Rethinking Forward and Spot Exchange Rates in Internationsal Trading

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Arbitrage-Free Affine Models of the Forward Price of Foreign Currency

Federal Reserve Bank of New York Staff Reports Arbitrage-Free Affine Models of the Forward Price of Foreign Currency J. Benson Durham Staff Report No. 665 February 2014 Revised April 2015 This paper presents preliminary findings and is being distributed to economists and other interested readers solely to stimulate discussion and elicit comments. The views expressed in this paper are those of the author and are not necessarily reflective of views at the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author. Arbitrage-Free Affine Models of the Forward Price of Foreign Currency J. Benson Durham Federal Reserve Bank of New York Staff Reports, no. 665 February 2014; revised April 2015 JEL classification: G10, G12, G15 Abstract Common affine term structure models (ATSMs) suggest that bond yields include both expected short rates and term premiums, in violation of the strictest forms of the expectations hypothesis (EH). Similarly, forward foreign exchange contracts likely include not only expected depreciation but also a sizeable premium, which similarly contradicts pure interest rate parity (IRP) and complicates inferences about anticipated returns on foreign currency exposure. Closely following the underlying logic of ubiquitous term structure models in parallel, and rather than the usual econometric approach, this study derives arbitrage-free affine forward currency models (AFCMs) with closed-form expressions for both unobservable variables. Model calibration to eleven forward U.S. dollar currency pair term structures, and notably without any information from corresponding term structures, from the mid-to-late 1990s through early 2015 fits the data closely and suggests that the premium is indeed nonzero and variable, but not to the degree implied by previous econometric studies. -

Relevant Market/ Region Commercial Transaction Rates

Last Updated: 31, May 2021 You can find details about changes to our rates and fees and when they will apply on our Policy Updates Page. You can also view these changes by clicking ‘Legal’ at the bottom of any web-page and then selecting ‘Policy Updates’. Domestic: A transaction occurring when both the sender and receiver are registered with or identified by PayPal as residents of the same market. International: A transaction occurring when the sender and receiver are registered with or identified by PayPal as residents of different markets. Certain markets are grouped together when calculating international transaction rates. For a listing of our groupings, please access our Market/Region Grouping Table. Market Code Table: We may refer to two-letter market codes throughout our fee pages. For a complete listing of PayPal market codes, please access our Market Code Table. Relevant Market/ Region Rates published below apply to PayPal accounts of residents of the following market/region: Market/Region list Taiwan (TW) Commercial Transaction Rates When you buy or sell goods or services, make any other commercial type of transaction, send or receive a charity donation or receive a payment when you “request money” using PayPal, we call that a “commercial transaction”. Receiving international transactions Where sender’s market/region is Rate Outside of Taiwan (TW) Commercial Transactions 4.40% + fixed fee Fixed fee for commercial transactions (based on currency received) Currency Fee Australian dollar 0.30 AUD Brazilian real 0.60 BRL Canadian -

Relevant Market/ Region Commercial Transaction Rates

Last Updated: 31, May 2021 You can find details about changes to our rates and fees and when they will apply on our Policy Updates Page. You can also view these changes by clicking ‘Legal’ at the bottom of any web-page and then selecting ‘Policy Updates’. Domestic: A transaction occurring when both the sender and receiver are registered with or identified by PayPal as residents of the same market. International: A transaction occurring when the sender and receiver are registered with or identified by PayPal as residents of different markets. Certain markets are grouped together when calculating international transaction rates. For a listing of our groupings, please access our Market/Region Grouping Table. Market Code Table: We may refer to two-letter market codes throughout our fee pages. For a complete listing of PayPal market codes, please access our Market Code Table. Relevant Market/ Region Rates published below apply to PayPal accounts of residents of the following market/region: Market/Region list Vietnam (VN) Commercial Transaction Rates When you buy or sell goods or services, make any other commercial type of transaction, send or receive a charity donation or receive a payment when you “request money” using PayPal, we call that a “commercial transaction”. Receiving international transactions Where sender’s market/region is Rate Outside of Vietnam (VN) Commercial Transactions 4.40% + fixed fee Fixed fee for commercial transactions (based on currency received) Currency Fee Australian dollar 0.30 AUD Brazilian real 0.60 BRL Canadian dollar -

Sada Reddy: Fiji's Economic Situation

Sada Reddy: Fiji’s economic situation Talk by Mr Sada Reddy, Governor of the Reserve Bank of Fiji, to the Ministry of Information, Communications and Archives, Suva, 22 April 2009. * * * I’m very humbled that I had been appointed the Governor of the RBF. I have taken this responsibility at a time when the whole world is going through very difficult times. And, of course, as you know we have our own economic problems here. There are a lot of challenges ahead of us but I am very confident that with my appointment I’ll be able to make a big difference in the recovery of the Fiji economy. I realize the big challenges lying ahead. But given my long experience in this organization running RB is not going to be difficult for me. I’ve worked in the RBF for last 34 yrs in all the important policy areas and have been the Deputy Governor for the last 14 years so. It’s the policy choices that I have to make would be the challenge. I need the cooperation of the Government, of the financial system, in particular, the banks, and the business community to make our policies successful. In the next few months I’ll be actively engaging all the key players and explain our policies and what we need to do so that we are able to somehow buffer ourselves from what’s happening around the world. I think we underestimated the impact of the global crisis on the Fiji economy. It is having a very major impact. -

![Arxiv:2101.09738V2 [Q-Fin.GN] 21 Jul 2021](https://docslib.b-cdn.net/cover/9896/arxiv-2101-09738v2-q-fin-gn-21-jul-2021-829896.webp)

Arxiv:2101.09738V2 [Q-Fin.GN] 21 Jul 2021

Currency Network Risk Mykola Babiak* Jozef Baruník** Lancaster University Management School Charles University First draft: December 2020 This draft: July 22, 2021 Abstract This paper identifies new currency risk stemming from a network of idiosyncratic option-based currency volatilities and shows how such network risk is priced in the cross-section of currency returns. A portfolio that buys net-receivers and sells net- transmitters of short-term linkages between currency volatilities generates a significant Sharpe ratio. The network strategy formed on causal connections is uncorrelated with popular benchmarks and generates a significant alpha, while network returns formed on aggregate connections, which are driven by a strong correlation component, are partially subsumed by standard factors. Long-term linkages are priced less, indicating a downward-sloping term structure of network risk. Keywords: Foreign exchange rate, network risk, idiosyncratic volatility, currency predictability, term structure JEL: G12, G15, F31 arXiv:2101.09738v2 [q-fin.GN] 21 Jul 2021 *Department of Accounting & Finance, Lancaster University Management School, LA1 4YX, UK, E-mail: [email protected]. **Institute of Economic Studies, Charles University, Opletalova 26, 110 00, Prague, CR and Institute of Information Theory and Automation, Academy of Sciences of the Czech Republic, Pod Vodarenskou Vezi 4, 18200, Prague, Czech Republic, E-mail: [email protected]. 1 1 Introduction Volatility has played a central role in economics and finance. In currency markets, a global volatility risk has been proposed by prior literature as a key driver of carry trade returns. While the global volatility risk factor is intuitively appealing, there is little evi- dence on how idiosyncratic currency volatilities relate to each other. -

Country Scheme Alpha 3 Alpha 2 Currency Albania MC / VI ALB AL

Country Scheme Alpha 3 Alpha 2 Currency Albania MC / VI ALB AL Lek Algeria MC / VI DZA DZ Algerian dinar Argentina MC / VI ARG AR Argentine peso Australia MC / VI AUS AU Australian dollar -Christmas Is. -Cocos (Keeling) Is. -Heard and McDonald Is. -Kiribati -Nauru -Norfolk Is. -Tuvalu Christmas Island MC CXR CX Australian dollar Cocos (Keeling) Islands MC CCK CC Australian dollar Heard and McDonald Islands MC HMD HM Australian dollar Kiribati MC KIR KI Australian dollar Nauru MC NRU NR Australian dollar Norfolk Island MC NFK NF Australian dollar Tuvalu MC TUV TV Australian dollar Bahamas MC / VI BHS BS Bahamian dollar Bahrain MC / VI BHR BH Bahraini dinar Bangladesh MC / VI BGD BD Taka Armenia VI ARM AM Armenian Dram Barbados MC / VI BRB BB Barbados dollar Bermuda MC / VI BMU BM Bermudian dollar Bolivia, MC / VI BOL BO Boliviano Plurinational State of Botswana MC / VI BWA BW Pula Belize MC / VI BLZ BZ Belize dollar Solomon Islands MC / VI SLB SB Solomon Islands dollar Brunei Darussalam MC / VI BRN BN Brunei dollar Myanmar MC / VI MMR MM Myanmar kyat (effective 1 November 2012) Burundi MC / VI BDI BI Burundi franc Cambodia MC / VI KHM KH Riel Canada MC / VI CAN CA Canadian dollar Cape Verde MC / VI CPV CV Cape Verde escudo Cayman Islands MC / VI CYM KY Cayman Islands dollar Sri Lanka MC / VI LKA LK Sri Lanka rupee Chile MC / VI CHL CL Chilean peso China VI CHN CN Colombia MC / VI COL CO Colombian peso Comoros MC / VI COM KM Comoro franc Costa Rica MC / VI CRI CR Costa Rican colony Croatia MC / VI HRV HR Kuna Cuba VI Czech Republic MC / VI CZE CZ Koruna Denmark MC / VI DNK DK Danish krone Faeroe Is. -

Foreign Exchange Training Manual

CONFIDENTIAL TREATMENT REQUESTED BY BARCLAYS SOURCE: LEHMAN LIVE LEHMAN BROTHERS FOREIGN EXCHANGE TRAINING MANUAL Confidential Treatment Requested By Lehman Brothers Holdings, Inc. LBEX-LL 3356480 CONFIDENTIAL TREATMENT REQUESTED BY BARCLAYS SOURCE: LEHMAN LIVE TABLE OF CONTENTS CONTENTS ....................................................................................................................................... PAGE FOREIGN EXCHANGE SPOT: INTRODUCTION ...................................................................... 1 FXSPOT: AN INTRODUCTION TO FOREIGN EXCHANGE SPOT TRANSACTIONS ........... 2 INTRODUCTION ...................................................................................................................... 2 WJ-IAT IS AN OUTRIGHT? ..................................................................................................... 3 VALUE DATES ........................................................................................................................... 4 CREDIT AND SETTLEMENT RISKS .................................................................................. 6 EXCHANGE RATE QUOTATION TERMS ...................................................................... 7 RECIPROCAL QUOTATION TERMS (RATES) ............................................................. 10 EXCHANGE RATE MOVEMENTS ................................................................................... 11 SHORTCUT ............................................................................................................................... -

Currency Exchange Rates

Pacific Data Hub .Stat metadata Currency exchange rates Data description Title Currency exchange rates Description Number of U.S. Dollars per of domestic currency unit for currencies used in Pacific Island Countries and Territories. Monthly and yearly values for end-of-period and period-average exchange rates since 1950 are based on data from IMF International Financial Statistics. Data identification Identifier SPC:DF_CURRENCIES(2.0) URL https://stats.pacificdata.org/vis?locale=en&facet=6nQpoAP&constraints[0]=6nQpoAP%2C0%7CEconomy%23ECO%23&start=0 &dataflow[datasourceId]=SPC2&dataflow[dataflowId]=DF_CURRENCIES&dataflow[agencyId]=SPC&dataflow[version]=2.0 Data source Monthly and yearly currency exchange rates are collected from IMF International Financial Statistics, using the SDMX API. Exchange rates are domestic currency per U.S. Dollar for currencies used by Pacific Island Countries and Territories : Australian Dollar, CFP Franc, Fiji Dollar, Kina, New Zealand Dollar, Pa’anga, Solomon Islands Dollar, Tala and Vatu. End of period rates and period average rates are collected. The call to IMF API used to collect the data is : http://dataservices.imf.org/REST/SDMX_XML.svc/CompactData/IFS/A+M.FJ+NC+PG+SB+TO+VU+WS+AU+NZ.ENDA_XDC_USD_RATE+ENDE_XD C_USD_RATE?startPeriod=1950&endPeriod=2050 Data processing Data values are rounded to 4 decimal places. Quarterly values are calculated from monthly values: end of perdiod value of the last month of the quarter is used for end of period rate, average of average monthly rates is used for period average rate. Reference area ISO3166-1 alpha 2 codes are recoded to ISO 4217 currency codes this way : Temporal coverage First period 1950 Last period Current month-1 Data scheduling Frequency Monthly and yearly Timeliness Data is refreshed at the beginning of each month, timeliness of data for individual currencies has not been assessed. -

Understanding Currency Hedging

Understanding currency hedging At Kiwi Wealth, we use currency hedging to reduce the risk to returns that can arise from the change in value of one currency against another. Being exposed to volatile movements in foreign currencies adds another element of risk to our portfolios and to manage the risk we use a technique called currency hedging. What is currency hedging? The best way to understand hedging is to think of it as reducing or removing a particular risk. In the case of currency hedging, the risk is that if a currency changes in value it can adversely affect the returns on a portfolio. There are different instruments that a Manager can use to help manage this risk. One such instrument is a forward currency contract, in which the managers locks in the future value of a currency to the current rate of exchange. Currency hedging has also given an additional return thanks to New Zealand’s interest rates, which are higher than most offshore rates. Kiwi Wealth portfolios are invested globally, which means their returns in New Zealand dollars are exposed to movements in the exchange rate. In other words, the returns on overseas investments are muted by a rising Kiwi dollar. Alternatively – and more positively - the gains on overseas investments can be strengthened by a falling New Zealand dollar. To partially protect against a rising New Zealand dollar, we hedge a proportion of portfolios to reduce exposure to the currency risk. How does currency hedging work at Kiwi Wealth? Kiwi Wealth fully hedges our NZ Fixed Interest strategy (including the Kiwi Wealth Fixed Interest PIE) so this portfolio is immune from movements in foreign currencies. -

International Currency Codes

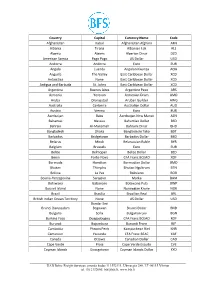

Country Capital Currency Name Code Afghanistan Kabul Afghanistan Afghani AFN Albania Tirana Albanian Lek ALL Algeria Algiers Algerian Dinar DZD American Samoa Pago Pago US Dollar USD Andorra Andorra Euro EUR Angola Luanda Angolan Kwanza AOA Anguilla The Valley East Caribbean Dollar XCD Antarctica None East Caribbean Dollar XCD Antigua and Barbuda St. Johns East Caribbean Dollar XCD Argentina Buenos Aires Argentine Peso ARS Armenia Yerevan Armenian Dram AMD Aruba Oranjestad Aruban Guilder AWG Australia Canberra Australian Dollar AUD Austria Vienna Euro EUR Azerbaijan Baku Azerbaijan New Manat AZN Bahamas Nassau Bahamian Dollar BSD Bahrain Al-Manamah Bahraini Dinar BHD Bangladesh Dhaka Bangladeshi Taka BDT Barbados Bridgetown Barbados Dollar BBD Belarus Minsk Belarussian Ruble BYR Belgium Brussels Euro EUR Belize Belmopan Belize Dollar BZD Benin Porto-Novo CFA Franc BCEAO XOF Bermuda Hamilton Bermudian Dollar BMD Bhutan Thimphu Bhutan Ngultrum BTN Bolivia La Paz Boliviano BOB Bosnia-Herzegovina Sarajevo Marka BAM Botswana Gaborone Botswana Pula BWP Bouvet Island None Norwegian Krone NOK Brazil Brasilia Brazilian Real BRL British Indian Ocean Territory None US Dollar USD Bandar Seri Brunei Darussalam Begawan Brunei Dollar BND Bulgaria Sofia Bulgarian Lev BGN Burkina Faso Ouagadougou CFA Franc BCEAO XOF Burundi Bujumbura Burundi Franc BIF Cambodia Phnom Penh Kampuchean Riel KHR Cameroon Yaounde CFA Franc BEAC XAF Canada Ottawa Canadian Dollar CAD Cape Verde Praia Cape Verde Escudo CVE Cayman Islands Georgetown Cayman Islands Dollar KYD _____________________________________________________________________________________________ -

New Zealand Dollar Report

New Zealand Dollar Report Report by PwC Treasury Advisory 9 February 2021 Table of contents NZD/USD forecast and generic hedging recommendations 3 NZD/USD remains within range as data continues to print strongly 4 Key drivers of the NZD/USD exchange rate outlook 6 Get in touch 7 pwc.co.nz/services/treasury-and-debt-advisory 9 February 2021 PwC 2 NZD/USD forecast and generic hedging recommendations Spot rate: 0.7165 Exporter hedging recommendations: ● 0 - 12 month = Use existing hedging. Ensure midpoints are maintained with orders between 0.7100 and 0.7010, with staggered orders to 0.6930 in order to be near maximums. Clients contact us for specific recommendations. ● ● 12 - 24 month (non-filter test activated) = Target moves back below 0.7000 in order to layer in new hedging. Preference for collar options for any new hedging at this time. Clients contact us for specific recommendations. ● ● 12+ months (filter test activated) = 2-year filter test activation requires spot rate of 0.6016. 3-year filter test activation requires spot rate of 0.6005. Core NZD/USD exchange rate views Importer hedging recommendations: ● Global support factors for the NZD (through equity markets, EUR/USD, AUD/USD) ● 0 - 6 month payments = Maintain maximums of policy above 0.7150. continuing to provide upward pressure on the exchange rate (EUR through gradual ● fiscal integration, AUD via strong commodities and RBA settings, equities through ● 6 - 12 month payments = Should be well hedged. Replenishing recently post-vaccine upward swing and rotation). Equity market pricing extremely optimistic, so struck orders between 0.7200 and 0.7300 to be halfway between slower acceleration expected in 2021, tempering the extent of NZD strength. -

Financial Stability Effects of Foreign-Exchange Risk Migration

Financial Stability Effects of Foreign-Exchange Risk Migration∗ Puriya Abbassi Falk Br¨auning Deutsche Bundesbank Federal Reserve Bank of Boston November 7, 2019 Abstract Firms trade derivatives with banks to mitigate the adverse impact of exchange-rate fluctuations. We study how the related migration of foreign exchange (FX) risk is managed by banks and affects both credit supply and real economic variables. For iden- tification, we exploit the Brexit referendum in June 2016 as a quasi-natural experiment in combination with detailed micro-level FX derivatives data and the credit register in Germany. We show that, prior to the referendum, the corporate sector substantially increased the usage of derivatives, and banks on the other side of the trade did not fully intermediate that FX risk, but retained a large proportion of it in their own books. As a result, the depreciation of the British pound in the aftermath of the referendum poses a shock to the capital base of affected banks. We show that loss-facing banks in response cut back credit to firms, including to those without FX exposure to begin with. These results are stronger for less capitalized banks. Firms with ex-ante exposure to loss-facing banks experience a 32 percent larger reduction in credit than industry peers, and a stronger reduction in cash holdings and investment of about 8 and 2 percent, respectively. Our results show how a bank's uninsured derivatives book can take one corporation's FX risk and turn it into another corporation's financing risk. Keywords: Foreign Exchange Risk, Financial Intermediation, Risk Migration, Finan- cial Stability JEL Classification: D53, D61, F31, G15, G21, G32 ∗We thank participants at the Boston Macro-Finance Junior Meeting and the Federal Reserve System Banking Conference.