Eurex Clearing Circular 157/14

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

Eurex Clearing Circular 004/14

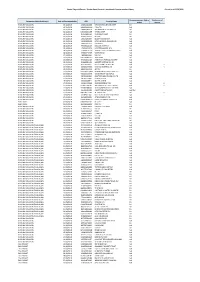

eurex clearing circular 004/14 Date: 8 January 2014 Recipients: All Clearing Members of Eurex Clearing AG and Vendors Authorized by: Thomas Laux Action required High priority Composition of GC Pooling® Equity Basket and Acceptance of equity collaterals for margining by Eurex Clearing Related Eurex Clearing Circular: 146/13 Contact: Risk Control, T +49-69-211-1 24 52, [email protected] Content may be most important for: Attachment: Overview of composition of GC Pooling® Equity Basket Ü Middle + Backoffice and acceptance of equity collaterals for margining by Ü Auditing/Security Coordination Eurex Clearing, effective 15 January 2014 Please find attached the list of admitted equities for collateralisation of trades in the GC Pooling® Equity Basket, effective 15 January 2014. At the same time, these equities will be admitted as collaterals for margining by Eurex Clearing. Additionally, all equities which are part of the DAX®, EURO STOXX 50® or SMI® remain eligible as collaterals. The attachment contains an overview of admissible equity collaterals and the concentration limit per ISIN for trades in the GC Pooling® Equity Basket. Eurex Clearing AG T +49-69-211-1 24 52 Chairman of the Executive Board: Aktiengesellschaft mit Mergenthalerallee 61 F +49-69-211-1 84 40 Supervisory Board: Thomas Book (CEO), Sitz in Frankfurt/Main 65760 Eschborn [email protected] Hugo Bänziger Heike Eckert, Thomas Laux, HRB Nr. 44828 Mailing address: Internet: Erik Tim Müller, Andreas Preuss USt-IdNr. 60485 Frankfurt/Main www.eurexclearing.com DE194821553 Germany Amtsgericht Overview of composition of GC Pooling® Equity Basket and acceptance of equity collaterals for margining by Eurex Clearing, effective 15 January 2014 ISIN Instrument Name Nbr Of Eligible Shares DE000BASF111 BASF SE NA O.N. -

CCP Instruments As of 2003 03 27 Engl

First introduction sequence of CCP instruments as of March 27, 2003 CCP Instruments DAX Block Crossing DAX (Xetra XXL) + corresponding instruments 1 DE0008232125 LHA LUFTHANSA AG VNA O.N. 1 BC0008232125 BCLHA LUFTHANSA AG VNA O.N. 2 DE0007172009 SCH SCHERING AG O.N. 2 BC0007172009 BCSCH SCHERING AG O.N. CCP Instruments MDAX + corresponding instruments Block Crossing MDAX (Xetra XXL) 1 DE0002457561 HEIJ HEIDELBERGCEMENT O.N. NST 2 DE0005072102 BZL BERU AG O.N. 1 BC0005072102 BCBZL BERU AG 3 DE0005085906 AWD AWD HOLDING AG O.N. 2 BC0005085906 BCAWD AWD HOLDING AG O.N. 4 DE0005200000 BEI BEIERSDORF AG O.N. 3 BC0005200000 BCBEI BEIERSDORF AG O.N. 5 DE0005245500 BOS HUGO BOSS AG ST O.N. 6 DE0005245534 BOS3 HUGO BOSS AG VZO O.N. 4 BC0005245534 BBOS3 HUGO BOSS AG VZO O.N. 7 DE0005278006 BUD BUDERUS AG O.N. 5 BC0005278006 BCBUD BUDERUS AG O.N. 8 DE0005408116 ARL AAREAL BANK AG 6 BC0005408116 BCARL AAREAL BANK AG 9 DE0005408884 LEO LEONI AG NA O.N. 7 BC0005408884 BCLEO LEONI AG 10 DE0005421903 DGX DEGUSSA AG O.N. 8 BC0005421903 BCDGX DEGUSSA AG O.N. 11 DE0005439004 CON CONTINENTAL AG O.N. 9 BC0005439004 BCCON CONTINENTAL AG O.N. 12 DE0005471601 TNH TECHEM O.N. 10 BC0005471601 BCTNH TECHEM O.N. 13 DE0005591002 DYK DYCKERHOFF ST O.N. 14 DE0005591036 DYK3 DYCKERHOFF VZO O.N. 11 BC0005591036 BDYK3 DYCKERHOFF VZO O.N. 15 DE0005753008 CZZ CELANESE AG O.N. 12 BC0005753008 BCCZZ CELANESE AG O.N. 16 DE0005773303 FRA FRAPORT AG FFM.AIRPORT 13 BC0005773303 BCFRA FRAPORT AG 17 DE0005785604 FRE FRESENIUS AG O.N. -

Designated Sponsor Erfordernis D 20210526

Aktien der Liquiditätskategorie A* gültig ab 26. Mai 2021 ISIN Instrument XLM Umsatz AT0000A0E9W5 S+T AG O.N. 35.97 4,280,782.85 DE0005089031 UTD.INTERNET AG NA 16.07 7,772,202.57 DE0005111702 ZOOPLUS AG 51.91 4,208,078.51 DE0005140008 DEUTSCHE BANK AG NA O.N. 5.40 111,925,300.01 DE0005158703 BECHTLE AG O.N. 14.58 12,440,739.68 DE0005190003 BAY.MOTOREN WERKE AG ST 3.92 116,673,048.94 DE0005190037 BAY.MOTOREN WERKE VZO 28.08 5,185,694.74 DE0005200000 BEIERSDORF AG O.N. 6.23 32,370,380.77 DE0005313704 CARL ZEISS MEDITEC AG 16.63 13,469,738.82 DE0005408116 AAREAL BANK AG 25.45 5,802,419.24 DE0005408884 LEONI AG NA O.N. 73.50 3,114,435.16 DE0005419105 CANCOM SE O.N. 25.16 5,547,456.62 DE0005439004 CONTINENTAL AG O.N. 7.21 58,481,792.62 DE0005470306 CTS EVENTIM KGAA 21.36 7,096,059.32 DE0005470405 LANXESS AG 12.23 15,402,539.66 DE0005493365 HYPOPORT SE NA O.N. 60.33 3,344,480.07 DE0005545503 1+1 DRILLISCH AG O.N. 27.93 4,681,191.15 DE0005550636 DRAEGERWERK VZO O.N. 50.73 3,327,527.09 DE0005552004 DEUTSCHE POST AG NA O.N. 3.95 119,438,574.31 DE0005557508 DT.TELEKOM AG NA 3.70 154,511,909.75 DE0005565204 DUERR AG O.N. 22.09 7,100,402.33 DE0005659700 ECKERT+ZIEGLER AG O.N. 44.12 3,806,078.02 DE0005664809 EVOTEC SE INH O.N. -

Authorizations for Capital Raisings and Convertible Bond Issues (2017)

Authorizations for Capital Raisings and Convertible Bond Issues (2017) DAX® and German MDAX® Companies clearygottlieb.com Preface This booklet presents a summary overview of authorizations for capital raisings and convertible bond issuances of all DAX® and German MDAX® companies based on their 2017 annual general meetings.* The amount of any authorized capital reflected in this booklet takes into account any issuance of shares out of authorized capital entered into the commercial register prior to July 31, 2017. The amount of any convertible bond authorization and underlying conditional capital reflected in this booklet takes into account the issuance of any convertible bonds based on such authorization prior to July 31, 2017 and the amount of conditional capital underlying such convertible bonds as more fully described in this booklet. Consistent with the nature of the booklet as a summary overview, the information on the authorizations for capital raisings and convertible bond issuances provided herein is limited to the key parameters of the relevant authorized capital, convertible bond authorization and conditional capital. A more detailed analysis of, e.g., the feasibility of a certain capital raising will always require a comprehensive review of the complete wording of the authorization(s) concerned. In particular, the amount of new shares, convertible bonds or treasury shares previously issued or sold under exclusion of subscription rights during the term of the authorization available for the proposed capital raising typically will have to be applied towards the volume limitations applicable to such capital raising in case of an exclusion of subscription rights. The companies covered in this booklet are the DAX® and German MDAX® companies as of the last index rebalancing date on September 6, 2017. -

Anouncement Template

Automatic Re-registration to Nominee according to §67,4 (5) Stock Corporation Act (AktG) (ALU) - List of Participating Issuers Name ISIN Date 3W Power S.A. LU1072910919 03.06.2014 ADC African Development Corporation AG DE000A1E8NW9 24.10.2011 adidas AG DE000A1EWWW0 11.10.2010 AG Ems DE0007472458 11.08.2014 AIXTRON SE DE000A0WMPJ6 17.10.2008 aleo solar AG DE000A0JM634 11.10.2006 All for One Steeb AG DE0005110001 12.05.2009 Allianz SE DE0008404005 03.04.2006 artnet AG DE000A1K0375 11.10.2011 asknet AG DE0005173306 14.12.2007 Aurum Deutschland AG DE000A1R1JJ4 29.07.2014 BASF SE DE000BASF111 09.08.2010 Bayer AG DE000BAY0017 01.10.2009 BEKO HOLDING AG AT0000A0ZHT2 01.12.2014 Biofrontera AG DE0006046113 21.08.2007 bmp Beteiligungsmanagement AG DE000A0EAMY5 30.11.2012 Brenntag AG DE000A1DAHH0 27.04.2010 BrainLAB AG DE0005207906 17.07.2006 Celesio AG DE000CLS1001 01.11.2006 Ceritech AG DE000A1X3SE4 18.06.2014 Daimler AG DE0007100000 03.04.2006 Delticom AG DE0005146807 01.03.2007 Deufol SE DE000A1R1EE6 20.02.2013 Deutsche Annington Immobilien SE DE000A1ML7J1 20.08.2013 Deutsche Beteiligungs AG DE000A1TNUT7 22.08.2013 Deutsche Bank AG DE0005140008 18.04.2006 Deutsche Börse AG DE0005810055 07.04.2006 Deutsche Operating Leasing AG DE0005249304 23.04.2009 Deutsche Post AG DE0005552004 01.01.2007 Deutsche Postbank AG DE0008001009 01.01.2007 Deutsche Rohstoff AG DE000A0XYG76 31.05.2010 Deutsche Telekom AG DE0005557508 03.04.2006 Dialog Semiconductor plc GB0059822006 29.09.2010 DIC Asset AG DE000A1X3XX4 20.09.2013 Ecommerce Alliance AG DE000A12UK08 10.09.2014 ElringKlinger AG DE0007856023 29.08.2007 E.ON SE DE000ENAG999 11.08.2008 Epigenomics AG DE000A11QW50 02.10.2014 EQS Group AG DE0005494165 26.04.2010 euromicron AG DE000A1K0300 27.03.2012 eValue Ventures AG DE000A1RFM45 11.12.2012 Name ISIN Date Evonik Industries AG DE000EVNK013 15.03.2013 F24 AG DE000A12UK24 22.04.2015 Fanorakel AG DE000A0DQ1K9 02.09.2009 FinLab AG DE0001218063 27.10.2008 freenet AG DE000A0Z2ZZ5 02.11.2009 GAGFAH S. -

Online-Appendix Zu

Online-Appendix zu „Impact of Weather on the Stock Market Returns of Different Industries in Germany“ Astrid Schulte-Huermann WHU – Otto Beisheim School of Management Junior Management Science 5(3) (2020) 295-311 Appendix Appendix A. List of companies included in each sector Financials Telecommunication Technology Consumer Non- Industrials Healthcare Basic Materials Consumer Cyclicals Utilities Cyclicals ALLIANZ SE DT TELEKOM N INFINEON TECH BEIERSDORF DEUTSCHE POST BAYER N AG BASF SE ADIDAS N RWE DEUTSCHE BANK 1&1 DRILLISCH SAP SE BAYWA N DT LUFTHANSA A FRESENIUS MEDI HEIDELBERGCEMEBAY MOT WERKE ENCAVIS DT BOERSE N FREENET N AG BECHTLE KWS SAAT SIEMENS N FRESENIUS SE HENKEL AG&CO V CONTINENTAL AG E ON MUENCH. RUECK UNITED INTERNE DIALOG SEMICON SUEDZUCKER WIRE CARD MERCK KGAA LINDE PLC DAIMLER AG N AAREAL BANK NEMETSCHEK AIRBUS SE CARL ZEISS MED THYSSENKRUPP A VOLKSWAGEN VZ ALSTRIA OFF RE SOFTWARE DUERR AG EVOTEC AURUBIS A SPRINGER SE COMMERZBANK ADVA OPTICAL N FRAPORT GERRESHEIMER FUCHS PETRO VZ FIELMANN DEUTSCHE WOHNE AIXTRON NA GEA GROUP MORPHOSYS K+S AG NA HUGO BOSS N DT EUROSHOP NA CANCOM SE HOCHTIEF QIAGEN NV LANXESS PROSIEBENSAT1 HANNOVER RUECK COMPUGROUP MED MTU AERO ENGIN SARTORIUS VZ SYMRISE AG PUMA TAG IMMOBILIEN ISRA VISION AMADEUS FIRE DRAEGERWERK VZ WACKER CHEMIE RHEINMETALL ADLER REAL ES S&T AG BERTRANDT RHOEN KLINIKUM KLOECKNER + CO RTL GROUP DIC ASSET SMA SOLAR TECH BILFINGER SALZGITTER BOR. DORTMUND DT BETEIL AG TAKKT CEWE STIFTUNG SGL CARBON CECONOMY GRENKE XING DEUTZ CTS EVENTIM HAMBORNER REIT ZOOPLUS DR HOENLE HORNBACH HYPOPORT AG HAMBURGER HAFE RATIONAL PATRIZIA IMMOB HEIDELBERG DRU SAF HOLLAND SA WUESTENR&WUERT INDUS HOLDING STEINHOFF JENOPTIK JUNGHEINRICH V KOENIG & BAUER KRONES AG LEONI AG N NORDEX PFEIFFER VACUU SIXT SE VOSSLOH AG WACKER NEUSON WASHTEC Company data retrieved from Thomson Reuters Datastream, 2019 40 Appendix B. -

Women-On-Board-Index

WoB-Index 100 II AR V WOMEN-ON-BOARD-INDEX 100 II Frauenanteil im Aufsichtsrat und Vorstand der aktuell 107 börsennotierten und voll mitbestimmten Unternehmen (Stand 31.10.2020 - aktualisiert zum 06.11.2020) Gesamt Zahl Anteil Zahl Zahl Anteil WoB-Index Vergleich Position Unternehmen zahl AR- Frauen Frauen Vorst. Frauen Frauen 100 II AR z. Stand 31.10.2020 Mitgl. AR AR mitgl. Vorst. Vorst. + V 14.01.15 Änderung Notierung 1 ÜSTRA Hannoversche Verkehrsbetriebe Reg. Markt 20 7 35,00% 3 2 66,67% 50,83% (+) 38,33 2 Ceconomy AG SDAX 19 9 47,37% 2 1 50,00% 48,68% (+) 36,18 3 Gerry Weber International AG Reg. Markt 12 6 50,00% 3 1 33,33% 41,67% (+) 29,17 4 BREMER LAGERHAUS-GESELLSCHAFT Reg. Markt 16 6 37,50% 7 3 42,86% 40,18% NEU 5 Deutsche Telekom AG DAX / TecDAX 20 8 40,00% 8 3 37,50% 38,75% (+) 12,92 6 Bilfinger SE SDAX 12 5 41,67% 3 1 33,33% 37,50% (+) 33,33 6 OSRAM Licht AG MDAX 12 5 41,67% 3 1 33,33% 37,50% (+) 29,17 8 Commerzbank AG MDAX 20 8 40,00% 6 2 33,33% 36,67% (+) 19,17 8 thyssenkrupp AG MDAX 20 8 40,00% 3 1 33,33% 36,67% (+) 24,17 10 SAP SE DAX / TecDAX 18 9 50,00% 5 1 20,00% 35,00% (+) 23,89 11 Audi AG Reg. Markt 20 7 35,00% 6 2 33,33% 34,17% (+) 31,39 12 Covestro AG DAX 12 5 41,67% 4 1 25,00% 33,33% NEU 13 Grammer AG Reg. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327 -

Authorizations for Capital Raisings and Convertible Bond Issues 2015

Authorizations for Capital Raisings and Convertible Bond Issues DAX® and German MDAX® Companies (Based on 2015 Annual Meetings) © 2016 Cleary Gottlieb Steen & Hamilton LLP. All rights reserved. Preface This booklet presents a summary overview of authorizations for capital raisings and convertible bond issuances of all DAX® and German MDAX® companies based on their 2015 annual general meetings. The amount of any authorized capital reflected in this booklet takes into account any issuance of shares out of authorized capital entered into the commercial register prior to December 2015. The amount of any convertible bond authorization and underlying conditional capital reflected in this booklet takes into account the issuance of any convertible bonds based on such authorization prior to December 2015 and the amount of conditional capital underlying such convertible bonds as more fully described in this booklet. All information regarding the free float of the selected companies as of the last index rebalancing date in December 2015 was taken from a website of Deutsche Börse AG (www.dax-indices.com) where such information can be found under “Downloads” → “Composition & Indicators” → “Composition DAX” and “Composition MDAX”. Deutsche Börse AG regularly calculates the free float for index weighting purposes according to the definition set out in Section 2.3 of the “Guide to the Equity Indices of Deutsche Börse” which is also available under www.dax-indices.com (“Downloads” → “Guides & Factsheets”). Inclusion in the DAX® and MDAX® requires, among other things, a minimum free float of 10%. We hope you will find this booklet useful. We will be pleased to answer any queries you may have in connection with the information presented in this booklet. -

Tracker Quant Research - Investment Recommendation History Current As of 05/10/2018

Cantor Fitzgerald Europe - Tracker Quant Research - Investment Recommendation History Current as of 05/10/2018 Recommendation - Add or Disclosures of Recommendation Producer(s) Date of Recommendation ISIN Security Name Delete Interest NICOLINA NIOULICOU 05/10/2018 US29414D1000 ENVISION HEALTHCARE CORP Del NICOLINA NIOULICOU 04/10/2018 GB00BD6GN030 CYBG PLC Add NICOLINA NIOULICOU 04/10/2018 GB00BQ8P0644 VIRGIN MONEY HOLDINGS UK Del NICOLINA NIOULICOU 04/10/2018 US87162W1009 SYNNEX CORP Add NICOLINA NIOULICOU 04/10/2018 US2124851062 CONVERGYS CORP Del NICOLINA NIOULICOU 04/10/2018 US4825391034 KLX INC Del NICOLINA NIOULICOU 03/10/2018 US81618T1007 SELECT INCOME REIT Add NICOLINA NIOULICOU 03/10/2018 US4595061015 INTL FLAVORS & FRAGRANCES Add NICOLINA NIOULICOU 02/10/2018 FR0000073272 SAFRAN SA Add NICOLINA NIOULICOU 28/10/2018 FR0000121667 ESSILORLUXOTTICA Add NICOLINA NIOULICOU 28/10/2018 IT0001479374 LUXOTTICA GROUP SPA Del NICOLINA NIOULICOU 28/10/2018 GB0005203376 JARDINE LLOYD THOMPSON GROUP Add NICOLINA NIOULICOU 28/10/2018 AT0000746409 VERBUND AG Add NICOLINA NIOULICOU 27/10/2018 IE0002424939 DCC PLC Add NICOLINA NIOULICOU 26/09/2018 US03349M1053 ANDEAVOR Del NICOLINA NIOULICOU 26/09/2018 US56585A1025 MARATHON PETROLEUM CORP Add NICOLINA NIOULICOU 25/09/2018 US3665051054 GARRETT MOTION INC-WI Add NICOLINA NIOULICOU 25/09/2018 US15189T1079 CENTERPOINT ENERGY INC Add 4 NICOLINA NIOULICOU 25/09/2018 DE000EVNK013 EVONIK INDUSTRIES AG Add 4 NICOLINA NIOULICOU 25/09/2018 GB0001411924 SKY PLC Del NICOLINA NIOULICOU 25/09/2018 GB00BWFGQN14 -

Studieninformationstag 2010

Investor relations 2.0 – An international benchmark study Kristin Koehler, M.A. University of Leipzig | Institute of Communication and Media Studies | August 2011 1 / Kristin Koehler | University of Leipzig | www.communicationmanagement.de Content Outline of the study Research design Empirical insights Best practices Summary of findings 2 / Kristin Koehler | University of Leipzig | www.communicationmanagement.de Outline of the study _ Online content analysis of top 30 listed businesses in the United States (Dow Jones Industrial Average), Germany (DAX), UK (FTSE), France (CAC) and Japan (Nikkei) _ In addition, comparison of the IR 2.0 engagement of German companies listed in DAX, MDAX, TecDAX and SDAX _ Longitudinal design for German and U.S. indices: first IR 2.0 study conducted in 2009 (see DIRK research edition, vol. 17, Köhler, K. (2010): Investor relations and social media) _ Organized by the University of Leipzig, Kristin Koehler, M.A. _ Thanks to Melanie Gerasch and Isabel Reinhardt for their support 3 / Kristin Koehler | University of Leipzig | www.communicationmanagement.de Outline of the study Aims and focus _ Monitoring the status quo in the field of investor relations 2.0 in an international context _ Identifying trends and developments for German and U.S. businesses _ Identifying best practices _ Comparing use of social media for IR purposes in different countries and cultural settings 4 / Kristin Koehler | University of Leipzig | www.communicationmanagement.de Research design _ Online content analysis of 280 listed companies