Association of Energy Engineers New York Chapter www.aeeny.org

October 2009 Newsletter Part 1

Building a Bridge of (and to) the Future

By Henry Fountain., NYTimes, Oct 13 09

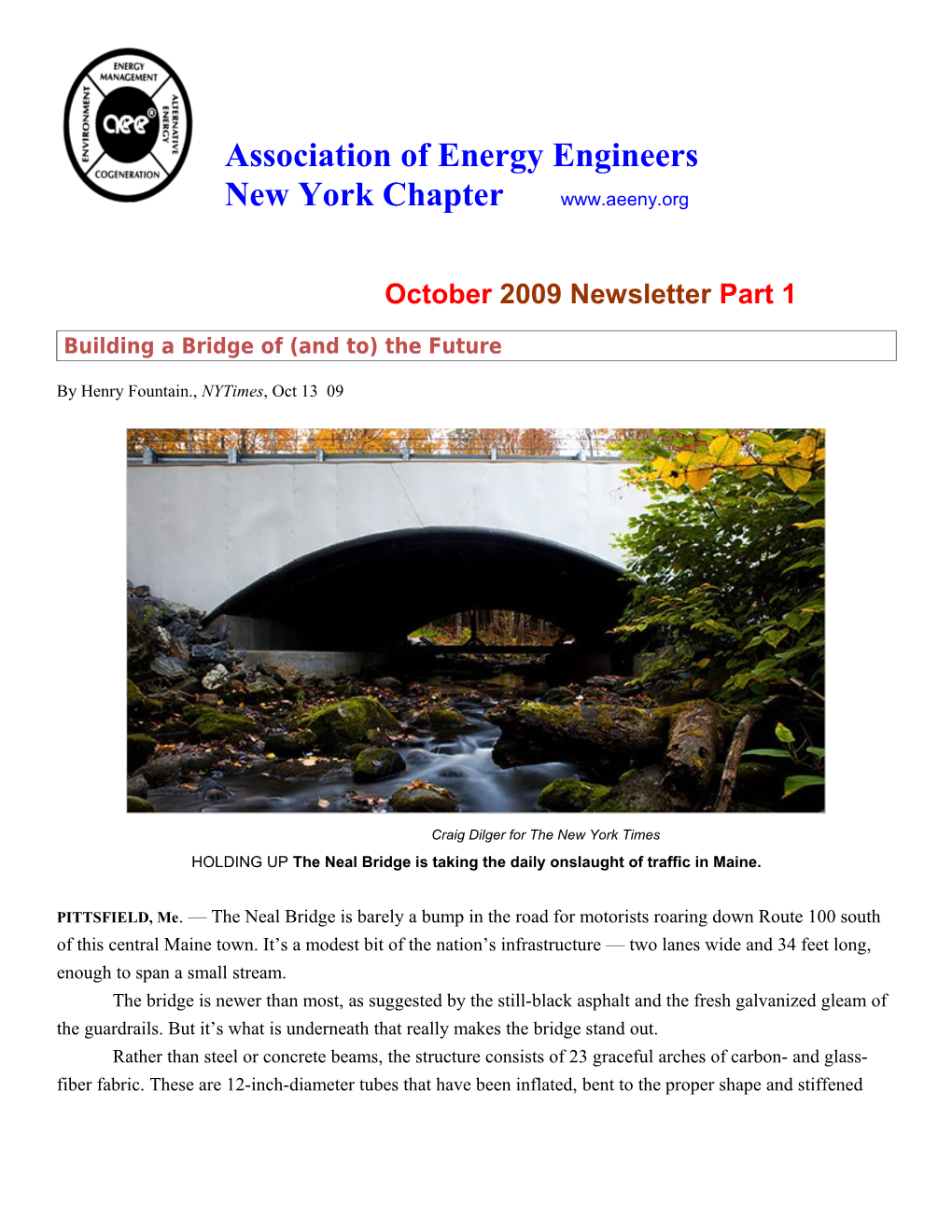

Craig Dilger for The New York Times HOLDING UP The Neal Bridge is taking the daily onslaught of traffic in Maine.

PITTSFIELD, Me. — The Neal Bridge is barely a bump in the road for motorists roaring down Route 100 south of this central Maine town. It’s a modest bit of the nation’s infrastructure — two lanes wide and 34 feet long, enough to span a small stream. The bridge is newer than most, as suggested by the still-black asphalt and the fresh galvanized gleam of the guardrails. But it’s what is underneath that really makes the bridge stand out. Rather than steel or concrete beams, the structure consists of 23 graceful arches of carbon- and glass- fiber fabric. These are 12-inch-diameter tubes that have been inflated, bent to the proper shape and stiffened with a plastic resin, then installed side by side and stuffed with concrete, like giant manicotti. Covered with composite decking and compacted soil, the arches support a standard gravel-and-asphalt roadway. The bridge is the first of what its designers, about 50 miles up the road at the University of Maine in Orono, hope will be many of its type, combining composite materials with more conventional ones like concrete. With an estimated 160,000 of the nation’s 600,000 road bridges in need of repair or replacement, if it or other hybrid designs catch on, they could mark a breakthrough in the use of fiber-reinforced plastics, known as F.R.P., on highways. “This was an experiment for us,” said Habib J. Dagher, director of the university’s Advanced Structures and Composites Center, where the design was developed over seven years. “It was time to get out of the lab and see if it really works.” The bridge, built last November for about $600,000, is being monitored with deflection sensors and other instruments, and so far is holding up under the daily onslaught of traffic. “It went amazingly well,” Dr. Dagher said. “We learned a lot. It turned out to be $170,000 less expensive than a precast bridge.” It worked so well, in fact, that it attracted the attention of the Obama administration; Transportation Secretary Ray LaHood toured the center in August. And a second, similar bridge was completed in late summer, farther north, in Anson. The fiber-arch design was the lowest of seven bids. Long the stuff of surfboards and pleasure boats, and more recently used in aircraft wings and other components, plastic polymers reinforced with fibers were first researched for use in bridges in the 1980s. Civil engineers were attracted to them for the same reasons other designers were — their strength, light weight and corrosion resistance. But the materials have not exactly revolutionized highway infrastructure. F.R.P. strips and sheets have been used to repair concrete or steel on existing bridges, or to strengthen structures against earthquakes. Glass- fiber rods have replaced steel in some reinforced concrete work, because corrosion of steel rebar from road de- icing chemicals destroys concrete. When it comes to larger-scale structural components, however, fiber-reinforced plastics have had less of an impact. They have mostly been used in bridge decking, where corrosion resistance is critical and the lighter weight allows for a higher “live” load of vehicles. Only a handful of bridges have major support beams made from them. One reason F.R.P. components haven’t caught on, experts say, is that engineers and contractors have little experience with the materials, and full standards guiding their use in highway construction have not been developed. Engineers “have to deal with life-safety issues,” said John P. Busel, director of the composites growth initiative of the American Composites Manufacturers Association. “They have a desire to understand how materials fully develop and how they fully last before they specify them.”

2 The materials also do not always interact well with others. One problem with F.R.P. bridge decks, for example, is that the road surface — asphalt or concrete, applied as an overlay — can wear out quickly, said Lijuan Cheng, an assistant professor of engineering at the University of California, Davis. But the main argument against using fiber-reinforced plastics has been economic. “No. 1 is the upfront cost issue,” said Paul Ziehl, an associate professor of engineering at the University of South Carolina. “That’s a tough one to get around.” Dr. Ziehl, who helped design and test F.R.P. beams used on a small bridge in Texas, said the problem was that no two projects were the same. “If you’re going to design things that really make sense from an optimized engineering standpoint, they are going to be one-of-a-kind items at first, until economies of scale kick in,” he said. The beams for the Texas bridge, for example, were custom designed and built using a labor-intensive method. “The construction industry is very persnickety about cost,” Mr. Busel said. With F.R.P. decks, he added, “we’re more expensive, sometimes twice as expensive,” as conventional ones. What contractors need to understand, he said, is that there are transportation, labor and equipment savings from using lighter components, and potential maintenance savings, too. Such savings were all part of the goal for the University of Maine’s design, Dr. Dagher said. Little costly F.R.P. material is used — it serves largely as a shell for the concrete, which is cheaper. The tubes help protect the concrete from de-icing chemicals, potentially reducing maintenance costs, and no internal rebar is needed. “It’s exoskeleton reinforcement,” Dr. Dagher said. The arches are not the only hybrid design in use. John Hillman, an engineer and president of HC Bridge Company in Wilmette, Ill., has developed straight beams that combine polymers with concrete and steel. The basic beam consists of a rectangular F.R.P. tube with an arch-shaped conduit formed inside it. The conduit is filled with concrete, which provides compressive strength, and steel rods along the bottom of the tube provide tensile strength. The beams have been used on a test railroad bridge in Colorado and several road bridges in Illinois and New Jersey. “Everything about the beam is designed to be compatible with conventional means of construction,” said Mr. Hillman, who has been working on the design for 14 years. “We’re very close right now to parity with concrete and steel on an installed-cost basis.” Mr. Hillman’s beams still have to be delivered by truck, although they are light enough that several can be carried on one flatbed. The University of Maine arches, on the other hand, can be fabricated on site — the fabric inflated, bent around a simple form and infused with resin using a vacuum pump. Before they are filled with concrete they are light enough to be installed quickly, without the need for large cranes or other heavy- duty equipment. The second bridge was built in nine working days, Dr. Dagher said. A spinoff company is working on more plans, including an 800-foot project that consists of multiple short spans. “We see single 300-foot spans in the future,” Dr. Dagher said. “We’re excited about taking this to the next level.” Copyright 2009 The New York Times Company

3 ADVERTISEMENT The Superintendents Technical Association (aka the Supers Club) is the first technical society of multifamily building maintenance personnel. For free e-mail edition of monthly newsletter, visit our Web site: www.nycSTA.org or ask Dick Koral, [email protected]

Current NY Chapter AEE Sponsors: The New York Chapter of AEE would like to thank our corporate sponsors who help underwrite our activities. Please take a moment to visit their websites and learn more about them:

. Duane Morris LLP

. Constellation Energy

. Innoventive Power

. Association for Energy Affordability

. R3 Energy Management

If you or your firm is interested in sponsoring the New York Chapter of AEE, please contact Jeremy Metz at [email protected].

A Greenhouse Gas That Is Already a Commodity By Andrew C. Revkin, NYTimes, Oct 14 09

FOR YEARS, many environmental groups and experts on the growing human contribution to the planet’s heat- trapping greenhouse effect have sought to turn carbon dioxide into a commodity by giving it a rising price. Through a so-called cap and trading system, those making extra-deep cuts in emissions can profit by selling what amounts to their extra credit to those who cannot afford to cut their own gas releases so deeply or quickly. But the second most important heat-trapping greenhouse gas from human activities, methane, already has a distinct value. It’s the main ingredient in natural gas, a fuel that is increasingly seen as a vital bridge toward a less-polluting global energy supply. Nonetheless, vast amounts of methane escape from landfills, livestock, coal mines and oil and gas wells, pipelines and storage tanks. The video above, (not shown here) shot in various places in oil and gas country for the Environmental Protection Agency, vividly shows emissions escaping from all manner of equipment. The emissions are in many cases avoidable — at a profit.

4 Changing practices are capturing growing amounts of landfill and coal-mine methane. Changed feed for livestock and other agricultural practices can cut the flow from cattle (as can eating less meat, of course). And there is plenty that can be done to stanch emissions from the oil and gas industry. In a story appearing Thursday in The New York Times, which I wrote with great contributions from Clifford Krauss in Texas and Andrew Kramer in Moscow, experts at the E.P.A. acknowledge publicly for the first time that the flow from standard practices at gas wells, not including leaky valves and the like, is at least 12 times higher than the longstanding agency estimate. The new total, again just from gas wells, has the climate-warming power in a year of the carbon dioxide emitted by eight million cars. And agency officials say the total could be many times higher than that. Companies working to cut flows of the gas from oil storage tanks say that source of emissions is similarly grossly underestimated. This, of course, is both a big environmental problem (the escaping gas contributes to local smog) and a financial opportunity, particularly given that methane, besides having 25 times the climate impact of carbon dioxide when the gases are compared over a 100-year period, is a fuel and chemical feedstock. Reducing such releases alone would only blunt warming in the long run, climate scientists stress. This is particularly true because carbon dioxide, unlike methane, accumulates (like water in a filling bathtub with a clogged drain). Marcus Sarofim, who conducted studies of the climate benefits of cutting methane emissions while at the Massachusetts Institute of Technology and is now in Washington on a fellowship, put it this way: There are two problems in the climate world. There’s the short-term problem, where we want to slow the rate of changes we are already seeing such as Arctic sea ice retreat, more frequent heat waves, and increasing stress on ecosystems. Reducing methane is a cheap, fast solution to the short term problem. But we still need be working on solving the long term problem, where the accumulation of carbon dioxide in the atmosphere will eventually swamp the reductions we can get from all the other gases. Copyright 2009 The New York Times Company

Alternative Energy Projects Stumble on a Need for Water By Todd Woody, NYTimes, Sept 30 09

AMARGOSA VALLEY, Nev. — In a rural corner of Nevada reeling from the recession, a bit of salvation seemed to arrive last year. A German developer, Solar Millennium, announced plans to build two large solar farms here that would harness the sun to generate electricity, creating hundreds of jobs. But then things got messy. The company revealed that its preferred method of cooling the power plants would consume 1.3 billion gallons of water a year, about 20 percent of this desert valley’s available water. Now Solar Millennium finds itself in the midst of a new-age version of a Western water war. The public is divided, pitting some people who hope to make money selling water rights to the company against others concerned about the project’s impact on the community and the environment. “I’m worried about my well and the wells of my neighbors,” George Tucker, a retired chemical engineer, said on a blazing afternoon.

5 Here is an inconvenient truth about renewable energy: It can sometimes demand a huge amount of water. Many of the proposed solutions to the nation’s energy problems, from certain types of solar farms to biofuel refineries to cleaner coal plants, could consume billions of gallons of water every year. “When push comes to shove, water could become the real throttle on renewable energy,” said Michael E. Webber, an assistant professor at the University of Texas in Austin who studies the relationship between energy and water. Conflicts over water could shape the future of many energy technologies. The most water-efficient renewable technologies are not necessarily the most economical, but water shortages could give them a competitive edge. In California, solar developers have already been forced to switch to less water-intensive technologies when local officials have refused to turn on the tap. Other big solar projects are mired in disputes with state regulators over water consumption. To date, the flashpoint for such conflicts has been the Southwest, where dozens of multibillion-dollar solar power plants are planned for thousands of acres of desert. While most forms of energy production consume water, its availability is especially limited in the sunny areas that are otherwise well suited for solar farms. At public hearings from Albuquerque to San Luis Obispo, Calif., local residents have sounded alarms over the impact that this industrialization will have on wildlife, their desert solitude and, most of all, their water. Joni Eastley, chairwoman of the county commission in Nye County, Nev., which includes Amargosa Valley, said at one hearing that her area had been “inundated” with requests from renewable energy developers that “far exceed the amount of available water.” Many projects involve building solar thermal plants, which use cheaper technology than the solar panels often seen on roofs. In such plants, mirrors heat a liquid to create steam that drives an electricity-generating turbine. As in a fossil fuel power plant, that steam must be condensed back to water and cooled for reuse. The conventional method is called wet cooling. Hot water flows through a cooling tower where the excess heat evaporates along with some of the water, which must be replenished constantly. An alternative, dry cooling, uses fans and heat exchangers, much like a car’s radiator. Far less water is consumed, but dry cooling adds costs and reduces efficiency — and profits. The efficiency problem is especially acute with the most tried-and-proven technique, using mirrors arrayed in long troughs. “Trough technology has been more financeable, but now trough presents a separate risk — water,” said Nathaniel Bullard, a solar analyst with New Energy Finance, a London research firm. That could provide opportunities for developers of photovoltaic power plants, which take the type of solar panels found on residential rooftops and mount them on the ground in huge arrays. They are typically more expensive and less efficient than solar thermal farms but require a relatively small amount of water, mainly to wash the panels. In California alone, plans are under way for 35 large-scale solar projects that, in bright sunshine, would generate 12,000 megawatts of electricity, equal to the output of about 10 nuclear power plants. Their water use would vary widely. BrightSource Energy’s dry-cooled Ivanpah project in Southern California would consume an estimated 25 million gallons a year, mainly to wash mirrors. But a wet-cooled solar trough power plant barely half Ivanpah’s size proposed by the Spanish developer Abengoa Solar would draw 705 million gallons of water in an area of the Mojave Desert that receives scant rainfall. One of the most contentious disputes is over a proposed wet-cooled trough plant that NextEra Energy Resources, a subsidiary of the utility giant FPL Group, plans to build in a dry area east of Bakersfield, Calif. NextEra wants to tap freshwater wells to supply the 521 million gallons of cooling water the plant, the Beacon Solar Energy Project, would consume in a year, despite a state policy against the use of drinking-quality water for power plant cooling.

6 Mike Edminston, a city council member from nearby California City, warned at a hearing that groundwater recharge was already “not keeping up with the utilization we have.” The fight over water has moved into the California Legislature, where a bill has been introduced to allow renewable energy power plants to use drinking water for cooling if certain conditions are met. “By allowing projects to use fresh water, the bill would remove any incentives that developers have to use technologies that minimize water use,” said Terry O’Brien, a California Energy Commission deputy director. NextEra has resisted using dry cooling but is considering the feasibility of piping in reclaimed water. “At some point if costs are just layered on, a project becomes uncompetitive,” said Michael O’Sullivan, a senior vice president at NextEra. Water disputes forced Solar Millennium to abandon wet cooling for a proposed solar trough power plant in Ridgecrest, Calif., after the water district refused to supply the 815 million gallons of water a year the project would need. The company subsequently proposed to dry cool two other massive Southern California solar trough farms it wants to build in the Mojave Desert. “We will not do any wet cooling in California,” said Rainer Aringhoff, president of Solar Millennium’s American operations. “There are simply no plants being permitted here with wet cooling.” One solar developer, BrightSource Energy, hopes to capitalize on the water problem with a technology that focuses mirrors on a tower, producing higher-temperature steam than trough systems. The system can use dry cooling without suffering a prohibitive decline in power output, said Tom Doyle, an executive vice president at BrightSource. The greater water efficiency was one factor that led VantagePoint Venture Partners, a Silicon Valley venture capital firm, to invest in BrightSource. “Our approach is high sensitivity to water use,” said Alan E. Salzman, VantagePoint’s chief executive. “We thought that was going to be huge differentiator.” Even solar projects with low water consumption face hurdles, however. Tessera Solar is planning a large project in the California desert that would use only 12 million gallons annually, mostly to wash mirrors. But because it would draw upon a severely depleted aquifer, Tessera may have to buy rights to 10 times that amount of water and then retire the pumping rights to the water it does not use. For a second big solar farm, Tessera has agreed to fund improvements to a local irrigation district in exchange for access to reclaimed water. “We have a challenge in finding water even though we’re low water use,” said Sean Gallagher, a Tessera executive. “It forces you to do some creative deals.” In the Amargosa Valley, Solar Millennium may have to negotiate access to water with scores of individuals and companies who own the right to stick a straw in the aquifer, so to speak, and withdraw a prescribed amount of water each year. “There are a lot of people out here for whom their water rights are their life savings, their retirement,” said Ed Goedhart, a local farmer and state legislator, as he drove past pockets of sun-beaten mobile homes and luminescent patches of irrigated alfalfa. Farmers will be growing less of the crop, he said, if they decide to sell their water rights to Solar Millennium. “We’ll be growing megawatts instead of alfalfa,” Mr. Goedhart said. While water is particularly scarce in the West, it is becoming a problem all over the country as the population grows. Daniel M. Kammen, director of the Renewable and Appropriate Energy Laboratory at the University of California, Berkeley, predicted that as intensive renewable energy development spreads, water issues will follow. “When we start getting 20 percent, 30 percent or 40 percent of our power from renewables,” Mr. Kammen said, “water will be a key issue.” Copyright 2009 The New York Times Company

7 Bargain-Basement Skyscrapers

Buildings that sold for $500 mil in 2007 may now be worth half that. And vultures are circling giddily in the air.

By Devin Leonard, New York, Sept 27 09

(L-R) 777 Third Avenue; 11 Times Square (Photo: Christopher Griffith ) ON A SWELTERING DAY at the tag end of summer, M. Myers Mermel, a 47-year-old former Morgan Stanley banker turned real-estate vulture investor, stands in his pin-striped suit outside an elegant white 23-story building at Madison Avenue and 61st Street. The place brings back fond memories. Mermel had the pleasure of flipping the tower above Barneys twice in the last six years as Manhattan property values soared. First, he bought it for $160 million in 2003 with the help of a wealthy Los Angeles family. Mermel filled the upper floors with hedge funds whose managers loved gazing at Central Park from their desks. “The hedge-fund guys were fairly price-insensitive,” he chuckles. Rents soared. Three years later, Mermel and his backers sold the building for $220 million to Broadway Partners. Mermel was certain that there was more money to be made here. So he kept a minority interest in the property. Sure enough, Mermel and Broadway Partners sold 660 Madison Avenue to Risanamento, an Italian real-estate firm, for $375 million in 2007. He got out just before the credit crunch hit. Since then, he has raised $50 million for a vulture fund. Now he plans to prey on competitors who weren’t so lucky. One of the properties that Mermel is circling is 660 Madison Avenue. Since the economy collapsed, Manhattan office-building prices have fallen as much as 50 percent. Mermel estimates that this one is now worth $143 million—considerably less than Risanamento’s $175 million mortgage. He is heartened by news that the Milan-based company is trying to unload the tower to stave off bankruptcy. It only improves his chances of picking it up again cheaply. One of the building’s engineers, a guy with a shaved head and an outer-borough accent, is leaving for lunch and notices Mermel on the sidewalk. “Hey, you coming back?” he asks.

8 Mermel grins. “Seriously, you in the market?” “I’m always in the market.” “Call me,” the engineer yells over his shoulder as he disappears into the crowd. How bad is the Manhattan skyscraper market? Not as bad as in the seventies, when New York nearly declared bankruptcy, nor as troubled as in the nineties, when the skyline was full of empty towers from the Reagan boom. But according to Mermel’s firm Tenantwise, which tracks 12,800 commercial buildings, the midtown office-vacancy rate, including sublease space, reached 17 percent at the end of July—a 38 percent increase compared with the beginning of the year. The firm says midtown rents fell 28 percent, to $58 a square foot. In other words, “if you bought within the last two years on a two-year note with the expectation that you could rent to hedge funds at $225 a square foot, you are screwed,” says Tom Fink of Trepp, a firm that tracks office-building debt. The city has already witnessed some spectacular flameouts, like when Harry Macklowe defaulted on $7 billion worth of short-term debt that he had borrowed from Deutsche Bank and the hedge fund Fortress Investment Group to buy seven midtown office towers and was forced to relinquish his prized GM Building to Mort Zuckerman’s Boston Properties. And there are undoubtedly more to come. According to Trepp, $80 billion worth of securitized commercial-real-estate loans come due in 2010 across the country—$7.6 billion on New York City buildings. Some real-estate moguls will find new lenders to refinance their debt. But many won’t. No wonder vultures are hoping to pick up buildings at half off their 2007 prices. If investment banks start clamoring for office space again, their profits could be enormous. “We are just waiting for things to ripen,” says David W. Levinson, chairman of L&L Holding, a real-estate company that has started a vulture fund with Prudential Financial kicking in up to $500 million. “Then I think we are going to see the opportunity of a lifetime.” That’s certainly the way Mermel sees it. Accompanied by his driver Ruben, he’s agreed to give a tour of “distressed” midtown office buildings, and he has a woeful tale for each one. It’s almost as if he were polishing his arguments for future negotiations with their beleaguered owners. Even now, of course, there is only so much a vulture can buy with $50 million in Manhattan, although he hopes to raise a lot more than that. Mermel thinks the biggest distressed skyscrapers on his list will be devoured by companies like Boston Properties. “I hope to make a nice living on the smaller ones,” he says.

Canadian Research Highlight – Storm Water Ecologically Engineered Stormwater Management — Five Case Studies (66590) This study evaluates the costs and benefits of using ecological stormwater management instead of traditional engineered solutions in urban environments. Using five cases, all within the Colquitz watershed in the District of Saanich, B.C., it found that ecological stormwater systems can offset infrastructure costs, reduce a development's environmental impact, and lessen chances of downstream flooding and hence flooded basements. It also has the potential to create more visually appealing neighborhoods, if incorporated properly, which may add sales value.

CCNY's New Architecture School Reuses Former Library's Structure By Lawrence Biemiller, The Chronicle of Higher Education, Oct 14 09

9 City College of New York has dedicated its new architecture-school building. (Bruce Damonte photos)

TO CREATE a new, 135,000-square-foot home for the City College of New York's Bernard and Anne Spitzer School of Architecture, Rafael Viñoly Architects gutted the university's 1950s Morris Rafael Cohen Library, on West 135th Street, and reused the five-story structure's concrete frame and floors. The firm added an exterior of glass and pre-cast concrete panels and created an outdoor amphitheater on the roof that offers views of Central Park and the Manhattan skyline while also serving as a clerestory to light the building's interior. Landscaping by Lee Weintraub completes the project. An atrium cut through the middle of the old structure (above) provides a focal point for the new interior and lets daylight fall from the clerestory through the building. The atrium is crisscrossed by metal bridges and stairs that both aid circulation and provide visual interest. Faculty offices on mezzanines overlook open studio spaces. The $52-million building, dedicated last month, also houses exhibition space at the bottom of the atrium, three classrooms, a library, administrative offices, a model shop, and street-level offices for the City College Architecture Center, which offers consulting services for nonprofit organizations. City College is part of the City University of New York.

10 Clerestory that illuminates the interior also forms a rooftop amphitheater.

--

NOTE: Your comments about any aspect of the newsletter are welcome.

11 Jakob Dall for The New York Times Mr. Tranberg uses a special pump to extract the heat from his cows’ milk, then uses the warmth to heat his brick farmhouse. From Turbines and Straw, Danish Self-Sufficiency By John Tagliabue, NYTimes, Sept 30 09

SAMSO, Denmark — The people of this Danish island have seen the future, and it is dim and smells vaguely of straw. With no traffic lights on the island and few street lights, driving its roads on a cloudless night is like piercing a black cloud. There is one movie theater, few cars and even fewer buses, except for summer, when thousands of tourists multiply the population. Yet last year, Samso (pronounced SOME-suh) completed a 10-year experiment to see whether it could become energy self-sufficient. The islanders, with generous amounts of aid from mainland Denmark, busily set themselves about erecting wind turbines, installing nonpolluting straw-burning furnaces to heat their sturdy brick houses and placing panels here and there to create electricity from the island’s sparse sunshine. By their own accounts, the islanders have met the goal. For energy experts, the crucial measurement is called energy density, or the amount of energy produced per unit of area, and it should be at least 2 watts for every square meter, or 11 square feet. “We just met it,” said Soren Hermansen, the director of the local Energy Academy, a former farmer who is a consultant to the islanders. In December, when the United Nations-sponsored summit meeting on climate change convenes in Denmark, many of the delegates will be swept out to visit Samso. They will see its successes, but also how high the hurdles are for exporting the model from this little island, a hilly expanse roughly the size of the Bronx.

12 On a recent visit, Mr. Hermansen recounted, the Egyptian ambassador to Denmark admired all the energy-creating devices the islanders had installed, then asked how many people lived here. When he was told about 4,000, he replied with exasperation, “That’s three city blocks in Cairo!” Undaunted, Mr. Hermansen told him, “That’s maybe where you should start, not all of Egypt, take one block at a time.” Jorgen Tranberg, 55, agreed. “If there were no straw, we’d have no fuel, but we have straw,” he said, sipping coffee on the 250-acre dairy farm where he milks 150 Holsteins. “Everywhere is different,” he said. “Norway has waterfalls, we have wind. The cheapest is oil and coal, that’s clear.” The farmers, he said, used to burn the straw on their fields, polluting the air. Now, they use it to heat their homes. Counting only the wind turbines on the island, but not those that the islanders have parked offshore in the Kattegat Strait, the island produces just enough electricity for its needs. (With the offshore turbines it can even export some.) However, its heating plants, burning wheat and rye straw grown by its farmers, cover only about 75 percent of the island’s heating needs, continuing its reliance on imported oil and gas. The islanders have been inventive. Mr. Tranberg uses a special pump to extract the heat from his cows’ milk, then uses the warmth to heat his house. He has even invested in wind turbines. He purchased one outright for $1.2 million, with a bank loan; it now stands in a row of five just behind his brick farmhouse. He later bought a 50 percent stake in another turbine. But all that spins is not gold, he soon found out. When a gearbox burned out in one mill three years ago, the repair cost more than $150,000. He did not say how much he makes from selling the electricity. Energy experts emphasize that it is crucial for the islanders to squeeze energy out of their island without relying heavily on sea-based turbines. Not every region of the world is blessed with an expanse of thousands of miles of ocean at its doorstep. “Otherwise, it becomes a public-relations exercise,” said Philip Sargent, one of the founders of the Cambridge Energy Forum in England. Yet the experiment could also be useful as a demonstration of technology, he said, or simply to clarify the scale of what is needed, “on densely populated islands like the British Isles.” Many islanders, like Uffe Bach and his wife, Else Marie, have treated the energy experiment as a profit- making venture. Mr. Bach, 63, who sports a ponytail, is a Johnny Cash fan and boasts that he is the only owner of a Harley-Davidson on the island. He says he did most of the work rebuilding the schoolhouse where they now live, installing a special wood-burning oven to heat the downstairs and laying 1,300 feet of pipe in a field behind the house to pump warmth from the ground to heat the rest of the house. Ten years ago, the Bachs paid $40,000 for a share in a wind turbine off the south shore, last year pocketing a dividend of $4,700 from the sale of its electricity. Else Marie, 45, said it was only natural for the islanders to embrace the energy project. “People here were poor,” she said. “So they had to think differently.” On the winding main street of Tranebjerg, whose population of 829 makes it by far the island’s largest town, Jytte Nauntoft, 46, sells appliances in a store that her husband’s family has owned for generations. The islanders, she said, have all the necessary home appliances, like washers and dryers, refrigerators and stoves. Yet, she added, “Electricity is expensive, so they buy the basic models.” There is no gas, so gas stoves are nonexistent, and the cool climate makes air-conditioners unnecessary. Five years ago, she said, with the help of state subsidies, she and her husband erected a small windmill behind their home, which now supplies almost all their electricity. Like Mr. Bach they use a heat pump to draw warmth from the ground to heat their rooms. In the bookshop opposite Ms. Nauntoft’s appliance store, Liselotte Andersen, 50, a sales clerk, said “it became natural for us” to embrace the energy project. The project was also crucial, she said, to provide islanders a sense of purpose, and jobs. The island has no high schools, so older children leave for boarding schools or live with relatives off-island after grade school. Many do not return.

13 Two of Ms. Andersen’s three sons are living off the island. Asked whether she thought they would return, she replied, “We hope some will come back. “I think the eldest will come back,” she added. “If he found a small farm.” Copyright 2009 The New York Times Company

The Upside of Down Catastrophe, Creativity and the Renewal of Civilization

By Thomas Homer-Dixon

IN The Upside of Down, political scientist and award-winning author Thomas Homer-Dixon argues that converging stresses could cause a catastrophic breakdown of national and global order — a social earthquake that could hurt billions of people. But he shows that this outcome isn't inevitable; there's much we can do to prevent it. And after setting out a general theory of the growth, breakdown, and renewal of societies, he shows that less severe types of breakdown could open up extraordinary opportunities for creative, bold reform of our societies. Homer-Dixon contends that five "tectonic stresses" are accumulating deep underneath the surface of today's global order:

energy stress, especially from increasing scarcity of conventional oil;

economic stress from greater global economic instability and widening income gaps between rich and poor;

demographic stress from differentials in population growth rates between rich and poor societies and from expansion of megacities in poor societies;

environmental stress from worsening damage to land, water forests, and fisheries; and,

climate stress from changes in the composition of Earth's atmosphere. Of the five, energy stress plays a particularly important role, because energy is humankind's master resource. When energy is scarce and costly, everything a society tries to do including growing its food, obtaining enough fresh water, transmitting and processing information, and defending itself becomes far harder. The effect of the five stresses is multiplied by the rising connectivity and speed of our societies and by the escalating power of small groups to destroy things and people, including, potentially, whole cities. Drawing parallels between the challenges we face today and the crisis faced by the Roman empire almost two thousand years ago, Homer-Dixon argues that these stresses and multipliers are potentially a lethal mixture. Together, they greatly increase the risk of a cascading collapse of systems vital to our wellbeing a phenomenon he calls "synchronous failure." Societies must do everything they can to avoid such an outcome. On the other hand, if people are well-prepared, they may be able to exploit less extreme forms of breakdown to achieve deep reform and renewal of institutions, social relations, technologies, and entrenched habits of behavior. This is likely our best hope for a prosperous and humane future.

14 Excerpts from The Upside of Down

Prologue: Firestorm San Francisco, Thursday, April 19, 1906

THE WIND HAD SHIFTED. Now the inferno turned its attention westward. Block by block, it savaged some of the city's finest houses. As the mayor, chief of police, and members of the municipal council retreated from building to building before the flames, they decided the city would make one last stand. The final line of defense, they announced, would be Van Ness Avenue, a broad residential boulevard bisecting San Francisco from north to south. The street lay directly in the fire's path: if they could use it as a firebreak, they might be able to halt the advance. But if this last effort failed, what remained of the city would surely be lost. Early the previous day, an enormous earthquake had shattered the city's core, snapping cast- iron water mains like twigs, toppling thousands of chimneys, and upending coal-burning stoves and boilers. Electrical utility poles fell over, bringing down live wires in showers of sparks. Gas lines ruptured. Kerosene and oil poured out of burst fuel tanks. In seconds, sparks and fuel combined, and dozens of fires exploded across the city. Then, energized by the wood in the city's buildings, small fires coalesced into mighty firestorms. Even when firefighters could maneuver around the piles of earthquake debris in the streets, they found no water in the hydrants. By noon on the 19th, the fire had destroyed almost ten square kilometers of the city east of Van Ness Avenue. The financial district, Market Street, and the district south of Market were smoking ruins...

F i r e s t o r m The wind had shifted. Now the inferno turned its attention westward. Block by block, it savaged some of the city’s finest houses. As the mayor, chief of police, and members of the municipal council retreated from building to building before the flames, they decided the city would make one last stand. The final line of defense, they announced, would be Van Ness Avenue, a broad residential boulevard bisecting San Francisco from north to south. The street lay directly in the fire’s path: if they could use it as a firebreak, they might be able to halt the advance. But if this last effort failed, what remained of the city would surely be lost. Early the previous day, an enormous earthquake had shattered the city’s core, snapping cast- iron water mains like twigs, toppling thousands of chimneys, and upending coal-burning stoves and boilers. Electrical utility poles fell over, bringing down live wires in showers of sparks. Gas lines ruptured. Kerosene and oil poured out of burst fuel tanks. In seconds, sparks and fuel combined, and dozens of fires exploded across the city. Then, energized by the wood in the city’s buildings, small fires coalesced into mighty firestorms. Even when firefighters could maneuver around the piles of earthquake debris in the streets, they found no water in the hydrants.

15 By noon on the 19th, the fire had destroyed almost ten square kilometers of the city east of Van Ness Avenue. The financial district, Market Street, and the district south of Market were smoking ruins. Chinatown was ablaze, and the docks, ferry terminal, and Telegraph Hill were under siege. The U.S. army had tried to deprive the fire of easily combustible material by blowing up hundreds of undamaged buildings in front of the flames. But so far their efforts had been futile, and supplies of dynamite were almost gone. Orders went out to concentrate all soldiers, police, workers, and fire engines for the climactic fight along a sixteen-block section of Van Ness. They would raze the houses along the east side of the boulevard. So the last pounds of dynamite were brought on wagons from the Presidio and Alcatraz, placed in the buildings basements, and connected to fuses. Police and volunteers rushed from house to house to evacuate residents. And because there wasn’t enough dynamite, the army wheeled field cannon into position along the west side of Van Ness. The guns’muzzles pointed across the street. The fire crested Nob Hill a few blocks to the east, enveloped the brand new Fairmont Hotel, and now surged down California, Sacramento, and Washington Streets toward Van Ness. A broad wall of flames and smoke closed in on the defenders. At 4 p.m., the cannon opened fire on the elegant mansions lining the east side of the street. “The sight was one of stupendous and appalling havoc,”wrote a correspondent for The New York Times,“as the cannons were trained on the palaces and the shot tore into the walls and toppled the buildings in ruins.”Simultaneously fuses were lit, and as the dynamite exploded, “the dwellings of millionaires were lifted into the air by the power of the blast and dropped to the earth a mass of dust and debris.” For hours, above the roar of the approaching flames, the air shook with the steady concussion of exploding artillery shells and dynamite. When the fire reached Van Ness, it seemed it would breach the defensive line.“ The fire spread across the broad thoroughfare, ”wrote the Times correspondent, “and the entire western addition, which contains the homes of San Francisco’s wealthier class, seemed doomed.”But when the smoke cleared the next morning, the defenders found to their joy that their strategy had been largely successful. The flames had jumped the street in only a few places. By then, though, it was obvious that much of the city had been obliterated. Hundreds of thousands of people had no shelter or food, and authorities feared famine and epidemic. Looking across San Francisco ’s smoldering hulk that day, no one could have imagined that such appalling destruction would also produce some good; that it would not only lead to a rejuvinated city but also trigger a wave of events that would sweep around the world and, years hence, help create the Federal Reserve System of the United States ………………………

16 NY Chapter AEE Board Members David Ahrens [email protected] 718- 677-9077x110 Michael Bobker [email protected] 646-660-6977 Robert Berninger [email protected] 212- 639-6614 Timothy Daniels [email protected] 212- 312-3770 Jack Davidoff [email protected] 718-963-2556 Fredric Goldner [email protected] 516- 481-1455 Bill Hillis [email protected] 845-278-5062 Placido Impollonia [email protected] 212-669-7628 Dick Koral [email protected] 718- 552-1161 John Leffler [email protected] 212-868-4660x218 John Leffler [email protected]?? Robert Meier [email protected] 212-328-3360 Ryan Merkin [email protected] 212-564-5800 x 16 Jeremy Metz [email protected] 212-338-6405 John Nettleton [email protected] 347-835-0089 Asit Patel [email protected] 718- 292-6733x205 Dave Westman [email protected] 212-460-6588 Chris Young [email protected] 914-442- 4387

Board Members Emeritus Paul Rivet [email protected] George Kritzler [email protected] Alfred Greenberg [email protected] 914-422-4387 George Birman

Past Presidents Mike Bobker (2003-05), Asit Patel (2000-03), Thomas Matonti (1998-99), Jack Davidoff (1997-98), Fred Goldner (1993-96), Peter Kraljic (1991-92), George Kritzler (1989-90), Alfred Greenberg (1982-89), Murray Gross (1981-82), Herbert Kunstadt (1980-81), Sheldon Liebowitz (1978-80)

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, economic, scientific, and technical issues. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

17