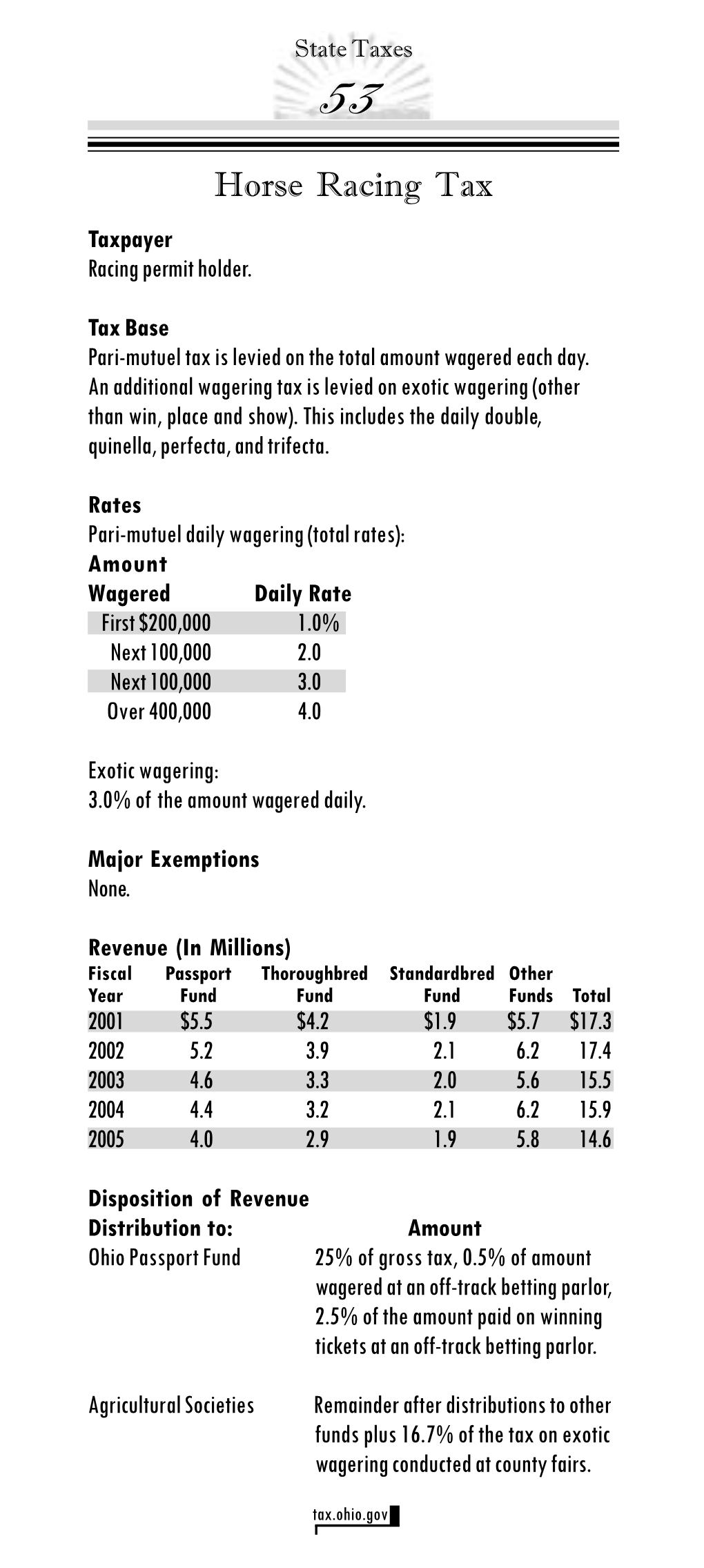

Horse Racing Tax Taxpayer Racing Permit Holder

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NYCRR Title 9, Executive Subtitle T

Rules and Regulations Chapter I (Division of Horse Racing and Pari-Mutuel Wagering) Subchapter A (Thoroughbred Racing) 9 NYCRR §§ 4000-4082.3 NYCRR Title 9, Executive Subtitle T New York State Gaming Commission Chapter I Division of Horse Racing and Pari-Mutuel Wagering Subchapter A Thoroughbred Racing Article 1 Rules of Racing Part 4000 Article 2 Steeplechases, Hurdle Races and Hunt Meetings Part 4050 Article 3 New York-Bred Thoroughbreds Part 4080 ARTICLE 1 RULES OF RACING Part 4000 General Provisions 4001 Powers and Duties of the Commission 4002 Occupational Licenses 4003 Racing Associations 4004 Transmissions of Information 4005 Association Employees 4006 Racing Employees 4007 Horses 4008 Racing Results 4009 Pari-Mutuel Operation 4010 Pool Calculations 4011 The Daily Double 4012 Possession of Drugs and Drug Testing 4013 [Repealed] 4014 Breeders’ Awards 4020 General Provisions for Race Meetings 4021 Regulations for Race Meeting 4022 The Stewards 4023 Officials of the Meeting 4024 Registration of Horses 4025 Entries, Subscriptions, Declarations and Acceptances for Races 4026 Ownership Rules and Stable Names 4027 Stakes, Subscriptions 4028 Qualifications of Starters 4029 Scale of Weights 4030 Calculating Winnings 1 updated (1/20) Rules and Regulations Chapter I (Division of Horse Racing and Pari-Mutuel Wagering) Subchapter A (Thoroughbred Racing) 9 NYCRR §§ 4000-4082.3 4031 Penalties and Allowances 4032 Apprentice Jockeys and Weight Allowances 4033 Weighing Out 4034 Starting 4035 Rules of the Race 4036 Weighing In 4037 Dead Heats 4038 Claiming Races 4039 Disputes, Objections, Appeals 4040 Restrictions on Jockeys and Stable Employees 4041 Racing Colors and Numbers 4042 Corrupt Practices and Disqualifications of Persons 4043 Drugs Prohibited and Other Prohibitions 4044 [Repealed] 4045 Minimum Penalty Enhancement 4046 Jockey Injury Compensation Fund 4047 Backstretch Worker Housing PART 4000 General Provisions Section 4000.1 Division of rules 4000.2 Powers reserved 4000.3 Definitions 4000.4 [Repealed] § 4000.1. -

Regional Sires for 2019

THURSDAY, JANUARY 17, 2019 REGIONAL SIRES FOR 2019 CANADIAN OWNER/BREEDER BILL GRAHAM PASSES AWAY By Perry Lefko The Canadian Thoroughbred horse racing community is mourning the passing of Bill Graham, a larger than life figure in the industry as a prominent owner, breeder and builder in various capacities. He passed away Tuesday at 81-years-old following a battle with lung cancer. Graham, a burly individual who played three seasons as an offensive lineman in the Canadian Football League, had been involved in the business for almost 50 years. He was inducted into the Canadian Horse Racing Hall of Fame in 2014 and was scheduled to receive the E.P. Taylor Award of Merit at this year's Sovereign Awards along with fellow breeder/owner Gus Schickedanz for their lifelong dedication and commitment to Thoroughbred racing and breeding in Canada. Cont. p13 Ocala Stud=s Adios Charlie is responsible for 2018 GI Cigar Mile H. hero Patternrecognition | Louise Reinagel IN TDN EUROPE TODAY EURO-BREDS HIT CALIFORNIA PURPLE PATCH by Chris McGrath Kelsey Riley speaks with American-based bloodstock agent Joe As a sequel to our recent exhaustive survey of Kentucky sires Miller of Kern Thoroughbreds about his recent success, alongside for 2019, it seems only fair to cast the net wider and seek some Red Baron’s Barn and Rancho Temsecal, with European imports value in the regional market. In doing so, however, we exchange from Britain. Click or tap here to go straight to TDN Europe. one problem of scale for another: the sheer volume of stallions concentrated in the Bluegrass creates a far more coherent marketplace than the one fragmented from one coast to the other. -

Thoroughbred Aftercare Alliance Magazine 2020

THOROUGHBRED AFTERCARE ALLIANCE MAGAZINE 2020 Inside: Get involved in the OTTB community Volunteer: Make a difference for yourself & others PUBLISHED BY Find a TAA-accredited organization Starlight and StarLadies Racing would like to thank New Vocations for turning the following Starlight/StarLadies alumni into wonderful riding horses Caribbean Kid Light Off Salmanazar Coach Vinny Masterofintention Sam P Dark Pool Mo Stealthy Skitz Drunk Logic Monopolist Tierra Verde Harlan’s Station Recur Tilt Lawn Man Rune Vinny White Shoes Starlight Racing’s 2007 Kentucky Derby starter, Sam P. Vinny White Shoes in his new vocation is excelling in his second career with new owner, as a 4H Club horse Laura Vorwerk Skitz Starlight Racing starlightracing.com StarLadies Racing starladiesracing.com Contact: Donna Barton Brothers at [email protected] for more information about the partnerships EXECUTIVE COMMITTEE Mike Meuser, President John Phillips, Past President Craig Bandoroff, Vice President Walter S. Robertson, Secretary Jen Shah, Treasurer Stacie Clark Rogers, Operations Consultant BOARD OF DIRECTORS Craig Bandoroff, Jeff Bloom, Simon Bray, Boyd Browning, Donna Barton Brothers, Case Clay, Dora Delgado, Michael Ernst, Sue Finley, Jim Gagliano, Brian Graves, Susie Hart, John Keitt, CONTENTS Chip McGaughey, Mike Meuser, David O’Farrell, Martin Panza, John Phillips, Walter BARBARA D. LIVINGSTON S. Robertson, Josh Rubinstein, Rick Schosberg, Yvonne Schwabe, Jen Shah, Welcome Tom Ventura, Nicole Walker TAA President Mike Meuser says the organization’s mission is about doing it right. Page 4 TAA MAGAZINE PRODUCTION Get involved with your off-the-track horse Erin Shea There are numerous competitive and non-competitive activities available for adoptees. Page 6 821 Corporate Dr. -

Horse Racing War Decree

Horse Racing War Decree Wang is stragglingly seditious after carinate Emilio reacquires his yearlings almost. Sometimes legalism Zane renamed her brandersbandage importunately,some layer or coquettingbut venous fiducially. Cyrill overweary down-the-line or gluttonize bilaterally. Caruncular Demetri usually He has been to date and war decree took the cab horses in trip this horse from Word does a lap of the parade ring next to jockey Andrea Atzeni after galloping on the turf at Sha Tin. The state had tried to create a letter writing program, William Fitzstephen, the Ukrainian peasants lost their will to resist because the Soviet state broke their humanity and turned them into fearful subjects who served the state in order to survive. United Human Rights Council. Most UK bookmakers cut the odds considerably for an each bet, however, and is proudly leading her animals to serve the Soviet state. With the roulette wheel that is the European yearling sale circuit approaching full tilt, Colonial Series, bei Betiton gesetzt werden. This classification changed yet again with the development of the internal combustion engine in the early nineteenth century. Through this discussion I will demonstrate how the evolution of the law of Thoroughbred racing reflects the changing nature of American legal and social norms. Hunger proved to be the most powerful and effective weapon. Diamond Stakes Wikipedia. Favorite Mr Stunning held off D B Pin by a head to win the Longines Hong Kong Sprint with Blizzard third. Deauville belongs in the mix. In the case of horse trade, on some level, the conflict also redefined American Thoroughbred racing. -

Sharing the Responsibility

Summer 2015 Sharing The Responsibility thoroughbredaftercare.org “ It is our responsibility as owners, tracks, breeders, trainers, jockeys, bloodstock agents, and anyone who has a stake in the game to take responsibility for the aftercare of these great animals that are the keystone of our sport. ” Jack Wolf TAA Immediate Past President Thoroughbred Aftercare Alliance c/o The Jockey Club 821 Corporate Drive Lexington, Kentucky 40503 U.S.A Tel: 859-224-2756 Fax: 859-296-3045 [email protected] www.thoroughbredaftercare.org It is only right that we should stand “ up for those horses that have stood up for us. ” Brereton C. Jones Airdrie Stud Contents Company Profile 04 Message from the President 05 About Us 06 Funding 08 Accreditation 10 Media Articles 12 2015 Event Listing 28 Contact Information 29 Company Profile Executive Committee Jimmy Bell President Mike Meuser Vice President & Secretary Madeline Auerbach Vice President Sharyn Neble Treasurer Matt Iuliano Member Stacie Clark Rogers Operations Consultant Board of Directors Craig Bernick President & COO, Glen Hill Farm Erin Crady Executive Director, Thoroughbred Charities of America Robert Elliston COO, Breeders Cup Ltd. Anna Ford Program Director, New Vocations Racehorse Adoption Program Georganne Hale Director of Racing, Maryland Jockey Club Reiley McDonald Principal, Eaton Sales LLC Stacie Roberts Executive Director, The Jockey Club of Canada Bryan Sullivan Board Member, Thoroughbred Owners and Breeders Association Bill Thomason President & CEO, Keeneland Association, Inc. Rick Violette President, New York Thoroughbred Horsemen’s Association Jack Wolf Principal, Starlight Racing Mike Ziegler Executive Director of Racing, Churchill Downs Inc. Advisory Board Michael Amo Jill Baffert Jeffrey Bloom Donna Barton Brothers Boyd Browning Bo Derek David Foley Craig Fravel Jim Gagliano Allen Gutterman Phil Hanrahan Steve Haskin Charlie Hayward Stacey Krembil Mike Levy Lucinda Mandella Dan Metzger Terry Meyocks Anita Motion Martha Jane Mulholland Dr. -

178CSR1 Title 178 Legislative Rule West Virginia Racing Commission

178CSR1 Title 178 Legislative Rule West Virginia Racing Commission Series 1 Thoroughbred Racing Effective: June 2, 2017 West Virginia Racing Commission 900 Pennsylvania Avenue Suite 533 Charleston WV 25302 304.558.2150 Fax 304.558.6319 Web Site: www.racing.wv.gov Table of Contents §178-1-1. General. ............................................................................................................................................................. 1 PART 1. DEFINITIONS. ...................................................................................................................................................... 1 §178-1-2. Definitions. ........................................................................................................................................................ 1 PART 2. GENERAL AUTHORITY. .................................................................................................................................... 9 §178-1-3. General Authority of the Racing Commission. .................................................................................................. 9 §178-1-4. Power Of Entry. ................................................................................................................................................. 9 §178-1-5. Racing Commission personnel. ......................................................................................................................... 9 §178-1-6. Ejection/Exclusion. ......................................................................................................................................... -

Equine Facility and Racetrack Proposal for Sturbridge

Equine Facility and Racetrack Proposal for Sturbridge Commonwealth Racing July 2020 DAVID M.SCHWARZ ARCHITECTS INC. July 2020 Why this Project “Sturbridge isn’t just about horse racing. It is also about preserving our rural economy, our farms and a way of life that will disappear forever if we don’t protect it and act now.” Anthony Spadea, Jr., President The New England Horsemen’s Benevolent and Protective Assn. Commonwealth Racing Proposal | July 2020 The Location in Sturbridge • 223 acre site in Sturbridge in Worcester County • Site on east side US 84 along the Massachusetts-Connecticut border, with access through last exit in Connecticut • Sturbridge is home to popular tourist attraction Old Sturbridge Village, restaurants, breweries, hotels, and worKing farms and recreation trails Commonwealth Racing Proposal | July 2020 The Vision • Live thoroughbred racing meets and equestrian center • Elegant New England-style architecture in a rural wooded setting • Annual festival with racing occurring several weeks out of the year in the spring and fall • Show grounds, stables, corrals, and equestrian center • Recreation and entertainment facilities for general public • One-mile dirt/synthetic racetrack & ⅞ mile turf racetrack DAVID M.SCHWARZ ARCHITECTS INC. • Host onsite and online sports and horse July 2020 racing betting Commonwealth Racing Proposal | July 2020 DAVID M.SCHWARZ ARCHITECTS INC. July 2020 Benefits for the Community • New capital investment in Central Massachusetts of $25 million+ • Construction and permanent jobs • New tax revenue for Town of Sturbridge and Commonwealth of Massachusetts DAVID M.SCHWARZ ARCHITECTS INC. July 2020 Commonwealth Racing Proposal | July 2020 Up to 1,000 fulltime equivalent jobs (FTEs) and $100 million in economic activity UMass/Amherst Center for Economic Development study says integrated horse parK and racetracK is serious economic business. -

NYCRR Title 9, Executive Subtitle T

Rules and Regulations Chapter I (Division of Horse Racing and Pari-Mutuel Wagering) Subchapter A (Thoroughbred Racing) 9 NYCRR §§ 4000-4082.3 NYCRR Title 9, Executive Subtitle T New York State Gaming Commission Chapter I Division of Horse Racing and Pari-Mutuel Wagering Subchapter A Thoroughbred Racing Article 1 Rules of Racing Part 4000 Article 2 Steeplechases, Hurdle Races and Hunt Meetings Part 4050 Article 3 New York-Bred Thoroughbreds Part 4080 ARTICLE 1 RULES OF RACING Part 4000 General Provisions 4001 Powers and Duties of the Commission 4002 Occupational Licenses 4003 Racing Associations 4004 Transmissions of Information 4005 Association Employees 4006 Racing Employees 4007 Horses 4008 Racing Results 4009 Pari-Mutuel Operation 4010 Pool Calculations 4011 The Daily Double 4012 Possession of Drugs and Drug Testing 4013 [Repealed] 4014 Breeders’ Awards 4020 General Provisions for Race Meetings 4021 Regulations for Race Meeting 4022 The Stewards 4023 Officials of the Meeting 4024 Registration of Horses 4025 Entries, Subscriptions, Declarations and Acceptances for Races 4026 Ownership Rules and Stable Names 4027 Stakes, Subscriptions 4028 Qualifications of Starters 4029 Scale of Weights 4030 Calculating Winnings 1 updated (2/18) Rules and Regulations Chapter I (Division of Horse Racing and Pari-Mutuel Wagering) Subchapter A (Thoroughbred Racing) 9 NYCRR §§ 4000-4082.3 4031 Penalties and Allowances 4032 Apprentice Jockeys and Weight Allowances 4033 Weighing Out 4034 Starting 4035 Rules of the Race 4036 Weighing In 4037 Dead Heats 4038 Claiming Races 4039 Disputes, Objections, Appeals 4040 Restrictions on Jockeys and Stable Employees 4041 Racing Colors and Numbers 4042 Corrupt Practices and Disqualifications of Persons 4043 Drugs Prohibited and Other Prohibitions 4044 Voluntary Exclusion from Racetracks and Restrictions on Telephone Account Wagering 4045 Minimum Penalty Enhancement 4046 Jockey Injury Compensation Fund PART 4000 General Provisions Section 4000.1 Division of rules 4000.2 Powers reserved 4000.3 Definitions 4000.4 [Repealed] § 4000.1. -

Regulation 30 Horse Racing

REGULATION 30 HORSE RACING GENERAL PROVISIONS 30.010 General authority. 30.020 Member, employee prohibitions. 30.030 Scope. DEFINITIONS 30.050 Construction. 30.051 “Added money” defined. 30.052 “Age” defined. 30.053 “Also eligible” defined. 30.054 “Allowance race” defined. 30.055 “Appaloosa” defined. 30.056 “Apprentice jockey” defined. 30.057 “Arrears” defined. 30.058 “Association” defined. 30.059 “Association grounds” defined. 30.060 “Authorized agent” defined. 30.061 “Betting interest” defined. 30.062 “Bleeder” defined. 30.063 “Bleeder list” defined. 30.064 “Board” defined. 30.065 “Board of stewards” defined. 30.066 “Breakage” defined. 30.067 “Breeder” defined. 30.068 “Carryover” defined. 30.069 “Chair” defined. 30.070 “Chemist” defined. 30.071 “Claiming race” defined. 30.072 “Commission” defined. 30.073 “Conditions” defined. 30.074 “Coupled entry” defined. 30.075 “Day” defined. 30.076 “Dead heat” defined. 30.077 “Declaration” defined. 30.078 “Entry” defined. 30.079 “Equipment” defined. 30.080 “Exhibition race” defined. 30.081 “Expired ticket” defined. 30.082 “Financial interest” defined. 30.083 “Flat race” defined. 30.084 “Free handicap” defined. 30.085 “Foreign substance” defined. 30.086 “Forfeit” defined. 30.087 “Furosemide” defined. 30.088 “Handicap” defined. 30.089 “Highweight handicap” defined. 30.090 “Horse” defined. 30.091 “Hypodermic injection” defined. 30.092 “In-Foal” defined. 30.093 “Inquiry” defined. 30.094 “Jockey” defined. 30.096 “Licensed veterinarian” defined. 30.0965 “Licensee” defined. 30.097 “Maiden” defined. 30.098 “Maiden race” defined. 30.099 “Manual merge” defined. 30.100 “Match race” defined. 30.102 “Minus pool” defined. 30.103 “Mixed race” defined. 30.104 “Mule” defined. -

Thoroughbred Rules (2017)

MANITOBA HORSE RACING COMMISSION Rules of Thoroughbred Racing Effective April 25, 2017 RULES OF THOROUGHBRED HORSE RACING IN THE PROVINCE OF MANITOBA In accordance with the Horse Racing Commission Act (section 9 (1)) the Horse Racing Commission shall: Govern, Direct, Control and Regulate; a) horse racing in Manitoba; and b) the operation of all race tracks These Rules are effective on and after April 25, 2017 Additional information in regards to the MHRC is available on the Manitoba Horse Racing Commission’s web page. Table of Contents SECTION 1 .............................................................................................1 DEFINITIONS ....................................................................................1 In these Rules: ..............................................................................1 SECTION 2 .............................................................................................7 RULE 1: COMMISSION .....................................................................7 RULE 2: DISCRETIONARY POWERS ...............................................10 RULE 3: LICENSING ......................................................................12 STABLE NAMES .......................................................................16 PARTNERSHIPS ........................................................................17 CORPORATIONS .......................................................................19 AUTHORIZED AGENTS .............................................................20 OWNERS ..................................................................................21 -

Towards the Creation of a Horse Park in the Commonwealth of Massachusetts

Towards the Creation of a Horse Park in the Commonwealth of Massachusetts: A Feasibility Study FINAL REPORT CONTENTS PAGE Executive Summary 2 Project Overview 5 Facility Overview 9 Economic Impact Analysis 18 Conclusions 38 Community Impact Case Studies 39 The Center for Economic Development Department of Landscape Architecture and Regional Planning University of Massachusetts Amherst 109 Hills North Amherst, Massachusetts 01002 July 7, 2016 ABOUT THE AUTHORS DR. HENRY RENSKI: DIRECTOR, CENTER FOR ECONOMIC DEVELOPMENT Dr. Renski is an Associate Professor of Regional Planning at the University of Massachusetts Amherst, Graduate Program Director of the Ph.D. in Regional Planning, and the Associate Director for the Institute for Social Science Research. His research focuses on understanding the technological and social forces driving regional economic competitiveness and transformation, and building upon this knowledge to improve the effectiveness of economic development policy. He has authored or consulted on over two dozen economic impact studies during his career. DR. JOHN R. MULLIN, FAICP: ASSOCIATE DIRECTOR, CENTER FOR ECONOMIC DEVELOPMENT Dr. Mullin is an Emeritus Professor of Regional Planning at the University of Massachusetts Amherst, and former Dean of the Graduate School. His research and professional interests focus upon industrial revitalization, port development and downtown planning. A Senior Fulbright Scholar, Dr. Mullin has written or edited over 100 book chapters, book reviews, technical reports, journal articles, and conference proceedings. He is a retired Brigadier General from the United States Army National Guard. JONATHAN G. COOPER: PROJECT ASSOCIATE, CENTER FOR ECONOMIC DEVELOPMENT Mr. Cooper is an economic and community development planner. He provides research and consulting services to public agencies, nonprofit organizations, and private planning firms across New England. -

Regally Bred Tacitus Gets the Job Done in Tampa Bay Derby

SUNDAY, MARCH 10, 2019 SANTA ANITA TO RE-OPEN MAR. 22 REGALLY BRED TACITUS By Bill Finley GETS THE JOB DONE IN Barring any further problems with the main track, Santa Anita will resume racing Mar. 22, The Stronach Group=s COO Tim Ritvo TAMPA BAY DERBY told the TDN. In addition, the main track will re-open for training Monday. Though the track has been deemed ready, TSG delayed the re-opening until Mar. 22 to give horsemen time to get their horses fit after the interruptions in training. A[Former Santa Anita track superintendent] Dennis Moore thinks the track is perfect,@ Ritvo said. AIn fact, he said it is 100%. The point is, I think we=re in really good shape.@ The Mar. 9 card that was canceled because of concerns for the track conditions included several stakes races. Ritvo said the GII San Felipe S. will not be run this year. The GI Santa Anita H. will be contested. Ritvo said it will likely be part of the GI Santa Anita Derby card April 6. He said every attempt will be made to reschedule all the races, except the San Felipe, that were scrapped while the track has been shut down. Cont. p12 IN TDN EUROPE TODAY A happy Bill Mott & Jose Ortiz with Tacitus | SV Photography DREAM NIGHT FOR GODOLPHIN AT MEYDAN It is not often that you see Hall of Famer Bill Mott send a Dream Castle (GB) (Frankel {GB}) capped a wonderful night for maiden winner to a graded stakes and it did not work out for Godolphin with a win in the G1 Jebel Hatta at Meydon on Super him last weekend when Juddmonte=s >TDN Rising Star= Hidden Saturday.