British Columbia Coal Industry Overview 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coal Studies ELK VALLEY COALFIELD, NORTH HALF (825102, 07, 10, 11) by R

Coal Studies ELK VALLEY COALFIELD, NORTH HALF (825102, 07, 10, 11) By R. J. Morris and D. A. Grieve KEYWORDS: Coalgeology, Elk Valley coalfield, Mount the area is formed by Hmretta andBritt creeks, and is Veits, Mount Tuxford, HenretlaRidge, Bourgeau thrust, coal immediately north of the Fc'rdingRiver operations of Fording rank, Elk River syncline, Alexander Creek syncline. Coal Ltd.(Figure 4-1-1).The northernboundary is the British Columbia - Alberta border. The map area includes INTRODUCTION the upper Elk Valley and a portion of the upper Fording Detailed geological mapping and sampling of the north Valley. half of theElk Valley coalfieldbegan in 1986 and were Most of the area is Crown land and includes three c:od completed in 1987. The end poduct, a preliminary map at a properties. The most southerly comprises the north end ol'tbe scale of 1: IO OOO, will extend available map coverage in the Fording Coal Ltd. Fording River property. Adjacent to the coalfield north from the areas covered by Preliminary Maps north is theElk River property, in which Fording Coal 51 and 60 (Figure 4-l-l),which in turn expanded previous currently holds aSO-per-cent interest. Coal rights to the most coverage in the adjacent Crowsnest coalfield (Preliminary northerly property, formerly known as tlne Vincent option, Maps 24, 27,31 and 42). are reserved to the Crown Work in 1986 (Grieve, 1987) was mainly concentrated in Exploration history of the Weary Ridge - Bleasdell Creek the Weary Ridge ~ Bleasdell Creek area. Themore extensive area was summarized by Grieve (1987). Of the remailing 1987 field program was completed by R.J. -

A Review of Large Cretaceous Ornithopod Tracks, with Special Reference to Their Ichnotaxonomy

bs_bs_banner Biological Journal of the Linnean Society, 2014, 113, 721–736. With 5 figures A review of large Cretaceous ornithopod tracks, with special reference to their ichnotaxonomy MARTIN G. LOCKLEY1*, LIDA XING2, JEREMY A. F. LOCKWOOD3 and STUART POND3 1Dinosaur Trackers Research Group, University of Colorado at Denver, CB 172, PO Box 173364, Denver, CO 80217-3364, USA 2School of the Earth Sciences and Resources, China University of Geosciences, Beijing 100083, China 3Ocean and Earth Science, National Oceanography Centre, University of Southampton, Southampton SO14 3ZH, UK Received 30 January 2014; revised 12 February 2014; accepted for publication 13 February 2014 Trackways of ornithopods are well-known from the Lower Cretaceous of Europe, North America, and East Asia. For historical reasons, most large ornithopod footprints are associated with the genus Iguanodon or, more generally, with the family Iguanodontidae. Moreover, this general category of footprints is considered to be sufficiently dominant at this time as to characterize a global Early Cretaceous biochron. However, six valid ornithopod ichnogenera have been named from the Cretaceous, including several that are represented by multiple ichnospecies: these are Amblydactylus (two ichnospecies); Caririchnium (four ichnospecies); Iguanodontipus, Ornithopodichnus originally named from Lower Cretaceous deposits and Hadrosauropodus (two ichnospecies); and Jiayinosauropus based on Upper Cretaceous tracks. It has recently been suggested that ornithopod ichnotaxonomy is oversplit and that Caririchnium is a senior subjective synonym of Hadrosauropodus and Amblydactylus is a senior subjective synonym of Iguanodontipus. Although it is agreed that many ornithopod tracks are difficult to differentiate, this proposed synonymy is questionable because it was not based on a detailed study of the holotypes, and did not consider all valid ornithopod ichnotaxa or the variation reported within the six named ichnogenera and 11 named ichnospecies reviewed here. -

A Review of Vertebrate Track-Bearing Formations

5 Lockley, M.G. & Lucas, S.G., eds., 2014, Fossil footprints of western North America: NMMNHS Bulletin 62 A REVIEW OF VERTEBRATE TRACK-BEARING FORMATIONS FROM THE MESOZOIC AND EARLIEST CENOZOIC OF WESTERN CANADA WITH A DESCRIPTION OF A NEW THEROPOD ICHNOSPECIES AND REASSIGNMENT OF AN AVIAN ICHNOGENUS RICHARD T. MCCREA1, LISA G. BUCKLEY1, A. GUY PLINT2, PHILIP J. CURRIE3, JAMES W. HAGGART4, CHARLES W. HELM1 AND S. GEORGE PEMBERTON5 1Peace Region Palaeontology Research Centre; Box 1540; Tumbler Ridge, British Columbia; V0C 2W0; CANADA; 2Department of Earth Sciences; University of Western Ontario; London, Ontario; N6A 5B7; CANADA; 3Department of Biological Sciences; University of Alberta, Edmonton, Alberta; T6G 2E9; CANADA; 4Geological Survey of Canada; 1500-605 Robson Street; Vancouver, British Columbia; V6B 5J3; CANADA; 5Department of Earth and Atmospheric Sciences; University of Alberta; Edmonton, Alberta; T6G 2E3; CANADA Abstract—The past quarter century has seen a marked increase in the recognition of fossil vertebrate tracksites in western Canada. Most of these finds were made in Alberta and British Columbia, but the Yukon Territory can lay claim to at least one tracksite and probably has the potential to yield more sites. The record of dinosaur tracks with skin impressions has increased dramatically, and is now represented by specimens of ankylosaurs, large ornithopods, small theropods and tyrannosauroids. Notable new finds include the first record of sauropods in Canada, evidence of herding behavior in ankylosaurs and the first pterosaur tracks in Canada. First discoveries of track specimens from several formations in western Canada include the Mountain Park Member of the Gates Formation in Alberta, and the Boulder Creek, Goodrich, Kaskapau, Cardium and Marshybank formations in northeastern British Columbia. -

Paper 1983-1

STRATIGRAPHY AND smInmmmy mms ON THE BULL- I(OUNTAIN-PEACE RIVERCANYON, CARBON CREEK AREA NORTHEASTERN BRITISH COLUMBIA (930/15, 16; 94B/1, 2) INTRODUCTION As the new District Geologist at Charlie lake, 1982 fieldwork was orientedtoward gaining a grasp of theregional and loc,slstratigraphy andsedimentology of thecoal-bearing sequences in the Northeast Coal- field. In thisregard I am indebted to Dave Gibsonand Con Stott of the GeologicalSurvey of Canada, Paul Cowley and NormanDuncan of Utah Mines Ltd.,and Charlie Williams of Gulf Canada ResourcesInc. for informative discussions. Fieldwork was concentrated in the area betweenBullhead Mountain on the east andPardonet Creek on the west (Fig.27). lhis areaincludes coal licences of Utah Mines Ltd.,Gulf Canada Resources Inc.., Shell Canada ResourcesLimited, andCinnabar Peak Mines Ltd.Recently published paperson the area includethose of Gibson(19781, St.ott and(Gibson (1980), andAnderson (1980). There are two coal-bearingformations in the area, theGething Formation of theBullhead Groupand theBickford Formation of thme Minnes ,:roup. The GethingFormation overlies the Bickford Formation and is sepsrated from it by the Cadomin Formation,which is variablypebbly sandstone to conglomerate (see stratigraphic column, Table 1). Regionallythe Cadomin Formation may rest on unitslower in the succession than the Bickford.According toStott (1973) this is due to an unconformitywhich progressivelytruncates underlying strata in a southwest-northeast direction. TABLE 1. SIWLIFIED STRATIGRPPHY OF THEMiNNES ANDBULLHEAD GROUPS (UPPERJWASSIC+CWER CRETACEOUS) IN THE BULLHEADMOUNTAIKPARDONET CREEK AREA BuIGething Formationlhead bal measures &CUD Cadomin Formation Pebblysandstone, quartzitic sandstone,conglomerate Mlnnes BickfordFormation Carbonaceousmeasures Grou p Monach FormtionFeldspathic sandstone, minor mounts of quartzite battle Peaks Formation Interbedded sandstone and shale bnteith Formatlon @per quartzites Lower greysandstones,, teldspathlc sandstones 93 ?he stratigraphy of thearea is notyet satisfactorily resolved (D. -

The Lower Cretaceous Flora of the Gates Formation from Western Canada

The Lower Cretaceous Flora of the Gates Formation from Western Canada A Shesis Submitted to the College of Graduate Studies and Research in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in the Department of Geological Sciences Univ. of Saska., Saskatoon?SI(, Canada S7N 3E2 b~ Zhihui Wan @ Copyright Zhihui Mian, 1996. Al1 rights reserved. National Library Bibliothèque nationale 1*1 of Canada du Canada Acquisitions and Acquisitions et Bibliographic Services services bibliographiques 395 Wellington Street 395. rue Wellington Ottawa ON KlA ON4 Ottawa ON K1A ON4 Canada Canada The author has granted a non- L'auteur a accordé une licence non exclusive licence allowing the exclusive permettant à la National Libraxy of Canada to Bibliothèque nationale du Canada de reproduce, loan, distribute or sell reproduire, prêter, distribuer ou copies of this thesis in microfom, vendre des copies de cette thèse sous paper or electronic formats. la fome de microfiche/nlm, de reproduction sur papier ou sur foxmat électronique. The author retains ownership of the L'auteur conserve la propriété du copyright in this thesis. Neither the droit d'auteur qui protège cette thèse. thesis nor substantial extracts fiom it Ni la thèse ni des extraits substantiels may be printed or otherwise de celle-ci ne doivent être imprimés reproduced without the author's ou autrement reproduits sans son permission. autorisation. College of Graduate Studies and Research SUMMARY OF DISSERTATION Submitted in partial fulfillment of the requirernents for the DEGREE OF DOCTOR OF PHILOSOPHY ZHIRUI WAN Depart ment of Geological Sciences University of Saskatchewan Examining Commit tee: Dr. -

Memorial to Alexander Rankin Cameron 1927–2000 RUSSELL R

Memorial to Alexander Rankin Cameron 1927–2000 RUSSELL R. DUTCHER Box 128, Carbondale, Illinois 62903-0128 WILLIAM SPACKMAN 170 Rosin Court, Wilmington, North Carolina 28405 As we move forward in our chosen professions, we become acquainted with many colleagues who become friends, professionally and oftentimes socially. By their very nature, geology and closely allied fields attract a large number of individuals who are in their chosen field because of the great satisfaction that stems from learning about Earth and its evolution. In turn, they enjoy imparting their knowledge to others—sometimes in a formal fashion through teaching and in publications, and sometimes through informal discussions, which may be spontaneous in origin. Every once in a while we meet a colleague who displays all of the traits to which everyone aspires. A human being that we just know makes life a little better for all of us, and by their very presence, makes the world a better place. Such a person was Alex Cameron. Alexander Rankin Cameron was born on January 24, 1927, in Toronto, Canada. At an early age Alex and his family moved to Cape Breton Island in the Canadian province of Nova Scotia. He received his bachelor of science degree from St. Francis Xavier University in Antigonish, Nova Scotia, in 1952. He spent the following summer at the Coal Research Laboratory of the Geological Survey of Canada in Sydney, Nova Scotia, under the guidance of Peter A. Hacque- bard. In the fall of 1952, he joined the staff of the Coal Research Section at Pennsylvania State University as a research assistant and graduate student in the Department of Geology and Geo- physics. -

Conodont Biofacies in a Ramp to Basin Setting (Latest Devonian and Earliest Carboniferous) in the Rocky Mountains of Southernmost Canada and Northern Montana

U. S. DEPARTMENT OF THE INTERIOR U. S. GEOLOGICAL SURVEY Conodont biofacies in a ramp to basin setting (latest Devonian and earliest Carboniferous) in the Rocky Mountains of southernmost Canada and northern Montana by Lauret E. Savoy1 and Anita G. Harris 2 Open-File Report 93-184 This report is preliminary and has not been reviewed for conformity with Geological Survey editorial standards or with the North American Stratigraphic Code. Any use of trade, product, or firm names is for descriptive purposes only and does not imply endorsement by the U.S. Government. \ Department of Geology and Geography, Mount Holyoke College, South Hadley, MA 01075 2 U.S. Geological Survey, Reston, VA 22092 1993 TABLE OF CONTENTS ABSTRACT 1 INTRODUCTION 2 LITHOSTRATIGRAPHY AND DEPOSITIONAL SETTING 2 CONODONT BIOSTRATIGRAPHY AND BIOFACIES 8 Palliser Formation 8 Exshaw Formation 13 Banff Formation 13 Correlative units in the Lussier syncline 15 PALEOGEOGRAPfflC SETTING 17 CONCLUSION 23 ACKNOWLEDGMENTS 23 REFERENCES CITED 24 APPENDIX 1 38 FIGURES 1. Index map of sections examined and major structural features of the thrust and fold belt 3 2. Correlation chart of Upper Devonian and Lower Mississippian stratigraphic units. 4 3. Selected microfacies of the Palliser Formation. 5 4. Type section of Exshaw Formation, Jura Creek. 6 5. Lower part of Banff Formation, North Lost Creek. 7 6. Conodont distribution in Palliser and Exshaw formations, Inverted Ridge. 9 7. Conodont distribution in upper Palliser and lower Banff formations, Crowsnest Pass. 11 8. Conodont distribution in upper Palliser, Exshaw, and lower Banff formations, composite Jura Creek - Mount Buller section. 12 9. -

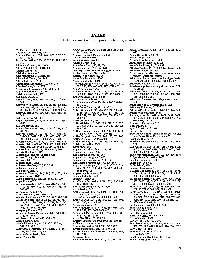

The Letters F and T Refer to Figures Or Tables Respectively

INDEX The letters f and t refer to figures or tables respectively "A" Marker, 312f, 313f Amherstberg Formation, 664f, 728f, 733,736f, Ashville Formation, 368f, 397, 400f, 412, 416, Abitibi River, 680,683, 706 741f, 765, 796 685 Acadian Orogeny, 686, 725, 727, 727f, 728, Amica-Bear Rock Formation, 544 Asiak Thrust Belt, 60, 82f 767, 771, 807 Amisk lowlands, 604 Askin Group, 259f Active Formation, 128f, 132f, 133, 139, 140f, ammolite see aragonite Assiniboia valley system, 393 145 Amsden Group, 244 Assiniboine Member, 412, 418 Adam Creek, Ont., 693,705f Amundsen Basin, 60, 69, 70f Assiniboine River, 44, 609, 637 Adam Till, 690f, 691, 6911,693 Amundsen Gulf, 476, 477, 478 Athabasca, Alta., 17,18,20f, 387,442,551,552 Adanac Mines, 339 ancestral North America miogeocline, 259f Athabasca Basin, 70f, 494 Adel Mountains, 415 Ancient Innuitian Margin, 51 Athabasca mobile zone see Athabasca Adel Mountains Volcanics, 455 Ancient Wall Complex, 184 polymetamorphic terrane Adirondack Dome, 714, 765 Anderdon Formation, 736f Athabasca oil sands see also oil and gas fields, Adirondack Inlier, 711 Anderdon Member, 664f 19, 21, 22, 386, 392, 507, 553, 606, 607 Adirondack Mountains, 719, 729,743 Anderson Basin, 50f, 52f, 359f, 360, 374, 381, Athabasca Plain, 617f Aftonian Interglacial, 773 382, 398, 399, 400, 401, 417, 477f, 478 Athabasca polymetamorphic terrane, 70f, Aguathuna Formation, 735f, 738f, 743 Anderson Member, 765 71-72,73 Aida Formation, 84,104, 614 Anderson Plain, 38, 106, 116, 122, 146, 325, Athabasca River, 15, 20f, 35, 43, 273f, 287f, Aklak -

Paper 1986-1

PALYNOLOGICAL ZONATION AND CORRELATION OF THE PEACE RIVER COALFIELD NORTHEASTERN BRITISH COLUMBIA By Jane Broatch INTRODUCTION BurntRiver, however, the chzlractcr of the formationchanses enough to allow four distinct m8:mben to be identified and for the Strataofthe Peace Ri\erCoalfield formcd along the Southwestern Minnes Formation to become a targel. for coal exploration. edge of the Jurassic/Crclaceous (:learwntct Sed. The rocks were deposited during a series of m:tjar and minor transgressive- Cadomin Formation: The Ckidomin conglomerate lies uncon regressive cycles and reflect a conlplex depositional setting. Map- mably on the Minnes Formation. Although quite variable in 1hi:k- ping and correlation of economic cwal deposlts are difficult. but the ness (3 to 200 metres). a general trcnd of thinning eastward :and task is made more so by numerous thrusts and folds which occurred northward is evident(Stott. 196x1. Within the study are;, the when the region underwent comp:ession. A diverse body of geo- CadominFormation is predominantly conglomerate, but the logiral information from a variely of disciplines is required to northwest it becomes a pebbly sandstrlne containing silty, shaly, ;lad unravel the structure and stratigrallhy. coaly lenses. Where this occurs it is mapped as the Dresser Fortr a- tion, after the nomenclature of Hughes. PREVIOUS WORK Gething Formation: The G,:thzng Formation is a domin:mly terrestrial sequence of interbedded conglomerate, sandstone, silt- Stratigraphic work in the area (Flg. 49-1 i was carried out by Stott Stone, and mudstone. Coal occu.s in tne upper halfof the form:h,n (1968, 1973, 1974, 19x1) andHughes (1964, 1967).Extensive but is only of economic importance in the central regions 01 the drilling by coal companiesha!, provided core samples and coalfield. -

Bedrock Geology of Alberta

Alberta Geological Survey Map 600 Legend Bedrock Geology of Alberta Southwestern Plains Southeastern Plains Central Plains Northwestern Plains Northeastern Plains NEOGENE (± PALEOGENE) NEOGENE ND DEL BONITA GRAVELS: pebble gravel with some cobbles; minor thin beds and lenses NH HAND HILLS FORMATION: gravel and sand, locally cemented into conglomerate; gravel of sand; pebbles consist primarily of quartzite and argillite with minor amounts of sandstone, composed of mainly quartzite and sandstone with minor amounts of chert, arkose, and coal; fluvial amygdaloidal basalt, and diabase; age poorly constrained; fluvial PALEOGENE PALEOGENE PALEOGENE (± NEOGENE) PALEOGENE (± NEOGENE) UPLAND GRAVEL: gravel composed of mainly white quartzite cobbles and pebbles with lesser amounts of UPLAND GRAVEL: gravel capping the Clear Hills, Halverson Ridge, and Caribou Mountains; predominantly .C CYPRESS HILLS FORMATION: gravel and sand, locally cemented to conglomerate; mainly quartzite .G .G and sandstone clasts with minor chert and quartz component; fluvial black chert pebbles; sand matrix; minor thin beds and lenses of sand; includes gravel in the Swan Hills area; white quartzite cobbles and pebbles with lesser amounts of black chert pebbles; quartzite boulders occur in the age poorly constrained; fluvial Clear Hills and Halverson Ridge gravels; sand matrix; ages poorly constrained; extents poorly defined; fluvial .PH PORCUPINE HILLS FORMATION: olive-brown mudstone interbedded with fine- to coarse-grained, .R RAVENSCRAG FORMATION: grey to buff mudstone -

Stratigraphy, Paleotectonics and Paleoenvironments of the Morrison Formation in the Bighorn Basin of Wyoming and Montana Dibakar Goswami Iowa State University

Iowa State University Capstones, Theses and Retrospective Theses and Dissertations Dissertations 1993 Stratigraphy, paleotectonics and paleoenvironments of the Morrison Formation in the Bighorn Basin of Wyoming and Montana Dibakar Goswami Iowa State University Follow this and additional works at: https://lib.dr.iastate.edu/rtd Part of the Geology Commons Recommended Citation Goswami, Dibakar, "Stratigraphy, paleotectonics and paleoenvironments of the Morrison Formation in the Bighorn Basin of Wyoming and Montana " (1993). Retrospective Theses and Dissertations. 10434. https://lib.dr.iastate.edu/rtd/10434 This Dissertation is brought to you for free and open access by the Iowa State University Capstones, Theses and Dissertations at Iowa State University Digital Repository. It has been accepted for inclusion in Retrospective Theses and Dissertations by an authorized administrator of Iowa State University Digital Repository. For more information, please contact [email protected]. INFORMATION TO USERS This manuscript has been reproduced from the microfilm master. UMI films the text directly from the original or copy submitted. Thus, some thesis and dissertation copies are in typewriter face, while others may be from any type of computer printer. The quality of this reproduction is dependent upon the quality of the copy submitted. Broken or indistinct print, colored or poor quality illustrations and photographs, print bleedthrough, substandard margins, and improper alignment can adversely afiect reproduction. In the unlikely event that the author did not send UMI a complete manuscript and there are missing pages, these will be noted. Also, if unauthorized copyright material had to be removed, a note will indicate the deletion. Oversize materials (e.g., maps, drawings, charts) are reproduced by sectioning the original, beginning at the upper left-hand corner and continuing from left to right in equal sections with small overlaps. -

British Columbia Geological Survey Geological Fieldwork 1992

PEACE RIVER COALFIELD DIGITAL MAPPING PROJECT, 1992 FIELDWORK (93V9, 10) By J.M. Cunningham and B.W. Sprecher KEYWORDS: Coal geology, Peace River, digital com- Road access from the city of Dawson Crf :ek to the ~nt~p pilation, Belcourt Creek, Wapiti Lake, stratigraphy. coal area is by the Old Heritage Hi::hway (52). Wi:hin the wntnl exploration, Monkman Park, Kakwa Recreational Area, part of the map area, logging and well-axes roads pwide Belcourt Creek Park. access for four-wheel-drive truck. Mounttin bikes we’e used where roads were impaw~hle by truck. More renote INTRODUCTION areas in the west and south we::e reached b: helicopur. The mapping completed during the 1992 field season DIGITAL COMPILATION AND IvlAPPING covered the Belcourt Creek (931/9) map sheet and half of the adjacent Wapiti Lake (931/10) map sheet (Figure 5-4-l). Most of the data collected during the cm)mpilation and These map areas straddle the foothills of the Rocky Moun- field mapping have been incorporated into a digital tains in northeast British Columbia, at the southeast end of database. The methodology used has bee I described :o the Peace River coalfield (Figure 5-J-2). This area is of varying degrees in previous articles (Kilby md Wrig,htson, particular interest because of proposed park additions and 19X7a. b, c; Kilby and Johrston, 1988~1, t, c; Kilt,> and new parks in the Monkman Pass region which may include Hunter, 1990; Hunter and Cunningham, 199la, b; (III- segments of the coalfield. ningham and Sprecher, 1992~1, tr) and so will only be b.xfly The work done this summer essentially completes the summarized here.