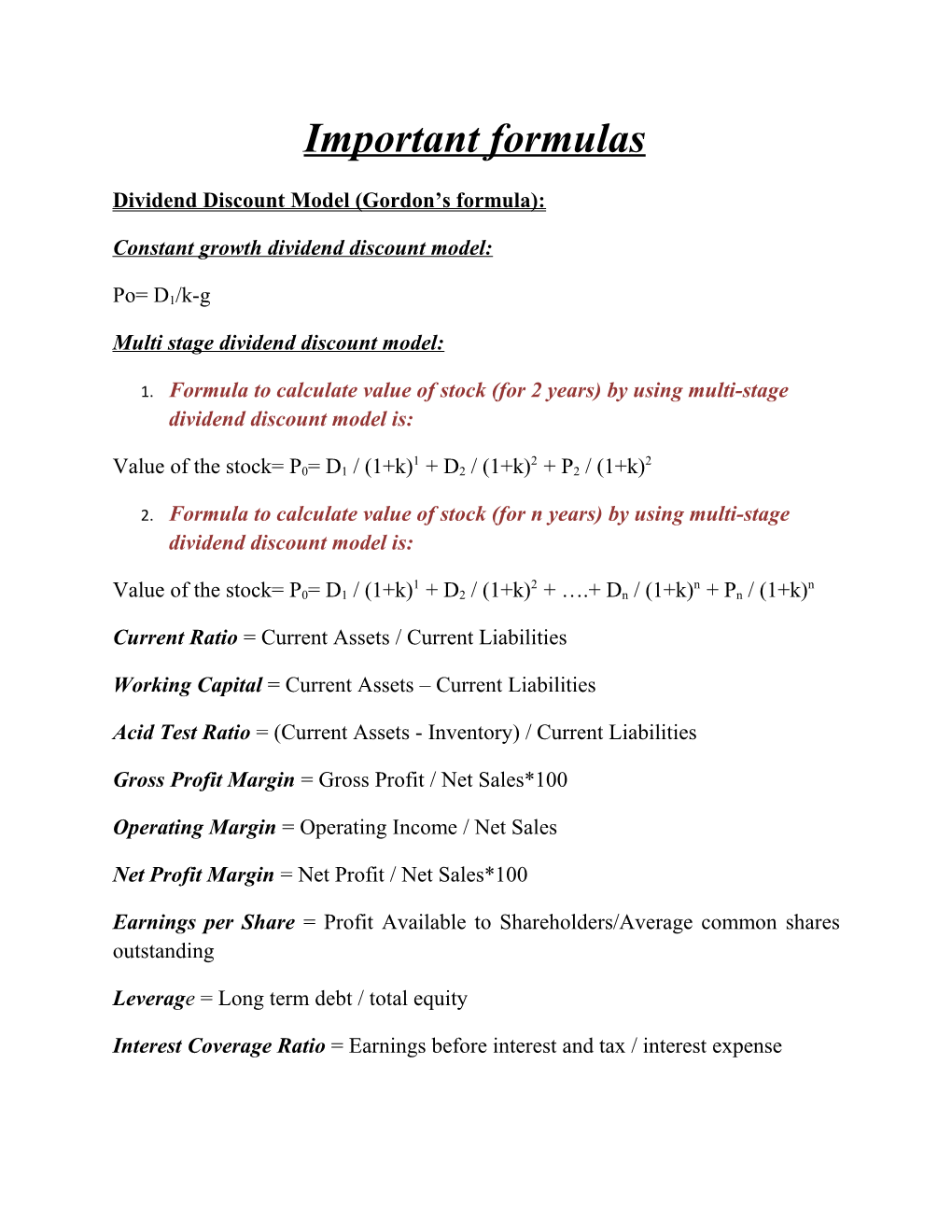

Important formulas

Dividend Discount Model (Gordon’s formula):

Constant growth dividend discount model:

Po= D1/k-g

Multi stage dividend discount model:

1. Formula to calculate value of stock (for 2 years) by using multi-stage dividend discount model is:

1 2 2 Value of the stock= P0= D1 / (1+k) + D2 / (1+k) + P2 / (1+k)

2. Formula to calculate value of stock (for n years) by using multi-stage dividend discount model is:

1 2 n n Value of the stock= P0= D1 / (1+k) + D2 / (1+k) + ….+ Dn / (1+k) + Pn / (1+k)

Current Ratio = Current Assets / Current Liabilities

Working Capital = Current Assets – Current Liabilities

Acid Test Ratio = (Current Assets - Inventory) / Current Liabilities

Gross Profit Margin = Gross Profit / Net Sales*100

Operating Margin = Operating Income / Net Sales

Net Profit Margin = Net Profit / Net Sales*100

Earnings per Share = Profit Available to Shareholders/Average common shares outstanding

Leverage = Long term debt / total equity

Interest Coverage Ratio = Earnings before interest and tax / interest expense DPS (dividend per share) = Dividends paid to Shareholders / Average common shares outstanding

Dividend Yield = Annual Dividends / Current Market Share Price

P/E = Current Market Share Price / EPS

ROE = Net income after taxes/Stockholder’s equity

Book value per share = Stockholder’s equity excluding preferred shares/No. Shares Outstanding

ROA (Return on Asset) = Net income after tax/ total assets

SUE (standardized unexpected earnings) = (Actual quarterly EPS – Forecast quarterly EPS)/ Standardization variable

Bond price = PV (interest) +PV (principal) = CCF [1-1/(1+r)n]/r

OR

2 n n Bond price = CF1/(1+r) +CF2/(1+r) +...+CFn/ (1+r) +PAR Value/ (1+r) Where:

CF1= coupon payment for first year

nd CF2= coupon payment for 2 year and so on

Effective annual rate = (1+ r/n)n -1

Where: r= yield to maturity n = number of payments per year

Semi-annual realized Compound Yield =

RCY =[total ending wealth / purchase price of bond] ½*n – 1.0 n

Macaulay Duration = D = Σ PV (CFt) * t / Market price i=1 Where: t = the time period at which the cash flow is expected to be received n = the number of periods to maturity

PV (CFt) = present value of the cash flow in period t, discounted at the yield to maturity.

Market price = the bond's current price or present value of all the cash flows

Holding period return = Ending value – Beginning value + Income

Beginning value

Total risk = General risk + Specific risk OR

= Market risk + Issuer risk OR

= Systematic risk + Nonsystematic risk

Total Return = TR = Any cash payments received + Price changes over the period

Price at which the asset is purchased

TR = CFt + (PE - PB)

PB = CFt + PC

PB Where:

CFt = cash flows during the measurement period t

PE = price at the end of period t or sale price

PB = purchase price of the asset or price at the beginning of the period PC = change in price during the period, or PE minus PB

Cumulative Wealth Index = CWIn = WI0 (1 + TR1) (1 + TR2) … (1 + TRn) Where:

CWIn = the cumulative wealth index as of the end of period n WI0 = the beginning index value, typically $1

TR1, n = the periodic TRs in decimal form

Total return in Domestic terms = RR x Ending value of foreign currency

Beginning value of foreign currency

Where:

RR= Return Relative

Arithmetic Mean = = ΣX

n Or the sum of each of the values being considered divided by the total, number of values n.

1/n Geometric Mean = G = [(1 + TR1) (1 + TR2)... (1 + TRn)] – 1

Inflation Adjusted Returns = TRIA = (1 + TR) - 1 (1 + IF)

Where:

TRIA = the inflation-adjusted total return IF = the rate of inflation

Standard Deviation =

Where:

X = each value in the set = the mean of the observations n = the number of returns in the sample s = σ = (σ2)1/2 = standard deviation Expected Return for a Security =

Where:

E (R) = the expected return on a security' th Ri = the i possible return th Pi = the probability of the i return Ri m = the number of possible returns

The variance of returns =

Covariance between securities = m

σAB = Σ [RA,i – E (RA)] [RB,i – E(RB)] pri i=1 Where:

σAB = the covariance between securities A and B

RA = one possible return on 'security A

E(RA) = the expected value of the return on security A , m = the number of likely outcomes for a security for the period

Relating the Correlation Coefficient and the Covariance: ρAB = σ AB / σA σB

Return (TR) on security i = Ri = αi + βiRM + еi

Where:

Ri = the return (TR) on security i

RM = the return (TR) on the market index:

αi = that part of security i’s .return independent of market performance

βi = a constant measuring the expected change in the dependent variable, Ri given a change in the independent variable, RM

еi = the random residual error;

Required rate of return on asset i= ki = Risk-free rate + Risk premium CAPM equation: ki = RF + βi [E (RM) - RF] Where: ki = the required rate of return on asset i

E(RM) = the expected rate of return on the market portfolio

βi = the beta coefficient for asset i Risk premium for security i = βi (market risk premium) = βi [E (RM) - RF]

Market value of a portfolio = Rp=VE -VB ⁄ VB Where:

VE is the ending value of the portfolio and VB is its beginning value.

Reward–to-variability ratio =RVAR = [TRp - RF] / SDp = Excess return / risk

Reward-to-volatility ratio = RVOL = [TRp - RF] / βp

Basis risk of futures= Cash price - Futures price

Stocks estimated value = V0 -/Estimated EPS x expected P/E ratio