COVER SHEET for SEC FORM 17-A SEC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Memorandum of Agreement

LIST OF POWER MAC CENTER PARTICIPATING REDEMPTION OUTLETS BRANCH (METRO MANILA) ADDRESS 1 Ayala Malls Cloverleaf 2/L Ayala Malls Cloverleaf, A. Bonifacio Ave., Brgy. Balingasa, Quezon City 2 Circuit Lane G/L Ayala Malls Circuit Lane, Hippodromo, Makati City 3 Festival Supermall UGF Expansion Area, Festival Supermall, Filinvest City, Alabang, Muntinlupa City 4 Glorietta 5 3/L Glorietta 5, Ayala Center, Makati City 5 Greenbelt 3 2/L Greenbelt 3, Ayala Center, Makati City 6 Power Plant Mall 2/L Power Plant Mall, Rockwell Center, Poblacion, Makati City 7 SM Aura Premier 3/L SM Aura Premier, 26th St. Corner McKinley Parkway, Bonifacio Global City, Taguig City 8 SM City Bacoor 4/L Cyberzone, SM City Bacoor Gen. Aguinaldo Cor. Tirona Bacoor, Cavite 9 SM City BF Parañaque 3/L Cyberzone, SM City BF Paranaque, Dr. A. SantoS Ave., Brgy. BF HomeS, Paranaque City 10 SM City Dasmariñas 2/L Cyberzone, SM City DaSmarinaS Brgy. Sampaloc 1, DaSmarinaS City, Cavite 11 SM City Fairview 3/L Cyberzone, SM Fairview, Brgy. Greater Lagro, Quezon City 12 SM City Marikina G/L SM City Marikina, Marcos Highway, Marikina City 13 SM Mall of Asia 2/L SM Mall of Asia, Central Business Park Bay Blvd., Pasay City 14 SM Megamall 4/L Cyberzone, SM Megamall Bldg. B, EDSA, Mandaluyong City 15 SM South Mall 3/L Cyberzone, SM Southmall, Alabang Zapote Road, LaS PinaS City 16 The Annex at SM City North EDSA 4/L Cyberzone, Annex Bldg at SM City North EDSA, Quezon City 17 The Podium 3/L The Podium, 18 ADB Avenue, Ortigas Center, Mandaluyong City 18 TriNoma 3/L Mindanao Wing, TriNoma, Quezon City BRANCH (PROVINCIAL) ADDRESS 1 Abreeza Mall 2/L Abreeza Ayala Mall, J.P. -

Investor Kit 2019

Malls INVESTOR KIT 2019 This presentation is available online through www.smprime.com Disclaimer This presentation does not constitute a prospectus or other offering memorandum in whole or in part. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of the Company. There shall be no sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to any qualification under the securities laws of such state or jurisdiction. This presentation has not been and will not be reviewed or approved by any statutory or regulatory authority or any stock exchange in the Philippines or elsewhere. Prospective investors should undertake their own assessment with regard to their investment and they should obtain independent advice on any such investment’s suitability, inherent risks and merits and any tax, legal and accounting implications which it may have for them. This presentation contains statements about future events and expectations that constitute “forward-looking statements.” These forward-looking statements include words or phrases such as the Company or its management “believes”, “expects”, “anticipates”, “intends”, “may”, “plans”, “foresees”, “targets”, “aims” “would”, “could” or other words or phrases of similar import. Similarly, statements that describe the Company's objectives, plans or goals are also forward-looking statements. All such forward-looking statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those contemplated by the relevant forward-looking statement. Such forward-looking statements are made based on management’s current expectations or beliefs as well as assumptions made by, and information currently available to, management. -

2015 SMPHI Annual Report

SUSTAINING GROWTH, DELIVERING VALUE 10th Floor, OneE-com Center Harbor Drive, Mall of Asia Complex Pasay City 1300, Philippines Email: [email protected] www.sminvestments.com 2 IFC Our Business Philosophy 2 Business Highlights & Impact 6 Financial Highlights 7 Shareholder Value SM INVESTMENTS CORPORATION SM INVESTMENTS OUR BUSINESS PHILOSOPHY 8 Ten-Year Performance Overview 10 Our Business Footprint 12 Message to Shareholders SM Investments Corporation is the Philippines’ largest 14 President’s Report publicly-listed holding company that holds a group of sustainable businesses in retail, property and financial services. The Group thrives on leadership, innovation 18 RETAIL OPERATIONS and highly synergistic operations. • THE SM STORE Our Vision is to build world-class businesses that are • SM Markets catalysts for development in the communities we serve. Our long history of sustained growth is an indication of our ability to deliver value for all our stakeholders through sound financial management, leadership, innovation, long-term sustainability efforts and a comprehensive development program for all our host communities. Through our interests and activities, Our Mission is to strive to be a good corporate citizen by partnering with our host communities in providing consistently high standards of service to our customers, look after the welfare of our employees, and deliver sustainable returns to our shareholders at all times, upholding the highest standards of corporate governance in all our businesses. 28 PROPERTY Over the years, we have been committed to sustaining • Malls our growth, in creating value and delivering quality • Residences products and services that our millions of customers aspire for. We are here to serve. -

HSBC's Red Mastercard Rewards Catalogue

Irresistable rewards. HSBC’s Red Mastercard Rewards Catalogue REAL REWARDS ARE WORTH THE WAIT. TREAT YOURSELF TO A MYRIAD OF REWARDS TAILORED ESPECIALLY FOR YOU. HSBC’s Credit Card Rewards Catalogue features over 65 rewards items ranging from everyday basics, dining delights, shopping perks and much much more. HOW TO REDEEM YOUR REWARDS ONLINE REDEMPTION Step 1: Log on to www.hsbc.com.ph Step 2: Click and view the Rewards e-catalogue specific to your HSBC Credit Card. Step 3: Pick the items you wish to redeem and take note of the following details; a. Item name b. Item/Product code Should you wish to redeem using Pure Points, use the item code for Pure Points indicated in the catalogue. Should you wish to redeem under the Fast Track* option, use the Fast Track code indicated inside the gray boxes in the catalogue. c. Bonus Points Should you wish to redeem using Pure Points, use the Bonus Points indicated in the catalogue. Should you wish to redeem under the Fast Track* option, use the Bonus Points required inside the gray boxes in the catalogue. d. Redemption Center Code** of items which are for pick-up. The list of Redemption Center Codes can be found at the back of the catalogue. e. Cash Amount Should you wish to redeem via the Fast Track option, indicate the amount of cash out required inside the gray boxes. Step 4: Redeem your Rewards items Via SMS • Claim code shall be sent to your mobile number in HSBC records • Once received, proceed to the redemption center and present the following: – SMS indicating the claim code – HSBC Credit Card used for redemption – Valid government-issued ID * Under the Fast Track redemption, Cardholders will be eligible to claim the Rewards at lower Bonus Points and charge the cash portion to his/her HSBC Credit Card through straight payment. -

MEMO EXPRESS.Pdf

MERCHANT BRANCHES MEMO EXPRESS SM SOUTHMALL ALABANG ZAPOTE RD ALMANZA UNO LAS PINAS CITY 1740 MEMO EXPRESS CYBERZONE SM CITY FAIRVIEW REGALADO AVE. GREATER LAGRO QUEZON CITY 1100 MEMO EXPRESS UNIT CZ24 SM CITY BF D.A.S.A COR PRES AVE BRGY BF HOMES PARANAQUE CITY 1700 MEMO EXPRESS 345 ALABANG ZAPOTE RD ROBINSON PLACE LAS PINAS BRGY TALON LAS PINAS CITY 1740 MEMO EXPRESS UNIT 303 2F ARCADIA BLDG SANTA ROSA TAGAYTAY ROAD DON JOSE STA. ROSA CITY LAGUNA 4026 MEMO EXPRESS CZ234 SM CITY BACOLOD RECLAMATION ARE BACOLOD CITY 6100 MEMO EXPRESS SM CENTER ANGONO MANILA EAST ROAD SAN ISIDRO ANGONO RIZAL 1930 MEMO EXPRESS SM MEGA CENTER MELENCIO SAN ROQUE CABANATUAN CITY NUEVA ECIJA 3100 MEMO EXPRESS CY 20 SM CITY GENSAN CORNER SANTIAGO BLVD SAN MIGUEL ST. LAGAO GEN SANTOS CITY 9500 MEMO EXPRESS SPACE 3-052 3F NEW GLORIETTA 2 AYALA CENTER SAN LORENZO MAKATI CITY 1224 MEMO EXPRESS L3-341 ROBINSONS NORTH ABUCAY BRGY 91 TACLOBAN CITY 6500 MEMO EXPRESS L2 2019 ROBINSON PLACE ORMOC CHRYSANTHEMUM SUBD. COGON ORMOC CITY 6541 MEMO EXPRESS CZ 3008 17 SM CITY LEGAZPI TAHAO ROAD LEGAZPI CITY ALBAY 4500 MEMO EXPRESS RM 814 PACIFIC LAND CTR BLDG QUITIN PAREDES ST. BRGY 289 ZONE 027 DIST 111 BINONDO MANILA 1006 MEMO EXPRESS SPACE 3111 ABREEZA MALL JP LAUREL AVE DAVAO CITY 8000 MEMO EXPRESS THE DISTRICT MALL AGUINALDO HIWAY COR. DAANG HARI ROAD ANABU II D CITY OF IMUS CAVITE 4103 MEMO EXPRESS L3 ROBINSON PLACE SANTIAGO MABINI SANTIAGO CITY 3311 MEMO EXPRESS 239 SM CITY CAUAYAN MAHARLIKA HIGHWAY DISTRICT 2 CAUAYAN CITY ISABELA 3305 MEMO EXPRESS CENTRIO MALL CM RECTO AVENUE BRGY 24 CAGAYAN DE ORO CITY 9000 MEMO EXPRESS L3-338 ROBINSON PLACE MALOLOS SUMAPANG MATANDA CITY MALOLOS BULACAN 3300 MEMO EXPRESS 3RD LEVEL SPACE 3029A FAIRVIEW TERRACES QUIRINO HIGHWAY PASONG PUTIK QUEZON CITY 1012 MEMO EXPRESS SPACE 2 02448 ROBINSON PLACE PUEBLO DE PANAY LAWAAN ROXAS CITY 5800 MEMO EXPRESS CZ 015 25 SM CITY SAN JOSE DEL MONTE BRGY TUNGKONG MANGGA CITY OF SAN JOSE DEL MONTE BULACAN 3023 MEMO EXPRESS UNIT 326 3RD FLR AYALA MALLS LEGAZPI RIZAL ST. -

Securities and Exchange Commission

COVER SHEET SEC Registration Number 1 6 3 4 2 Company Name S M I N V E S T M E N T S C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) 1 0 t h F l o o r , O n e E - C o m C e n t e r , H a r b o r D r i v e , M a l l o f A s i a C o m p l e x , C B P - 1 A , P a s a y C i t y 1 3 0 0 Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A COMPANY INFORMATION Company’s Email Address Company’s Telephone Number/s Mobile Number – 8857-0100 – Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 1,260 (as of March 31, 2021) 04/28 12/31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Mr. Frederic C. DyBuncio – 8857-0100 – Contact Person’s Address th 10 Floor, One E-Com Center, Harbor Drive, Mall of Asia Complex, CBP-1A, Pasay City 1300 Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

Diversification Strategies of Large Business Groups in the Philippines

Philippine Management Review 2013, Vol. 20, 65‐82. Diversification Strategies of Large Business Groups in the Philippines Ben Paul B. Gutierrez and Rafael A. Rodriguez* University of the Philippines, College of Business Administration, Diliman, Quezon City 1101, Philippines This paper describes the diversification strategies of 11 major Philippine business groups. First, it reviews the benefits and drawbacks of related and unrelated diversification from the literature. Then, it describes the forms of diversification being pursued by some of the large Philippine business groups. The paper ends with possible explanations for the patterns of diversification observed in these Philippine business groups and identifies directions for future research. Keywords: related diversification, unrelated diversification, Philippine business groups 1 Introduction This paper will describe the recent diversification strategies of 11 business groups in the Philippines. There are various definitions of business groups but in this paper, these are clusters of legally distinct firms with a managerial relationship, usually by virtue of common ownership. The focus on business groups rather than on individual firms has to do with the way that business firms in the Philippines are organized and managed. Businesses that are controlled and managed by essentially the same set of principal owners are often organized as separate corporations, not as separate divisions within the same firm, as is often the case in American corporations like General Electric, Procter and Gamble, or General Motors (Echanis, 2009). Moreover, studies on emerging markets have pointed out that business groups often occupy dominant positions in the business landscape in markets like India, Korea, Indonesia, Thailand, and the Philippines (Khanna & Palepu, 1997; Khanna & Yafeh, 2007). -

Banking-Sched-Dec-30-2019.Pdf

BANKING SCHEDULES FOR THE HOLIDAY SEASON Banking Schedule of Selected Branches December 30,2019 Selected Regular Branches A. Regular Opening Hours Up to 3:00 PM LUZON Abra - Bangued Albay - Daraga Albay - Tabaco Angeles - Balibago Angeles - Miranda Antipolo - Circumferential Rd. Aurora Blvd. - Broadway Centrum Baguio - Bokawkan Road Baguio - Harrison Road Baguio - Kennon Road Baguio - Legarda Baguio - Leonard Wood Road Baguio - Luneta Baguio - Marcos Highway Balsigan Baguio - Marcos Highway Centerpoint Baguio - Session Road Balanga - Capitol Drive Baliwag - JP Rizal Balubaran - MacArthur Highway Batangas - Balayan Batangas - Bauan Batangas - Diego Silang Batangas - Gulod Batangas - Nasugbu Batangas City - Rizal Avenue Benguet - La Trinidad Bocaue - MacArthur Highway Bulacan - Bocaue Bulacan - Hagonoy Bulacan - Obando Bulacan - Primark Plaridel Bulacan - San Jose Del Monte Bulacan - San Miguel Bulacan - San Rafael Bulacan - Sapang Palay Bulacan Sta. Maria - Bagbaguin Bulacan Sta. Maria - M.G. de Leon Cagayan - Aparri Caloocan - Primark Deparo Carmen Planas Cavite - Congressional Road Cavite - Dasmariñas Salawag Cavite - Gen Trias San Francisco Cavite - Imus Aguinaldo Highway Cavite - Naic Cavite - P. Burgos Cavite - Silang Aguinaldo Highway Cavite - Trece Martires Cavite Imus - The District Clark - Philexcel Business Park Dagupan - Tapuac Eastwood City - IBM Plaza Echague EDSA - East Caloocan Ilocos Norte - Batac Ilocos Sur - Cabugao Ilocos Sur - Candon Ilocos Sur - Narvacan Iriga City Isabela - Ilagan Isabela - Primark Cordon Isabela - -

Cebu-Ebook.Pdf

About Cebu .........................................................................................................................................2 Sinulog festival....................................................................................................................................3 Cebu Facts and Figures .....................................................................................................................4 Cebu Province Towns & Municipalities...........................................................................................5 Sites About Cebu and Cebu City ......................................................................................................6 Cebu Island, Malapascus, Moalboal Dive Sites...............................................................................8 Cebu City Hotels...............................................................................................................................10 Lapu Lapu Hotels.............................................................................................................................13 Mactan Island Hotels and Resorts..................................................................................................14 Safety Travel Tips ............................................................................................................................16 Cebu City ( Digital pdf Map ) .........................................................................................................17 Mactan Island ( Digital -

Download Rate 82 Sessions Conducted 526 Childcare Leaves Credited 81% Access Rate 42% Activated Accounts Vs

Integrated Report 2020 1 Our Story Inspiring Resilience Integrated Report 2020 2 Integrated Report 2020 Our Story About this Report (102-46, 102-47, 102-49, 102-50, 102-51, 102-54) SM Prime Holdings, Inc. presents the first annual Integrated Report and the ninth edition following the Global Reporting Initiative (GRI) Framework. This Integrated Report features the International Integrated Reporting Council (IIRC) framework that uses the economic, environment, social and governance pillars of sustainability in combination with the six capitals: Financial, Manufactured, Intellectual, Environment, Human and Social and Relationship. The financial and non-financial information contained herein covers reporting from January to December 2020 and discusses SM Prime’s assets where the business has an organizational boundary. The report shares the performance and consolidated data of its malls, residences, leisure resorts, offices, hotels and convention centers. This report has been prepared in accordance with the GRI Standards: Core Option and the Task Force on Climate-related Financial Disclosures alongside multiple internationally recognized frameworks such as the UN Sustainable Development Goals, UN Global Compact and the Sendai Framework for Disaster Risk Reduction (2015-2030). This report is entitled Inspiring Resilience to describe the year in terms of the Company’s strength, dedication and response to Cover Photo: any challenge. SM Mall of Asia’s iconic globe reflects a public health and safety message in line with #SafeMallingatSM. The online version of the 2020 SM Prime Integrated Report is Next Page: available at the SM Prime website (www.smprime.com). Part of the Bike-Friendly SM program, commuters ply the new bike lane at the Feedback on the report may be sent to [email protected]. -

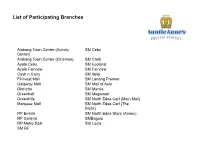

List of Participating Branches

List of Participating Branches Alabang Town Center (Activity SM Cebu Center) Alabang Town Center (Cinemas) SM Clark Ayala Cebu SM Ecoland Ayala Fairview SM Fairview Cash n Carry SM Iloilo Filinvest Mall SM Lanang Premier Gateway Mall SM Mall of Asia Glorietta SM Manila Greenbelt SM Megamall Greenhills SM North Edsa Cart (Main Mall) Marquee Mall SM North Edsa Cart (The Block) RP Ermita SM North Edsa Store (Annex) RP Galleria SMBaguio RP Metro East Sta Lucia SM BF List of Participating Branches Bonifacio High St BGC Visayas Jcentre Mall Bakilid Robinson's Bacolod Glorie;a 5 Cebu Mactan Domes@c Airport SM City Bacolod Jupiter St., Maka Asiatown I.T. Park Mactan Internaonal Airport Island City Mall Tagbilaran Bohol Kapunan Loyola Heights Ayala Center, Ac@ve Zone Parkmall Cebu Port Center Rizal Plaza Tagbilaran Bohol Molito Mun@nlupa Ayala Center, Kiosk Pueblo Verde Brgy Basak Umbria cor Rosales Calbayog NAIA1 Ayala Center, Fully Booked Raintree Mall Robinson's Dumaguete NAIA3 Ayala Center, Terraces Robinsons Cybergate Sol Y Mar Bldg. Dumaguete City Robinsons Galleria Banilad Town Centre Robinsons Place SM City Manduriao- iloilo SM Mall of Asia Capitol Site, Osmena Blvd Shopwise Basak SM Megamall Cebu Doctors Hospital SM City, Cinema Mindanao Solenad 2 Laguna C.P Bldg, Maribago SM City Consolacion Samping Bldg Butuan Star Cruises Bldg., Newport City Gaisano Tabunok SM City, Fiesta Strip Centrio Mall CDO Virra Mall Greenhills Insular JP Rizal St., Tabok SM City, Kiosk Alnor Complex Cotabato Synergis I.T. Center Abreeza Mall Davao SM City The Annex Davao Metro Lifestyle Complex Davao SM City Davao SM City Gensan List of Participating Branches Festival Supermall SM City Marilao Glorietta SM City North Edsa Harrison Plaza SM City Novaliches Lucky Chinatown Mall SM City Olongapo Robinsons Galleria SM City Pampanga Robinsons Place SM City Sta. -

Paylink Merchants 2005

LIST OF AFFILIATED MERCHANTS Count Merchant No. Legal Name DBA Name Address1 Address 2 City Area Code / Desc 1 181933 ABENSON, INC. ABENSON - PAYLINK (ALABANG) TIERRA NUEVA SUBD. ALABANG MUNTINLUPA 33 - MUNTINLUPA 2 1117761 ABENSON, INC. ABENSON - PAYLINK (BULACAN) IS PAVILIONS MEYCAUAYAN 58 - BULACAN 3 181834 ABENSON, INC. ABENSON - PAYLINK (CALOOCAN) RIZAL AVE. EXT. CALOOCAN CALOOCAN CITY 28 - CALOOCAN 4 1117167 WALTER MART STA ROSA, INC. ABENSON - PAYLINK (DASMARINAS) WALTERMART, KM 30 BO BUROL AGUINALDO DASMARINAS 59 - CAVITE 5 290288 ABENSON, INC. ABENSON - PAYLINK (ERMITA) 3/F ROBINSONS PLACE ERMITA MANILA 20 - MANILA 6 231852 ABENSON, INC. ABENSON - PAYLINK (EVER ORTIGA G/F EVER GOTESCO ORTIGAS AVE., STA. LUCIA, PASIG CITY PASIG CITY 25 - PASIG 7 231878 ABENSON, INC. ABENSON - PAYLINK (FARMER'S) FARMER'S PLAZA CUBAO QUEZON CITY 21 - QUEZON CITY 8 182485 ABENSON, INC. ABENSON - PAYLINK (GALLERIA) ORTIGAS AVE., QUEZON CITY QUEZON CITY 21 - QUEZON CITY 9 182469 ABENSON, INC. ABENSON - PAYLINK (GREENHILLS) UNIMART SUPERMART GREENHILLS SAN JUAN, METRO MANILA SAN JUAN 23 - SAN JUAN 10 181917 ABENSON, INC. ABENSON - PAYLINK (HARRISON) 1ST FLR. HARRISON PLAZA COMML. VITO CRUZ, MALATE MANILA 20 - MANILA 11 182501 ABENSON, INC. ABENSON - PAYLINK (LAS PINAS) 269 ALABANG ZAPOTE ROAD PAMPLONA LAS PINAS 32 - LAS PINAS 12 289397 ABENSON, INC. ABENSON - PAYLINK (METROPOLIS) G/F MANUELA METROPOLIS ALABANG MUNTINLUPA 33 - MUNTINLUPA 13 181875 ABENSON INCORPORATED ABENSON - PAYLINK (QUAD) QUAD I, MCC . MAKATI CITY 22 - MAKATI 14 181768 ABENSON, INC. ABENSON - PAYLINK (SHERIDAN) 11 SHERIDAN ST., MANDALUYONG MANDALUYONG 24 - MANDALUYONG 15 181859 ABENSON, INC. ABENSON - PAYLINK (SM CITY) SM CITY NORTH EDSA QUEZON CITY QUEZON CITY 21 - QUEZON CITY 16 181784 ABENSON, INC.