The University of Texas at El Paso College of Business Administration, Department of Accounting ACCT 3321-Intermediate Accounting I Solutions In-Class Exercise ICC10a, Fall Semester 2005

Valuation and Allocation of Purchase Price

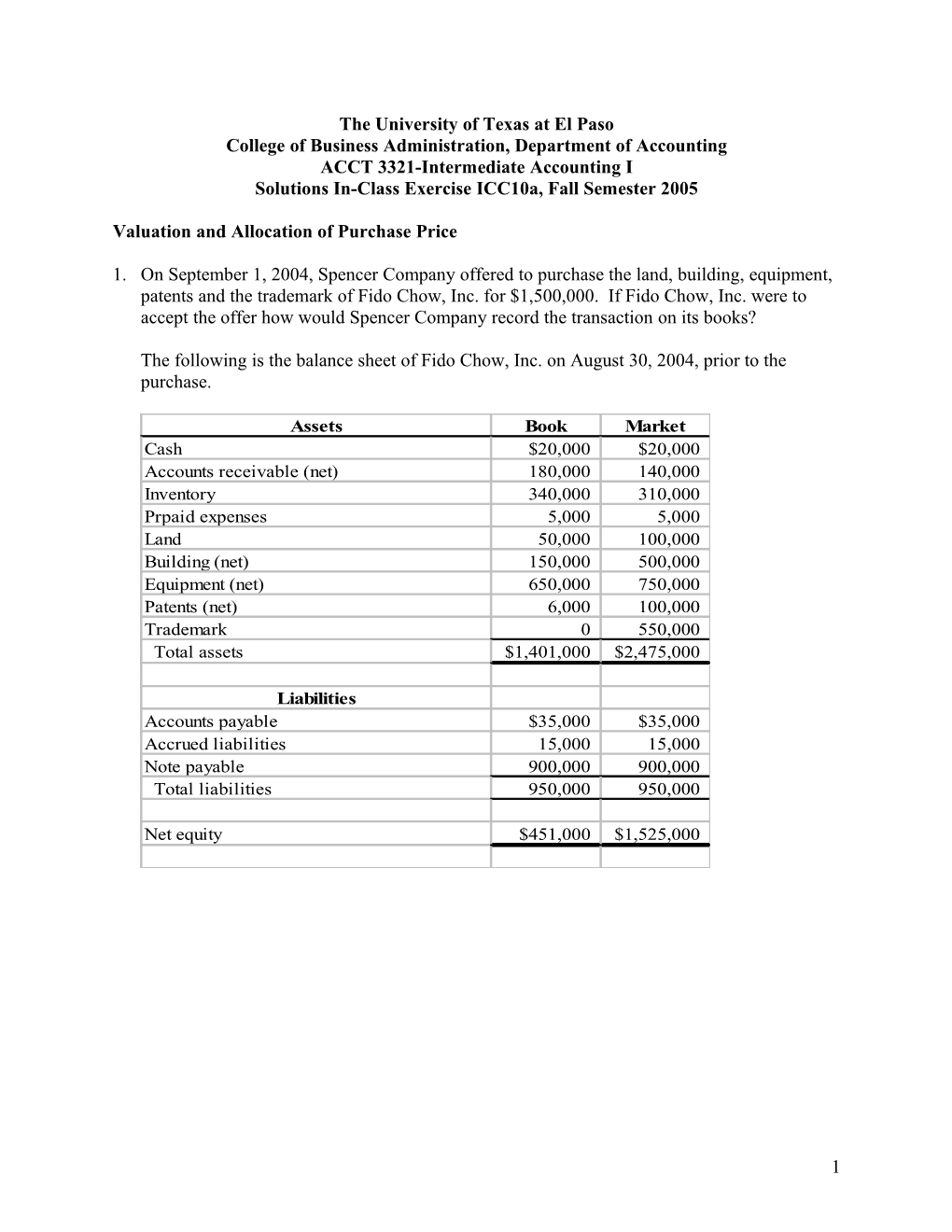

1. On September 1, 2004, Spencer Company offered to purchase the land, building, equipment, patents and the trademark of Fido Chow, Inc. for $1,500,000. If Fido Chow, Inc. were to accept the offer how would Spencer Company record the transaction on its books?

The following is the balance sheet of Fido Chow, Inc. on August 30, 2004, prior to the purchase.

Assets Book Market Cash $20,000 $20,000 Accounts receivable (net) 180,000 140,000 Inventory 340,000 310,000 Prpaid expenses 5,000 5,000 Land 50,000 100,000 Building (net) 150,000 500,000 Equipment (net) 650,000 750,000 Patents (net) 6,000 100,000 Trademark 0 550,000 Total assets $1,401,000 $2,475,000

Liabilities Accounts payable $35,000 $35,000 Accrued liabilities 15,000 15,000 Note payable 900,000 900,000 Total liabilities 950,000 950,000

Net equity $451,000 $1,525,000

1 Using the following worksheet, allocate the purchase price for Spencer Company assuming the Fido Chow, Inc. agrees to the offer.

Assets Market % Cost Land $100,000 5.00% $75,000 Building (net) 500,000 25.00% 375,000 Equipment (net) 750,000 37.50% 562,500 Patents (net) 100,000 5.00% 75,000 Trademark 550,000 27.50% 412,500 Total assets $2,000,000 100.00% $1,500,000

Using the above information prepare the journal entry to record the transaction.

Account Debit Credit Land $75,000 Building 375,000 Equipment 562,500 Patents 75,000 Trademark 412,500 Cash $1,500,000 To record the purchase of Fido Chow, Inc.

2. Fido Chow, Inc. refused the offer from Spencer Company but indicated that the company was for sale in total for approximately $2,000,000. After lengthy negotiations The buyer and seller settled on the following terms:

Spencer Company agreed to pay $100,000 in cash, 250 shares of Spencer Company common stock with a par value of $100 per share, which is traded on the NASDAC and $200,000 per year payable at the end of each year for 10 years. The normal cost of capital for Spencer Company is 8% per annum. On August 30, 2004, Spencer Company stock traded for $1,000 per share. Determine the purchase price (to the nearest dollar) and allocate that purchase price to the various assets and liabilities. Any cost in excess of fair value should be allocated to goodwill.

Determination of Purchase Price: Cash $100,000 Common stock 250 shares & $1,000 250,000 Installment note PVOA Annuity $200,000 Factor, n=10, i=8% 6.71008 1,342,016 Total purchase price $1,692,016

2 Allocation of Purchase Price: Assets Purchased Cost Cash $20,000 Accounts receivable 140,000 Inventory 310,000 Prepaid expenses 5,000 Land 100,000 Building 500,000 Equipment 750,000 Patents 100,000 Trademark 550,000 Goodwill 167,016 Total assets $2,642,016

Liabilities Assumed Accounts payable $35,000 Accrued liabilities 15,000 Note payable 900,000 Total liabilities 950,000

Net Purchase Price $1,692,016

3 Prepare the journal entry that will need to be recorded on Spencer Company’s books as a result of this purchase.

Account Debit Credit Cash $20,000 Accounts receivable 140,000 Inventory 310,000 Prepaid expenses 5,000 Land 100,000 Building 500,000 Equipment 750,000 Patents 100,000 Trademark 550,000 Goodwill 167,016 Accounts payable $35,000 Accrued liabilities 15,000 Note payable 900,000 Cash 100,000 Installment note payable 1,342,016 Common stock 25,000 Additional paid-in capital 225,000 $2,642,016 $2,642,016

4 3. Spencer Company entered into the following transactions during 2003.

Date Transaction 1/2/04 A new machine was purchased and put into service. The invoice price of the machine was $190,000. In addition the company had to pay $2,700 for freight and $42,000 for installation costs.

2/28/04 The company incurred $29,500 in expenses to repave the parking lot.

5/18/04 The company purchased the property next door as part of a plant expansion strategy. The purchase price consisted of 100,000 shares of Spencer Company stock which is currently actively traded for $22 per share. Legal fees and title insurance were $14,500

7/29/04 The company sold an old machine for $25,000. The original purchase price of the machine was $80,000 and the company had accumulated depreciation through the date of sale in the amount of $47,000.

11/30/04 The company purchased a new vehicle for $22,000 in cash plus the trade-in of an old vehicle. The old vehicle was originally purchased for $40,700 and had accumulated depreciation through the date of exchange of $31,000. The blue book market value of the old vehicle was $12,000.

Prepare the journal entry in general journal format for each of the above transactions.

Date Account Debit Credit 1/2/04 Machinery and Equipment $234,700 Cash $234,700 To record the cost of a new machine

Analysis of the cost of the new machine: Invoice price $190,000 Freight in 2,700 Installation costs 42,000 Total cost $234,700

2/28/04 Land improvements $29,500 Cash $29,500 To record the costs of paying the parking lot.

5 Date Account Debit Credit 5/18/04 Land $2,214,500 Cash $2,214,500 To record the cost of purchasing the land next door for plant expansion.

Analysis of cost of land: Market value per share $22 Shares of stock issued 100,000 Purchase price 2,200,000 Legal fees and title insurance 14,500 Total cost of land $2,214,500

7/29/04 Cash $25,000 Loss on sale of machinery 8,000 Accumulated depreciation, old machine 47,000 Old Machine $80,000 To record the sale of an old machine

Analysis of loss on sale of machinery: Original cost of old machine $80,000 Accumulated depreciation 47,000 Book value of old machine 33,000 Selling price 25,000 Loss on sale of old machine $8,000

11/30/04 New vehicle $34,000 Accumulated depreciation, old vehicle 31,000 Old vehicle $40,700 Gain on exchange 2,300 Cash 22,000 To record the purchase of a new vehicle and the trade in of an old vehicle

Gain (loss) on exchange (trade-in) of vehicle: Fair value of new vehicle: FV of old vehicle $12,000 Cash paid 22,000 Cost of new vehicle $34,000 Analysis of gain on exchange: Blue book value of old vehicle $12,000 Original cost $40,700 Accumulated depreciation 31,000 Book value of old vehicle 9,700 Gain on exchange $2,300

6