2009 Conference Program

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fall 2011 BAEP 556: Technology Feasibility Analysis

BAEP 556 – Allen– Fall 2011 – Tues. 6:30 Fall 2011 BAEP 556: Technology Feasibility Analysis Lloyd Greif Center for Entrepreneurial Studies Marshall School of Business, Bridge Hall One (lower level) University of Southern California Los Angeles, CA 90089‐0801 Phone: 213‐740‐0641 Fax: 213‐740‐2976 www.marshall.usc.edu/entrepreneur www.marshall.usc.edu/ctc www.n2tec.org www.theventureedge.com Teaching Team: Kathleen Allen Ph.D. Bio: http://www.marshall.usc.edu/greif/faculty.htm Ph 213‐740‐0659 Email: [email protected] Scott Lenet, Founder and Managing Director, DFJ Frontier. Bio: http://www.dfjfrontier.com/scott.shtml [email protected] TA: Jon Bassett, Associate, DFJ Frontier [email protected] Course Section: 14418R Tuesdays 6:30‐9:30 p.m. ACC 236 Office hours: Mondays: 2:00–5:00 p.m. and Tuesdays 2:00‐5:00 p.m. and by appointment at other times and days. So that we are not interrupted during our visit and schedule enough time, I recommend that you make an appointment. Please e‐mail me with your appointment request. E‐mail also works for short questions, as I respond to e‐mail daily. Phone/SKYPE conferences are also encouraged. Prerequisite To be successful in this course and enjoy the best experience, you should have a sincere interest or passion for learning and experiencing how an idea can become a real business. This is a hands‐on course that will require your active participation. It is not for those who simply want to listen and take notes. The rewards for your effort go well beyond the grade you will receive. -

September 2014 M&A and Investment Summary

September 2014 M&A and Investment Summary Expertise. Commitment. Results. Table of Contents 1 Overview of Monthly M&A and Investment Activity 3 2 Monthly M&A and Investment Activity by Industry Segment 9 3 Additional Monthly M&A and Investment Activity Data 42 4 About Petsky Prunier 57 Securities offered through Petsky Prunier Securities, LLC, member of FINRA. This M&A and Investment Summary has been prepared by and is being distributed in the United States by Petsky Prunier, a broker dealer register with the U.S. SEC and a member of FINRA. Petsky Prunier is not affiliated with Altium Capital Ltd, but has partnered with Altium to expand its international presence. Altium has not prepared or verified the information in this Summary. Persons in the United States should contact Petsky Prunier for further information or services. This M&A and Investment Summary is not being distributed by Altium Capital Ltd in the United States and Altium Capital Ltd is not offering any services to persons in the United States. 2| M&A and Investment Summary September 2014 M&A and Investment Summary for All Segments Transaction Distribution . A total of 428 deals were announced in September 2014, of which 236 were worth $37.5 billion in aggregate reported value . Software was the most active and highest reported value segment with 92 deals announced, of which 46 were reported at $13.5 billion in aggregate value . Digital Media/Commerce was another active segment with 85 transactions that were worth $4.5 billion . Strategic buyers announced 197 deals (46 percent of total volume), of which 40 were worth $24.9 billion in aggregate value . -

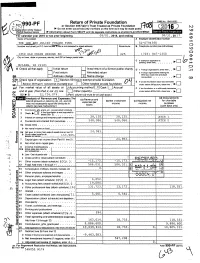

990 -PF Return of Private Foundation

tt -., '___1 OMB No 1545-0052 Z Fom,'990 -PF Return of Private Foundation -. m or Section 4947(a)(1) Trust Treated as Private Foundation ' 1 N ` '- r Do not enter social security numbers on this form as it may be made public. ZJDepartm ent of the Treasury ► Inntemal Revenue Service 10, Information about Form 990-PF and its separate instructions is at www.irs.gov/fomt990pf. • 1R+ _-Fr calanrtar vaar 2018 nr tax year heninninn 09/01 _ 2016 and e ndinn 08/31 - 20 17 Ca Name of foundation A Employer Identification number THE LEE-AND JULIET FOLGER FUND 52-0794388 O Number and street (or P O box number mail is not delivered to street address) Room/suite B Telephone number (see instructions) V C) 1350 OLD CHAIN BRIDGE RD ^^ -/ l 425 (703) 847-1350 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is ► pending , check here. O O MCLEAN, VA 22101 O G Ch-eck all that apply Initial return Initial return of a former public charity 0 1 Foreign organizations , check here. , 10' :JJ Final return Amended return 2 Foreign organizations meeting the 85% test, Do Address chan ge X Name chang e computation , ► co off Check type of organization X Section 501 (c)(3) exempt private foundation (lt E If private foundation status was terminated Section 4947 ( a ) (1 ) nonexem pt charitable trust Other taxable p rivate foundation 0 under section 507(b)(1)(A), check here . ► CqI Fair market value of all assets at J Accounting method X Cash Accrual F If the foundation is in a 613-mont termination end of year (from Part Il, col (c), line Other (specify) under section 507(b )(1)(B), check here • ► 32, 736, 074. -

Creating a Sound Economy Through Advanced Manufacturing with Advanced Materials, Robust Supply Chains, and Exports

MAKING PROSPERITY CREATING A SOUND ECONOMY THROUGH ADVANCED MANUFACTURING WITH ADVANCED MATERIALS, ROBUST SUPPLY CHAINS, AND EXPORTS RESEARCH PREPARED FOR e Advanced Manufacturing Jobs and Innovation Accelerator Challenge Innovations in Advanced Materials and Metals Manufacturing Project and e Greater Portland Export Initiative AUTHOR: DR. BETH FITZ GIBBON | APRIL 2015 THIS REPORT WAS PREPARED UNDER AN AWARD FROM THE U.S. DEPARTMENT OF COMMERCE ECONOMIC DEVELOPMENT ADMINISTRATION | GRANT AWARD NUMBER 07 79 06921 “Tending the Beast”; charcoal and pastel on canvas, 72 x 50", © 2014 Donna Steger The machinists in this department at Enoch Manufacturing in Clackamas, Oregon, work on older-style screw machines, which are fully automatic but not computerized. Once the machines are set up, they continue producing high-volume, quality, turned components with consistent accuracy and minimal human intervention. This piece depicts the intense efforts of the workers as heroic, using care and precision to produce parts that fulfill the needs of both local and global commerce. Original Artwork reproduced with permission of the artist, Donna Steger: The Art Of Work As Works Of Art™ GREATER PORTLAND REGIONAL ADVANCED MANUFACTURING & MATERIALS INDUSTRY PROFILES MAKING PROSPERITY Creating a Sound Economy through Advanced Manufacturing with Advanced Materials, Robust Supply Chains and Exports Research prepared for: The Advanced Manufacturing Jobs and Innovation Accelerator Challenge Grant, Innovations in Advanced Materials and Metals Manufacturing Project, and the Greater Portland Export Initiative Author: Dr. Beth Fitz Gibbon April 2015 This publication was prepared by the Columbia River Economic Development Council. The statements, conclusions, and recommendations are those of the author and do not reflect the views of the Economic Development Administration. -

Shaking the Moneytreetm Q1 2012 Update

www.pwc.com Shaking the MoneyTreeTM Q1 2012 Update PricewaterhouseCoopers/National Venture Capital Association MoneyTreeTM Report based on data from Thomson Reuters Randy Churchill Director, Emerging Company Services [email protected] (213) 217-3819 About the report • PricewaterhouseCoopers and the National Venture Capital Association produce the MoneyTree Report™ based on data from Thomson Reuters • „Core‟ measure of equity investments in venture-backed companies in the United States • Companies have received at least one round of financing involving a professional VC firm or equivalent • Captures: tranches, not term sheets, foreign VCs, qualified private placement • Excludes: debt, bridge loans, recaps, roll-ups, IPOs, PIPEs, leasing, etc. • MoneyTree™ Report in its 15th year • Results online at www.pwcmoneytree.com and www.nvca.org Shaking the MoneyTreeTM Q1 2012 2 ($ in billions) in ($ Shaking the MoneyTree the Shaking VentureAnnual InvestmentsCapital 1982 toQ1 2012 investments total MoneyTree $100 $120 $80 $60 $40 $20 $0 1982 $1.5 1983 $2.8 1984 $2.9 1985 $2.8 TM 1986 $3.1 1987 $3.4 1988 $3.4 1989 $3.3 1990 $2.8 1991 $2.2 1992 $3.6 1993 $3.7 1994 $4.1 1995 $8.0 1996 $11.4 1997 $14.9 1998 $21.3 1999 $54.7 2000 $105.2 2001 $41.0 2002 $22.2 2003 $19.7 2004 $23.2 2005 $23.6 2006 $27.5 2007 $31.8 2008 $30.0 2009 $20.1 2010 $23.3 Q1 2012 Q1 2011 $29.1 Q1 2012 $5.8 3 MoneyTree total investments: Q1 2005 – Q1 2012 ($ in billions) $9.0 $8.0 $8.4 $8.2 $8.1 $8.0 $8.0 $7.8 $7.0 $7.6 $7.5 $7.3 $7.3 $7.2 $7.1 $6.9 $6.0 $6.7 $6.7 $6.6 $6.4 -

=> Draper Fisher Jurvetson

Suche Suchen Benutzername: Anmelden Erweiterte Suche | Di. 20.01.2009 Passwort: Login Ad hoc•Mitteilungen: 19.01. METRO AG • 19.01. transtec Aktiengesellschaft • Anzeige: CFDs • Zwei Strategien. Zwei Konten. Eine Plattform. Google•Anzeigen Gold Aktien Spekulative Aktien Aktien Kaufempfehlung Boerse Kurse Business Wire · Aktuelle Nachrichten · Archiv < zurück < · Druckversion 30.05.2008 18:55 Draper Fisher Jurvetson, DFJ Frontier, and Zone Ventures Award $250,000 to NeuroVigil in Fourth Annual DFJ Venture Challenge Leading early•stage venture capital firms Draper Fisher Jurvetson (DFJ) and its network partners DFJ Frontier and Zone Ventures hosted the Luxusvillen St. Tropez fourth annual DFJ Venture Challenge in Menlo Park on Wednesday. Privater Luxus in Ramatuelle mit allen With a grand prize of $250,000 in seed stage funding, the competition Services. Ab 27.000€/Woche. www.Rhein•Property.de/St•Tropez is believed to be the largest winner•take•all business plan competition for university students. During the morning session, 16 teams from 12 universities on the West Coast presented business plans to a panel of 10 judges, comprised of venture capitalists from the DFJ Network. Six Verlustwarnung 2009 teams were selected as finalists and presented extended versions of DAX Ende 2009 unter 2.203 Punkten • their business plans and answered further questions from the judges in Retten Sie Ihr Geld! a second round of competition in the afternoon. Falkentelegramm.de/Finanzkrise_2009 Following the final round of judging, NeuroVigil was awarded $250,000 in seed funding. NeuroVigil is poised to revolutionize brain analysis and plans to target the sleep, transportation, and pharmaceutical industries. The company, which comprises several Nobel Laureates and leading business strategists, was founded in 2007 by Dr. -

Silicon Valley London Woodside Capital Partners (WCP)

Silicon Valley London Woodside Capital Partners (WCP) proudly releases the inaugural healthcare report “State of Digital Health”. In 2016, healthcare cost in the US was $3.3 Trillion – 17.9% of GDP, passing $10,000 per capita mark for the first time ever. According to CMS, by 2026, the figure is projected to grow to $5.7 Trillion – 19.8% of GDP. The answer to curbing and reversing the trend with respect to healthcare costs lies in large part to the movement towards Digital Health, or ‘Health Tech’. The proliferation of devices and applications across the healthcare spectrum has led to a data tsunami – the “what”. Machine Learning, Artificial Intelligence and overall Big Data analytics are leading to real-time actionable insights – the “so what”. We have entered the realm of the Internet of Medical Things (IoMT), with ubiquitous connectivity and measurement of everything from our vitals and nutrition to physical activity and medical compliance. We are just starting to leverage that data in a meaningful way and seeing early impact on health and well-being. In 2017, venture investments in Digital Health startups exceeded $6 Billion for the first time, and the trend seems to be accelerating with $1.6 Billion invested in Q1, 2018. The juxtaposition of rising healthcare costs and increased Digital Health investments is not all that surprising. Advances in underlying real-time analytics and potential of leading edge innovations around genomics are turning the perceived fiction of personalized medicine into a real possibility. Foundational disruptions such as Blockchain, while relatively nascent, are creating excitement (and some anxiety) around secure, immutable data sharing across silos – with healthcare as the ideal use case. -

Entrepreneurzell Lurie Institute Year-In-Review FALL 2006/WINTER 2007

EntrepreneurZell Lurie Institute Year-in-Review FALL 2006/WINTER 2007 www.zli.bus.umich.edu FROM THE EXECUTIVE DIRECTOR IN THIS ISSUE THOMAS C. KINNEAR I invite you to share our sense of accomplishment in Student Led Venture & Commercialization Funds creating many exciting opportunities for students at the Ross School of Business to engage in real-time, Intensive Courses in Venture Capital & Private Equity real-world entrepreneurial and seed and venture-capi- tal investment experiences throughout their academic Outstanding Student Leaders – Awards & Scholarships careers at the University of Michigan. These students broaden their understanding of the innovation process Action-Based Learning Initiatives and the challenges of new-business creation through Internships their exposure to, and collaboration on joint projects Business Plan Competitions with, other students from the University’s top-ranked Dare to Dream Student Start-up Grants College of Engineering and School of Medicine. I am Multidisciplinary Action Projects pleased to report the continued growth and success of our two student-led investment funds, internship pro- Entrepreneur & Venture Club gram, funding for student start-ups, and business plan competitions. Together, these initiatives help to foster Entrepalooza and Michigan Growth Capital Symposia business ideation and development while students earn their degrees. Thank you for your participation In the News and support, which have kept Michigan’s Zell Lurie Institute ranked among the top 10 entrepreneurial- education institutions at business schools nationwide. I welcome the continued engagement of business and investment leaders in our alumni community, as well as those who remain loyal friends of the Institute. The Student-Run Wolverine Venture Fund Provides Financing, Strategic Guidance and Support to Emerging Companies and Lays the Foundation for Future Business Growth The Wolverine Fund (WVF) continues to be the only student directed venture fund associated with a business school. -

FINAL Oregon Capital Scan 2016

Oregon Capital Scan 2016 Submitted by: Lundquist College of Business University of Oregon December 2016 Sponsored by: STEERING COMMITTEE The Oregon Community Foundation Melissa Freeman - Chair Business Oregon John Saris, Heather Stafford, Nate Wildfire CTC Consulting|MyCFO Jon Finney Federal Reserve Bank of San Francisco Ian Galloway The Ford Family Foundation Nancy Straw Lemelson Foundation Rachel Brunette Meyer Memorial Trust Sayer Jones Northwest Health Foundation Jason Hilton Office of the State Treasurer Tom Rinehart Oregon’s Small Business Development Network Noah Brockman 2 | P a g e ABOUT THE SPONSORS The Oregon Community Foundation The mission of The Oregon Community Foundation is to improve life in Oregon and promote effective philanthropy. OCF works with individuals, families, businesses and organizations to create charitable funds to support the community causes they care about. Through these funds, OCF awards more than $60 million annually in grants and scholarships. Thousands of citizens have created a permanent endowment for Oregon through OCF – an endowment that will help Oregonians today and for generations to come. Business Oregon Business Oregon works to create, retain, expand and attract businesses that provide sustainable, living-wage jobs for Oregonians through public-private partnerships, leveraged funding and support of economic opportunities for Oregon companies and entrepreneurs. CTC|myCFO CTC |myCFO is member of BMO Financial Group (NYSE, TSX: BMO), one of the largest diversified financial services providers in North America. BMO Financial Group offers a full range of wealth management products and services, including investment management, trust and estate services, and private banking. CTC provides investment advice to high net worth families, multi ‐family offices, trusts, endowments, foundations and pension plans. -

NEWS Draper Fisher Jurvetson, DFJ Frontier, and Zone Ventures Award

Search... Homepage Stockquotes Indices Stocks A-Z Gainers/losers Recommendations News International NEWS MOSTREAD Currencies -A.P. Møller - Mærsk A/S RSS CA College - San Diego New Way to Raise Capital Earn Your Business Mgmt Degree CCSD Angelpitch uses video pitches to connect Company Announcement A.P. Request Free Information Today! Entrepreneurs and Angels. Møller - Mærsk A/S - (13:56 - 19/01) -The Orchard Announces Draper Fisher Jurvetson, DFJ Frontier, and Zone Ventures Substantial New Additions to Personal pages Award $250,000 to NeuroVigil in Fourth Annual DFJ Venture its Classical Offering (08:00 - 18/01) My portfolio Challenge My list 30/05/2008 - 17:51 -Census Bureau Daily Feature Log in for Sunday, January 18: Soccer (05:01 - 18/01) Leading early-stage venture capital firms -Australia Week 2009 Black Tie Draper Fisher Jurvetson (DFJ) and its network Gala to Honor Eric Bana, partners DFJ Frontier and Zone Ventures Rachel Griffiths and Tennis hosted the fourth annual DFJ Venture Legend Rod Laver Challenge in Menlo Park on Wednesday. With a (16:01 - 18/01) grand prize of $250,000 in seed stage funding, the competition is believed to be the largest -FLSmidth to announce winner-take-all business plan competition for reduction in workforce university students. During the morning (13:33 - 19/01) session, 16 teams from 12 universities on the West Coast presented business plans to a panel -A Sharp Fall in Business of 10 judges, comprised of venture capitalists Confidence but Opportunities from the DFJ Network. Six teams were selected Remain, Says Norton Rose as finalists and presented extended versions of Report their business plans and answered further (23:01 - 19/01) questions from the judges in a second round of competition in the afternoon. -

(WIRED) As Implemented by the U.S

This workforce solution was funded by a grant awarded under Workforce Innovation in Regional Economic Development (WIRED) as implemented by the U.S. Department of Labor’s Employment and Training Administration. The solution was created by the grantee and does not necessarily reflect the official position of the U.S. Department of Labor. The Department of Labor makes no guarantees, warranties, or assurances of any kind, express or implied, with respect to such information, including any information on linked sites and including, but not limited to, accuracy of the information or its completeness, timeliness, usefulness, adequacy, continued availability, or ownership. This solution is copyrighted by the institution that created it. Internal use by an organization and/or personal use by an individual for non-commercial purposes is permissible. All other uses require the prior authorization of the copyright owner. NEWS RELEASES Events Venture Communities Program Venture Communities :: A Golden Capital Network System 10/29/08 2:52 PM MARCH 6, 2008 News Category : Monterey Bay Capital Network Formed to Cultivate Innovation, Community News Investment, and Growth Companies Monterey, CA February 4, 2008— The Association for Monterey Bay Area Governments and Golden Capital Network (goldencapital.net) today announced a partnership to launch the Monterey Bay Capital Network at the West Coast Venture Capital Conference, March 10-11, at the Monterey Plaza Hotel and Spa in Monterey, CA. The West Coast Venture Capital Conference will feature up to 40 promising early stage companies from throughout the western U.S. presenting to the largest gathering of accredited angel and venture capital investors ever to attend an event in the Monterey Bay region. -

Pacific Northwest

Submitted by Business Innovation Institute Lundquist College of Business University of Oregon PACIFIC NORTHWEST Understanding the Regional Investment Landscape Published March 2016 Support & Contribution Pacific Northwest Capital Scan SPONSOR Threshold Group is a family-owned wealth management firm that serves high-net-worth families, individuals, and private foundations across 25 states from offices in Seattle, WA, Gig Harbor, WA, San Francisco, CA, and Philadelphia, PA. Ranked among 2014’s Top 50 Wealth Managers in the U.S. by Forbes magazine and with over $3 billion in assets under management, Threshold provides investment management, family office administration, and financial and philanthropic planning along with access to innovative impact investment opportunities that align with client values. Approximately $1 billion, and growing, is managed on behalf of clients who are aligned with impact or mission-related investing, spanning a broad range of asset classes, geographies, social and environmental issues. Threshold Group was founded and is owned by the Russell family, which created the global investment services firm known today as Russell Investments. While most often recognized for its stock indices, Russell Investments’ core competency was built through decades of excellence in the evaluation of investment managers. Data based on assets under management as of 12/31/2015. © 2016 Threshold Group is a Registered Investment Advisor. The information presented herein was researched and created exclusively by the University of Oregon’s Innovation Institute, which is independent of and not affiliated with Threshold Group. Accordingly, Threshold Group takes no responsibility for the views, opinions, findings, conclusions and data presented herein and did not in any way independently verify the accuracy of any such views, opinions, findings, conclusions or data.