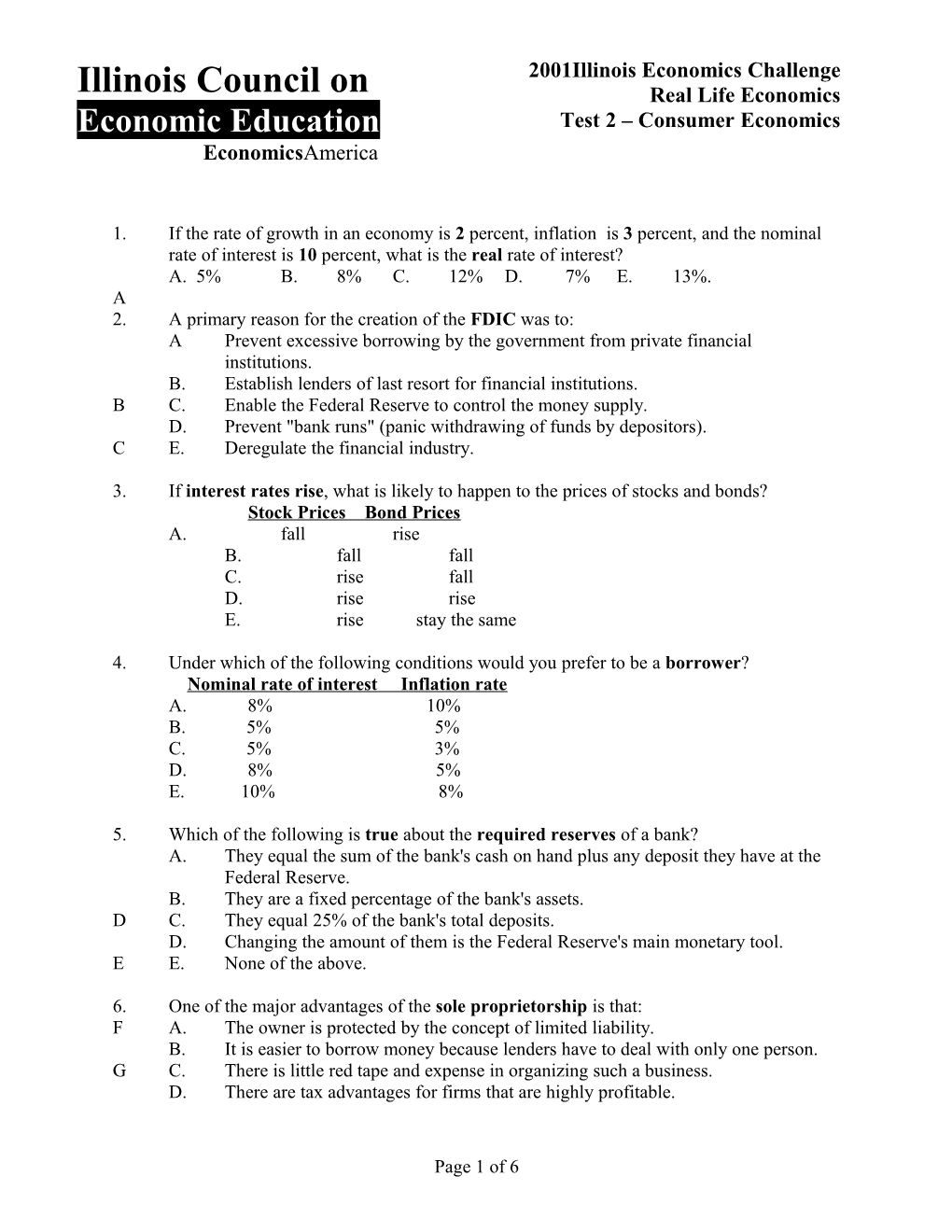

2001Illinois Economics Challenge Illinois Council on Real Life Economics Economic Education Test 2 – Consumer Economics EconomicsAmerica QUESTION SET 1

1. If the rate of growth in an economy is 2 percent, inflation is 3 percent, and the nominal rate of interest is 10 percent, what is the real rate of interest? A. 5% B. 8% C. 12% D. 7% E. 13%. A 2. A primary reason for the creation of the FDIC was to: A Prevent excessive borrowing by the government from private financial institutions. B. Establish lenders of last resort for financial institutions. B C. Enable the Federal Reserve to control the money supply. D. Prevent "bank runs" (panic withdrawing of funds by depositors). C E. Deregulate the financial industry.

3. If interest rates rise, what is likely to happen to the prices of stocks and bonds? Stock Prices Bond Prices A. fall rise B. fall fall C. rise fall D. rise rise E. rise stay the same

4. Under which of the following conditions would you prefer to be a borrower? Nominal rate of interest Inflation rate A. 8% 10% B. 5% 5% C. 5% 3% D. 8% 5% E. 10% 8%

5. Which of the following is true about the required reserves of a bank? A. They equal the sum of the bank's cash on hand plus any deposit they have at the Federal Reserve. B. They are a fixed percentage of the bank's assets. D C. They equal 25% of the bank's total deposits. D. Changing the amount of them is the Federal Reserve's main monetary tool. E E. None of the above.

6. One of the major advantages of the sole proprietorship is that: F A. The owner is protected by the concept of limited liability. B. It is easier to borrow money because lenders have to deal with only one person. G C. There is little red tape and expense in organizing such a business. D. There are tax advantages for firms that are highly profitable.

Page 1 of 6 2001Illinois Economics Challenge Real Life Economics Test 2 – Consumer Economics

H E. The owner is exempt from the antitrust laws.

7. Which of the following is true of partnerships? A. Each partner is liable for all business debts. B. Each partner is liable for only his or her share of business debts. C. All partners are protected by the concept of limited liability. D. Each partner must post a bond to guarantee that all business debts will be paid. E. Partnerships can only be dissolved at the death of a partner.

8. An exclusive right granted by government for seventeen years to an inventor of a product is a: A. Copyright. B. Franchise. C. Patent. D. License E. Payoff.

9. If you invest $100 today at 6% interest, and leave it there, if there are no taxes and no inflation, it will grow to $400 in: A. Six years B. Twelve years C. Twenty years D. 24 years E. Forty years.

10. What form of endorsement would you use if you received a paycheck and wanted to deposit it to your savings account? A. Blank endorsement. I B. Restrictive endorsement. C. Full endorsement. J D. Qualified endorsement. F. Ringing endorsement.

11. The life insurance policy that provides the same dollar value of benefits at the same premium rate as long as the policy holder lives is: A. Term life insurance. K B. Variable annuity life insurance. C. Straight life insurance. L D. Limited payment life insurance. E. Old age insurance.

12. A $100 deductible collision insurance policy on an automobile means: M A. The policy holder may deduct $100 from income taxes. B. The policy holder may deduct $100 from each insurance premium payment. N C. The policy holder pays at most $100 in fines for a moving violation. D. The policy holder pays for all repairs costing more than $100. O E. The policy holder pays the first $100 of repairs.

Page 2 of 6 2001Illinois Economics Challenge Real Life Economics Test 2 – Consumer Economics

13. Which of the following is not an essential element of a contract? A. Mutual agreement. B. Written. C. By legally competent people. D. Something of value exchanged. E. Lawful exchange.

14. Pat offers Rick a sum of $100 for some work. Rick says he will do the work for $150. Rick has made: A. An agreement B. A counter-offer. P C. A contract. D. An exchange. Q E. A combination.

15. Which of the following statements is a warranty? R A. “This book is fit for everybody to read.” B. “This truck will carry safely a load of two tons.” S C. “This stock will double in value in two weeks.” D. “This shoe will make you a better basketball player.” E. “Over three billion sold.”

16. Which of the following checks is valid? T A. Not signed by the payer. B. Personal check dated April 2, 2100. U C. Bank and account drawn against are not given. D. Amount, account, payee, and payer’s signature are painted on the side of a cow. V E. None of the above checks are valid.

17. Which of the following lenders generally charges the highest rate of interest on an unsecured consumer loan? A. A credit card company. W B. A credit union. C. A pawnshop. D. A local bank. E. An insurance company.

18. Which of the following investments is likely to be safest? A. Home mortgages. B. Railroad company bonds. C. U.S. government bonds. D. Stocks in food packing companies. E. Stocks in high-technology companies.

Page 3 of 6 2001Illinois Economics Challenge Real Life Economics Test 2 – Consumer Economics

19. Which of the following investments is likely to offer the highest returns over ten years? A. Home mortgages. B. Railroad company bonds. C. U.S. government bonds. D. Stocks in food packing companies. E. Stocks in high-technology companies.

20. Where would Sears go to investigate your credit-worthiness? A. The police department. B. Your school principal. C. The Internal Revenue Service. D. A credit bureau. E. The Better Business Bureau.

21. Under existing personal bankruptcy law, credit card companies such as Visa or Discover have: A. The right to repossess your automobile. B. The right to make you sell your house. C. The rights of a secured creditor. D. The rights of an unsecured creditor. E. The right to petition for redress.

22. Grocery stores post the price per unit to: A. Enable you to compare their prices with the prices at other stores. B. Enable you to compare different brands and different package sizes in their store. C. Enable you to decide whether or not to use a coupon. D. Comply with the Truth in Lending Act. E. Disclose what the store paid for the item.

23. Why does a lender such as a bank or a credit card company want to know the occupation of the person applying for the loan or credit? A. The occupation gives the lender information about how much money the person earns. B. The occupation gives the lender information about the person’s trustworthiness. C. The occupation gives the lender information about the person’s past credit history. D. The occupation gives the lender information about the employer’s past credit history. E. The occupation gives the lender information to report to the Internal Revenue Service.

Page 4 of 6 2001Illinois Economics Challenge Real Life Economics Test 2 – Consumer Economics

24. What occurs when buyers and sellers exchange goods and services for payments in the form of cash or credit? A. A credit history. B. A voluntary exchange. C. Decision making. D. Market price adjustments. E. Open market operations.

25. From 1975 to 2000, incomes of which of the following have grown the most? A. Pensioners. B. High-school dropouts. C. High-school graduates. D. College graduates. E. Immigrants.

26. Owners of corporations receive what benefit? A. They are not taxed for the income the corporation receives. B. They always control the company. C. They are sole proprietors of the corporation. D. Their liability for loss is limited to the value of the stock they own. E. They receive salaries from the corporation.

27. Many agreements between a union and an employer specify that workers shall be promoted, laid off, or recalled from layoff according to their A. Age. B. Performance. C. Seniority. D. Need. E. Ability.

28. Which of the following life insurance policies does not include a savings element? X A. Term life. B. Universal life. C. Whole life. D. Variable life. E. All include a savings element.

29. The warranty on a new car covers: Y A. Oil changes. B. Tire replacement. C. Adjustment of the brakes. D. Spark plug replacement. F. Cleaning the floor mats.

Page 5 of 6 2001Illinois Economics Challenge Real Life Economics Test 2 – Consumer Economics

30. Which of the following is not an advantage of home ownership? Z A. Mortgage payments are a form of automatic saving. B. The home owner decides when to sell the house. C. The home owner can avoid unexpected repair bills. AA D. The home owners can decorate the house as they see fit. F. Ownership is a way of establishing a better credit rating.

Page 6 of 6 2001Illinois Economics Challenge Real Life Economics Test 2 – Consumer Economics

ANSWER KEY CONSUMER ECONOMICS 2001

1. D 2. D 3. B 4. A 5. A 6. C 7. A 8. C 9. D 10. B 11. C 12. E 13. B 14. B 15. B 16. D 17. A 18. C 19. E 20. D 21. D 22. B 23. A 24. B 25. D 26. D 27. C 28. A 29. C 30. C

Page 7 of 6