AMIS H627, SUPPLEMENTAL PROBLEMS

SP1: Choose the best response.

1. Which of the following has primary responsibility for the fairness of the representations made in financial statements? (a) client’s management. (b) independent auditor. (c) audit committee. (d) AICPA. (e) PCAOB.

2. Which of these organizations is designated to issue attestation standards? (a) American Institute of Certified Public Accountants. (b) Governmental Accounting Standards Board. (c) Financial Accounting Standards Board. (d) General Accounting Office.

3. Rothermel & Co., CPAs, policies require that all members of the audit staff submit weekly time reports to the audit manager, who then prepares a weekly summary work report regarding variance from budget for Rothermel's review. This provides written evidence of Rothermel & Co.'s professional concern regarding compliance with which of the following generally accepted auditing standards? (a) Quality control. (b) Due professional care. (c) Adequate review. (d) Adequate planning.

4. An independent auditor should design the audit to provide reasonable assurance of detecting errors and fraud that might have a material effect on the financial statements. Which of the following, if material, would be an example of fraud as defined in Statements on Auditing Standards? (a) Misappropriation of an asset or groups of assets. (b) Clerical mistakes in the accounting data underlying the financial statements. (c) Mistakes in the application of accounting principles. (d) Misinterpretation of facts that existed when the financial statements were prepared.

5. If an independent auditor's examination leading to an opinion on financial statements causes the auditor to believe that material misstatements exist, the auditor should (a) consider the implications and discuss the matter with appropriate levels of management. (b) make the investigation necessary to determine whether the misstatements have in fact occurred. (c) request that management investigate to determine whether the misstatements have in fact occurred. (d) consider whether the misstatements were the result of a failure by employees to comply with existing internal control procedures. 2 SP2:

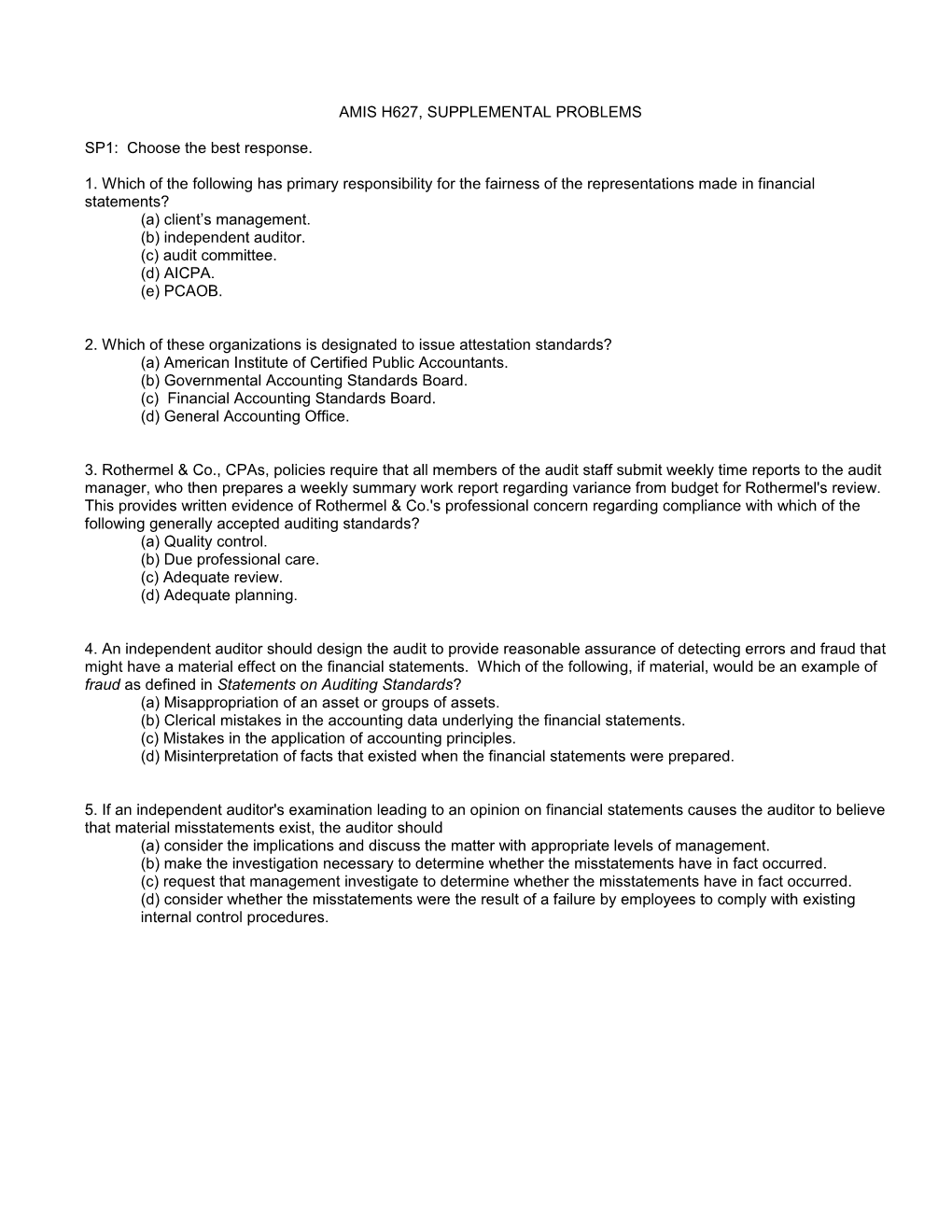

Part A Your comparison of the gross margin percentage for Baker Pharmacy for the years 20X3 through 20X6 shows a significant decline:

20X6 20X5 20X4 20X3 Sales (thousands) $14,211 $12,916 $11,462 $10,351 Cost of Goods Sold (thousands) 9,223 8,266 7,313 6,573 Gross margin $ 4,988 $ 4,650 $ 4,149 $ 3,778 Percentage 35.1 36.0 36.2 36.5

A discussion with Susan Adams, the controller, brings to light two possible explanations. She informs you that the industry gross profit percentage in the retail drug industry declined fairly steadily for three years, which accounts for part of the decline. A second factor was the declining percentage of the total volume resulting from the drug part of the business. The drug sales represent the most profitable portion of the business, yet the competition from discount drugstores prevents it from expanding as fast as the nondrug items such as magazines, candy, and many other items sold. Adams feels strongly that these two factors are the cause of the decline. To investigate the controller's explanation, you gather the following information from independent sources and the client's records:

Industry Drug Nondrug Drug Cost Nondrug Cost Gross Profit Sales Sales of Goods Sold of Goods Sold Percentage

20X6 $5,126 $9,085 $3,045 $6,178 32.7 20X5 $5,051 $7,865 $2,919 $5,347 32.9 20X4 $4,821 $6,641 $2,791 $4,522 33.0 20X3 $4,619 $5,732 $2,665 $3,908 33.2

The industry is defined as "retailers of drugs and related products."

Required: Evaluate the explanation provided by Adams, showing calculations to support your conclusions. What are the ramifications for the audit plan of your analysis?

Part B For your current audit, you perform ratio and trend analysis. Evaluate the effect of each of the following findings on the audit plan.

1. Commission expense as a percentage of sales has stayed constant for several years but has increased significantly in the current year. Commission rates have not changed.

2. The rate of inventory turnover has steadily decreased for four years.

3. Inventory as a percentage of current assets has steadily increased for four years.

4. The absolute amounts of (1) depreciation expense and (2) depreciation expense as a percentage of gross fixed assets are significantly smaller than in the preceding year. 3 SP3:

Part A The following are misstatements that have occurred in one of your clients, a retail and wholesale grocery company.

1. A vendor's invoice was paid twice for the same shipment. The second payment arose because the vendor sent a duplicate copy of the original invoice two weeks after payment was due.

2. Employees in the receiving department took sides of beef for their personal use. When a shipment of meat was received, the receiving department filled out a receiving report for the amount of goods actually received and forwarded the report to the accounting department. At that time, two sides of beef were put in an employee's pickup truck rather than in the storage freezer.

3. A salesperson sold an entire carload of lamb at a price below cost because she did not know the cost of lamb had increased in the past week.

4. On the last day of the year, a truckload of beef was set aside for shipment, but was not shipped. Because it was still on hand, it was counted as inventory. The shipping document was dated the last day of the year, so it was also included as a current-year sale.

Required: For each item, suggest a control procedure that would correct the deficiency. If the deficiency is not corrected, identify the audit objective for which your assessment of control risk would be affected.

Part B Following are partial descriptions of internal control structures.

1. When Mr. Clark orders materials for his machine-rebuilding plant, he sends a duplicate purchase order to the receiving department. During the delivery of materials, Mr. Smith, the receiving clerk, records the receipt of shipment on this purchase order. After recording, Mr. Smith sends the purchase order to the accounting department, where it is used to record materials purchased and accounts payable. The materials are transported to the storage area by forklifts. The purchased quantities are recorded on storage records.

2. Every day hundreds of employees clock in using time cards at Generous Motors Corporation. The timekeepers collect these cards once a week and deliver them to the computer department. There the data on the cards are entered into the computer. The information entered into the computer is used in the preparation of the labor cost distribution records, the payroll journal, and the payroll checks. The treasurer, Mrs. Webber, compares the payroll journal with the payroll checks, signs the checks, and returns them to Mr. Strode, the supervisor of the computer department. The payroll checks are distributed to the employees by Mr. Strode.

3. The smallest branch of Connor Cosmetics in South Bend employs Mary Cooper, the branch manager, and her sales assistant, Janet Hendrix. The branch uses a bank account in South Bend to pay expenses. The account is kept in the name of "Connor Cosmetics--Special Account." To pay expenses, checks must be signed by Mary Cooper or by the treasurer of Connor Cosmetics, John Winters. Cooper receives the canceled checks and bank statements. She reconciles the branch account and files canceled checks and bank statements in her records. Monthly, she prepares reports of disbursements and sends them to the home office.

Required: (a) List weaknesses in internal control for each of the above. (b) State the type(s) of misstatement that may occur. (c) Suggest how the internal control could be improved. 4 SP4: Gale Brewer, CPA, has been the partner in charge of the audit of Merkle Manufacturing Company, a client listed on the Midwest Stock Exchange, for 13 years. Merkle has had excellent growth and profits in the past decade, primarily as a result of the excellent leadership provided by Bill Merkle and other company executives. Brewer has always enjoyed a close relationship with the company and prides himself on having made several constructive comments over the years that have aided in the success of the company. Several times in the past few years, Brewer's CPA firm has considered rotating a different audit team on the engagement, but this has been strongly resisted by both Brewer and Merkle. For the first few years of the audit, the internal control structure was inadequate and the accounting personnel were not well qualified for their duties. Extensive audit evidence was required during the audit, and numerous adjusting entries were necessary. However, because of Brewer's constant prodding, the internal control structure improved gradually and competent personnel were hired. In recent years, there were normally no audit adjustments required. During the past three years, Brewer was able to devote less time to the audit because of the relative ease of conducting the audit and the cooperation obtained during the engagement. In the current year's audit, Brewer decided the total time budget for the engagement should be kept about the same as in recent years. The senior in charge of the audit, Phil Warren, was new on the job but highly competent, and he had a reputation of being a fast worker. The fact that Merkle had recently acquired a new division through merger would probably add to the time, but Warren's efficiency would compensate for it. The interim tests of the internal control structure took somewhat longer than expected because of the use of several new assistants, a change in the accounting system to computerize the inventory and several other aspects of the accounting records, a change in accounting personnel, and the existence of a few more errors in the tests of the system. Neither Brewer nor Warren was concerned about the budget deficit, however, because they could easily make up the difference at year-end. At year-end, Warren assigned responsibility for inventory to an assistant who also had not been on the audit before, but was competent and extremely fast at his work. Even though the total value of inventory increased, he reduced the sample size from that of other years because there had been few errors the preceding year. He found several items in the sample that were overstated due to pricing errors and obsolescence, but the combination of all the errors in the sample was immaterial. He completed the tests in 25 percent less time than the preceding year. The entire audit was completed on schedule and in slightly less time than the preceding year. There were only a few adjusting entries for the year, and only two of them were material. Brewer was extremely pleased with the results and wrote a special complimentary letter to Warren and the inventory assistant. Six months later, Brewer received a telephone call from Merkle and was informed that the company was in serious financial trouble. Subsequent investigation revealed that the inventory had been significantly overstated. The major cause of the misstatement was the inclusion of obsolete items in inventory (especially in the new division), pricing errors due to the new computer system, and the inclusion of nonexistent inventory in the final inventory listing. The new controller had intentionally overstated the inventory to compensate for the reduction in sales volume from the preceding year.

Required: (a) List the major deficiencies in the audit and state why they took place. (b) What things should have been apparent to Brewer in the conduct of the audit? (c) If Brewer's firm is sued by stockholders or creditors, what is the likely outcome?

SP5: Choose the best response. 1. Auditors sometimes use comparison of ratios as audit evidence. For example, an unexplained decrease in the ratio of gross profit to sales may suggest which of the following possibilities? (a) Unrecorded purchases. (b) Unrecorded sales. (c) Merchandise purchases being charged to selling and general expense. (d) Fictitious sales.

2. A CPA is auditing the financial statements of a small telephone company and wishes to test whether customers are being billed. One procedure that the CPA might use is to (a) trace a sample of postings from the billing control to the subsidiary accounts receivable master file. (b) balance the accounts receivable master file to the general ledger control account. (c) check a sample of listings in the telephone directory to the billing control. (d) confirm a representative number of accounts receivable.

SP6: Choose the best response. 5 1. An auditor mailed accounts receivable confirmations to three groups as follows:

Group 1: Positive confirmations to wholesale customers Group 2: Negative confirmations to current (i.e., nondelinquent) retail customers Group 3: Positive confirmations to past-due retail customers

Confirmation responses for each group vary from 10 to 90 percent. The most likely response percentages are (a) Group 1--90 percent, Group 2--50 percent, Group 3--10 percent (b) Group 1--90 percent, Group 2--10 percent, Group 3--50 percent (c) Group 1--50 percent, Group 2--90 percent, Group 3--10 percent (d) Group 1--10 percent, Group 2--50 percent, Group 3--90 percent

2. The negative form of accounts receivable confirmation request is particularly useful except when (a) internal control surrounding accounts receivable is considered to be effective. (b) a large number of small balances is involved. (c) the auditor believes that the persons receiving the requests are likely to give them consideration. (d) individual account balances are relatively large.

3. Which of the following is the best argument against using negative confirmations of accounts receivable? (a) The cost per response is excessively high. (b) There is no way of knowing if the intended recipients received them. (c) Recipients are likely to feel that the confirmation is a subtle request for payment. (d) The inference drawn from receiving no reply may not be correct.

4. The return of a positive confirmation of accounts receivable without an exception attests to the (a) collectibility of the receivable balance. (b) accuracy of the receivable balance. (c) accuracy of the aging of accounts receivable. (d) accuracy of the allowance for bad debts.

5. A CPA obtains a January 10 cutoff bank statement for the client directly from the bank. Very few of the outstanding checks listed on the client's December 31 bank reconciliation cleared during the cutoff period. A probable cause for this is that the client (a) is engaged in kiting. (b) is engaged in lapping. (c) transmitted the checks to payees after year-end. (d) has overstated its year-end bank balance.

6. On December 31, 20X7, a company erroneously prepared an accounts payable transaction (debit cash, credit accounts payable) for a transfer of funds between banks. A check for the transfer was drawn January 3, 20X8. This error resulted in overstatements of cash and accounts payable at December 31, 20X7. Of the following procedures, the least effective in disclosing this error is review of the (a) December 31, 20X7, bank reconciliation for the two banks. (b) December 31, 20X7, check register. (c) support for accounts payable at December 31, 20X7. (d) schedule of interbank transfers. 6 SP7: During your observation of the November 30, 20X2, physical observation of Jay Company, you note the following unusual items. For each item, describe the additional procedures that you would perform.

1. Electric motors in the finished goods storeroom that are not tagged. Upon inquiry, you are informed that the motors are on consignment to Jay Company.

2. A cutting machine (one of Jay’s main products) in the receiving department, with a large REWORK tag attached.

3. A crated cutting machine in the shipping department, addressed to a nearby U.S. naval base, with a Department of Defense “Material Inspection and Receiving Report” attached, dated November 30, 20X2, and signed by the Navy Source Inspector.

4. A small, isolated storeroom containing five types of dusty raw materials. Inventory tags are attached to all of the materials, and your test counts agree with the tags.

5. A bunch of prenumbered tags in the waste basket. Upon inquiry and inspection, you find out that most of the prenumbered tags that had been incorrectly filled out are being destroyed and thrown away.

SP8: For each of the following independent situations, decide which type of audit opinion is appropriate.

1. Subsequent to the date of the financial statements as part of her postbalance sheet date audit procedures, a CPA learned of heavy damage to one of the client's two plants due to a recent fire; the loss will not be reimbursed by insurance. The newspapers described the event in detail. The financial statements and notes as prepared by the client did not disclose the loss caused by the fire.

2. A CPA is engaged in the examination of the financial statements of a large manufacturing company with branch offices in many widely separated cities. The CPA was not able to count the substantial undeposited cash receipts at the close of business on the last day of the fiscal year at all branch offices. As an alternative to this auditing procedure used to verify the accurate cutoff of cash receipts, the CPA observed that deposits in transit as shown on the year-end bank reconciliation appeared as credits on the bank statement on the first business day of the new year. He was satisfied as to the cutoff of cash receipts by the use of the alternative procedure.

3. For the past five years a CPA has audited the financial statements of a manufacturing company. During this period, the examination scope was limited by the client as to the observation of the annual physical inventory. Since the CPA considered the inventories to be of material amount and she was not able to satisfy herself by other auditing procedures, she was not able to express an unqualified opinion on the financial statements in each of the five years. The CPA was allowed to observe physical inventories for the current year ended December 31, 20X7, because the client's banker would no longer accept the audit reports. In the interest of economy, the client requested the CPA not to extend her audit procedures to the inventory as of January 1, 20X7.

4. A CPA has completed his examination of the financial statements of a bus company for the year ended December 31, 20X7. Prior to 20X7, the company had been depreciating its buses over a 10-year period. During 20X7, the company determined that a more realistic estimated life for its buses was 12 years and computed the 20X7 depreciation on the basis of the revised estimate. The CPA has satisfied himself that the 12-year life is reasonable. The company has adequately disclosed the change in estimated useful lives of its buses and the effect of the change on 20X7 income in a note to the financial statements. 7 SP9: Determine whether each of the following is a violation of the AICPA Code of Professional Conduct.

1. John Brown is a CPA, but not a partner, with three years of professional experience with Lyle and Lyle, CPAs, a one-office CPA firm. He owns 25 shares of stock in an audit client of the firm, but he does not take part in the audit of the client and the amount of stock is not material in relation to his total wealth.

2. In preparing a client's personal tax returns, Phyllis Allen, CPA, observed that deductions for contributions and interest were unusually large. When she asked the client for documentation to support the deductions, she was told, "Ask me no questions and I will tell you no lies." Allen completed the returns on the basis of the information acquired from the client.

3. A client requests assistance of J. Bacon, CPA, in the installation of a computer system to maintain production records. Bacon has no experience in this type of work and no knowledge of the client's production records, so he obtained assistance from a computer consultant. The consultant does not practice public accounting, but Bacon is confident of her professional skills. Because of the highly technical nature of the work, Bacon is not able to review the consultant's work.

4. Five small Chicago CPA firms have formed an interfirm working paper review program. Under the program, each firm designates two partners to review the working papers, including the tax returns and the financial statements, of another CPA firm taking part in the program. At the end of each review, the auditors who prepared the working papers and the reviewers have a conference to discuss the strengths and weaknesses of the audit. They do not obtain authorization from the audit client before the review takes place.

5. James Thurgood, CPA, stayed longer than he should have at the annual Christmas party of Thurgood and May, CPAs. On his way home he drove through a red light and was stopped by a policeman, who saw that he was intoxicated. In a jury trial, Thurgood was found guilty of driving under the influence of alcohol. This was not his first offense, so he was sentenced to 30 days in jail and his driver's license was revoked for one year.

6. Jane Wendal, CPA, set up a casualty and fire insurance agency to complement her auditing and tax services. She does not use her own name on anything pertaining to the insurance agency and has a highly competent manager, Frank Jones, who runs it. Wendal frequently requests Jones to review the adequacy of a client's insurance with management if it seems underinsured. She feels that she provides a valuable service to clients by informing them when they are underinsured.

7. Rankin, CPA, provides tax services, management advisory services, and bookkeeping services and conducts audits for the same client. Since the firm is small, the same person frequently provides all the services.

SP10: Jackson is a sophisticated investor. As such, she was initially a member of a small group that was going to participate in a private placement of $1 million of common stock of Clarion Corporation. Numerous meetings were held between management and the investor group. Detailed financial and other information was supplied to the participants. Upon the eve of completion of the placement, it was aborted when one major investor withdrew. Clarion then decided to offer $2.5 million of Clarion common stock to the public pursuant to the registration requirements of the Securities Act of 1933. Jackson subscribed to $300,000 of the Clarion public stock offering. Nine months later, Clarion's earnings dropped significantly. The stock dropped 20 percent beneath the offering price. In addition, the Dow Jones Industrial Average was down 10 percent from the time of offering. Jackson sold her shares at a loss of $60,000 and seeks to hold all parties liable who participated in the public offering including Allen, Dunn, and Rose, Clarion's CPA firm. Although the audit was performed in conformity with generally accepted auditing standards, there were some relatively minor irregularities. The financial statements of Clarion Corporation, which were part of the registration statement, contained minor misleading facts. Clarion and Allen, Dunn, and Rose believe that Jackson's asserted claim is without merit.

Required: (a) Assuming Jackson sues under the Securities Act of 1933, what will be the basis of her claim? (b) What are the probable defenses that Allen, Dunn, and Rose might assert given the above facts?