Local Authorities Pension Plan Cost of Living

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jason Kenney Elected Leader of UCP October 30, 2017

Jason Kenney Elected Leader of UCP October 30, 2017 JASON KENNEY ELECTED LEADER OF THE UNITED CONSERVATIVE PARTY OF ALBERTA Introduction In a victory surprising for its size and decisiveness, Jason Kenney won the leadership of the United Conservative Party of Alberta (UCP) on Saturday, October 28. Kenney took 61.1 per cent of the almost 60,000 votes cast, besting former Wildrose Party leader Brian Jean with 31.5 per cent, and 7.3 per cent for Doug Schweitzer, who managed the late Jim Prentice’s Progressive Conservative leadership campaign in 2014. Background The win capped a fifteen-month process that began when Kenney launched the idea of uniting Alberta Conservatives into one party, and is a significant tribute to his organizational skills and superior ground game. Kenney’s success had several key steps: • On July 16, 2016, he announced he would seek the leadership of the Progressive Conservative Party on a platform of merging with Wildrose. • On March 18, 2017, he was elected leader of the Progressive Conservative Party with more than 75 per cent of the delegate votes. • Two months later, Kenney and Brian Jean announced a merger referendum among the membership of the PCs and Wildrose to be held on July 22. • The referendum was strongly passed by both parties by identical approvals of 96 per cent, which created the United Conservative Party and led the way to last Saturday’s leadership victory. Deep Political & Government Experience Born in Toronto and raised in Saskatchewan, Jason Kenney began his political life as a Liberal in 1988, serving as executive assistant to Ralph Goodale, then leader of the provincial Liberal Party. -

Alberta Counsel Newsletter Issue 99 2020

THE ISSUE Alberta’s Premier Review of 99 NEWS Politics and Government Vitality JANUARY/2020 from UNPRECEDENTED DECADE IN ALBERTA POLITICS Jim Prentice, although victorious, renounced his seat right after the provincial election, sending Calgary Lougheed voters to the polls for the 3rd time in roughly one year. In the September 3, 2015 by-election they elected Prassad Panda of the COMES TO AN END Wildrose Party. Tragedy struck in the fall of 2015 with the unfortunate death of former Cabinet Minister Manmeet Bhullar. Robert Reynolds, Q.C. He was killed in a traffic accident on Highway 2 around Red Deer when he attempted to help a motorist during a snowstorm and was struck himself. His successor in Calgary-Greenway was Prab Gill who ran as a PC, but would ultimately become an Independent amidst accusations of participating in voter irregularity. How amazing were the 2010s in Alberta politics? The decade saw the demise of the Progressive Conservative Party, which had governed Alberta from 1971 – 2015. It saw the first NDP government in the province’s history, which also turned out to Undoubtedly the biggest political move during the period was the creation of the United Conservative Party (UCP) from the merger of the PC and Wildrose parties. Jason Kenney won the leadership by defeating Wildrose Leader Brian Jean and now Senior Editor: Pascal Ryffel be the only one-term government since Alberta entered Confederation and became a province in 1905. There were 6 Minister of Justice Doug Schweitzer. The resignation of long-time PC and then UCP MLA Dave Rodney led to Kenney Publisher: Alberta Counsel premiers in the decade (Stelmach, Redford, Hancock, Prentice, Notley and Kenney). -

University of Lethbridge Alumnus Manwar Khan to Hold Anti-‐Bullying

For Immediate Release — Wednesday, August 12, 2015 University of Lethbridge alumnus Manwar Khan to hold Anti-Bullying Rally for victims of bullying and violence What: Do Not Be a Bystander Anti-Bullying Rally When: Saturday, August 15, 11:30 a.m. Where: Calgary City Hall – Municipal Plaza space Edmonton-based activist and University of Lethbridge alumnus Manwar Khan (BSc ’07), a father of twins, is holding a rally in Calgary at the Calgary City Hall as he continues to campaign across the province against bullying and violence. “We will be gathering in front of City Hall to show our support for every known and unknown victim of bullying and violence in Alberta,” says Khan, who witnessed a violent attack on an Edmonton LRT train in December 2012. It led to the death of one man and the incarceration of another. Khan invites everyone to gather at City Hall at 11:30 a.m. to rally in support of those who have been affected by violence and bullying. He is also asking people who are not able to attend the rally to leave their porch lights on from 6 to 7 p.m. on August 15, 2015 to show their support for the stand against violence and bullying. Khan established a series of anti-bullying rallies in 2013 and 2014, holding events in Edmonton, Calgary, Lethbridge and Airdrie. He has vowed to continue to represent victims of bullying and to try and stem the onset of violence so that it does not persist in society. “I believe firmly that it is a matter of great importance to teach our children that bullying is simply not acceptable in our society if we are to achieve safety and happiness for all,” he says. -

Mla Directory

MLA DIRECTORY Airdrie Athabasca-Sturgeon-Redwater Banff-Cochrane Mrs. Angela Pitt (W) Mr. Colin Piquette (ND) Mr. Cameron Westhead (ND) Constituency Office Constituency Office Constituency Office 209 Bowers Street B-4705 49 Avenue 102, 721 Main Street Airdrie, AB T4B 0R6 Athabasca, AB T9S 0B5 PO Box 8650 Phone: 403.948.8741 Phone: 780.675.3232 Canmore, AB T1W 0B9 Toll-Free: 1.888.948.8741 Fax: 780.675.2396 Phone: 403.609.4509 Fax: 403.948.8744 Email:athabasca.sturgeon.redwater@assembl Toll-Free: 1.866.760.8281 Email: [email protected] y.ab.ca Fax: 403.609.4513 Email:[email protected] Barrhead-Morinville-Westlock Battle River-Wainwright Bonnyville-Cold Lake Mr. Glenn van Dijken (W) Mr. Wes Taylor (W) Mr. Scott Cyr (W) Mailing Address Constituency Office Constituency Office Box 4250 123 - 10 Street Box 5160 Barrhead, AB T7N 1A3 Wainwright, AB T9W 1N6 #2, 4428 - 50 Avenue Phone: 780.674.3225 Phone: 780.842.6177 Bonnyville, AB T9N 2G4 Fax: 780.674.6183 Fax: 780.842.3171 Phone: 780.826.5658 Email:barrhead.morinville.westlock@a Email:[email protected] Fax: 780.826.2165 ssembly.ab.ca Email:[email protected] Calgary-Acadia Calgary-Bow Calgary-Buffalo Hon. Brandy Payne (ND) Member Deborah Drever (ND) Hon. Kathleen Ganley (ND) Constituency Office Constituency Office Constituency Office #10, 8318 Fairmount Drive SE 6307 Bowness Rd NW #130, 1177 - 11 Avenue SW Calgary, AB T2H 0Y8 Calgary, AB T3B 0E4 Calgary, AB T2R 1K9 Phone: 403.640.1363 Phone: 403.216.5400 Phone: 403.244.7737 Fax: 403.592.8171 Fax: 403.216.5402 Fax: 403.541.9106 Email:[email protected] Email:[email protected] Email:[email protected] Calgary-Cross Calgary-Currie Calgary-East Hon. -

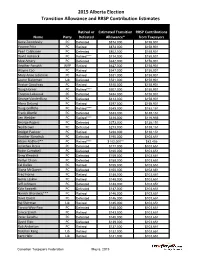

2015 Alberta Election Transition Allowance and RRSP Contribution Estimates

2015 Alberta Election Transition Allowance and RRSP Contribution Estimates Retired or Estimated Transition RRSP Contributions Name Party Defeated Allowance* from Taxpayers Gene Zwozdesky PC Defeated $874,000 $158,901 Yvonne Fritz PC Retired $873,000 $158,901 Pearl Calahasen PC Defeated $802,000 $158,901 David Hancock PC Retired**** $714,000 $158,901 Moe Amery PC Defeated $642,000 $158,901 Heather Forsyth WRP Retired $627,000 $158,901 Wayne Cao PC Retired $547,000 $158,901 Mary Anne Jablonski PC Retired $531,000 $158,901 Laurie Blakeman Lib Defeated $531,000 $158,901 Hector Goudreau PC Retired $515,000 $158,901 Doug Horner PC Retired**** $507,000 $158,901 Thomas Lukaszuk PC Defeated $484,000 $158,901 George VanderBurg PC Defeated $413,000 $158,901 Alana DeLong PC Retired $397,000 $158,901 Doug Griffiths PC Retired**** $349,000 $152,151 Frank Oberle PC Defeated $333,000 $138,151 Len Webber PC Retired**** $318,000 $116,956 George Rogers PC Defeated $273,000 $138,151 Neil Brown PC Defeated $273,000 $138,151 Bridget Pastoor PC Retired $238,000 $138,151 Heather Klimchuk PC Defeated $195,000 $103,651 Alison Redford** PC Retired**** $182,000** $82,456 Jonathan Denis PC Defeated $177,000 $103,651 Robin Campbell PC Defeated $160,000 $103,651 Greg Weadick PC Defeated $159,000 $103,651 Verlyn Olson PC Defeated $158,000 $103,651 Cal Dallas PC Retired $155,000 $103,651 Diana McQueen PC Defeated $150,000 $103,651 Fred Horne PC Retired $148,000 $103,651 Genia Leskiw PC Retired $148,000 $103,651 Jeff Johnson PC Defeated $148,000 $103,651 Kyle Fawcett -

Orange Chinook: Politics in the New Alberta

University of Calgary PRISM: University of Calgary's Digital Repository University of Calgary Press University of Calgary Press Open Access Books 2019-01 Orange Chinook: Politics in the New Alberta University of Calgary Press Bratt, D., Brownsey, K., Sutherland, R., & Taras, D. (2019). Orange Chinook: Politics in the New Alberta. Calgary, AB: University of Calgary Press. http://hdl.handle.net/1880/109864 book https://creativecommons.org/licenses/by-nc-nd/4.0 Attribution Non-Commercial No Derivatives 4.0 International Downloaded from PRISM: https://prism.ucalgary.ca ORANGE CHINOOK: Politics in the New Alberta Edited by Duane Bratt, Keith Brownsey, Richard Sutherland, and David Taras ISBN 978-1-77385-026-9 THIS BOOK IS AN OPEN ACCESS E-BOOK. It is an electronic version of a book that can be purchased in physical form through any bookseller or on-line retailer, or from our distributors. Please support this open access publication by requesting that your university purchase a print copy of this book, or by purchasing a copy yourself. If you have any questions, please contact us at [email protected] Cover Art: The artwork on the cover of this book is not open access and falls under traditional copyright provisions; it cannot be reproduced in any way without written permission of the artists and their agents. The cover can be displayed as a complete cover image for the purposes of publicizing this work, but the artwork cannot be extracted from the context of the cover of this specific work without breaching the artist’s copyright. COPYRIGHT NOTICE: This open-access work is published under a Creative Commons licence. -

Background Information on Sole-‐Sourced Contract Between The

Background information on sole-sourced contract between the Province of Alberta and the Tervita Corporation Documents The Canadian Taxpayers Federation (CTF) was leaked the full, unredacted contact made between the Province of Alberta and the Tervita Corporation signed on July 15, 2013 for flood recovery in High River, Alberta. The CTF also received tips from anonymous whistleblowers that demolitions conducted under the sole-sourced contract between the Government of Alberta and the Tervita Corporation required closer examination. The CTF filed a Freedom of Information (FOI) request for the cost of these demolitions. Contact The contract required of the Tervita Corporation, “assessment, planning, and management services and execution of Deconstruction and/or Demolition, Water Management, and Waste and Asset Management, and Earthworks services to be provided in the Town of High River, Alberta related to the flooding…” The contract awards the Tervita Corporation a sum not to exceed $45 million including expenses. Schedule C of the leaked contract lay out rates of equipment and personnel that the Tervita Corporation may bill the Province of Alberta for. Schedule C also allows the Tervita Corporation to charge a cost + 15 per cent markup for “3rd party mobilization.” In effect, the contract awards the Tervita Corporation $45 million for general flood-related work, for which it need only submit the bill. Derek Fildebrandt May 2014 Alberta Director Canadian Taxpayers Federation Freedom of Information (FOI) request for demolition costs Quote/Cost -

Legislative Assembly of Alberta the 27Th Legislature Second Session

Legislative Assembly of Alberta The 27th Legislature Second Session Standing Committee on Community Services Bill 202, Municipal Government (Municipal Auditor General) Amendment Act, 2009 Tuesday, November 24, 2009 12:10 p.m. Transcript No. 27-2-12 Legislative Assembly of Alberta The 27th Legislature Second Session Standing Committee on Community Services Doerksen, Arno, Strathmore-Brooks (PC), Chair Hehr, Kent, Calgary-Buffalo (AL), Deputy Chair Benito, Carl, Edmonton-Mill Woods (PC) Bhardwaj, Naresh, Edmonton-Ellerslie (PC) Chase, Harry B., Calgary-Varsity (AL) Johnson, Jeff, Athabasca-Redwater (PC) Johnston, Art, Calgary-Hays (PC) Lukaszuk, Thomas A., Edmonton-Castle Downs (PC) Notley, Rachel, Edmonton-Strathcona (ND) Rodney, Dave, Calgary-Lougheed (PC) Sarich, Janice, Edmonton-Decore (PC) Bill 202 Sponsor Johnston, Art, Calgary-Hays (PC) Support Staff W.J. David McNeil Clerk Louise J. Kamuchik Clerk Assistant/Director of House Services Micheline S. Gravel Clerk of Journals/Table Research Robert H. Reynolds, QC Senior Parliamentary Counsel Shannon Dean Senior Parliamentary Counsel Corinne Dacyshyn Committee Clerk Erin Norton Committee Clerk Jody Rempel Committee Clerk Karen Sawchuk Committee Clerk Rhonda Sorensen Manager of Communications Services Melanie Friesacher Communications Consultant Tracey Sales Communications Consultant Philip Massolin Committee Research Co-ordinator Stephanie LeBlanc Legal Research Officer Diana Staley Research Officer Rachel Stein Research Officer Liz Sim Managing Editor of Alberta Hansard Transcript produced by Alberta Hansard November 24, 2009 Community Services CS-257 12:10 p.m. Tuesday, November 24, 2009 possible vote at the end. Having heard most of the presentations, Title: Tuesday, November 24, 2009 cs read most of the presentations, and in my travels met with munici- [Mr. -

Premier Promotes Verlyn Olson and Greg Weadick to Cabinet Cal Dallas Becomes the New Parliamentary Assistant to Finance

February 17, 2011 Premier promotes Verlyn Olson and Greg Weadick to cabinet Cal Dallas becomes the new Parliamentary Assistant to Finance Edmonton... Premier Ed Stelmach announced today that Wetaskiwin-Camrose MLA Verlyn Olson, QC, has been named Minister of Justice and Attorney General, and Lethbridge West MLA Greg Weadick has been named Minister of Advanced Education and Technology. “I’m pleased to welcome Verlyn and Greg to the cabinet table,” said Premier Stelmach. “Verlyn and Greg bring the necessary talent and experience - Greg as a parliamentary assistant and Verlyn as a long-time member of the bar - to complete our cabinet team. Our cabinet will continue to provide the steady leadership required right now to continue building a better Alberta.” Premier Stelmach also named a new Parliamentary Assistant to the Minister of Finance and Enterprise. “I’m pleased that Red Deer South MLA Cal Dallas, who had been serving as the Parliamentary Assistant in Environment, will take over this important role and work closely with Finance Minister Lloyd Snelgrove,” said the Premier. Premier Stelmach also announced changes to committee memberships. Joining the Agenda and Priorities Committee are Sustainable Resource Development Minister Mel Knight, Children and Youth Services Minister Yvonne Fritz and Agriculture and Rural Development Minister Jack Hayden. New members of Treasury Board are Len Webber, Minister of Aboriginal Relations, Heather Klimchuk, Minister of Service Alberta, and Naresh Bhardwaj, MLA for Edmonton-Ellerslie. The new Cabinet members will be sworn in Friday, February 18 at 8:30 a.m. at Government House. Lloyd Snelgrove was sworn in as Minister of Finance and Enterprise on January 31. -

Naughty and Nice to Taxpayers List’ 2013

‘Naughty and Nice to Taxpayers List’ 2013 Naughty Alison Redford: Premier Redford flies around the world more than Santa Claus and gives out more free gifts paid for by debt than the big man in red could ever hope to, using mere elves. Total expense: $82,872 Notable airfare expense claims: o $7,875 to New Brunswick o $6,092 to Chicago o $5,927 to Toronto Notable hotel expense claims: o $876/night in Washington (x2) o $772/night in New York (x3) o $635/night in Toronto (x2) o $649/night in Ottawa (x2) Notable meal & hospitality claims o $22 coffees in Washington o $31 hamburger in Washington Doug Horner: Government debt is sort of like making the kids pay Santa for mom and dad’s presents. Since Doug is leaving behind debt for the little ones, Santa is likely to leave behind a lump of coal for him this year. Large debt and deficit; Even the Auditor General can’t figure out how to make sense out of his books; Initially banning the CTF from the budget lockup. Thomas Lukaszuk: Less naughty than last year, but Minister Lukaszuk sure does love flying to Calgary any chance that the can get. No driving for him. He even managed to find an excuse to be in Calgary on ‘government business’ for five days during Stampede. The last time Santa spent five days at Stampede, the elves fell behind on Cabbage Patch Kids and Mrs. Claus made him sleep on the couch for a week. Add to this his threat to raise beer taxes, and he really had no chance of making the Nice List this year. -

Len Webber Named New Minister of International and Intergovernmental Relations Premier Ed Stelmach Also Appoints New Parliamentary Assistants

September 16, 2009 Len Webber named new Minister of International and Intergovernmental Relations Premier Ed Stelmach also appoints new Parliamentary Assistants Edmonton... Premier Ed Stelmach has announced that Calgary-Foothills MLA Len Webber will be sworn in as the new Minister of International and Intergovernmental Relations by Lieutenant Governor Norman L. Kwong on Thursday, September 17. “I’m very pleased to have Len at the cabinet table,” said Premier Stelmach. “He has performed exceptionally well as the Parliamentary Assistant for Energy, and I’m happy to have him join cabinet in the crucial portfolio of International and Intergovernmental Relations.” Premier Stelmach also named Calgary-Egmont MLA Jonathan Denis as the new Parliamentary Assistant for Energy. Cardston-Taber-Warner MLA Broyce Jacobs becomes the Parliamentary Assistant for Agriculture and Rural Development (ARD). And Battle River-Wainwright MLA Doug Griffiths moves from his role as the Parliamentary Assistant in ARD to become the Parliamentary Assistant for the Department of Solicitor General and Public Security. Premier Stelmach also announced the following Cabinet committee changes to fill existing vacancies: Advanced Education and Technology Minister Doug Horner has been named the new vice-chair of the Agenda and Priorities Committee, while Culture and Community Spirit Minister Lindsay Blackett has been named to the Agenda and Priorities Committee. Athabasca-Redwater MLA Jeff Johnson and Airdrie-Chestermere MLA Rob Anderson have been named to Treasury Board. Also, Minister of Justice and Attorney General Alison Redford and Employment and Immigration Minister Hector Goudreau have been added to the roster of Deputy Government House Leaders. -30- Assignment Editors: Media are invited to attend the swearing-in of new International and Intergovernmental Relations Minister Len Webber. -

Alberta Hansard

Province of Alberta The 29th Legislature First Session Alberta Hansard Thursday afternoon, June 11, 2015 The Honourable Robert E. Wanner, Speaker Legislative Assembly of Alberta The 29th Legislature First Session Wanner, Hon. Robert E., Medicine Hat (ND), Speaker Jabbour, Deborah C., Peace River (ND), Deputy Speaker and Chair of Committees Feehan, Richard, Edmonton-Rutherford (ND), Deputy Chair of Committees Aheer, Leela Sharon, Chestermere-Rocky View (W) Malkinson, Brian, Calgary-Currie (ND) Anderson, Shaye, Leduc-Beaumont (ND) Mason, Hon. Brian, Edmonton-Highlands-Norwood (ND), Anderson, Wayne, Highwood (W) Government House Leader Babcock, Erin D., Stony Plain (ND) McCuaig-Boyd, Hon. Margaret, Barnes, Drew, Cypress-Medicine Hat (W) Dunvegan-Central Peace-Notley (ND) Bhullar, Manmeet Singh, Calgary-Greenway (PC) McIver, Ric, Calgary-Hays (PC), Bilous, Hon. Deron, Edmonton-Beverly-Clareview (ND), Leader of the Progressive Conservative Opposition Deputy Government House Leader McKitrick, Annie, Sherwood Park (ND) Carlier, Hon. Oneil, Whitecourt-Ste. Anne (ND) McLean, Stephanie V., Calgary-Varsity (ND), Carson, Jonathon, Edmonton-Meadowlark (ND) Deputy Government Whip Ceci, Hon. Joe, Calgary-Fort (ND) McPherson, Karen M., Calgary-Mackay-Nose Hill (ND) Clark, Greg, Calgary-Elbow (AP) Miller, Barb, Red Deer-South (ND) Connolly, Michael R.D., Calgary-Hawkwood (ND) Miranda, Ricardo, Calgary-Cross (ND) Coolahan, Craig, Calgary-Klein (ND) Nielsen, Christian E., Edmonton-Decore (ND) Cooper, Nathan, Olds-Didsbury-Three Hills (W), Nixon, Jason, Rimbey-Rocky Mountain House-Sundre (W), Official Opposition House Leader Official Opposition Whip Cortes-Vargas, Estefania, Strathcona-Sherwood Park (ND) Notley, Hon. Rachel, Edmonton-Strathcona (ND), Cyr, Scott J., Bonnyville-Cold Lake (W), Premier Official Opposition Deputy Whip Orr, Ronald, Lacombe-Ponoka (W) Dach, Lorne, Edmonton-McClung (ND) Payne, Brandy, Calgary-Acadia (ND) Dang, Thomas, Edmonton-South West (ND) Phillips, Hon.