Corporate Tax Policy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Replacements in Indices

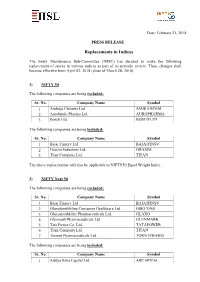

Date: February 21, 2018 PRESS RELEASE Replacements in Indices The Index Maintenance Sub-Committee (IMSC) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from April 02, 2018 (close of March 28, 2018). 1) NIFTY 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Ambuja Cements Ltd. AMBUJACEM 2 Aurobindo Pharma Ltd. AUROPHARMA 3 Bosch Ltd. BOSCHLTD The following companies are being included: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 Grasim Industries Ltd. GRASIM 3 Titan Company Ltd. TITAN The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 GlaxoSmithkline Consumer Healthcare Ltd. GSKCONS 3 Glaxosmithkline Pharmaceuticals Ltd. GLAXO 4 Glenmark Pharmaceuticals Ltd. GLENMARK 5 Tata Power Co. Ltd. TATAPOWER 6 Titan Company Ltd. TITAN 7 Torrent Pharmaceuticals Ltd. TORNTPHARM The following companies are being included: Sr. No. Company Name Symbol 1 Aditya Birla Capital Ltd. ABCAPITAL Sr. No. Company Name Symbol 2 Ambuja Cements Ltd. AMBUJACEM 3 Aurobindo Pharma Ltd. AUROPHARMA 4 Bosch Ltd. BOSCHLTD 5 General Insurance Corporation of India GICRE 6 L&T Finance Holdings Ltd. L&TFH 7 SBI Life Insurance Company Ltd. SBILIFE 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Ahluwalia Contracts (India) Ltd. AHLUCONT 3 Apar Industries Ltd. APARINDS 4 AstraZenca Pharma India Ltd. ASTRAZEN 5 Corporation Bank CORPBANK 6 Dalmia Bharat Ltd. -

1St Floor, Akruti Corporate Park, Near GE Garden

NATIONAL COMMODITY CLEARING LIMITED Circular to all Members of the Clearing Corporation Circular No. : NCCL/RISK-001/2020 Date : January 29, 2020 Subject : Approved Securities under Scheme of Deposit – List of Eligible Securities All members are hereby informed that in terms of SEBI circular No. CDMRD/DMP/CIR/P/2018/126 dated September 07, 2018 and further to Clearing Corporation Circular No. NCCL/RISK-036/2019 dated December 27, 2019, the Clearing Corporation has now revised the list of eligible securities to be accepted as collateral with appropriate haircut. The updated list of securities that shall be accepted as collateral along with their respective haircuts is given in Annexure I and Annexure II. Annexure III and Annexure IV contain the changes from the existing list. The new list will be applicable from beginning of trading day February 5, 2020. Members and participants are requested to note the above. For and on behalf of National Commodity Clearing Limited Ruchit Chaturvedi Head – Risk Management For further information / clarifications, please contact 1. Customer Service Group on toll free number: 1800 266 6007 2. Customer Service Group by e-mail to : [email protected] 1 / 16 Registered Office: 1st Floor, Akruti Corporate Park, Near G.E. Garden, LBS Road, Kanjurmarg West, Mumbai 400 078, India. CIN No. U74992MH2006PLC163550 Toll Free: 1800 266 6007, Website: www.nccl.co.in Annexure I – List of Approved Securities with applicable haircut of 15% or VaR, whichever is higher. I. The maximum value of any Security acceptable as collateral shall not exceed INR 35 Crores across all members at any given point in time. -

HRM Practices

Journal of Asia Business Studies Investment and collaboration: the Indian model for “best” HRM practices Pramila Rao, Article information: To cite this document: Pramila Rao, (2016) "Investment and collaboration: the Indian model for “best” HRM practices", Journal of Asia Business Studies, Vol. 10 Issue: 2, pp.125-147, https://doi.org/10.1108/JABS-03-2015-0033 Permanent link to this document: https://doi.org/10.1108/JABS-03-2015-0033 Downloaded on: 16 October 2017, At: 04:54 (PT) References: this document contains references to 88 other documents. To copy this document: [email protected] The fulltext of this document has been downloaded 344 times since 2016* Users who downloaded this article also downloaded: (2016),"Determinants of a successful cross-border knowledge transfer in franchise networks", Journal of Asia Business Studies, Vol. 10 Iss 2 pp. 148-163 <a href="https://doi.org/10.1108/JABS-05-2015-0052">https://doi.org/10.1108/ JABS-05-2015-0052</a> (2016),"Design leaps: business model adaptation in emerging economies", Journal of Asia Business Studies, Vol. 10 Iss 2 pp. 105-124 <a href="https://doi.org/10.1108/JABS-01-2015-0009">https://doi.org/10.1108/JABS-01-2015-0009</a> Access to this document was granted through an Emerald subscription provided by emerald-srm:616458 [] For Authors If you would like to write for this, or any other Emerald publication, then please use our Emerald for Authors service information about how to choose which publication to write for and submission guidelines are available for all. Please visit www.emeraldinsight.com/authors for more information. -

Birla Group Holdings Private Limited: Rating Reaffirmed, Rated Amount Enhanced for Commercial Paper Programme

May 27, 2021 Birla Group Holdings Private Limited: Rating reaffirmed, rated amount enhanced for Commercial Paper Programme Summary of rating action Previous Rated Current Rated Instrument* Amount Amount Rating Action (Rs. crore) (Rs. crore) Commercial Paper (CP) Programme 3,500 4,000 [ICRA]A1+; assigned / reaffirmed Non-convertible debentures programme 500 0 [ICRA]AA- (stable); reaffirmed and withdrawn Non-convertible debentures programme 1,000 1,000 [ICRA]AA- (stable); reaffirmed Total 5,000 5,000 *Instrument details are provided in Annexure-1 Rationale The ratings factor in the position of Birla Group Holdings Private Limited (BGHPL) as one of the main holding companies of the Aditya Birla Group. The ratings factor in the company’s equity ownership of listed Group entities including Grasim Industries Limited (rated [ICRA]AAA(Stable)/A1+), Aditya Birla Capital Limited (rated [ICRA]AAA(Stable)/A1+), Aditya Birla Fashion and Retail Limited (rated [ICRA]AA(Stable) /A1+) and Hindalco Industries Limited. The ratings also factor in the company’s adequate liquidity position backed by the market value of its holdings in listed Group entities and its strategic holdings in non-listed Group companies (including other Group holding companies). Further, ICRA expects the Group to extend capital support to BGHPL, as and when required. The ratings are constrained by the standalone financials of the company and the negative net worth on its balance sheet. The outlook is Stable for the company. ICRA has reaffirmed and withdrawn the rating outstanding on non-convertible debenture programmes of BGHPL aggregating Rs. 500 crore in line with request received from the company. -

Grasim Industries Ltd

GRASIM INDUSTRIES LTD. January 23, 2012 BSE Code: 500300 NSE Code: GRASIM Reuters Code: GRAS.BO Bloomberg Code: GRASIM:IN Grasim Industries Limited (GIL), a flagship of the Aditya Birla Group, is among Market Data India's largest companies in the private sector in terms of assets and turnover. Rating BUY Initially established as a textile manufacturer in 1947, GIL has successfully diversified into VSF (Viscose Staple Fiber), Cement, Sponge Iron and Chemicals CMP (`) 2,540 Target (`) over the past years. During FY11, the cement division contributed to 75% of 2,912 revenues with VSF contributing 21%. The other segments include textiles and Potential Upside ~15% chemicals that contributed 2% each. Duration Medium Term 52 week H/L (`) 2,625/1,981 All time High (`) 3,830 Investor’s Rationale Decline from 52WH (%) 3.2 Rise from 52WL (%) 28.2 Beta 0.74 GIL, a flagship of the Aditya Birla Group, is expected to garner a Mkt. Cap (` bn) 232.9 consolidated revenue growth at a ~CAGR 12% during FY’11-13E to `279.5 billion, Enterprise Value (` bn) 324.1 while the net profit is expected to outpace revenue growth by growing at a Fiscal Year Ended CAGR of over 37% to `42.8 billion during same period. FY10A FY11A FY12E FY13E GIL maintains leadership position in the two distinct businesses viz. VSF Revenue (`bn) 204.9 221.4 247.7 279.5 business and Cement business. In order to retain its leadership position in both Net Profit(`bn) 31.0 22.8 33.0 42.8 key businesses, the company has lined up total capex of around ~`144 billion to Share Capital 0.9 0.9 0.9 0.9 be spent over FY’12-FY’14E. -

Aon Hewitt Announces Best Employers India 2016

Aon Hewitt Announces Best Employers India 2016 It’s indisputable: Best Employers lead the way with better business results India, April 7, 2016 –Aon Hewitt, the global talent, retirement and health solutions business of Aon plc (NYSE: AON), announced its list of Best Employers – India 2016. The Aon Best Employers study was first conducted in Asia in 2001. The purpose of the program is to gain insights into companies that are creating real competitive advantage through their people, to explore what makes a workplace of choice and to identify the Best Employers in the region. The Aon Best Employers program is the most comprehensive study of its kind in Asia Pacific. It is run in 12 markets: Australia & New Zealand China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Taiwan, Thailand as well as in the Middle East. A total of 113 organizations representing 12 key industries, cumulatively employing approximately 950,000 employees, participated in the 2016 Aon Best Employers India study. The study research methodology involves a rigorous process, conducted over a nine-month period that culminates in a solid, credible list of Best Employers decided by an external panel of independent jury. The jury for the 2016 edition comprised eminent business leaders and academicians including: Prof Rajan Gupta, Professor at MDI. Mr. Raman Roy, BPO industry pioneer and Chairman and Chief, Quattro Ms. Renu Sud Karnad Managing Director, HDFC Limited Dr. Santrupt Misra , CEO, Carbon Black Business and Director, Group HR, Aditya Birla Group Mr. -

Challenges and Strategies to Knowledge Management: Case Studies of Selected Companies

Symbiosis Centre for Management & Human Resource Development Online access @ www.publishingindia.com Challenges and Strategies to Knowledge Management: Case Studies of Selected Companies Jeet Singh Moradabad Institute of Technology, Moradabad-244001, Uttar Pradesh Preeti Yadav Institute of Rural Management, Jaipur-302018, Rajasthan Abstract We are in a knowledge economy. Individuals compete with people all over the world. In the private sector, t is no longer necessary to belong to any particular race, caste or creed. To impact the bottom-line of an organization and an individual's goals and aspirations, the very basic necessity is to provide them with the basic requirements. And yes, knowledge management is as important as food, water and air. There is no one size fits all way to effectively tap a firm’s intellectual capital. To create value, companies must focus on how knowledge is used to build critical capabilities. Knowledge management is complex and multifaceted; item compasses everything the organisation does to make knowledge available to the business, such as embedding key information in systems and processes, applying incentives to motivate employees and forging alliances to infuse the business with new knowledge. Effective knowledge management requires a combination of many organisational elements – people, process and technology – in order to ensure that the right knowledge is brought to bear at the right time. As Peter Drucker put it, “Knowledge is and will be the basic economic resource.” In simple words, the key function of management is to engineer and manage knowledge. Management must encourage new knowledge to come forward. Everyone’s knowledge must be tapped. -

Grasim Industries Standalone Profitability Comes Under Pressure Stock Update Stock

Grasim Industries Standalone profitability comes under pressure Stock Update Stock Sector: Diversified Grasim Industries Limited’s (Grasim) adjusted standalone net profit declined by 35.5% y-o-y to Rs. 526.5 crore on account of weak Result Update operating profit margin (OPM) in both viscose and chemical divisions. The VSF division was affected by global capacity overhang, elevated Change further by U.S.-China trade war. Caustic soda also performed poorly on the operational front owing to increased domestic capacity and weak Reco: Hold demand. Exit prices for both VSF and caustic soda are lower, which is CMP: Rs. 734 expected to put pressure on its standalone operations. Going ahead, with its capacity expansion plans in both verticals, the company expects Price Target: Rs. 803 to see gradual improvement in profitability. On the other hand, the key overhang on Grasim related to the funding of Vodafone Idea remains, as á Upgrade No change â Downgrade management would consider fund infusion at the time it arises. We have lowered our standalone estimates for FY2020-FY2021, factoring weak profitability in the VSF and chemical divisions. On account of increasing Company details losses in Vodafone Idea, its rising funding requirements and little clarity Market cap: Rs. 48,293 cr emerging from Grasim’s management on funding Vodafone Idea, we continue to maintain our Hold rating on the stock with an unchanged 52-week high/low: Rs. 959/636 SOTP-based price target (PT) of Rs. 803. Key Positives NSE volume: (No of 19.0 lakh shares) Lower pulp prices benefits to be visible in VSF profitability in the coming quarters. -

Company Reliance Industries Limited Tata Consultancy Services

Top 1000 Private Sector Companies (Rank-wise List) Company Reliance Industries Limited Tata Consultancy Services (TCS) Infosys Technologies Ltd Wipro Limited Bharti Tele-Ventures Limited ITC Limited Hindustan Lever Limited ICICI Bank Limited Housing Development Finance Corp. Ltd. TATA Steel Limited Ranbaxy Laboratories Limited HDFC Bank Ltd Tata Motors Limited Larsen & Toubro Limited (L&T) Satyam Computer Services Ltd. Maruti Udyog Limited Bajaj Auto Ltd. HCL Technologies Ltd. Hero Honda Motors Limited Hindalco Industries Ltd Reliance Energy Limited Grasim Industries Limited Jet Airways (India) Ltd. Sun Pharmaceuticals Industries Ltd Cipla Ltd. Gujarat Ambuja Cements Ltd. Videsh Sanchar Nigam Limited The Tata Power Company Limited Sterlite Industries (India) Ltd. Associated Cement Companies Ltd. Nestlé India Ltd. Hindustan Zinc Limited GlaxoSmithKline Pharmaceuticals Limited Siemens India Ltd. Motor Industries Company Limited Mahindra & Mahindra Limited UTI Bank Ltd. Zee Telefilms Limited Bharat Forge Limited ABB Limited i-Flex Solutions Ltd. Dr. Reddy's Laboratories Ltd. Nicholas Piramal India Limited Kotak Mahindra Bank Limited Reliance Capital Ltd. Ultra Tech Cement Ltd. Patni Computer Systems Ltd. Wockhardt Limited Indian Petrochemicals Corporation Limited Biocon India Limited Essar Oil Limited. Asian Paints Ltd. Dabur India Limited Jaiprakash Associates Limited JSW Steel Limited Tata Chemicals Limited Tata Tea Limited Tata Teleservices (Maharashtra) Limited The Indian Hotels Co. Ltd. Glenmark Pharmaceuticals Limited NIRMA Limited Jindal Steel & Power Ltd HCL Infosystems Ltd. Cadila Healthcare Limited Colgate-Palmolive (India) Limited The Great Eastern Shipping Company Limited Aventis Pharma India Ltd Ashok Leyland Limited Pantaloon Retail (India) Limited Indian Rayon And Industries Limited Financial Technologies (India) Ltd United Phosphorus Limited Matrix Laboratories Limited Sesa Goa Limited Lupin Ltd Cummins India Limited Crompton Greaves Limited. -

Grasim Industries Limited Discussion on New Business Foray

/ Grasim Industries Limited Discussion on New Business Foray January 23, 2021 MANAGEMENT: MR. DILIP GAUR - MANAGING DIRECTOR – GRASIM INDUSTRIES LIMITED MR. HIMANSHU KAPANIA – BUSINESS HEAD – BIRLA WHITE MR. ASHISH ADUKIA - CHIEF FINANCIAL OFFICER - GRASIM INDUSTRIES LIMITED Page 1 of 19 Grasim Industries Limited January 23, 2021 Moderator: Ladies and gentlemen, good day and welcome to the conference call for a “Discussion on New Business Foray” hosted by Grasim Industries Limited. As a reminder, all participant lines will be in the listen-only mode, and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing ‘*’ then ‘0’ on your touchtone phone. Please note that this conference is being recorded. I now hand the conference over to Mr. Ashish Adukia -- Chief Financial Officer, Grasim Industries Limited. Thank you. And over to you, sir. Ashish Adukia: Thank you. Good morning, everyone. This is Ashish Adukia – CFO of Grasim. Grasim, as you know, has a long and successful history of incubating large new businesses for the group. While we started as a Textiles company 74-years back, but since then, we have incubated many dealership businesses under Grasim. We entered into Chemicals business as backward integration to VSF. And now, we've made it into an independent business, which is the largest player in the country. We entered into Cement when market was entrenched with incumbents, but over time, we created the “Number One Cement Company” with commanding presence across the country, supported by a strong brand that resonates with customers and trade. -

CSR Brochure 2015

nd NHRDN 2 Summit Corporate Social Responsibility ‘From Act to Action’ Hilton Hotel, Mumbai 24th -25 th July 2015 Summit Director ▲ Dr. H. Chaturvedi, Director, Bimtech About the Summit ▲ ▲ Summit Themes The Summit will Enable to • Creating Framework for Effective CSR Governance Corporates to learn from experiences of various organisations specially • How to Create Effective CSR Partnership CSR planning and implementation within the current financial year, cut • Building the CSR Management & Delivery Capacity across the key components of the stipulated framework. • Role of Implementation Agencies • How to Measure, Communicate & Create Better Impact Prepare a clear blueprint for action based on learning’s of the summit. ▲ Key Takeaways • Learn perspectives of practitioners of eminence and excellence. • Gain intellectual stimulation by listening to the best & innovative practices. • Get an opportunity to network & share practical experiences with fellow delegates. ▲ Our Partners/Sponsors Associate Co- Partner Sponsors Communication & Process B-School Online Media Design Partner Partner Partners Partner ▲ Some of the Speakers Invited Mr Devendra Fadnavis Ms Shibani Sharma Khanna Dr Vineeta Roy Hon'ble Chief Minister Channel Director - NDTV Good Times, Associate Professor Maharashtra Creative Head - NDTV Lifestyle Lead-CSR Mr Praveen Aggarwal NDTV Bimtech Head & Chief Operating Officer Dr Huzaifa Khorakiwala Ms Shikha Sharma Swades Foundation Chief Executive Officer Managing Director & Chief Execuitve Officer Mr Deepak Arora Wockhardt Foundation -

Annual-Report-Utcl-2019-20.Pdf

The Chairman’s Letter to Shareholders Dear Shareholder, COVID-19 and the associated lockdowns across countries have triggered a once-in-a-century crisis for the society and the economy in 2020. January now seems like a month of a bygone era – such has been the enormity of change. This is a defining period in human and business history: one that will test the resilience of individuals, societies, corporations, and nations. Given the fog of uncertainty all around, it is hard to be prescient in these times. But there is little doubt on one reality: companies with quality leadership, sound business fundamentals, and a track record of winning in turbulent times, will emerge as champions in the new global order. Mr. Aditya Vikram Birla Global Economy It has been several months since the pandemic engulfed the world and yet there is a lot of uncertainty We live by his values. with respect to the extent of the economic contraction due to this Integrity, Commitment, crisis, and the subsequent pace of Passion, Seamlessness recovery. This year will see an economic and Speed. contraction, but this 2020 recession is turning out very different from the past recessions. It has been too 01-35 Corporate Overview 2 36-133 Statutory Reports 3 134-320 Financial Statements UltraTech Cement Limited Annual Report 2019-20 confidence. Some sectors, like airlines and zones during the lockdown, where economic strengthening its business relationships. hospitality, will take time to recover fully. activity remained severely constrained. The Aditya Birla Group is also closely And some supply chain disruption effects Correspondingly, India’s GDP is likely to examining the evolving changes in the will linger.