Mahoning County Single Audit for the Year Ended December 31, 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Radio Stations in Ohio

Not logged in Talk Contributions Create account Log in Article Talk Read Edit View history Search Wikipedia List of radio stations in Ohio From Wikipedia, the free encyclopedia Main page The following is a list of FCC-licensed radio stations in the U.S. state of Ohio, which can be sorted Contents by their call signs, frequencies, cities of license, licensees, and programming formats. Featured content Current events Call City of Frequency Licensee Format[3] Random article sign license[1][2] Donate to Wikipedia Radio Advantage One, Wikipedia store WABQ 1460 AM Painesville Gospel music LLC. Interaction Jewell Schaeffer WAGX 101.3 FM Manchester Classic hits Help Broadcasting Co. About Wikipedia Real Stepchild Radio of Community portal WAIF 88.3 FM Cincinnati Variety/Alternative/Eclectic Recent changes Cincinnati Contact page WAIS 770 AM Buchtel Nelsonville TV Cable, Inc. Talk Tools The Calvary Connection WAJB- What links here 92.5 FM Wellston Independent Holiness Southern Gospel LP Related changes Church Upload file WAKR 1590 AM Akron Rubber City Radio Group News/Talk/Sports Special pages open in browser PRO version Are you a developer? Try out the HTML to PDF API pdfcrowd.com Permanent link WAKS 96.5 FM Akron Capstar TX LLC Top 40 Page information WAKT- Toledo Integrated Media Wikidata item 106.1 FM Toledo LP Education, Inc. Cite this page WAKW 93.3 FM Cincinnati Pillar of Fire Church Contemporary Christian Print/export Dreamcatcher Create a book WAOL 99.5 FM Ripley Variety hits Communications, Inc. Download as PDF Printable version God's Final Call & Religious (Radio 74 WAOM 90.5 FM Mowrystown Warning, Inc. -

Mahoning County, Ohio 2019 Comprehensive Annual Financial

Mahoning County, Ohio 2019 Comprehensive Annual Financial Report For Fiscal Year Ended Ralph T. Meacham, CPA December 31, 2019 Mahoning County Auditor Introductory Section Mahoning County, Ohio Comprehensive Annual Financial Report For the Year Ended December 31, 2019 Ralph T. Meacham, CPA Mahoning County Auditor Stacy A. Marling Chief Deputy Auditor Prepared by the Mahoning County Auditor’s Office Mahoning County, Ohio Comprehensive Annual Financial Report For the Year Ended December 31, 2019 Table of Contents Page I. Introductory Section Table of Contents .......................................................................................................................................... i Letter of Transmittal ...................................................................................................................................... v Principal Officials ........................................................................................................................................ xi Organizational Chart – Mahoning County ................................................................................................. xii GFOA Certificate of Achievement ............................................................................................................ xiii II. Financial Section Independent Auditor’s Report ....................................................................................................................... 1 Management’s Discussion and Analysis ...................................................................................................... -

Cancels Circu on All Current Periodicals

WHAT'S INSIDE: CAMPUS LIFE PAGE 5 INSPIRATIONAL Women's Center gets new. SPEAKER COMES TO coordinator YSU PAGE 5 SPORTS PAGE 6 Penguins suffer second loss Volume 81, No. 8 Youngstown State University • Youngstown, Ohio Tuesday, October 20,1998 dedication High Five family U Mayor says donation will help generations of students to live the American Dream. - • NICOLE TANNER 44 This is a true example of how com• Editor in chief munity partnership comes together to Beneath all the bricks ami mor• make something special happen.?? tar of the newest building on cam• pus, there lies the immense gener• Vern Snyder osity of a family who has been in• volved in the community since Vice President of Development and 1918—-the Beeghlys. Community Affairs This generosity was honored at 6 p.m. Thursday during the dedi• and mortar, but advice as well." ceremony, relaying some of the cation ceremony of the Beeghly The total gift from all members family's history in the Mahoning College of Education. of the Beeghly family for the new Valley and adding that the college "This is a true example of How college totaled more than $2.2 mil• of education is the 10th building community partnership comes to• lion, said Cochran. to bear the Beeghly family name. gether to make something special He also noted a new endow• Others include the YSU Physi• happen," said Vern Snyder, vice ment from the Beeghlys, which cal Education Center and buildings president of development and will provide ongoing funds for the at Westminster College, Mount community affairs. -

Broadcast Actions 9/23/2004

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 45826 Broadcast Actions 9/23/2004 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 09/13/2004 DIGITAL TV APPLICATIONS FOR LICENSE TO COVER GRANTED ND BLEDT-20031104ABX KSRE-DT PRAIRIE PUBLIC License to cover construction permit no: BMPEDT-20030616AAE, 53313 BROADCASTING, INC. callsign KSRE. E CHAN-40 ND , MINOT Actions of: 09/20/2004 FM TRANSLATOR APPLICATIONS FOR MAJOR MODIFICATION TO A LICENSED FACILITY DISMISSED NC BMJPFT-20030312AJR DW282AJ TRIAD FAMILY NETWORK, INC. Major change in licensed facilities 87018 E NC , BURLINGTON Dismissed per applicant's request-no letter was sent. 104.5 MHZ TELEVISION APPLICATIONS FOR ASSIGNMENT OF LICENSE DISMISSED MT BALCT-20040305ACI KTGF 13792 MMM LICENSE LLC Voluntary Assignment of License, as amended From: MMM LICENSE LLC E CHAN-16 MT , GREAT FALLS To: THE KTGF TRUST, PAUL T. LUCCI, TRUSTEE Form 314 AM STATION APPLICATIONS FOR RENEWAL GRANTED OH BR-20040329AIT WJYM 31170 FAMILY WORSHIP CENTER Renewal of License CHURCH, INC. E 730 KHZ OH , BOWLING GREEN Page 1 of 158 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 45826 Broadcast Actions 9/23/2004 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 09/20/2004 AM STATION APPLICATIONS FOR RENEWAL GRANTED MI BR-20040503ABD WLJW 73169 GOOD NEWS MEDIA, INC. -

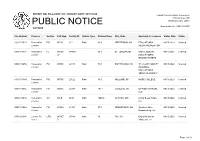

Public Notice >> Licensing and Management System Admin >>

REPORT NO. PN-2-200917-01 | PUBLISH DATE: 09/17/2020 Federal Communications Commission 445 12th Street SW PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 ACTIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000113523 Renewal of FM WCVJ 612 Main 90.9 JEFFERSON, OH EDUCATIONAL 09/15/2020 Granted License MEDIA FOUNDATION 0000114058 Renewal of FL WSJB- 194835 96.9 ST. JOSEPH, MI SAINT JOSEPH 09/15/2020 Granted License LP EDUCATIONAL BROADCASTERS 0000116255 Renewal of FM WRSX 62110 Main 91.3 PORT HURON, MI ST. CLAIR COUNTY 09/15/2020 Granted License REGIONAL EDUCATIONAL SERVICE AGENCY 0000113384 Renewal of FM WTHS 27622 Main 89.9 HOLLAND, MI HOPE COLLEGE 09/15/2020 Granted License 0000113465 Renewal of FM WCKC 22183 Main 107.1 CADILLAC, MI UP NORTH RADIO, 09/15/2020 Granted License LLC 0000115639 Renewal of AM WILB 2649 Main 1060.0 CANTON, OH Living Bread Radio, 09/15/2020 Granted License Inc. 0000113544 Renewal of FM WVNU 61331 Main 97.5 GREENFIELD, OH Southern Ohio 09/15/2020 Granted License Broadcasting, Inc. 0000121598 License To LPD W30ET- 67049 Main 30 Flint, MI Digital Networks- 09/15/2020 Granted Cover D Midwest, LLC Page 1 of 62 REPORT NO. PN-2-200917-01 | PUBLISH DATE: 09/17/2020 Federal Communications Commission 445 12th Street SW PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 ACTIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. -

State of Ohio Emergency Alert System Plan

STATE OF OHIO EMERGENCY ALERT SYSTEM PLAN SEPTEMBER 2003 ASHTABULA CENTRAL AND LAKE LUCAS FULTON WILLIAMS OTTAWA EAST LAKESHORE GEAUGA NORTHWEST CUYAHOGA SANDUSKY DEFIANCE ERIE TRUMBULL HENRY WOOD LORAIN PORTAGE YOUNGSTOWN SUMMIT HURON MEDINA PAULDING SENECA PUTNAM MAHONING HANCOCK LIMA CRAWFORD ASHLAND VAN WERT WYANDOT WAYNE STARK COLUMBIANA NORTH RICHLAND ALLEN EAST CENTRAL ‘ HARDIN CENTRAL CARROLL HOLMES MERCER MARION AUGLAIZE MORROW JEFFERSON TUSCARAWAS KNOX LOGAN COSHOCTON SHELBY UNION HARRISON DELAWARE DARKE CHAMPAIGN LICKING GUERNSEY BELMONT MIAMI MUSKINGUM WEST CENTRAL FRANKLIN CLARK CENTRAL MONTGOMERY UPPER OHIO VALLEY MADISON PERRY NOBLE MONROE PREBLE FAIRFIELD GREENE PICKAWAY MORGAN FAYETTE HOCKING WASHINGTON BUTLER WARREN CLINTON ATHENS SOUTHWEST ROSS VINTON HAMILTON HIGHLAND SOUTHEAST MEIGS CLERMONT SOUTH CENTRAL PIKE JACKSON GALLIA BROWN ADAMS SCIOTO LAWRENCE Ohio Emergency Management Agency (EMA) (20) All Ohio County EMA Directors NWS Wilmington, OH NWS Cleveland, OH NWS Pittsburgh, PA NWS Charleston, WV NWS Fort Wayne, IN NWS Grand Rapids, MI All Ohio Radio and TV Stations All Ohio Cable Systems WOVK Radio, West Virginia Ohio Association of Broadcasters (OAB) Ohio SECC Chairman All Operational Area LECC Chairmen All Operational Area LECC Vice Chairmen Ohio SECC Cable Co-Chairman All Ohio County Sheriffs President, All County Commissioners Ohio Educational Telecommunications Network Commission (OET) Ohio Cable Telecommunications Association (OCTA) Michigan Emergency Management Agency Michigan SECC Chairman Indiana Emergency Management Agency Indiana SECC Chairman Kentucky Emergency Management Agency Kentucky SECC Chairman Pennsylvania Emergency Management Agency Pennsylvania SECC Chairman West Virginia Emergency Management Agency West Virginia SECC Chairman Additional copies are available from: Ohio Emergency Management Agency 2855 West Dublin Granville Road Columbus, Ohio 43235-2206 (614) 889-7150 TABLE OF CONTENTS PAGE I. -

Sryl: . Broar .T:R Ydor Ua:Al NG "%1J $T4 Cyrt,Io Suo=.Tsir¿

SEPTEMBER 26, 1955 35c PER COPY gg8 Ie d sryL:_. BROAr .t:r yDOr ua:aL NG "%1j $t4 cyrT,Io suo=.Tsir¿. .T,, !3-T6.In ` F IL,IQ,1 Tun .rTf..aycn T E 1.e44 vihifria..... Complete Index Page 10 W110 IS IOWA'S FAVORITE RADIO STATION Wants " ore V's, Forget the U's FOR Page 27 FARM PROGRAMS! Advice on Spot Radio BBDO's Anderson Page 30 n l n- -1 I . v Has Saturated WHO WMT Wgl'i NAX WOW KMA KICD KGLO KSCJ KXEL 0% of City Homes `,. 44.6% 18.8 %A ° 4.3 % x,4.1 3.9 1.5% 1.3 1.3% 1.1% Page 32 o rnu 4o More Film Firms' Drop Tv Boycott THE data i_n 4 tre otre crt Oi Dr. Forest L. Whañ s owa Radi. evision Audience Survey -the of this famed study. Farming is big business in Iowa, and Iowans' overwhelming preference for WHO farm program is FEATURE SECTiON far from a freak. It's the result of heads -up planning Begins on Page 37 -in programming, personnel and research . in Public Service and audience promotion. BUY ALL of IOWA - Write direct or ask Free & Peters for your copy of the 1954 I.R.T.A. Survey. It will tell you more about Plus `Iowa Plus" -with radio and television in Iowa than you could glean from weeks of personal travel and study. WHO Des Moines . 50,000 Waits & PETERS, INC., Col. )}. J. Palmer, President National Representatives THE NEWSWEEKLY P. A. Loyet, Resident Manager OF RADIO AND TV "The South's First Television Station" ELE ISION ICHMOND RICHMOND, VA. -

Aloe'''io in the \Iatter 01' MAR 2 G ZOOZ L'tilifllai

OOCKET FILE COPY ORIGINAl Before the Federal Communications Commission Washington, D.C. 20554 Aloe'''IO In the \Iatter 01' MAR 2 G ZOOZ l'tilIfllAI. ~I'" ",,,_ Rules and Policies Concerning MI!JE fE lItE SB:IlETAAr \Iultiple Ownership orRadio Broadcast .\1\1 Docket No. 01-317 Stations in Local Markets Dctinition or Radio Markets \Il'vl Docket No. 00-244 COMMENTS OF TIlE OFFICE OF COMMUNICATION, INC. OF TIlE UNITED CHURCH OF CHRIST Of Counsel: Christopher R. Day Angela 1. Campbell Institute for Public Representation Janelle Hu, Law Student Georgetown University Law Center Georgetown University Law Center 600 New Jersey Avenue, N.W. Suite 312 Washington, D.C. 20001 Phone: (202) 662-9535 Dated: March 27, 2002 ------------ SL:\L\I.\RY The Omee ol"Communieation, fnL of the Lnited Church of Christ ("LCC") is extremely C<lnccrned ahoutlhe massivc consolidation that has <lccurred in many local radio markets in rceent years. ;\s detailed helmv, diversity and c<lmpditi<ln have declined dramatically in m'II1\' l<lealradio markets. Furthermore, the ('ommlssi<ln and the DO.!'s "case-hy-case" analysis 01' many mergers has ,'ailed to protect diversity or serve the public IIltercst. Accordingly, UCC urges the Commission to adopt a "hright-line" test Illr radio mergers in order to protect the puhlic interest. while ensuring that radio l11cr~crs arc rroccsscd in a expeditious manner. III response 10 the Commission rClJuest Il)r methods to measure the characteristics of [<leal radi<l markets, LJCC urges the Commission to analyze diversity and competition in local radio markets hy counting the numher of inderendently-owned radio stations within the geograrhie houndaries of local Arhitron ,vktro Markets. -

Jones-11-OCR-Page-0036.Pdf

Gahanna Paris Broken Arrow Corvallis wcvo 104.9 t* WMCM 90. 1 KGOW 92.1 F * KBVR 90. l Galion Piqua Chickasha KFLY-FM 101.5 WQLX 102.3 E ti WPTW-FM 95.7 I KXXK 105.5 KLOO-FM 106. l Gallipolis Portsmouth Clinton Eagle Point WJEH-FM 101.5 I WNXT-FM 99.3 I KWOE-FM 106.9 t* KEPO B9. l Gambier I WPAY-FM 104. 1 c Duncan Eugene * WKCO 91.9 Pt. Clinton t KRHD-FM 102.3 KBMC 94.5 Georgetown I WRWR-FM 94.5 Durant I KFMY 97.9 E t WURD 97.7 Reading t* KHIB 91.9 * KLCC 90.3 R Granville * WRCJ 89.3 KSEO-FM 107.l I KPNW-FM 99. l * WDUB 90.9 Salem Edmond * KRVM 91.9 Greenville I WSOM-FM 105. l '* KCSC 90. l * KWAX 91.1 R I WORK 106.5 Sandusky I KWHP 97.7 I KZEL-FM 96. 1 t* WGVO 88.3 WLEC-FM 102.7 M Enid Klamath Falls Hamilton Sidney I KCRC-FM 96.9 KAGM 98.5 *WHSS 89.5 WMVR-FM 105.5 M Eufaula KLAD-FM 92.5 I WQMS 96.5 Springfield KCES 102.3 * KTEC 88. 1 WYCH 103.5 D I WBLY-FM 102.9 Henryetta la Grande Hillsboro '* WEEC 100.7 I KHEN-FM 99.5 t* KEOL 91.1 WSRW-FM 106.7 * wuso 89.l Idabel KFMT 98.3 Holland Steubenville KWDG 96.7 lake Oswego I WPOS-FM 102.3 I WRKY 103.5 Langston I KQIV 106.7 F Ironton Streetsboro * KALU 90.7 Lebanon WITO 107.l M * WSTB 91.5 Lawton KOMS 103.7 Jackson Struthers I KLAW 101.5 G Mc Minnville WCJO 97.7 * WKTL 90.7 I KRLG 98. -

CPY Document

Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Review ofthe Emergency Alert System ) EB Docket No. 04-296 COMMENTS OF THE OHIO ASSOCIATION OF BROADCASTERS Wade H. Hargrove Mark J. Prak Marcus W. Trathen BROOKS, PIERCE, McLENDON, HUMPHREY & LEONARD, L.L.P. Wachovia Capitol Center, Suite 1600 150 Fayetteville Street Mall (27601) Post Office Box 1800 Raleigh, North Carolina 27602 Telephone: (919) 839-0300 Facsimile: (919) 839-0304 Counsel to the Ohio Association ofBroadcasters October 29,2004 Table of Contents Summary iii I. BACKGROUND 1 II. THE STATE OF OHIO EMERGENCY ALERT PLAN 2 III. RESPONSES TO INQUIRIES IN THE NOTICE 5 A. National Alerts 6 B. Mandatory Participation 7 C. Model State Plans 10 D. New Equipment 11 E. Training 12 F. Cable Overrides 13 G. Digital Media 14 Conclusion 15 - 11 - Summary DAB and its members are committed to EAS, which is a critical component of each station's commitment to serving the public interest and providing local service. DAB supports the Commission's proposal to strengthen the system of transmitting national emergency alerts, and supports the testing that would be required to ensure the functionality of such a national alert system. Whether to institute national alerts and associated tests is an issue best left to the federal government to determine and coordinate. DAB's experience is that broadcasters take EAS obligations seriously and that the current level of mandatory participation in EAS is appropriate. OAB believes that station decisions whether to broadcast particular local and state emergency messages should remain voluntary and that station participation in state and local alerts has been widespread and effective. -

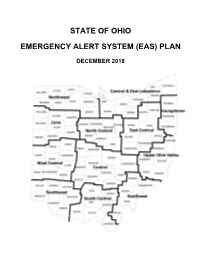

State of Ohio Emergency Alert System (Eas)

STATE OF OHIO EMERGENCY ALERT SYSTEM (EAS) PLAN DECEMBER 2018 APPROVALS This State of Ohio Emergency Alert System (EAS) Plan was developed by the State of Ohio EAS Emergency Communications Committee, in cooperation with the National Weather Service (NWS) and the Ohio Emergency Management Agency (EMA). GREG SAVOLDI, Chair RONALD D. FORD, Vice Chair State Emergency Communications Committee State Emergency Communications Committee WNCI, State Primary Ohio Emergency Management Agency JONATHON McGEE, Cable Co-Chair State Emergency Communications Committee Ohio Cable Telecommunications Association LISA M. FOWLKES JOHN BORN, Director Chief, Public Safety & Homeland Security Bureau Ohio Department of Public Safety Federal Communications Commission JACQUELINE WILLIAMS, Director SIMA MERICK, Executive Director Ohio Department of Commerce Ohio Emergency Management Agency DAVE CARWILE, Chief Technology Officer KENNETH HAYDU, Meteorologist in Charge Ohio Educational Telecommunications Network National Weather Service, Wilmington, OH Commission GREG ARMSTRONG CHRISTINE MERRITT, President WBNS, Alternate State Primary Ohio Association of Broadcasters State Emergency Communications Committee This Plan supersedes all previously published State EAS Plans. Revised Dec. 2018 DISTRIBUTION Ohio Emergency Management Agency (EMA) (20) All Ohio County EMA Directors NWS Wilmington, OH NWS Cleveland, OH NWS Pittsburgh, PA NWS Charleston, WV NWS Fort Wayne, IN NWS Grand Rapids, MI All Ohio Radio and TV Stations All Ohio Cable Systems WOVK Radio, West Virginia Ohio -

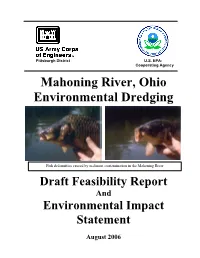

Feasibility Study

Pittsburgh District U.S. EPA: Cooperating Agency Mahoning River, Ohio Environmental Dredging Fish deformities caused by sediment contamination in the Mahoning River Draft Feasibility Report And Environmental Impact Statement August 2006 DEPARTMENT OF THE ARMY PITTSBURGH DISTRICT, CORPS OF ENGINEERS WILLIAM S. MOORHEAD FEDERAL BUILDING 1000 LIBERTY AVENUE PITTSBURGH, PA 15222-4186 REPLY TO ATTENTION OF Planning and Environmental Branch August 2006 Project Name: Mahoning River, Ohio, Environmental Dredging, Draft Feasibility Report and Environmental Impact Statement Lead Agency: Pittsburgh District, U.S. Army Corps of Engineers Cooperating Agency: U.S. Environmental Protection Agency, Region 5 Contact: Mr. Carmen Rozzi, Public Involvement Specialist, Pittsburgh District, Corps of Engineers, 1000 Liberty Avenue, Pittsburgh, PA 15222-4186. Telephone Number: 412-395-7227, e-mail: [email protected] Abstract The Pittsburgh District has been authorized by Section 312 of the Water Resources Development Act of 1990 to remove and remediate contaminated sediments present within the Mahoning River that flows through the City of Youngstown and surrounding communities in Mahoning and Trumbull Counties, Ohio. The lower Mahoning River is one of the most heavily contaminated rivers in the United States. For much of the 20th Century, the river was used by numerous steel and related industries as a water supply source as well as an unregulated sewer to dump tons of waste materials. Since the downturn of the local steel industry in the 1980’s and 1990’s, water quality within the lower Mahoning River began to improve, but past industrial contamination has persisted within sediments deposited along the banks and river bottom.