Moftic WTO Monitor

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alea Iacta Es: How Spanish Olives Will Force a Radical Change of the CAP Jacques Berthelot ([email protected]), SOL, 7 November 2018

Alea iacta es: how Spanish olives will force a radical change of the CAP Jacques Berthelot ([email protected]), SOL, 7 November 2018 Contents Summary Introduction I – The sequence of the investigation and the arguments put forward by the protagonists 1.1 – The products at issue: processed ripe olives, raw olives or both? 1.2 – The anti-dumping investigation 1.3 – The countervailing (or anti-subsidies) investigation II – Complementary fundamental arguments 2.1 – Why the EU agricultural products are not exported at their "normal value" 2.2 – Almost all EU product-specific agricultural domestic subsidies may be sued under the AoA and ASCM 2.3 – Which subsidies are product-specific (PS)? 2.4 – The case of the EU alleged PS decoupled direct payments 2.4.1 – Spanish ripe olives receive fully decoupled PS subsidies 2.4.2 – Why the other EU agricultural subsidies are not decoupled but are essentially PS 2.4.2.1 – The mixed behaviour of the guardians of the temple of decoupled subsidies 2.4.2.2 – The EU mantra that decoupled subsidies imply a market orientation of the CAP 2.4.2.3 – The reasons why the EU agricultural subsidies are not decoupled but mainly PS 2.4.2.4 – The case of input subsidies 2.4.3 – The WTO Appellate Body has departed from the GATT definition of dumping 2.4.4 – The best rebuttals of the assertion that the EU subsidies are decoupled NPS III – The consequences to draw to delete dumping and to build a totally new CAP 3.1 – Deleting the dumping impact of EU exports, particularly to developing countries 3.1.1 – Changing -

Market Access in Services 99 C

S P E C I S T A U L D I MARKETACCESS: UNFINISHEDBUSINESS E POST-URUGUAYROUND S INVENTORYANDISSUES ThisstudywaspreparedbyWTO'sEconomicResearchandAnalysisDivisionwith importantcontributionsbytheAgricultureandCommoditiesDivision,theTradein ServicesDivisionandtheIntegratedDataBaseSectionoftheStatisticsDivision. TheprojectcoordinatorwasMarcBacchetta. 6 Table of Contents Page Section I: Introduction 1 Section II: Industrial Products 7 A. Post-Uruguay Round tariffs 7 B. Other trade policy measures 18 Technical Notes to Section II 24 Appendix to Section II 28 Section III: Agricultural Products A. The Agreement on Agriculture’s origins 45 B. Trade policies under the Agriculture Agreement 46 C. Trends in trade and continuation of the reform process 64 Appendix Tables 68 Section IV: Services 97 A. The international services economy 97 B. Market access in services 99 C. The Uruguay Round and subsequent negotiations 103 D. What can be expected in the new round? 114 E. Issues arising in negotiations 122 Appendix to Section IV 133 Bibliography 141 i Tables, Boxes and Figures Page Section II Table II.1. Bound tariffs on industrial products. Scope of bindings, simple averages, standard deviations and tariff peaks 8 Table II.2. Bound tariffs on industrial products. Simple averages by country and MTN category 11 Table II.3. Bound tariffs on industrial products. Simple average tariff and standard deviation by stage of processing 14 Table II.4. Bound and applied tariffs on industrial products. Simple averages 17 Table II.5. Applied tariffs on industrial products. Duty free lines, simple averages, standard deviations and tariff peaks. 19 Table II.6. Frequency of core non-tariff barriers of selected countries 20 Table II.7. Pervasiveness of core non-tariff barriers affecting the manufacturing sector 21 Table II.8. -

Subsidies on Upland Cotton

United States – Subsidies on Upland Cotton (WT/DS267) Executive Summary of the Rebuttal Submission of the United States of America September 1, 2003 Introduction and Overview 1. The comparison under the Peace Clause proviso in Article 13(b)(ii) must be made with respect to the support as “decided” by those measures. In the case of the challenged U.S. measures, the support was decided in terms of a rate, not an amount of budgetary outlay. The rate of support decided during marketing year 1992 was 72.9 cents per pound of upland cotton; the rate of support granted for the 1999-2001 crops was only 51.92 cents per pound; and the rate of support that measures grant for the 2002 crop is only 52 cents per pound. Thus, in no marketing year from 1999 through 2002 have U.S. measures breached the Peace Clause.1 2. Brazil has claimed that additional “decisions” by the United States during the 1992 marketing year to impose a 10 percent acreage reduction program and 15 percent “normal flex acres” reduced the level of support below 72.9 cents per pound. However, the 72.9 cents per pound rate of support most accurately expresses the revenue ensured by the United States to upland cotton producers. Even on the unrealistic assumption that these program elements reduced the level of support by 10 and 15 percent, respectively (that is, the maximum theoretical effect these program elements could have had), the 1992 rate of support would still be 67.625 cents per pound, well above the levels for marketing years 1999-2001 and 2002. -

Trade Liberalization in China's Accession To

Trade Liberalization in China’s Accession to WTO Elena Ianchovichina and Will Martin World Bank Abstract China’s forthcoming accession to the WTO involves reforms across a wide range of sectors in China, both in directly trade-related sectors and behind the border. The implications of these reforms are greatly influenced by the starting point—a partially reformed economy with relatively high import duties, but in which export sectors benefit from liberal duty exemptions on their inputs. The paper takes account of this special feature in assessing the implications of reform. We find that China and its major trading partners gain from accession, while some competing countries suffer smaller losses. The adjustments required are greatly reduced by the dramatic liberalization that China undertook in the 1990s. JEL Classification: F02, F13, F14. ________________________________________________________________________ *Corresponding address: Elena Ianchovichina, MC8-810, World Bank, 1818 H St NW, Washington DC 20433. Ph 1-202-458-8910. Fax 1-202-522-1557. Email: [email protected] I. Introduction Accession to the WTO will be a major milestone in China’s economic development, modernization and integration into the world economy. Completion of the accession formalities will not be the end, but rather the beginning, of a new process of reform and adaptation that builds on the sweeping economic changes begun in 1978. The reform era in China, and other East Asian transition economies (Martin, 2001), has been a period of extraordinary growth in trade and output. Part of the growth in trade has been a consequence of economic reforms that have stimulated opening to the outside world, and part has been a consequence of the economic growth that opening to the world has done so much to facilitate. -

Conflicts Between U.S. Law and the World Trade Organization's Dispute Settlement Reports: Should the Court of International

Conflicts Between U.S. Law and the World Trade Organization’s Dispute Settlement Reports: Should the Court of International Trade and the Federal Circuit Seek to Reconcile Their Decisions with the WTO’s Reports in the Antidumping and Countervailing Duty Area? By Neal J. Reynolds1 I. Introduction In April 1994, the Uruguay Round Agreements, which were designed to establish a more comprehensive regime governing international trade among member states, were adopted by the United States and more than one hundred other nations.2 As the text of the Agreements indicated, they were “reciprocal and mutually advantageous arrangements {that were} directed to the substantial reduction of tariffs and other barriers to trade and the elimination of discriminatory treatment in international trade relations.”3 Among its other important achievements, the Uruguay Round established the World Trade Organization (“WTO”), which was designed to be a “permanent forum for member governments to address issues affecting their multilateral trade relations as well as to supervise implementation of the trade agreements negotiated in the Uruguay Round.”4 One important component of the Uruguay Round negotiations was the adoption of two 1 Mr. Reynolds is the Assistant General Counsel for Litigation at the U.S. International Trade Commission. The views expressed in this paper are solely those of the author. The paper was not prepared by the Commission or on its behalf, and does not represent the official views of the Commission or any individual commissioner. 2 See generally Final Act Embodying the Uruguay Round of Multilateral Trade Negotiations, April 15, 1994. 3 Agreement Establishing the World Trade Organization, Chapeau, April 15, 1994. -

Peru's Trade in Services: Multilateral and Preferential Liberalization

MILE 11 Thesis | September 2011 Peru’s Trade in Services: Multilateral and Preferential Liberalization Cristina Sanchez Rocha Supervisor: Pierre Sauvé MILE 11 World Trade Institute Cristina Sánchez Rocha TABLE OF CONTENTS TABLE OF CONTENTS .................................................................................................................... 2 LIST OF ABREVIATIONS ................................................................................................................. 4 1. Introduction.................................................................................................................................... 6 2. Peru’s Services Trade Profile........................................................................................................ 8 2.1. Peru’s services economy and foreign trade........................................................................... 8 2.2. Peru’s Inward and Outward Foreign Direct Investment (FDI).............................................. 10 2.3. Peru’s statistics on Mode 3.................................................................................................. 11 2.3.1. FDI received by Peru................................................................................................. 11 2.3.1. Peru’s FDI abroad ..................................................................................................... 12 3. Revealed Comparative Advantage Index.................................................................................... 14 3.1. Services Exports................................................................................................................. -

The Bali Agreemtn, at Last: an Assessment from the Perspective Of

THE BALI AGREEMENT, AT LAST AN ASSESSMENT FROM THE PERSPECTIVE OF DEVELOPING COUNTRIES WORKING PAPER | December 2014 EUGENIO DÍAZ-BONILLA AND DAVID LABORDE Name Introduction and On December 7, 2013, after several days of work and the usual posturing and drama, Members of the WTO closed the Ninth Ministerial Conference with an agreement on the organization’s first comprehensive multilateral trade package. Until that point, the trade agreements completed since the WTO’s creation in 1995 had been mainly regional and plurilateral ones, including some but not all WTO members. In many cases, these agreements were negotiated outside of the WTO altogether. The implementation of the Bali agreement should have taken place during 2014 but reached an impasse by the end of June; the reasons why will be discussed in detail below, but it was basically due to differences in opinion about the WTO’s treatment of public food stocks in developing countries.1 Only on November 27, 2014, almost a year after the original Bali Ministerial, did WTO members managed to patch up their differences. 2 This recent agreement allows the implementation of the assorted policy decisions that were supposed to have been settled at Bali but were held up by the dispute on public food stocks to finally proceed, and puts back on track the post-Bali work program that should now be defined by mid-2015. This paper discusses the results of the Bali Ministerial Conference of December 2013 (sometimes called the “Bali Pack- age”), the problems encountered during 2014, and how were they solved in November 2014, as well as the potential implications for the post-Bali work program which remains critical to unlocking the Doha Round. -

Policy and Progress in Moroccan Agriculture: a Retrospective and Perspective

Topics in Middle Eastern and African Economies Vol. 3, September 2001 POLICY AND PROGRESS IN MOROCCAN AGRICULTURE: A RETROSPECTIVE AND PERSPECTIVE Channing Arndt, Purdue University and Wallace E. Tyner, Purdue University Email: [email protected] JEL Codes: Q1, Q2 The policy reforms in Moroccan agriculture brought about through the process of structural and sectoral adjustment and the engagements undertaken by Morocco in the context of the General Agreement on Tariffs and Trade (GATT) represent important milestones in Moroccan agricultural history (1). Since 1985, reforms have been undertaken, especially with respect to domestic agricultural markets. Both authors have been closely involved in the reform process (Arndt since 1990 and Tyner since 1985). The process has been drawn out, halting, and highly complex. Throughout this article, we have tried to strike a balance between the need to generalize, in order to make the discussion accessible to readers unfamiliar with the evolution of Moroccan agricultural policy, and the need to present enough detail to be true to the facts. In this paper, we draw from available sources and our experience to argue three related points. 1) The impacts of reforms undertaken to date have, by and large, been positive. This reflects much more the dismal state of agricultural policy in 1985 rather than a positive rating of the reform process or the current policy environment. 2) Accordingly, further reforms, especially with respect to trade policy, are desirable. 3) Future reforms require important policy trade-offs, especially with respect to price stability for strategic agricultural commodities (bread wheat, sugar and oilseeds). Structural and Sectoral Adjustment At the dawn of agricultural sector adjustment in 1985, the Moroccan agricultural sector was marked by one of the highest levels of state intervention in the world. -

Chapter 17 the Seattle Ministerial Conference

CHAPTER 17 THE SEATTLE MINISTERIAL CONFERENCE The third WTO Ministerial Conference was held last year from November 30 to December 3 in Seattle, United States. The focus of the Conference was to be a decision on launching of the so-called “New Rounds,” which would be the next round of negotiations to follow the Uruguay Round, and corresponding decision on the scope and modalities of the new round. Article IV:1 of the Marrakesh Agreement Establishing the World Trade Organization (hereinafter, “WTO Agreement”) stipulates that “there shall be a Ministerial Conference composed of representatives of all the Members, which shall meet at least once every two years.” The first Ministerial Conference was held in Singapore in December 1996; the second, in Geneva, Switzerland in May 1998. The 1999 Conference was the third one. The four-day meeting did not reach a conclusion. At the same time, the launching of the new round was frozen and the Ministerial Declaration was not issued. It was decided that the discussion was suspended and will resume. This chapter contains an outline of the major developments regarding the new round of negotiations since the conclusion of the Uruguay Round, and brief comments on the preparation process for the Ministerial Conference and the discussions in Seattle. 1. Developments since the Conclusion on the Uruguay Round (1) First Ministerial Conference in Singapore (December 9-13, 1996) This was the first Ministerial Conference following the conclusion of the Uruguay Round in Marrakesh on April 15, 1994 and the transition from the GATT to the WTO in January 1995. -

Subsidies on Upland Cotton (WT/DS267)

United States – Subsidies on Upland Cotton (WT/DS267) Comments of the United States of America on the Comments by Brazil and the Third Parties on the Question Posed by the Panel I. Overview 1. The United States thanks the Panel for this opportunity to provide its views on the comments by Brazil and the third parties on the question concerning Article 13 of the Agreement on Agriculture (“Agriculture Agreement”) posed by the Panel in its fax of May 28, 2003.1 The interpretation of Article 13 (the “Peace Clause”) advanced by Brazil and endorsed by some of the third parties is deeply flawed. Simply put, Brazil fails to read the Peace Clause according to the customary rules of interpretation of public international law. Its interpretation does not read the terms of the Peace Clause according to their ordinary meaning, ignores relevant context, and would lead to an absurd result. 2. Brazil reads the Peace Clause phrase “exempt from actions” to mean only that “a complaining Member cannot receive authorization from the DSB [Dispute Settlement Body] to obtain a remedy against another Member’s domestic and export support measures that otherwise would be subject to the disciplines of certain provisions of the Agreement on Subsidies and Countervailing Measures . or Article XVI of GATT 1994.’”2 However, Brazil’s reading simply ignores parts of the definition of “actions” that it quotes: “The dictionary definition of ‘actions’ is ‘the taking of legal steps to establish a claim or obtain a remedy.”3 Thus, while the United States would agree that the phrase “exempt from actions” precludes “the taking of legal steps to . -

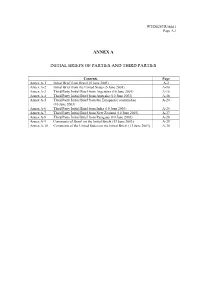

Annex a Initial Briefs of Parties and Third Parties

WT/DS267/R/Add.1 Page A-1 ANNEX A INITIAL BRIEFS OF PARTIES AND THIRD PARTIES Contents Page Annex A-1 Initial Brief from Brazil (5 June 2003) A-2 Annex A-2 Initial Brief from the United States (5 June 2003) A-10 Annex A-3 Third Party Initial Brief from Argentina (10 June 2003) A-15 Annex A-4 Third Party Initial Brief from Australia (10 June 2003) A-18 Annex A-5 Third Party Initial Brief from the European Communities A-20 (10 June 2003) Annex A-6 Third Party Initial Brief from India (10 June 2003) A-25 Annex A-7 Third Party Initial Brief from New Zealand (10 June 2003) A-27 Annex A-8 Third Party Initial Brief from Paraguay (10 June 2003) A-28 Annex A-9 Comments of Brazil on the Initial Briefs (13 June 2003) A-29 Annex A-10 Comments of the United States on the Initial Briefs (13 June 2003) A-38 WT/DS267/R/Add.1 Page A-2 ANNEX A-1 BRAZIL’S BRIEF ON PRELIMINARY ISSUE REGARDING THE “PEACE CLAUSE” OF THE AGREEMENT ON AGRICULTURE 5 June 2003 TABLE OF CONTENTS Page I. INTRODUCTION AND SUMMARY ............................................................................... 2 II. ANALYSIS OF THE PHRASE "EXEMPT FROM ACTIONS" ................................... 3 III. THE CONTEXT OFF ARTICLE 13 DEMONSTRATES THAT THERE IS NO LEGAL REQUIREMENT FOR THE PANEL TO FIRST MAKE A FINDING ON THE PEACE CLAUSE BEFORE PERMITTING BRAZIL TO SET OUT ITS ARGUMENT AND CLAIMS REGARDING US VIOLATIONS OF THE SCM AGREEMENT ................................................................................................. 5 IV. RESOLUTION OF THRESHOLD ISSUES PRIOR TO PROVIDING PARTIES THE OPPORTUNITY TO PRESENT ALL OF ITS EVIDENCE IS CONTRARY TO THE PRACTICE OF EARLIER PANELS .................................. -

Foreign Trade Remedy Investigations of U.S

Foreign Trade Remedy Investigations of U.S. Agricultural Products Updated November 10, 2020 Congressional Research Service https://crsreports.congress.gov R46263 SUMMARY R46263 Foreign Trade Remedy Investigations of November 10, 2020 U.S. Agricultural Products Anita Regmi Foreign countries appear to be making greater use of punitive measures affecting U.S. Specialist in Agricultural agricultural exports. These measures, corresponding to duties the United States has long imposed Policy on imports found to be traded unfairly and injuring U.S. industries, have the potential to reduce the competitiveness of U.S. agricultural exports in some foreign markets. Recent changes in U.S. Nina M. Hart agricultural policy, including several large ad hoc domestic spending programs—valued at up to Legislative Attorney $60.4 billion—in response to international trade retaliation in 2018 and 2019, and to economic disruption caused by the Coronavirus Disease (COVID-19) pandemic in 2020, may increase the likelihood of foreign measures that adversely affect U.S. agricultural trade. Randy Schnepf Specialist in Agricultural The imposition of anti-dumping and countervailing duties is governed by the rules of the World Policy Trade Organization (WTO) and of WTO’s 1995 Agreement on Agriculture (AoA). Under the AoA, member countries agreed to reform their domestic agricultural support policies, increase access to imports, and reduce export subsidies. The AoA spells out the rules to determine whether policies are potentially trade distorting. If a trading partner believes that imported agricultural products are sold below cost (“dumped”) or benefit from unfair subsidies, it may impose anti-dumping (AD) or countervailing duties (CVD) on those imports to eliminate the unfair price advantage.