Annual Report 2010 Year Ended March 31, 2010 Annual Report 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1. Outline of Submarine Cable Systems

NEC’s Submarine Cable System December 5, 2008 NEC Corporation Broadband Network Operations Unit Executive General Manager Masamichi Imai 1. Outline of Submarine Cable Systems 2 © NEC Corporation 2008 1-1. The History of Submarine Cables 1850:First Telegraph cable at Dover Strait 1858:First Trans-Atlantic Telegraph Cable (1876:Graham Bell invents the Telephone) 1906: Submarine Cable Tokyo-Guam 1956:First Trans-Atlantic Coaxial Cable (1963: Satellite Communications between Japan and US begins) 1964:First Trans-Pacific Coaxial Cable 1988:First Trans-Oceanic Optical Cable(1 Gb/s) 1999:Trans-Oceanic Optical Cable (640 Gb/s) 2001:Trans-Oceanic Optical Cable (1.28~Tb/s) 3 1-2. Summary of Submarine Cable Systems Station A Station B ・Burial up to sea depth of 1500m Max. Sea Depth 8,000m ・Avg 1m-3m burial (Max.15m) (at 8000m below sea level, water pressure is equivalent to holding a car on one’s thumb.) = Repeater Placed at 40Km~100km intervals ←Cables are laid in deep trenches Max. Transmission Distance 12,000~13,000km Japan to US West Coast is approx. 8,000km At least 80~100 repeaters are required. 4 1-3. Components of a Submarine Cable System Dry Side Wet Side Submarine Repeater Line Terminal Equipment Submarine Cables (inc.. fiber.) Power Feeding Equipment Supervisory System Network Protection Equipment Overall System Monitoring (SDH system) Repeater Performance Monitoring Installation Cableship 5 1-4. Technical Trends CoaxialCoaxial FiberFiber OpticsOptics Optical 40G DWDM Amplifier 10G DWDM System 2.5G DWDM 5G Single Optical Regenerator System 1.3 / 1.55 μm Coaxial Repeater System 1970 1980 1990 2000 NowNow 6 1-5. -

Leading Optical Device Manufacturers Release Common Specifications for 40 Gbit/S Solutions Based on XLMD Optical Device Multi-Source Agreement

Leading Optical Device Manufacturers Release Common Specifications for 40 Gbit/s Solutions Based on XLMD Optical Device Multi-Source Agreement Multi-Source Agreement Enables Multiple Vendors to Produce 40 Gbit/s Optical Devices Based on a Unified Standard TOKYO, JAPAN & SAN DIEGO, CA: February 21, 2008 – Eudyna Devices Inc., Mitsubishi Electric Corp., NEC Electronics Corp., Oki Electric Industry Co., Ltd., Opnext Inc. and Sumitomo Electric Industries, Ltd., today announced, in advance of OFC/NFOEC, common specifications for pigtail type optical devices based on the 40 Gbit/s Optical Device Multi-Source Agreement (XLMD-MSA*1), introduced by the six companies in March 2007. The newly available XLMD-MSA specifications detail the external-modulation laser transmitter devices with built-in driver ICs and the PIN-TIA*2 receiver devices that comply with 40 Gbit/s interface standard for SONET OC-768*3. 10 Gbit/s optical transmission interfaces are widely deployed in Metropolitan Area Networks (MAN), Local Area Networks (LAN) and Storage Area Networks (SAN). These networks currently form the backbone of broadband infrastructure, consequently increasing the popularity of 40 Gbit/s optical transmission interfaces. The XLMD-MSA aims to establish compatible sources of 40 Gbit/s optical transmitter and receiver devices embedded into the 40 Gbit/s optical transceiver modules. This agreement will accelerate the growth of the 40 Gbit/s transceiver module market, providing advanced solutions to high capacity network and storage systems. All members will promote the MSA-compliant products in order to achieve consistent customer delivery and market growth. The XLMD-MSA specifications for compatible optical devices include: Mechanical dimensions and pin assignments of pigtail type optical devices High speed electrical interface using a dual SMPM*4 connectors Optical and electrical characteristics The specifications are now available at the XLMD-MSA web site. -

PUBLIC SUBMISSION Posted: November 20, 2020 Tracking No

Page 1 of 2 As of: 11/23/20 10:03 AM Received: November 18, 2020 Status: Posted PUBLIC SUBMISSION Posted: November 20, 2020 Tracking No. 1k4-9k60-8cjw Comments Due: December 03, 2020 Submission Type: Web Docket: PTO-C-2020-0055 Request for Comments on Discretion to Institute Trials Before the Patent Trial and Appeal Board Comment On: PTO-C-2020-0055-0001 Discretion to Institute Trials Before the Patent Trial and Appeal Board Document: PTO-C-2020-0055-0452 Comment from Japan Business Machine and Information System Industries Association Submitter Information Name: Hideaki Chishima Address: Lila Hijirizaka 7FL 3-4-10, Mita Minato-ku, Tokyo, Japan, 1080073 Email: [email protected] Phone: +81-3-6809-5495 Fax: +81-3-3451-1770 Submitter's Representative: Hideki Sanatake Organization: Japan Business Machine and Information System Industries Association General Comment Dear Sir, This post is for Japan Business Machine and Information System Industries Association (JBMIA) to submit its comments in response to solicitation of public comments by USPTO as announced in Federal Register / Docket No. PTO-C-2020-0055. The comments are attached hereto. JBMIA is a Japanese incorporated association which was renamed in 2002 from Japan Business Machine Makers Association established originally in 1960. JBMIA consists of 40 member companies engaged in business machine and information system and 5 supporting companies. Almost all of the member companies have actively filed patent applications in the USA. https://www.fdms.gov/fdms/getcontent?objectId=0900006484967b2a&format=xml&sho... 11/23/2020 Page 2 of 2 Sincerely, Hideaki Chishima (Mr) Intellectual Property Committee Secretariat Attachments JBMIA Comment (finnal) https://www.fdms.gov/fdms/getcontent?objectId=0900006484967b2a&format=xml&sho.. -

NEC Electronics and Renesas to Integrate Business Operations Establishment of the World’S Third Largest Semiconductor Company

NEC Electronics and Renesas to Integrate Business Operations Establishment of the World’s Third Largest Semiconductor Company KAWASAKI, Japan, TOKYO, Japan, April 27, 2009 -- NEC Electronics Corporation (NEC Electronics; TSE: 6723), Renesas Technology Corp. (Renesas), NEC Corporation (NEC; TSE: 6701), Hitachi, Ltd. (Hitachi; TSE: 6501 / NYSE: HIT), and Mitsubishi Electric Corporation (Mitsubishi Electric; TSE: 6503) today agreed to enter into negotiations to integrate business operations at NEC Electronics and Renesas. 1. Background and goals of business integration NEC Electronics was established in 2002, separating from NEC, and Renesas was established in 2003, integrating semiconductor units at Hitachi and Mitsubishi Electric. Both as leading semiconductor companies, NEC Electronics and Renesas provide a wide variety of semiconductor solutions, primarily specializing in microcontroller units (MCUs). In light of fierce global competition in the semiconductor market, NEC Electronics and Renesas have agreed to explore the possibility of business integration in order to further strengthen their business foundations and technological assets while increasing corporate value through enhanced customer satisfaction. By integrating the world’s two largest MCU suppliers (*1), the new company will provide one of the most competitive MCU product lineups throughout the world. NEC Electronics and Renesas both focus on the fast-growing field of system-on-chip (SoCs) products. NEC Electronics is a leading producer of SoCs for digital consumer electronics, while Renesas is a well established manufacturer of SoCs for mobile phones and automotive applications. By reinforcing the companies’ respective strengths and development resources the new company will provide globally competitive SoC products. In terms of the discrete semiconductor business, both companies will define strategies to enhance the competitiveness of analog and discrete products that generate synergies with MCUs. -

DIRECTV® Universal Remote Control User's Guide

DirecTV-M2081A.qxd 12/22/2004 3:44 PM Page 1 ® DIRECTV® Universal Remote Control User’s Guide DirecTV-M2081A.qxd 12/22/2004 3:44 PM Page 2 TABLE OF CONTENTS Introduction . .3 Features and Functions . .4 Key Charts . .4 Installing Batteries . .8 Controlling DIRECTV® Receiver. .9 Programming DIRECTV Remote . .9 Setup Codes for DIRECTV Receivers . .10 Setup Codes for DIRECTV HD Receivers . .10 Setup Codes for DIRECTV DVRs . .10 Programming to Control Your TV. .11 Programming the TV Input Key . .11 Deactivate the TV Input Select Key . .11 Programming Other Component Controls . .12 Manufacturer Codes . .13 Setup Codes for TVs . .13 Setup Codes for VCRs . .16 Setup Codes for DVD Players . .19 Setup Codes for Stereo Receivers . .20 Setup Codes for Stereo Amplifiers . .22 Searching For Your Code in AV1 or AV2 Mode . .23 Verifying The Codes . .23 Changing Volume Lock . .24 Restore Factory Default Settings . .25 Troubleshooting . .26 Repair or Replacement Policy . .27 Additional Information . .28 2 DirecTV-M2081A.qxd 12/22/2004 3:44 PM Page 3 INTRODUCTION Congratulations! You now have an exclusive DIRECTV® Universal Remote Control that will control four components, including a DIRECTV Receiver, TV, and two stereo or video components (e.g 2nd TV, DVD, or stereo). Moreover, its sophisticated technology allows you to consolidate the clutter of your original remote controls into one easy-to-use unit that's packed with features such as: z Four-position slide switch for easy component selection z Code library for popular video and stereo components z Code search to help program control of older or discon- tinued components z Memory protection to ensure you will not have to re- program the remote when the batteries are replaced Before using your DIRECTV Universal Remote Control, you may need to program it to operate with your particular com- ponent. -

NEC Electronics Corporation to Be Held on February 24, 2010

(Translation) The following is an English translation of the Notice of the Extraordinary General Meeting of Shareholders of NEC Electronics Corporation to be held on February 24, 2010. The Company provides this translation for your reference and convenience only and without any warranty as to its accuracy or otherwise. NEC Electronics Corporation 1753, Shimonumabe, Nakahara-ku, Kawasaki, Kanagawa Junshi Yamaguchi President February 2, 2010 To Our Shareholders: NOTICE OF THE EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS The Extraordinary General Meeting of Shareholders (the "General Meeting") of NEC Electronics Corporation (the "Company") will be held as follows: 1. DATE: February 24, 2010 (Wednesday) at 10:00 A.M. (Japan Standard Time) 2. PLACE: Tamagawa Renaissance City Hall located at 1753, Shimonumabe, Nakahara-ku, Kawasaki, Kanagawa, Japan 3. AGENDA OF THE GENERAL MEETING MATTERS TO BE VOTED UPON: (1) Approval of the Merger Agreement between the Company and Renesas Technology Corp. (2) Partial Amendment to the Articles of Incorporation (3) Election of Seven Directors (4) Election of One Corporate Auditor (5) Revision of the Amount of Remuneration for Directors and Corporate Auditors (6) Issuance of New Shares Offered by way of Third Party Allotment 4. EXERCISE OF VOTING RIGHTS (1) If shareholder does not indicate acceptance or rejection of the agenda items when exercising a voting right via postal mail, the Company shall treat such cases as 1 (Translation) indication of acceptance. (2) In the event that a shareholder exercises a voting right by electromagnetic method (the Internet), even if the voting form is returned to us by postal mail, the Company shall treat the shareholder’s vote by electromagnetic method (the Internet) as the effective exercise of the voting right. -

Sony 20% Panasonic 16% Samsung 19% NEC 25% LG 15% Sharp

Audio Visual Equipment, Accessories & Services RFP # 20-12 Offeror Company Name : Item No. Category Manufacturer Name Proposed Discount Presentation & Displays - Flat Panel Displays Sony 20% Presentation & Displays - Flat Panel Displays Panasonic 16% Presentation & Displays - Flat Panel Displays Samsung 19% Presentation & Displays - Flat Panel Displays NEC 25% Presentation & Displays - Flat Panel Displays LG 15% Presentation & Displays - Flat Panel Displays Sharp Professional 17% Presentation & Displays - Flat Panel Displays Christie Digital 10% Presentation & Displays - Flat Panel Displays Maxell 26% Presentation & Displays - Flat Panel Displays Microsoft 2% Presentation & Displays - Flat Panel Displays Newline 10% Presentation & Displays - SMART Technologies- Flat Panel Displays Education 23% Presentation & Displays - SMART Technologies- Flat Panel Displays Enterprise 15% Presentation & Displays - Flat Panel Displays Mitsubishi 10% Presentation & Displays - Flat Panel Displays Multitaction 5% Presentation & Displays - Flat Panel Displays Planar 10% Presentation & Displays - Flat Panel Displays DTEN 5% Presentation & Displays - Any Other Listed Brands Flat Panel Displays not listed 5% Presentation & Displays - Projection and Displays Panasonic 12% Presentation & Displays - Projection Screens Da-Lite/Legrand 22% Presentation & Displays - Projection Screens Draper 22% Presentation & Displays - Projection Screens Stewart 20% Presentation & Displays - Any Other Brand Not Projection Screens Listed 5% Item No. Category Manufacturer Name Proposed -

Integrated Report 2019 Contents Editorial Policy NEC Has Published Integrated Annual Reports Containing Both Financial and Non-Financial Information Since 2013

Integrated Report 2019 Contents Editorial Policy NEC has published integrated annual reports containing both financial and non-financial information since 2013. Starting in 2018, having defined its materiality, Business Strategy and Vision NEC has changed the name of the report to the “Integrated Report.” 03 What's NEC Integrated Report 2019 comprises four chapters, respectively titled Business Strategy and Vision, 05 NEC's Value Creation Journey Business Activities, Management Foundation, and Corporate Data. 07 Message from the President Business Strategy and Vision describes the progress 13 Value Creation Process of the Mid-term Management Plan 2020 and our initiatives to create value, such as implementation of 15 Feature: NEC Safer Cities our priority themes from an Environmental, Social and Governance (ESG) perspective, or “materiality.” Business 19 Initiatives to Ensure Respect for Human Activities includes a message from the CFO along with an overview from each of our segments and an Rights Such as Privacy Policies and introduction of our principle international locations. Measures Aligned with Societal Expectations Management Foundation introduces the Company’s initiatives in support of sustainable management. 21 Sustainably and Socially Literate NEC will keep endeavoring to provide increasingly Human Resources transparent and continuous information while incorporating feedback from various stakeholders. 23 Environmental Action with a Particular Reporting Period Focus on Climate Change April 1, 2018 to March 31, 2019 (hereinafter -

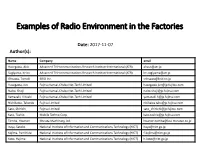

Radio Environment in Factories

Examples of Radio Environment in the Factories Date: 2017-11-07 Author(s): Name Company email Hasegawa, Akio Advanced Telecommunications Research Institute International (ATR) [email protected] Sugiyama, Keizo Advanced Telecommunications Research Institute International (ATR) [email protected] Ohsawa, Tomoki BRID Inc. [email protected] Hasegawa, Jun Fujitsu Kansai-Chubu Net-Tech Limited [email protected] Naito, Shoji Fujitsu Kansai-Chubu Net-Tech Limited [email protected] Yamazaki, Hiroaki Fujitsu Kansai-Chubu Net-Tech Limited [email protected] Nishikawa, Takurou Fujitsu Limited [email protected] Sato, Shinichi Fujitsu Limited [email protected] Kato, Toshio Mobile Techno Corp. [email protected] Tomita, Hisanori Murata Machinery, Ltd. [email protected] Itaya, Satoko National Institute of Information and Communications Technology (NICT) [email protected] Kojima, Fumihide National Institute of Information and Communications Technology (NICT) [email protected] Koto, Hajime National Institute of Information and Communications Technology (NICT) [email protected] Author(s): Name Company email Mochinaga, Mika National Institute of Information and Communications Technology (NICT) [email protected] Ezure, Yuichiro NEC Communication Systems, Ltd. [email protected] Ito, Chikashi NEC Communication Systems, Ltd. [email protected] Kobayashi, Tsukasa NEC Corporation [email protected] Maruhashi, Kenichi NEC Corporation [email protected] Nakajima, Taketoshi NEC Corporation [email protected] Okayama, Yoshimitsu NEC Corporation [email protected] Tsuji, Akira NEC Corporation [email protected] Zein, Nader NEC Europe Ltd. -

(Japan) № Company Name (Japan) № Company Name (Overseas) № Company Name (Overseas) 恩益禧数碼応用産品貿易(上海)有限公司 (NEC 1 NEC Corporation 29 NEC Embedded Technology, Ltd

Data Collection Scope: 92 Companies comprising NEC Corporation and NEC Group companies (41 in Japan and 51 overseas) № Company Name (Japan) № Company Name (Japan) № Company Name (Overseas) № Company Name (Overseas) 恩益禧数碼応用産品貿易(上海)有限公司 (NEC 1 NEC Corporation 29 NEC Embedded Technology, Ltd. 1 NEC Corporation of America 27 Information Systems (Shanghai), Ltd.) 2 ABeam Consulting Ltd. 30 NEC Fielding, Ltd. 2 NEC Canada, Inc. 28 NEC Hong Kong Limited 3 OCC Corporation 31 NEC Platforms, Ltd. 3 NEC Laboratories America, Inc. 29 NEC Taiwan Ltd. (台湾恩益禧股份有限公司) 4 NEC Nexsolutions, Ltd. 32 NEC Patent Service, Ltd. 4 Niteo Technologies, Private Limited 30 NEC Asia Pacific Pte. Ltd. 5 SHIMIZU SYNTEC Corporation 33 NEC Friendly Staff, Ltd. 5 NEC Energy Solutions, Inc. 31 NEC Corporation of Malaysia Sdn. Bhd. 6 Sunnet Corporation 34 NEC Management Partner, Ltd. 6 NEC Latin America S.A. 32 NEC Corporation (Thailand) Ltd. 7 Bestcom Solutions Inc. 35 NEC Livex, Ltd. 7 NEC Argentina S.A. 33 NEC Technologies India Private Limited Institute for International Socio-Economic 8 YEC Solutions Inc. 36 Studies 8 NEC Chile S.A. 34 NEC Philippines, Inc. 9 KIS Co., Ltd. 37 TAKASAGO, Ltd. 9 NEC de Colombia S.A. 35 NEC Vietnam Company Limited 10 NEC Space Technologies, Ltd. 38 NEC Display Solutions, Ltd. 10 NEC de Mexico, S.A.de C.V. 36 PT. NEC Indonesia 11 NEC Network and Sensor Systems, Ltd. 39 Showa Optronics Co., Ltd. 11 NEC Europe Ltd. 37 NEC Australia Pty Ltd 12 NEC Aerospace Systems, Ltd. *40 Nippon Avionics Co., Ltd. 12 NEC Deutschland GmbH 38 NEC New Zealand Limited 13 Cyber Defense Institute, Inc. -

Necmitsubishi Electric Visual Systems Corporation To

FOR IMMEDIATE RELEASE Media Contact: Tim Dreyer NECMitsubishi Electronics Display (630) 4674559 [email protected] NECMITSUBISHI ELECTRIC VISUAL SYSTEMS CORPORATION TO BECOME NEC CORPORATION WHOLLYOWNED SUBSIDIARY NECMitsubishi Electronics Display will Continue Market Leadership in Flat Panel Display Industry CHICAGO – Feb. 21, 2005 – NECMitsubishi Electronics Display (“NECMitsubishi”) today announced that its parent company NECMitsubishi Electric Visual Systems Corporation (“NM Visual”), a joint venture company of NEC Corporation and Mitsubishi Electric Corporation since January 2000, will become a whollyowned subsidiary of NEC Corporation on March 31, 2005. On becoming a whollyowned subsidiary of NEC Corporation, a $47 billion worldwide provider of computer and communications solutions, the company will be renamed and repositioned as an NEC display solutions company. The new company will commence operations wellpositioned for success with fullaccess to NEC Corporation’s robust technology, research and development and rich history of product innovation. NEC Corporation will acquire 100% ownership of NM Visual, a company that has developed a strong market leading position in display products, achieved six consecutive quarters of profitability and owns the premier brand in the display industry, NEC MultiSync ® . “We are very proud of our accomplishments as NECMitsubishi Electronics Display, and we are excited to be able to further leverage the strengths of NEC Corporation as we move forward,” said President and COO T.J. Trojan. “We firmly believe that the new ownership structure will provide many new opportunities for future growth through the access of new products and services and the simplification of our gotomarket strategies.” The combination of NEC’s technology leadership in liquid crystal display (“LCD”) technology and Mitsubishi Electric’s manufacturing expertise in highend cathode ray tube (“CRT”) technology in the year 2000 positioned the joint venture for strong growth in the display industry. -

Arrival of Network Society, and Global Competition (1993-1998)

Challenge of Management Reform, and Globalization Chapter 7 Arrival of Network Society, and Global Competition (1993-1998) 197 C h a p t e r 7 1. Efforts toward Corporate Restructuring President Jun Jinguji assumes office, and new management policy By early 1992, it was clear that the bubble economy had col- lapsed. Although Japan’s economic growth in the fiscal year ending in March 1993 had grown 0.4 percent, during the next three years, through to March 1995, the economy experienced zero growth in real terms. This marked the start of the “Heisei recession.” Oki Electric’s financial results for the interim period ended September 30, 1992, recorded a huge operating loss of 19.3 billion yen, forcing the company to halt dividend payments for the first time in 14 years. The Electronic Devices Division, hit directly by a slump in de- mand for memory, recorded a substantial loss in the interim financial results. Sales of information processing systems to financial institu- tions also floundered, negatively affecting the Information Systems Division. In the backdrop of the decline in revenue and profit, the fixed cost from large capital investments, mainly in semiconductors, became a heavy burden. The deficit from net interest expenses also increased, while the latent loss from declining stock prices exceeded 10 billion yen. Amidst a worsening of the business slump caused by the bubble economy’s collapse, the board of directors of Oki Electric voted on October 30, 1992, to have President Kosugi become chairman and Senior Managing Director Jun Jinguji become president. At the same time, Chairman Hashimoto was appointed senior advisor.