A Review of Different Approaches for Measuring Knowledge Value in Organizations

KAMRAN FATAHI, ABBAS AFRAZEH Department of Industrial Engineering Amirkabir University of Technology No. 424, Hafez Avenue, Tehran, Iran IRAN

Abstract: Organization’s knowledge is often created, stored, distributed and shared tacitly. Regarding this, quantifying and measurement and finally evaluation of knowledge has been become a very challenging and difficult problem in organizations. In this paper after classifying the available approaches in the literature, we review the main four approaches of measuring knowledge value which are mostly used and understood by academics and practitioners. These approaches are: 1) Macro and Micro approach in measuring knowledge value, 2) Individual and Organizational approach in measuring knowledge value, 3) Knowledge Audit approach in measuring knowledge value and 4) Knowledge project’s life cycle approach in measuring knowledge value. Since there are many goals in measuring knowledge value, the application domain of each approach is discussed and compared to each other.

Key-Words: Knowledge-Knowledge management-Knowledge value-Knowledge measurement-Organization’s knowledge

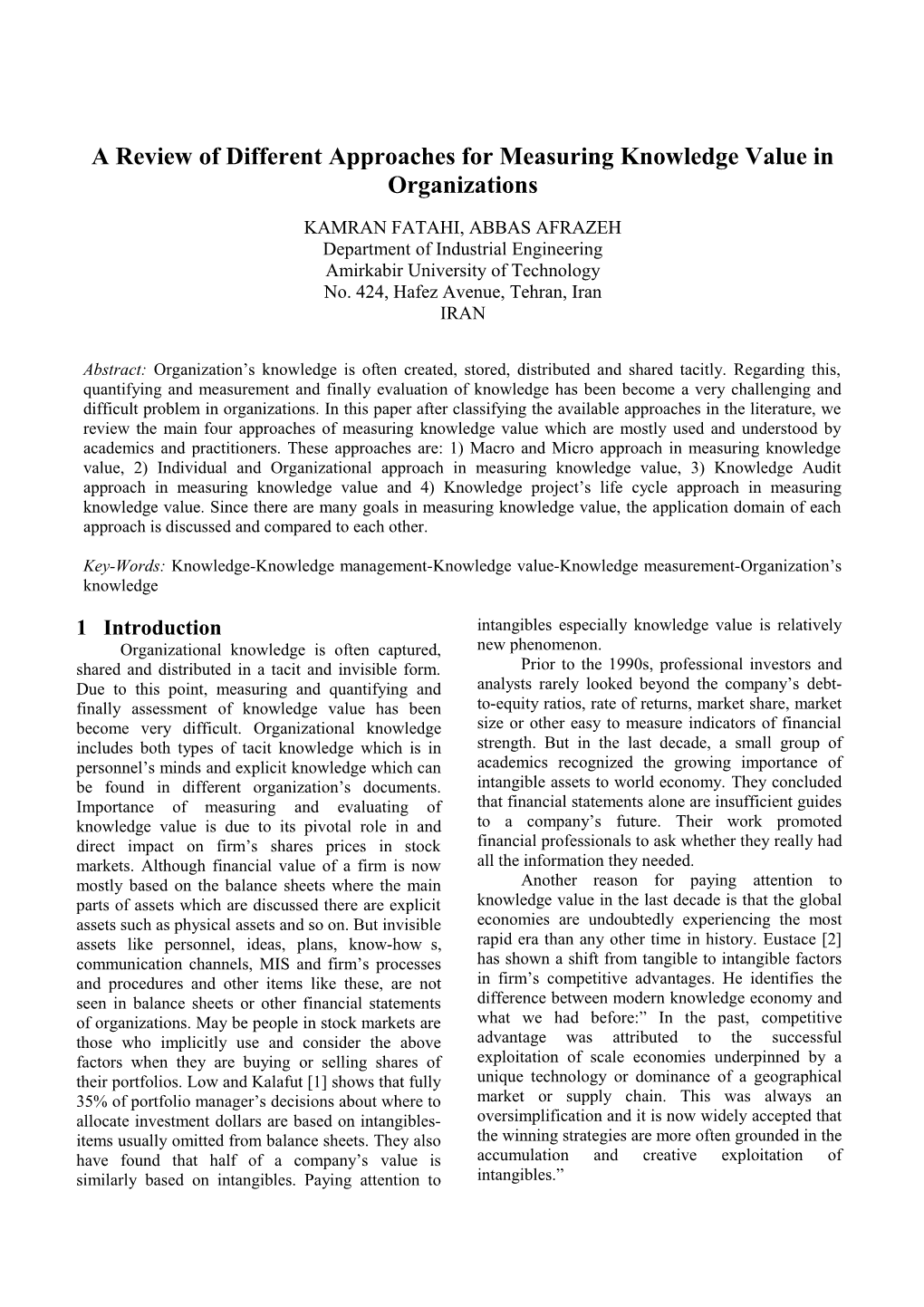

1 Introduction intangibles especially knowledge value is relatively Organizational knowledge is often captured, new phenomenon. shared and distributed in a tacit and invisible form. Prior to the 1990s, professional investors and Due to this point, measuring and quantifying and analysts rarely looked beyond the company’s debt- finally assessment of knowledge value has been to-equity ratios, rate of returns, market share, market become very difficult. Organizational knowledge size or other easy to measure indicators of financial includes both types of tacit knowledge which is in strength. But in the last decade, a small group of personnel’s minds and explicit knowledge which can academics recognized the growing importance of be found in different organization’s documents. intangible assets to world economy. They concluded Importance of measuring and evaluating of that financial statements alone are insufficient guides knowledge value is due to its pivotal role in and to a company’s future. Their work promoted direct impact on firm’s shares prices in stock financial professionals to ask whether they really had markets. Although financial value of a firm is now all the information they needed. mostly based on the balance sheets where the main Another reason for paying attention to parts of assets which are discussed there are explicit knowledge value in the last decade is that the global assets such as physical assets and so on. But invisible economies are undoubtedly experiencing the most rapid era than any other time in history. Eustace [2] assets like personnel, ideas, plans, know-how s, communication channels, MIS and firm’s processes has shown a shift from tangible to intangible factors and procedures and other items like these, are not in firm’s competitive advantages. He identifies the seen in balance sheets or other financial statements difference between modern knowledge economy and of organizations. May be people in stock markets are what we had before:” In the past, competitive those who implicitly use and consider the above advantage was attributed to the successful factors when they are buying or selling shares of exploitation of scale economies underpinned by a their portfolios. Low and Kalafut [1] shows that fully unique technology or dominance of a geographical 35% of portfolio manager’s decisions about where to market or supply chain. This was always an allocate investment dollars are based on intangibles- oversimplification and it is now widely accepted that items usually omitted from balance sheets. They also the winning strategies are more often grounded in the have found that half of a company’s value is accumulation and creative exploitation of similarly based on intangibles. Paying attention to intangibles.” Furthermore, the contribution of 2 Goals of measuring and evaluating manufacturing resources in value added has been knowledge value in organizations reduced while the contribution of knowledge assets There are many goals which one may want to has been increased. Adding to this, key knowledge measure or assess knowledge value. Briefly the main assets such as know-how s and leading business goals of measuring and evaluation of knowledge practices (and indeed entire business models) now value in organizations are as follow: migrate rapidly around the world on touch of a button. Value chains always had a limited lifetime in Finding the real value of an organization competitive markets, but now eroding much faster not only based on explicit financial assets than before. Hence, companies need an innovation but considering intangible values. machine to keep them one step ahead. Continuous Determining the productivity of different evolution and renewal of this capability is the main know ledges through an organization. preoccupation of corporate strategy today. After craft Valuing firm’s staff and determining their era and mass production era in the two last centuries, salaries in today’s organizations. the current era is called mass customization which Budget allocation to projects forces firms to be more flexible than before to meet Determining the amount of achieving customer’s demands. This leads firms to acquire organization’s strategic goals intelligent systems for planning and controlling their activities. Although firms unfortunately have not 3 Macro and Micro approach in understood well this importance of knowledge assets knowledge value evaluation yet, the contribution of knowledge management In the current business climate, there is a investments in firm’s budget has been increased. growing need to spell out the concrete impact of Researches done by Hill and Youngman [3], knowledge projects on business performance. Youngman [4] and Nakamura [5] approved our There are two different approaches in arguments: measuring and evaluation of knowledge value with Investment in knowledge intangibles is respect to level of analysis: macro and micro now a substantial budgetary outlay for approach [6]. national economies, firms and individuals. Hill and Youngman [3] estimate that 3.1 The macro view: intangible investment in order of 10% of Quantifying the intangible assets of an the GDP of the developed economies goes organization by using tools such as the Balanced unrecorded as such. Scorecard, score boards, indexes and ‘navigators’. Creative occupation in the US rose from According to Karl-Erik Sveiby [11] the concept of 1.9% of the total in 1950 to 5.8% in 2000 intangible assets attempts to capture the value of (Nakamura) human capital, competencies, customer relationships, Knowledge workers are the fastest employee collaboration or diversity in an growing segment of the OECD s labor organization. On the basis of these concepts, tools force, with an average annual growth rate such as the Skandia navigator have been created to of 3% during the 1990s. serve as strategic and monitoring device. 70-90% of the value generated by the The main benefit of macro approaches is that corporate sector is attributable to they allow an organization to consider performance intangibles and lies outside the scope of indicators that are not purely financial. This is based our existing measurement and tracking on the assumption that the ultimate performance of a systems. By the 1998 only 15% of the S&P company is down to its intangible assets. By 500s market value was attributed to contrast, most financial indicators essentially refer to tangible assets, compared to 62% in 1982. past performance and therefore reflect outcomes rather than the value-generating drivers in an The rest of paper is as follows. In section 2, organization. the goals of measuring and assessment of knowledge 3.2 The micro view: value will be stated. In sections 3 to 6, the four main In micro approach knowledge value will be approaches of knowledge value measurement and measured through evaluation of knowledge projects evaluation are discussed and finally section 7 and their impacts on other parameters in includes the conclusion. organizations. Thus in this approach a casual loop is constructed and then the impacts of knowledge proposed over a century ago about the value of projects on economic drivers of organization will be capital and labor. determined. These theories claim that only capital assets Causal loop diagrams show the cause and increased the productivity of labor. Consequently, effect structure of a system through the relationships the productivity of an enterprise is measured only in between its key parts. These diagrams can help us terms of the productivity of its capital, such as understand complicated relationships where many Return-on-Assets or Return-on-Investment. The factors interact and there are few, if any, simple providers of capital are then entitled to the surplus, linear cause effect relationships. Causal loop called profit or rent. If knowledge happens to be diagrams were popularized by the Systems Thinking necessary for labor to make better uses of capital, field where they are an important component of that becomes the justification for a higher wage rate viewing an organization as a total entity rather than for labor. By this reasoning, those performing the as independent units. For example the following actual labor are not entitled to collect rent from the model can represent the relationship between knowledge they have accumulated. Labor can intangible assets and firm value. receive only fair compensation for the time worked.

Variable Resources/Capabilities/ Value construct Value variable Governance constructs

TechnologyTechnology Ability Ability ResourcesResources and and Reputation Reputation CapabilitiesCapabilities

PoliciesPolicies and and procedures procedures

AccountingAccounting systems systems Operational-levelOperational-level governance Valu CommunicationCommunication governance Market/bookMarket/book mechanisms mechanisms e ratioratio EmployeeEmployee contingent contingent pay pay

BoardBoard insiders insiders Board stock ownership Board stock ownership HighHigh level level governancegovernance CEOCEO contingent contingent pay pay mechanismsmechanisms

OutsideOutside block block holders holders

Fig. 1 Value creation model [7]

4 Individual and corporate point of The most they are allowed to claim is to be awarded premium wages and a bonus here or there. view approach The above reasoning is not only misleading, but results in judging the value of employees on the Indiscriminate discarding of knowledge assets, basis of their wages, rather than how fast they whether in the form of accumulated employee accumulate useful knowledge. The productivity of training or legacy software, has origins in ideas labor is not only a matter of wages. Productivity comes from knowledge capital aggregated in the employee's head in the form of useful training and something for which they have spent untold hours company-relevant experience. listening and talking while delivering nothing of Increasing in useful knowledge related to tangible value to paying customers. Their brains firm's activities and its value can be viewed at have become repositories of an accumulation of individual and organizational points of view [8]. insights on how "things work here" - something that is often labeled by the vague expression "company 4.1 The individual point of view: culture." Their heads carry a share of the company's We describe this approach by illustrating an knowledge capital, which makes them a shareholder example. Suppose you hire an untrained person who of the most important asset a firm owns even though meets entry level requirements, such as literacy, a it never shows up on any financial reports. Using this work ethic and socially acceptable behavior traits. approach, companies can calculate the overhead they His or her wage will be based on prevailing wage pay compared with increase in productivity of their rates for entry level skills. Ten years later, that personnel. In this case they can evaluate knowledge person becomes a manager or expert, earning three capital of the organization in order to give the right times the entry level wages. How does a firm justify direction on knowledge investments in their spending three times more on the identical person? organizations. This can be done by adding some Another example may be the difference between two additional elements to balance sheets showing people with approximately same resume and seven knowledge capital of people and organization. years of experience but one of them has two years of experience more than the other in our organization. Should their salaries be the same? 5 Knowledge audit approach in The accumulation of company-specific knowledge value evaluation knowledge explains the difference. During those ten As said before, Knowledge value has pivotal years, the organization invested anywhere from a contribution in total firm's value and then they year's to several years of salary in helping the should be measured in order to identify the employee to function more effectively. Hardly any of knowledge value. Accounting for all the intangible that expense shows up as a direct cost. Most of it is assets, and intellectual property such as: human in the form of attending meetings, having phone capital, customer capital, patents and brands is conversations, keeping up with company gossip and paramount in the new economy. These intangibles making errors which, if corrected, can be charged to must be properly included in the corporate financial learning. None of that contributes to anything the accounts. Intangible-knowledge-assets accounting customer is willing to pay for. For the second must now show the corporate value of knowledge by example again we have a situation in which one of demonstrating how it is, or how it can be, converted our employees is more familiar with firm procedures into purchasable goods and services: for instance, the and may have more productivity than the other one. innovation elements of the modern automobiles. This In the eyes of employee, he would learn new skills is the purpose and role of knowledge management. by company's investments in addition to what he The problem is that, intangible assets are not easy to promotes himself by reading books or going to quantify, measure and value. The universally seminars. If a corporation's investment in people acknowledged difficulties encountered in attempting increases the value of people faster than their to quantify and measure corporate knowledge-value salaries, everybody gains. Thus if the knowledge of offers a strong case for the knowledge audit. The the employee makes him more marketable he would knowledge audit (K-Audit) is a systematic and learn it and the value of organization as a function of scientific examination and evaluation of the explicit value of its people will get higher. This is the view of and tacit knowledge resources in the company [9]. corporate on organization knowledge value which is The K-Audit investigates and analyses the current described in the next section. knowledge-environment and culminates, in a diagnostic and prognostic report on the current 4.1 The corporate point of view: corporate ‘knowledge health’. The report provides In this approach the organization knowledge evidence as to whether corporate knowledge value value comprises the total knowledge value besides potential is being maximized. their people and so when an employee who leave the In this respect the K-Audit measures the risk workplace every night, may never return while and opportunities faced by the organization with storing in their heads knowledge acquired while respect to corporate knowledge. A K-Audit receiving full pay. Furthermore they possess therefore, contributes to the company’s improvement of its market and financial value by providing life cycle. In the earliest stages of knowledge researched, evidence-based information and management implementation, formal measurement knowledge as to the ‘real’, existing and potential rarely takes place, nor is it required. As KM becomes corporate wealth, most of which would remain more structured and widespread and companies hidden and under valued. All K-Audit methodologies move into stages two, three, and four, the need for should ensure measurement of the quantity and measurement steadily increases. As KM becomes quality of existing knowledge and the efficiency and institutionalized--a way of doing business--the effectiveness of current KM practices to determine if importance of KM specific measures diminishes, and knowledge value potential is being maximized. the need to measure the effectiveness of knowledge- Different knowledge audit models will place intensive business processes replaces them. different levels of emphasis on the key indicators and measurement. There are different K-Audit methodologies for the identification and valuation of corporate knowledge. Here we introduce Ann Hylton's STAGE 1: STAGE 2: STAGE 3: STAGE 4: STAGE 5: ENTER AND EXPLORE DISCOVER EXPAND AND INSTITUTIONALIZE methodology, the ©HyA-K-Audit, which places ADVOCATE AND AND SUPPORT KNOWLEDGE EXPERIMENT CONDUCT MANAGEMENT great emphasis on the quantification and PILOTS measurement of human knowledge capital, existing

I

m and potential. What follows is the methodology of p

o

r

t the ©HyA-K-Audit, of which there are three main a

n

c elements: e ©HyA-K-Audit K-Survey – collecting, collating, analyzing and measuring corporate knowledge data and information via the voice of the knowledge people. It Time includes Face-to-Face interviews ©HyA-K-Audit K-Inventory – stock-taking Fig. 2 KM measurement bell curve and measurement of tacit and explicit knowledge to determine the actual and potential knowledge wealth ©HyA-K-Audit K-Map – building and 7 Conclusion development of a corporate knowledge For the last two hundred years, neo-classical map of the structure and flow of economics has recognised only two factors of knowledge, highlighting who has what production: labour and capital. This is now changing. knowledge and how they disseminate and Information and knowledge are replacing capital and share knowledge in the corporate energy as the primary wealth-creating assets, just as knowledge community the latter two replaced land and labor 200 years ago. In addition, technological developments in the 20th century have transformed the majority of wealth- 6 Life cycle approach in knowledge creating work from physically-based to "knowledge- value evaluation based.". Technology and knowledge are now the key This approach is effective when we use it with factors of production. With increased mobility of a micro approach concurrently. In other words, information and the global work force, knowledge knowledge value will be identified by evaluating the and expertise can be transported instantaneously impacts of implementing knowledge management around the world, and any advantage gained by one (KM) projects on financial and performance company can be eliminated by competitive indicators in different stages of knowledge project improvements overnight. The only comparative lifecycle using measures and gauges [10]. These advantage a company will enjoy will be its process impacts can be shown in reports such as personnel of innovation--combining market and technology strength and capability with firm's processes, the role know-how with the creative talents of knowledge of captured knowledge in developing new products, workers to solve a constant stream of competitive brands and etc, length of customer lists. problems--and its ability to derive value from The need for measurement of KM follows a information. We are now an information society in a bell curve pattern through the life cycle of a business knowledge economy where knowledge management is essential. In addition, because knowledge largely resides with people, knowledge as a potential asset cannot be treated like a natural or man-made physical resource. This human-capital-asset must be carefully nurtured in order to extract the capital value from it. In this paper four major approaches for measuring and evaluating knowledge value were discussed. It is notable that those are not tools which one uses them in practice, but they are approaches which propose a set of tools. For example when we micro approach, system dynamics techniques a tool for modeling and evaluating knowledge value can be used. Also these approaches should be selected considering the objective of measuring and evaluating knowledge value.

References: [1] Low J. and Kalafut P. C., the Invisible Advantage, Optimize, June 2002. [2] Eustace C., A New Perspective on the Knowledge Value Chain, Presentation at the Autonomous University of Madrid, 25 November 2002. [3] Hill P. and Youngman R., PRISM Interim Report, WPS, 2002, Also Available at www.euintangibles.net [4] Youngman R., The Measurement of Intangibles in Macro-Economic Statistics, PRISM Final Report, 2003 and working paper at www.euintangibles.net [5] Nakamura L., What is the US Gross Investment in Intangibles, Proceedings of the 4th Conference on Intangibles, New York University, 2001 [6] Perkmann M., Measuring Knowledge Value: Evaluating the Impact of Knowledge Projects, KIN brief # 7, 2002 [7] Schnatterly K. and Marita C., Resources, Management Systems, and Governance: Keys to Value Creation, In Strategy Processes; Shaping the Contours of the Field by Charkravarthy B. et al, Oxford: Blackwell Publishing, 2003 [8] Strassmann P., Measuring and Managing Knowledge Capital, Knowledge Executive Report, 1999 [9] Hylton A., Measuring and Assessing Knowledge Value and Pivotal Role of the Knowledge Audit, Hylton Associates, 2002 [10] Lopez K. et al, Measurement of Knowledge Management, Knowledge Management, 2001 [11] Sveiby K., What is Knowledge Management?, article from www.sveiby.com, 1996