Excise Policy 2020-21

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sirmaur District, Himachal Pradesh

Series-E For official use only Government of India Ministry of Water Resources CENTRAL GROUND WATER BOARD GROUND WATER INFORMATION BOOKLET SIRMAUR DISTRICT, HIMACHAL PRADESH NORTHERN HIMALAYAN REGION DHARAMSALA September, 2013 2013 जल संरषण व्ष 2013 जल संरण वषx 2013 Ground Water Information Booklet Sirmaur District, Himachal Pradesh CONTENTS DISTRICT AT A GLANCE Page No. 1.0 INTRODUCTION 1 2.0 CLIMATE & RAINFALL 3 3.0 GEOMORPHOLOGY & SOILS 3 4.0 GROUND WATER SCENARIO 4 4.1 Hydrogeology 4 4.2 Ground Water Resources 10 4.3 Ground Water Quality 12 4.4 Status of Ground Water Development 12 5.0 GROUND WATER MANAGEMENT STRATEGY 13 5.1 Ground Water Development 13 5.2 Water Conservation & Artificial Recharge 15 6.0 GROUND WATER RELATED ISSUES & PROBLEMS 15 7.0 AWARENESS & TRAINING ACTIVITY 16 8.0 AREAS NOTIFIED BY CGWA / SGWA 16 9.0 RECOMMENDATIONS 17 जल संरण वषx 2013 SIRMAUR DISTRICT AT A GLANCE 1. GENERAL PERTICULARS A. Location : North latitude 30022’00”- 31001”00 & East longitude 77°01’00” - 77050’00” B Area : 2,825 sq. km C. District & Tehsil Headquarter : Nahan D. Number of Tehsils : 6 E. Number of Sub-Tehsils 4 F. Number of Blocks : 5 G. Number of Towns : 3 H. Number of Villages : 968 I. Population Total : 5,29,855 persons (2011) i. Rural : 4,72,690 persons ii Urban : 57,165 persons iii Schedule Caste : 1,60,745 persons iv Scheduled tribes : 11,262 persons J. Work Force i. Cultivators : 1,15,992 persons ii. Agricultural Laborers : 5,953 persons K. Literacy : 68.44 % M. -

Economic Survey of Himachal Pradesh 2018-19

ECONOMIC SURVEY OF HIMACHAL PRADESH 2018-19 Economic and Statistics Department FOREWORD Economic Survey is one of the budget documents which indicates the important economic activities and achievements of the Government. The salient features of the economy of Himachal Pradesh during 2018-19 are presented in Part-I, and statistical tables on various subjects are given in Part-II. I am thankful to all the departments and public undertakings for their co-operation in making available the material included in the Survey. The burden of collection and updating the huge and voluminous data and its presentation in a concise and inter-related form was borne by the Economic and Statistics Department. I appreciate and commend the work done by the officers and officials of this department. Anil Kumar Khachi Additional Chief Secretary (Finance, Plg., and Eco. & Stat.) to the Govt. of Himachal Pradesh. I N D E X Contents Pages 1. General Review 1 2. State Income and Public Finance 9 3. Institutional and Bank Finances 14 4. Excise and Taxation 32 5. Price Movement 34 6. Food Security and Civil Supplies 36 7. Agriculture and Horticulture 41 8. Animal Husbandry and Fisheries 58 9. Forest and Environment 67 10. Water Resource Management 73 11. Industries and Mining 76 12. Labour and Employment 79 13. Power 83 14. Transport and Communication 102 15. Tourism and Civil Aviation 108 16. Education 112 17. Health 128 18. Social Welfare Programme 135 19. Rural Development 147 20. Housing and Urban Development 154 21. Panchayati Raj 160 22. Information and Science Technology 162 ------------------------------------------ Part-I ECONOMIC SURVEY-2018-19 ------------------------------------------ 1. -

HPAS-11173813.Pdf

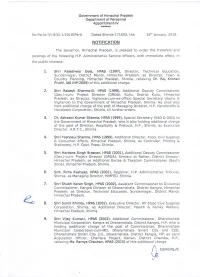

- --~- Government of Himachal Pradesh Department of Personnel Appoi ntment-IV ****** No .Per(A-IV)-8(6 )-1/2 0 18( Pa rt) Dated Shimla-171002, the 16th January, 2018 . NOTIFICATION The Governor, Himachal Pradesh, is pleased to order the transfers and postings of the following H.P. Administrative Service officers, with immediate effect, in the public interest:- 1. Shri Rajeshwar Gael, HPAS (1997), Director, Technical Education, Sundernagar, District Mandi, Himachal Pradesh, as Director, Town & Country Planning, Himachal Pradesh, Shimla, relieving Dr. Raj Krishan Pruthi, lAS (HP:2009) of this additional charge. 2. Shri Rakesh Sharma-III, HPAS (1998), Additional Deputy Commissioner (Dev.)-cum- Project Director (DRDA), Kullu, District Kullu, Himachal Pradesh, as Director, Vigilance-cum-ex-officio Special Secretary (Home & Vigilance) to the Government of Himachal Pradesh, Shimla. He shall also hold additional charge of the post of Maoaging Director, H.P. Handicrafts & Handloom Corporation, Shimla, till further orders. 3. Dr. Ashwani Kumar Sharma, HPAS (1999), Special Secretary (SAD & GAD) to the Government of Himachal Pradesh, who is also holding additional charge of the post of Director, Hospitality & Protocol, H.P. , Shimla, as Executive Director, H.R.T.C. , Shimla . 4. Shri Yashpaul Sharma, HPAS (1999), Additional Director, Food, Civil Supplies & Consumer Affairs, Himachal Pradesh, Shimla, as Controller, Printing & Stationery, H.P. Govt. Press, Shimla. 5. Shri Harbans Singh Brascon, HPAS (2001), Additional Deputy Commissioner (Dev.)-cum- Project Director (DRDA), Sirmaur at Nahan, District Sirmaur, Himachal Pradesh, as Additional Excise & Taxation Commissioner (South Zone), Himachal Pradesh, Shimla. 6. Smt. Rima Kashyap, HPAS (2001), Registrar, H.P. Administrative Tribunal, Shimla, as Managing Director, HIMFED, Shjmla. -

DISTT. BILASPUR Sr.No. Name of the Schools DISTRICT

DISTT. BILASPUR Sr.No. Name of the Schools DISTRICT The Principal, Govt. Sr. Secondary School Bharari, Teh. Ghumarwain, P.O BILASPUR 1 Bharari, Distt. Bilaspur. H.P Pin: 174027 The Principal, Govt. Sr. Secondary School Dangar, Teh. Ghumarwain, BILASPUR 2 P.O. Dangar,Distt. Bilaspur. H.P Pin: 174025 The Principal,Govt. Senior Secondary School,Ghumarwin, Tehsil BILASPUR 3 Ghumarwin, P.O.District Bilaspur,Himachal Pradesh, Pin-174021 The Principal,Govt. Senior Secondary School,Hatwar, Tehsil Ghumarwin, BILASPUR 4 P.O. Hatwar, District Bilaspur,Himachal Pradesh, Pin-174028 The Principal,Govt. Senior Secondary School,Kuthera, Tehsil Ghumarwin, BILASPUR 5 P.O. Kuthera,District Bilaspur,Himachal Pradesh, Pin-174026 The Principal,Govt. Senior Secondary School Morsinghi, Tehsil BILASPUR 6 Ghumarwin, P.O.Morsinghi,District Bilaspur, H.P. 174026 The Principal,Govt. Senior Secondary School,Chalhli, Tehsil Ghumarwin, BILASPUR 7 P.O. Chalhli, District Bilaspur,H. P, Pin-174026 The Principal, Govt. Senior Secondary School,Talyana,,Teh Ghumarwin, BILASPUR 8 P.O. Talyana,District Bilaspur,H. P, Pin-174026 The Principal, Govt. Senior Secondary School, Berthin Tehsil Jhandutta, BILASPUR 9 P.O. Berthin District Bilaspur,H. P. Pin-174029 The Principal, Govt. Senior Secondary School, Geherwin, Teh Jhandutta, BILASPUR 10 P.O. GehrwinDistrict Bilaspur, H. P. Pin- The Principal, Govt. Senior Secondary School,Jhandutta, Tehsil Jhandutta, BILASPUR 11 P.O.Jhandutta, District Bilaspur, H. P Pin-174031 The Principal,Govt. Senior Secondary School,Jejwin, P.O.District Bilaspur, BILASPUR 12 Himachal Pradesh, Pin- The Principal, Govt. Senior Secondary School,Koserian, Tehsil Jhandutta, BILASPUR 13 P.O. Kosnria,District Bilaspur, H. P. Pin-174030 The Principal, Govt. -

Kangra, Himachal Pradesh

` SURVEY DOCUMENT STUDY ON THE DRAINAGE SYSTEM, MINERAL POTENTIAL AND FEASIBILITY OF MINING IN RIVER/ STREAM BEDS OF DISTRICT KANGRA, HIMACHAL PRADESH. Prepared By: Atul Kumar Sharma. Asstt. Geologist. Geological Wing” Directorate of Industries Udyog Bhawan, Bemloe, Shimla. “ STUDY ON THE DRAINAGE SYSTEM, MINERAL POTENTIAL AND FEASIBILITY OF MINING IN RIVER/ STREAM BEDS OF DISTRICT KANGRA, HIMACHAL PRADESH. 1) INTRODUCTION: In pursuance of point 9.2 (Strategy 2) of “River/Stream Bed Mining Policy Guidelines for the State of Himachal Pradesh, 2004” was framed and notiofied vide notification No.- Ind-II (E)2-1/2001 dated 28.2.2004 and subsequently new mineral policy 2013 has been framed. Now the Minstry of Environemnt, Forest and Climate Change, Govt. of India vide notifications dated 15.1.2016, caluse 7(iii) pertains to preparation of Distt Survey report for sand mining or riverbed mining and mining of other minor minerals for regulation and control of mining operation, a survey document of existing River/Stream bed mining in each district is to be undertaken. In the said policy guidelines, it was provided that District level river/stream bed mining action plan shall be based on a survey document of the existing river/stream bed mining in each district and also to assess its direct and indirect benefits and identification of the potential threats to the individual rivers/streams in the State. This survey shall contain:- a) District wise detail of Rivers/Streams/Khallas; and b) District wise details of existing mining leases/ contracts in river/stream/khalla beds Based on this survey, the action plan shall divide the rivers/stream of the State into the following two categories;- a) Rivers/ Streams or the River/Stream sections selected for extraction of minor minerals b) Rivers/ Streams or the River/Stream sections prohibited for extraction of minor minerals. -

HP Administrative Service Officer

Government of Himachal Pradesh Department of Personnel Appointment-IV ****** No.Per(A-IV)-B(6)-1/2015-Part Dated Shimla-2, the ;;;..t~ February, 2015. NOTIFICATION The Governor, Himachal Pradesh, is pleased to order the transfer of Shri Shiv Krishan, HPAS (2009), Regional Transport Officer, Una, District Una, Himachal Pradesh and to post him as Sub Divisional Officer (Civil), Sarkaghat, District Mandi, Himachal Pradesh, relieving Sub Divisional Officer (Civil), jogindernagar, of this additional charge, with immediate effect, in the public interest. He shall also hold additional charge of the post of Sub Divisional Officer (Civil), Dharampur, District Mandi, Himachal Pradesh, relieving Tehsildar, Sandhole, of this additional charge, in the public interest. By Order Parthasarathi Mitra Chief Secretary to the Government of Himachal Pradesh. Endst. No. As above, Dated Shimla-l71 002, th~ebrUary, 2015. Copy forwarded to:- 1. All the Additional Chief Secretaries to the Government of Himachal Pradesh, Shimla-l71 002. 2. The Additional Chief Secretary (Transport) to the Government of Himachal Pradesh, Shimla-2. 3. The Additional Chief Secretary to Chief Minister, Himachal Pradesh, Shimla-2. 4. The Pro Private Secretary to Chief Minister, Himachal Pradesh, Shimla-2. 5. The Divisional Commissioner, Mandi Division, District Mandi, H.P. 6. The Director, Transport, Parivahan Bhawan, Himachal Pradesh, Shimla-3. 7. The Deputy Commissioner, Mandi, District Mandi, Himachal Pradesh. 8. The Deputy Commissioner, Una, District Una, Himachal Pradesh. 9. All the officers concerned for immediate compliance. 10.The Sr. Private Secretary to Chief Secretary to the Government of Himachal Pradesh, Shimla-171002. 1l.The Controller (Finance & Accounts). Deptt. of Personnel, H.P. -

2017-18 Page 1 and Are Protected by Fairly Extensive Cover of Natural Vegetation

For Official Use Only GOVERNMENT OF INDIA MINISTRY OF WATER RESOURCES CENTRAL GROUND WATER BOARD GROUND WATER YEAR BOOK HIMACHAL PRADESH (2017-2018) NORTHERN HIMALAYAN REGION DHARAMSHALA (H.P) March, 2019 GOVERNMENT OF INDIA MINISTRY OF WATER RESOURCES RIVER DEVELOPMENT AND GANGA REJUVENATION CENTRAL GROUND WATER BOARD GROUND WATER YEAR BOOK HIMACHAL PRADESH (2017-2018) By Rachna Bhatti Vidya Bhooshan Scientist ‘C’ Senior Technical Assistant (Hydrogeology) NORTHERN HIMALAYAN REGION DHARAMSHALA (H.P) March, 2019 GROUND WATER YEAR BOOK HIMACHAL PRADESH 2017-2018 EXECUTIVE SUMMARY Central Ground Water Board, NHR has set up a network of 128 National Hydrograph Stations in the state of Himachal Pradesh. The monitoring commenced in the year 1969 with the establishment of 3 observation wells and since, then the number of monitoring station are being increased regularly so as to get the overall picture of ground water scenario in different hydrogeological set up of the state. Most of the area in Himachal Pradesh is hilly enclosing few small intermontane valleys. The traditional ground water structures under observation at present are dugwells and are mostly located in the valley areas only. Therefore, the ground water regime monitoring programme is concentrated mainly in valley areas of the state and some places in hard rock areas. All the 128 National Hydrograph Stations are located only in 7 districts out of the 12 districts in Himachal Pradesh. The reason being hilly terrain, hard approachability and insignificant number of structures available for monitoring. The average annual rainfall in the state varies from 600 mm to more than 2400 mm. The rainfall increases from south to north. -

Places to Visit in Chail, Himachal Pradesh

Places to visit in Chail, Himachal Pradesh Chail is a popular Hill Station located in Himachal Pradesh Chail is located in Himachal Pradesh, India. It used to be a small town until the 19 th Century when Maharaja Bhupinder Singh of Patiala decided to make it his summer retreat. Most of the properties of the Maharaja have been taken over by the Indian government and some of those are being used by the State’s Tourism Department as attractions for excursionists. Chail is quite popular amongst those tourists who wish to avoid crowd, which they can easily find in a major tourist destination such as Shimla. Attractions in Chail Chail Sanctuary: The town is surrounded by thick forests of Deodar and Oak, which are home to a myriad of animals. The Chail Sanctuary covers more than 10,000 hectares and visitors may spot animals such as goral, sambar, barking deer, red jungle fowl, cheer, and many more. Cricket Ground: It is located at a height of 2,144 m above the sea level. The cricket ground in Chail is the highest cricket ground in the world. It was built in 1893 and is a surrounded by forests that offer a very picturesque view. Maharaja’s Palace: The palace was built in 1891 and features a number of elaborate furnishings designed to suit the exquisite taste of the Maharaja. The palace is also a resort where visitors can enjoy the luxuries of life. Chail Gurudwara: The gurudwara was one of the first buildings to be constructed after the completion of the Maharaja’s palace. -

Mineral Resources of Himachal Pradesh by Arun K

Mineral Resources Of Himachal Pradesh By Arun K. Sharma , State Geologist , Himachal Pradesh Geological Wing , Department of Industries, Udyog Bhawan , Shimla-1 , Himachal Pradesh -171009 Rajneesh Sharma, Geologist, Geological Wing , Department of Industries, Udyog Bhawan , Shimla-1 , Himachal Pradesh -171009 Dr. H. R. Dandi Geologist, Geological Wing , Department of Industries, Udyog Bhawan , Shimla-1 , Himachal Pradesh -171009 i Mineral Resources of Himachal Pradesh Arun K. Sharma , Rajneesh Sharma, Dr. H. R. Dandi Contents Content Page No 1 Introduction 1 2 Minerals 1 3 Mineral Deposits 2 3.1 Igneous Minerals 3 3.2 Metamorphic Minerals. 3 3.3 Sedimentary Minerals. 3 3.4 Hydrothermal minerals. 4 4 Distinctive Characters of the Minerals 4 4.1 Color 4 4.2 Streak 4 4.3 Luster 4 4.4 Hardness 4 4.5 Specific Gravity 5 4.6 Cleavage 5 4.7 Crystal form 6 5 Mineral Resource 6 5.1 Inferred Mineral Resource 6 5.2 Indicated Mineral Resource 6 5.3 Measured Mineral Resource 7 6 Mineral Reserve 7 6.1 Probable Mineral Reserve 7 6.2 Proven Mineral Reserve 7 7 Distinctive Characters of the Mineral Deposit 7 8 Importance of Mineral Resources 8 9 Global Scenario 8 9.1 History 8 9.2 Modern mineral history 10 10 National Scenario 12 10.1 Past history 12 10.2 Pre Independence era 13 10.3 Post Independence Period 13 10.4 Present mining scenario 14 ii 11 Geology of Himachal Pradesh 21 11.1 Sub-Himalayas 22 11.2 Lesser Himalayas 22 11.3 Higher Himalayas 23 11.4 Geological Structural Belts 24 11.4.1 Siwalik Autochthon to Parautochthon Belt. -

Fgekpyizns'kljdkj Vkcdkjhvkcavu Dh ?Kks”K.Kk,A O”Kz2021&22

fgekpyizns’kljdkj GOVERNMENT OF HIMACHAL PRADESH vkcdkjhvkcaVu dh ?kks”k.kk,a o”kZ2021&22 ANNOUNCEMENTSFOR THE ALLOTMENT OF RETAIL EXCISE VENDS BY RENEWAL/DRAW OF LOTS/TENDER-CUM-AUCTION FOR THE YEAR 2021-22. 1 jkT; dj ,oavkcdkjhfoHkkx fgekpyizns’k DEPARTMENT OF STATE TAXES AND EXCISE HIMACHAL PRADESH *** ANNOUNCEMENTS TO BE MADE AT THE TIME OF ALLOTMENTBY RENEWALOFTHE EXCISE LICENSES FOR THE RETAIL VENDS OF COUNTRY LIQUOR, FOREIGN LIQUOR AND COUNTRY FERMENTED LIQUOR IN HIMACHAL PRADESH FOR THE FINANCIAL YEAR 2021-22. THE EXCISE POLICY 2021-22 WAS APPROVED BY THE CMM ON DATED 24-05-2021 DATED 24-05-2021 VIDE GOVT. LETTER NO.EXN-F(18)/2021 DATED 25-05-2021. 2 TABLE OF CONTENTS CHAPTER TITLE Page No. NO. 1. INTRODUCTORY 4 2. MAIN PROVISIONS OF THE PROCEDURE FOR 5-11 ALLOTMENT ON APPLICATION AND BY DRAW OF LOTS 3. MAIN PROVISIONS OF THE PROCEDURE FOR 12-17 BIDDING THROUGH AUCTION-CUM-TENDERS. 4. MAIN PROVISIONS OF THE PROCEDURE FOR 18-21 RENEWAL 5. MINIMUM GUARANTEED QUOTA AND ANNUAL FIXED 22-26 LICENSE FEE 6. DUTIES AND FEES ETC 27-37 7. COUNTRY LIQUOR 38-42 8. FOREIGN LIQUOR 43-47 9. GRANT OF COUNTRY FERMENTED AND DISTILLED 48 LIQUOR LICENSES IN FORM L-20-B, L-20-C, L-20-CC AND L-20-D 10. OBSERVANCE OF DRY DAYS AND SALE HOURS 49 11. NEW LICENSES 50-54 12. MISCELLANEOUS 55-65 13 BIO BRANDS POLICY 66-67 14. ANNEXURE 68-135 3 CHAPTER-I: INTRODUCTORY 1.1 The liquor licenses, shall be granted subject to the provisions of the Himachal Pradesh Excise Act, 2011 and the Rules framed thereunder from time to time. -

Why I Became a Hindu

Why I became a Hindu Parama Karuna Devi published by Jagannatha Vallabha Vedic Research Center Copyright © 2018 Parama Karuna Devi All rights reserved Title ID: 8916295 ISBN-13: 978-1724611147 ISBN-10: 1724611143 published by: Jagannatha Vallabha Vedic Research Center Website: www.jagannathavallabha.com Anyone wishing to submit questions, observations, objections or further information, useful in improving the contents of this book, is welcome to contact the author: E-mail: [email protected] phone: +91 (India) 94373 00906 Please note: direct contact data such as email and phone numbers may change due to events of force majeure, so please keep an eye on the updated information on the website. Table of contents Preface 7 My work 9 My experience 12 Why Hinduism is better 18 Fundamental teachings of Hinduism 21 A definition of Hinduism 29 The problem of castes 31 The importance of Bhakti 34 The need for a Guru 39 Can someone become a Hindu? 43 Historical examples 45 Hinduism in the world 52 Conversions in modern times 56 Individuals who embraced Hindu beliefs 61 Hindu revival 68 Dayananda Saraswati and Arya Samaj 73 Shraddhananda Swami 75 Sarla Bedi 75 Pandurang Shastri Athavale 75 Chattampi Swamikal 76 Narayana Guru 77 Navajyothi Sree Karunakara Guru 78 Swami Bhoomananda Tirtha 79 Ramakrishna Paramahamsa 79 Sarada Devi 80 Golap Ma 81 Rama Tirtha Swami 81 Niranjanananda Swami 81 Vireshwarananda Swami 82 Rudrananda Swami 82 Swahananda Swami 82 Narayanananda Swami 83 Vivekananda Swami and Ramakrishna Math 83 Sister Nivedita -

Page7 New Setup.Qxd (Page 1)

DAILY EXCELSIOR, JAMMU MONDAY, APRIL 18, 2016 (PAGE 7) NMC urges PM for extra grants J&K Central Para Military Force Welfare to regularize daily rated workers Association elects new office bearers Excelsior Correspondent include Jammu and Srinagar cities Excelsior Correspondent president for Rajouri. in the list of proposed 100 smart For Kathua district, Jankar JAMMU, Apr 17: National cities, Shastri pointed out that JAMMU, Apr 17: All J&K Chand was elected as president, Mazdoor Conference (NMC) including these two cities in the Central Para Military Force Karan Singh as vice-president urged Prime Minister Narendra list of 100 smart cities of the coun- Welfare Association has elected and Sat Pal as cashier. Modi to include Rs 7000 crore try would ensure more flow of its new office bearers of the cen- For Samba district, more as an additional grant in the funds to upgrade modernized tral body and district units. Gurbachan was elected as presi- announced financial package to civic amenities in these cities. S S Manhas has been elected dent, Chuni Lal as vice-presi- meet the expenditure on accounts He also called upon the SEECC-A Chairman Amar Nath Thakur and others address- of absorption and regularization Chief Minister to formulate policy ing a press conference at Jammu on Sunday. Leader of SVDSCB addressing a press conference at Jammu on Sunday. SEECC-A formed with Amar Mata Vaishno Devi Baridars urge Nath Thakur as chairman Excelsior Correspondent the Education Department PM to fulfill his election promise authorities. JAMMU, Apr 17: