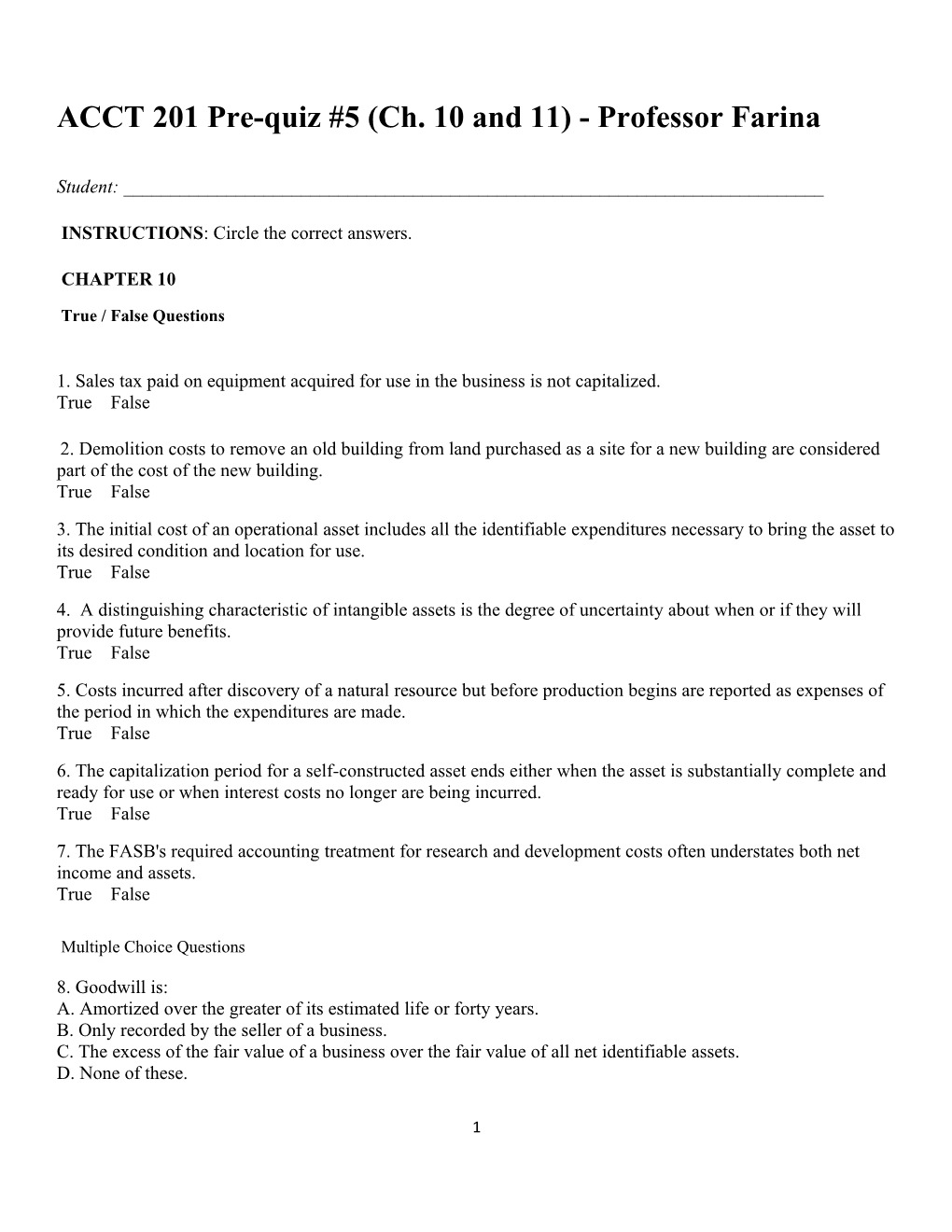

ACCT 201 Pre-quiz #5 (Ch. 10 and 11) - Professor Farina

Student: ______

INSTRUCTIONS: Circle the correct answers.

CHAPTER 10

True / False Questions

1. Sales tax paid on equipment acquired for use in the business is not capitalized. True False

2. Demolition costs to remove an old building from land purchased as a site for a new building are considered part of the cost of the new building. True False

3. The initial cost of an operational asset includes all the identifiable expenditures necessary to bring the asset to its desired condition and location for use. True False

4. A distinguishing characteristic of intangible assets is the degree of uncertainty about when or if they will provide future benefits. True False

5. Costs incurred after discovery of a natural resource but before production begins are reported as expenses of the period in which the expenditures are made. True False

6. The capitalization period for a self-constructed asset ends either when the asset is substantially complete and ready for use or when interest costs no longer are being incurred. True False

7. The FASB's required accounting treatment for research and development costs often understates both net income and assets. True False

Multiple Choice Questions

8. Goodwill is: A. Amortized over the greater of its estimated life or forty years. B. Only recorded by the seller of a business. C. The excess of the fair value of a business over the fair value of all net identifiable assets. D. None of these.

1 9. An exclusive 20-year right to manufacture a product or use a process is a: A. Patent. B. Copyright. C. Trademark. D. Franchise.

10. When selling operational assets for cash: A. The seller recognizes a gain or loss for the difference between the cash received and the fair value of the asset sold. B. The seller recognizes a gain or loss for the difference between the cash received and the book value of the asset sold. C. The seller recognizes losses, but not gains. D. None of these.

11. Which of the following does not pertain to accounting for asset retirement obligations? A. They accrete (increase over time) at the company's credit-adjusted risk-free rate. B. They must be recognized according to SFAS 143. C. Statement of Financial Accounting Concepts No. 7 is applied when adjusting cash flow obligations for uncertainty. D. All of these pertain to accounting for asset retirement obligations.

12. Grab Manufacturing Co. purchased a ten-ton draw press at a cost of $180,000 with terms of 5/15, n/45. Payment was made within the discount period. Shipping costs were $4,600, which included $200 for insurance in transit. Installation costs totaled $12,000, which included $4,000 for taking out a section of a wall and rebuilding it because the press was too large for the doorway. The capitalized cost of the ten-ton draw press is: A. $171,000. B. $183,600. C. $187,600. D. $185,760.

13. Vijay Inc. purchased a 3-acre tract of land for a building site for $320,000. On the land was a building with an appraised value of $120,000. The company demolished the old building at a cost of $12,000, but was able to sell scrap from the building for $1,500. The cost of title insurance was $900 and attorney fees for reviewing the contract was $500. Property taxes paid were $3,000, of which $250 covered the period subsequent to the purchase date. The capitalized cost of the land is: A. $336,400. B. $336,150. C. $334,650. D. $201,150.

2 14. Juliana Corporation purchased all of the outstanding stock of Caldwell Inc., paying $2,700,000 cash. Juliana assumed all of the liabilities of Caldwell. Book values and fair values of acquired assets and liabilities were:

Juliana would record goodwill of: A. $1,180,000. B. $ 600,000. C. $ 880,000. D. $ 100,000.

15. Simpson and Homer Corporation acquired an office building on three acres of land for a lump-sum price of $2,400,000. The building was completely furnished. According to independent appraisals, the fair values were $1,300,000, $780,000, and $520,000 for the building, land, and furniture and fixtures, respectively. The initial values of the building, land, and furniture and fixtures would be: A. $1,300,000, $780,000, $520,000. B. $1,200,000, $720,000, $480,000. C. $720,000, $1,200,000, $480,000. D. None of these.

16. The basic principle used to value an asset acquired in a nonmonetary exchange is to value it at: A. Fair value of the asset(s) given up. B. The book value of the asset given plus any cash or other monetary consideration received. C. Fair value or book value, whichever is smaller. D. Book value of the asset given.

17. Bloomington Inc. exchanged land for equipment and $3,000 in cash. The book value and the fair value of the land were $104,000 and $90,000, respectively.

Bloomington would record equipment at and record a gain/(loss) of:

A. B. C. D. None of these is correct.

3 18. Interest may be capitalized: A. On routinely manufactured goods as well as self-constructed assets. B. On self-constructed assets from the date an entity formally adopts a plan to build a discrete project. C. Whether or not there is specific borrowing for the construction. D. Whether or not there are actual interest costs incurred.

On June 1, 2008, the Crocus Company began construction of a new manufacturing plant. The plant was completed on October 31, 2009. Expenditures on the project were as follows ($ in millions):

On July 1, 2008, Crocus obtained a $70 million construction loan with a 6% interest rate. The loan was outstanding through the end of October, 2009. The company's only other interest-bearing debt was a long-term note for $100 million with an interest rate of 8%. This note was outstanding during all of 2008 and 2009. The company's fiscal year-end is December 31.

19. What is the amount of interest that Crocus should capitalize in 2008, using the specific interest method? A. $1.90 million B. $1.95 million C. $2.96 million D. None of these is correct.

20. Software development costs are capitalized if they are incurred: A. Prior to point at which technological feasibility has been established. B. After commercial production has begun. C. After technological feasibility has been established but prior to the product availability date. D. None of these is correct.

21. During 2009, Prospect Oil Corporation incurred $4,000,000 in exploration costs for each of 15 oil wells drilled in 2009. Of the 15 wells drilled, 10 were dry holes. Prospect uses the successful efforts method of accounting. Assuming that Prospect depletes 30% of the oil discovered in 2009, what amount of these exploration costs would remain on its 12/31/09 balance sheet? A. $ 6 million B. $14 million C. $20 million D. $42 million

CHAPTER 11 4 True / False Questions

22. Any method of depreciation should be both systematic and rational. True False

23. Total depreciation is the same over the life of an asset regardless of the method of depreciation used. True False

24. Activity-based methods of depreciation are appropriate for assets whose service life is a function of use rather than time. True False

25. A change in the estimated recoverable units used to compute depletion requires retroactive adjustments to the financial statements. True False

Multiple Choice Questions

26. Assuming an asset is used evenly over a four-year service life, which method of depreciation will always result in the largest amount of depreciation in the first year? A. Straight-line. B. Units-of-production. C. Double-declining balance. D. Sum-of-the-year's digits.

For #27, #28 and #29: Cutter Enterprises purchased equipment for $72,000 on January 1, 2009. The equipment is expected to have a five-year life and a residual value of $6,000.

27. Using the double-declining balance method, depreciation for 2009 and the book value at December 31, 2009 would be: A. $26,400 and $45,600. B. $28,800 and $43,200. C. $28,800 and $37,200. D. $26,400 and $36,600.

28. Using the double-declining balance method, depreciation for 2010 would be: A. $28,800. B. $18,240. C. $17,280. D. None of these is correct.

5 29. Using the sum-of-the-years'-digits method, depreciation for 2009 and book value at December 31, 2009 would be: A. $22,000 and $44,000. B. $22,000 and $50,000. C. $24,000 and $48,000. D. $24,000 and $42,000.

On June 30, 2009, Prego Equipment purchased a precision laser-guided steel punch that has an expected capacity of 300,000 units and no residual value. The cost of the machine was $450,000 and is to be depreciated using the units-of-production method. During the six months of 2009, 24,000 units of product were produced. During 2010, 70,000 units were produced. At the end of 2010, engineers estimated that the machine can realistically be used to produce only another 160,000 units.

30. Prego would report depreciation in 2009 of: A. $36,000. B. $43,900. C. $18,000. D. $21,950.

For #31 and #32: On March 31, 2009, M. Belotti purchased the right to remove gravel from an old rock quarry. The gravel is to be sold as roadbed for highway construction. The cost of the quarry rights was $164,000, with estimated salable rock of 20,000 tons. During 2009, Belotti loaded and sold 4,000 tons of rock and estimated that 16,000 tons remained at December 31, 2009. During 2010, Belotti loaded and sold 8,000 tons, but estimated at December 31, 2010, that 12,000 tons remained.

31. Belotti would record depletion in 2009 of: A. $41,000. B. $32,800. C. $30,750. D. $24,600.

32. Belotti would record depletion in 2010 of: A. $54,667. B. $65,600. C. $52,480. D. $55,760.

33. In January of 2009, Vega Corporation purchased a patent at a cost of $200,000. Legal and filing fees of $50,000 were paid to acquire the patent. The company estimated a 10-year useful life for the patent and uses the straight-line amortization method for all intangible assets. In 2012, Vega spent $40,000 in legal fees for an unsuccessful defense of the patent. The amount charged to income (expense and loss) in 2012 related to the patent should be: A. $ 40,000. B. $ 65,000. C. $215,000. D. $ 25,000.

6 34. Nanki Corporation purchased equipment on 1/1/07 for $650,000. In 2007 and 2008, Nanki depreciated the asset on a straight-line basis with an estimated useful life of 8 years and a $10,000 residual value. In 2009, due to changes in technology, Nanki revised the useful life to a total of six years with no residual value. What depreciation would Nanki record for the year 2009 on this equipment? A. $108,333. B. $106,667. C. $122,500. D. None of these is correct.

35. Murgatroyd Co. purchased equipment on 1/1/07 for $500,000, estimating a four-year useful life and no residual value. In 2007 and 2008, Murgatroyd depreciated the asset using the sum-of-years'-digits method. In 2009, Murgatroyd changed to straight-line depreciation for this equipment. What depreciation would Murgatroyd record for the year 2009 on this equipment? A. $ 75,000. B. $125,000. C. $150,000. D. None of these is correct.

36. In testing for recoverability of an operational asset, an impairment loss is required if the: A. Asset's book value exceeds the undiscounted sum of expected future cash flows. B. Undiscounted sum of its expected future cash flows exceeds the asset's book value. C. Present value of expected future cash flows exceeds its book value. D. None of these.

37. At the end of its 2009 fiscal year, a triggering event caused Janero Corporation to perform an impairment test for one of its manufacturing facilities. The following information is available:

The manufacturing facility is: A. Impaired because its book value exceeds expected future cash flows. B. Not impaired because its book value exceeds undiscounted future cash flows. C. Not impaired because it continues to produce revenue. D. Impaired because its book value exceeds fair value.

7 38. In 2008, Antle Inc. had acquired Demski Co. and recorded goodwill of $245 million as a result. The net assets (including goodwill) from Antle's acquisition of Demski Co. had a 2009 year-end book value of $580 million. Antle assessed the fair value of Demski at this date to be $700 million, while the fair value of all of Demski's identifiable tangible and intangible assets (excluding goodwill) was $550 million. The amount of the impairment loss that Antle would record for goodwill at the end of 2009 is: A. $150 million B. $ 95 million C. $ 0 D. None of these is correct

39. Which of the following types of subsequent expenditures is normally capitalized: A. Additions. B. Improvements. C. Rearrangements. D. All of these are normally capitalized.

40. Short answer question: Answer the problem below on a separate piece of paper. Attach your solution to this pre-quiz.

At the beginning of 2007, Metatec, Inc. acquired Ellison Technology Corporation for $575 million. In addition to cash, receivables, and inventory, the following assets and their fair values were also acquired: Plant and equipment (depreciable assets) $120 million Patent 35 million Goodwill 125 million The plant and equipment are depreciated over a 10-year useful life on a straight-line basis. There is no estimated residual value. The patent is estimated to have a 5-year useful life, no residual value, and is amortized using the straight-line method. At the end of 2009, a change in business climate indicated to management that the operational assets of Ellison might be impaired. The following amounts have been determined: Plant and equipment: Undiscounted sum of future cash flows $70 million Fair value 60 million Patent: Undiscounted sum of future cash flows $20 million Fair value 13 million Goodwill: Fair value of Ellison Technology $420 million Fair value of Ellison's net assets (excluding goodwill) 370 million Book value of Ellison's net assets (including goodwill) 470 million* *After first recording any impairment losses on plant and equipment and the patent. Required: 1. Compute the book value of the plant and equipment and patent at the end of 2009. 2. Determine the amount of any impairment loss to be recorded, if any, for the three assets.

8 9