Fund Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MFS® Emerging Markets Equity Fund (Class R6 Shares) Second Quarter 2021 Investment Report

MFS® Emerging Markets Equity Fund (Class R6 Shares) Second quarter 2021 investment report Current portfolio manager Robert Lau will relinquish his portfolio management responsibilities on the portfolio, effective August 1, 2021. NOT FDIC INSURED MAY LOSE VALUE NOT A DEPOSIT Before investing, consider the fund's investment objectives, risks, charges, and expenses. For a prospectus, or summary prospectus, containing this and other information, contact MFS or view online at mfs.com. Please read it carefully. ©2021 MFS Fund Distributors, Inc., 111 Huntington Avenue, Boston, MA 02199. FOR DEALER AND INSTITUTIONAL USE ONLY. Not to be shown, quoted, or distributed to the public. PRPEQ-FEM-30-Jun-21 34135 Table of Contents Contents Page Fund Risks 1 Disciplined Investment Approach 2 Market Overview 3 Executive Summary 4 Performance 5 Attribution 6 Significant Transactions 10 Portfolio Positioning 11 Characteristics 14 Portfolio Outlook 15 Portfolio Holdings 18 Additional Disclosures 20 Country and region information contained in this report is based upon MFS classification methodology which may differ from the methodology used by individual benchmark providers. Performance and attribution results are for the fund or share class depicted and do not reflect the impact of your contributions and withdrawals. Your personal performance results may differ. Portfolio characteristics are based on equivalent exposure, which measures how a portfolio's value would change due to price changes in an asset held either directly or, in the case of a derivative contract, indirectly. The market value of the holding may differ. 0 FOR DEALER AND INSTITUTIONAL USE ONLY. - MFS Emerging Markets Equity Fund PRPEQ-FEM-30-Jun-21 Fund Risks The fund may not achieve its objective and/or you could lose money on your investment in the fund. -

The Stock Exchange of Hong Kong Limited

NEWS RELEASE 19 November 2014 Market Highlights of Shanghai-Hong Kong Stock Connect Hong Kong Exchanges and Clearing Limited today (Wednesday) issued the following market statistics in response to media enquiries: Northbound Trading Southbound Trading Daily quota balance RMB 10,388 mil (20.1% used) RMB 10,247 mil (2.4% used) Turnover RMB 2,842 mil* HKD 496 mil** No. of orders 92,471 8,936 No. of trades 90,790 12,822 * 6.1 per cent of Northbound turnover was from Sell Trades. ** 23.2 per cent of Southbound turnover was from Sell Trades. Northbound Trading (Top 10 most actively traded stocks) Rank Stock Stock Name Buy Trade Sell Trade Turnover (RMB) Code Value (RMB) Value (RMB) (Buy trade + Sell trade) 1 601006 DAQIN RAILWAY 309,588,606 21,584,482 331,173,087 2 601318 PING AN INSURANCE 249,481,290 29,915 249,511,205 3 600104 SAIC MOTOR 211,237,657 13,070,264 224,307,921 4 601601 CHINA PACIFIC 219,301,725 22,121 219,323,846 INSURANCE 5 601398 INDUSTRIAL AND 154,570,452 11,252,004 165,822,456 COMMERCIAL BANK OF CHINA 6 600435 NORTH NAVIGATION 121,818,828 - 121,818,828 CONTROL TECHNOLOGY 7 600009 SHANGHAI 85,187,201 - 85,187,201 INTERNATIONAL AIRPORT 8 601939 CHINA 74,571,541 4,619 74,576,160 CONSTRUCTION BANK 9 600036 CHINA MERCHANTS 74,047,266 212,300 74,259,566 BANK 10 600519 KWEICHOW MOUTAI 68,888,157 5,043,004 73,931,161 …/2 香港中環港景街一號國際金融中心一期 12 樓 12/F, One International Finance Centre, 1 Harbour View Street, Central, Hong Kong 電話 Tel: + 852 2522 1122 傳真 Fax: +852 2295 3106 網址 Website: www.hkex.com.hk 電郵 E-mail: [email protected] - 2 - Southbound Trading (Top 10 most actively traded stocks via Special Participant) Rank Stock Stock Name Buy Trade Sell Trade Turnover (HKD) Code Value (HKD) Value (HKD) (Buy trade + Sell trade) 1 3998 BOSIDENG 8,017,260 12,925,420 20,942,680 INTERNATIONAL HOLDINGS LTD. -

Chinese Liquor Making a Name on World Stage

12 | Tuesday, July 7, 2020 CHINA DAILY From left: A worker inspects Moutai liquor labels. Rows of Moutai liquor are sealed on the production line. Staff members package Moutai bottles. PHOTOS PROVIDED TO CHINA DAILY Chinese liquor making a name on world stage Brand index reports “Moutai believes that only if it stratospheric rise of produces the best liquor in the world can it lay the firmest founda Moutai as company’s tion for its brand value growth.” commitment to high The enormous Chinese market provides the strongest support for quality strengthened Moutai’s growth, he stressed. “Chi na’s reform and openingup and eco By YUAN SHENGGAO nomic rise over the past four decades have nurtured a large mar hinese distiller Moutai is ket with more than 1.3 billion peo the world’s fastest growing ple, where if your product is popular brand, according to the top and well recognized, you will cer 100 global brands list. It tainly gain huge space for growth. Crose 17 places from 2019 to become “In this regard, Moutai is fortu the 18th most valuable brand in the nate to have grown in one of the world. most dynamic markets and an open The rankings of the 2020 BrandZ and inclusive economic environ Top 100 Most Valuable Global ment. The former gives us the Brands were released by communi strength to grow, while the latter cation services group WPP and con provides us with the opportunity to sulting company Kantar at the end learn from outstanding peers such of June. as CocaCola and Diageo.” Seventeen Chinese brands made Li said: “Cultural consensus and the 2020 BrandZ top 100. -

Kweichow Moutai Growth Declines on Slow Deliveries

CHINA DAILY Tuesday, October 30, 2018 BUSINESS 17 Kweichow Moutai growth Execs optimistic on import expo By WANG YING in Shanghai products, their know-how, “Shanghai has become a [email protected] and how interesting they are vital center for advanced as a company,” said Brian technology leadership — for Top multinational corpora- Duperreault, president, CEO ABB and the world ... We will tions’ executives have and director of finance cor- make full use of the city’s declines on slow deliveries expressed their enthusiasm poration American Interna- existing advantages and for the first China Internation- tional Group Inc. make clear the main challen- al Import Expo set to launch According to Severin ges facing Shanghai, focus Share price of on Nov 5, as part of the nation’s Schwan, CEO of Roche Group, support policies on measures efforts to expand opening-up. the pharmaceuticals giant that can address the challen- liquor maker slips While attending the 30th will showcase its cutting-edge ges, and develop specific but consumption International Business Lead- technology at the import plans and solutions,” Spies- ers’ Advisory Council, held expo, covering early research shofer said, explaining the upgrades to buoy annually in Shanghai, busi- and development, integrated company’s rationale. ness leaders said they are diagnosis and treatment solu- “We are not only seeing future prospects optimistic about China’s tions, and personalised progress in Shanghai’s reform opening-up policy and new healthcare offerings. and opening-up, but we at By ZHU WENQIAN in Beijing opportunities. Roche are taking an active role and YANG JUN in Guiyang “The import expo is in the development of China’s unprecedented in China for biomedical industry. -

Premium China Funds Management

Premium China Fund Top 10 Portfolio Holdings as at 31 January 2021 Tencent (Media & Entertainment) Market Cap: USD 843.3 Billion • Tencent, a world leader in the internet-related services space, provides services across instant messaging, social media, email, web-portals, e-commerce, advertising, online payment as well as multiplayer games. • With offerings including QQ Instant Messenger and WeChat, Tencent is providing similar services to the likes of Facebook, Twitter and WhatsApp. By the end of Q2 2018, QQ had 803 million monthly active user accounts, whilst WeChat, since its launch in 2011, accommodates for over 1 Billion monthly active users. • In November 2017, Tencent's market value reached US$528 billion, surpassing Facebook’s market value at the time, which resulted in it being recognised as one of the world's top 5 most valuable public companies. Meituan Dianping (Retailing) Market Cap: USD 270.1 Billion • Meituan Dianping is China’s leading e-commerce platform service, operating well-known apps such as Meituan, Dianping, Meituan Waimai and Mobike. • With services across 200 categories, Meituan’s businesses encompass catering, on-demand delivery, car hailing, bike sharing, hotel and travel bookings, movie ticketing and others enter- tainment services. • The company’s services spread across 2,800 cities and counties, reaching total revenue streams of RMB 515.6 billion in 2018. Pinduoduo (Retailing) Market Cap: USD 203.9 Billion • Pinduoduo was founded in September 2015 as a “new e-commerce” platform dedicated to providing value-for-money products and interesting interactive shopping experiences for its users. • After three years of establishment, the platform has gathered 41.85 billion annual active buyers and more than 360 million active merchants. -

2019Semi-Annual Report

CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds SEMI-ANNUAL 2019 REPORT For the six months ended 30 June 2019 Value Partners Limited 43rd Floor, The Center 99 Queen’s Road Central, Hong Kong Tel: (852) 2880 9263 Fax: (852) 2565 7975 Email: [email protected] Website: www.valuepartner-group.com In the event of inconsistency, the English text of this Semi-Annual Report shall prevail over the Chinese text. This report shall not constitute an offer to sell or a solicitation of an offer to buy shares in any of the funds. Subscriptions are to be made only on the basis of the information contained in the explanatory memorandum, as supplemented by the latest semi-annual and annual reports. CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) CONTENTS Pages General information 2-3 Manager’s report 4-8 Statement of fnancial position (unaudited) 9 Investment portfolio (unaudited) 10-13 Statement of movements in portfolio holdings (unaudited) 14-15 SEMI-ANNUAL REPORT 2019 For the six months ended 30 June 2019 1 CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) GENERAL INFORMATION Manager Legal Advisors Value Partners Limited With respect to Cayman Islands law: 43rd Floor, The Center Maples and Calder 99 Queen’s Road Central P.O. Box 309, Ugland House Hong Kong Grand Cayman, KY1-1104 Cayman Islands Directors of the Manager Dato’ Seri Cheah Cheng Hye With respect to Hong Kong law: Mr. So Chun Ki Louis Deacons Mr. -

Research and Analysis Report of Kweichow Moutai Company

Academic Journal of Business & Management ISSN 2616-5902 Vol. 3, Issue 7: 1-5, DOI: 10.25236/AJBM.2021.030701 Research and Analysis Report of Kweichow Moutai Company Yinglin Qian School of Economics, Northwest University for Nationalities, Qujing, Yunnan 655000, China Abstract: Fiedler mentioned "does not exist a kind of is suitable for various situation of universal principles and methods of management, management can only act according to the circumstances of the specific", moutai company is the most influential brand in China and to achieve a monopoly in the competition and development, based on the fundamental analysis and technical analysis, maotai company for the industry analysis, company analysis and technical analysis, This paper probes into the development prospect of Maotai Company, obtains some problems existing in the development and puts forward corresponding investment suggestions for investors. Keywords: industry analysis, technical analysis, investment advice 1. Overview of Kweichow Moutai Company 1)Company business summary and analysis of capital ownership structure Since its establishment, the company has been engaged in a variety of businesses, including the production, sales and service of Maotai liquor, the production and sales of beverage, food and packaging materials, the development of anti-counterfeiting technology and the research and development of related products of the information industry. It belongs to the beverage manufacturing industry in the food and beverage industry, and is the typical representative of maotai-flavor liquor in China. It wants to have a famous reputation both at home and abroad, and it is the only liquor industry in China that has won the title of "green food" and "organic food". -

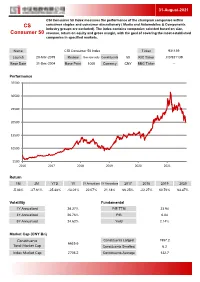

CS Consumer 50

31-August-2021 CSI Consumer 50 Index measures the performance of the champion companies within CS consumer staples and consumer discretionary ( Media and Automobiles & Components industry groups are excluded). The index contains companies selected based on size, Consumer 50 revenue, return on equity and gross margin, with the goal of covering the most established companies in specified markets. Name CSI Consumer 50 Index Ticker 931139 Launch 20-Mar-2019 Review Semiannually Constituents 50 RIC Ticker .CSI931139 Base Date 31-Dec-2004 Base Point 1000 Currency CNY BBG Ticker -- Performance 35500 30500 25500 20500 15500 10500 5500 2016 2017 2018 2019 2020 2021 Return 1M 3M YTD 1Y 3Y Annualized 5Y Annualized 2017 2018 2019 2020 -5.03% -27.61% -25.48% -13.01% 22.07% 21.18% 66.25% -22.27% 60.76% 63.47% Volatility Fundamental 1Y Annualized 28.27% P/E TTM 23.94 3Y Annualized 26.76% P/B 6.04 5Y Annualized 24.62% Yield 2.14% Market Cap (CNY Bn) Constituents Constituents Largest 1957.2 6635.6 Total Market Cap Constituents Smallest 6.2 Index Market Cap 2705.2 Constituents Average 132.7 31-August-2021 Exchange Breakdown Sector Breakdown 40.9% 48.4% Shanghai Consumer Disc. 51.6% Shenzhen Consumer Staples 59.1% Top 10 Constituents Ticker Name Sector Exchange Weight 600519 Kweichow Moutai Co Ltd Consumer Staples Shanghai 14.03% 000858 Wuliangye Yibin Co Ltd Consumer Staples Shenzhen 13.19% 000333 Midea Group CO., LTD Consumer Disc. Shenzhen 12.03% 601888 China Tourism Group Duty Free Corporation Limited Consumer Disc. Shanghai 8.24% 600887 Inner Mongolia Yili Industrial Group Co Ltd Consumer Staples Shanghai 7.65% 000651 Gree Electric Appliances,Inc. -

Foreign Bonds

Quarterly Portfolio Disclosure |March 31, 2020 CI ICBCCS S&P China 500 Index ETF (CHNA.B) Summary of Investment Portfolio Sector Breakdown† as at 3/31/20 Top 25 Holdings* as at 3/31/20 Sector________________________________ ___________________________% of Net Asset Value Description________________________________ ___________________________% of Net Asset Value Financials 21.4 % Alibaba Group Holding Ltd. 9.7 % Consumer Discretionary 19.3 % Tencent Holdings Ltd. 9.1 % Communication Services 12.3 % Ping An Insurance Group Co. of China Ltd. 4.6 % Industrials 9.0 % China Construction Bank Corp. 2.8 % Information Technology 8.2 % China Merchants Bank Co., Ltd. 2.6 % Consumer Staples 7.7 % Kweichow Moutai Co., Ltd. 2.6 % Materials 5.8 % Industrial & Commercial Bank of China Ltd. 2.3 % Health Care 5.8 % China Mobile Ltd. 1.4 % Real Estate 5.1 % Meituan Dianping 1.4 % Utilities 2.5 % Bank of China Ltd. 1.3 % Energy 2.4 % JD.com, Inc. 1.2 % Other Assets less Liabilities‡ 0.5 % Jiangsu Hengrui Medicine Co., Ltd. 1.1 % Total 100.0 % Industrial Bank Co., Ltd. 1.1 % † The ETF’s sector breakdown is expressed as a percentage of net Midea Group Co., Ltd. 1.0 % asset value and may change over time. In addition, a sector may be Gree Electric Appliances, Inc. of Zhuhai 1.0 % comprised of several industries. It does not include derivatives (if CITIC Securities Co., Ltd. 1.0 % any). China Minsheng Banking Corp., Ltd. 1.0 % ‡ Other assets include investment of cash collateral for securities on Wuliangye Yibin Co., Ltd. 1.0 % loan (if any). Anhui Conch Cement Co., Ltd. -

Baijiu Makers See Revenues Rise on Strong Middle-Class Demand

CHINA DAILY Monday, January 16, 2017 Markets | BUSINESS 17 Baijiu makers see revenues rise CSRC seen mulling easier rules on stock on strong middleclass demand futures trading Other higherend By LI XIANG daily staples see [email protected] robust sales on China’s securities regula rising incomes tor is reportedly considering relaxing the restrictions on The basic condi the trading of stock index By BLOOMBERG futures. Any such move tion for loosen would underscore its inten Drink a baijiu toast to the tion to gradually restore the ing the trading new year. China’s consumer market function that has staples stocks, led by makers of almost come to a halt since curbs on index the fiery Chinese liquor, are the market rout in 2015. futures is in helping drive stock gains this Relaxation measures will year as sales prospects get likely include reducing the place.” rosier. minimum margin require As China’s markets ment from 40 percent to 20 Xun Yugen, chief strategist endured a year of turmoil percent of the contract value at Haitong Securities Co Ltd amid concerns over the eco and increasing the maximum nomic outlook, consumer sta daily trading volume from 10 ples was the only sector on the contracts to 20 per investor, country’s key stocks Chinese media reported, cit exchanges with positive ing people familiar with the >90 returns last year. Those busi matter. nesses, which sell things for Chinese online media outlet percent daily use, surged with average thepaper.cn reported that the the yoy drop in trading vol revenue in fiscal 2017 forecast regulator is likely to announce ume of index futures in 2016 to grow three times as quickly the decision within this as their global peers. -

Executive Disorder: Mapping the US Ban on Chinese Stocks

The Average China Investor’s Portfolio (as of January 8, 2021) TheDenotes Average stocks banned China under US executive Investor’s order Portfolio (as of 8 Jan 2021) DATA INSIGHT Alibaba Meituan China Construction Ping An 9.4% Dianping Bank Insurance (H) Executive Disorder: 2.9% 1.6% 1.6% Mapping the US ban on Ping An China Merchants Ind. & Comm. Insurance (A) Bank (A) Bank of China Chinese stocks 0.9% 0.9% 0.8% Last November, the Trump administration JD.com Bank of China announced a ban on US investors holding 1.6% China Merchants 0.6% Bank (H) Chinese stocks with suspected military links. 0.5% With little initial guidance on which stocks CONSUMER DISCRETIONARY FINANCIALS were covered by the ban, investors were at Pinduoduo Tal Education 1.6% 0.6% first left guessing as to how their portfolios would be affected. Over the last few weeks, China Tourism however, updates from the Treasury and moves 0.5% NIO by index providers to drop offending stocks 1.3% have gradually filled in the blanks, leading to an emerging picture of the executive order’s New Oriental Edu. impact on major benchmarks. Despite some 0.6% big names, like China Mobile and CNOOC, Tencent NetEase Xiaomi HANGZHOU 9% 0.9% 1.3% HIKVISION falling on the US government’s blacklist and 0.5% grabbing headlines, the overall weight of SMIC (H) 0.3% banned stocks at the beginning of 2021 was CHINA MOBILE 0.7% SMIC (A) relatively modest, totaling less than 3% of 0.1% weight in the average China investor’s portfolio, COMMUNICATION SERVICES INFORMATION TECHNOLOGY and concentrated among telecom shares, IT CHINA UNITED NETWORK DAWNING INFO. -

Emerging Asia Fund A-GBP for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET EMERGING ASIA FUND A-GBP 30 NOVEMBER 2019

pro.en.xx.20191130.LU0528227852.pdf Emerging Asia Fund A-GBP For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET EMERGING ASIA FUND A-GBP 30 NOVEMBER 2019 Strategy Fund Facts Teera Chanpongsang adopts a bottom-up investment approach and constructs his Launch date: 21.04.08 portfolio on a stock by stock basis. He searches for companies that trade below Portfolio manager: Teera Chanpongsang intrinsic value. This can be because improving fundamentals are not being reflected in the price or growth potential is not fully understood. He also looks for restructuring and Appointed to fund: 21.04.08 turnaround opportunities as well as cyclical turns in certain industries. He is sensitive to Years at Fidelity: 25 valuation and will not pay any price for growth. Meeting companies and in-depth Fund size: £813m discussions with Fidelity’s in-house analysts form the basis of the majority of Teera’s Number of positions in fund*: 67 investment decisions. Fund reference currency: US Dollar (USD) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • Aims to provide long-term capital growth with the level of income expected to be Other share classes may be available. Please refer to the prospectus for more details. low. • At least 70% invested in the shares of companies that have their head office or a Launch date: 04.08.10 main part of their activity in the less developed countries of Asia.