Unit 5 Test Study Guide: AP Microeconomics - Tit-for-Tat / repeated games

Monopolistic competition - Cartels and anti-trust policy - How P&Q is chosen - Price leadership - Barriers to entry

- Number of firms 4 types of goods Market failure - Short- vs long-run inefficiency Public goods ‐ Free rider problem ‐ - Excess capacity Rival in consumption ‐ Excludability ‐ Common resources ‐ Tragedy of the commons ‐ - Product differentiation Private goods ‐ Artificially scarce goods - Relationship to efficiency Oligopoly Externalities ‐ - Game theory Marginal private, social cost ‐ Marginal private, social benefit ‐ - Payoff matrix / interdependency Positive externalities: MPB < MSB ‐ Negative externalities: MPC < MSC ‐ - Dominant strategy Social optimum point ‐ - Nash equilibrium Deadweight loss from externalities ‐ Pigouvian tax or subsidy ‐ - Collusion Coase theorem

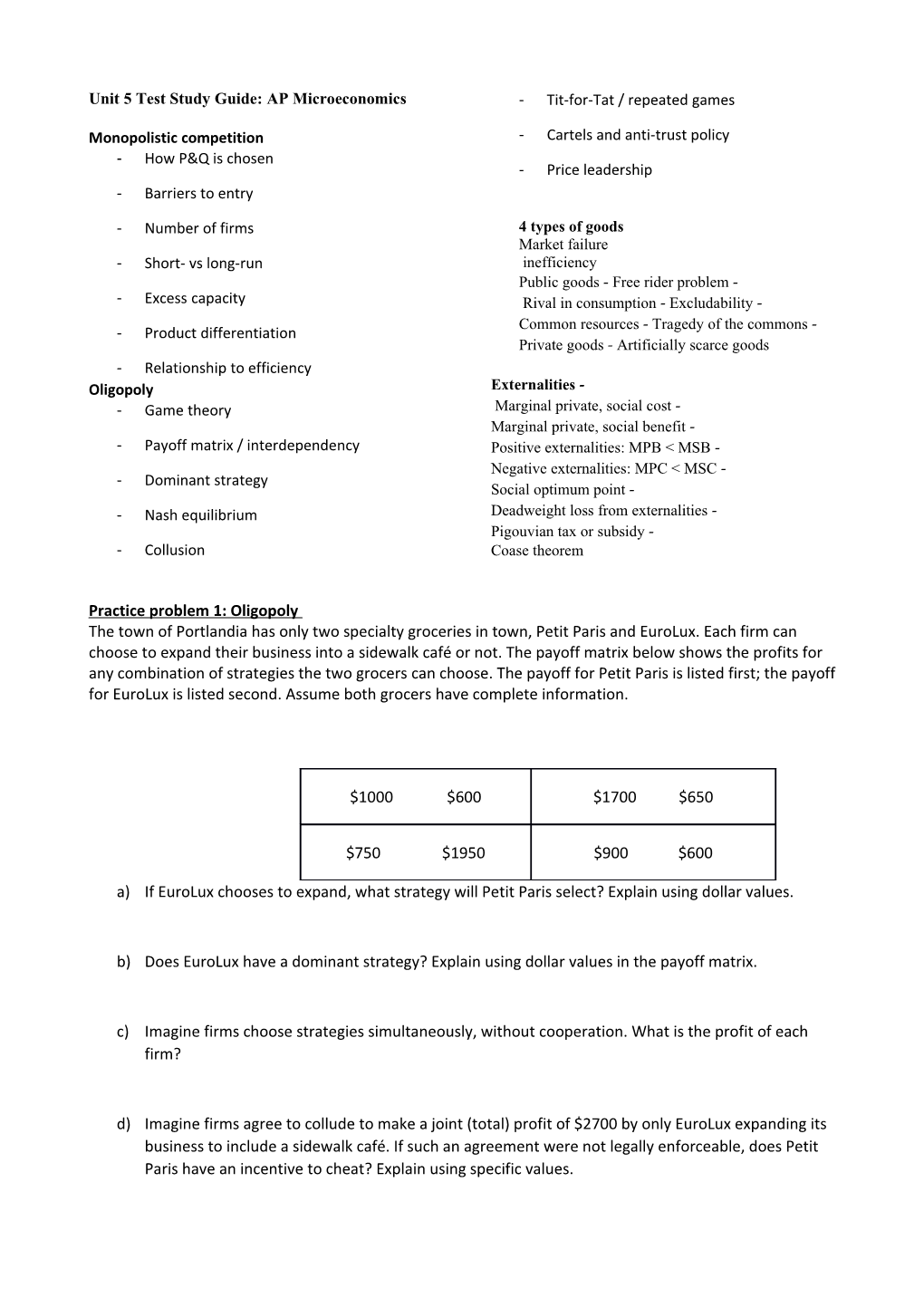

Practice problem 1: Oligopoly The town of Portlandia has only two specialty groceries in town, Petit Paris and EuroLux. Each firm can choose to expand their business into a sidewalk café or not. The payoff matrix below shows the profits for any combination of strategies the two grocers can choose. The payoff for Petit Paris is listed first; the payoff for EuroLux is listed second. Assume both grocers have complete information.

$1000 $600 $1700 $650

$750 $1950 $900 $600

a) If EuroLux chooses to expand, what strategy will Petit Paris select? Explain using dollar values.

b) Does EuroLux have a dominant strategy? Explain using dollar values in the payoff matrix.

c) Imagine firms choose strategies simultaneously, without cooperation. What is the profit of each firm?

d) Imagine firms agree to collude to make a joint (total) profit of $2700 by only EuroLux expanding its business to include a sidewalk café. If such an agreement were not legally enforceable, does Petit Paris have an incentive to cheat? Explain using specific values. Practice problem 2: Monopolistic A firm named Pac-Box produces specialty lunch boxes in a monopolistically competitive industry. The company currently produces the profit-maximizing quantity of lunch boxes in the short-run.

(a) From the graph above, identify each of the following: (i) The quantity produced (ii) The price charged (iii) The firm’s profit or loss (b) In the long-run, explain how the following will be affected (e.g., increase, decrease, or no change): (i) The number of firms (ii) The firm’s profit (c) In the long-run equilibrium, will the firm achieve the follow? Explain your reasoning. (i) Allocative efficiency (ii) Productive efficiency (iii) Economies of scale

(d) How does a lump sum tax affect this model? How does a per-unit tax affect this model? Answers to practice FRQs Problem 1 – game theory a) Petit Paris will expand as well, because their profit will be $1000 rather than $750. b) EuroLux does not have a dominant strategy. If Petit Paris expands, then EuroLux should not expand because they would make $650 rather than $600. But if Petit Paris doesn’t expand, EuroLux should expand, because they’d have profits of $1,950 rather than $600. c) Petit Paris will earn $1700 and EuroLux will earn $650. d) Yes, Petit Paris would have an incentive to cheat. Petit Paris only earns $750 if they do not expand, but if they also expand, they’d get another $300 in profits.

Problem 2 – monopolistic competition a) (i) 160 (ii) $16 (iii) $3 x 160 = $480 b) (i) increases as firms can and will enter the market in response to profits(ii) will decrease to zero c) (i) No, because price charged by the firm is greater than marginal cost. (ii) No, because the firm will charge a price greater than the minimum LR average total cost (iii) Yes, because the firm will operate in the part of the LRATC curve where ATC is falling d. lump sum tax: ATC increases; per-unit: MC increases, shift to left, ATC will increase