VP Marketing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MOTOROLA DROID 2 USER GUIDE Congratulations More •Answers: Touch > Help Center

MOTOROLA DROID 2 USER GUIDE Congratulations More •Answers: Touch > Help Center. DROID2 by Motorola You can also flick your home screen left or right to DROID2 by Motorola gives you a high quality imaging, see the Tips & Tricks widgets. video, and multimedia experience. Your new phone also syncs , feeds, messages, e-mails, photos, and •Updates: Phone updates, PC software, online help much more—from sources like Facebook, Twitter, and more at motorola.com/mydroid2. MySpace, Gmail, your email at work—and serves • Accessories: Find accessories for your phone at them all up just the way you want them. www.motorola.com/products. • Download BLOCKBUSTER videos, straight to your handset. • Stream and store multimedia on any DLNA™ Certified device in your home network. No memory cards to swap, no cables to attach. • DROID2 by Motorola syncs your favorite social networking sites—all your messages, all the latest Notes: updates—so you can stay connected, right from your home screen. • All screen shots in this guide are simulated. Actual displays may vary. Caution: Before assembling, charging or using your • Instructions to perform tasks in this guide may phone for the first time, please read the important change depending on the software version on legal and safety information packaged with your your phone. phone. Once your phone is up and running, touch Menu > Settings > About phone > Safety • Unless specified otherwise, all instructions to information to read the full information. perform tasks in this guide assume that you are starting from the home screen. Congratulations 1 Your phone the important keys & connectors When you open or turn your phone, the screen adjusts for you. -

PDF Slidedeck

Designing for the mobile form factor Kirill Grouchnikov Android, Google Inc. Overview • Characteristics of a great UI • Why mobile is different • From design to implementation Overview • Characteristics of a great UI • Why mobile is different • From design to implementation What is a great UI? • User friendly • Responsive • Polished Square Seesmic doubleTwist TweetDeck User friendliness • Simple flows that assist in completing tasks • Task-oriented instead of feature-oriented • Guide the user instead of fight the user • Build on user’s knowledge of the domain Responsiveness • Visual confirmation of a user action • Long tasks not blocking the UI • Progress of long running tasks Visual polish • Visual appeal as important as functionality • Macro-level as well as micro-level • Visual consistency to anchor the flows Is mobile different? • Similar problems • Similar solutions • Different form factor Overview • Characteristics of a great UI • Why mobile is different • From design to implementation Form factor • Smaller screens, bigger controls • Rotation and ratio change • User interaction • Screen density • Limited resources Form factor • Smaller screens, bigger controls • Rotation and ratio change • User interaction • Screen density • Limited resources Screen size Screen size • Finger interaction • Small controls - user frustration • Onscreen keyboard - even less space for controls Screen size • Hide optional controls • Split long forms into separate screens • Annotate fields for better keyboard modes Form factor • Smaller screens, bigger -

February 2010 Admob Mobile Metrics Report

AdMob Mobile Metrics Report AdMob serves ads for more than 15,000 mobile Web sites and applications around the world. AdMob stores and analyzes the data from every ad request, impression, and click and uses this to optimize ad matching in its network. This monthly report offers a snapshot of its data to provide insight into trends in the mobile ecosystem. February 2010 Find archived reports and sign up for future report notifications at metrics.admob.com. AdMob Mobile Metrics Report February 2010 New and Noteworthy For this month's report, we separate the traffic in our network into three categories – smartphones, feature phones, and mobile Internet devices – to examine the growth rates of each over the past year and look at the traffic share of smartphone operating systems and manufacturers of feature phones. * In February 2010, smartphones accounted for 48% of AdMob’s worldwide traffic, up from 35% in February 2009. The strong growth of iPhone and Android traffic, fueled by heavy application usage, was primarily responsible for the increase. In absolute terms, smartphone traffic increased 193% over the last year. * Feature phones declined from 58% to 35% of AdMob's total traffic as users began switching to smartphones. Although the share of traffic from feature phones as a category declined, in absolute terms traffic grew 31% year-over-year. * The mobile Internet devices category experienced the strongest growth of the three, increasing to account for 17% of traffic in AdMob’s network in February 2010. The iPod touch is responsible for 93% of this traffic; other devices include the Sony PSP and Nintendo DSi. -

February 5, 2010 Electronic Filing Marlene Dortch, Secretary Federal

February 5, 2010 Electronic Filing Marlene Dortch, Secretary Federal Communications Commission 445 12th Street, SW 12th Street Lobby, TW-A325 Washington, D.C. 20554 Re: Ex Parte Letter; GN Docket No. 09-191; WC Docket No. 07-52 Dear Ms. Dortch: CTIA – The Wireless Association® (“CTIA”) recently filed comments in the Commission’s proceeding on “Preserving the Open Internet” detailing the policy and economic reasons why Internet neutrality rules are inappropriate for the competitive, innovative and consumer-focused wireless broadband market. CTIA argued that the Commission should not develop and apply potentially damaging net neutrality rules that are based on a fear of speculative, not actual, harms. This filing identifies why developing and applying any such rules to the competitive wireless industry based on speculation is likely to be significantly off mark, and dangerous. In the following pages, CTIA analyzes the speculative harm that was detailed by one notable critic of the wireless industry, Professor Tim Wu of Columbia University, and concludes that the dark vision of the wireless future envisioned by Professor Wu was startlingly inaccurate and has never come to pass. In his February 2007 working paper for the New America Foundation, Professor Wu detailed a parade of harms that would befall wireless consumers absent a litany of FCC regulations. Contrary to the professor's view of how the ecosystem would evolve, in the absence of regulation, every element of the wireless ecosystem has expanded. Today, the fact that there are over -

T-Mobile CLIQ with MOTOBLUR User Guide

FOCUS ON WHAT MATTERS. MOTOROLA CLIQ™ with MOTOBLUR™ Congratulations More information On your phone—Press Home > My Account. MOTOROLA CLIQ with MOTOBLUR On any phone—Call 1-800-734-5870. MOTOROLA CLIQ with MOTOBLUR is the latest way to stay up to date on the friends and information that On your computer—Go to mean the most to you. Finally, spend less time www.motorola.com/mycliq. managing your life and more time living it. After you create a MOTOBLUR account, you can also • Sync contacts, messages, feeds and updates from log in and find help with today’s most popular social sites MOTOBLUR: www.motorola.com/mymotoblur. • Always backed-up + AGPS for locating your phone + So, whether you want to talk, read, watch, or play, we remote wipe = totally secure can help. • Never be out of contact with a full HTML browser, 3G/HSDPA and even Wi-Fi Caution: Before assembling, charging or using your phone for the first time, please read the Safety, Regulatory, & Legal Information provided with your phone. Once your phone is up and running, press Menu > Settings > About phone > Safety & regulatory to read the full information. Congratulations 1 Your phone When you turn your phone, the home screen adjusts for you. 3.5mm Headset Jack Notification LED On=Charged. 3G 11:35 Flashing=New 298 minutes away from cake. notification. 15 min ago Trevor Gilley Ringer Off Black turtleneck and a 3G 11:35 5 min ago Switch Power Key Vanessa Eskridge 298 minutes away from cake. Ultra secret double-agent Press to put the 15 min ago Volume Keys display to sleep, London Partly Sunny Trevor Gilley or hold to turn 20˚ MarketMarket Browser Black turtleneck and a beret, and off. -

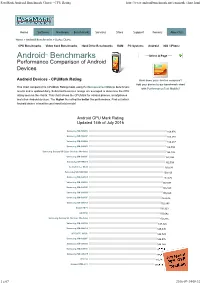

Passmark Android Benchmark Charts - CPU Rating

PassMark Android Benchmark Charts - CPU Rating http://www.androidbenchmark.net/cpumark_chart.html Home Software Hardware Benchmarks Services Store Support Forums About Us Home » Android Benchmarks » Device Charts CPU Benchmarks Video Card Benchmarks Hard Drive Benchmarks RAM PC Systems Android iOS / iPhone Android TM Benchmarks ----Select A Page ---- Performance Comparison of Android Devices Android Devices - CPUMark Rating How does your device compare? Add your device to our benchmark chart This chart compares the CPUMark Rating made using PerformanceTest Mobile benchmark with PerformanceTest Mobile ! results and is updated daily. Submitted baselines ratings are averaged to determine the CPU rating seen on the charts. This chart shows the CPUMark for various phones, smartphones and other Android devices. The higher the rating the better the performance. Find out which Android device is best for your hand held needs! Android CPU Mark Rating Updated 14th of July 2016 Samsung SM-N920V 166,976 Samsung SM-N920P 166,588 Samsung SM-G890A 166,237 Samsung SM-G928V 164,894 Samsung Galaxy S6 Edge (Various Models) 164,146 Samsung SM-G930F 162,994 Samsung SM-N920T 162,504 Lemobile Le X620 159,530 Samsung SM-N920W8 159,160 Samsung SM-G930T 157,472 Samsung SM-G930V 157,097 Samsung SM-G935P 156,823 Samsung SM-G930A 155,820 Samsung SM-G935F 153,636 Samsung SM-G935T 152,845 Xiaomi MI 5 150,923 LG H850 150,642 Samsung Galaxy S6 (Various Models) 150,316 Samsung SM-G935A 147,826 Samsung SM-G891A 145,095 HTC HTC_M10h 144,729 Samsung SM-G928F 144,576 Samsung -

MMS Copy of Supported Devices

Good For Enterprise ‐ Certified Devices Country Network Platform Device All All Android Asus Eee Pad Transformer Prime All All Android Cisco Cius All All Android Google Nexus One All All Android HTC Desire (globally unlocked) All All Android HTC Legend (globally unlocked) All All Android HTC One (Google Play Edition) All All Android Kindle Fire All All Android LG Optimus 2X (globally unlocked) All All Android Moto G (Global unlocked) All All Android Moto G (US unlocked) All All Android Motorola Milestone (globally unlocked) All All Android Motorola Milestone 2 (globally unlocked) All All Android Motorola Xoom 2 WiFi All All Android Motorola Xoom WiFi All All Android Nexus 10 All All Android Nexus 4 All All Android Nexus 5 All All Android Nexus 7 (2012, 2013, WiFi only) All All Android Samsung Galaxy Nexus (globally unlocked) All All Android Samsung Galaxy Note 8 (WiFi only) All All Android Samsung Galaxy Note 10.1 (Intl. WiFi only) All All Android Samsung Galaxy Note 10.1 (U.S WiFi only) All All Android Samsung Galaxy Note 10.1 (2014) (WiFi only) All All Android Samsung Galaxy S II All All Android Samsung Galaxy S III (globally unlocked) All All Android Samsung Galaxy S III mini All All Android Samsung Galaxy S4 (Google Play Edition) All All Android Samsung Galaxy S4 (GT‐I9500) All All Android Samsung Galaxy S4 (GT‐I9505) All All Android Samsung Galaxy Tab 2 7 (WiFi only) All All Android Samsung Galaxy Tab 3 (7‐inch) All All Android Samsung Galaxy Tab 3 (8‐inch) All All Android Samsung Galaxy Tab 10.1 (WiFi only) All All Android Samsung -

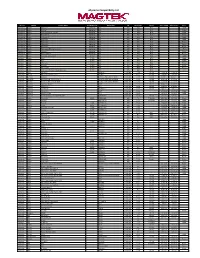

Udynamo Compatibility List

uDynamo Compatibility List Reader Manuf. Device Name Alt. Model Info Model Info OS OS Version Carrier Date Added Date Tested Type iDynamo 5 Apple iPad Air 2 Lightning N/A iOS N/A N/A Tablet iDynamo 5 Apple iPad Air* Lightning N/A iOS N/A N/A Tablet iDynamo 5 Apple iPad with Retina Display* Lightning N/A iOS N/A N/A Tablet iDynamo 5 Apple iPad mini 3 Lightning N/A iOS N/A N/A Tablet iDynamo 5 Apple iPad mini 2 Lightning N/A iOS N/A N/A Tablet iDynamo 5 Apple iPad mini* Lightning N/A iOS N/A N/A Tablet iDynamo 5 Apple iPhone 5c* Lightning N/A iOS N/A N/A Phone iDynamo 5 Apple iPhone 5s* Lightning N/A iOS N/A N/A Phone iDynamo 5 Apple iPhone 5* Lightning N/A iOS N/A N/A Phone iDynamo 5 Apple iPod touch (5th* generation) Lightning N/A iOS N/A N/A iPod iDynamo 5 Apple iPhone 6* Lightning N/A iOS N/A N/A Phone iDynamo 5 Apple iPhone 6 Plus* Lightning N/A iOS N/A N/A Phone iDynamo Apple iPad (3rd generation) 30 PIN N/A iOS N/A N/A Tablet iDynamo Apple iPad 2 30 PIN N/A iOS N/A N/A Tablet iDynamo Apple iPad 30 PIN N/A iOS N/A N/A Tablet iDynamo Apple iPhone 4s 30 PIN N/A iOS N/A N/A Phone iDynamo Apple iPhone 4 30 PIN N/A iOS N/A N/A Phone iDynamo Apple iPhone 3GS 30 PIN N/A iOS N/A N/A Phone iDynamo Apple iPod touch (3rd and 4th generation) 30 PIN N/A iOS N/A N/A iPod uDynamo Acer liquid MT liquid MT Android 2.3.6 101.18 1/24/14 1/24/14 uDynamo Alcatel Alcatel OneTouch Fierce 7024W Android 4.2.2 101.18 3/6/14 3/6/14 uDynamo ALCATEL Megane ALCATEL ONE TOUCH 5020T Android 4.1.2 101.18 8/10/15 8/10/15 uDynamo ALCATEL ALCATEL ONE TOUCH IDOL X ALCATEL -

Windows-Tippek

DVD DVD 09 Friss 9 GB ÚJ! Videotesztek a DVD-n R 95 2010 A LEGÚJABB DRIVEREK, HASZNOS PROGRAMOK, A HÓNAP JÁTÉKAI, EXKLUZÍV CSOMAgok… Szakértőink és a legjobb hardverek a képernyőn – HD minőségben Mobil vagy PNA? GO DIGITAL! Ingyenes mobilszoftverek a drága navieszközök helyett 64 2010/09 _ CHIPONLINE.HU R Jobb, mint a Microsoft R 26 CHIP szervizpakk Windows 7-hez Windows-tippek 64 Bit USB 3.0 bátraknak 5 perc alatt telepíthető Tuning a végsőkig: ezzel gyorsabb lesz a számítógépe, mint az első napon! Teljes verzió: Tesztelve: Biztonságban az Találati arány, adatbiztonság, algoritmus: összes jelszavunk mennyire jó valójában a keresőóriás R 50 Így lesznek biztonságban az adatai Top tárolóegység + megfelelő backup-stratégia = nincs több adatvesztés R 72 7 oldalas extra: 3 hónap ingyen: hogyan szerkesztik Tesztverzió csak a a profik a fényképeket 96 CHIP olvasóinak Fotózás R Exkluzív próbaverzió 1995 Ft, előfizetéssel 1395 Ft Nero 1 XXII. évfolyam, 9. szám, 2010. szeptember 7 teljes verzió a DVD-n 0 Windows-tippek bátraknak >> bátraknak Új Windows-tippek >> a >> böngészőtechnológiák Szervizcsomag Windowshoz A >> legjobb A szoftverek zombik nyomában >> A nagy Google teszt navigáció? >> vagy autók >> >> Behálózott Mobiltelefon Spameltávolítás Kiadja a Motor-Presse Budapest Lapkiadó Kft. Vezércikk ÖRÖMMEL JELENTHETJÜK, HOGY A MAGAZIN ÚJ ROVATTAL bővülT: ezentúl olvasóink videoteszteket is találnak majd a CHIP DVD-jén. Szerkesztői ajánlat A célunk az volt, hogy 5-10 perces videotesztjeinkben minden eddiginél részletesebben, látványosabb formában mutassuk be a hónap legérdekesebb termékeit, jelen számunkban az Nvidia GTX 460-as kártyáját és a Synology hálózati adattárolóját. A felvéte- leket a szerkesztőségben és a CHIP tesztlaborban rögzítettük, a ka- mera elé pedig (némi győzködés után) természetesen a CHIP szer- kesztői, szakértői álltak, így önök is közelebbi ismeretségbe kerül- Harangozó Csongor hetnek velük. -

Bedienungsanleitung Samsung I5700 Galaxy Spica

Benutzerhandbuch Anweisungssymbole Machen Sie sich zuerst mit den Symbolen vertraut, Dieses die Ihnen in diesem Handbuch begegnen werden: Handbuch Warnung– Situationen, in denen Sie oder andere verletzt werden könnten verwenden Vorsicht– Situationen, in denen Ihr Gerät oder andere Geräte beschädigt werden Dieses Benutzerhandbuch soll Sie durch die könnten Funktionen und Merkmale Ihres Mobiltelefons führen. Hinweis– Hinweise, Tipps zur Verwendung oder Zusatzinformationen X Siehe– verweist auf Seiten mit zugehörigen Informationen, z.B.: X S.12 (bedeutet "siehe Seite 12") II • Google, Android Market, Google Talk, Google → Gefolgt von– gibt die Reihenfolge der Mail und Google Maps sind Warenzeichen von Optionen oder Menüs an, die Sie für die Google, Inc. Durchführung eines Schritts auswählen • YouTube ist ein Warenzeichen von YouTube, LLC. müssen, z.B.: Wählen Sie Nachrichten → Das YouTube®-Logo ist ein registriertes Neue Nachricht (bedeutet Nachrichten, Warenzeichen von YouTube, LLC. verwenden Handbuch Dieses gefolgt von Neue Nachricht) • Bluetooth® ist ein weltweit eingetragenes Warenzeichen der Bluetooth SIG, Inc. – [] Viereckige Klammern– verweist auf Bluetooth QD ID: B015818. Telefontasten, z.B.: [ ] (bedeutet die • Wi-Fi®, das Logo Wi-Fi CERTIFIED und das Logo Ein-/Aus-Taste) Wi-Fi sind eingetragene Marken von Wi-Fi Alliance. Urheberrechtsinformationen • DivX® ist eine eingetragene Marke Rechte an allen Technologien und Produkten, die mit von DivX, Inc., und wird unter diesem Gerät verbunden sind, sind das Eigentum Lizenz verwendet. der jeweiligen Eigentümer: "Pat. 7,295,673" • Dieses Produkt verfügt über eine auf Linux basierende Android-Plattform, die sich durch JavaScript-basierte Software umfassend erweitern lässt. III INFO ZU DIVX VIDEO DivX® ist ein digitales Videoformat, das von DivX, Inc. -

HTC Hero User Manual

User Manual www.htc.com Please Read Before Proceeding THE BATTERY IS NOT CHARGED WHEN YOU TAKE IT OUT OF THE BOX. DO NOT REMOVE THE BATTERY PACK WHEN THE DEVICE IS CHARGING. YOUR WARRANTY IS INVALIDATED IF YOU DISASSEMBLE OR ATTEMPT TO DISASSEMBLE THE DEVICE. PRIVACY RESTRICTIONS Some countries require full disclosure of recorded telephone conversations, and stipulate that you must inform the person with whom you are speaking that the conversation is being recorded. Always obey the relevant laws and regulations of your country when using the recording feature of your phone. INTELLECTUAL PROPERTY RIGHT INFORMATION Copyright © 009 HTC Corporation. All Rights Reserved. HTC, the HTC logo, HTC Innovation, ExtUSB, HTC Hero, HTC Sense, HTC Peep, Footprints, HTC Sync, and HTC Care are trademarks and/or service marks of HTC Corporation. Copyright © 009 Google Inc. Used with permission. Google, the Google logo, Android, Google Search, Google Maps, Gmail, YouTube, Android Market, and Google Talk are trademarks of Google Inc. Google, the Google logo and Google Maps are trademarks of Google, Inc. TeleAtlas® Map Data ©009. Street View Images ©009 Google. Microsoft, Windows, Windows XP, Windows Vista, Word, Excel, PowerPoint, and Outlook are either registered trademarks or trademarks of Microsoft Corporation in the United States and/or other countries. Bluetooth and the Bluetooth logo are trademarks owned by Bluetooth SIG, Inc. Wi-Fi is a registered trademark of the Wireless Fidelity Alliance, Inc. microSD is a trademark of SD Card Association. Copyright © 009, Esmertec AG. All Rights Reserved. Java, JME and all other Java-based marks are trademarks or registered trademarks of Sun Microsystems, Inc. -

What's in Your Pocket?

MY DAD’S MOBILE DEVICE WHAT HAS BEEN, WILL BE AGAIN DID SOMEONE YOU KNOW GET A ONE? Samsung Galaxy Nexus Samsung Nexus S 4G Motorola Defy Mini iPhone Samsung Galaxy S II HTC EVO 3D Samsung Galaxy Note AT & T Samsung Galaxy Player Samsung Stratosphere Samsung Galaxy Ace Plus Entry iPad Samsung Galaxy S II Skyrocket LG Thrill 4G level Android phone Motorola Droid RAZR HTC ThunderBolt Sony Ericsson Aoba LT28at Samsung Epic 4G Touch Motorola Photon 4G Sony Ericsson Nozomi LT26i iPod Touch BlackBerry Torch Samsung Droid Charge Sony Ericsson Nypon LT22i HTC Titan LG Optimus 2X Sony Ericsson Pepper LT27i HTC Rezound HTC Rhyme Sony Ericsson Kumquat ST25i LG Enlighten Toshiba with world’s thinnest BlackBerry Bold Android tablets....... 10.1 inches tablet Samsung Infuse 4G Acer Iconia Tab A200 Toshiba with Organic EL tablet HTC EVO Design 4G Acer Iconia Tab A700 Toshiba with water proof tablet Motorola Droid Bionic Asus Eee Pad Transformer Lite Toshiba with low cost 7 inches Samsung Focus Asus Eee Pad Memo tablet Samsung Galaxy S 4G Coby MID7042 7,8,9,10 Velocity Cruz with T507 Android HTC Inspire 4G Geniatech Enjoy TV 4.0 tablet Sony Ericsson Xperia PLAY HTC Fireball LTE handset LG Velocity Cruz with T510 Android HTC Droid Incredible 2 Spectrum phone for Verizon 4.0 tablet Casio G'zOne Commando Successor of Optimus 3D ViewSonic ViewPad tablet Nokia Astound Prada Note ViewSonic ViewPad smartphone Motorola Droid X2 Motorola Motoluxe WHAT WILL YOU DO WITH IT? Text Email Read News Twitter post Facebook poke Flickr photo YouTube video Pandora radio