Universal Registration Document 2019/20

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Presentación De Powerpoint

www.profearias.com Nombre en la Fecha Edad No. Club País - Liga Jugador Posición de Juego Camiseta Nacimiento Decimal 1 Sporting CP Portugal RUI PEDRO DOS SANTOS PATRICIO RUI PATRICIO 15/02/1988 29,75 PORTERO 2 Rangers FC Escocia BRUNO EDUARDO REGUFE ALVES B. ALVES 27/11/1981 35,97 DEFENSOR CENTRAL 3 Besiktas JK Turquia KLÉPER LAVERAN LIMA FERREIRA PEPE 26/02/1983 34,72 DEFENSOR CENTRAL 4 FC Lokomotiv Moscow Rusia MANUEL HENRIQUE TAVARES FERNANDES M. FERNANDES 05/02/1986 31,78 MEDIOCAMPISTA 5 Borussia Dortmund Alemania RAPHAËL ADELINO JOSÉ GUERREIRO RAPHAEL 22/12/1993 23,90 DEFENSOR LATERAL 6 Dalian Yifang FC China JOSÉ MIGUEL DA ROCHA FONTE FONTE 22/12/1983 33,90 DEFENSOR CENTRAL 7 Real Madrid CF España CRISTIANO RONALDO DOS SANTOS AVEIRO RONALDO 05/02/1985 32,77 DELANTERO 8 AS Monaco Francia João FILIPE IRIA SANTOS MOUTINHO J. MOUTINHO 08/09/1986 31,19 MEDIOCAMPISTA 9 AC Milan Italia ANDRÉ MIGUEL VALENTE SILVA ANDRÉ SILVA 06/11/1995 22,03 DELANTERO 10 West Ham United FC Inglaterra João MÁRIO NAVAL DA COSTA EDUARDO J. MÁRIO 19/01/1993 24,82 MEDIOCAMPISTA 11 Manchester City FC Inglaterra BERNARDO MOTA VEIGA DE CARVALHO E SILVA BERNARDO 10/08/1994 23,27 MEDIOCAMPISTA 12 Olympique Lyon Francia ANTHONY LOPES LOPES 01/10/1990 27,12 PORTERO 13 SL Benfica Portugal RÚBEN SANTOS GATO ALVES DIAS RUBEN DIAS 14/05/1997 20,51 DEFENSOR CENTRAL 14 Sporting CP Portugal WILLIAM SILVA DE CARVALHO WILLIAM 07/04/1992 25,61 MEDIOCAMPISTA 15 FC Porto Portugal RICARDO DOMINGOS BARBOSA PEREIRA RICARDO 06/10/1993 24,11 DEFENSOR LATERAL 16 Sporting CP Portugal BRUNO MIGUEL BORGES FERNANDES B. -

This File Was Created by Oracle Reports. View This Document in Page Layout Mode

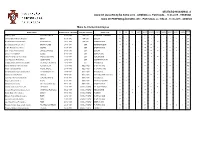

This file was created by Oracle Reports. View this document in Page Layout mode. SELEÇÃO NACIONAL A JOGO DE QUALIFICAÇÃO EURO 2016 - ARMÉNIA vs. PORTUGAL - 13.06.2015 - YEREVAN JOGO DE PREPARAÇÃO EURO 2016 - PORTUGAL vs. ITÁLIA - 16.06.2015 - GENÈVA Mapa de Internacionalizações Total Nome / Name Dt nascimento / Birthdate Posição / Position Clube / Club AA BB OL SUB23 SUB21 SUB20 SUB19 SUB18 SUB17 SUB16 SUB15 Anthony Lopes ANTHONY LOPES 01-10-1990 GR / GK OLYMPIQUE LYONNAIS 1 11 1 17 1 6 37 António Alberto Bastos Pimparel BETO 01-05-1982 GR / GK SEVILHA 10 1 3 2 2 2 3 5 28 Rui Pedro Dos Santos Patricio RUI PATRICIO 15-02-1988 GR / GK SPORTING SAD 36 1 1 14 8 10 4 11 5 90 Bruno Eduardo Regufe Alves BRUNO ALVES 27-11-1981 DEF FENERBAHCE SK 78 1 3 19 10 111 Cédric Ricardo Alves Soares CÉDRIC 31-08-1991 DEF SPORTING SAD 3 10 18 17 5 11 11 75 Daniel Filipe Martins Carriço DANIEL CARRIÇO 04-08-1988 DEF SEVILHA 0 1 16 10 15 8 13 8 71 Eliseu Pereira Santos ELISEU 01-10-1983 DEF BENFICA SAD 7 1 2 2 12 Fábio Alexandre Silva Coentrão FÁBIO COENTRÃO 11-03-1988 DEF REAL MADRID 48 1 7 7 10 1 74 José Miguel Da Rocha Fonte JOSÉ FONTE 22-12-1983 DEF SOUTHAMPTON FC 2 1 1 4 Ricardo Alberto Silveira De Carvalho RICARDO CARVALHO 18-05-1978 DEF AS MONACO 79 3 14 9 3 1 109 Adrien Sébastien Perruchet Silva ADRIEN SILVA 15-03-1989 MED / MID SPORTING SAD 2 13 7 6 17 3 48 André Filipe Brás André ANDRÉ ANDRÉ 26-08-1989 MED / MID VITÓRIA SC SAD 1 1 2 Bernardo Mota Veiga Carvalho Silva BERNARDO SILVA 10-08-1994 MED / MID AS MONACO 1 9 13 23 Danilo Luis Hélio Pereira -

P19 Layout 1

TUESDAY, DECEMBER 22, 2015 SPORTS Porto go top as beaten Sporting miss out on record LISBON: Sporting Lisbon missed out on and Jorge Jesus’ side equalled a record was a header, while their goalkeeper league run to seven games when they the 81st minute with a header and Raul a club record eighth straight Primeira set by Domingos Paciencia’s 2011 team saved three certain goals.” saw off Rio Ave 3-1 to remain third on 31 Jimenez added a third. Sixth-placed Rio League win when they lost 1-0 at Uniao when they beat Moreirense 3-1 last Goals from Danilo Pereira and Vincent points, five off the pace. Ave fell behind Vitoria de Setubal, who da Madeira on Sunday. weekend. Aboubakar, and Hector Herrera’s stylish Jonas’ fourth-minute opener was can- moved up to fifth with a 3-1 victory at The defeat, their first in the league Madeira struck the only goal of the back-heeled effort, gave Julen celled out by Renan Bressan’s superb bottom club Tondela, while Moreirense this season, cost them top spot to Porto game when Danilo Dias headed past Rui Lopetegui’s Porto a 3-0 lead before Rui long-range free kick for visiting Rio Ave beat Nacional 2-0. who defeated Academica de Coimbra 3- Patricio at the far post. Pedro replied late on for visiting nine minutes later. On Saturday, Arouca defeated 1. Sporting had won 11 and drawn two “Uniao had one shot on goal,” said Academica. Benfica’s superiority eventually told Maritimo 4-1 and Vitoria de Guimaraes of their opening 13 matches this season coach Jesus, “and it wasn’t even a shot, it Benfica extended their unbeaten when Jonas bagged his second goal in won 1-0 at Estoril. -

OL / LILLE Pour Maier

esprit Novembre 2017 n° 393 LE MAGAZINE DES PARTENAIRES DE L ’OLYMPIQUE LYONNAIS Portrait À 19 H Un nouveau vaisseau amiral OL / LILLE pour Maier Implantée au cœur de la Presqu’Ile depuis près de 20 ans, la Maison Maier continue de grandir et de s’embellir, pour le plus grand bonheur d’une clientèle où se croisent des familles lyonnaises et des touristes interna- tionaux toujours plus nombreux. En abandonnant sa boutique historique COMPOSITION DES ÉQUIPES du 91 de la rue Edouard Herriot pour la Anthony LOPES – 1 1 – Adam JAKUBECH transférer quelques mètres plus loin, au Mapou YANGA MBIWA – 2 2 – Kévin MALCUIT 99, Jean-Louis Maier ne s’est pas conten- RAFAEL – 4 3 – Junior ALONSO Mouctar DIAKHABY – 5 5 – Adama SOUMAORO té d’un saut de puce. Cet acteur incon- MARCELO – 6 Clément GRENIER – 7 6 – Ibrahim AMADOU tournable du commerce de luxe dans Houssem AOUAR – 8 7 – Anwar EL GHAZI l’hyper-centre de Lyon a même frappé un Mariano DIAZ – 9 9 – Ezequiel PONCE Bertrand TRAORÉ – 10 10 – Yassine BENZIA grand coup, en donnant plus de visibilité Memphis DEPAY – 11 11 – Luiz ARAUJO Jordan FERRI – 12 à son vaisseau amiral. Désormais instal- architecturales de ce très bel immeuble du 14 – Imad FARAJ e Willem GEUBBELS – 13 lé dans un écrin flambant neuf, il totalise XIX siècle. » 15 – Edgar IE Jérémy MOREL – 15 2 Lucas MOCIO – 16 16 - Mike MAIGNAN 132 m de surface et 27 mètres de façades Avec la concrétisation de ce transfert, Jean- Myziane MAOLIDA – 17 17 –Valère POLLET en angle de rue. -

Friday Football Quiz 8 - Answer Sheet © Football Teasers 2021 11 Questions (39 Answers) - 18/10/2019

Friday Football Quiz 8 - Answer Sheet © Football Teasers 2021 11 Questions (39 answers) - 18/10/2019 http://www.footballteasers.co.uk Download our iOS and Android app containing over 3000 football quiz questions.... http://bit.ly/ft5-app 1. Three members of the Republic of Ireland's 2002 World Cup squad played for Leeds United at the time. Name them. 1. Ian Harte 2. Robbie Keane 3. Gary Kelly 2. Name the four Champions League semi finalists from the 2008-2009 season. 1. Barcelona 2. Chelsea 3. Manchester United 4. Arsenal 3. Who took over from Ossie Ardiles as Newcastle United manager? 1. Kevin Keegan 4. Name the Argentinian who was sent off against England in the 1966 World Cup quarter final. 1. Antonio Rattin 5. Who was the "white feather" who scored a hat-trick on his Premier League debut? 1. Fabrizio Ravanelli 6. Who was Brendan Rodger's first signing for Liverpool? 1. Fabio Borini 7. Which Brazilian played the whole 120 minutes in the 2012 Champions League Final and also scored in the penalty shoot out? 1. David Luiz 8. Outside of London, six stadiums were used at the 1966 World Cup. Name them. 1. Old Trafford 2. Goodison Park 3. Villa Park 4. Hillsborough 5. Roker Park 6. Ayresome Park 9. In the 2004-2005 Premier League season which teams were sponsored by Friends Provident, 888.com, Chang, Proton and O2. 1. Southampton 2. Middlesbrough 3. Everton 4. Norwich City 5. Arsenal 10. Name the stadiums of the following teams.... FC Porto, Lazio, Red Star Belgrade and FC Basel. -

Uefa Women's Champions League

UEFA WOMEN'S CHAMPIONS LEAGUE - 2019/20 SEASON MATCH PRESS KITS San Mamés Stadium - Bilbao Wednesday 26 August 2020 20.00CET (20.00 local time) Paris Saint-Germain Matchday 9 - Semi-finals Olympique Lyonnais Last updated 24/08/2020 13:07CET UEFA WOMEN'S CHAMPIONS LEAGUE OFFICIAL SPONSORS Squad list 2 Legend 4 1 Paris Saint-Germain - Olympique Lyonnais Wednesday 26 August 2020 - 20.00CET (20.00 local time) Match press kit San Mamés Stadium, Bilbao Squad list Paris Saint-Germain Current season All-time UWCLQ UWCL UWCL UEFA No. Player Nat. DoB Age D Pld Gls Pld Gls Pld Gls Pld Gls Goalkeepers 1 Charlotte Voll GER 22/04/1999 21 - - - - - - - - - 16 Christiane Endler GER 23/07/1991 29 - - - 3 - 9 - 9 - 30 Arianna Criscione ITA 18/02/1985 35 - - - - - 8 - 9 - 40 Alice Pinguet FRA 29/06/2002 18 - - - - - - - - - Defenders 2 Benedicte SImon FRA 02/06/1997 23 - - - - - - - - - 4 Paulina Dudek POL 16/06/1997 23 - - - 2 1 11 2 23 6 5 Alana Cook ENG 11/04/1997 23 - - - 4 - 5 - 5 - 14 Irene Paredes ESP 04/07/1991 29 - - - 4 - 17 3 17 3 Midfielders 6 Luana BRA 02/05/1993 27 - - - - - 5 - 13 3 8 Grace Geyoro FRA 02/07/1997 23 - - - 2 - 14 - 14 - 10 Nadia Nadim DEN 02/01/1988 32 - - - 5 - 25 11 25 11 12 Ashley Lawrence CAN 11/06/1995 25 - - - 4 - 13 - 13 - 13 Sara Däbritz GER 15/02/1995 25 - - - 3 - 17 2 17 2 15 Karina Sævik NOR 24/03/1996 24 - - - 4 1 4 1 4 1 18 Laurina Fazer FRA 13/10/2003 16 - - - - - - - - - 20 Perle Morroni FRA 15/10/1997 22 - - - 3 - 14 - 14 - 24 Formiga BRA 03/03/1978 42 - - - 3 2 12 2 12 2 27 Lea Khelifi FRA 12/05/1999 21 - - -

Stade De La Mosson

LE PRÉSIDENT Laurent NICOLLIN Né le 26 janvier 1973 à Montpellier (Hérault) Né quelques mois avant la création du club montpelliérain, Laurent Nicollin a grandi et s’est construit à travers le MHSC. Il a suivi pas à pas l’évolution du club de son enfance jusqu’au poste de Président Délégué qu’il a occupé pendant plus de 10 ans. Durant cette période, il a notamment géré le club au quotidien et pris la mesure de chaque service et du rôle de toutes les composantes du MHSC. Un apport important pour la continuité du club puisque Laurent Nicollin le connait sur le bout des doigts. Au fil des années, il a apporté une vraie vision, mélange de respect du passé, d’innovation et de construction à moyen et long terme. Si sa part de responsabilité lors du titre en 2012 est indéniable, il a également mené des projets plus structurels notamment celui du centre d’entraînement Bernard-Gasset Mutuelles du Soleil, inauguré en mars 2015 et a insufflé le renouveau de la section féminine et de la formation. Depuis la disparition du Président et fondateur du club, Louis Nicollin, Laurent Nicollin a pris sa succession pour en assurer la pérennité et continuer de le faire grandir. Outre la progression de l’équipe première (10e il y a 2 ans, 6e à l’issue du dernier exercice), il s’attelle à pérenniser l’identité et l’état d’esprit du club et s’investit pleinement dans des projets d’avenir dont celui de la construction du nouveau stade et le développement des actions à destination du public montpelliérain. -

Pdf Maghreb Info Du 2021-01-17

L’information : liberté … responsabilité déCès de moussa CherChali L’information : liberté … responsabilité le Président tebboune adresse ses condoléances Espace « Si Mustapha a été parmi •Saliha Aouès les vaillants libre moudjahidine de la première heure » Dimanche 17 Janvier 2021 /Sarl El Miled El Djadid Information et Communication / N° 293 Prix 20 DA Au-Delà des hommes, Page 3 un pays Dimanche 17 Janvier 2021 /Sarl El Miled El Djadid Information et Communication / N° 293 Prix 20 DA proverbe l y a bien longtemps que la télévision nationale ne nous a gratifiés de ces belles soirées thématiques qui C’est de la confiance que naît la trahison mettent en avant et c’est amplement mérité, des fi- gures intellectuelles de notre pays. Celles qui s’en sont al- le nombre insignifiant de ConCessionnaires risque ilées, le pays aux tripes, comme elles l’ont toujours porté Préservation des esPèCes menaCées de leur vivant. et par le truchement de la petite lucarne, il de Créer un monoPole du marChé s’est introduit des visages, des voix et des convictions à damner l’âme des moins enclins à la chose culturelle. un bonheur suprême de revoir, réécouter et apprécier des sommités culturelles nationales disparues tragiquement, Elaboration emportés par la maladie, usés par les attentes vaines dans Elaboration l’espoir de travailler librement, de donner du leur et de se faire entendre à défaut de se faire écouter. des hommes de renommé, des gens du savoir, des personnes intègres, d’une loi relative pleines de probité, de sincérité… qui s’en sont allées sans d’une loi relative demander leur reste même mal jugées incomprises, igno- rées même, parfois poursuivies pour des actes qu’il n’ont pas commis. -

SPORTS 2424 Saturday, December 9, 2017 Gunners Hit BATE

Everton finally P23 win in Europa SPORTS 2424 Saturday, December 9, 2017 Gunners hit BATE London Debuchy was widely expected to leave rsenal cruised to victory over BATE Arsenal in the summer but has worked his ABorisov in their final Europa League way back into Wenger’s side and arrowed forgroup game as Arsene Wenger’s fringe home a 6perfectly-placed drive to put the players made another case for Premier hosts ahead with his first goal in almost League involvement. three years. With top spot in Group H already Danny Welbeck had a good chance to assured, the Gunners made light work of the double the advantage at the midway point of Belarusian champions in front of a record- the half, latching onto Wilshere’s pinpoint low Emirates Stadium crowd. pass before shooting straight at BATE While the official figure was 54,648, it goalkeeper Denis Scherbitski as he raced appeared less than 30,000 fans were present from his line. to see Arsenal run riot with an emphatic and Walcott had already been denied by easy 6-0 win. Scherbitski when he doubled Arsenal’s lead Mathieu Debuchy’s second goal for as Nemanja Milunovic could only turn the club got the ball rolling before Theo Welbeck’s poor touch into his path. Walcott and Jack Wilshere netted, with a Walcott thought he had a second moments Denis Polyakov own goal, an Olivier Giroud later but this time Milunovic was in the right penalty and a fine Mohamed Elneny strike place at the right time, clearing off the line as wrapping things up. -

Differentgame Handbook of the Premier League 2017-18

Differentgame Handbook of the Premier League 2017-18 League Champions (13 times): 1930/31, 1932/33, 1933/34, 1934/35, 1937/38, 1947/48, 1952/53, 1970/71, 1988/89, 1990/91, 1997/98, 2001/02, 2003/04 FA Cup Winners (13 times): 1929/30, 1935/36, 1949/50, 1970/71, 1978/79, 1992/93, 1997/98, 2001/02, 2002/03, 2004/05, 2013/14, 2014/15, 2016/17 Manager: Arsene Wenger Home Ground: Emirates Stadium, London Nickname: The Gunners After 22 years it’s goodbye, Arsene... It was a difficult season for Arsenal. The team finished 6th in the league – it’s worst position for over 20 years. During the season, Arsenal lost two great attacking players in Alexis Sanchez (who went to Man Utd), and Olivier Giroud (who went to Chelsea). You can see from the table below that those two guys took lots of shots. Arsenal needed to replace them to keep scoring goals. Alexandre Lacazette and Pierre-Emerick Aubameyang came to the club and did just that. End of an era Player Shots Total xG Goals FKnT xG Corner xG DFK xG Pen xG Head xG The main problem for Alexandre Lacazette 67 12.41 14 0.46 0.79 0.00 1.56 0.44 Arsenal was in defence. Alexis Sánchez 86 10.67 9 0.35 0.44 1.09 1.56 0.97 For a team aiming to be Olivier Giroud 45 7.73 7 0.23 1.36 0.00 0.00 2.85 in the top four places in the league, The Gunners Pierre-Emerick Aubameyang 30 6.68 9 0.00 0.86 0.03 1.56 0.14 simply let opponents take too many shots Aaron Ramsey 54 6.37 7 0.36 0.71 0.00 0.00 0.41 against them – enough Alex Iwobi 45 4.21 3 0.08 0.32 0.00 0.00 0.06 to expect to concede 46 goals. -

Tactical Line-Up Nigeria - France

FIFA Women's World Cup France 2019™ Group A Tactical Line-up Nigeria - France # 25 17 JUN 2019 21:00 Rennes / Roazhon Park / FRA Nigeria (NGA) Shirt: light green/white Shorts: white Socks: light green/white # Name Pos 16 Chiamaka NNADOZIE GK 3 Osinachi OHALE DF 4 Ngozi EBERE DF 5 Onome EBI DF 8 Asisat OSHOALA FW 9 Desire OPARANOZIE (C) X FW 10 Rita CHIKWELU X MF 13 Ngozi OKOBI MF 17 Francisca ORDEGA X FW 18 Halimatu AYINDE MF 20 Chidinma OKEKE DF Substitutes 1 Tochukwu OLUEHI GK 2 Amarachi OKORONKWO MF 6 Evelyn NWABUOKU MF 7 Anam IMO FW 11 Chinaza UCHENDU MF 12 Uchenna KANU FW 15 Rasheedat AJIBADE MF Matches played 19 Chinwendu IHEZUO FW 08 Jun NOR - NGA 3 : 0 ( 3 : 0 ) 21 Alaba JONATHAN GK 12 Jun NGA - KOR 2 : 0 ( 1 : 0 ) 22 Alice OGEBE FW 23 Ogonna CHUKWUDI MF 14 Faith MICHAEL A DF Coach Thomas DENNERBY (SWE) France (FRA) Shirt: navy blue Shorts: white Socks: red # Name Pos 16 Sarah BOUHADDI GK 2 Eve PERISSET DF 3 Wendie RENARD DF 6 Amandine HENRY (C) MF 10 Amel MAJRI DF 13 Valerie GAUVIN FW 14 Charlotte BILBAULT MF 17 Gaetane THINEY MF 18 Viviane ASSEYI FW 19 Griedge MBOCK BATHY DF 20 Delphine CASCARINO FW Substitutes 1 Solene DURAND GK 4 Marion TORRENT DF 5 Aissatou TOUNKARA DF 7 Sakina KARCHAOUI DF 8 Grace GEYORO MF 9 Eugenie LE SOMMER X FW 11 Kadidiatou DIANI FW Matches played 12 Emelyne LAURENT FW 07 Jun FRA - KOR 4 : 0 ( 3 : 0 ) 15 Elise BUSSAGLIA MF 12 Jun FRA - NOR 2 : 1 ( 0 : 0 ) 21 Pauline PEYRAUD-MAGNIN GK 22 Julie DEBEVER DF 23 Maeva CLEMARON MF Coach Corinne DIACRE (FRA) GK: Goalkeeper A: Absent W: Win GD: Goal difference VAR: Video Assistant Referee DF: Defender N: Not eligible to play D: Drawn Pts: Points AVAR 1: Assistant VAR MF: Midfielder I: Injured L: Lost AVAR 2: Offside VAR FW: Forward X: Misses next match if booked GF: Goals for C: Captain MP: Matches played GA: Goals against MON 17 JUN 2019 20:04 CET / 20:04 Local time - Version 1 22°C / 71°F Hum.: 54% Page 1 / 1. -

Saisonbericht HSV-Fanprojekt 18/19

Saisonbericht HSV Fanprojekt 2018 / 2019 Einleitung und Vorbemerkung zum Saisonbericht 2018/19........................................... 6 1. HSV-Fanprojekt im Überblick................................................................................... 12 1.1 Die Arbeit des Fanprojekts.................................................................................... 12 1.2 Veranstaltungskalender........................................................................................ 12 1.3 Spielbegleitungen Hamburger SV.......................................................................... 17 1.4 Spielbegleitungen HSV II, HSV III und andere Veranstaltungen ............................... 21 1.5 Fanhaus, Fanprojektstand und Fanhausaktivitäten ............................................... 23 1.6 BAG-Nord-Frauen ................................................................................................. 25 1.6 F_in Netzwerk Frauen im Fußball.......................................................................... 25 1.7 Besuch einer Studentinnen-Gruppe aus Wien........................................................ 25 1.8 Teilnahme an der Veranstaltung “Starke Mädchen, Starke Frauen“........................ 26 1.9 Young Supporters/U18 Touren ............................................................................. 26 1.10 Arbeit und Umgang mit Stadionverboten ............................................................. 27 1.11 Kooperation und Vernetzung .............................................................................