7Th Fiscal Period (Ended Jan 2014) COMFORIA RESIDENTIAL REIT

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shanghai, China Overview Introduction

Shanghai, China Overview Introduction The name Shanghai still conjures images of romance, mystery and adventure, but for decades it was an austere backwater. After the success of Mao Zedong's communist revolution in 1949, the authorities clamped down hard on Shanghai, castigating China's second city for its prewar status as a playground of gangsters and colonial adventurers. And so it was. In its heyday, the 1920s and '30s, cosmopolitan Shanghai was a dynamic melting pot for people, ideas and money from all over the planet. Business boomed, fortunes were made, and everything seemed possible. It was a time of breakneck industrial progress, swaggering confidence and smoky jazz venues. Thanks to economic reforms implemented in the 1980s by Deng Xiaoping, Shanghai's commercial potential has reemerged and is flourishing again. Stand today on the historic Bund and look across the Huangpu River. The soaring 1,614-ft/492-m Shanghai World Financial Center tower looms over the ambitious skyline of the Pudong financial district. Alongside it are other key landmarks: the glittering, 88- story Jinmao Building; the rocket-shaped Oriental Pearl TV Tower; and the Shanghai Stock Exchange. The 128-story Shanghai Tower is the tallest building in China (and, after the Burj Khalifa in Dubai, the second-tallest in the world). Glass-and-steel skyscrapers reach for the clouds, Mercedes sedans cruise the neon-lit streets, luxury- brand boutiques stock all the stylish trappings available in New York, and the restaurant, bar and clubbing scene pulsates with an energy all its own. Perhaps more than any other city in Asia, Shanghai has the confidence and sheer determination to forge a glittering future as one of the world's most important commercial centers. -

Tokyo Great Garden Spring Campaign

Enlightenment with Asakura style philosophy 7RN\R Former AsakuraAsakura Fumio Garden (Asakura Museum of Sculpture, Taito) 7-18-10 Yanaka, Taito-ku 103-3821-4549 *UHDW National - designated Place of Scenic Beauty "Former Asakura Fumio Garden" Asakura Sculpture Museum is the building that was a studio and residence of Fumio Asakura (1883 ~1964) a leading sculptor of modern Japan. Asakura designed and supervised the building which was completed in 1935. Asakura died in 1964, but the building was opened to the public as a Asakura Sculpture Museum since 1967 by the family of the deceased (transferred to Taito-ku in 1986), in 2001 the building is registered in the tangible cultural heritage of the country. In 2008 the integration of architecture and gardens were admitted for their value and artistic appreciation and *DUGHQ the entire site has been designated as a national scenic spot as "The former gardens of Fumio Asakura". Since 2009 to 2013 was carried out conservation and restoration works on a large scale and appearance could be restored even when Asakura was alive. Admission General 500 yen (300 yen). Elementary, middle and high school students 250 yen (150 yen) *( ) inside is a group rate of more than 20 people *Persons holding the Handicapped person's passbook or a Certificate Issued for Specific Disease Treatment and their caregivers is free Yearly Passport: 1,000 yen (same price for all visitors) 6SULQJ Open 9:30 - 16:30 (Admission until 16:00) Closed Mondays and Thursdays Open on holidays and Closed on the day following a holidays Year-end and New Year holidays *During changing exhibitions, etc. -

Comfort Urban Smart

COMFORIA RESIDENTIAL REIT, INC ~Investor Presentation~ COMFORT 8th Fiscal Period (ended July 2014) September 2014 URBAN SMART Table of Contents 1. 8th Fiscal Period Highlights 5. Appendix Financial Highlights - 4 – P&L: 8th Period -23- Portfolio Highlights - 5 - Balance Sheet: 8th Period -24- 2. 8th Fiscal Period Results 8th ~ 9th Period Performance Forecast -25- Financial Results for the 8th Fiscal Period - 7 - CRR Characteristics -26- Stable Occupancy Rate - 8 - “COMFORIA” Series -27- Fluctuations in Rent Rate - 9 - “COMFORIA” Series Representative Properties -28- External Growth-①: PO Effect & Acquisition Portfolio Policy -29- Capacity -10- # of Net migration and Household in Tokyo 23 Wards -30- External Growth-②: Post-offering Acquisitions -11- Demand & Price Stability of Tokyo 23 Ward Assets -31- Property Management Initiatives -12- Portfolio Map (as at 8th FP end) -32- Financial Strategy-①: Borrowings & Bond Issue -13- Portfolio List -33- Financial Strategy-②: Financial Indicators Appraisal Value -36- (as at 8th FP end) -14- Occupancy and Rent Rates -39- Expansion of Retail Investor Base -15- Overview of Portfolio (as at 8th FP end) -40- 3. Future Strategy Status of Interest-bearing Debt (as at 8th FP end) -42- External Growth Targets -17- Unitholders (as at 8th FP end) -43- Solid External Growth-①: Historical Performance -18- Historical Unit Price -44- rd Solid External Growth-②: Opportunities Agenda of the 3 Unitholders’ Meeting -45- & Pipeline -19- Governance -46- 4. Performance Forecast Overview -

“Tokyo Great Garden Autumn Campaign”(PDF:2035KB)

An Appreciation of ASAKURA’s Philosophy ASAKURA MuseumMuseum of Sculpture, Taito (Former ASAKURA Fumio Garden) 7-18-10 Yanaka, Taito-ku 103-3821-4549 National-designated Place of Scenic Beauty "Former ASAKURA Fumio Garden" National-Registered Tangible Cultural Property ASAKURA Museum of Sculpture is the building that was a studio and residence of ASAKRA Fumio (1883~1964) a leading sculptor of modern Japan. ASAKURA designed and supervised the building Tokyo which was completed in 1935. ASAKURA died in 1964, but the building was opened to the public as a ASAKURA Museum of Sculpture since 1967 by the family of the deceased (transferred to Taito-ku in 1986), in 2001 the building is registered in the tangible cultural heritage of the country. In 2008 the integration of architecture and gardens were admitted for their value and artistic appreciation and the entire site has been designated as a national scenic spot as “Former ASAKURA Fumio Garden”. Since 2009 to 2013 was carried out conservation and restoration works on a large scale and appearance could be restored even when ASAKURA was alive. It is a facility that you can enjoy sculptures, architecture, and gardens. Great Admission General 500 yen (300 yen) Elementary, middle and high school students 250 yen (150 yen) *( ) inside is a group rate of more than 20 people *Persons holding the Handicapped person's passbook or a Certificate Issued for Specific Disease Treatment and their caregivers is free Yearly Passport: 1,000 yen (same price for all visitors) Open 9:30 - 16:30 (Admission until 16:00) Closed Mondays and Thursdays (Opened on holidays and closed on the day following a holiday) Garden Year-end and New Year holidays *During changing exhibitions, etc. -

Area Locality Address Description Operator Aichi Aisai 10-1

Area Locality Address Description Operator Aichi Aisai 10-1,Kitaishikicho McDonald's Saya Ustore MobilepointBB Aichi Aisai 2283-60,Syobatachobensaiten McDonald's Syobata PIAGO MobilepointBB Aichi Ama 2-158,Nishiki,Kaniecho McDonald's Kanie MobilepointBB Aichi Ama 26-1,Nagamaki,Oharucho McDonald's Oharu MobilepointBB Aichi Anjo 1-18-2 Mikawaanjocho Tokaido Shinkansen Mikawa-Anjo Station NTT Communications Aichi Anjo 16-5 Fukamachi McDonald's FukamaPIAGO MobilepointBB Aichi Anjo 2-1-6 Mikawaanjohommachi Mikawa Anjo City Hotel NTT Communications Aichi Anjo 3-1-8 Sumiyoshicho McDonald's Anjiyoitoyokado MobilepointBB Aichi Anjo 3-5-22 Sumiyoshicho McDonald's Anjoandei MobilepointBB Aichi Anjo 36-2 Sakuraicho McDonald's Anjosakurai MobilepointBB Aichi Anjo 6-8 Hamatomicho McDonald's Anjokoronaworld MobilepointBB Aichi Anjo Yokoyamachiyohama Tekami62 McDonald's Anjo MobilepointBB Aichi Chiryu 128 Naka Nakamachi Chiryu Saintpia Hotel NTT Communications Aichi Chiryu 18-1,Nagashinochooyama McDonald's Chiryu Gyararie APITA MobilepointBB Aichi Chiryu Kamishigehara Higashi Hatsuchiyo 33-1 McDonald's 155Chiryu MobilepointBB Aichi Chita 1-1 Ichoden McDonald's Higashiura MobilepointBB Aichi Chita 1-1711 Shimizugaoka McDonald's Chitashimizugaoka MobilepointBB Aichi Chita 1-3 Aguiazaekimae McDonald's Agui MobilepointBB Aichi Chita 24-1 Tasaki McDonald's Taketoyo PIAGO MobilepointBB Aichi Chita 67?8,Ogawa,Higashiuracho McDonald's Higashiura JUSCO MobilepointBB Aichi Gamagoori 1-3,Kashimacho McDonald's Gamagoori CAINZ HOME MobilepointBB Aichi Gamagori 1-1,Yuihama,Takenoyacho -

COMFORIA RESIDENTIAL REIT, INC ~Investor Presentation~ 6Th

COMFORIA RESIDENTIAL REIT, INC ~Investor Presentation~ 6th Fiscal Period (ended July 2013) As of September 2013 Table of Contents 1. IPO Highlights 6. Appendix z Public Listing of COMFORIA RESIDETIAL REIT, z P&L: 6th Period -25- Inc (“CRR”) - 4 - z Balance Sheet: 6th Period -26- 2. Executive Summary z CRR Characteristics -27- z Executive Summary - 6 - z “COMFORIA” Series -28- th 3. 6 Fiscal Period Results z Portfolio Policy -30- th z Financial Results for the 6 Fiscal Period - 8 - z “COMFORIA” Series Representative Properties z Stable Occupancy Rate - 9 - -31- z Fluctuations in Rent Rate -10- z Portfolio Map (as at end of Jul’13) -32- z Internal Growth -11- z Portfolio List -33- 4. Growth Strategies z Appraisal Value -35- z Overview of Growth Strategies -13- z Occupancy and Rent Rates -37- z RoFR through Anonymous Partnership Equity z Overview of Portfolio -38- Interests -14- z Status of Interest-bearing Debt (as at end of Jul’13) z Sponsor Pipeline -15- -40- z Acquisitions during 7th Period -16- z Unitholders (as at end of Jul’13) -41- z Portfolio Summary -17- z Historical Unit Price -42- z External Growth -18- z Household Statistics in Tokyo Area -43- z Financial Strategy -19- z Governance -44- z Overview of CRR -45- 5. 7th Period Performance Forecast z Overview of Asset Management Company -46- z 7th Period Forecast of Financial Results -23- 2 1. IPO Highlights 3 Public Listing of COMFORIA RESIDETIAL REIT, Inc (“CRR”) Conducting asset management specialized in residential properties while focusing on earnings stability and growth IPOIPO -

Ramen Flavor of Japan, Skills of Japan

Favorite Dining Experiences of the Ordinary Japanese Izakaya & Ramen zakaya is a kind of bar / restaurant that serves drinks together with a diverse menu of dishes, ranging from simple to elaborate. Many izakaya have special techniques and features, like fish tanks for keeping live fish, counters where you can sit and watch the food being prepared, or special presentation methods like serving dishes on big rice spoons. The origin of izakaya dates back to the start of the 8th century, when they appear in anecdotes and songs in the Kojiki (A Record of Ancient Matters). They developed in earnest in the Edo era (1603~1868). Liquor shops that sold measures of alcoholic drinks changed to allow drinking on the premises, and eventually started serving simple snacks. The act of drinking on the premises was called “izake”, which means literally “drinking while remaining”, so a liquor shop (sakaya) providing that service came to be called an “izakaya”. Some such amen is another popular favorite. The roots of establishments remain, in the form of standup drinking ramen go back to Chinese noodle cuisine. In counters connected to liquor stores, which serve as social the Meiji era (1868-1912) Chinese restaurants centers for local people. opened in the Chinatown districts that sprang up around the ports that had newly opened to the world, By the 1970s, the image of izakaya was a place where and they spread to districts all around the country in the male company employees would go in groups of two Taisho era (1912-1926). Developing into unique forms or three, to drink nihonshu (sake) together. -

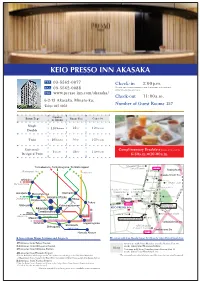

00A.M. Number of Guest Rooms

TEL 03-5562-0077 Check-in 3:00 p.m. FAX We may cancel your reservation, if you do not arrive at the indicated 03-5562-0088 arrival time without any notice. URL www.presso-inn.com/akasaka/ Check-out 11:00 a.m. 6-2-13 Akasaka, Minato-ku, 157 Tokyo 107-0052 Number of Guest Rooms Number Room Type Capacity of Rooms Room Size Single 146 Rooms 12m2 1-2 Persons Double Twin 10 Rooms 16m2 1-2 Persons Universal- (Example pictured above) 1 Room 24m2 1-3Persons Complimentary Breakfast Designed Twin 6:30a.m. 10:00a.m. Akasaka Fudo-son● To Ikebukuro To Komagome To Nishi-nippori Itokuji Temple Exit 10 Nagatacho Sta. JR Yamanote Line Bic Camera● Ginza Line Akasaka-mitsuke Sta. Mitsubishi UFJ● Shinjuku ● Seven-Eleven ●Prudential Tower Marunouchi Line Hitotsugi Dori Mitsui Marunouchi Line Akasaka ACT Theater FamilyMart Sumitomo Akasaka BLITZ Akasaka Sacas Harajuku Otemachi ● Meiji-jingumae ● ● Akasaka Biz TULLY’S ●Hie Shrine Akasaka-mitsuke Namboku Line Chiyoda Line Hibiya Akasaka Tower ●COFFEE Ginza Line Omote-sando Sta. Tokyo Chiyoda ●FamilyMart Exit 5b Line Shibuya Kokkai-gijidomae Sanno-shita Sotobori Dori (Hie Shrine Entrance) Akasaka Post Office Tameike-sanno Ebisu Hikawa Park● ●Sanno Park Tower Hibiya Line Namboku Line Ginza Meguro ●Koban Toei Asakusa Line Akasaka 2-chome Koban-mae Kokkaigijido-mae Sta. Gotanda Higashi-ginza Shimbashi Shinagawa ORIX Akasaka Keikyu Line 2-chome Building● Tameike-sanno Sta. Haneda Airport Exit 11 Access from Major Stations and Airports 1-minute walk from Akasaka Station Exit 5b on the Tokyo Metro Chiyoda Line 19 minutes from Tokyo Station 10-minute walk from Akasaka-mitsuke Station Exit 10 minutes from Shinagawa Station on the Ginza Line/Marunouchi Line 24 Metro 19 minutes from Shinjuku Station 7-minute walk from Tameike-sanno Station Exit 11 on the Ginza Line/Namboku Line 40 minutes from Haneda Airport (Take the Keikyu Line which merges into the Toei Asakusa Line and change to the Tokyo Metro Hibiya Line *e estimated time indicated above may dier from the time actually required. -

7 R N \ R * U H D W * D U G H Q &Dpsdljq 7 R N \ R * U H D W

Become acquainted with the philosophy of Asakura 7RN\R Former Asakura FumioFumio Garden (Asakura Museum of Sculpture, Taito) *UHDW 7-18-10 Yanaka, Taito-ku 103-3821-4549 National - designated Place of Scenic Beauty "Former Asakura Fumio Garden" Asakura Sculpture Museum is the building that was a studio and residence of Fumio Asakura (1883 ~1964) a leading sculptor of modern Japan. Asakura designed and supervised the building which was completed in 1935. Asakura died in 1964, but the building was opened to the public as a Asakura Sculpture Museum since 1967 by the family of the deceased (transferred to Taito-ku in 1986), in 2001 the building is registered in the tangible cultural heritage of the country. In 2008 the *DUGHQ integration of architecture and gardens were admitted for their value and artistic appreciation and the entire site has been designated as a national scenic spot as "The former gardens of Fumio Asakura". Since 2009 to 2013 was carried out conservation and restoration works on a large scale and appearance could be restored even when Asakura was alive. Admission General 500 yen (300 yen). Elementary, middle and high school students 250 yen (150 yen) *( ) inside is a group rate of more than 20 people $XWXPQ *Persons holding the Handicapped person's passbook or a Certificate Issued for Specific Disease Treatment and their caregivers is free Yearly Passport: 1,000 yen (same price for all visitors) Open 9:30 - 16:30 (Admission until 16:00) Closed Mondays and Thursdays Open on holidays and Closed on the day following a holidays Year-end and New Year holidays *During changing exhibitions, etc. -

Location Quality Safety Service

COMFORIA RESIDENTIAL REIT, INC ~Investor Presentation~ Location 9th Fiscal Period (ended January 2015) April 2015 Quality Safety Service Table of Contents 1. 9th Fiscal Period Highlights 6. Appendix Financial Highlights - 4 – P&L: 9th Period -24- Portfolio Highlights - 5 - Balance Sheet: 9th Period -25- 2. 9th Fiscal Period Results 8th ~ 10th Period Performance Forecast -26- Financial Results for the 9th Fiscal Period - 7 - Effective Utilization of TOKYU FUDOSAN HOLDINGS Stable Occupancy Rate - 8 - Group -27- Fluctuations in Rent Rate - 9 - “COMFORIA” Series -28- Property Management Initiatives -10- “COMFORIA” Series Representative Properties -29- External Growth -11- Portfolio Policy -30- Financial Profile -12- # of Household in Tokyo -31- 3. Offering Highlights # of Housing Starts and Net Migration of Tokyo Offering Summary -14- 23 Ward Assets -32- Offering Results -15- Portfolio Map (as at April 1, 2015) -33- 4. Future Strategy Portfolio List -34- Appraisal Value -38- External Growth Targets -17- Occupancy and Rent Rates -42- DPU Level Enhancement from External Growth -18- Overview of Portfolio (as at 9th FP end) -43- Market Recognition and Growth Strategy -19- Status of Interest-bearing Debt (as at 9th FP end) -45- Continuous External Growth by sponsor support -20- Unitholders (as at 9th FP end) -46- 5. Performance Forecast Historical Unit Price and Trading -47- Performance Forecast -22- Expansion of Retail Investor Base -48- Governance -49- Overview of CRR -50- Overview of Asset Management Company -

Tokyo Great Garden Spring Campaign

Experience the Beauty of Tokyo's Japanese Gardens Tokyo Great Garden Spring Campaign Campaign Period 2019/3/16(Saturday)~4/14(Sunday) 7RN\R ~ What is Tokyo Great Garden Spring Campaign? ~ *UHDW The aim of this campaign is to show the attractiveness of Tokyo Japanese gardens. Also, taking advantage of the period of cherry blossoms, *DUGHQ parks and gardens have prepared special events. This campaing is sposored by "Tokyo Japanese Garden Hospitality Comitee". Taking the opportunity 6SULQJ of holding Tokyo 2020 Olympic and Paralympic Games, the comittee provides information about Japanese gardens in Tokyo. &DPSDLJQ ~Major Events~ Campaign Period 2019/3/16(Saturday) ○Light up ~4/14(Sunday) Rikugien Gardens (March 21 ‒ April 3), Tokyo National Museum (March 22, 23, 29, 30), Happo-en ○Recital, concert Kyu-Shiba-rikyu Gardens (3/24), Kyu-Iwasa- ki-tei Gardens (March 9, 10), Toshima City Mejiro Garden (March 29), Yamamoto-tei (March 2, 3, 10, 17, 23, 24, 30, 31) ○Garden guide Hama-rikyu Gardens, Kyu-Shiba-rikyu Gardens, Koishikawa Korakuen Gardens, Rikugien Gardens, Kyu-Iwasaki-tei Gardens, Mukoji- ma-Hyakkaen Gardens, Kiyosumi Gardens, Kyu- Furukawa Gardens, Tonogayato Gardens (For the day of the event see the event section of each garden) ○Special exhibition Tokyo Metropolitan Teien Art Museum (Janu- Published February 2019 ary 26 ‒ April 7), Nezu Museum (March 31, April 13 ‒ May 12) If you present this brochure at "the marked garden," you will receive a limited time service! Hama Palace where sea breeze blows Japanese Garden as a reminder -

Programme Helicity Thinkshop 3

Programme Helicity Thinkshop 3 at Institute of Industrial Science (IIS), University of Tokyo 19-24 November 2017 Programme Sunday, 19 - Monday 20 November Sunday, 19 November 2017 Reception 1800-2100 Reception at Room An301-302 at Institute of Industrial Science (IIS), University of Tokyo http://www.iis.u-tokyo.ac.jp/en/access/ Monday, 20 November 2017 Helicity fundamentals 0950-1000 Opening Session 1-1 (Chair: Manolis Georgoulis) 1000-1030 Absolute measures of helicity Mitchell Berger University of Exeter 1030-1100 Magnetic helicity as a predictor of the solar cycle Gareth Hawkes and Mitchell Berger University of Exeter 1100-1130 Quadratic helicity in MHD Peter Akhmet'ev [1] and Simon Candelaresi [2] [1] IZMIRAN, Russian Academy of Sciences, [2] University of Dundee 1130-1255 Lunch Break 1255-1300 Director General of IIS Session 1-2 (Chair: Mitchell Berger) 1300-1330 Field line helicity as a tool for coronal physics Anthony Yeates [1], Gunnar Hornig [2], and M. H. Page [1] Durham University, [2] University of Dundee P-1 Programme Monday 20 November 1330-1400 Measuring changing field connectivity of interacting flux ropes Christopher Prior and Anthony Yeates Durham University 1400-1430 Topology conserving magnetic field evolution Simon Candelaresi [1], David Pontin [1], Gunnar Hornig [1], Christopher Berg-Smiet, and Dirk Bouwmeester [1] University of Dundee 1430-1500 Tea Break Session 1-3 (Chair: Nobumitsu Yokoi) 1500-1530 Dynamo theory and Wolf number prediction Nathan Kleeorin Ben-Gurion University of the Negev 1530-1600 Inverse cascades