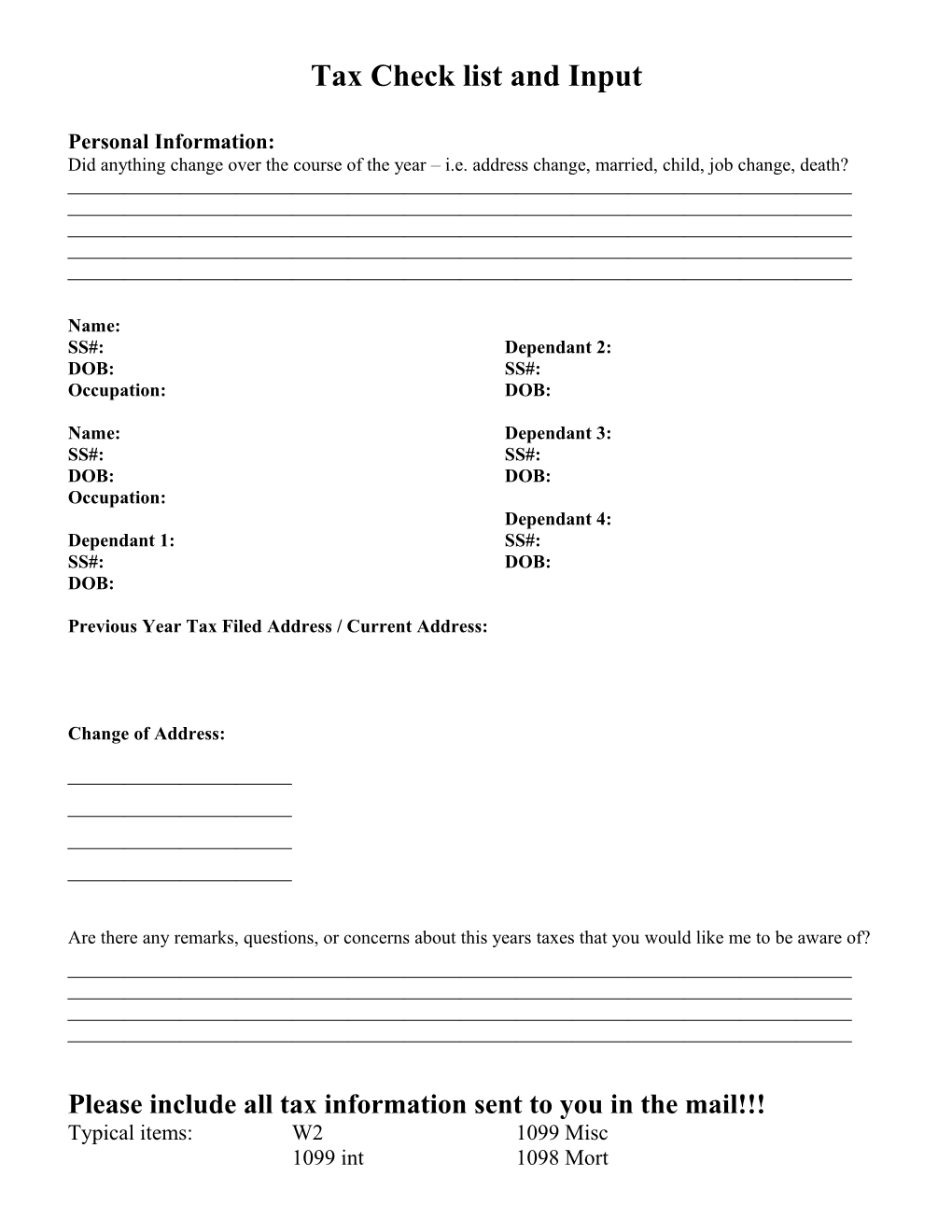

Tax Check list and Input

Personal Information: Did anything change over the course of the year – i.e. address change, married, child, job change, death?

Name: SS#: Dependant 2: DOB: SS#: Occupation: DOB:

Name: Dependant 3: SS#: SS#: DOB: DOB: Occupation: Dependant 4: Dependant 1: SS#: SS#: DOB: DOB:

Previous Year Tax Filed Address / Current Address:

Change of Address:

Are there any remarks, questions, or concerns about this years taxes that you would like me to be aware of?

Please include all tax information sent to you in the mail!!! Typical items: W2 1099 Misc 1099 int 1098 Mort Is there any income NOT listed on a form sent to you in the mail that I need to be aware of?

Please list gross receipts, and any income not reported by form and the reason for the income here:

Since I will be able to determine your income easily from the above information – your itemized deductions may have changed over the course of the year. Please follow the rubric and apply your figures to the categories that apply to your situation. It is imperative that you have documented proof such as receipts, mileage logs and documents to establish the validity of these deductions.

List all NON-Self Employment deductions here:

Moving Expenses

Medical Expenses

Real Estate Taxes

Automobile Registration Fee’s

Gifts to Charity (you must have a signed receipt that has the words “no goods or services provided” for your donation) Please itemize cash and non cash separately Total Cash Total Non Cash

Un-reimbursed Employee Expenses

Medical Expenses Prescription medication: Health Insurance Premiums: Medical Care: Long Term Care Premiums: Doctors and Dentist Bills: Hospital Bills: Eye Glasses and Contact Lens: Medical Equipment: Medical Transportation: Medical Miles Drive:

Miscellaneous Deductions Union and Professional Dues: Professional Subscriptions: Uniforms and Protective Clothing: Job Search Costs: Legal and Investment Advisement:

List all Self Employment deductions here (or un-reimbursed business expenses): Advertising: Car and Truck Expense: Commissions and Fees: Contract Labor: Medical Insurance: Legal and Professional Fees: Office Expense: Rents or Leases: Repairs/Maintenance: Supplies: Taxes and Licenses: Travel, Meals, Entertainment:

Do you have a Home Office? Yes No If yes – how many square feet is you home? How many square feet is your home office? Utilities (telephone, fax, HOA, water, gas)

Rental Information – this is if you own another home and rent it out to others

Property Address for Rental

Interest on Mortgage Taxes Paid Gardening Expense Pest Control Utilities Materials / Supplies Repairs

Please list anything that you added or purchased that may be depreciated over a useful life – usually larger ticket items (like a new kitchen, fence, flooring items, roof):

Automobile Information: (A mileage log is required in an audit to substantiate your use) Make: Miles Driven Total for year: Model: Miles Driven for Business: Year: Interest Paid on car YTD: Year Purchased and cost:

Make: Miles Driven Total for year: Model: Miles Driven for Business: Year: Interest Paid on car YTD: Year Purchased and cost:

Make: Miles Driven Total for year: Model: Miles Driven for Business: Year: Interest Paid on car YTD: Year Purchased and cost:

Any other deductions you think you deserve and why?:

Client Specific Items from last year and looking forward this year:

Did you purchase anything NEW??? Please list the item, the cost, and the date acquired and sales tax you paid. Did you weatherize your home or do any energy efficient upgrades to your property?

If there is anything else I need, I will call you to get the information. A Quicken file of your Expenses is always helpful. Thank you.

If you are eligible for a refund – would you like your refund direct deposited? Yes No

If so please give the following information: Bank Name: (or provide a VOID check) Bank Address:

Account Number: Routing Number: