Bangalore 2019 April-June

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Prabhavathi Elegant

https://www.propertywala.com/prabhavathi-elegant-bangalore Prabhavathi Elegant - Whitefield, Bangalore Apartment for sale in White field 1, 2, 3 BHK near ashram road Prabhavathi Elegant is luxurious project of Prabhavathi Developers, offering you 1/2/3 BHK Residential apartments and located at Whitefield, Bangalore. Project ID : J781190017 Builder: Prabhavathi Properties: Apartments / Flats, Independent Houses Location: Prabhavathi Elegant,Kadugodi, Whitefield, Bangalore - 560037 (Karnataka) Completion Date: Jan, 2015 Status: Started Description Prabhavathi Elegant is available on peaceful, posh, and pollution free surrounding of Whitefield, Bangalore. It offers you 1/2/3 BHK Residential apartments with all aspect modern amenities features like well-equipped gym, covered car parking, automatic lift, swimming pool etc. The project having 60% of the total land as open space, this open space will provide you fresher air to the residents. Many significant area and prime location is very close to from the project where you can easily access the city for your daily needs. Type - 1/2/3 BHK Apartments Sizes - 970 - 1200 Sq. Ft. Price - On Request Amenities Automatic Lift Swimming Pool Party Hall Covered Car Parking Well Equipped Gym Prabhavathi Builders and Developers Pvt. Ltd. made its debut in 2007 under the leadership of Mr. BE Praveen Kumar, who is founder of Managing director. I have proud in announcing that we are today one of the fastest growing realtors in Bangalore with our primary focused being on Residential apartments. We have been credited with over 25 completed projects in Bangalore, Prabhavathi Bliss I, Prabhavathi Plasma, Prabhavathi Rishab, Prabhavathi Woods, Prabhavathi Meridian are a few names which are now given possession to its buyer. -

Behrouz Biryani

Online Offer – Behrouz Biryani: • G 42, Shree Mahalaxmi Shops, Rudra Square, Bodakdev, Ahmedabad • 25, Rivera Arcade, Near Prahlad Nagar Garden, Prahlad Nagar, Ahmedabad • 2, IM Complex, Vastrapur Lake, Vastrapur, Ahmedabad • G/F 1, Animesh Complex, Panchavati Ellis Bridge, Near Chandra Colony, C G Road, Ahmedabad • 14, Ground Floor, Vitthal the Mall, Near Swagat Status, Chandkheda • C-19-20 Swagat Rainforest 2, Village Kudasan, Ta and District, Airport Gandhinagar Highway, Gandhinagar, Ahmedabad • 7th Cross Road, 8th Main, BTM Layout, Bangalore • Near Sony World Signal, Koramangala 6th Block, Bangalore • Kodichikkanahalli Main Road, Begur Hobli, Bommanahalli, Bangalore • Ground Floor, Actove Hotel, Kadubisanahalli, Marathahalli, Bangalore • Food Court, Sjr I-Park, Built In, Whitefield, Bangalore • Old Airport Road, Old Airport Road, Bangalore • Devatha Plaza, Residency Road, Bangalore • 123, Kamala Complex, AECS Layout, ITPL Main Road, Whitefield, Bangalore • 2318, Sector 1, Near NIFT College, HSR Layout, Bangalore • Kaggadaspura, CV Raman Nagar, Bangalore • Shop A-94 6/2, Opposite State Bank of India, 2nd Phase, J P Nagar, Bangalore • 101, Ground Floor, Manjunatha Complec, 22nd Main Road, 2nd Stage, Banashankari, Bangalore • Site No 8, New No 1, Channasandra, Property No 121, 2nd Main Road, Kr Puram Hobli, Kasturi Nagar, Bangalore • Shop 10-11, Electronic City Phase-1, 2nd Cross Road, Near Infosys Gate 1, Bangalore • 2283, 1st Main Road, Sahakar Nagar D Block, Bangalore • 3, 1st Floor, Apple City, Kadugodi Hoskote, Main Road, Seegehalli, Bangalore • Shop No. 837, BEML 3rd Stage, Halagevaderahalli, Rajarajeshwari Nagar, Bangalore • Dodaballapur Main Road, Puttenahalli, Yelahanka, Bangalore • Colony Skylineapartment, Canara Bank, Chandra Layout, Bangalore • Shop No. 90, First Floor, Sanjay Nagar Main Road, Geddalahalli, Bangalore • 6, First Floor, 9 Cross, 2nd Main, Binnamangala, 1st Stage, Indiranagar, Bangalore • Shop No. -

List of Affiliated Colleges College Slno College Address Town District Phone 01 Phone 02 Email Code 1 6001 Govt

List of affiliated Colleges College Slno College Address Town District Phone 01 Phone 02 email Code 1 6001 Govt. First Grade College for Boys Kolar - 563 101 Kolar Kolar 9448703610 08152-222014 2 6002 Govt. First Grade College for Women Kolar - 563 101 Kolar Kolar 9448310292 9448551944 3 6003 Govt. First Grade College Bangarpet - 563 114 Bangarpet Kolar 9739601069 4 6004 Govt. First Grade College Bangaru Tirupathi Bangaru Tirupathi Kolar 8277490804 08153-277088 5 6005 Govt. First Grade College Behind BEO Office, Robertsonpet, 3rd Cross, KGF - 563 122 K.G.F Kolar 7204783372 6 6006 Govt. First Grade College Malur - 563 130 Malur Kolar 9886152726 9448562961 7 6007 Govt. First Grade College Mulabagalu - 563 131 Mulbagal Kolar 9886668896 8 6008 Govt. First Grade College Mulabagalu - 563 131 Mulbagal Kolar 9886668896 [email protected] 9 6009 Govt. First Grade College Srinivasapura - 563 135 Srinivasapura Kolar 9663701201 08157-246804 10 6010 Govt. First Grade College Vemgal - 563 101 Vemagal Kolar 9886632427 08152 246499 Smt. Danamma Channabasavaiah College of Arts, Commerce, 11 6101 Opp. to SBI Bank, Kolar Main Road, Bangarpet Bangarpet Kolar 9141814905 9060777990 [email protected] Science & Management Studies K.G.F Main road, near food godown, S.G. Kote post, Bangarpet - 12 6102 Alpha Degree College Bangarpet Kolar 9900023325 563 162 13 6103 K.G.F Frist Grade College Oorgam, K.G.F. - 563 120 K.G.F Kolar 9449730978 9449730798 14 6104 Sri Baghawan Mahaveer Jain Degree College Geetha Road, Robertsonpet, KGF - 563 122 K.G.F Kolar -

Panel Advocate List – Bangalore Co

PANEL ADVOCATE LIST – BANGALORE CO SL No Name of the Advocate Address Contact No E mail id 1. 5Ananthamurthy K R 3/3, Near STD English School, Prashanthanagar, T Dasarahalli, Bengaluru – 560040, III Floor, Dr. Ismail Building, Sardar Patrappa Road, Bengaluru - 560002 2. 6Ananthamurthy T K Off : 159/2, Rangaswamy Temple 3386640 (R) Street, Balepet, Bengaluru – 560003 Res : 598, II Cross, 7th Main, Vijayanagar, Bengaluru - 560040 3. 7Ananthanarayana B N Res : 7/48, 4th Cross, Lingarajapuram, Bengaluru – 560084 Off : 3/8, Karnic Road, Shankarapuram, Bengaluru 4. 8Annapurna Bevinje No. 4, Kodagi Building, Gundopanth Street, (Behind City Market) Bengaluru 5. 1Arakeshwara T N 232, Kadri nivas, 68th Cross, 3353431 / 0 Rajajinagar 5th Block, Bengaluru – 9845126875 560010 6. 1Arun Ponnappa M 702, Silver Lake Terrace, 167, 5583063 1 Richmond Road, Bengaluru - 560025 7. 1C K Annice Res : No.22, Prateeksha Unity Lane, 5714828 (R) 2 9th Cross, Ejipura Vivekanagar, Bengaluru – 560047 5550967 (O) Off : No.35, Lubbay Masjid Road, Bengaluru - 560001 8. 1Ashok N Nayak 105, III Cross, Gandhinagar, 2267332 (O) 4 Bengaluru - 560009 5252909 (R) 9. 1N H Ananthanarasimha No. 19, 10th Main, 27th Cross, 6715453 5Shastri Banashankari II Stage, Bengaluru - 560070 10. 1Ashwathaiah B 15, (I Floor), Link Road, 6 Seshadripuram, Bengaluru - 560020 11. 1Ashwatharanayana K Off : 21/1, Vasavi Vhambers, No. 14, I 6700521, 7 Floor, Kanya Kalyana Mantapa, 9448258115 Lalbagh Fort Road, Near Minerva Circle, Bengaluru – 560004 Res : 1034, 12th A Cross, J P Nagar I Phase, Bengaluru - 560078 12. 1D Ashwathappa 101/226, 25th Cross, 6th Block, 6548552 8 Jayanagar, Bengaluru - 560082 13. 1Ashwin Haladi Off : No. -

BENGALURU PPN LIST of HOSPITALS S No HOSPITAL NAME ADDRESS CITY STATE PIN CODE

BENGALURU PPN LIST OF HOSPITALS S No HOSPITAL NAME ADDRESS CITY STATE PIN CODE 17 Dr. M.H. Mari Gowda Road(Hosur Road), Opp. Park Area Wilson 1 Abhaya Hospital Bengaluru Karnataka 560027 Garden Bangalore - 560027 2 Bangalore Hospital No.202. R.V. Road, South End Circle Jayanagar, Bangalore Bengaluru Karnataka 560004 44-45/2 2nd Cross, R R Mohan Roy Ext, Bengaluru, Bengaluru, 3 Healthcare Global Enterprises (HCG) Bengaluru Karnataka 560027 Karnataka, 560027 4 Chaitanya Hospital 80, P & T Colony, Rt Nagar, Bangalore-32 Bengaluru Karnataka 560032 #100 Bhimajyothi, Lic Colony, Woc Road, Basaveshawaranagar, 5 Chord Road Hospital Bengaluru Karnataka 560079 Bangalore 6 Citi Hospital 25/91 Chord Road 11 Block Rajajinagar Bangalore Bengaluru Karnataka 560010 7 Hcg Koramangala #88, 17th ”A” Main, 2nd Cross, 5th Block, Koramangala Bengaluru Karnataka 560095 Devi Super Speciality Eye Hospital Private #434, 18th Main, 80 Feet Road, 6th Block, Koramangala Bus Depot, 8 Bengaluru Karnataka 560095 Limited Koramangala. 9 D G Hospital No. 274/275, M.K. Puttalingaiah Road, Padmanabhanagar Bengaluru Karnataka 560070 10 Dr Zamindars Microsurgical Eye Centre # 1013, 3rd Cross, 1st Block, Hrbr Layout, Kalyan Nagar Bengaluru Karnataka 560033 11 Gayathri Hospital Pvt Ltd # 91 Magadi Chord Road Vijayanagar Bengaluru Karnataka 560040 12 Hosmat Hospital 45 Magrath Road Off Richmond Road Bangalore, Off Richmond Road Bengaluru Karnataka 560001 Karthik Netralaya Institute Of Ophthalmology Pvt 13 89 7th Cross, Nr Colony Ashok Nagar, Nr Colony, Ashok Nagar Bengaluru Karnataka 560050 Ltd Ramamurthy Nagar Extn, Raghavendra Nagar, Tambuchetty Palya 14 Koshys Hospital Bengaluru Karnataka 560016 Main Road M S Ramaiah Memorial Hospital, M.S.R. -

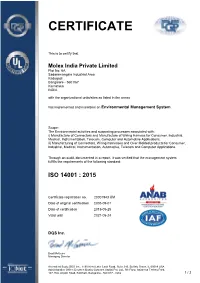

20001943 UM Date of Original Certification 2005-09-01 Date of Certification 2018-05-25 Valid Until 2021-05-24

CERTIFICATE This is to certify that Molex India Private Limited Plot No. 6A Sadaramangala Industrial Area Kadugodi Bangalore - 560 067 Karnataka INDIA with the organizational units/sites as listed in the annex has implemented and maintains an Environmental Management System. Scope: The Environmental activities and supporting processes associated with: i) Manufacture of Connectors and Manufacture of Wiring Harness for Consumer, Industrial, Medical, Instrumentation, Telecom, Computer and Automotive Applications. ii) Manufacturing of Connectors, Wiring harnesses and Over Molded products for Consumer, Industrial, Medical, Instrumentation, Automotive, Telecom and Computer Applications. Through an audit, documented in a report, it was verified that the management system fulfills the requirements of the following standard: ISO 14001 : 2015 Certificate registration no. 20001943 UM Date of original certification 2005-09-01 Date of certification 2018-05-25 Valid until 2021-05-24 DQS Inc. Brad McGuire Managing Director Accredited Body: DQS Inc., 1130 West Lake Cook Road, Suite 340, Buffalo Grove, IL 60089 USA Administrative Office: Deutsch Quality Systems (India) Pvt. Ltd., 5th Floor, Anjaneya Techno Park, 147, HAL Airport Road, Kodihalli, Bangalore - 560 017 - India 1 / 2 Annex to certificate Registration No. 20001943 UM Molex India Private Limited Plot No. 6A Sadaramangala Industrial Area Kadugodi Bangalore - 560 067 Karnataka INDIA Business Location Scope Relation # 20006122 Molex India Private Limited Assembly of Electronic Connectors Unit - 2, Plot # 2A2 and Wiring Harness. Devasandra Industrial Area Whitefield Main Road Mahadevapura Post Bangalore – 560 048 Karnataka INDIA 20001945 Molex (India) Private Limited The Environmental activities and C 7 & 8, G.I.D.C. Electronics Estate supporting processes associated with K- Road, Sector 25 the Manufacture of Consumer, Gandhinagar – 382 044 Industrial, Medical, Instrumentation, Gujarat Telecom, Computer and Automotive INDIA Connectors. -

311K Bus Time Schedule & Line Route

311K bus time schedule & line map 311K Shivajinagara Bus Station - Kadugodi Bapuji View In Website Mode circle The 311K bus line (Shivajinagara Bus Station - Kadugodi Bapuji circle) has 2 routes. For regular weekdays, their operation hours are: (1) Kadugodi Bapuji Circle: 6:40 AM - 9:45 PM (2) Shivajinagara Bus Station: 6:12 AM - 9:00 PM Use the Moovit App to ƒnd the closest 311K bus station near you and ƒnd out when is the next 311K bus arriving. Direction: Kadugodi Bapuji Circle 311K bus Time Schedule 47 stops Kadugodi Bapuji Circle Route Timetable: VIEW LINE SCHEDULE Sunday 6:40 AM - 9:45 PM Monday 6:40 AM - 9:45 PM Shivajinagara Bus Station Tuesday 6:40 AM - 9:45 PM Shivajinagara Bus Station Central Street, Bangalore Wednesday 6:40 AM - 9:45 PM B.M.T.C. Connactor Thursday 6:40 AM - 9:45 PM Hospital Road, Bangalore Friday 6:40 AM - 9:45 PM Maniksha Parade Ground Saturday 6:40 AM - 9:45 PM Manipal Centre Manipal Centre Dickenson Road, Bangalore 311K bus Info Direction: Kadugodi Bapuji Circle Begum Mahal Stops: 47 Trip Duration: 54 min Gurudwara Line Summary: Shivajinagara Bus Station, Shivajinagara Bus Station, B.M.T.C. Connactor, Philips Millenium Halsuru Maniksha Parade Ground, Manipal Centre, Manipal RMZ entrsnce, Bangalore Centre, Begum Mahal, Gurudwara, Philips Millenium Halsuru, Halasuru, Indiranagar Depot-6, Halasuru Indiranagara R.T.O. O∆ce, Binnamangala, Isolation Hospital, Swamy Vivekananda Metro Station, Indiranagar Depot-6 N.G.E.F. Main Road, N.G.E.F., Baiyappanahalli Metro Station, Cs-Ernst Young Bennigonahalli, Benniganahalli, Tin Factory, K.R.Puram Railway Indiranagara R.T.O. -

City Address1

City Address1 Deloitte, Campus Block-C, Divyashree Technopolis, Yamalur Post, HAL, Old Airport Road, BANGALORE Bangalore - 560 037 BANGALORE Infosys Ltd., 1st Main Road, M&C Building, Electronics City, Bangalore - 560 100 BANGALORE Infosys Ltd., Terminal Building, Infosys Campus, Electronics City, Bangalore - 560 100 MFAR Mall, Ground Floor, Embassy Manyata Park, SEZ Building, Opp. BEL Corporate Office, BANGALORE Outer Ring Road, Nagavara, Bangalore 560 045 SAP Labs India Private Limited, 138, Export Promotion Industrial Park, Whitefield, Bangalore BANGALORE 560 066 No.15/3 & 16/5, Salarpuria Hallmark, A Block, Kadubeesannahalli, Outer Ring Road, BANGALORE Marathahalli, Bangalore - 560 037 BANGALORE Kempegowda International Airport, Alpha 2 terminal, Devanahalli, Bangalore - 560 300 Infosys Ltd., Survey No.210, Manikonda Village, Lingampally, Rangareddy (dist), Hyderabad - HYDERABAD 500 032 ANZ Support Services India Pvt. Ltd, “Eucalyptus,” Ground Floor, Manyata Embassy Business BANGALORE Park, Bangalore - 560 045 BANGALORE Infosys Ltd, KEC FC Building, Electronics City, Bangalore 560100 Plot No. 25 and 23, Konappana Agrahara Village, Begur Hobli, Electronics City, Bengaluru, Bangalore Karnataka 560100 BANGALORE Infosys Ltd., 144, Building#8, Infosys Campus, Electronics City, Bangalore - 560 100 MYSORE Infosys Ltd, Arena Food Court, Plot No.350, Hebbal, Mysore - 570 027 HCL Technologies Ltd., Special Economic Zone (SEZ), 129, Jigani Industrial Area, Bommasandra- BANGALORE Jigani Link Road, Bangalore - 562 106 BANGALORE M.S. Ramaiah Hospital, -

Bangalore Branch 1 .Pdf

Id : 161162 Id : 10888 Id : 163066 Dr. Rachana C Dr. Sowmya Ramachandrachar Dr. Durga Akhila Rohith CH 3 Santara Magan Place Apt, A-121A, Shivpuri T Point Saguna Medical Center, Behind Maaruti Dental Collage New Vijjaynagar NTR Circle, Kammanahalli Ghaziabad - 201009 Dharmavaram Off Bannergatta Road Uttar Pradesh Anantapur - 515671 Bangalore - 080-26430022 09868055042 Andhra Pradesh Karnataka 9538905550 9886519792 Id : 85984 Id : 15717 Id : 10593 Dr. Saumitra Saravana Dr. M.R. Kasinath Dr. Suneetha Rao Stafford Dental Centre Kashis Dental Clinic # 565, 1st Floor No.315, Garrison Ville Road 21, Old Market Road 7th Main, HAL IInd Stage Stafford, Virginia V.V. Puram Bangalore - 560 008 Pin-521244 Bangalore - 560 004 Karnataka Karnataka 9844355701 Id : 10129 Id : 44281 Id : 2686 Dr. P B Cariappa Dr. Madan Nanjappa Dr. Nisha S. Hedge 11/1, Hayes Road 14, Palmgrove Road No. 309, Mukund Apartments Bangalore - 560 025 Austintown Palmgrove Road, Karnataka Bangalore - 560 047 Victoria Layout 9880364153 Karnataka Bangalore - 560 047 98450-35286 Karnataka 9886404342 Id : 10744 Id : 11009 Id : 44276 Dr. Nisha Mehta Dr. Vinay Krishnamurthy Rao Dr. Karthik Venkataraghavan Adarsh Dental Clinic B2-111, "KRISHNA", Sector - B, VI B Main Vibha Dental Care Centre 44, Kilari Road, B.V.K.Iyengar Rd. Cross Road, No.166, 22nd Cross Domlur Majestic Yelahanka Satellite Town 2nd Stage, Nr Kalki Temple Bangalore - 560 053 Bangalore - 560 064 Bangalore - 560 071 Karnataka Karnataka Karnataka 9341352044 9482229939 9845258974 Id : 10798 Id : 10110 Id : 10746 Dr. Jill Gnanamuthu Dr. B. Subhashchandra Shetty Dr. Manoj Christopher J. L-25, Sector - 14, Pete Channapa Indl. Estate H. H. Hospital Road No. -

319C Bus Time Schedule & Line Route

319C bus time schedule & line map 319C Kempegowda Bus Station - Kadugodi Bus View In Website Mode Station The 319C bus line (Kempegowda Bus Station - Kadugodi Bus Station) has 2 routes. For regular weekdays, their operation hours are: (1) Kadugodi: 6:20 AM - 8:50 PM (2) Kempegowda Bus Station: 6:30 AM - 7:40 PM Use the Moovit App to ƒnd the closest 319C bus station near you and ƒnd out when is the next 319C bus arriving. Direction: Kadugodi 319C bus Time Schedule 47 stops Kadugodi Route Timetable: VIEW LINE SCHEDULE Sunday 6:20 AM - 8:50 PM Monday 6:20 AM - 8:50 PM Kempegowda Bus Station Majestic Platform 6A, Bangalore Tuesday 6:20 AM - 8:50 PM Kodays Circle Wednesday 6:20 AM - 8:50 PM Khodays Circle, Bangalore Thursday 6:20 AM - 8:50 PM Maharanis College Friday 6:20 AM - 8:50 PM Maharani College Saturday 6:20 AM - 8:50 PM Sheshadri Road, Bangalore K.R.Circle K.R.Circle 319C bus Info Direction: Kadugodi St Marthas Hospital Corporation Stops: 47 Trip Duration: 61 min Corporation Line Summary: Kempegowda Bus Station Majestic, Kodays Circle, Maharanis College, Maharani College, St.Joseph High School K.R.Circle, K.R.Circle, St Marthas Hospital Corporation, Corporation, St.Joseph High School, Richmond Circle Richmond Circle, Richmond Circle, St Joseph College, Brigade Road, Mayo Hall, Electric B Station Richmond Circle (M.G.Road), Trinity Circle / Lido Talkies, Begum Mahal, Philips Millenium Halsuru, Halasuru, Ground Floor The Residency , 133/1 Indiranagar Depot-6, Binnamangala, Isolation Hospital, Swamy Vivekananda Metro Station, St Joseph -

Pin Code Covered Branches

ABM Sl.No BRANCH Region ADDRESS Std code Land Line number Number 1 Bengaluru-K.G.Road Bengaluru IST FLOOR, FKCCI BUILDING, KEMPE GOWDA ROAD, Bengaluru 080 22264216 2 Bengaluru-Chickpet Bengaluru # 88, First Floor, SLN Complex, Srinivasa Mandir Road, Balepet, Bengaluru 080 22955852 3 Bengaluru-Nehrunagar Bengaluru NO.45/46, NAGAPPA STREET, SHESHADRIPURAM, NEHRUNAGAR, Bengaluru 080 23561920 4 Bengaluru-Srirampuram Bengaluru GROUND FLOOR, 61, VISHNU PRIYA TOWERS, MAHAKAVI KUVEMPU ROAD, NEAR DEVAYYA PARK, SRIRAMPURAM, Bengaluru 080 22955899 5 Bengaluru-City Market Bengaluru No.19-20, 1st Main Road, Behind KSRTC Satellite Bus Stand, Byatarayanapura, Mysuru Road, Bengaluru 080 22955854 6 Bengaluru-Jayanagar IX Block Bengaluru "SHRI KSHETRA COMPLEX", NO.911, 39TH CROSS, 28TH MAIN, 9TH BLOCK, JAYANAGAR, Bengaluru 080 22955863 7 Bengaluru-Yeshwanthpur Bengaluru NO.33, PIPELINE ROAD, BEHIND RTO COMPLEX, YESHWANTHPUR, Bengaluru 080 22955910 8 Bengaluru-Murphy Town Bengaluru 109, OLD MADRAS ROAD, OPP.ADARSHA THEATRE, S.V.ROAD, HALASURU, Bengaluru 080 22955881 9 Bengaluru-Wilson Garden Bengaluru NO.279, 10TH CROSS, WILSON GARDEN, Bengaluru 080 22955908 10 Bengaluru-Rajajinagar Bengaluru 382, GROUND FLOOR, DR. RAJKUMAR ROAD, VI BLOCK, RAJAJINAGAR, Bengaluru 080 22955888 11 Bengaluru-Minerva Circle Bengaluru 163, GROUND FLOOR, RAJESHWARI COMPLEX, R.V.ROAD, V.V.PURAM, Bengaluru 080 26573077 12 Bengaluru-Chamarajpet Bengaluru 8/1, GROUNDFLOOR, "BELVET", 5TH MAIN, CHAMARAJ PET, Bengaluru 080 22955850 13 Bengaluru-Ashoknagar Bengaluru 16/2 (OLD NO.13/9), -

V-500FB Bus Time Schedule & Line Route

V-500FB bus time schedule & line map V-500FB Kadugodi Bus Station - Central Silk Board View In Website Mode The V-500FB bus line (Kadugodi Bus Station - Central Silk Board) has 2 routes. For regular weekdays, their operation hours are: (1) Central Silk Board: 9:25 AM - 4:55 PM (2) Kadugodi Bus Station: 8:00 AM - 3:30 PM Use the Moovit App to ƒnd the closest V-500FB bus station near you and ƒnd out when is the next V-500FB bus arriving. Direction: Central Silk Board V-500FB bus Time Schedule 29 stops Central Silk Board Route Timetable: VIEW LINE SCHEDULE Sunday Not Operational Monday 9:25 AM - 4:55 PM Kadugodi Bus Station Tuesday Not Operational Kadugodi Bridge SH 35, Bangalore Wednesday Not Operational Prajwal School Thursday Not Operational Friday Not Operational Hope Farm (Towards Varthuru) Whiteƒeld Main Road, Bangalore Saturday Not Operational Munish Singh Hospital Sai Baba General Hospital V-500FB bus Info White Field Post O∆ce Direction: Central Silk Board Stops: 29 Brooke Bond Trip Duration: 52 min Line Summary: Kadugodi Bus Station, Kadugodi Varthur Kodi Bridge, Prajwal School, Hope Farm (Towards Varthuru), Munish Singh Hospital, Sai Baba General Varthur Road, Bangalore Hospital, White Field Post O∆ce, Brooke Bond, Ramagondanahalli Varthuru Varthur Kodi, Ramagondanahalli Varthuru, Siddapura, Thubarahalli, Kundalahalli Gate, Varthur Road, Bangalore Munnekolalu Cross / Spice Garden, Marathahalli Siddapura Bridge Flyover, Marathahalli Multiplex, Kadabisanahalli, New Horizon College, Devarabisanahalli, Cs-Accenture B7 Eco Space, Thubarahalli