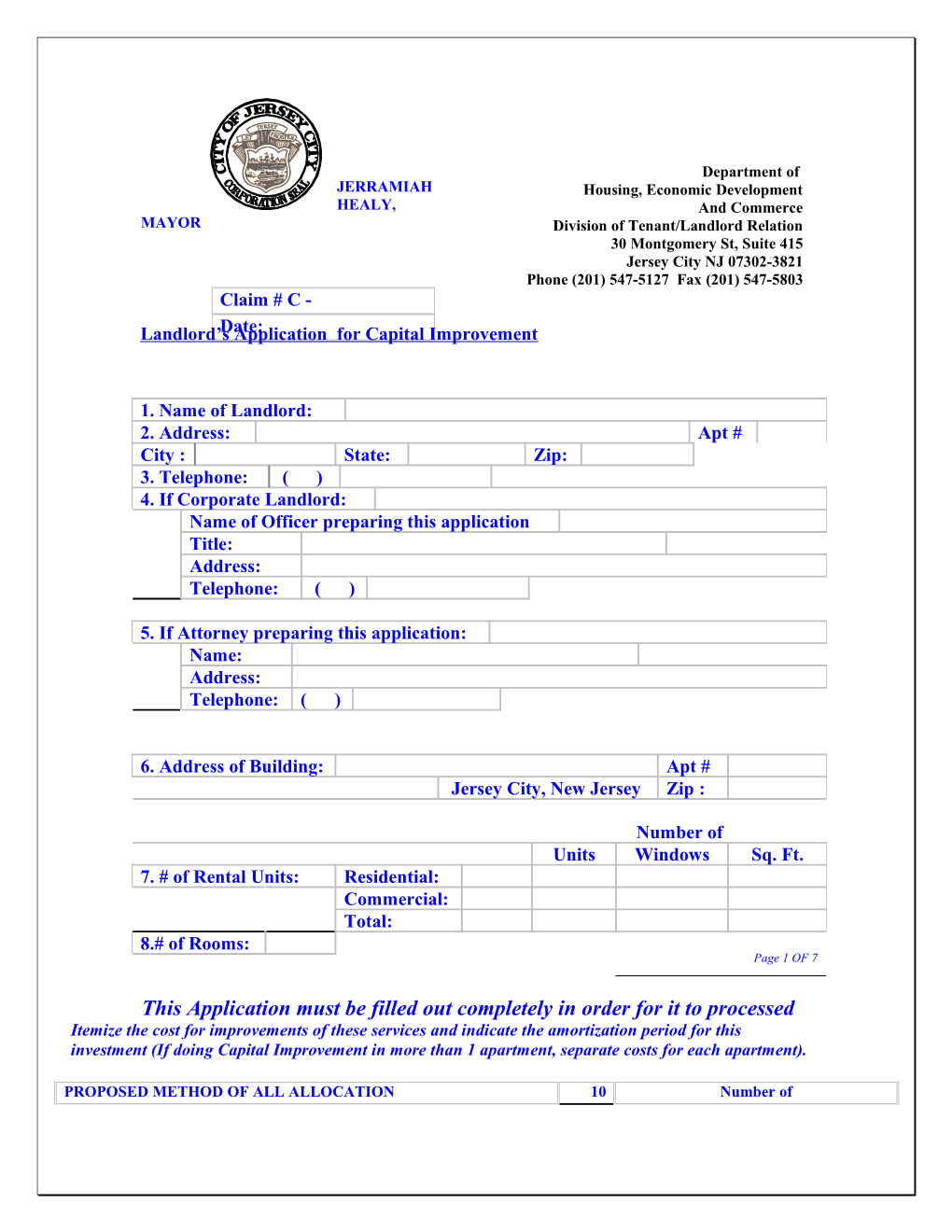

Department of JERRAMIAH Housing, Economic Development HEALY, And Commerce MAYOR Division of Tenant/Landlord Relation 30 Montgomery St, Suite 415 Jersey City NJ 07302-3821 Phone (201) 547-5127 Fax (201) 547-5803 Claim # C - Landlord’sDate: Application for Capital Improvement

1. Name of Landlord: 2. Address: Apt # City : State: Zip: 3. Telephone: ( ) 4. If Corporate Landlord: Name of Officer preparing this application Title: Address: Telephone: ( )

5. If Attorney preparing this application: Name: Address: Telephone: ( )

6. Address of Building: Apt # Jersey City, New Jersey Zip :

Number of Units Windows Sq. Ft. 7. # of Rental Units: Residential: Commercial: Total: 8.# of Rooms: Page 1 OF 7

This Application must be filled out completely in order for it to processed Itemize the cost for improvements of these services and indicate the amortization period for this investment (If doing Capital Improvement in more than 1 apartment, separate costs for each apartment).

PROPOSED METHOD OF ALL ALLOCATION 10 Number of Common Areas Cost years Sq. ft Windows Rooms Units Items Heating : $

Structural: $

Plumbing: $

Fire prevention: $

Electrical, Others: $

$

Apt # Items: Heating : $

Structural:

Plumbing:

Fire prevention:

Electrical, Others:

Total $ Page 2 of 7 PROPOSED METHOD OF ALL ALLOCATION 10 Number of years Apt # Cost Sq. ft Windows Rooms Units Items Heating : $

Structural: $

Plumbing: $

Fire prevention: $

Electrical, Others: $

$

Apt # Heating : $

Structural:

Plumbing:

Fire prevention:

Electrical, Others:

Total $ If more space is needed duplicate this page Page 3 of 7 DATE: VENDOR ITEM COST TOTAL $ Page 4 OF 7 CLAIM # C - PLEASE COMPLETE AS APPLICABLE

PROPOSED ALLOCATION OF COSTS OF CAPITAL IMPROVEMENT OR IMPROVED OR INCREASED SERVICES.

NUMBER OF ALLOCATION OF COSTS PER Current Rent Proposed Tenant’s Name Apt # Phone # Rooms Windows Sq Ft. Unit Room Window Sq. ft. Rent Increase New Rent

Page 5 of 7 NOTICE OF CAPITAL IMPROVEMENT

Landlord’s Name:

Address:

City: State: Zip:

Phone: ( )

Building address:

Jersey City, New Jersey: Zip:

Dear: Apt #

Please be advised that I have made an application for a capital improvement rent increase to the Rent Leveling Board. The basis for this application is for improvement performed on your building/apartment, as follows ( summary of improvement):

I am requesting a rent increase of $ per room/per apartment/per window per month, for a total increase of $ per month for your apartment.

This increase can not be collected prior to the Rent Leveling Board making a final decision on the application.

This notice is to comply with § Chapter 260 – 5. C (Multiple Dwelling Rent Control) of the Jersey City Code.

A copy of my application together with supportive documentation is filed in the Rent Leveling Office, 30 Montgomery Street, 4th Floor, Room 415, Jersey City, N.J. 07302. You may write to request a copy from me, the Landlord.

Date: Signed by:

Page 6 of 7 CERTIFICATION IN SUPPORT OF APPLICATION STATE OF NEW JERSEY

SS:

COUNTY OF HUDSON

Having submitted this application and the required documentation I hereby certify, that to the best of my knowledge, all the information and attachments supplied are accurate, and that there is no attempt on my part to conceal any evidence that may have a bearing on this request.

I am aware that if any of the information supplied in this application is willfully false I am subject to punishment.

I further certify that I have served notice of this application upon each of the tenants as required by § chapter 260- 5, C of the Jersey City Code (Multiple Dwelling Rent Control); and that copies of said notice to the tenants are hereby attached.

Landlord signature:

Sworn to and subscribed before me

This Day of 200

Notary Public (Form B-10P Page 7 of 7 File RG Check list for Capital Improvement Application

1- Complete Capital Improvement Application, Notarized ( page # 6 ) 2- Description of work that was done during the Capital Improvement (pictures before and after). 3- Proof that work was done- proposal for work 4- Proof of payment, Canceled checks, receipts, or credit card payments. 5- Copies of applicable permits, and of compliance to applicable official codes approval 6- Fee payment of $ 10.00 per unit – checks made to City of Jersey City Treasury 7- Current Rent Registration with this office

Formula for calculating rent increase

Example:

All Capital Improvement is depreciated over a 10 year useful life. You may divide by 120 months (10 years dep.) Prorate that result into the # of apartments (if apartments are equal in sizes). If apartments are not equal in size use # of rooms

$10,000 divided by 120 months (10 years) = $ 83.33 divided by (# of rooms) = $ ? Amount per apartment a month

E.g. $ 10,000 spent equally in a 6 family apartment (all of the same size). Will result in a monthly rent increase per apartment as follows:

$ 83.33 divides by 6 apts. Equal $ 13.88 increase per apt. per month

P.S. each apartment can only be increased in proportion to how it benefits from the Capital Improvement work. § 260-5. Capital improvement and service charge.

A. [Amended 3-11-1992 by Ord. No. 92-013] A landlord may apply to the Bureau of Rent Leveling for a service charge for increased or improved services. The landlord shall submit a written proposal with cost estimates to the Rent Leveling Board prior to performing any major or capital improvement work, showing how the work will affect all dwelling units. The landlord shall include the substance of said proposal in the notice of application to each tenant sent pursuant to Subsection C of this section. The aforesaid notice shall advise the tenants that they have a right to request a hearing before the Rent Leveling Board with respect to the proposed capital improvement work. Final approval by the Board shall not be considered until the capital improvement work has been completed and after the Board has received necessary documentation, at which time a final hearing will be scheduled. The landlord shall compute the average cost of the computed capital improvement or service by the number of years of useful life of the improvement as claimed by the landlord for federal income tax depreciation purposes. The landlord shall propose to apportion the average cost of completed improvement or service per year of useful life among the tenants in the dwelling in accordance with one of the following methods:

(1) If the capital improvement benefits certain housing spaces only, then the cost of those improvements shall be surcharged to only these units.

(2) If the capital improvement benefits all housing spaces but in varying degrees according to the amount of living area of each housing space, then the cost for the improvements shall be charged according to either the number of rooms or the space in proportion to the total rentable area in the dwelling.

(3) If the capital improvement is equally beneficial to all housing spaces regardless of the living area within any housing space, then the cost of the improvements shall be charged according to the number of housing spaces within the dwelling.

B. All work done on the property must be performed with the appropriate proper local approval as evidenced by permits and the completed capital improvements must be in accord with building, fire, plumbing, electrical and any other code regulations. Before any capital increase is approved, an inspection shall be required to be made by a qualified inspector of the Department of Housing, Economic Development and Commerce together with an inspection by the Office of the Construction Official in order to document the nature of the work performed and that the structure is in substantial compliance. A certificate of occupancy must be secured if required by law. The landlord shall furnish with the application a certification of the true cost of each improvement signed by a qualified inspector and an affidavit by the landlord that the amount claimed in the application is attributable only to the specific building which is the subject of the application. [Amended 3-11-1992 by Ord. No. 92-013; 8-13-1997 by Ord. No. 97-052]

C. Notice procedure. Prior to any application under this section, the landlord shall serve upon each tenant, by registered or certified mail or personal service of a notice of application filing setting forth the basis for said application, the amount of rental increase or surcharge applied for with respect to that tenant and the calculations involved. A sample copy of such notice shall be filed with the application of the landlord together with an affidavit or certification of service of notice of application upon each tenant. Tenants who request a copy of the complete application shall have one provided by the landlord.

D. Determination. The Rent Leveling Board may grant the landlord a rental surcharge or increase under the provisions of this section. No landlord shall impose upon any tenant a rent surcharge or increase under this section without first obtaining approval from the Rent Leveling Board. It shall be within the discretion of the Board to fix the effective date of any approval of a rental surcharge or increase to be at any reasonable time after determination. A surcharge granted under the provisions of this section shall not be considered rent for purposes of computing cost-of-living rental increases pursuant to §§ 260-2, 260-3 and 260-4. After the landlord has filed his or her application for an increase with all supporting documents and materials, no new material will be considered by the Hearing Officer or Board unless such new material is filed with the Board and notice identifying such new material and setting forth a description of such material is served upon each tenant no later than 10 days prior to the date of the hearing. Tenants who request a copy of the capital improvement file and any new materials submitted to the Board or hearing officer shall have one provided by the landlord at least five days prior to any hearing date. [Amended 3-13-1986 by Ord. No. C-183]

E. Computations.

(1) A landlord must provide as part of his or her application a completed Rent Leveling Board form indicating the method and term of depreciation of the capital improvements claimed by the landlord.

(2) In the case of all capital improvements, the depreciation period shall be calculated according to its useful life, which in no case shall exceed 10 years for major capital improvements and five years for minor capital improvements. [Amended 8-12-1998 by Ord. No. 98-116]

(3) In the case of such major capital improvements, the capital improvement charge shall be a part of the permanent base rent. [Amended 8-12-1998 by Ord. No. 98-116]

(4) Major capital improvements shall consist of a substantial change in the housing accommodations such as would materially increase the rental value in a normal market and which consists of capital improvements to building-wide operating systems, including but not limited to items such as complete plumbing or electrical replacement for the entire building or a complete new roof. Major capital improvements shall also include complete kitchen and bathroom replacements for an individual apartment unit.

(5) In the case of minor capital improvements, the capital improvement charge shall not be a part of the permanent base rent, nor shall any financing costs be included as part of said surcharge.

(6) Minor capital improvements shall consist of all capital improvements not classified as major capital improvements.

(7) A capital improvement increase resulting hereunder shall not exceed 15% of the legal rent for the first year of such increase. Any further amount of increase which would have resulted based upon the landlord’s application hereunder shall be apportioned equally over the remaining period of the capital improvement charge.

(8) Except in the case of emergency capital improvements, as defined in Subsection G, a landlord shall be entitled to only one major capital improvement increase in any twelve-month period.

F. The Board, in computing the amount spent for capital improvements, may consider the reasonable value of construction services performed by the owner in the actual capital improvement work. Where allowed, this shall include professional consultation or other similar services of the owner and is limited to actual labor and materials invested by the owner.

G. In the case of emergency major capital improvements a landlord shall not be required to obtain Board approval prior to performing said capital improvement work. The landlord shall be required to obtain Board approval for any capital improvement charge after the capital improvement work has been completed as otherwise provided for capital improvement charges herein. For purposes of this section, “emergency capital improvement” shall mean a capital improvement made to correct a condition causing immediate and/or imminent danger to the health or safety of occupants of the subject premises, as defined by the Division of Construction Code Official, Fire Department and/or Building Department. The landlord shall notify the Division of Construction Code Official of this condition as soon as possible. [Amended 8-13-1997 by Ord. No. 97-052] For Official Use Only

Department of Housing, Economic Development And Commerce Division of Tenant/Landlord Relation 30 Montgomery St, Suite 415 Jerramiah Healy, Mayor Jersey City NJ 07302-3821 Phone (201) 547-5127 Fax (201) 547-5803 Director Charles Odei REGISTRATION LANDLORD (Please type or print legibly) Property Block No. Lot No. No. of Units

Owner Tel. No.

Address City State Zip

THIS PROPERTY (CHECK ONE) IS: IS NOT: PRESENTLY UNDER RENT CONTROL

IF PROPERTY IS NOT UNDER RENT CONTROL, INDICATE EXEMPTION NOTICE: IF PROPERTY IS NOT UNDER RENT CONTROL, STOP HERE AND RETURN FORM TO: DIVISION OF TENANT/LANDLORD RELATIONS, 30 MONTGOMERY ST. SUITE 415, JERSEY CITY, 07302 Section A IF OWNER OF RECORD IS A CORPORATION, LIST CORPORATE OFFICERS ALONG WITH RESPECTIVE ADDRESS Title Name Address City State Zip

Title Name Address City State Zip

Title Name Address City State Zip

IF OWNER OF PROPERTY IS A PARTNERSHIP, LIST PARTNERS WITH RESPECTIVE ADDRESS. Name Address City State Zip

Name Address City State Zip

Name Address City State Zip

IF THE ADDRESS OF ANY OWNER OF RECORD IS NOT LOCATED IN THE COUNTY IN WHICH THE PREMISES ARE LOCATED, THE NAME AND ADDRESS OF A PERSON WHO RESIDES IN THE COUNTY IN WHICH THE PREMISES ARE LOCATED AND IS AUTHORIZED TO ACCEPT NOTICE FROM A TENANT AND TO ISSUE RECEIPT THEREOF AND TO ACCEPT SERVICE ON BEHALF OF THE OWNER OF RECORD. Name Address City State Zip

Section B THE NAME ADDRESS AND TELEPHONE NUMBER OF AN INDIVIDUAL REPRESENTATIVE OF THE OWNER OF RECORD WHO MAY CONTACTED AT ANY TIME IN THE EVENT OF AN EMERGENCY AFFECTING THE PREMISES OR ANY UNITS OF THE SPACE THEREIN, INCLUDING SUCH EMERGENCIES AS THE FAILURE OF ANY ESSENTIAL SERVICE OR SYSTEM, AND WHO HAS AUTHORITY TO MAKE EMERGENCY DECISION CONCERNING THE BUILDING AND ANY REPAIR THERETO OR EXPENDITURE IN CONNECTION THEREWITH: Name Address City State Zip Tel. No. Registered Agent Name Address City State Zip Tel. No.

Managing Agent Name Address City State Zip Tel. No. Super., Janitor or Custodian Name Address City State Zip Tel. No. SECTION C MORTGAGEES: Name Address City State Zip Tel. No.

Name Address City State Zip Tel. No.

LFRM 06/12/2002

For Official Use Only

Property Block No. Lot No.

SECTION D IF FUEL IS BEING USED TO HEAT BUILDING AND THE LANDLORD FURNISHES THE HEAT IN THE BUILDING. THE NAME AND ADDRESS OF THE FUEL DEALER SERVICING THE BUILDING AND THE GRADE OF FUEL USED: Dealer Address City State Zip Tel. No. Fuel Grade

TENANT REGISTRATION

REGISTER ANY CHANGES IN INFORMATION AND IN TENANCY WITH THIS OFFICE NO LATER THAN SEVEN (7) DAYS AFTER THEY OCCUR. CHARGES PERCENT AMOUNT CLAIM NO. APT. NO. EFFECTIVE DATE Mm/dd/yy

Last cost of living incrfease

CHARGES PERCENT AMOUNT CLAIM NO. APT. NO. EFFECTIVE DATE Mm/dd/yy

Last Hardship Rental Increase

CHARGES PERCENT AMOUNT CLAIM NO. APT. NO. EFFECTIVE DATE Mm/dd/yy

Last Capital Improvemt CHARGES PERCENT AMOUNT CLAIM NO. APT. NO. EFFECTIVE DATE Mm/dd/yy

Last Vacant Housing Space Improvemt increase

For Official Use Only For multiple dwelling units make extra copies.

TENANT REGISTRATION

LIST APARTMENT NUMBERS, RESPECTIVE TENANTS NAME, BASE RENT AND ACTUAL RENT EXCLUDES ANY SURCHARGES, SUCH AS TAX SURCHARGES. CAPITAL IMPROVEMENT SURCHARGE AND SERVICES. IF APARTMENT UNIT NUMBER, ASSIGN A PERMANENT NUMBER: Apt. Rms. Last Name First Name Base Rent Actual Rent

REGISTER ANY CHANGES IN INFORMATION AND IN TENANCY WITH THIS OFFICE NO LATER THAN SEVEN (7) DAYS AFTER THEY OCCUR.

BY SUBMITTING THIS FORM THE LANDLORD(S) STATE/STATES, UNDER PENALTY OF LAW, THAT THE INFORMATION SUBMITTED IS TRUE TO THE BEST OF HIS/HER (THEIR) KNOWLEDGE. THE LANDLORD(S) FURTHER STATE/STATES THAT ALL THE TENANT LISTED ON THE FORM HAVE BEEN SERVED COPIES OF HIS RENT REGISTRATION, THEREBY NOTIFYING THEM OF THEIR RIGHT TO CONTACT THE OFFICE OF RENT CONTROL REGARDING ANY MISINFORMATION THEY MAY KNOW OF.

LANDLORD SIGNATURE ______MONTH ______DAY ______YEAR ______

LANDLORD SIGNATURE ______MONTH ______DAY ______YEAR ______LFRM 6/12/2002