Home Loan Application

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ME Bank up for Grabs Book Values on the Australian LACHLAN MOFFET GRAY Securities Exchange

ME Bank up for grabs book values on the Australian LACHLAN MOFFET GRAY Securities Exchange. 18 January 2021 The approaches follow the departure of outgoing boss Jamie E Bank is believed to be McPhee last year, after speculation in informal talks with a started mounting that a sale of the M private-equity backed lender could be on the agenda, with consortium of investors about a some shareholders eager to embark potential sale of the industry super on an exit. fund-owned lender that is estimat- Mr McPhee had run the bank ed to be worth at least $1.1bn. for more than 10 years and his exit It is understood that the came after the bank was entangled consortium involved has backing in controversy over abrupt changes opinion is divided as to whether from an industry executive linked to mortgage redraw facilities during the buyer should be another bank to a neobank and is thought to be the COVID-19 crisis, although he or private equity. offering a price around its book said at the time his departure was The challenge for Australian value, estimated to be between not related to the controversy. listed banks when it comes to $1.1bn and $1.5bn. It is understood that Mr McPhee buying ME is that with most trad- Sources say that the consor- is not involved in the latest consor- ing at below their net asset value tium believes ME Bank could tium approach. themselves, a deal remains uneco- be taken down the financial ME Bank is owned by 26 nomical unless they can secure it at technology business route, with industry super funds, including a major discount. -

Annual Review 2014 Financial Year

20120143 2014 ANNUAL REVIEW. ME BANK AWARDS. ME BANK WON THE FOLLOWING AWARDS IN THE 2014 FINANCIAL YEAR CANSTAR AWARDS 2014 CANSTAR Award 2014 CANSTAR Award 2014 CANSTAR Award Gold Medal - Gold Medal - Gold Medal - Outstanding Value Outstanding Value Outstanding Value Transaction Account Savings Account Mortgage 2014 CANSTAR Award 2014 CANSTAR Award Gold Medal - Gold Medal - Outstanding Value Outstanding Value Home Loan Deposit Account MONEY MAGAZINE AWARDS 2014 Money Magazine 2014 Money Magazine Best of the Best Awards - Best of the Best Awards - Best Short-Term Deposit Best Long-Term Deposit SMART INVESTOR AWARDS 2014 Smart Investor 2014 Smart Investor Blue Ribbon Awards - Blue Ribbon Awards - Regional Bank of the Year Best Short-Term Deposit OTHER AWARDS ON-MAJ N OR ST B E A B N K B 2014 Australian 2014 Mozo People’s 2014 Australian D M Mortgage Awards - Choice Awards Lending Awards - Best Non-Major Bank BDM Gold Medal Best Customer Experience CONTENTS. ONE: MESSAGES FROM THE CHAIRMAN AND CEO. 3 TWO: ABOUT ME BANK. 5 Overview 5 Products and Services 5 Customers 6 THREE: 2014 PERFORMANCE. 7 Overview 7 Financial Performance 7 Operational Efficiency 8 Balance Sheet 8 Funding 10 Capital Management 11 FOUR: PRIORITIES. 12 Overview 12 The Transformation Program 12 Growing Network Deposits 13 Workplace Banking 14 Mobile Lenders 14 Growing Primary Bank Relationships 15 Other Notable Changes 15 FIVE: RISK MANAGEMENT. 16 SIX: GOVERNANCE. 17 Corporate Governance 17 Board 17 SEVEN: EXECUTIVE TEAM. 23 EIGHT: CORPORATE RESPONSIBILITY. 26 Overview 26 People 26 Community 28 Environment 30 NINE: KEY FINANCIAL INFORMATION. 32 2 ME Bank Annual Review 2014 ONE: MESSAGES FROM THE CHAIRMAN AND CEO. -

Australian Major Banks FY2019 Results

Challenges, choices and complexities Australian major banks F Y2019 results November 2019 “Bankprofitabilityisunderthreat,ROEhashalved overthepast15years.NIMshavehalvedoverthat period.Wearenowmuchclosertoourcostof equity.Theabilitytoholdthemachinetogetheras itis...isunsustainable.Ithinktheideathatthese universal,mass-marketbanksaregoingtocontinue tothrive,Idon’tagreethat’sthecase.Iamnot sayingthere’sgoingtobenone,butIdon’tbelieve thatthisissustainableinthefuture.’’ Shayne Elliott CEO,ANZi Growthwasa challenge Efficiencyiscritical Cashprofitdeclinedby Total income Total expenses declined by 3.7% increased by 0.8% 7.8% Creditriskincreasing Lendinggrowthhasslowed OntracktomeetAPRA’s ‘unquestionablystrong’ (90DPD+GIA)/GLA Total average increased by interest earning CET1 14 bps assets 3.3% target of 10.5% Source:FY2019resultsandinvestorpresentationsforANZ,CBA,NABandWBC:Deloitteanalysis. Challenges, choices and complexities | Australian major banks FY2019 results Majorbanks:FY2019results AtypicalAustralianbankingreportingseasonafewyearsago Ontopofthis,bankshavehadtoimplementAPRA’sBanking wascharacterisedbyhighretailbankingReturnonEquity ExecutiveAccountabilityRegime(BEAR)effectivefrom1July2018. (ROE),positivejaws,lowerbaddebts,andabovesystem Withintensivecompetitivepressuresfrominternationalbanks mortgage growth. and non-traditionalplayers;‘zerobound’interestanddepositrates; SolidGDPgrowth,highimmigrationintake,andaresilientjob highercapitalrequirementsforNZbusinesses;continuedlarge markethaveprovidedafavourablebackdroptotheAustralian remediationprograms,andthepermanentincreaseinregulatory -

The World's Most Active Banking Professionals on Social

Oceania's Most Active Banking Professionals on Social - February 2021 Industry at a glance: Why should you care? So, where does your company rank? Position Company Name LinkedIn URL Location Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) Rank Change 1 Teachers Mutual Bank https://www.linkedin.com/company/285023Australia 451 34 7.54% ▲ 4 2 P&N Bank https://www.linkedin.com/company/2993310Australia 246 18 7.32% ▲ 8 3 Reserve Bank of New Zealand https://www.linkedin.com/company/691462New Zealand 401 29 7.23% ▲ 9 4 Heritage Bank https://www.linkedin.com/company/68461Australia 640 46 7.19% ▲ 9 5 Bendigo Bank https://www.linkedin.com/company/10851946Australia 609 34 5.58% ▼ -4 6 Westpac Institutional Bank https://www.linkedin.com/company/2731362Australia 1,403 73 5.20% ▲ 16 7 Kiwibank https://www.linkedin.com/company/8730New Zealand 1,658 84 5.07% ▲ 10 8 Greater Bank https://www.linkedin.com/company/1111921Australia 621 31 4.99% ▲ 0 9 Heartland Bank https://www.linkedin.com/company/2791687New Zealand 362 18 4.97% ▼ -6 10 ME Bank https://www.linkedin.com/company/927944Australia 1,241 61 4.92% ▲ 1 11 Beyond Bank Australia https://www.linkedin.com/company/141977Australia 468 22 4.70% ▼ -2 12 Bank of New Zealand https://www.linkedin.com/company/7841New Zealand 4,733 216 4.56% ▼ -10 13 ING Australia https://www.linkedin.com/company/387202Australia 1,319 59 4.47% ▲ 16 14 Credit Union Australia https://www.linkedin.com/company/784868Australia 952 42 4.41% ▼ -7 15 Westpac https://www.linkedin.com/company/3597Australia -

ME Bank, the Fairer Banking Alternative

ME Bank, the fairer banking alternative. About ME Bank ME Bank’s origins date back to 1994, where, as Super At ME Bank, we pride ourselves on delivering exceptional Members Home Loans, we began offering low cost customer service. When you call ME Bank, you speak to home loans to members of industry super funds and a real person – not a machine – right here in Australia. unions. Today ME Bank is the only bank in Australia It’s hardly surprising then, that compared to other banks, which is 100 percent owned by Australia’s leading people who bank with ME Bank are consistently more industry super funds. These super funds have more satisfied and more likely to promote their bank to than 5 million members and over $180 billion in other people.* funds under management. The Bank has also been awarded the It’s in the Bank’s DNA to provide members with a genuine 2011 Mozo’s People’s Choice Award for alternative to the profit driven big banks, offering products “Best Bank Customer Service”. 2011 BEST that are simple, low cost and fair. And that doesn’t just bank mean providing better value banking – it incorporates a As well as home loans, ME Bank offers customer service a full suite of banking products from responsible lending policy that strives to make sure you s transaction accounts to credit cards, people’ never take on an unmanageable level of debt. choice personal loans and term deposits. *CoreData brandmanagement Net Promoter Score (NPS) Survey December 2010: The NPS of customer satisfaction is determined by taking the percentage of “promoters”, those who are highly likely to recommend the product or service, and subtracting the percentage of “detractors”, those who are unlikely to recommend. -

Electronic Transaction Dispute

electronic transaction dispute. Mail: ME, Card Disputes, Reply Paid 1345, Melbourne, VIC 8060 Email: [email protected] Fax: (03) 9708 4740 For any enquiries contact us on 13 15 63 or visit mebank.com.au Section 1 - Your account details Account type: Credit card Transaction Account Savings Account Personal Loan Home Loan Card number (if applicable) Account number (not required for credit card disputes) Section 2 - Account holder details Title (Mr/Mrs/Miss/Ms/other) Given name(s) Family name Residential address (P.O. Box addresses are not acceptable) State Postcode Mobile Home phone Work phone ( ) ( ) Section 3 - Last valid transaction details Date Time Amount Location D D M M Y Y : am/pm $ . Type of transaction: EFTPOS ATM Internet inc. Mobile App Phone banking Bank@Post Credit card purchase Section 4 - Disputed transaction details (if there are more than 3 transactions, please attach details) Transaction 1 Date Time Amount D D M M Y Y : am/pm $ . ATM operator fee $ . Merchant name Location Type of transaction: EFTPOS ATM Internet inc. Mobile App Phone banking Bank@Post Credit card purchase Transaction 2 Date Time Amount D D M M Y Y : am/pm $ . ATM operator fee $ . Merchant name Location Type of transaction: EFTPOS ATM Internet inc. Mobile App Phone banking Bank@Post Credit card purchase Transaction 3 Date Time Amount D D M M Y Y : am/pm $ . ATM operator fee $ . Merchant name Location Type of transaction: EFTPOS ATM Internet inc. Mobile App Phone banking Bank@Post Credit card purchase Have you authorised someone to use your card? Yes please complete Section 5 No go to Section 6 Members Equity Bank Limited ABN 56 070 887 679. -

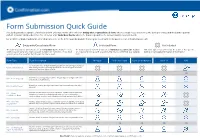

Form Submission Quick Guide This Guide Provides a Sample of Banks and Form Offerings

Form Submission Quick Guide This guide provides a sample of banks and form offerings. Banks offer either an Entity wide / Consolidated form, where a single request is sent to the bank per entity, and the bank responds with all accounts and products for that entity; or offer Individual Forms where the bank responds to the account number provided only. For a full list of banks and forms offered, please refer to the In Network Responder Report generated from the Reports section in Confirmation.com. Entity wide/Consolidated Form Individual Form Not Included The bank responds to form details on an entity wide basis. Auditors send a The bank responds to form details on an individual account basis. Auditors This form type is not offered by the bank as the specific single request using one main account number for reference. If no main are required to set up each account number to be confirmed as a separate bank does not supply information in this manner. account exists the customer identification number is used. form. Form Type Form Description Westpac St George Bank Bank of Melbourne Bank SA NAB For each form sent, the bank will then provide an extensive report of all your Client Consolidated bank dealings for the legal entity specified. No other form types should be submitted if this form option is used. OR An asset account is typically a current, cheque, deposit, savings, investment AU – Asset (Deposit) and any other credit balance. A liability account is typically a bank loans, term loans and any other debit AU – Liability (Loan) balances. -

Money Matters – in 2020

Money Matters – in 2020 Much has happened recently, are you up to date? The Internet continues to transform money transactions. Many people, particularly seniors, are not fully aware of recent changes in shopping, buying, selling and banking. What is secure and what is not, How to shop and bank safely, How to use recent facilities to make transactions easier. Let us explore these things -------- Alarming reports on ½ $B scams in 2018, should you be worried? Be aware of where most risks are, phone calls and emails. Such as : ATO “if you don’t pay $x,ooo we have to issue a warrant for your arrest and see you arrested”, also from romance and investment sites, calls from Telstra, NBN, Microsoft etc. By comparison, electronic banking and buying is very low risk. Banking risk is fully covered by banking guarantees. Ways to pay now About 9 out of 10 payments are now cashless. Bpay – for common regular payments, gas, electricity, licenses etc Credit/debit card – Paywave or insert, particularly for shops and cafes Mobile phones and Payment watches and other contactless devices Payment managers - PayPal, Post Pay, Ali Pay (for Chinese tourists) Direct bank transfers - PayID. Using cards - 3 ways Magnetic stripe, (swipe) Contact, (insert) Paywave, – best, (NFC wireless) Avoid using PIN, except where required Do we need banks anymore? Banking around the world is changing dramatically. Many overseas banks no longer accept cash or cheques. This is now happening in Australia. In Australia banks are closing many branches, saving costs of staff, rent and other costs. It has been reported that CBA will be closing 300 branches, And reducing staff by some 10,000 We still need banking facilities, but don’t need to visit a bank now. -

For Imm Ediat E Relea

Article No. 8641 Available on www.roymorgan.com Link to Roy Morgan Profiles Monday, 15 February 2021 ING home loan customers once again the most satisfied with their bank, followed by Bendigo, Bankwest and ME Bank New financial data from Roy Morgan shows ING not only retained its position at the top of banking customer satisfaction ratings among home loan customers, it increased an already exceptional score of 94.4% in November 2020 to 95.1% in December. This is up 5.8% on a year earlier (89.3% in December 2019). In fact, Australia’s top 12 banks collectively increased their home loan customer satisfaction from 74% in December 2019 to 79.5% a year later. E The data covers July to December 2020. This period began with more than Australian 436,000 home loans deferred, as customers impacted by the COVID-19 pandemic took an initial payment pause of up to six months, and ended with all but around 100,000 of these borrowers having resumed payments. Following leader ING is Bendigo Bank, with a home loan customer satisfaction rating of 88.1% (a lift from 83.3% a year earlier). Next are Bankwest and ME Bank, equal on 88% each. For Bankwest this is a jump up from its rating of 77.1% a year earlier, however ME Bank actually fell from a 91.4% satisfaction rating. CBA once again has the highest home loan customer satisfaction among the big four banks, with a rating of 80%. Total home loan customer satisfaction with the big four banks as a group is 77.6%. -

Australian Banking by Numbers

Community investment Community investment Balance Sheet Commonwealth Bank – In 2018 CommBank Foundation invested ANZ – In 2018 ANZ invested $137 million in the community including Taxes & more than $13 million to support 1220 community organisations refugee and indigenous employment, rural/regional community Financial Highlights through its Community and Centenary Grants programs. CBA is also grants, and foregone revenue to aid disaster recovery. MoneyMinded supporting future generations with $50 million invested in education financial education has helped 580,000 people and over 40,000 low- f Number of bank employees & Funding programs since 2015. income people have participated in the ANZ Saver Plus program. Income 132,000 Levies f in Australia Macquarie Group – In FY18 Macquarie staff and the Macquarie Arab Bank Australia – Supporting Medical Research through The - Net interest income $66 billion k Balance sheetd Group Foundation contributed more than $28 million dollars and Brain Cancer Group and Westmead Medical Research Foundation, Taxes and levies paid Number of bank customers 18 million 60,000 volunteer hours to more than 1,500 charitable organisations, and supporting the Art Gallery of NSW (learning curve lecture series) - Fees/commissions $33 billion a,k Bank assets $3.9 trillion including Social Ventures Australia, Women’s Community Shelters, and the Australian World Orchestra (AWO) Academy. - Tax paidf $13.9 billion Number of bank shareholders 2.3 million CareerTrackers, Raise Foundation and the Clontarf Foundation. Total operating income $99 billion Bank of Sydney – Supports over 150 multicultural community e Dividends paid by banks to Bank liabilities $3.6 trillion - Major Bank Levy $1.5 billion f $26 billion Bank of America Merrill Lynch – Supports 47 NGOs in 12 markets groups annually, as well as being an ongoing supporter of Brain Expensesf shareholders in the APAC region, focused on driving economic and social Cancer Research. -

Insights from National Research

THE FINANCIAL PSYCHOLOGY OF AUSTRALIAN HOUSEHOLDS. INSIGHTS FROM NATIONAL RESEARCH. HOUSEHOLD FINANCIAL COMFORT REPORT. FOURTH SURVEY - JULY 2013. ABOUT THIS REPORT. The ME Bank Household The Household Financial Comfort THE ROAD FROM HERE. Financial Comfort Report provides Index specifically measures: The Household Financial Comfort in-depth and critical insights • Overall household financial Report reflects ME Bank’s mission into the financial situation of comfort by asking respondents to understand the financial Australians based on a survey to estimate their financial mindset of Australian households of about 1,500 households. comfort as well as their in order to deliver a fairer This Report presents the key expectations and confidence banking alternative. Over time, findings from the fourth survey across 11 measures, the Report will track changes in conducted in early June 2013, • Other findings about household comfort and in doing so, highlight following previous surveys in savings, investments, debt, the ongoing – and potentially October 2011, June 2012 and living expenses, net wealth and shifting – differences between December 2012. standard of living in retirement, household types, in terms of and financial comfort and behaviours The Report includes but is not in managing finances. limited to, the Household Financial • Financial management Comfort Index, which measures behaviours and worries. The Household Financial Comfort ongoing changes to households’ Report will be a source of ongoing perceptions of their own financial information to public policy comfort, providing important makers, financial institutions insights into the changing financial and social welfare organisations and economic psychology of and will hopefully assist in Australian households. decisions regarding taxation, superannuation, banking, financial regulation, welfare reform, financial education and other related matters. -

Broker's Guide to Non-Major Banks

BROKER’S GUIDE April 2021 Broker’s Guide to Non-Major Banks WHAT BROKERS TURNAROUND TIMES HOW THE NON-MAJORS WANT IN FOCUS ARE SERVING BROKERS P.12 P.14 P.18 Cover.indd 1 9/03/2021 3:31:57 PM Home loans that tick all the right boxes for essential workers We serve education, emergency services We are the only Australian bank with retail and health workers nationally in all states deposits, mortgages, and wholesale funding and territories all certified as ethical or responsible We’re one of a small number of banks We understand our essential workers like participating in the First Home Loan deposit no other bank, that’s why we have products scheme to help essential workers own their and features tailored for them. Offers such home sooner as 100% offset facilities on fixed rate home loans, or 35-year loan terms to help keep We have been named one of the World’s the monthly payments down. Most Ethical Companies® for the eighth year in a row Unlock nationwide access to hundreds of thousands of essential workers in niche industry sectors. Become an accredited Teachers Mutual Bank Limited broker today to access four customer-owned industry banking divisions. To find out more or to become accredited contact [email protected] or 1300 86 22 65 Teachers Mutual Bank Limited ABN 30 087 650 459 AFSL/Australian Credit Licence 238981. Membership eligibility applies to join the Bank. All applications for credit are subject to our responsible lending criteria. Fees and charges apply. You can find our Consumer Lending terms and conditions available online or from any of our offices.