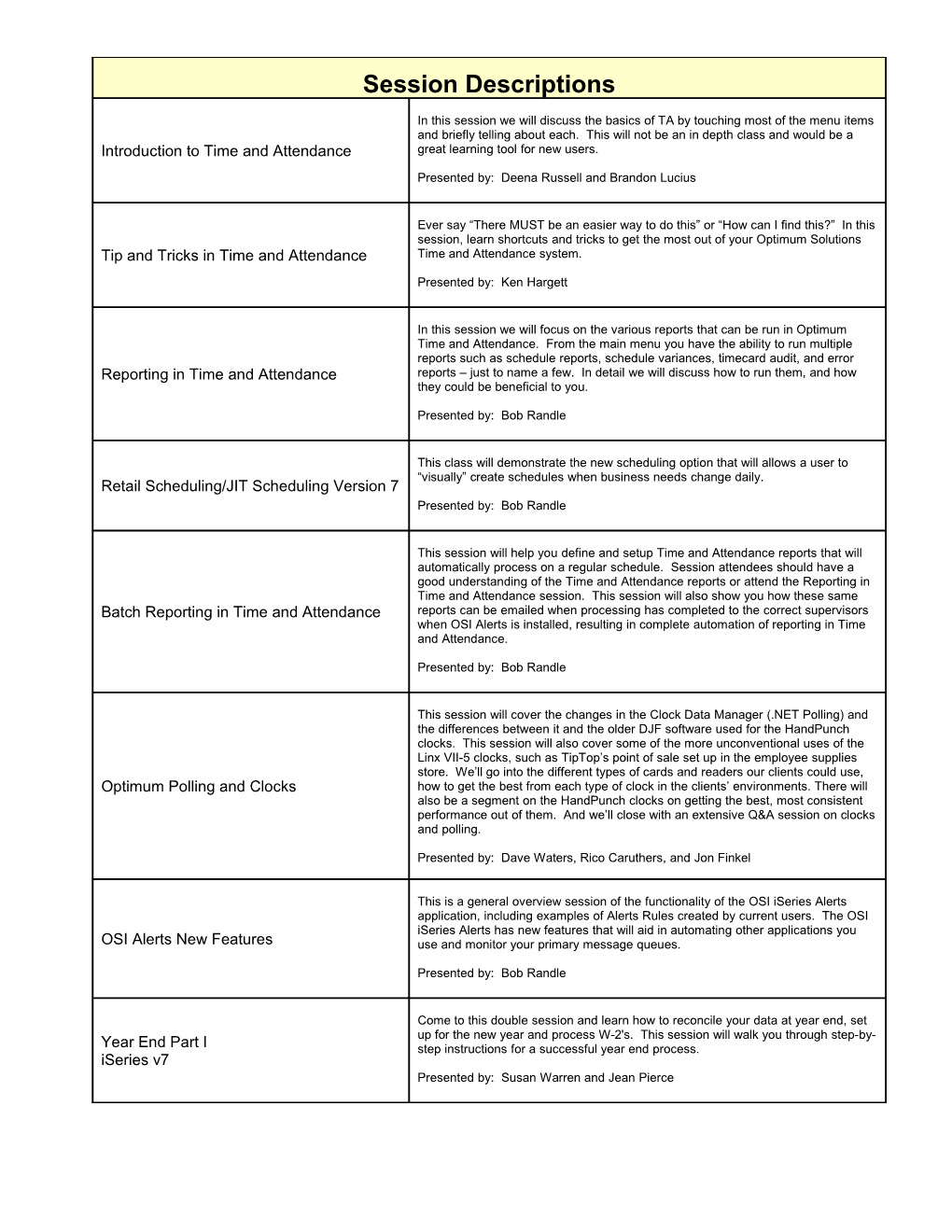

Session Descriptions

In this session we will discuss the basics of TA by touching most of the menu items and briefly telling about each. This will not be an in depth class and would be a Introduction to Time and Attendance great learning tool for new users.

Presented by: Deena Russell and Brandon Lucius

Ever say “There MUST be an easier way to do this” or “How can I find this?” In this session, learn shortcuts and tricks to get the most out of your Optimum Solutions Tip and Tricks in Time and Attendance Time and Attendance system.

Presented by: Ken Hargett

In this session we will focus on the various reports that can be run in Optimum Time and Attendance. From the main menu you have the ability to run multiple reports such as schedule reports, schedule variances, timecard audit, and error Reporting in Time and Attendance reports – just to name a few. In detail we will discuss how to run them, and how they could be beneficial to you.

Presented by: Bob Randle

This class will demonstrate the new scheduling option that will allows a user to “visually” create schedules when business needs change daily. Retail Scheduling/JIT Scheduling Version 7 Presented by: Bob Randle

This session will help you define and setup Time and Attendance reports that will automatically process on a regular schedule. Session attendees should have a good understanding of the Time and Attendance reports or attend the Reporting in Time and Attendance session. This session will also show you how these same Batch Reporting in Time and Attendance reports can be emailed when processing has completed to the correct supervisors when OSI Alerts is installed, resulting in complete automation of reporting in Time and Attendance.

Presented by: Bob Randle

This session will cover the changes in the Clock Data Manager (.NET Polling) and the differences between it and the older DJF software used for the HandPunch clocks. This session will also cover some of the more unconventional uses of the Linx VII-5 clocks, such as TipTop’s point of sale set up in the employee supplies store. We’ll go into the different types of cards and readers our clients could use, Optimum Polling and Clocks how to get the best from each type of clock in the clients’ environments. There will also be a segment on the HandPunch clocks on getting the best, most consistent performance out of them. And we’ll close with an extensive Q&A session on clocks and polling.

Presented by: Dave Waters, Rico Caruthers, and Jon Finkel

This is a general overview session of the functionality of the OSI iSeries Alerts application, including examples of Alerts Rules created by current users. The OSI iSeries Alerts has new features that will aid in automating other applications you OSI Alerts New Features use and monitor your primary message queues.

Presented by: Bob Randle

Come to this double session and learn how to reconcile your data at year end, set up for the new year and process W-2's. This session will walk you through step-by- Year End Part I step instructions for a successful year end process. iSeries v7 Presented by: Susan Warren and Jean Pierce Come to this double session and learn how to reconcile your data at year end, set up for the new year and process W-2's. This session will walk you through step-by- Year End Part II step instructions for a successful year end process. iSeries v7 Presented by: Susan Warren and Jean Pierce

Paid time off plans can be set up for automatic accruals so that you don’t have to keep up with time off on paper anymore! Set up an unlimited number of plans to handle multiple sets of rules for all your employees. Then let the system keep up with accrued, earned, carryover, taken, and available hours for you. Plus, those PTO totals will be available to managers who may be working with Time & Attendance, iSeries v7 too. No more phone calls to payroll asking “How many hours of vacation do I have?”

Presented by: Susan Warren and Jean Pierce

Now that you know how to run regular run-of-the-mill payrolls, it’s time to expand your knowledge. In this session, you will learn how to process Void checks, Manual checks, and Gross Up calculations. We will also cover frequency overrides Special Payrolls so you can adjust tax liabilities for any on-demand checks that call for such. Retro iSeries v7 payrolls for union back pay will also be covered.

Presented by: Susan Warren and Jean Pierce

V7 reports are amazing! Join us to learn how to report exactly what you need by limiting selection criteria. Need to change from portrait to landscape? Want to Advanced Reporting create an export file? Change the page size or override the printer file? You will iSeries v7 even learn how to save a custom report so that you can run it again and again.

Presented by: Susan Warren and David Collazo

More and more state disbursement units are requiring that Child Support payments be remitted via Electronic Funds Transfer. If your company is sending a direct EFT of Child Support deposit file for employees’ wages, then you can meet those states’ requirements iSeries v7 for EFT of Child Support payments.

Presented by: Susan Warren and Jean Pierce

Automation of performance evaluations can save time by eliminating duplication of Performance Evaluations efforts. Add your performance evaluation forms to your OSI HR application so that substantiating documentation is all housed in one place. iSeries v7 Presented by: Sherry Dwyer

Track COBRA participants and their qualifying events in your Optimum Solutions HR software. Link benefits that may continue under COBRA with term dates and COBRA qualifying event dates so that your HRIS system can generate COBRA letters and billing statements. Bringing this function in-house can save time and money for iSeries v7 your company. Now wouldn’t your boss love to hear that?

Presented by: Robert Romine

Position Control is the process of defining all the “seats on the bus” within your organization, both vacant and occupied. Once those positions have been defined, Position Control you can expand this feature and use it as a tool to budget for salaries, analyze iSeries v7 hiring trends, and maintain control over the size of your employee population.

Presented by: Robert Romine We all want to make life easier – here’s your chance to learn how to get the most out of your Optimum Suite. Get tips on how to email direct deposit vouchers to your employees, use the Follow Up function when you have events or comments Tips & Tricks that need to be revisited, change tax frequency (and lots of other stuff!) on timecard iSeries v7 entry. And get introduced to our Wizards – you’ll never be the same!

Presented by: Susan Warren and Jean Pierce

Come to this double session and learn how to reconcile your data at year end, set Year End Part I up for the new year and process W-2's. This session will walk you through step-by- step instructions for a successful year end process. iSeries v6.2 Presented by: Deena Russell and Brandon Lucius

Come to this double session and learn how to reconcile your data at year end, set Year End Part II up for the new year and process W-2's. This session will walk you through step-by- step instructions for a successful year end process. iSeries v6.2 Presented by: Deena Russell and Brandon Lucius

This session will explain commonly made mistakes in payroll and how they can be fixed. The topics covered will include: how to correct an incorrect pay period/check date in history how to correct an incorrect tax code that was used on an employee Commonly Made Mistakes in Payroll and how to remove arrears from all employee deductions/benefits How To Fix Them how to correct an incorrect check number in history how to delete an employee number after payrolls have been run iSeries v6.2 how to add worker's comp codes to an employee's history from the employee file how to reload a journal entry how to reload direct deposit file how to delete an employee from direct deposit file

Presented by: Kellye Posey

Topics include: HR attendance feeding for TA and Payroll the difference between authorization codes and leaves pay types; Attendance points and the difference between TA points and HR points; Import reduction for leave time on salary Payroll, HR and TA working together employees; How to delete a payroll after importing from TA and start over when iSeries v6.2 info is incorrect; Comparing TA report totals to Payroll report totals to balance; Linking HR benefit codes with Payroll deductions/benefits

Presented by: Stacie Carney

Do you understand your general ledger entry for your payroll processing? This session will explain some basic accounting and also how and when to use the Payroll Accounting Period End Accrual Process.

Presented by: Laurie Johnston – HOM Furniture

Involuntary deduction administration is becoming a large burden for the payroll Garnishments, Levies, and Other department. Learn how to set up multiple child supports, garnishments, levies, etc Deductions in the most efficient way and also meet your federal and state requirements. iSeries v6.2 Presented by: Stacie Carney

A look at integrating YOUR custom programs with Optimum Payroll and/or Optimum HR. We will cover calls to custom programs from payroll processing and Tips and Tricks for System Modification employee maintenance, creating custom menus, and Timecard and General iSeries v6.2 Ledger Interfaces. We will also look at setting up test and multiple environments.

Presented by: Mike Hayes Now that you know how to run regular run-of-the-mill payrolls, it’s time to expand your knowledge. In this session, you will learn how to process Void checks, Manual checks, and Gross Up calculations. We will also cover deduction and Special Payrolls benefit overrides as well as how to override tax frequencies to adjust tax liabilities iSeries v6.2 for any on-demand checks that call for such. Bonus and Retro payrolls for union back pay will also be covered.

Presented by: Kellye Posey and Brandon Lucius

In this session you will learn how to set up levies, garnishments and multiple child Garnishments, Levies & Other Deductions supports, as well as how to set up the Payee (third Party Vendor) to process these checks while processing payroll. Windows Presented by: Dawn Spann

Come to this session and learn how to reconcile your data at year end, set up for Year End the new year and process W-2’s. This session will walk you through step-by-step instructions for a successful year end process. Windows Presented by: Eric Droke

Learn how to use Microsoft Excel with Window Suite tables to create your own Microsoft Excel Queries reports. Windows Presented by: James Katsias - Valley Proteins

This session will cover setting up paid time off accruals in OSI payroll software. PTO Accruals Attend to learn the various types of paid time off plans that may be setup within the system and the ins and outs of running accruals. Windows Presented by: Shaun Lewis

Concerned about security in Payroll and Human Resources? Attend this session to learn about your security options within the Optimum applications. OSI security Payroll / HR Security can be relaxed or very restrictive, depending on your individual needs – investigate Windows the possibilities.

Presented by: Dawn Cassidy

Ever made a mistake in Payroll? If you haven’t, you probably will soon enough. Payroll Adjustments This class is dedicated to learning ways for fixing those pesky mistakes through payroll and, also, how to run other out-of-the-ordinary payrolls. Windows Presented by: Eric Droke

How to Balance Quarter End Quarter End balancing made easy; Reports to run for comparisons. Windows Presented by: Dawn Spann

Optimum Time & Attendance is an advanced client/server time-tracking solution that increases productivity, tracks employee attendance more accurately, and allows companies to effectively manage their workforce. The business rule based Time and Attendance for Windows options provided by the system are imperative when dealing with numerous Overview employees and multiple schedules. Business rules such as, employee schedules, grace periods and over time rules can be defined at the company, organization, and/or employee level.

Presented by: Jessica Hogue HR and benefits professionals have long struggled with healthcare cost containment. Now that healthcare costs significantly exceed inflation with no end in sight, more employers are implementing Consumer-Driven Healthcare and The difference between FSA, HSA, HRA & wellness strategies. This presentation explains the differences between and the pros and cons of HSAs, HRAs and FSAs. Case studies illustrate various other Health Savings Accounts approaches, explore the link between individual lifestyle choices, and detail health risk factors and healthcare costs that support the trend toward wellness initiatives.

Presented by: Susan Heard – Paradigm Group

Discussion will include a partial list of ways you may be “Hit” by check fraud and things you can do to prevent it from happening to you. We will also have an overview of our PTM compatible checks and equipment for the Optimum Solutions Preventing Check Fraud software.

Presented by: Becky Holcomb – PTM

The employment statistics should frighten every employer. Some are feeling the gap now and, without action, it will only get worse. Over the next decade, an estimated 76 million Baby Boomers will be eligible to retire. The following Filling the Employment Gap with Mature generations are smaller and not fully qualified for the workforce so we could soon find ourselves more than 26 million workers short. We will separate fact from Workers fiction about employing mature workers, discuss ways to actively recruit them, and the benefits of retaining the ones we have.

Presented by: Diane Hilburn, SPHR – Bank of the Ozarks

New FMLA leave to care for injured military service members; New FMLA leave for "qualifying exigencies" in connection with a call to active military duty; New DOL Just When You Thought You Had the forms for employee eligibility, designation of FMLA leave, and medical certification; FMLA Mastered . . . They Changed the New employer notice requirements; New clarifications of old questions like what Rules on Us! qualifies as a chronic serious health condition Presented by: Kim Vance - Baker, Donelson, Bearman, Caldwell & Berkowitz

Conducting sound internal investigations; Responding to EEOC charges; Training Hot, Hot, Hot Topics in Employment Law -- front line managers to reduce legal risks; Understanding how new court Find Out How to Avoid Getting Burned by decisions affect your Human Resources policies and practices Employment Lawsuits Presented by: Kim Vance - Baker, Donelson, Bearman, Caldwell & Berkowitz

Most, if not all of you have company sponsored 401k plans as part of Human Resources or Payroll operations. This session will enlighten you on the hot topics in the 401k industry. We’ll discuss Safe Harbor Plans – what they are, the different options and the costs and benefits to you as a Company sponsor, individual participant, or the person processing the 401k system. We’ll also cover Automatic Enrollment – an idea that can save substantial effort for all who have to constantly 401K Retirement Plans follow up for participant enrollment when eligibility is satisfied. We’ll also cover fees – what are you paying, do you know where to look, do you know what to look for, what are the industry benchmarks, and is your plan in line with industry averages. This information will be valuable to you with your work, and to you as a participant in your plan.

Presented by: Randy Campbell – Smith Barney

Chances are, you have been asked or thought about what the benefits of adding a Roth 401k feature to your plan would mean. We’ll cover that, and talk about what others in the industry are doing. If your 401k plan has a participant loan feature, you probably wonder whether you are offering a retirement plan or running a credit union! We’ll discuss what some plan sponsors are doing to address the “loan 401k Loans, Roth, QDIA & PPA issue”. We also will discuss Qualified Default Investment Alternatives (QDIA’s), the activation of the Pension Protection Act (PPA) and what it means to you, and, since fees are on everybody’s mind, we will cover these as well.

Presented by: Randy Campbell – Smith Barney In this session you will learn how to interpret the orders for multiple child supports and garnishments to be compliant. You will also learn how to set up the Payee (Third Party Vendor) to process these checks while processing payroll. Finally, you Child Support & Garnishments will learn how to send Child Support payments electronically through the use of EFT.

Presented by: Nancy Brenner - Child Support Enforcement Office

The speaker will discuss the history of unclaimed property and how organizations report today. The session will address common myths and review the various Unclaimed Property Reporting Exposed: property types that are reportable by industry. Specific state requirements regarding due diligence, report filing dates and recent legislative changes will be Let’s Set the Records Straight provided.

Presented by: Heather Steffans – Fiserv Solutions