Thailand Retail Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Living & Working in Bangkok

www.pwc.com/th Living & Working in Bangkok PwC guide for expatriates 4th edition Welcome to Thailand and welcome to the fourth edition of PwC’s guide for expatriates, Living & Working in Bangkok. We’ve been advising on international assignments to Thailand for almost four decades. During this time we’ve helped with visas, work permits, tax, legal, human resources and employment issues for hundreds of clients from all over the world. Naturally, we’ve become involved in helping our clients with other needs such as accommodation suggestions, cultural orientation, international schooling recommendations and even advice on reputable tailors! The contents of this guide have been drawn together from the experiences of our expatriate clients and staff over the years and we hope we’ve compiled a useful reference book for expatriates and their families who have recently arrived in Bangkok. Since the publication of our last edition in 2006, many things have changed in Bangkok and there are even more tips and points that we’re proud to share with you. So welcome to Thailand. And we hope that you and your family will enjoy the challenge of living and working in this fascinating city. Enjoy your stay! Prapasiri Kositthanakorn Partner Contents I. General facts about Thailand • Geography and climate 2 • Time 3 • Brief history 3 • Population 4 • Religion 4 • Government and administration 5 • Thai Flag 5 • Thai Language 6 • Currency 9 • Weight and measurement 9 • Electricity supply 9 • Water 9 • Calendar (Public holidays) 10 • Business hours 10 • Living costs 11 II. Thai way of life • Common customs and mannerisms 14 • Superstitions 16 • Some Thai laws to be aware of 19 • Further reading 20 III. -

Seacon Bangkae

Perfect Vision Multimedia Your partner for the world of Information ...a story that move us... The Third wave An Information Revolution 2000-2100 Within a few decades, society rearranges itself - its world view; its basic values; its social and political structures; its arts; its key institutions. Fifty years later, there is a new world. and the people born then cannot even imagine the world in which their grandparents lived and into which their own parent were born. We are currently living through just such a transformation.” (Drucker, 1993) The Third wave An Information Revolution “Same as we now cannot imagine living without2000-2100 Electricity. Soon we won’t be able to imagine living without Information” ...so how has information technology changed our common senses?... Power of Connectivity Information technology grants us a godlike power of timeless and distance-less connectivity. We can touch almost anyone on this planet within a flick of time. With no extra effort than a click. Verb to “Search” “Search” has become our fundamental action of life, on par with “eat” or “sleep”. No matter what kind of information nowadays, it has to be searchable. Listen to the crowd No one cares about catchy slogan anymore, they simply go and ask other people what they think. How? Simply ask their friends on Facebook or just Twit it! Customize and Personalize Abundance and choices of products has driven products to become more customized for each market. In addition, information technology has enabled products and services to become more personalized for each and every customers. (Sheldon, 1994) Ignore, Ignore and Ignore! When there are too much things to see, too many advertising to read, the easiest escape is just to “Ignore it”. -

Eastern Seaboard Report

Eastern Seaboard Report October 2014 – Prepared by Mark Bowling, Chairman ESB Thailand's bearish automotive market has deterred two Japanese car makers, Mitsubishi Motors Corporation and Nissan Motor, from commencing production of their new eco- car. "Our parent company has not yet approved the exact time frame for production, as the domestic market has experienced weaker growth than was enjoyed in 2012," said Masahiko Ueki, president and chief executive of Mitsubishi Motors (Thailand). "Next year's prospects are unpredictable, as the economy and consumption will take time to recover," he said. Mitsubishi was one of the five companies that applied for Board of Investment (BoI) promotion for the second phase of the eco-car scheme. All eco-car production will be done at Mitsubishi's third plant in Laem Chabang Industrial Estate in Chon Buri province. The government confirmed changes to its high-speed development plan, adding a Bangkok-Rayong route and splitting the Nong Khai-Map Ta Phut route into two — Nong Khai-Nakhon Ratchasima and Nakhon Ratchasima-Bangkok-Map Ta Phut. The Nong Khai- Map Ta Phut route would cover 737 kilometres and cost 393 billion baht, while the Chiang Khong-Phachi route would be 655 km and cost 349 billion. Two high-speed rail routes costing a combined 741 billion baht would link Thailand with southern China. Bang Na-Trat office demand up - With office rents in Bangkok's central business district rising by 15% last year and nearly 6% more so far this year, more companies are considering Bang Na-Trat Road an alternative due to its competitive rents and convenient access to both the CBD and the Eastern Seaboard. -

Creating Curriculum of English for Conservative Tourism for Junior Guides to Promote Tourist Attractions in Thailand

English Language Teaching; Vol. 11, No. 3; 2018 ISSN 1916-4742 E-ISSN 1916-4750 Published by Canadian Center of Science and Education Creating Curriculum of English for Conservative Tourism for Junior Guides to Promote Tourist Attractions in Thailand Onsiri Wimontham1 1 English Education Curriculum, Nakhon Ratchasima Rajabhat University, Thailand Correspondence: Onsiri Wimontham, English Education Curriculum, Nakhon Ratchasima Rajabhat University, Thailand. E-mail: [email protected] Received: January 1, 2018 Accepted: February 13, 2018 Online Published: February 15, 2018 doi: 10.5539/elt.v11n3p67 URL: http://doi.org/10.5539/elt.v11n3p67 Abstract This research was supported the research fund of 2017 by Office of the Higher Education Commission of Thailand. The objectives of this research are listed below. 1). To form the model of teaching and learning English for local development by English curriculum (B. Ed.) students’ participation in training on out-of-classroom learning management, which focuses on the students’ English skills improvement along with developing the sense of love of their home towns. 2). To create curriculum of English training for conservative tourism for junior guides in Sung Noen District, Nakhon Ratchasima Province. 3). To promote conservative tourist attractions in Sung Noen District, Nakhon Ratchasima Province among foreign tourists, and to boost the local economy so that young generations can earn income and rely on themselves in the future. An interesting result from the research was more income gained from tourism in Sung Noen District, Nakhon Ratchasima Province between April 2016 and June in the same year. The junior guides’ ability to communicate and provide information about tourism in English was evaluated. -

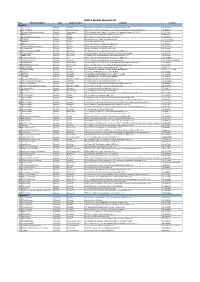

ICBCT's Wechat Merchant List No

ICBCT's WeChat Merchant list No. Merchant Name Area Business type Address Contact Bangkok 1 2000 Colors Bangkok Cosmetics 588 JJ Mall room F191 Floor 1 kampangphet 2 Rd, chatujak Bkk 10900 081-5710027 2 APT Real Estate Bangkok Apartment Rental 383 Fl.2 Room 204 Soi Sunvijai( Rama9 soi 13) Rama9 Rd, Bangkapi, Huaykhang BKK 10310 081-5825638 3 Automation & Technology Service Bangkok Service agency 888/150 mahatun plaza building, Fl15 ploenchit Rd, Lumpini,pathumwan BKK 10330 065-6656885 4 Baantoeyhorm Bangkok Clothing 55/9 soi train night market Ratchada Dindaeng BKK 10400 0869922526 5 Bangkok IVF Center Ladplao Bangkok Hospital 659 Praditmanoothum Rd, wangtonglang, BKK 10310 02-9331584-6 6 Havaianas Bangkok Clothing 979 Siam Center Fl.2 Rama1 Rd, Pathumwan BKK 02-2162038#101 7 Havaianas Bangkok Clothing 4,4/1-2,4/4 Central World Fl.2 02-2162038#101 8 Brilliant Gems Center Bangkok Jewelry 131 Sawankalok Rd, suan jidlada, Dusit BKK 10300 081-5640990 9 Chaba Thailand foot Massage Bangkok Massage 169/64 Ratchadapisek Rd, dindeang, BKK 10400 091-8743636 10 Charisma Gems Bangkok Jewelry 322/48 Asok-dindeang rd, dindeang, BKK 10400 081-6337591 11 China Town Scala Shark-Fin Bangkok Restaurant 483-485 yaowarat Rd, sampantawong, Sampantawong BKK 10100 081-8012233 12 Donmuang Hotel Bangkok Hotel motel 5 Soi Sorranakom3 (Taviwattana) Sorranakon rd, srikan, donmuang BKK 092-6422245 13 Eastern Sun Bangkok Hotel motel 29 Sukkhumvit 19 (wattana) Klongton-nuan,Wattana Bangkok 10110 086-3282829 14 Gold Stone Energy Bangkok Spa 976/19 Samsen Road Bangkapi -

OISHI's CYCLE

ANNUAL REPORT 2018 OISHI’s CYCLE Contents 8 Message from the Chairman 10 Message from the President and CEO 13 General Information 14 Financial Highlights 16 Board of Directors and the Executives 22 Business Policy and Overview 36 Business Nature 45 Risk Factors 50 Business Assets 57 Legal Disputes 57 Capital Structure 61 Management Structure 74 Information on the Board of Directors and the Executives 96 Remuneration of the Board of Directors and Executives 99 Share ownership of the Board of Directors and the Executives 100 Human Capital and Human Resources Development Policy 103 Internal Control 104 Internal Information Usage 105 Related Parties Transactions 118 Financial Status and the Company’s Performance 128 Report of the Board of Directors’ Responsibility for the Finance Reporting 129 Report of the Audit Committee 131 Report of the Sustainability and Risk Management Committee 132 Report of the Nomination Committee 133 Report of the Remuneration Committee 134 Report of the Good Corporate Governance Committee 135 Corporate Governance Report 153 Financial Statements 225 Corporate Social Responsibility and Sustainability Report 274 GRI Standards Contents 8 Message from the Chairman 10 Message from the President and CEO 13 General Information 14 Financial Highlights 16 Board of Directors and the Executives 22 Business Policy and Overview 36 Business Nature 45 Risk Factors 50 Business Assets 57 Legal Disputes 57 Capital Structure 61 Management Structure 74 Information on the Board of Directors and the Executives 96 Remuneration of the -

Stay and Play, Your Way Welcome to Avani Sukhumvit Bangkok Hotel

Stay and play, your way Avani Room Welcome to Avani Sukhumvit Bangkok Hotel CONVENIENCE AND STYLE A TRENDING NEIGHBOURHOOD The new-build Avani Sukhumvit Bangkok Hotel features Simultaneously buzzing and yet leisurely and laidback, Avani 8 rooms in signature Avani style – contemporary, sunlit, and Sukhumvit’s prime location combines main Sukhumvit Road showcasing wow views of Bangkok’s soaring skyline. living with indie neighbourhood exploration. Located in new lifestyle complex Century the Movie Plaza , wine and dine to Swim and chill above the cityscape. Hide away in the sanctuary your heart’s content. Zip to a meeting in the CBD, making full AvaniSpa. Explore the capital by BTS or discover up-and-coming use of the hotel’s direct BTS connection. Wander to the nearby On Nut’s many cafes, art galleries and street eats. W District for food truck tacos, live music, street art and local craft beers. Comfort and convenience in your city-centre spot. Gaze out at the city skyline from your Exterior stylish sanctuary. Decked out in cooling tones of charcoal, wood and gold, all rooms are spacious and sunlit with ergonomic furnishings and high-tech entertainment to keep you comfy. Guestroom Features Lobby • Enjoy panoramic city views • King or twin beds • Separate shower and bathtub in larger rooms / Walk-in shower • Complimentary tea and coffee making facilities • IDD dial phone • Bathrobe and slippers • Hairdryer • Universal power sockets • V / V electrical points Avani Deluxe Room • Electronic door - locking system • Personal safe • USB plugins-bedside -

Factors Associated with Quality of Life in the Elderly People with Ability in Sung Noen District, Nakhon Ratchasima Province

Review of Integrative Business and Economics Research, Vol. 6, NRRU special issue 238 Factors Associated with Quality of Life in the Elderly People with Ability in Sung Noen District, Nakhon Ratchasima Province Tanida Phatisena Varaporn Chatpahol Faculty of Public health, Nakhon Ratchasima Rajabhat University, Nakhon Ratchasima,Thailand ABSTRACT This objectives of this cross-sectional analytical research were to study the level of the quality of life and factors associated with quality of life in the elderly people with ability in Sung Noen distric, Nakhon Ratchasima province. The sample group consisted of 334 elderly people which selected by using multistage random sampling. Data collection was done by interview forms based upon the quality of life indicators by the WHO (WHOQOL_BREF_THAI) include 20 items within 4 components. The data was analysed by using percentage, mean, standard deviation and correlation tests: chi-square. The findings showed that overall the quality of life in the elderly people with ability was at a good level. Three components of physical domain, social relationships and the environment were rated at good level. A component of psychological domain was rated at a fair level. There was associations at 95% level of significance between the quality of life and health problems. Recommendation from this study was to the related organization should develop the quality of life of the elderly by promoting mental health and caring their own health care. Keywords : Quality of Life, Elderly, Ability 1. INTRODUCTION Thailand is currently facing an aging society resulting from change in population structure with the decrease in birth and death rate. This phenomena stem from the social and economic development in the previous decades bringing high technology in medicine and public health service, thus, expending the age of people. -

Central Pattana Plc. Property Development and Investment

Central Pattana Plc. Property Development and Investment CentralPlaza Marina Pattaya Re-launch on 19 December 2016 Corporate Presentation: 3Q16 Performance Review Contents ► Our Company ► Growth ► Financing ► Looking ahead ► Appendices 2 Our company CPN at a Glance To be the most admired and dynamic regional retail property VISION developer with world-class rewarding experience Mixed-use Project Development Malls Other related business Property funds Residential Commercial Hotel CPNRF CPNCG 7 Office Buildings 2 Hotels 1 1 Residence • Lardprao CPNRF: Central City Residence • Pinklao Tower A RM2, RM3, PKO, CMA, 23 @ Bangna • Pinklao Tower B Pinklao Tower A&B 6 • Bangna • CentralWorld Tower • Chaengwattana CPNCG: • Rama9 The Offices @ CentralWorld st 30 1.6 mn sqm 93% 1 Rank 16% Shopping Malls NLA Occ. Rate Retail Developer 9M16 Rev. Growth 3 Our company Strategic Shareholders CPN is one of the flagship businesses of the Central Group (Chirathivat Family). As a strong and supportive shareholder, the Chirathivat family brings to CPN a wealth of retail-related expertise through the family‟s long record and successful leadership in Thailand‟s dynamic and competitive landscape of shopping mall developments and department store / specialty store operations. Chirathivat Family 26% Local funds 19% Free float Foreign 53% 47% funds 73% Individuals Central 8% Group 27% Source: TSD as of 30 September 2016. 4 Our company Strategic Shareholder CPN‟s strong synergy with the Central Group helps CPN to attract dynamic tenants, increase people traffic and -

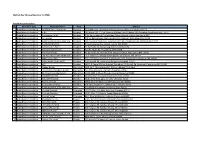

Untitled Spreadsheet

WeChat Pay Chinese New Year for SMEs Hotel&Accommodation No. Merchant type Merchant Name Area Address 1 Hotel&Accommodation EASTERN SUN - Arte Hotel Bangkok 29 Sukkhumvit 19 (wattana) Klongton-nuan,Wattana Bangkok 10110 2 Hotel&Accommodation A.R.E Bangkok 383 Room 201 Fl.2 Soi Soonvijai4( Rama9 soi13) Rama 9 Rd, bangkapi,huaykwang Bkk 10310 3 Hotel&Accommodation Donmuang Hotel Bangkok 5 Soi Sorranakom3 (Taviwattana) Sorranakon rd, srikan, donmuang BKK 4 Hotel&Accommodation Kim Hostel Bangkok 5/5 Soi Ratchatapun, Ratchaprarod Rd, Makasan, Ratchatewi BKK 10400 5 Hotel&Accommodation RAWI WARIN RESORT AND SPA Bangkok 1412 Q House Asok 14Fl. Sukkhumvit 21 Rd, Klongtoeynuan, Wattana BKK 10110 6 Hotel&Accommodation SUANLUM BAZAAR Bangkok 5 Ratchadapisek Rd, Jompol, jatujak Bkk 10900 7 Hotel&Accommodation Sukhumvit 15 Place Bangkok 52 Ratchada Rd, Huaykhang, BKK 10310 (Branch) 8 Hotel&Accommodation Swissotel LeConcorde Bangkok 204 Ratchada Rd, Huaykhang, BKK 10320 9 Hotel&Accommodation The Picnic Hotel Bangkok 39 Soi rangnum, Phayathai Re, tanonphayathai, Ratchatewi BKK 10400 10 Hotel&Accommodation THE RESIDENCE ON THONGLOR Bangkok 73 sukkhuvit 55 (thonglor) Klongtonnuan,wattana, Bkk 10110 11 Hotel&Accommodation White Ivory Hotel Bangkok 535, 537 Soi Krungthon 6, Krungthonburi Rd, Banglumpoo, Klongsan Bkk 10600 12 Hotel&Accommodation WING HENG (THAILAND) Bangkok 3789 Rama4 Rd, Prakanong,Klongnuan Bangkok 10110 13 Hotel&Accommodation APT Bangkok 383 Fl.2 Room 204 Soi Sunvijai( Rama9 soi 13) Rama9 Rd, Bangkapi, Huaykhang BKK 10310 14 Hotel&Accommodation Manee House Chiangmai 23/5 Soi 7, Moonmuang Rd, Sripoom,Muang Chiangmai 15 Hotel&Accommodation The Pavana Chiangmai Resort Chiangmai 165 Moo.4 huaysai, maerim, chiangmai 50180 16 Hotel&Accommodation X2 Vibe Chiang Mai Decem Chiangmai 10/18 M00. -

11661287 31.Pdf

The Study on the Integrated Regional Development Plan for the Northeastern Border Region in the Kingdom of Thailand Sector Plan: Chapter16 Transportation CHAPTER 16 TRANSPORTATION 16.1 International and Inter-Urban Transport System of Thailand 16.1.1 National Highway System in Thailand The DOH1 network of national highways has a total route length of approximately 55,000 km, of which there are about 20,000 km of 1-, 2- and 3-digit roads and 30,000 km of 4-digit roads. All provinces (changwats) are connected to this network and most long-distance (inter-province) traffic uses these roads. Table 16.1 Highway Classification by Numbering System 1-digit route Highway Route No.1: Bangkok - Chiangrai (Phaholyothin Road) Highway Route No.2: Saraburi - Nongkai (Friendship Road) Highway Route No.3: Bangkok - Trad (Sukhumvit Road) Highway Route No.4: Bangkok - Amphoe Sadao, Songkla (Petchkasem Road) 2- digit route Primary highway in the regions 3-digit route Secondary highway in the regions 4-digit route Highway linking Changwat and Amphoe or important places in that province. Source: Department of Highways, Ministry of Transport and Communications 1 Department of Highway, Ministry of Transport and Communication, Thailand 16-1 PLANET NESDB - JICA Table 16.2 Highway Classification by Jurisdiction (1) Special Highway and Highways registered at the Department of Highways (DOH) by the order of National Highway the Director-General with the approval of the Minister. Highways registered at the Department of Highways (DOH) by the order of (2) Concession Highways the Director-General with the approval of the Minister. Roads registered at Provincial City Hall by the order of the Governor with (3) Rural Roads the consent of the Director-General of the Public Works, Department of the Secretary-General of the Office of the Accelerated Rural Development. -

Centara Grand at Centralworld Contact Details

Centara Grand at CentralWorld Contact Details Property Code: CGCW Official Star Rating: 5 Address: 999/99 Rama 1 Road,Pathumwan Bangkok 10330,Thailand Telephone: (+66) 2-100-1234 Hotel Fax: (+66) 2-100-1235 E-mail: [email protected] Official Hours of Operation: 24 hours GPS Longtitude: 100.539515018463 GPS Latitude: 13.7468157419102 General Manager Tel: (+66) 2-100-1234 #6100 Administrator Tel: (+66) 2-100-1234 Reservation Tel: (+66) 2-100-1234 #1 Reception Tel: (+66) 2-100-1234 #14 Sales Tel: (+66) 2-100-1234 #6547 Google my Business URL: https://goo.gl/maps/VkGDcCXES76QzH7X6 Google my Direction URL: https://www.google.com/maps/dir//999+Centara+Grand+at+CentralWorld,+99+Rama+I+Rd,+Pathum+Wan,+Pathum+W an+District,+Bangkok+10330/@13.747717,100.5365583,17z/data=!4m8!4m7!1m0!1m5!1m1!1s0x30e2992f7809567f:0xccc050cff0e7d 234!2m2!1d100.538747!2d13.747717 Recommended For Centara Grand at CentralWorld Families Single travellers Couples and honeymooners Business travellers MICE Shoppers Young travellers Group of friends Centara Grand at CentralWorld Building Total number of building(s) 1 Building: Centara Grand & Bangkok Convention Centre at CentralWorld Building name: Centara Grand & Bangkok Convention Centre at CentralWorld Year built: 2008 Last renovated in: - How many floors: 55 How many rooms: 505 Number of keys: 512 Location: Central to the business district, Centara Grand and Bangkok Convention Centre at CentralWorld is connected to major shopping and entertainment complexes by skywalk, and offer easy access to the mass transit systems. A rapid rail link directly to and from Suvarnabhumi Airport where travellers can check-in their luggage before boarding the train is 10 minutes away from the hotel.