Economic Survey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notification

Government of Jammu and Kashmir (UT) OFFICE OF THE CHIEF EDUCATION OFFICER KISHTWAR Ground Floor Mini Secretariat New DC Complex Kishtwar (E-mail: [email protected]/ Fax: 01995-261000) Sub:-Tentative Seniority list of Jr.Librarian / Junior Assistants/ In-Charge Junior Assistants / Laboratory Assistants/ In-Charge Laboratory Assistants / Library Assistants /In-Charge Library Assistants of District Kishtwar. NOTIFICATION The tentative seniority list of Jr. Librarian / Junior Assistants/ In-Charge Junior Assistants / Laboratory Assistants/ In-Charge Laboratory Assistant / Library Assistant /In- Charge Library Assistants has been framed on the basis of feedback received from the all the Drawing Disbursing Officer of Kishtwar District and is uploaded in the website (www.schedujammu.nic.in) for information of the concerned officials for verifying their particulars with reference to their original service records. Any variation in the particulars / dropout in the list shall be reported to this office, with documentary evidence duly recommended by the respective Drawing Disbursing Officers and such claim should reach this office within 05 days from the date of publication of this notification in the newspapers. After expiry of stipulated period of 05 days, the Drawing & Disbursing Officer (DDOs ) concerned will furnish the service particulars of the officials with the following certificate conspicuously recorded at the bottom of service particulars, so that final updated seniority list will be prepared by this office accordingly. 1. That the official listed in the tentative seniority list has genuine appointment on substantive basis. Any official having any criminal cases in VOJ/Crime, FIR, Court or departmental enquiry be conspicuously noted in the remarks Colum mention the FIR No. -

Magazine1-4 Final.Qxd (Page 2)

"People tend to .... Page 4 SUNDAY, MARCH 7, 2021 INTERNET EDITION : www.dailyexcelsior.com/sunday-magazine Healthy mind nourishes....Page 3 REASI Land of Shiva Shrines Romesh Mengi Parvati the story of his immortality, he left his serpent king, Sheshnag at Anantnag . Shesh Nag came in the human form Cradled in the lap of the Trikuta peaks, in the proximity as Vasudev. One of the sons of Vasudev was Dhansar who of the river Chenab, lies the mystic area of Reasi with the was a saintly person. sacred caves and temples of Lord Shiva. Reasi is famous for As the local belief goes, in the ancient times there was a its striking natural beauty and religious beliefs. Deep inside demon that lived near Karua Jheel and committed atrocities this land, one can find many famous temples, caves which on the people of village Karua. The villagers sought help of make an impact on the visitor, who is left with a sense of Baba Dhansar to get rid of the Demon. It is believed that wonder about the creation of God, enhanced by the effort of Baba Dhansar prayed to Lord Shiva for help. Lord Shiva man. Reasi district has many historical places that have arrived and helped in killing the Demon. The temple of Baba been beautifully and tastefully crafted and have ever since Dhansar and a cave of Lord Shiva near Karua Jheel has remained the talk of UT and country. There are several caves become a place of worship. and temples in the district which are dedicated to Lord Shiva and hold importance during the religious Festival Kansi Patta (Gupt Kashi) "Maha Shivratri". -

1 Mohd Hussain S/O Mohd Ibrahim R/O Dargoo Shakar Chiktan 01.02

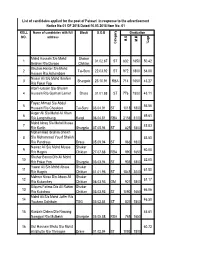

List of candidates applied for the post of Patwari in response to the advertisement Notice No:01 OF 2018 Dated:10.03.2018 Item No: 01 ROLL Name of candidates with full Block D.O.B Graduation NO. address M.O M.M %age Category Category Mohd Hussain S/o Mohd Shakar 1 01.02.87 ST 832 1650 50.42 Ibrahim R/o Dargoo Chiktan Ghulam Haider S/o Mohd 2 Tai-Suru 22.03.92 ST 972 1800 54.00 Hassan R/o Achambore Nissar Ali S/o Mohd Ibrahim 3 Shargole 23.10.91 RBA 714 1650 43.27 R/o Fokar Foo Altaf Hussain S/o Ghulam 4 Hussain R/o Goshan Lamar Drass 01.01.88 ST 776 1800 43.11 Fayaz Ahmad S/o Abdul 5 56.56 Hussain R/o Choskore Tai-Suru 03.04.91 ST 1018 1800 Asger Ali S/o Mohd Ali Khan 6 69.61 R/o Longmithang Kargil 06.04.81 RBA 2158 3100 Mohd Ishaq S/o Mohd Mussa 7 45.83 R/o Karith Shargole 07.05.94 ST 825 1800 Mohammad Ibrahim Sheikh 8 S/o Mohammad Yousf Sheikh 53.50 R/o Pandrass Drass 05.09.94 ST 963 1800 Nawaz Ali S/o Mohd Mussa Shakar 9 60.00 R/o Hagnis Chiktan 27.07.88 RBA 990 1650 Shahar Banoo D/o Ali Mohd 10 52.00 R/o Fokar Foo Shargole 03.03.94 ST 936 1800 Yawar Ali S/o Mohd Abass Shakar 11 61.50 R/o Hagnis Chiktan 01.01.96 ST 1845 3000 Mehrun Nissa D/o Abass Ali Shakar 12 51.17 R/o Kukarchey Chiktan 06.03.93 OM 921 1800 Bilques Fatima D/o Ali Rahim Shakar 13 66.06 R/o Kukshow Chiktan 03.03.93 ST 1090 1650 Mohd Ali S/o Mohd Jaffer R/o 14 46.50 Youkma Saliskote TSG 03.02.84 ST 837 1800 15 Kunzais Dolma D/o Nawang 46.61 Namgyal R/o Mulbekh Shargole 05.05.88 RBA 769 1650 16 Gul Hasnain Bhuto S/o Mohd 60.72 Ali Bhutto R/o Throngos Drass 01.02.94 ST -

Scheme Registration Guidelines

1 (1 )/2020-SSS Government of India Ministry of Commerce & Industry Department for Promotion of Industry & Internal Trade (Special Scheme Section) ***** Udyog Bhawan, New Delhi Dated: 01st April, 2021 To Principal Secretary (l&C) Govt. of Jam.mu & Kashmir, Civil Secretariat, Jammu-180004 (J&K.) Subject: General Operational Guidelines for Registration of Units under New Central Sector Scheme for Industrial Development of Jam.mu & Kashmir- regarding. Sir, I am directed to forward herewith General Operational Guidelines for Registration of Units under New Central Sector Scheme for Industrial Development of Jam.mu & Kashmir. 2. It is requested that the Guidelines may be uploaded on website of the UT Govt. of J&K along with wide circulation in the public domain. 3. The Home Page of the Scheme Portal is expected to be hosted in the today evening, however Login and submitting application on the portal shall be available within couple of days. 4. This issues with the approval of Secretary, DPIIT (Chairman, Steering Committee). Yours faithfully ~1t1}J., _,DI//; c~:=sc-:,- /r4,...,/-i:'"' (Ganesh H. Nikhare) 1 Under Secretary to Govt of India Tel No. 23062823 Email: [email protected] Copy to: 1. Director of Industries (Jammu), Directorate of Industries & Commerce, 1st Floor, Udyog Bhawan, Rail Head Complex, Jammu-180012. 2. Director oflndustries (Kashmir), Directorate of Industries & Commerce, Sanat Ghar, Bemina Srinagar-190014. 3. General Manager, JKDFC, Ground floor, Udyog Bhawan, Jam.mu (J&K)-180004. 4. NIC, DPIIT with the request to upload it on the portal of the scheme (jknis.dipp.gov.in) and DPIIT website. F. -

Statistical Handbook District Kargil 2018-19

Statistical Handbook District Kargil 2018-19 “STATISTICAL HANDBOOK” DISTRICT KARGIL UNION TERRITORY OF LADAKH FOR THE YEAR 2018-19 RELEASED BY: DISTRICT STATISTICAL & EVALUATION OFFICE KARGIL D.C OFFICE COMPLEX BAROO KARGIL J&K. TELE/FAX: 01985-233973 E-MAIL: [email protected] Statistical Handbook District Kargil 2018-19 THE ADMINISTRATION OF UNION TERRITORY OF LADAKH, Chairman/ Chief Executive Councilor, LAHDC Kargil Phone No: 01985 233827, 233856 Message It gives me immense pleasure to know that District Statistics & Evaluation Agency Kargil is coming up with the latest issue of its ideal publication “Statistical Handbook 2018-19”. The publication is of paramount importance as it contains valuable statistical profile of different sectors of the district. I hope this Hand book will be useful to Administrators, Research Scholars, Statisticians and Socio-Economic planners who are in need of different statistics relating to Kargil District. I appreciate the efforts put in by the District Statistics & Evaluation Officer and the associated team of officers and officials in bringing out this excellent broad based publication which is getting a claim from different quarters and user agencies. Sd/= (Feroz Ahmed Khan ) Chairman/Chief Executive Councilor LAHDC, Kargil Statistical Handbook District Kargil 2018-19 THE ADMINISTRATION OF UNION TERRITORY OF LADAKH District Magistrate, (Deputy Commissioner/CEO) LAHDC Kargil Phone No: 01985-232216, Tele Fax: 232644 Message I am glad to know that the district Statistics and Evaluation Office Kargil is releasing its latest annual publication “Statistical Handbook” for the year 2018- 19. The present publication contains statistics related to infrastructure as well as Socio Economic development of Kargil District. -

English June.Indd

In this Issue... • Saving the Hangul • Cricket stadium in Srinagar being upgraded • Mongolia keen to tap potential of Leh Berry plant • Kani shawl gets Geographical Indication (GI) tag • Reaching out • Sufi shrine, a symbol of Kashmiriyat • Tourists beat the heat in Patnitop • Leh hosts a ʻGreenʼ Rally • A Kashmir success story Vol. 1, No. 10, July 2010 Saving the Hangul Hangul, the state animal of Jammu and Kashmir, is the only survivor of the Red Deer group in the Indian subcontinent and, its population has been declining over the years due to habitat destruction, overgrazing by domestic livestock and poaching. Alarmed by the fall in numbers of this rare red deer, known scientifically as Cervus Elaphus Hanglu, and locally known as “Hangul”, the Government of Jammu and Kashmir is doing everything possible to save it from extinction. Battling for its survival, the Hangul are now scattered within the Dachigam National Park, which is located under the Zabarwan mountain range on the outskirts of Srinagar. The Dachigam National Park is the natural habitat of the Hangul, though in the summers, some of them cross the boundaries of the national park to graze in the higher mountain reaches. The state government has prepared a plan for Hangul conservation with the help of the Dehradun-based Wildlife Institute of India at a cost of Rs.220 million. The five-year plan has been submitted to the Union Ministry of Environment and Forests for approval. As part of the plan, the state government will buy field equipment, satellite images, GIS hardware and software. It would also build carnivore-proof enclosures, guard huts, watch towers and take steps to stop poachers. -

Compendium-2019

INDEX S. Subject Reference to Reference to Page No. Notification/SRO/ Rule No. Govt. Order/ Circular/OM etc. 1 2 3 4 5 1. Clarification regarding O. M. No. A/ 1 exercise of option Clar(2018)-II-1110 under rule 5 of Dated 02-01-2019. SRO-193 of 2018 dated 24-04-2018. 2. Family Pension case in No. A/41(2009)-C-840 2 respect of Divorced Dated 02-01-2019. daughters. 3. Adoption case of Late No. A/33(2015)-811 3 Mohd Yousuf ex- Dated 03-01-2019. welder/authorization of family pension. 4. Advisory for strict Circular No. A/ 4-5 adherence to rules, 35(2017)-1123 regulation or orders Dated 03-01-2019. governing the receipt of money, its custody and payment by the Government servant. 5. In-situ promotion(s) No. A/31(97)-488 6 subsequent to Dated 07-01-2019. foregoing functional promotion-clari- fication thereof. 6. Amendment in the SRO-22 7 J&K Financial Code dated 10-01-2019. Vol. I. ( ii ) 1 2 3 4 5 7. Date of next O. M. No. A/PS/DGC/ 8 increment-Rule 10 of Gen/2018-1268 J&K Civil Service Dated 16-01-2019. (Revised) Pay Rules, 2018-classification thereof . 8. Grant of hardship Government Order 9 allowance on Revised 22-F of 2019 Dated Pay Scales in favour 16-01-2019. of Police Personnel. 9. Payment of arrears of Government Order 10 interim Relief to the No. 48-F of 2019 members of Jammu dated 22-01-2019. and Kashmir Subordinate Judicial Services/Pensioners/ Family Pensioners. -

Force W Ise/State Wise List of Medal Aw Ardees to the Police Personnel

Force Wise/State Wise list of Medal awardees to the Police Personnel on the occasion of Independence Day 2020 SI. Name of States/ UTs P olice President’s Police Medal N o. Organization M edal for Police Medal (P M ) for G allantry (P P M ) for Meritorious (PMG) Distinguished S ervice S ervice 1 Andhra Pradesh 00 02 14 2 Arunachal Pradesh 03 00 01 3 A ssam 05 01 15 4 Chhattisgarh 03 00 11 5 G o a 00 00 01 6 G u jarat 00 02 17 7 H ary an a 00 01 11 8 Himachal Pradesh 00 01 03 9 Jh ark h an d 12 01 11 10 K arn atak a 00 01 18 11 K erala 00 00 06 12 Madhya Pradesh 00 04 16 13 Maharashtra 14 05 39 14 M an ip u r 00 01 06 15 M izo ram 00 01 02 16 N ag alan d 00 00 01 17 O d ish a 00 02 12 18 P u n jab 00 02 13 19 R ajasth an 00 02 16 20 S ikkim 00 01 01 21 T am il N ad u 00 02 21 22 T elan g an a 02 02 10 23 T rip u ra 00 00 06 24 Uttar Pradesh 23 06 73 25 Uttarakhand 00 00 04 26 West Bengal 00 01 20 UTs 27 Andaman & Nicobar 0 00 02 Islan d s 28 C h an d ig arh 0 01 00 29 Jammu & Kashmir 81 01 12 30 NCT of Delhi 16 03 16 31 Lakshadweep 0 01 01 32 P u d u ch erry 0 00 01 CAPFs/Other Organizations 33 Assam Rifles 0 00 10 34 BSF 01 05 46 35 CISF 0 02 23 36 CRPF 55 04 59 37 ITBP 0 03 11 38 NSG 0 00 04 39 SSB 0 01 11 40 IB (M H A ) 0 08 28 41 CBI 0 06 26 42 SPG 0 01 04 43 BPR&D 0 01 01 44 NCRB 0 00 01 45 NIA 0 01 04 46 SP V N P A 0 01 01 47 NDRF 0 01 04 48 L N JN N IC F S 0 0 01 49 NEPA 0 01 01 50 M/O Civil Aviation 0 00 00 51 M H A p ro p er 0 00 01 52 M/o Railways (RPF) 0 01 15 Total 215 80 631 List of Awardees Police Medal for Gallantry on the occasion of Independence Day-2020 ASSAM SI Name with date of Rank Medal Awarded No gallant action S/Shri 1 Anupam Gowala SI PMG 2 K u shal D as CT PMG 3 Titheswar Saikia CT PMG 4 Ashini Kumar Saikia CT PMG 5 Cham Hum Chakhap CT PMG ARUNACHAL PRADESH 6 Dr. -

Master Plan for Ganderbal

Draft MASTER PLAN FOR GANDERBAL -2032 Master Plan January 2013 FEEDBACK INFRA PRIVATE LIMITED & B E CONSULTANT TOWN PLANNING ORGANISATION, KASHMIR Government of Jammu and Kashmir Ganderbal Master Plan - 2032 Preface Cities have become concentrates of intelligence and demand large investments for their development. Large resources are spent on the development of various urban settlements but the condition of these towns continues to deteriorate because of piecemeal nature of expenditure and lack of definitive development schemes. Adhoc efforts neither result in better environment nor strengthen the economic base. In view of this, Town Planning Organisation, Kashmir has undertaken the preparation of the Master Plans for various towns, which envisages all encompassing development of these towns. Master Plans are expected to give impetus to the development and economic potential of the towns. In the first phase, the Master Plans of district headquarters have been taken up which will be followed up by Master Plans of other small and medium towns. The Government has also decided to outsource few Master Plans; however, the Master Plan for Ganderbal, which is on the threshold of becoming Class I town, has been outsourced to M/S Feedback Infra Private Limited, Gurgaon. The Master Plan-Ganderbal (2012-32) is the first planning effort in Kashmir region that has been outsourced to any private consultant by Town Planning Organisation, Kashmir. The studies involved in the preparation of Master Plan for Ganderbal (2012-32) concerns with the areas crucial to planning and development of the region. It has been a great privilege for M/S Feedback Infra Private Limited, Gurgaon to undertake the assignment of formulating the Master Plan of Ganderbal (2012-32). -

NW-49 Final FSR Jhelum Report

FEASIBILITY REPORT ON DETAILED HYDROGRAPHIC SURVEY IN JHELUM RIVER (110.27 KM) FROM WULAR LAKE TO DANGPORA VILLAGE (REGION-I, NW- 49) Submitted To INLAND WATERWAYS AUTHORITY OF INDIA A-13, Sector-1, NOIDA DIST-Gautam Buddha Nagar UTTAR PRADESH PIN- 201 301(UP) Email: [email protected] Web: www.iwai.nic.in Submitted By TOJO VIKAS INTERNATIONAL PVT LTD Plot No.4, 1st Floor, Mehrauli Road New Delhi-110074, Tel: +91-11-46739200/217 Fax: +91-11-26852633 Email: [email protected] Web: www.tojovikas.com VOLUME – I MAIN REPORT First Survey: 9 Jan to 5 May 2017 Revised Survey: 2 Dec 2017 to 25 Dec 2017 ACKNOWLEDGEMENT Tojo Vikas International Pvt. Ltd. (TVIPL) express their gratitude to Mrs. Nutan Guha Biswas, IAS, Chairperson, for sparing their valuable time and guidance for completing this Project of "Detailed Hydrographic Survey in Ravi River." We would also like to thanks Shri Pravir Pandey, Vice-Chairman (IA&AS), Shri Alok Ranjan, Member (Finance) and Shri S.K.Gangwar, Member (Technical). TVIPL would also like to thank Irrigation & Flood control Department of Srinagar for providing the data utilised in this report. TVIPL wishes to express their gratitude to Shri S.V.K. Reddy Chief Engineer-I, Cdr. P.K. Srivastava, Ex-Hydrographic Chief, IWAI for his guidance and inspiration for this project. We would also like to thank Shri Rajiv Singhal, A.H.S. for invaluable support and suggestions provided throughout the survey period. TVIPL is pleased to place on record their sincere thanks to other staff and officers of IWAI for their excellent support and co-operation through out the survey period. -

CJ Kashmir [Annexure List of Students Selected for Free Coaching Under 10% Reserved Departmental Quota

Government of Jam mu & Kashmir DI RECTO RA TE OF SCHOOL EDUCATION AS H MIR Subject:- List of Candidate for Pri, ak Coaching/Tuition Centres under 10% Reserved Departmental Quota for the session 2019-20 under different catagories. Pursuant to the Govt. Order No: 435-Edu of 2010 elated: 30-04-20 10, a list of 4439 candidates is forwarded to the Private Coaching/Tuition Centres under I 0% Reserved Departmental quota for the session 201 9-20 The following conditions shall be implemented in letter & spirit:• I. The concerned Private Coaching/Tuition Centres are advised to check the authenticity of the relevant Category on which benefit is claimed with the original documents before the selected candidate is allowed to join for free coaching under I0% departmental reserved quota in lieu of Govt. order referred above. 2. The concerned Private Coaching/Tuition Centres shall not allow the selected candidate, in case of any variation in the particulars of the selected candidates reflected in the order especially the categ<H:J' under which selected and shall be conveyed the same to this office within one week. 3. That the Selected candidates having any grievance shall approach this office within JO days positively, 4. That tire concerned Private Coaching/Tuition Centres shall submit tire detailed report to this office within one week about the joining of candidate. Sci/- Director School Education Kashmir Nu: DSEK/GS/10%/quota/862/2020 Dated: 08-01-2020 Copy to the:• ()1. Divisional Commissioner, Kashmir for information. 02. Commissioner/Secretary to Government. School Education Department Civil Secretariat, .la11111111 for information. -

Changes in Physico-Chemical Parameters at Different Sites Of

quac d A ul n tu a r e s e J i o r u e Naik et al., Fish Aquac J 2015, 6:4 r h n s i a F l Fisheries and Aquaculture Journal DOI: 10.4172/2150-3508.1000148 ISSN: 2150-3508 ResearchResearch Article Article OpenOpen Access Access Changes in Physico-chemical Parameters at different Sites of Manasbal Lake of Kashmir, India Gulzar Naik*, Mudasir Rashid and Balkhi MH Faculty of Fisheries, Sher-e-Kashmir University of Agricultural Sciences and Technology of Kashmir, Rangil, Ganderbal, Jammu and Kashmir, India Abstract In an aquatic ecosystem, the density and diversity of organisms depends on availability and quality of water. During the present study an attempt was made to analyse some of the important physico-chemical parameters of the water samples at three different sites of the Manasbal Lake to check the pollution load. Various parameters were analysed for a period of six months on monthly intervals by following standard methods. Among the various parameters recorded the overall Air temperature ranged from 7.2°C to 30.2°C; Surface water temperature ranged from 6.1°C to 26.5°C; Secchi-disc transparency from 1.5 m to 4.5m; Conductivity varied from 149 to 292 μScm-1; -1 -1 Dissolved oxygen from 2.4 to 8.8 mg L ; Free Co2 from 2.0 to 14.0 mg L ; pH from 8.1 to 9.2; Total Alkalinity varied from 126 to 243 mg L-1; Chloride values ranged from 5.9 to 33.5 mg L-1; Total Hardness ranged from 119 to 218 mg L-1; Ammonical Nitrogen varied from 27 to 193μg L-1; Nitrate Nitrogen varied from 31 to 286 μg L-1; Ortho-Phosphate Phosphorous varied from 4.3 to 33.0 μg L-1 and Phosphate Phosphorous ranged from 83.0 to 261 μg L-1.