ANNUAL REPORT 2016 Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Qualitative Evaluation of Rock Weir Field Performance and Failure Mechanisms

Qualitative Evaluation of Rock Weir Field Performance and Failure Mechanisms U.S. Department of the Interior Bureau of Reclamation Technical Service Center Denver, Colorado September 2007 U.S. Department of the Interior Mission Statement The mission of the Department of the Interior is to protect and provide access to our Nation’s natural and cultural heritage and honor our trust responsibilities to Indian tribes and our commitments to island communities. Mission of the Bureau of Reclamation The mission of the Bureau of Reclamation is to manage, develop, and protect water and related resources in an environmentally and economically sound manner in the interest of the American public. Qualitative Evaluation of Rock Weir Field Performance and Failure Mechanisms Authored by David M. Mooney, PhD, PE Hydraulic Engineer Division of Planning, MP-700 Mid Pacific Regional Office Sacramento, CA Christopher L. Holmquist-Johnson, MS, PE Hydraulic Engineer Sedimentation and River Hydraulics Group, 86-68240 Technical Service Center Denver, CO Elaina Holburn, MS, PE Hydraulic Engineer Sedimentation and River Hydraulics Group, 86-68240 Technical Service Center Denver, CO Reviewed by Blair P. Greiman, PhD, PE Hydraulic Engineer Sedimentation and River Hydraulics Group, 86-68240 Technical Service Center Denver, CO i Acknowledgements The following persons and/or entities contributed to this report: • Reclamation Funding: o Albuquerque Area Office o Pacific Northwest Regional Office o Science and Technology Office o Snake River Area Office • Technical Consultation: o Chester Watson, PhD, PE, Colorado State University o Christopher Thornton, PhD, PE, Colorado State University o Paula Makar, PE Bureau of Reclamation o Timothy Randle, MS, PE, Bureau of Reclamation • Field Data Collection: o Canyon R.E.O Rafting o Colorado State University o Pagosa Springs o 3-Forks Ranch o Snake River Area Office o Salmon Field Office ii Table of Contents 1 INTRODUCTION.............................................................................................................................. -

1425 – 1437 Market Street CONTENTS

INVESTOR PROSPECTUS WHEELING WV 1425 – 1437 Market Street CONTENTS 1 WHEELING CONTEXT 2 BUILDING ON MOMENTUM 3 1425 – 1437 MARKET STREET 4 INCENTIVE POTENTIAL 5 FINANCIAL MODEL Click on the title to jump to the section WHEELING CONTEXT 1 The birth place of West Virginia and The First State Capitol. Located on I-70, 55 miles southwest of Pittsburgh,120 miles east of Columbus, Ohio, and 130 miles south of Cleveland, Ohio. Wheeling is the largest city (population 27,052) in the Wheeling-Belmont County (Ohio) Metropolitan Statistical Area (population 138,948) that includes Ohio and Marshall Counties, WV, and Belmont County, OH. Pittsburgh Wheeling Columbus From the region’s largest trail system, to national schools of excellence, to a reorganized municipal government, the City of Wheeling offers a dynamic environment for future economic growth and development. There are many features that are unique to this area and we are proud of them! Our businesses enjoy the business climate as well with our advanced, motivated work force. The work force also enjoys being active in our various professional organizations. The area boasts year-round entertainment, leisure, sports, music, festivals, dining, shopping, and much more. Who We Are We are hardworking, dedicated people who enjoy an unrivaled quality of life. From our nationally ranked schools to award-winning hospitals, Wheeling is an exceptional place to raise a family. There are a plethora of year-round recreational activities including golf, boating, water sports, snow skiing, biking, hiking, tennis, skateboarding, swimming, and many more. Year-round entertainment is another amazing feature of the city including local, regional, and national concert series, festivals, pro sporting events, or try your luck with all of your favorite slots and table games. -

VENUECONNECT 2013 ATTENDEES As of 11/12/2013

VENUECONNECT 2013 ATTENDEES as of 11/12/2013 FULL_NAME COMPANY CITY STATE/ PROVINCE COUNTRY Aaron Hurt Howard L. Schrott Arts Center Indianapolis IN Abbie Jo Vander Bol Show Me Center Cape Girardeau MO Adam Cook Rexall Place & Edmonton Expo Centre Edmonton AB Canada Adam Saunders Robert A. (Bob) Bowers Civic Center Port Arthur TX Adam Sinclair American Airlines Center Dallas TX Adam Straight Georgia Dome Atlanta GA Adina Alford Erwin The Fox Theatre - Atlanta Atlanta GA Adonis Jeralds Charlotte Coliseum Charlotte NC Adrian Collier University Center Mercer University Macon GA Adrian Moreno West Cal Arena Sulphur LA AJ Boleski INTRUST Bank Arena/SMG Wichita KS AJ Holzherr Birmingham CrossPlex Birmingham AL Al Diaz McAllen Auditorium & Convention Center McAllen TX Al Karosas Bryce Jordan Center Penn State University University Park PA Al Rojas Kay Bailey Hutchison Convention Center Dallas TX Alan Freeman Louisiana Superdome & New Orleans Arena New Orleans LA Albert Driscoll Halifax Forum Community Association Halifax NS Albert Milano Strategic Philanthropy, LLC Dallas TX Alberto Galarza Humacao Arena & PAC Humacao PR Alexander Diaz Madison Square Garden New York NY Alexis Berggren Dolby Theatre Hollywood CA Allen Johnson Orlando Venues/Amway Center Orlando FL Andrea Gates-Ehlers UIC Forum Chicago IL Andrew McQueen Leflore County Civic Center/ Argi-Center Greenwood MS Andrew Thompson Harborside Event Center Fort Myers FL Andy Gillentine University of South Carolina Columbia SC Angel Mitchell Ardmore Convention Center Ardmore OK Angie Teel -

WALLACE WEIR FISH RESCUE FACILITY PROJECT Yolo Bypass

WALLACE WEIR FISH RESCUE FACILITY PROJECT Yolo Bypass FISH PASSAGE In water year 2014, the California Department of Fish and Wildlife (CDFW) and National Marine Fisheries Service RESTORATION GOALS / TARGET (NMFS) documented several hundred adult salmon in dead- Return special status migratory fish species to the end agricultural ditches in the Colusa Basin Drain system, Sacramento River that are unable to pass volitionally over and while many of these fish were rescued from the drain, the Wallace Weir. stress from the poor water quality conditions prevented these salmon from successfully contributing to the reproductive population. In the remainder of water year 2014 and in water LOCATION AND LANDOWNER year 2015, CDFW operated a fyke trap with wing walls at This project is located on private property at Wallace Wallace Weir to prevent straying adult salmonids and sturgeon Weir in Yolo County, where the Knights Landing Ridge from entering the Colusa Basin Drain; rescued fish were Cut meets the Yolo Bypass. The Wallace Weir is owned by returned to the Sacramento River. These fish rescue operations Knaggs Ranch, LLC and the David and Alice te Velde trust, have proven resource intensive and are not efficient at higher the successors of Hershey in the 1937 agreement. CDFW flows in the Knights Landing Ridge Cut (KLRC). Wallace will operate the fish rescue portion of the facility. Weir is a key water control structure in the bypass for flood conveyance and irrigation, but it is an obsolete structure which must be installed and removed annually using inflexible, labor FUNDING intensive methods. DWR and U.S. -

Arena Study Volume I

CITY OF SAVANNAH, GEORGIA PROPOSED ARENA FEASIBILITY STUDY VOLUME I OF II Prepared by: Barrett Sports Group, LLC Gensler JE Dunn Construction Thomas and Hutton May 6, 2016 TABLE OF CONTENTS VOLUME I OF II I. EXECUTIVE SUMMARY II. MARKET ANALYSIS III. PRELIMINARY FACILITY CHARACTERISTICS IV. SITE CONSIDERATIONS V. PRELIMINARY CONSTRUCTION COST ESTIMATES VI. FINANCIAL ANALYSIS VII. ECONOMIC IMPACT ANALYSIS VIII. CIVIC CENTER OVERVIEW IX. SUBCOMMITTEE REPORTS Page 1 TABLE OF CONTENTS VOLUME II OF II APPENDIX A: MARKET DEMOGRAPHICS APPENDIX B: DEVELOPMENT CASE STUDIES APPENDIX C: PROJECT SUMMARY WORKSHEETS: COST ESTIMATES APPENDIX D: WATER RESOURCE ANALYSIS APPENDIX E: WETLANDS APPENDIX F: ENVIRONMENTAL REVIEW REPORT APPENDIX G: STORMWATER MANAGEMENT APPROACH APPENDIX H: ARENA WATER & SEWER APPENDIX I: SUMMARY OF TRAFFIC ASSESSMENT APPENDIX J: BUILDING AND FIRE CODE CONSULTATION SERVICES LIMITING CONDITIONS AND ASSUMPTIONS Page 2 I. EXECUTIVE SUMMARY I. EXECUTIVE SUMMARY Introduction The Consulting Team (see below) is pleased to present our Proposed Arena Feasibility Study. The Consulting Team consists of the following firms . Barrett Sports Group (BSG) . Gensler . JE Dunn Construction . Thomas and Hutton . Coastline Consulting Services . Ecological Planning Group, LLC . Resource & Land Consultants . Terracon The City of Savannah, Georgia (City) retained the Consulting Team to provide advisory services in connection with evaluating the feasibility of replacing and/or redesigning Martin Luther King, Jr. Arena The Consulting Team has completed a comprehensive evaluation of the proposed site and potential feasibility and demand for a new arena that would host athletic events, concerts, family shows, and other community events The Consulting Team was tasked with evaluating the Stiles Avenue/Gwinnett Street site only and has not evaluated any other potential sites Page 4 I. -

Glenn Killinger, Service Football, and the Birth

The Pennsylvania State University The Graduate School School of Humanities WAR SEASONS: GLENN KILLINGER, SERVICE FOOTBALL, AND THE BIRTH OF THE AMERICAN HERO IN POSTWAR AMERICAN CULTURE A Dissertation in American Studies by Todd M. Mealy © 2018 Todd M. Mealy Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy May 2018 ii This dissertation of Todd M. Mealy was reviewed and approved by the following: Charles P. Kupfer Associate Professor of American Studies Dissertation Adviser Chair of Committee Simon Bronner Distinguished Professor Emeritus of American Studies and Folklore Raffy Luquis Associate Professor of Health Education, Behavioral Science and Educaiton Program Peter Kareithi Special Member, Associate Professor of Communications, The Pennsylvania State University John Haddad Professor of American Studies and Chair, American Studies Program *Signatures are on file in the Graduate School iii ABSTRACT This dissertation examines Glenn Killinger’s career as a three-sport star at Penn State. The thrills and fascinations of his athletic exploits were chronicled by the mass media beginning in 1917 through the 1920s in a way that addressed the central themes of the mythic Great American Novel. Killinger’s personal and public life matched the cultural medley that defined the nation in the first quarter of the twentieth-century. His life plays outs as if it were a Horatio Alger novel, as the anxieties over turn-of-the- century immigration and urbanization, the uncertainty of commercializing formerly amateur sports, social unrest that challenged the status quo, and the resiliency of the individual confronting challenges of World War I, sport, and social alienation. -

Wheeling Vs Charleston

GAME NOTES WHEELING SCHEDULE / STAT LEADERS WHEELING WEEK IN REVIEW: West Virginia Wesleyan held Wheeling to just 36 Overall: 0-4; MEC: 0-4; Home: 0-2; Away: 0-2 OFFENSIVE LEADERS: total rushing yards in the Cardinals’ 33-19 Rushing: setback in Buckhannon. Wheeling’s Tucker Date Opponent Time/Result S. Alli .................43 att., 137 yds., 1 TDs, 3.2 avg. Strachan was 25-for-38 on 310 yards Sep. 7 WEST LIBERTY* L 33-30 Receiving: passing with three touchdowns and a trio of Sep. 12 at Fairmont State* L 53-10 R. LaFollette .30 rec., 320 yds., 1 TD, 10.7 avg. interceptions. Jake Keenan notched a game- Sep. 19 URBANA* L 41-26 J. Davidson ....20 rec., 229 yds., 4 TD, 11.4 avg. high 111 yards receiving on six catches with a Sep. 28 at W.Va. Wesleyan* L 33-19 J. Keenan ......... 15 rec., 281 yds., 2 TD, 18.7 avg. touchdown. Rich White recorded a game- Oct. 5 CHARLESTON* 1 PM Passing: high 10 solo tackles for the Cardinal defense. Oct. 12 MCKENDREE 1 PM Oct. 19 at Notre Dame (Ohio)* 1 PM T. Strachan ...90 of 155, 1072 yds., 8 TD, 9 INT CHARLESTON WEEK IN REVIEW: Oct. 26 FROSTBURG STATE* 1 PM DEFENSIVE LEADERS: Charleston shutout Valparaiso in the second Tackles: half as the Golden Eagles defeated the Nov. 2 at Glenville State* 12 PM R. White ..................... 32 (s), 6 (a), 38 (t), 1.0 TFL Crusaders 19-13. It marked the first time a Nov. 9 WEST VIRGINIA STATE* 12 PM J. -

History of Hancock Ciounty; Virginia and West Virginia

HISTORY of HANCOCK COUNTY • Virginia and West Virginia o Sacramento Branch Genealogical Library BY JACK WELCH FIRST PRINTING © Copyright, 1963, by Jack Welch All rights reserved under International and Pan-American Copyright Conventions. Published in Wheeling, West Virginia, by The Wheeling News Printing & Litho Co. orewor* The physical features of Hancock County can be described quickly and easily. It is the northernmost county in West Virginia, bounded on the north and west by the Ohio River, on the east by Pennsylvania, and on the south by Brooke County. It is the smallest county in West Virginia with 88.55 square miles. It has three muni cipalities (Chester, New Cumberland, Weirton), three magisterial districts (Butler, Clay, Grant), and 37 voting precincts. Its agri cultural and industrial products include iron, steel, chinaware, pottery, bricks, fire clay, sheet metal, tin products, apples, dairy foods, and livestock. Hancock County, like any other inhabited area of the world, is more than a tiny block of land furnishing a livelihood for several thousands of people. It is a land that is built upon the labor, the ideals, the lives, and the deaths of those who have gone before. It is a forest turned into a farm, a farm turned into a town, and a town turned into an industrial site employing thousands of people. It is a man chopping a tree in a virgin forest, it is a woman taking up a "fie to protect her family from Indians, it is a man building a school, it is a man building a factory. All these things are Hancock County, as much of a reality as the topographical and statistical elements. -

Awards Victory Dinner

West Virginia Sports Writers Association Victory Officers Executive committee Member publications Wheeling Intelligencer Beckley Register-Herald Awards Bluefield Daily Telegraph Spirit of Jefferson (Charles Town) Pendleton Times (Franklin) Mineral Daily News (Keyser) Logan Banner Dinner Coal Valley News (Madison) Parsons Advocate 74th 4 p.m., Sunday, May 23, 2021 Embassy Suites, Charleston Independent Herald (Pineville) Hampshire Review (Romney) Buckhannon Record-Delta Charleston Gazette-Mail Exponent Telegram (Clarksburg) Michael Minnich Tyler Jackson Rick Kozlowski Grant Traylor Connect Bridgeport West Virginia Sports Hall of Fame President 1st Vice-President Doddridge Independent (West Union) The Inter-Mountain (Elkins) Fairmont Times West Virginian Grafton Mountain Statesman Class of 2020 Huntington Herald-Dispatch Jackson Herald (Ripley) Martinsburg Journal MetroNews Moorefield Examiner Morgantown Dominion Post Parkersburg News and Sentinel Point Pleasant Register Tyler Star News (Sistersville) Spencer Times Record Wally’s and Wimpy’s Weirton Daily Times Jim Workman Doug Huff Gary Fauber Joe Albright Wetzel Chronicle (New Martinsville) 2nd Vice-President Secretary-Treasurer Williamson Daily News West Virginia Sports Hall of Fame Digital plaques with biographies of inductees can be found at WVSWA.org 2020 — Mike Barber, Monte Cater 1979 — Michael Barrett, Herbert Hugh Bosely, Charles L. 2019 — Randy Moss, Chris Smith Chuck” Howley, Robert Jeter, Howard “Toddy” Loudin, Arthur 2018 — Calvin “Cal” Bailey, Roy Michael Newell Smith, Rod -

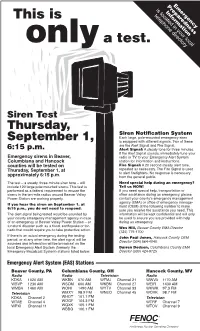

This Is Onlya Test

PreparednessEmergency is located in your local Information This is telephone directory a test. only Siren Test Thursday, Siren Notification System September 1, Each large, pole-mounted emergency siren is equipped with different signals. Two of these are the Alert Signal and Fire Signal. 6:15 p.m. Alert Signal: A steady tone for three minutes. If the Alert Signal sounds, immediately tune your Emergency sirens in Beaver, radio or TV to your Emergency Alert System Columbiana and Hancock station for information and instructions. counties will be tested on Fire Signal: A 20 second steady alert tone, Thursday, September 1, at repeated as necessary. The Fire Signal is used to alert firefighters. No response is necessary approximately 6:15 p.m. from the general public. The test – a steady, three-minute siren tone – will Need special help during an emergency? include 120 large pole-mounted sirens. This test is Tell us NOW! performed as a federal requirement to ensure the If you need special help, transportation or sirens in the ten-mile radius around Beaver Valley other assistance during an emergency, please Power Station are working properly. contact your county’s emergency management If you hear the siren on September 1, at agency (EMA) or office of emergency manage- 6:15 p.m., you do not need to respond. ment (OEM) at the following number to make sure you receive the assistance you need. This The alert signal being tested would be sounded by information will be kept confidential and will only your county emergency management agency in case be used to ensure you are provided with help of an emergency at Beaver Valley Power Station – or during an emergency. -

Download PDF 503.97 KB

Florida State University Libraries Electronic Theses, Treatises and Dissertations The Graduate School 2003 The Effect of Game Day Promotions on Consumer Behavior in the East Coast Hockey League (ECHL) Brian Edmund Pruegger Follow this and additional works at the FSU Digital Library. For more information, please contact [email protected] THE FLORIDA STATE UNIVERSITY COLLEGE OF EDUCATION THE EFFECT OF GAME DAY PROMOTIONS ON CONSUMER BEHAVIOR IN THE EAST COAST HOCKEY LEAGUE (ECHL) By BRIAN EDMUND PRUEGGER A Dissertation Submitted to the Department of Recreation Management, Sport Management and Physical Education In partial fulfillment of the requirements for the degree of Doctor of Philosophy Degree Awarded Spring Semester, 2003 The members of the committee approve the dissertation of Brian Edmund Pruegger defended on February 28, 2003 ______________________ Brenda Pitts Professor Directing Dissertation ______________________ Akihito Kamata Outside Committee Member _______________________ Annie. Clement Committee Member ________________________ Aubrey Kent Committee Member Approved: _______________________________________________________ Charles Imwold, Chair, Department of Physical Education ACKNOWLEDGEMENTS The author wishes to express his gratitude to Dr. A. Kamata, Dr. A. Clement and Dr. A. Kent for their time, guidance and assistance on this project. I would also like to thank Dr. P. Humphrey for her assistance in analyzing the statistical data and Dr. B Joyner for his direction in completing Chapter four. The fourteen ECHL marketing personnel need to be thanked and commended for completing the survey and contributing the data necessary for completion of this study. I would also like to thank my fellow doctoral students at Florida State for their input and guidance. Students deserving specific mention for their contribution to this project include: Doris Lu, Rachel Chang and Gary Lhotsky. -

Police Investigate Accidents

Ni!, I 0. - (.~ K WINTERSYILLE CITIZEN VOL. 4. NO. 43 THURSDAY, SEPTEMBER 15, 1966 - TWELVE PAGES $5.00 per year 10€ per copy Wayne Van Dine Hosts 11:00 PM News Jefferson County Police Investigate Accidents Wayne Van Dine, veteran WSTV- TV Newsman and Sports Direc- Republican Headquarters Wintersville Police were called shorter as the days go by-- tor, has been named Newscaster on to investigate a total of 33 and that headlights should be for Channel 9's 11:00 p.m. News, Officially Opened complaints including five traffic turned on 1/2 hour before dusk according to an announcement by accidents in the week just pass- and should be used for 1/2 hour Ted Eiland, Vice-president-gen- Jefferson County Republican ed. aiter aawn. eral manager of the Rust Craft .Headquarters was opened of- Two cars were involved in an Drive defensively, as other Station. ficially today at 183Northm Fourth accident on Main Street on Sep- drivers may not be as careful Wayne Van Dine is considered Street in Steubenville, Ohio by tember 8 when vehicles driven as you are. one of Channel 9's crack news Walter4 L. Myers, Jr., Chair- by Norma J. Medich of 444 Main reporter-photographers, and is man of the County Republican St., Wintersville and Joseph E. Convictions Posted unquestionably the best known, Central and Executive Commit- Saltsman of 1984 McCauslen most widely publicized television tees. Most of the County's key Manor collided as the car driven By Mayor's Court personality in the Wheeling-Steu- GOP leaders attended the cere- by Mrs.