Form 990O for NATIONAL RIFLE ASSOCIATION OF

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How the Firearms Industry and NRA Market Guns to Communities of Color

JANUARY 2021 How the Firearms Industry and NRA Market Guns to Communities of Color WWW.VPC.ORG COPYRIGHT AND ACKNOWLEDGMENTS Copyright © January 2021 Violence Policy Center Violence Policy Center 1025 Connecticut Avenue, NW Suite 1210 Washington, DC 20036 202-822-8200 The Violence Policy Center (VPC) is a national nonprofit educational organization that conducts research and public education on violence in America and provides information and analysis to policymakers, journalists, advocates, and the general public. This study was authored by VPC Executive Director Josh Sugarmann. Additional research assistance was provided by Alyssa Berkson, Jacob Gurvis, Nicholas Hannan, Ellie Pasternack, and Jill Rosenfeld. This study was funded with the support of The Joyce Foundation and the Lisa and Douglas Goldman Fund. For a complete list of VPC publications with document links, please visit http://www.vpc.org/publications. To learn more about the Violence Policy Center, or to make a tax-deductible contribution to help support our work, please visit www.vpc.org. 2 | VIOLENCE POLICY CENTER HOW THE FIREARMS INDUSTRY AND NRA MARKET GUNS TO COMMUNITIES OF COLOR TABLE OF CONTENTS Introduction 1 Section One: The National Shooting Sports Foundation (NSSF) and the Firearms Industry 4 Section Two: The National Rifle Association 20 Section Three: The NSSF and NRA Exploit COVID-19 in Their Marketing Efforts 28 Section Four: The Reality of Black and Latino Americans and Guns 32 Section Five: The Myth of Self-Defense Gun Use 36 Conclusion 38 This study is also available online at: https://vpc.org/how-the-firearms-industry-and-nra-market-guns-to-communities-of-color/. -

How the Gun Industry

MARKETING DEATH HOW THE GUN INDUSTRY USES THE NRA TO BOOST PROFITS AND UNDERMINE PUBLIC SAFETY While the country mourns the lives of multiple mass shooting victims and sufferers of gun violence, the radical gun lobby known as the National Rifle Association has not wavered in its stance against commonsense gun safety laws. The NRA claims to represent regular gun owners, but as of 2015, most of them disagreed with the NRA’s positions against universal background checks and assault weapons bans. Instead, the group is incentivized to take extreme policy views and spread rhetoric that helps pad the wallets of the gun industry. The NRA is financially backed by the gun industry and has multiple sitting board members with ties to gun and ammunition manufacturing. Today’s NRA does not speak for everyday gun- owners and sportsmen, but mainly represents the interests of the $13.5 billion-a-year gun industry. The NRA’s board of directors is filled with gun manufacturing executives, lawyers, and lobbyists. NRA First Vice President and CEO of Brownells, Inc., Pete Brownell, leads the “world’s largest supplier” of gun accessories and gunsmithing tools, which included the so-called “cop killer” bullets the Bureau of Alcohol, Tobacco and Firearms proposed to ban. Brownell, who has donated at least $1 million to the NRA, said that having gun industry leaders as NRA directors “ensures the NRA’s focus is honed on the overall mission of the organization.” Another NRA board member, CEO of Barrett Firearms Manufacturing Ronnie Barrett, created the first .50 caliber military-style rifle for civilian use and has testified to his rifles’ “usefulness against commercial planes.” In addition to the NRA directors who benefit from gun sales, the group’s board is packed with extremists who are out of step with typical American gun owners, and in many cases, even mainstream American values. -

September 30, 2019 Acting Director Margaret Weichert U.S. Office Of

September 30, 2019 Acting Director Margaret Weichert U.S. Office of Personnel Management 1900 E Street, NW Washington, D.C. 20415 Re: NRA Foundation Dear Ms. Weichert: On behalf of Everytown for Gun Safety, the nation’s largest gun violence prevention group, I write to urge you to investigate whether the NRA Foundation should be disqualified and expelled from participation in the Combined Federal Campaign (“CFC”), the workplace giving program for federal government employees. As you may be aware, over the past several months there has been a series of public disclosures and reports revealing substantial evidence of serious and wide-ranging financial impropriety at the National Rifle Association (“the NRA”) – a 501(c)(4) organiZation that according to its own regulatory filings controls CFC participant the NRA Foundation (which is a 501(c)(3) organiZation) – including self-dealing, improper enrichment of organiZation insiders, conflicts of interest, and violations of the not-for-profit laws. As a result, there are now active regulatory investigations by the Attorney General of the District of Columbia as to CFC participant the NRA Foundation and the NRA, and by the Attorney General of New York as to the NRA and its affiliated not-for-profit entities. These allegations and investigations of serious potential misconduct at the NRA are particularly troubling because, in the last two reported years, the NRA Foundation has sent over half of its revenue to the NRA, meaning that over $0.50 of every dollar raised through the federal government’s CFC for the NRA Foundation ended up in the coffers of the NRA. -

National Rifle Association of America

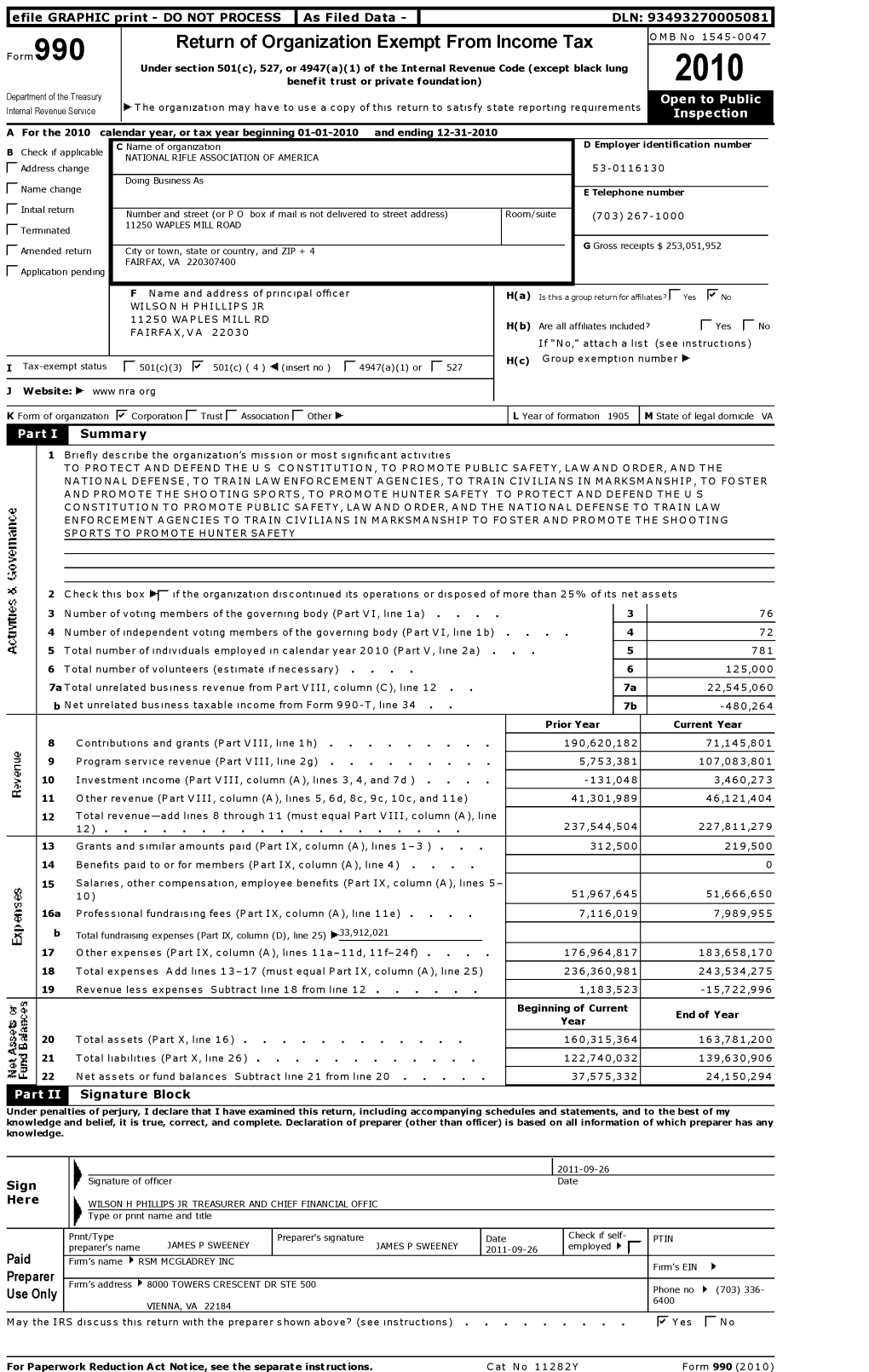

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93493270005081 Return of Organization Exempt From Income Tax OMB No 1545-0047 Form 990 Under section 501 (c), 527, or 4947( a)(1) of the Internal Revenue Code ( except black lung benefit trust or private foundation) 2010 Department of the Treasury Internal Revenue Service -The organization may have to use a copy of this return to satisfy state reporting requirements A For the 2010 calendar year, or tax year beginning 01 -01-2010 and ending 12 -31-2010 C Name of organization D Employer identification number B Check if applicable NATIONAL RIFLE ASSOCIATION OF AMERICA F Address change 53-0116130 Doing Business As F Name change E Telephone number fl Initial return Number and street (or P 0 box if mail is not delivered to street address ) Room/ suite (703) 267-1000 11250 WAPLES MILL ROAD (Terminated G Gross receipts $ 253,051,952 Amended return City or town , state or country , and ZIP + 4 FAIRFAX, VA 220307400 F_ Application pending F Name and address of principal officer H(a) Is this a group return for aff liates7 I Yes I' No WILSON H PHILLIPS JR. 11250 WAPLES MILL RD H(b) Are all affiliates included? F Yes F_ No FAIRFAX,VA 22030 If "IN o," attach a list (see instructions) H(c) Group exemption number 0- I Tax - exempt status F_ 501(c)(3) F 501( c) ( 4 I (insert no ) 1 4947(a)(1) or F_ 527 3 Website : - www nra org K Form of organization F Corporation 1 Trust F_ Association 1 Other 1- L Year of formation 1905 M State of legal domicile VA Summary 1 Briefly describe the organization -

April 27, 2019

NATIONAL RIFLE ASSOCIATION OF AMERICA REPORT OF THE SECRETARY TO THE ANNUAL MEETING OF MEMBERS Indianapolis, Indiana April 27, 2019 Article IV, Section 2 of the NRA Bylaws, as amended by vote of the members in 2017, requires the NRA Secretary to report business transactions in which entities led by NRA Board members, officers, or employees received payments in excess of $2,000 for goods and services provided to the NRA. I am required to transmit this information to the Board of Directors, and also to inform the members at the next Annual Meeting of Members. The following members of the Board of Directors and NRA staff have received payments from the Association for goods or service which total in excess of $2,000 with the Association in 2018: • Mr. Pete Brownell's company, Brownells, received $2,394.65 in membership commissions from the NRA. • Mr. Dave Butz received $100,000 in 2018 from the National Rifle Association as an independent contractor. • Ms. Sandra Froman's law firm received $13,060.16 from the NRA in support of her NRA public speaking and outreach activities. • Ms. Marion Hammer, Executive Director of Unified Sportsmen of Florida, received $270,000 for consulting services and legislative lobbying in Florida. • Mr. David Keene received $40,000 for support of public speaking appearances at Friends of NRA dinners and other outreach events. • The Director of the NRA's Competitive Shooting Division, Cole McCulloch, is the owner of Peacemaker National Training Center, a shooting facility in West Virginia. In 2018 Peacemaker received $70,500 for conducting and hosting the NRA World Shooting Championships. -

Youth Education Summit Annual Feature Issue

HENRY'S REPEATING SUPPORT More than 100 years of heritage in the firearms industry drives the family-owned business and strong support of the shooting sports at Henry Repeating Arms FATHERS IN THE FIELD How one Friends of NRA founder started a program to bring ministry, mentors and youth together through the outdoors. Y.E.S.YOUTH EDUCATION SUMMIT ANNUAL2017 FEATURE ISSUE QUARTER 3 | 2017 Traditions Features 4 Cover Story Y.E.S., We See the Future of Freedom The 2017 NRA Youth Education Summit brought 46 young leaders to D.C. for a week of unforgettable experiences and inspirations. ON THE COVER National News Chief Financial Officer, 14 16 The NRA Foundation HENRY'S REPEATING SUPPORT More than 100 years of heritage in the firearms industry drives the family-owned business and | | strong support of the shooting sports at PROGRAM PROFILE SNAPSHOT Capturing Henry Repeating Arms FATHERS IN THE FIELD How one Friends of NRA founder started a program to bring mentors and youth together through hunting. Fathers in the Field Y.E.S. Week in Photos 30 33 INDUSTRY CORNER | REP WRAP | Liz Foley Henry's Repeating Support Sparkles in South Texas Y.E.S.YOUTH EDUCATION SUMMIT ANNUAL2017 FEATURE ISSUE 2017 Youth Education Summit attend- Region Focus ees pause in front of the U.S. Capitol building during their busy schedule of The Latest Stories from Friends of NRA and activities in Washington, D.C. 18 NRA Foundation Grant Recipients Staff Mission Statement Editor & Designer Editorial Manager Co-Designer Established in 1990, The NRA Foundation, Inc. (“NRA Christina Paladeau Kristina Krawchuk Tyler Proksa Foundation”) is a 501(c)(3) tax-exempt organization that raises tax-deductible contributions in support of a wide range of firearms-related public interest activities of the National Board of Trustees & Officers Rifle Association of America and other organizations that Mr. -

NATIONAL RIFLE ASSOCIATION of AMERICA OFFICE of the GENERAL COUNSEL Digitally Signed

NATIONAL RIFLE ASSOCIATION OF AMERICA OFFICE OF THE GENERAL COUNSEL Digitally signed . 11250 WAPLES MILL ROAD Kathryn Ross FAIRFAX, VIRGINIA 22030 2018.03.20 15:57:51 -04'00' (703)267-1250 (703) 267-3985fax Maich 19,2019 Fedetal Election Commission Office of Complaints Examination and Legal Administration Atm: Jeff Jordan, Assistant General Counsel & Kim Collins, Paral^al 999 E Street, NW 4 Washington, DC 20463 Re:MUR7314 Dear Mr. Jordan, I represent the National Rifle Association of America (NRA) in this matter, and write in response to your letter of January 31,2018. The letter concerns a complaint by American Democracy Legal Fund (ADLF) alleging that Russian nationals "funnel[e(Q foreign funds through the NRA" in connection with the 2016 elections—specifically, it would seem, the presidential election—and/or "partic^ted in the NRA's decision-making process regarding election-related activities" in connecdon with the same election. For the reasons set forth below, ADLF's allegations are meritless, and no furtiier action should be taken in this MUK The complaint is based on tank speculation, sensationalized reporting, and ignorance of the NRA's stmcture and internal operations. It is devoid of any evidence concerning key elements of the violations it asserts, so much so that no response £com the NRA should be necessary to secure its dismissal with a finding of no reason to believe that a violation occurred. Nevertheless, out of an abundance of caution, we axe providing affidavits ftom knowledgeable sources within the NRA that refute -

In the United States District Court for the Northern District of Texas Dallas Division

Case 3:19-cv-02074-G Document 31 Filed 11/15/19 Page 1 of 150 PageID 422 IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF TEXAS DALLAS DIVISION NATIONAL RIFLE ASSOCIATION OF § AMERICA, § § Plaintiff and Counter-Defendant, § § and § § WAYNE LAPIERRE, § § Third-Party Defendant, § § v. § Case No. 3:19-cv-02074-G § ACKERMAN MCQUEEN, INC., § § Defendant and Counter-Plaintiff, § § and § § MERCURY GROUP, INC., HENRY § MARTIN, WILLIAM WINKLER, § MELANIE MONTGOMERY, AND JESSE § GREENBERG, § § Defendants. DEFENDANTS’ AMENDED ANSWER AND DEFENDANT/COUNTER-PLAINTIFF ACKERMAN MCQUEEN, INC.’S AMENDED COUNTERCLAIM AND THIRD-PARTY COMPLAINT Subject to and without waiving Defendants’ pending Motion to Dismiss (Doc. 38), come now Ackerman McQueen, Inc. (“AMc”), Mercury Group, Inc. (“Mercury”), Henry Martin (“Martin”), William Winkler (“Winkler”), Melanie Montgomery (“Montgomery”), and Jesse Greenberg (“Greenberg”) (collectively, “Defendants”), and file this, their Amended Answer to Plaintiff’s First Amended Complaint (the “Complaint”) and Counter-Plaintiff AMc’s Amended Counterclaim (the “Counterclaim”) and Amended Third-Party Complaint against Wayne LaPierre DEFENDANTS’ AMENDED ANSWER, COUNTERCLAIM AND THIRD-PARTY COMPLAINT PAGE 1 Case 3:19-cv-02074-G Document 31 Filed 11/15/19 Page 2 of 150 PageID 423 (“LaPierre”) (“Third-Party Complaint”) and respectfully show the Court as follows: I. RESPONSE TO “PRELIMINARY STATEMENT” The NRA adds these additional allegations and claims in order to expose a stunning pattern of corruption, fraud, and retaliation by Defendants that continues to come to light. Since the NRA terminated its relationship with AMc last Spring, newly unearthed text messages, emails, and interviews with former AMc employees, customers, and others have made two things abundantly clear: First, AMc exploited decades of trust and confidence in order to siphon assets from the NRA, lining the agency’s pockets at the expense of its client and in violation of the law. -

Blood Money II: How Gun Industry Dollars Fund The

BLOOD MONEY II HOW GUN INDUSTRY DOLLARS FUND THE NRA Blood Money ll How Gun Industry Dollars Fund the NRA This report is published in PDF format and is designed to be printed out in color as a single‐sided document in landscape page orientation. September 2013 Violence Policy Center The Violence Policy Center (VPC) is a national non‐profit educational organization that conducts research and public education on violence in America and provides information and analysis to policymakers, journalists, advocates, and the general public. This study was funded with the support of the David Bohnett Foundation, The Herb Block Foundation, The Broad Foundation, and The Joyce Foundation. This study was authored by VPC Executive Director Josh Sugarmann. Additional research assistance was provided by VPC Senior Policy Analyst Marty Langley and Ilana Goldman. Past studies released by the VPC include the following. Cash and Carry: How Concealed Carry Laws Drive Gun Industry Profits (July 2013) — Gun Deaths Outpace Motor Vehicle Deaths in 12 States and the District of Columbia in 2010 (May 2013) — Time Bomb: How the NRA Blocked the Regulation of Black and Smokeless Powder to the Benefit of Its Gun Industry “Corporate Partners” Today (April 2013) — Firearm Justifiable Homicides and Non‐Fatal Self‐Defense Gun Use: An Analysis of Federal Bureau of Investigation and National Crime Victimization Survey Data (April 2013) — Lost Youth: A County‐by‐County Analysis of 2011 California Homicide Victims Ages 10 to 24 (March 2013, annual study) — States With Higher -

The NRA and Russia: How a Tax-Exempt Organization Became

U.S. SENATE COMMITTEE ON FINANCE MINORITY STAFF REPORT THE NRA SEPTEMBER 2019 AND RUSSIA HOW A TAX-EXEMPT ORGANIZATION BECAME A FOREIGN ASSET ______THE NRA AND RUSSIA______ Table of Contents Introduction & General Overview of the Investigation ............................................. 2 Current Law Relating to Tax-Exempt Organizations ........................................... 9 Current Law Relating to Sanctioning of “Specially Designated Nationals” ...... 15 I. Official NRA Participation in the 2015 Moscow Trip ...................................... 17 II. Russian Contacts - NRA Officers and Donors Met with High Level Russian Government Officials and Oligarchs Close to Vladimir Putin on Multiple Occasions.......................................................................................................... 31 III. Private Inurement - Russian Influence Scheme Included Opportunities and Offers for Personal Financial Gain, Which at Least One NRA Officer and One NRA Donor Pursued ........................................................................................ 45 IV. Access to Other Conservative Organizations and Interests – From as Early as 2014, Torshin and Butina Relied on Their Growing Relationships with NRA Officers to Gain Access to Other Conservative Organizations ....................... 58 V. Conclusion ......................................................................................................... 75 1 ______THE NRA AND RUSSIA______ Introduction & General Overview of the Investigation The Finance Committee -

Playing with Firearms

Playing with Firearms A Proactive Public Relations Strategy to Ensure a Powerful and Profitable Future for the NRA Savannah Bailey Professor Richard Linowes Honors Capstone Spring 2013 2 Executive Summary As recently as December 2012, the National Rifle Association (NRA)’s aggressive and combative tone during public appearances following the shooting at Sandy HooK Elementary School accurately captured the group’s disconnect with the majority of Americans. While the NRA’s extremist-leaning position allows it to capitalize now on an energized base during a push for increased gun control, as a long-term strategy this damages both the NRA’s public favorability and reputational clout, in turn weaKening their financial position. A huge camp of Americans, many of them NRA members, support some of the less-restrictive gun measures without calling for an all-out ban on guns (see Appendix 1) – a highly unliKely resolution in any case given the Second Amendment of the U.S. Constitution. The NRA should employ Hill + Knowlton Strategies (H+K Strategies), a widely- respected global public relations firm, to adjust its strategy for engaging with both the public and the media. This investment will not only improve public opinion of the organization and ensure its cultural relevance far into the future but will also turn around the last four consecutive years of falling net income (see Appendix 2). By spending only about $260,000 annually (see Appendix 3), the NRA will see a return on investment of 1268% (see Appendix 4) from attracting new members, securing highly-valuable earned media placements and increasing overall goodwill as a result of our public relations strategies and tactics. -

Ilnittd ~Tatcs ~Mate WASHINGTON, DC 20510

ilnittd ~tatcs ~mate WASHINGTON, DC 20510 October 2, 2019 The Honorable Charles Rettig Commissioner Internal Revenue Service 11 11 Constitution A venue, NW Washington, DC 20224 Commissioner Rettig, The Internal Revenue Service (IRS) is responsible for administration of federal tax laws, including the enforcement oflnternal Revenue Code rules governing the activities of tax-exempt organizations. These rules exist not only to protect the federal tax system, but also to ensure that tax-exempt organizations and their resources are used exclusively in furtherance of their exempt purpose. Congress has long been concerned about foreign adversaries' potential exploitation of tax-exempt organizations to undermine American interests. 1 On July 15, 2018, Maria Butina was arrested in Washington, DC and charged by the federal government with conspiracy to act as an agent of the Russian Federation within the United States as part of an effort to gain political access within the United States utilizing a "GUN RIGHTS ORGANIZATION," understood to be the National Rifle Association of America (NRA)-a section 501(c)(4) tax-exempt organization. In April 2019, she pleaded guilty to one count of conspiracy to act as a foreign agent in the United States without registering with the U.S. Department of Justice (DOJ) and was sentenced to 18 months in prison. Following these developments the Finance Committee Ranking Member and other Democratic colleagues initiated an investigation into the NRA's interactions with Russian nationals, including Butina, other Russian nationals, including some sanctioned by the U.S. Government and officials of the Russian government, both in the U.S. and during the NRA delegation's 20 15 trip to Moscow.