20 Pricing Program (Required for IDP): Other: $ e l VAR Service Provider (Hosted): Gateway (optional): Aggregator: a

S VAR Vendor (Distributed): VAR Product: VAR Version:

f o

Purchase or Lease Purchase Lease* Software/Wireless t n Mon. Fee per Unit Per Auth Fee i Qty POS Description Item Code Price per Unit Term Monthly Monthly Rate per Unit o

P $ $ $ $ ) e r $ $ $ $ a w t $ $ $ $ f o $ $ S $ $ r Merchant Owns Software/Wireless o t Qty POS Description Item Code Reprogram Fee per Unit Pin Pad Encryption Mon. Fee per Unit Per Auth Fee n e $ $ $ m p i $ $ $ u q $ $ $ E ( Special Programs Qty POS Description Item Code Price per Unit Equipment Back from Merchant $ Used *Please note that all leases MUST complete the section immediately below. Initials are required. All applicable state and local taxes will be applied. Tax Exempt X THE LEASE IS A NON CANCELLABLE LEASE FOR THE FULL TERM OF MOS. TOTAL MONTHLY PAYMENT OF $ plus taxes, if applicable. AUTHORIZATION FOR AUTOMATIC WITHDRAWAL OF MONTHLY PAYMENTS Merchant hereby authorizes Elavon, through its Ladco Leasing division (“Lessor”), to automatically withdraw Merchant’s monthly lease payment and any amounts, including any and all taxes or other charges, owed in accordance with the lease, as applicable, by initiating debit entries to Merchant’s account at the financial institution (“Bank”) indicated hereon or such other financial institution used by Merchant from time to time. A lease payment (whether paid by debit or other means) that is not honored by Bank for any reason will be subject to a returned item service fee imposed by Lessor. This authorization shall remain in effect until Lessor has received written notice from Merchant of its termination.

2 Elavon 042011 Bank Name: ABA/Routing #: DDA Account #:

s SE # Auth w American Express: e e p

Fee N ESA One Point CAP # y s T

(10 digits) e

d Amex Monthly Volume: $ p $ r y a T

(7 digits) C EBT % $ $ 0.15 Amex Rate d r r e Other: a CNP Downgrade

h $ 0.30 % $ C t

r O e h g t n O i Flat Fee Option (ESA t Other: $ $ 7.95

s only): i x E t i P

b Debit – Includes INLK (Interlink), MSTO (Maestro), ACCL (Accell), AFFN, ALAS (Alaska), CU24, ITS (Shazam), P

e Bill Payment Portal

NETS, NYCE, PULSE and STAR B D

y e e y g c Dynamic Currency Conversion (DCC) – Rebate: 0.75% DCC Annual Registration Fee: $25.00 n n n o Money Manager Vendor:

a e

r or M h r r c Working Capital Vendor: u g x Multi-Currency C E n M t r

o MCP # Users Monthly Fee $ Set Up Type (check one) MID CHN ENT Set Up Fee $ p e

R MCP with OCM # Users Monthly Fee $ Set Up Type (check one) MID CHN ENT Set Up Fee $

ACS Remote ID Set Up Fee $ Monthly Fee $ t c Processing Options: POP (POS Image) ARC (POS Image) BOC ( POS Image or Cash Office Image) u d

o 1. ANNUAL check volume: $ 2. Average check amount: $ 3. Maximum check amount: $ r P s ECS Monthly Minimum: $ Please check box for each additional service option n S o C i

Conversion with Guarantee t NSF Service Fee Processing @ $2.00 per NSF item. E p g

O Not applicable for POP Guarantee and all ARC n

Guarantee Rate: % Per Transaction: $ i e c products i c r i v P

Conversion with Verification Collections r EnQuire Reporting Access: d e n S # users: @ each per month Per Transaction: $ Per Return Transaction: $ $29.95 a l

a n

Conversion Only Collections n Turn off return memo advices o i o i t t c Per Transaction: $ Per Return Transaction: $ i e d l d e A S

s Card Style Card Quantity Price g d r

n Monthly Pricing: $ per month i a Basic $ c i C (Includes transactions per location annually. Additional transaction billed $0.29 per

$ r C Standard P transaction)

G

$ C OR E Custom G

Max Card Value $ (Default $500) E Transaction Pricing: $ per transaction and $ per month.

3 Elavon 042011

9Substitute Form W- Notes EGC EGC Standard Card Order Details NetworkEGC EGC Options EGC Carriers # # # (Multiples 100 of only) City: Address: * :Name* Type:Business Imprint: Justification: Color: Text Style: Card

Name Name (of business) as shown on businessincomeyour tax Sole Forshould returns. Proprietors, this beowner’sthealways name.

Givex Elavon Misc Fee - Misc Fee - CustomUpgrade Card Graphic ServiceDesign Monthly # Online Admin- Card Carrierstotal (enter cards)

of Style of Style of Style

OR

Limited Limited Tax ClassificationLiability Company (D=disregarded– C=corporation, entity, P=partnership): Limited Partnership Text Logo Text Case (select Case ONE): Text ONE):(select Font

Left Sole Proprietor

(Imprinting details (

To avoid delay, please submit artwork to: avoid artworkplease submit To delay,

Center

Users

TaxExempt (includeOrganization documents that support Status)Exempt

Public Corp Right Arial Arial MUST $ $ $ $ $ $

Title Case State: State: be entered below) be entered

As As submitted Merchant Merchant Application

X X

Corp Closely Held

UPPER CASE 4

Zip Code: Zip Code:

VAR EGC Service Fees

Times NewTimes Roman Version: Software: VAR Manufacturer: VAR Lock BalancesAfter: Beginning: Applied: Fee Amount:

- same Apply - all tostates? Fee - Merchant percharged Transaction CardsCustomare- required

Service Fees Sub S Corp lower case

Monthly $

(Cardholder on chargedunused balances)

Monthsafter last Transaction date

r o As submitted )

Government

TIN Security TIN (Social#): ID TIN (Employer#): Quarterly less 60 less thanmonths)

Monthsof (default 72non-usemonths, be cannot

Y

N (if completeno, N (if for each state) (Assn/Estate/Trust)Other Annually

Partnership General $ (If LLC, LLC, indicateplease(If Cor D, P) 0.12

Elavon 042011

(cannot be less 12 mos) be than (cannot

X

Submitted Personal Guaranty Use OnlyOffice By Merchant Representations and Certifications Accepted by Member: by Accepted Elavon, Inc.: by Accepted RepX Signature: Sales were signatures bytheprovidedMerchant’s owner(s)asappropriate. orofficer(s), themy certifybest Toof theknowledge, I information that in providedApplication this Merchantwas byandthe provided Merchant completeaccurate.true,is and I thethat further certify X Signature: X Signature: undersigneduponofthe requestof successors designees, Elavon or any its agreesall or assigns andthat are involved theparties FairCredit in compliance with Act.Reporting receiveGuarantor(s)benefitno additional the guaranty.from The undersigned herebyconsumerreportingdirects any furnishagency reportto relates thata consumer credit thepersonally to Guarantor(s) successors. theinducementunderstandthat accept usto Applicationto this Merchantisconsideration theguarantyfor and thisguaranty thatforceremains and in even full effect the if guaranteewillnot be discharged theor affected Guarantors,ofby the death heirs,willbindall administrators, representativesand may be assigns and of theenforced ofbenefit by or for any our directly firstmay proceed withoutagainst Guarantor(s) ourexhausting other remedies personagainst any orentity responsible them oranytotherefore Thissecurity held by us or Merchant. Leased applicable)Equipment, with if Applicationthe Merchantandpursuant to asmayAgreement,be timeto fromamended with notice. time, or without understandfurtherGuarantor(s)that we guaranteethecontinuing full faithful andand performance of byMerchantits payment ofobligations eachand usduties(including, withoutto connectionChargebacks obligations limitation, and in inducement aprimary acceptAs us to Application,to this Merchant the undersignedGuarantor(s), Application, the Merchantby signing severally,jointly andunconditionally irrevocably, and Signature: X Signature: X Signature: * Transaction.not receive thata Chargeback for aTransaction. of an paymentReceipt of authorization does code merchant that not mean will understandsthat Merchantauthorization code an acceptancenot a guaranteeofis or asignedApplication shall constitute original. byafacsimiletransmission,and accomplished facsimile orcopy this Merchant a signed of DeliveryexecutedApplication. Merchantofcounterparts of Application this Merchantmaybe an constitute originalall takenand which, oftogether, one shall constitute thesame and Application inMerchantmayThis be ormore one signed each counterparts, whichshallof credit inquiriestoanswer those and information that us.furnish to authorizesalso Merchant reporting any person compileagencyor credit to information to necessaryto consider and review the acceptance Application.continuation thisMerchant of reports obtain orother credit onbackground ofinvestigation eachreports we them that anyrepresentativeand other partners, officers,Merchant, ownersproprietors, and/orof to and theindividual investigate andbusiness and history background Merchant, ofsuch each ourto acceptance us prior Application thisMerchantand of timethereafter,timeto tofrom documentsallowidentifyingtoidentify ustoand Merchant representative(s)authorizeyou. its openspersonaneachwho informationaccount. certainwe meansask forThis will and requires institutionsfinancialtolaw alland verify, obtain, information record identifies that help the Togovernment of and fight the funding activities,terrorism launderingmoney Federal NEW OPENING A ACCOUNT. ABOUT FOR PROCEDURES INFORMATION IMPORTANT termination. termination applicable of (60) Merchant’s fee writtenwithin sixty of days ofreceipt notice best efforts debit termination. use to Elavon will thethe in Merchant’s accountof the amount butrather innot a penalty,of reasonable light is harm the financial caused by Merchant’s early allin amounts$195,to addition agreesother Merchantthat owed. termination the early fee is set date below,willpay,theasforthMerchantliquidated damages,a termination to fee equal amounts terminatesother IfMerchant owed.the any second oratthird time during year the of Elavon, damages,pay an as liquidated termination early feeequal in $295,to additionto all withinoneterminates of Merchant If set year willimmediatelythe date below,Merchant forth haveApplication, meaningMerchant to the same TOSand ascribed them in MOG. of termination terms services. processing unless Capitalized otherwise inshall, thisdefined regulationsthePaymentandof Networks, understandsthat and willresult comply failure toin with all complyand the andAgreement, laws, applicabletherules, rules regulations including center.Notwithstanding servicesuch of non-receipt agreesany Merchantto or MOG,the TOS accessnot haveview does tocontact our our ator MOG the website TOS please customer and ourlocatedandat website at OperatingtheMerchantandGuidethe TOS bythisreference(“MOG”) incorporated herein incontainedconditions theAgreementlimitation, including,thisMerchant without Application, shallbeus, Transaction to theMerchant’s acceptance agreement and theofterms to and ortheApplication,transmission Merchant aTransaction ofReceipt or other of evidence a terms. Theauthorizedreview signature such by an Merchant therepresentativeof on set conditions and Service in ofhadforth the haveopportunityTerms and(“TOS”) an to its and Merchant representative(s)agreetheLeasedthat thetermsEquipment to subjectis ApplicationtheAgreement.Merchantand below,if bysigningFurther, equipment, leasing Applicationthis Merchantare toauthorized duly all tothis bind Merchantof provisions and owners, condition, principal partners, Merchant; or officers of(ii) andthe persons signing Application”)complete(“Merchantistrue and reflectsthebusiness, financialproperly “we” (i)all or “us”)(collectively, thatprovided this merchant information in application officesat asapplicable), “Member” TN with 7300 Highway, Chapman 37920 Knoxville, its and(“Merchant”) representative(s)representwarrant andInc. Elavon, (“Elavon”to or Representations Merchant By Certifications. andbelow,merchant the signingapplicant The requireInternal not documentthancertificationsServiceyour requiredavoidwithholding. Revenuedoesotherthe of to backup this any provision consent to https://www.merchantconnect.com/CWRWeb/pdf/MOG_Eng.pdf What Happens Next?What https://www.merchantconnect.com/CWRWeb/pdf/TOS_ENG.pdf Printed Name:Printed Name:Printed Name: Printed Name: Printed ,respectively.IfMerchant Printed Name:Printed 5

Marian Feldman requestedconsumerreportingfrom agencies. willincludeSuch information andthe name and to medirectly, Affiliates orinform through the entityof above, about reports theyhave me that otherfor purposeparties bylaw.any permittedI authorize direct agentsAXP, and Elavon,AXP reporting agencies, disclosingtoandsuch agent, information Affiliatestheir subcontractors, and exchange about information including me personally, by requestingreports consumer from defined toin Agreement, in the AXP verify the thisinformation application receiveandand Express Services ("AXP")AXP'sandTravel agents and Related Company, Inc. Affiliates, as informationhereinprovided complete, istrue, accurate. I Elavonand and authorize American bytheAmerican Express® AcceptanceAgreement”),CardAgreement (“AXP all that and amauthorized and thisapplicationsign to theabovesubmit for entity whichagrees to bound be AmericanExpress AcceptanceAgreement domestictrust(as301.7701-7).* sectioninRegulations defined States ofUnited lawsunder than theStates, estateor the or (othera foreignestate),an a partnership,company, created corporation, associationor United or the in organized U.S.if aindividual U.S.person you isU.S. an citizen, are:or who resident alien, a 3. aU.S. U.S.I tax are citizen other am person. For purposes, or federal a you considered and(c)the that amtowithholding, hasnotified longersubject backup noIRS me I as backup interest asubject resultdividends,of to or a failureor report all withholding to Internal IServiceor the notified Revenue(IRS) withholding, have by been I (b) not that am because: am backup from2. backup subject notexempt (a) I I withholding to am abe number waiting for I to issuedme), and (or am to thison is1. correct Merchant taxpayershown The Application number my identification Underpenaltiesperjury, certifies Merchant of that: LeasedEquipment. $50.00for tracking billing the administration,andtaxes andcertain of charges therelated to Ifleasing Merchant equipment, pay agrees an to “Lessor”amount feeannualin exceed an not to Program coveragefor Overview conditions.detailsand followingaccount PCI andapprovalSee Compliancecompliance DSS thevalidation.PCI provided validationof Merchant with eligible Datacompliance. forCoverage may be Breach account willbe charged approval, non-compliancea monthly$29.95 feeofuntil Elavon is (90) days approval,account of orin orbefore years subsequent on date the anniversary of designatedbyElavon. thatAny merchantnot validated has DSScompliancewithinninetyPCI useof the services attestanother qualified andPCI theassessortowebsite validation DSS on annuallyin years.subsequentAnnual FeeAdministrationof towillbe $35 charged thatmerchants Elavonwillwaivethisfeefor after of months six the date approval, account thechargingfee that theservices use thequalified of third with Elavonparty assessorhas whom partnered. merchant and Elavonlocations ofto then-current willbecost charged the services, merchants to AnnualFeeof to PCI merchant up based$175 per number,on account numberconnectivity,of PCI Administration Fee or the Annual below. Fee described later than after (90) ninety willbedays approval. Merchantaccount charged theAnnual either volume)to PCI an validate compliance basis,DSS annual on validation towith no initial occur Standards(“PCI Elavonrequires DSS”). Level(determined4merchants Transaction based on Allmust merchants with thePaymentcomply the ofrequirements Industry Data Card Security boundAgreement.bytheAXP of indicatinggoods services, its and/or to or otherwise bound, theintention entityagrees be to be mayterminate acceptingAgreement. By the AXP the AmericantheExpress purchase for Card entitymaybe enrolled in standardacceptance American Express’sCard and program, the entity pay). understand theentityI doesif that the not qualify Elavon forservicing theprogram that standardCard programwhichhas acceptance terms different different servicing (e.g. speeds of materialswelcomingprogramit,tofor either AXP perform AXP's Elavon forto services or AXP's AXP'sofapproval sent acopy thethe application, AXP the be entity ofwill Agreement and consumerreporting foragencies purposes.administrativemarketing understandand I uponthat addressof the agency the alsofurnishing report. AXP I authorize from use to the reports SSN#: SSN#: Title: Title: Rep Rep ID #:

- By - below,I signingandI represent readthat have 24677 Elavon 042011 Date: Date: Date: Date: Date: Date: Date:

Thank you for choosing us as your payment processor. We look forward to providing you with the best customer service in the industry.

Below are the steps that will be taken to get you up and running quickly.

1. Application and Credit Underwriting Your application will be sent to our Operations center for processing. It will be checked for completeness and accuracy. Our credit underwriting specialists will review the information provided, perform the necessary analysis, and approve or decline the application. We will contact you within 24-72 hours if we need you to provide additional information.

2. Deployment Once your application is approved and entered into our systems, our deployment team will prepare any equipment or software for shipment. You should receive your package within two-five days, depending on the method of shipping selected. Look inside the box for your Getting Started Kit — it contains a packing list, your Merchant Identification Number (MID), support materials, and information about training and service.

3. Training Once you receive your package, please call the training at 866-451-4007 to speak with one of our representatives. If we don’t hear from you, we will contact you to schedule a session. The session will cover information about credit card processing, how to set up use your processing terminal or software solution, and where to find helpful information.

4. PCI Compliance Validation Process Complete your Payment Card Industry Data Security Standard (PCI DSS) validation. Visit our PCI website, http://pci.elavon.com, for education and tips on protecting cardholder data. You can also connect with our Visa® and MasterCard® accredited Qualified Security Assessor (QSA) and Approved Scanning Vendor (ASV). You must provide a certificate of compliance validation within ninety days (90) of account approval to avoid a monthly non-compliance fee.

5. Communications You will receive an email from Elavon that contains helpful information about processing with us, as well as a quick link to MerchantConnect, our free online support tool. You will also receive a survey that will ask you to score us on a number of factors. We value your feedback, and ask that you kindly take two minutes to rate the sales process, training process, and overall level of service. We will periodically send you information to keep you informed about things that impact your business.

6. Service Help is always just a phone call away — we operate a 24/7 call center. Call 800-725-1243 to talk with a representative. For free online access to your account, go to https://www.merchantconnect.com. You can view your statement, display recent deposits, view chargeback and retrieval requests, access customer support, and much more.

Thank you for your business. We look forward to providing you the very best in service.

6 Elavon 042011