Legal Aspects for Student Body Organizations

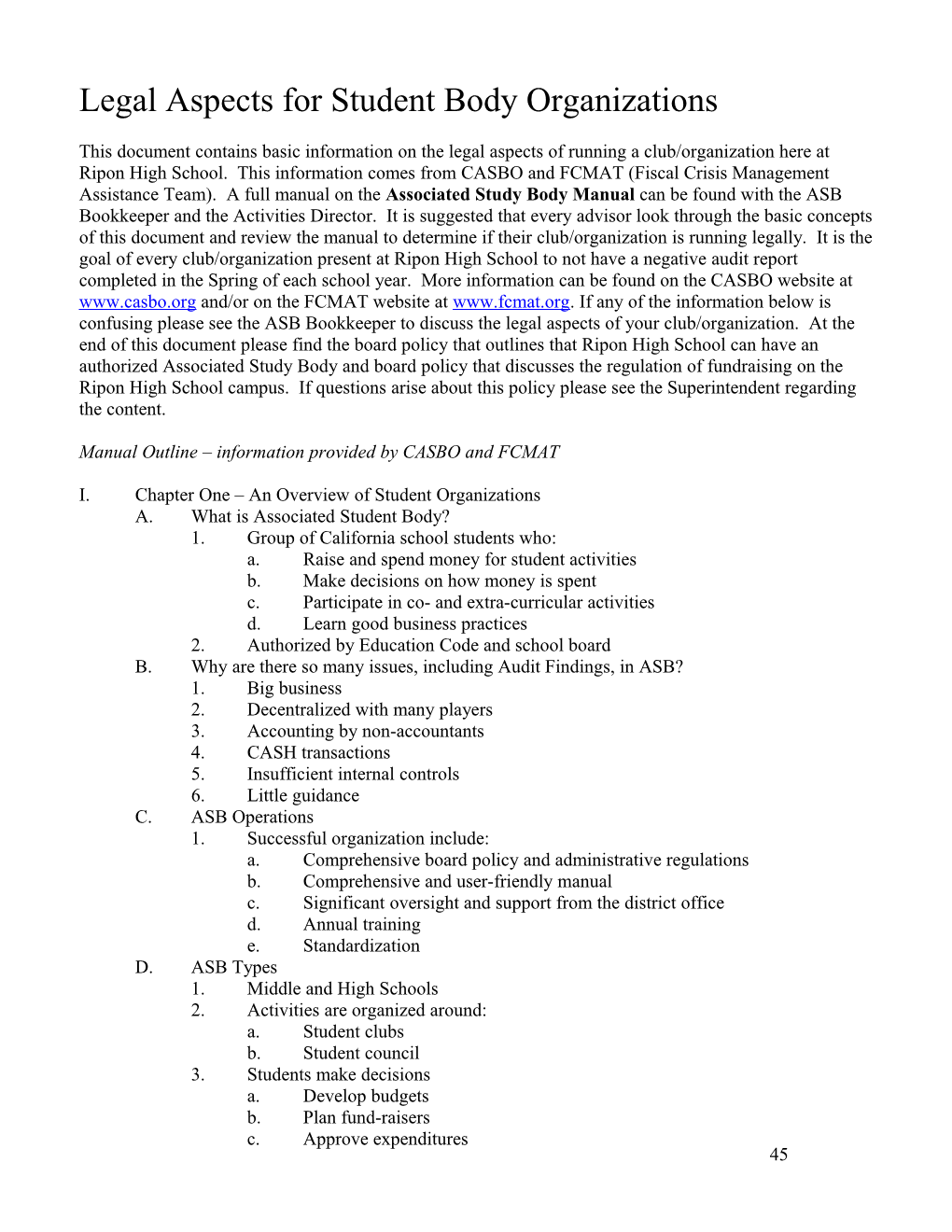

This document contains basic information on the legal aspects of running a club/organization here at Ripon High School. This information comes from CASBO and FCMAT (Fiscal Crisis Management Assistance Team). A full manual on the Associated Study Body Manual can be found with the ASB Bookkeeper and the Activities Director. It is suggested that every advisor look through the basic concepts of this document and review the manual to determine if their club/organization is running legally. It is the goal of every club/organization present at Ripon High School to not have a negative audit report completed in the Spring of each school year. More information can be found on the CASBO website at www.casbo.org and/or on the FCMAT website at www.fcmat.org. If any of the information below is confusing please see the ASB Bookkeeper to discuss the legal aspects of your club/organization. At the end of this document please find the board policy that outlines that Ripon High School can have an authorized Associated Study Body and board policy that discusses the regulation of fundraising on the Ripon High School campus. If questions arise about this policy please see the Superintendent regarding the content.

Manual Outline – information provided by CASBO and FCMAT

I. Chapter One – An Overview of Student Organizations A. What is Associated Student Body? 1. Group of California school students who: a. Raise and spend money for student activities b. Make decisions on how money is spent c. Participate in co- and extra-curricular activities d. Learn good business practices 2. Authorized by Education Code and school board B. Why are there so many issues, including Audit Findings, in ASB? 1. Big business 2. Decentralized with many players 3. Accounting by non-accountants 4. CASH transactions 5. Insufficient internal controls 6. Little guidance C. ASB Operations 1. Successful organization include: a. Comprehensive board policy and administrative regulations b. Comprehensive and user-friendly manual c. Significant oversight and support from the district office d. Annual training e. Standardization D. ASB Types 1. Middle and High Schools 2. Activities are organized around: a. Student clubs b. Student council 3. Students make decisions a. Develop budgets b. Plan fund-raisers c. Approve expenditures 45 4. Advisor and school principal a. Provide assistance and advice. 5. What is an ASB Club? a. Our secondary schools offer extra-curricular sports and there is money in ASB accounts for these sports. These “clubs” don’t have officers or formal meetings, and financial decisions are made by the coaches. Are these really clubs? 1. The students MUST play a major role. The whole idea of ASB is to get students involved. 2. In secondary schools, the students make the decisions and the adults assist. The format includes elected officers, formal meetings, and making the financial decisions. i) The coach/advisor must co-sign pre-authorization of expenditures, along with student officers. 3. Many athletic clubs are run incorrectly. If the adults are making the decisions, the appropriate format for this type of fundraising event is a parent or booster club, or in district accounts.

II. Chapter II – Who’s Involved in ASB Organizations? A. Who is involved? 1. State of California a. Legislature writes the law b. State agencies enact regulations based on the Laws c. California Department of Education develops policies regarding legislation or regulations 1. Codified in Title 5 of the California Code of Regulations d. State relies on district governing boards to enforce laws. 1. Annual Audit provides the State an update of how the districts are doing in this area. 2. Governing Board a. Ultimately responsible for everything in the district b. Approve formation of ASB (E.C. Section 48930) 1. Establishes parameters via board policy and regulations 3. Superintendent a. Ensures board policy implemented by staff b. Administrative Regulations include the detail procedures c. Communicate 1. Board policy guidelines 2. Discrepancies identified in audit 3. Allegations of improprieties will be investigated immediately 4. Business Office a. Responsible for general oversight of student body activities 1. Resource to site staff 2. Develop/update ASB manual 3. Provide training at least annually 4. Review financial reports – quarterly 5. Review reconciled bank statements – monthly 6. Work with site staff to resolve audit findings 5. Site Principal a. Students are more involved and active in an organized site 46 1. Communicate and enforce laws, policies, and procedures 2. Ensure student council is established 3. Appoint ASB and club advisors 4. Supervise ASB Bookkeeper and ASB Advisors 5. Approve fund-raisers/expenditures by the Activities Director 6. Work with district business office 6. The ASB Advisor(s) a. Necessary for each club and the student council/leadership class b. Works closely with students as the principal’s designee for ASB functions on a day-to-day basis c. Supervises the clubs’ and student council’s activities d. Important link between students, bookkeeper, and principal e. Ensure day-to-day adequate internal controls in place for fundraisers f. Assists their club in preparing an annual budget and revenue projection estimates g. Ensures only valid expenditures are made and authorized from student funds 7. The ASB Bookkeeper a. Safeguards ASB funds held at school site b. Ensures timely deposits with banks c. Maintain adequate financial records in accordance with established procedures d. Reconcile bank account EACH MONTH e. Ensure laws and district policies related to ASB are followed 8. The Student Council (Organized ASB) a. Represents the students b. Primary responsibilities include 1. Develop and adopt the annual budget for the student council/leadership class 2. Authorize the budget for all student clubs 3. Authorizes fundraising events for all student clubs 4. Approves expenditures from all student funds 5. Reviews financial reports and reconciliations from all student clubs c. Primary authority as to how the funds raised by students will be spent 9. The Independent Auditors a. Performs the annual financial review of the School district, including ASB funds/student financial activity. b. Report findings in the annual audit report if problems or significant weaknesses identified 1. Each finding will then have recommendation on how to correct the weaknesses 2. District must provide a written response to rectify the discrepancy in an Action Plan c. Serves as a technical resource d. Assist with fraud investigation, if requested 10. EVERYONE involved must report suspected fraud or abuse to principal and/or the business office 11. Food Services/Cafeteria Program – Both benefit the same students a. Assist ASB with compliance with food regulations b. ASB must be non-competitive 47 c. ASB and foodservices should build partnerships 12. Who is NOT involved? a. Booster Clubs b. Foundations c. Parent Groups 1. Not involved because the outside organizations are formed to provide support to the students and the school district, they: i) ARE NOT legally part of school or district ii) ARE NOT included with annual audit iii) SHOULD have a separate taxpayer ID number iv) MAY NOT use ASB accounts v) Funds are NOT controlled by students or principal vi) Board (or designee) approval required to fund-raise on campus during the school day 2. Cannot be commingled i) Non-student groups cannot deposit funds into the ASB accounts unless they are truly being donated to the ASB ii) Once the funds are donated to ASB, only the student organizations control how the funds will be used 3. See the Education Code in the Manual for further assistance in this section.

III. Chapter 3 – Laws and Regulations A. California Education Code 1. California Code of Regulations (CCR), Title 5 2. California Constitution 3. Revenue and Taxation Code 4. Internal Revenue Code 5. Penal Code B. Supplementary guidance is needed as laws and regulations governing ASB activities and funds are not sufficiently comprehensive to provide guidance in all areas. 1. Supplementary guidance is based on a. Sound business practices b. Good Internal controls c. Local school district board policies and administrative regulations d. Best practices from around California 2. Ed Code Section 48930 a. Grants the board authority for students to organize an ASB b. Purpose and privileges of student body activities 3. Ed Code Section 48933 a. Guidance on where student funds can be deposited or invested b. Three people must pre-approve the spending of ASB funds 4. Ed Code Section 48934 a. Allows ASB funds to be used to finance activities for non-instructional periods or to augment or enrich the district’s programs for kindergarten through six students. 5. Ed Code Section 48936 a. Provides guidance on additional uses of student funds, such as loans to other ASB organizations. 6. Ed Code Section 48937 48 a. Requires governing board to provide for supervision and audit of student funds. b. Allows the governing board to use the school district staff for ongoing audits of ASB funds. C. Fundraising Activities 1. Ed Code Section 48931 a. Grants the school board the authority to authorize the sale of food by student organizations. 2. Ed Code Section 48932 a. Grants the school board the authority to authorize student organizations to conduct activities, including fundraising during and after school hours. 3. Ed Code Section 51520 a. Prohibits teachers or others from soliciting students during the school day on school premises unless solicitation is for a charitable organization or an organization under the control of the district and has been approved by the board. 4. Ed Code Section 51521 a. Prohibits individuals from making solicitations on behalf of the district or ASB without approval of the governing board. 5. Penal Code 319 a. Defines lotteries 6. Penal Code 320 a. Any person contrives, prepares, sets up, proposes or draws any lottery is guilty of a misdemeanor. 7. Penal Code 320.5 a. California public schools are not eligible to participate in lotteries or games of chance. 8. Penal Code 326.5 a. Authorizes bingo games that are run by charitable organizations but state “no minors shall be allowed to participate in any bingo game.” D. Raffles and Games of Chance 1. Required eligibility a. Private non-profit groups (NOT ASB) b. Own Tax ID number c. Must register annually with Attorney General’s Registry of Charitable Trusts prior to raffle – Good for 12 months d. Must distribute at least 90% of gross receipts to beneficial or charitable purposes 2. Department of Justice 3. Board Policy a. District governing board must adopt policy and regulations that govern: 1. Establishment of the student body organization 2. Supervision of the organization’s activities 3. Operation and management of the organization’s fiancés 4. QUESTION on 50/50 Raffle a. The Class of 2008 would like to have a 50/50 fundraiser. They would sell tickets for $1.00 for one ticket and $5.00 for six tickets. The tickets would say Donation NOT Required and they would hand out a lollipop with each sale. b. The winner would receive half of the total money collected. 49 c. Would these procedures make this fundraiser legal? 5. ANSWER on 50/50 Raffle a. School districts, including student clubs, are not authorized to participate in raffles since they are NOT nonprofit organization exempt from state tax as defined in the Franchise Tax Coed (like the local PTA is). Rather, school districts are exempt from tax by virtue of being a political subdivision of the State of California. b. Many school groups print out tickets with the words “suggested donation” on them and call it a drawing rather than a raffle. That really doesn’t make it legal unless you are prepared to give anyone who asks for a ticket as many tickets as they want for free (no donation). Even if your district gives them for free, you still run the risk if someone wanted to challenge the issue as it is still legally a raffle. The only way to have a legal raffle is to work with an eligible nonprofit organization with their own tax identification number and who registers with the Attorney General on an annual basis, disbursing 90% of the profits to a charitable purpose. c. In your specific question, in addition to the tickets stating, “donation not required,” you are also giving a lollipop with each ticket. This is often done in the field, but the reality is that a lollipop costs a lot less than $1, and it is clear the real “reason” the tickets are purchased is for a 50/50 raffle. If each ticket were 25 cents, then it would be more realistic to state that the purchaser is really purchasing a lollipop for 25 cents, and then there is a chance something else might be won as a “door prize,” but that “door prize” being a 50/50 type again looks clearly like a raffle. A raffle can be defined as paying for a chance to win something of value. d. The best thing to do is to not conduct anything that could be considered a raffle. Have an outside group do it to stay away from any potential issues. 6. QUESTION on teachers doing fundraising a. As a teacher, why can’t I do my own fundraising for my own account at the school? 7. ANSWER on Teachers doing Fundraising a. State law prohibits any solicitation – sales or other requests for money – of students on school grounds during the school day except by district- controlled programs, such as the cafeteria, or by student groups, or charitable groups that have obtained board approval. 1. Teachers and other employees do not fall into these categories. b. A teacher’s fundraising to increase their class budget would be taxable income to that teacher, reportable to the Internal Revenue Service and Franchise Tax Board. c. Student body groups may participate in the district’s special income tax exempt status, but teachers cannot.

IV. Chapter 4 – School Food Sales Provisions of the Law A. Food Sales have been one of the most popular methods of fundraising, but has also become the most regulated! B. Vending Machines 1. Exclusive carbonated beverage vending contracts not allowed unless: a. Board policy in place b. Public hearing occurs to ensure adequate internal controls are in place c. All funds benefit public education 50 d. Comply with competitive bidding process e. Additional information in Chapter 11 C. High School Food Sales 1. During the school day (½ hour before school to ½ hour after) if: a. Specific nutrition requirements met b. Four annual sales for any and all groups 1. All on the same four days c. One student group daily sales 1. Usually the student council 2. Three types of food or beverage items d. No competition with Food Services Program e. Not prepared on campus or in private homes f. Safe food handling-compliance with the Health & Safety Code 2. Full meals or a la carte items, including snack if: a. No more than 250 calories per item, AND: 1. Less than 35% of calories from fat 2. Less than 10% of calories from saturated fat 3. Less than 35% of weight from sugar (except fruits and vegetables) 3. Full meals or a la carte items, including entrees if: a. Not more than 400 calories per item, AND: 1. Less than 36% of calories from fat 2. Must be categorized in the National School Lunch Program as an entrée. 4. Beverages restricted to 50% compliance July 2007 and 100% compliance July 2009: a. Water b. Milk (except whole milk) c. Fruit/Vegetable juice (minimum 50% juice, no added sweeteners) d. Electrolyte beverage with no more than 42 grams of added sweetener per 20 ounce serving. 5. Be aware of what is contained in your district’s Wellness Policy 6. Food Service Program is the “expert” in the district when there are questions in this area. 7. Non-compliant Food and Beverages a. May be sold if: 1. The sale takes place off campus 2. The sale takes place at least ½ hour after or before the school day. 3. The sale takes place at a school-sponsored event after the school day. b. Restrictions apply to all sales, including vending machines and student stores.

V. Chapter 5 – Forming the Organization A. Starting up ASB and/or New Clubs 1. Submit a formal application a. Title, powers and duties of the officers and the manner of their election. b. Scope of proposed activities c. Name of organization d. Endorsed by a club advisor 51 2. Clubs/Trust Accounts a. Currently enrolled students at the site b. Must have a: 1. Purpose 2. Constitution: outline policies and rules 3. Bylaws: identify operational parameters c. All new clubs should form according to the ASB constitution and board requirements in your specific district. 3. New clubs must be approved by: a. Student council b. Principal B. Student Club and Trust Accounts 1. Funds held in trust by student council a. ASB constitution or bylaws should state that funds of inactive clubs transfer to general ASB accounts after a certain period of time. C. Legal Requirements 1. Some school districts require an application for all ASB organizations on an annual basis so that it is clearly reflected who the current officers and members are, who will act as advisor, as well as ensuring the most current constitution and bylaws are on file. D. ASB Constitution 1. The school student council and each club must prepare and adopt an official constitution. 2. Must state the name and purpose of the organization and must present the framework within which the organization will operate. 3. Should clearly state all of the policies and rules for student governance of the student organization/club. 4. The Constitution should include: a. Background information on the organization b. The name of the organization c. The purpose of the organization d. The type of activities that the organization will conduct e. The membership requirements for the organization including the eligibility requirements. f. Definition of quorum g. How the constitution is amended h. Information on the officers and meetings i. The titles and terms of office and of the officers j. The duties of the officers k. How officers are elected and requirements of eligibility l. Whether or not the club/organization will be represented on the student council. m. How will representative to the student council be selected? n. What are the qualifications for eligibility on the student council? o. What are the term limits on the student council? p. How will club advisors be appointed. q. The time, frequency, and place for meetings r. Financial information s. How and when the budget is prepared. t. How expenses are approved 52 u. Who will monitor the budget? v. What types of financial statements and reports will be generated and distributed. w. How committees will be appointed x. How clubs within the student body organization will be formed, including their purpose, method of organization and discontinuance, financial activities and requirments for constitution and/or bylaws. E. ASB Bylaws 1. A set of bylaws that identifies operational parameters is also an important component of a club or ASB structure, even though only the student council is required to have one. F. Minutes of Meetings 1. The student council and each club must prepare and maintain a record of each meeting and action taken in them. 2. Demonstrate that policies and procedures are followed by ASB. 3. Review and approve at next meeting 4. Maintain a binder of all the approved minutes for the school year. 5. The minutes should include a. Name of the club or organization holding the meeting b. Date, time, and place of the meeting c. Names of those in attendance d. Names of the presiding officer e. Approval of minutes from the previous meeting f. What was discussed or reported on during the meeting g. Report on activities of standing committee(s) or special committee(s) h. What action was taken during the meeting, e.g., the budget was amended or the expenses were approved. i. The results of any votes taken, including who made a motion, who seconded the motion, and anyone in opposition, if applicable. j. Reporting on any communication to the ASB k. Listing of any unfinished business l. Date and time of next meeting m. What time the meeting adjourned n. Who prepared the minutes 6. Any information introduced to those attending the meeting should be attached to the original copy and kept on final, such as bylaws, project outlines and letters. The club secretary, or whoever took the minutes, should also signed the minutes when they are completed.

VI. Chapter 6 – General Business Practices A. Establishing a Bank Account 1. Work with the district business office as district approval required. 2. Use the district’s federal tax ID 3. Should be in the name of the ASB Organization 4. Exclusive use by ASB 5. At least 2 signers on account a. Not students b. Should have backup signers B. Internal Controls 1. Policies and procedures that: 53 a. Promotes successful fundraising b. Protect against improper fund disbursements c. Assure that unauthorized obligations cannot be incurred d. Provide reliable financial information e. Reduce the risk for fraud and abuse f. Protect employees and volunteers 2. Segregation of duties according to their functions a. Those who initiate or authorize transactions b. Those who execute the transactions c. Those with the responsibility for the item resulting from the transaction 3. Affected by practices and attitudes of management a. Does the principal set good example of following proper procedures & guidelines? b. Does ASB advisor ensure that students follow and understand policies and procedures? c. Does the business office provide continual assistance and training? d. Does the principal and advisor follow up on problems and take action? C. Basic Components and Internal Controls 1. Policies and procedures based on laws, regulations and sound business principles are established, implemented and maintained. 2. Policies and procedures are communicated to those involved. 3. Training occurs for those expected to carry out policies and procedures. 4. Adequate documentation of procedures are prepared and maintained. 5. Periodic monitoring is performed. 6. Internal controls do not completely eliminate the chance of errors occurring, but they do reduce the risk to an acceptable level. 7. Very few entities have perfect internal control structures, so management must develop techniques to offset any weakness. a. Internal control audits 1. Checklist contained in manual b. Annual independent audit D. Insurance 1. Responsibility for ASB having adequate insurance protection rests with the governing board. a. Delegated to business office 2. ASB should have: a. Fire insurance covering physical property b. Theft insurance covering funds and physical assets c. Workers’ Compensation for ASB employees d. Liability insurance

VII. Chapter 7 – Budgets and Budget Management A. Budget Format and Development 1. A budget is the financial plan for a specific period of time (usually one year). 2. Student council and individual clubs need to develop annual goals and reflect the plan of how to obtain those goals in a budget document. a. Estimated Revenue – What fundraisers should we have? b. Estimated Expense – What will the fundraiser cost us to hold? c. Estimated ending reserves and club carryover – Is there enough left over to accomplish the goals? 54 B. Budget Reports 1. Reports should include: a. Current budget b. Actual amounts received or expended to date c. Revised estimates of receipts and expenditures for the entire year 2. Information for governing board, community and district administration 3. Useful in modifying activities if financial circumstances change C. Budget Monitoring 1. Compare actual revenues and expenses to the current budget a. Is the budget realistic? b. Are we going to meet our goals? 2. Monitor at least monthly 3. Update as needed a. 10% variance 4. Is Carryover of Unexpended Balances Allowable? a. Carryover is the amount of money left at the end of the year after all bills are paid. b. Money should be spent by the students who raised it. c. Develop a board policy to limit carryover d. Carryover may be allowed for multi-year projects 5. Ripon High is allowed a certain percentage for a reserve.

VIII. Chapter 8 – Fundraising Events A. Things to Consider 1. Approval of fundraising events a. Ed Code Section 38932 – States the board must authorize fundraising. 2. Considerations a. Education experience b. Voluntary c. Frequency/schedule d. Student safety e. Allowable by insurance company B. Fundraising Approval 1. Governing board should review and approve ASB fundraising events at beginning of year, delegate that approval to someone else, or should approve policies and administrative regulations that delineate allowable and unallowable fundraising events. 2. Revise event schedule as changes occur. 3. Board can delegate authority to district designee. C. Allowable Fundraisers 1. Should contribute to educational experience and could include: a. Athletic events b. Concessions sales c. Entertainment and dances d. Advertising e. Publications f. Student store (See chapter 17 in full manual) g. Sale of food items (limited) h. Scholarships and trusts i. Gifts and grants 55 j. Cultural events/international fairs D. Unallowable Fundraisers 1. By law: a. Raffles/games of chance 2. Insurance coverage due to risk or health and safety concerns: a. Mechanical or animal rides b. Use of darts, arrows, or other weapons c. Objects thrown at people (pie toss) d. Dunk tanks e. Destruction of objects f. Trampolines 3. Ownership a. Rental of district property E. Things to Remember 1. Ask Questions first… a. Principal b. District business office c. Risk management

IX. Chapter 9 – Class Fees, Deposits and Other Charges A. Student Fees 1. California Constitution provides for a free school system. 2. Since 1874, the California Supreme Court had interpreted this to mean that this entitles students to be educated at the public’s expense. B. Non-Allowable Fees 1. Depositing fees into ASB does not make them allowable! 2. Title 5, California Code of Regulations, Section 350, specifically states: a. “A pupil enrolled in a school shall not be required to pay any fee, deposit, or other charge not specifically authorized by the law.” 3. School districts cannot levy fees as a condition for participation in any class, whether elective or compulsory. a. Security deposits: for locks, lockers, books, class apparatus, musical instruments, uniforms or other equipment. b. Fees for participation: in either curricular or extra curricular activities. c. All supplies: both necessary and supplemental, must be provided free of charge by the district whenever a particular curricular or extra-curricular program is adopted. 4. Gym or Physical Education Clothes a. Ed Code Section 49066 states that “no grade of a pupil participating in a physical education class may be adversely affected due to the fact that the pupil does not wear standardized physical education apparel where they failure to wear such apparel arises from circumstances beyond the control of the pupil,” such as lack of sufficient funds. b. California Department of Education has stated the position that a school district may require students to purchase their own gym clothes of a district specified design and color so long as the design and color are of a type sold for general wear outside of school. Once the required gym uniforms become specialized in terms of logos, school name or other similar characteristics not found on clothing for general use outside of school, they

56 are considered school supplies and the district must provide the uniforms free of charge. C. Allowable Fees 1. The following fees can be levied as authorized in the following Education Code section: a. Transportation to and from school 1. Ed Code Section 39807.5 b. Transportation of pupils to places of summer employment 1. Ed Code Section 39837 c. Adult School Fees 1. Ed Code Section 52612 d. Food charges when served to pupils 1. Ed Code Sections 38082 and 38084 e. Class materials can be sold to persons enrolled in adult classes. The materials shall be sold at no less than the cost to the district. Any article made is then the property of the person who made it. 1. Ed Code Sections 52612, 52615, and 17552 f. Lost or damaged books or other district supplies, not to exceed $10,000. 1. Ed Code Section 48904 g. Textbooks used in adult classes or a refundable deposit or loaned books. 1. Ed Code Section 60410 h. Tuition fees for pupils whose parents are actual and legal residents of an adjacent foreign country or an adjacent state. 1. Ed Code Sections 48050, 48051, 48052 i. Insurance for field trips 1. Ed Code Section 35331 j. Materials can be sold to a student for property the student has fabricated from such materials for their own use if the price does not exceed direct cost of the materials used and provided that the school district governing board has authorized such sales pursuant to an adopted board policy. This applies to classes such as wood shop or sewing where an item is taken home by the students, but not when the items remain at school. It also does not apply to food in home economic classes, which is eaten as part of the course work. 1. Ed Code Section 17551 k. Actual cost of duplication of public records or student records based on the California Public Records Act. 1. Ed Code Section 49091.14 l. Fees for outdoor science camp programs. The fee cannot be mandatory – no pupil shall be denied the opportunity to participate in a school camp program because of nonpayment of the fee. 1. Ed Code Section 35335 m. Charges for medical and accident insurance for athletic team members for those members who can afford to pay. 1. Ed Code Section 32221 n. Fees for field trips and excursions may be charged in connection with courses of instruction or school-related social, educational, cultural, athletic, or school band activities. But, no pupil shall be prevented from making the field trip or excursion because of lack of sufficient funds. 1. Ed Code Section 35330 X. Chapter 10 – Cash Receipt Management and Procedures 57 A. Cash Receipts Controls 1. Number one area of ASB findings 2. Ensure: a. ASB assets are protected b. Those who handle cash are protected 3. Principal needs to guarantee; a. Proper cash control procedures established and followed: 1. During fundraising event 2. When cash and checks given to ASB Bookkeeper for deposit into ASB account. 4. Internal Controls must be in place a. Proper cash control for all receipts b. Dual cash counts c. Endorse all checks – “For Deposits Only…” d. Safe storage e. Timely deposits (2-3 days) 1. Never leave un-deposited money at a school over weekends or holidays. f. Control over tickets and receipt forms g. Report overages and shortages 1. Loss of tickets the same as loss of cash 5. Cash Receipt Controls a. Pre-numbered tickets for all sales events b. Cash register for store type events c. Pre-numbered receipt books for all receipt transactions d. Tally sheets for designated activities e. Inventory control for vending machines B. Petty Cash and Change Accounts 1. Petty Cash a. To have cash available for making change or for making immediate cash payments of small amounts. 1. Must have same documentation as do other disbursements 2. Change Account a. Normally established for a specific period of time of an individual fundraiser or activity. 1. Solely for the purpose of making change 2. Expenditures CANNOT be made from this account b. When specific fundraiser is complete, the account should be deposited back into the bank account. C. Internal Control Procedures 1. Pre-numbered Tickets a. Dances b. Entertainment Events c. Car Washes d. Athletic Events e. Festivals 2. Cash Register a. Student Store b. Concession Stands 3. Pre-numbered Receipt Books 58 a. Publication sales b. Sale of advertising space 4. Tally sheets a. Car washes D. Cash Control Procedures for ASB Bookkeepers 1. Provide materials to ASB advisors for fundraisers, and keep stock on hand a. Ticket rolls b. Receipt books c. Forms 2. Responsible for receipts once received from ASB advisor until deposited 3. Count cash in presence of another person 4. Red Flags in an Audit a. Some things to look for: 1. Principal’s Discretionary Account 2. Coach’s Account 3. Faculty Account 4. PTA/Booster Accounts 5. Mrs. Jones’ Accounts 6. Sunshine Fund 7. Class Fees

XI. Chapter 11 – Vending Machines A. Policy Issues 1. Board policies and administrative regulations should be in place regarding: a. Where vending machines should be placed? b. Who is responsible for the machines? c. What products are permitted? d. Who is responsible for contract arrangements? B. Operations 1. Contract Arrangement a. Need a contract with vendor 1. Installation, maintenance, quality, quantity, commission rates, and types of food and drink. b. Competitive bid requirements c. Set policy and implement internal controls d. Annual public hearings e. Inventory controls 2. Financial Management a. ASB Managed 1. Most profit 2. Most work 3. Highest risk of theft 4. Counts as “One Daily Sale” b. Vendor Managed 1. Easiest 2. Least profit 3. Doesn’t count as “One Daily Sale” c. Food Services Managed 1. Doesn’t count as “One Daily Sale” 59 2. Can share profits with ASB XII. Chapter 12 – Gifts and Donations A. What do Gifts, Grants and Donations Include? 1. Vital contributions to California public schools come in a variety of forms. 2. Money, Material or Equipment a. Accepted by student body b. Approval by the school board or authorized designee c. Must have a legitimate use in the school program d. Consideration given to installation and maintenance costs before acceptance 3. Determine when received whether the donation is for student body or school district. a. For a specific school or program: deposit into district account b. For student activities: deposit into ASB account 4. Account for donated funds correctly when received a. Avoid future confusion b. Common audit finding B. Whose Donation is it? 1. Wording should indicate a. Recipient 1. School 2. Student group 3. Foundation 4. Booster 5. Other b. Purpose 1. Intent of donor should be clearly stated

XIII. Chapter 13 – Contracts A. Controls and Procedures 1. Develop a board policy stating: a. Authorized signers b. Dollar limits c. Required district office and legal review/authorization B. Contract Consideration 1. Develop standardized contracts for annual activities a. Clear terms and conditions b. Conforms to board policies/regulations c. Ensuring business office and/or legal counsel review contract before signing d. Adequate insurance terms and hold harmless clauses 1. Normally limit to one year 2. Special authority if more than one year e. Signatory authority f. Adequate funds available g. Project approved and budgeted by students h. No construction contracts 1. Only board should enter into C. Business Practice 1. Good business practices are a key component to success a. Clear identification in board policy for contracting authority 2. Defined responsibility and support role for staff 60 3. Contract negotiations a. Terms and conditions b. Price c. Deliverables 4. Mandatory review by business office if over certain amount 5. Limit contract term to one year

XIV. Chapter 14 – Allowable and Questionable Expenses A. Allowable Expenses 1. Must promote the students’ general welfare, morale, and educational experience 2. Must be directly linked to the students’ benefit 3. Must be pre-approved 4. Must be outside of what the school district should provide, or has provided in past, from their own general funding sources. 5. Must be expended in a manner approved by the student governing body. B. Allowable Expenses 1. Expenses CANNOT be considered a gift of public funds a. Must have a direct or substantial purpose b. Misappropriation of public funds is considered a criminal act, with no monetary limit specified. c. Better to be safe than sorry 2. Examples: a. Student magazines and newspaper subscriptions b. Field trips/excursions/outdoor education camps c. Extra-curricular athletics costs d. Student store products e. Social events f. Library books g. Scholarships h. Awards C. Unallowable Expenses 1. Ask these questions: a. Does the expense directly promote the general welfare, morale or educational experience of the students? b. Does the expense benefit students as a group? c. Could be considered a Gift of Public Funds? 2. If you answer NO to the questions 1&2, the expenses are unallowable 3. If you answer YES to question 3, the expenses are unallowable D. Prohibited Expenses 1. Include: a. Salaries/supplies that are the district’s responsibility b. Repair and maintenance of district equipment/facilities c. Items for employee personal use d. Faculty meeting costs e. Parent group costs f. Gifts of any kind g. Large awards h. Employee appreciation meals i. Employee clothing/attire 61 j. Donations k. Cash awards E. Are gifts allowable? 1. Not allowable, even if small in amount a. Previously been said that under $20.00 would be ok b. Recent court cases say differently c. Gift certificates should not be purchased (but merchants or individuals can donate them). F. Are donations to other organizations allowed? 1. Considered a Gift of Public Funds a. Funds have been raised under the district’s non-taxable status 2. Students can still organize fundraisers to support specific charities if clearly identified as such. a. Checks written to the organization/charity 3. Penny Drives 4. For needy families: legal foundation should be established G. Are awards allowed? 1. Authorized by Ed Code Section 44105 2. To employees for exceptional contributions/to students for excellence 3. Board required to adopt rules and regulations about awards a. If no policy or regulations, no awards allowed 4. Can’t exceed $200 unless in board policy 5. Awards to community members not considered authorized 6. Birthdays, weddings, funerals and holidays not considered an award H. Awards 1. Awards to employee allowed if: a. Propose procedures or ideas that are adopted and result in eliminating or reducing district expenditures or improving operations. b. Perform special acts or special services in the public interest c. Make exceptional contributions to the efficiency, economy or other improvement in operations of district. I. Are scholarships allowed? 1. Do not benefit a group of student but can be accepted if: a. Governing board, or authorized designee, approves b. Acceptance must be in writing, including all conditions prescribed by the donor. c. Statement must also be included regarding the disposition of any remaining balance. d. Each scholarship and trust account must be established 2. If going to approve scholarships, set guidelines a. How many b. How much 1. $250 per individual 2. No more than $1,000 in total 3. Check made payable to the college J. Is employee clothing/attire allowed? 1. No specific statutory or case authorizing such expense 2. Could be okay if required in order to perform his or her duties as a coach, club advisor, etc. if considered an “award” under Ed Code Section 44015 K. Are employee appreciation meals allowed? 1. Do not qualify as awards 62 2. Attorney General says not “actual and necessary” per Ed Code Section 44032 3. Don’t provide a direct and/or substantial purpose – so would be a gift of public funds. L. Good Business Practices to have in place: 1. Establish board policy and administration regulations on what is allowable 2. Establish procedures to follow if questions arise 3. Set parameters for determining appropriateness 4. Assign specific employee in the district office to provide assistance 5. Provide annual training

XV. Chapter 15 – Cash Disbursement Management and Procedures A. What basic internal controls should be in place? 1. Spending Student Money must be done in accordance with an established system that encompasses sound elements of internal control, good accounting practices, and in conformity with board regulations – Ed Code Section 48933 2. All disbursements properly authorized by students, and recorded in the minutes. 3. Adequate records, such as payment from original document only, must be maintained. 4. Payments are not made unless goods and services are authorized, and until the item is received. 5. Proper audit trail exists, including original detailed receipts. 6. Records are retained as established by policy or procedure. B. Basic Internal Controls 1. Employee protection 2. Never pay expenses from cash receipts a. Deposit cash and then write a check 3. Keep the checkbook and extra check stock in a safe, secure place 4. Never sign checks in advance – have a backup signer. 5. Use checks in proper sequence 6. Never make check out to cash C. What additional controls should exist for Organized ASB? 1. Purchase order/requisition completed prior to purchase. 2. All expenses must be pre-approved by 3 signatures (no purchase order): a. Student representative b. Board designee (principal) c. Certificated advisor 3. Check needs 2 signatures 4. Club minutes reflect issuance and approval of purchase order D. Are purchase orders really necessary? 1. Must be issued for purchases approved by the student council a. ASB not obligated to pay for an expenditure ordered by a teacher, student or other person who had not first received a written purchase order. 2. Purchase Orders must be pre-numbered and have multiple copies

XVI. Chapter 16 – Equipment Purchases and Management A. Equipment Purchases 1. Moveable personal property with a useful life of more than one year and a cost in excess of $500. a. Not land or buildings 63 b. Examples: Machines, furniture, vehicles, and furnishings 1. Not an integral part of a building 2. Need to consider a. Who owns b. Maintenance and repairs c. Insurance d. Risk exposures e. Inventory listing maintenance 3. Purchase should be approved by the school governing board B. Ownership Options 1. Remains properly of ASB a. Future students must maintain b. Additional insurance needed? c. Tagging system d. Fixed asset account in accounting system e. Keep inventory record for each item of equipment f. Annual inventory required of all equipment 2. Include: a. ASB donates purchase to district 1. District assumes maintenance and repair costs 2. Board should formally accept the donation 3. District insurance would cover 4. Tagging system in place 5. Already has an inventory listing and codes annual inventory

Chapter 17 – The Student Store - See Full Manual Chapter 18 – Employees and Consultants - See Full Manual Chapter 19 – Accounting and Financial Management - See Full Manual Chapter 20 – Bank Reconcilliations - See Full Manual Chapter 21 – Effective District Oversight - See Full Manual Chapter 22 – Student Organizations in Community Colleges - See Full Manual Chapter 23 – Where to Go for Help - See Full Manual

64