Letter Bill 0..3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ameren Il 2020 Mid-Year Corporate Political

AMEREN IL 2020 MID-YEAR CORPORATE POLITICAL CONTRIBUTION SUMMARY CommitteeID CommitteeName ContributedBy RcvdDate Amount Address1 City State Zip D2Part 25530 Friends of Mark Batinick Ameren 06/30/2020 $ 1,000.00 PO Box 66892 St. Louis MO 63166 Individual Contribution 17385 Friends of Mattie Hunter Ameren 06/30/2020 $ 2,500.00 P.O. Box 66892 St. Louis MO 63166 Individual Contribution 19155 Citizens for Tom Morrison Ameren 06/30/2020 $ 1,000.00 PO Box 66892 St. Louis MO 63166 Individual Contribution 31972 Citizens for Colonel Craig Wilcox Ameren 06/10/2020 $ 3,000.00 PO Box 66892 St Louis MO 63166 Individual Contribution 35553 Brad Stephens for State RepresentativeAmeren 06/04/2020 $ 1,000.00 P.O. BOX 66892 St. Louis MO 63166 Individual Contribution 34053 Committee to Elect Dan Caulkins Ameren 05/29/2020 $ 1,000.00 200 W Washington Springfield IL 62701 Individual Contribution 31821 Fowler for Senate Ameren 05/09/2020 $ 1,000.00 P.O. Box 66892 St. Louis MO 63166 Individual Contribution 35553 Brad Stephens for State RepresentativeAmeren 04/27/2020 $ 1,000.00 P.O. BOX 66892 St. Louis MO 63166 Individual Contribution 4261 Friends of Mary E Flowers Ameren 04/22/2020 $ 2,000.00 607 E. Adams Street Springfield IL 62739 Individual Contribution 34053 Committee to Elect Dan Caulkins Ameren 03/17/2020 $ 1,000.00 200 W Washington Springfield IL 62701 Individual Contribution 22882 Friends of Rita Mayfield Ameren 03/17/2020 $ 1,000.00 P.O. Box 66892 St. Louis MO 63166 Transfer In 25530 Friends of Mark Batinick Ameren 03/11/2020 $ 1,000.00 PO Box 66892 St. -

2020 Illinois General Election Results

2020 Illinois General Election Results DISCLAIMER: All noted races below have not been certified by the Illinois State Board of Elections and are subject to change. With the massive upswing of mail-in-voting this year, it is HIGHLY likely that many races will not be final until all ballots are in. In Illinois, ballots that are post-marked for Election Day have 2 weeks from Election Day to arrive and be counted. As a result, many of the close races noted below could change and we have marked some races as too close to call. The University of Illinois System Office of Governmental Relations will keep you updated as the Illinois State Board of Elections updates these races. Note, the State board of Elections has listed December 4th as its date to certify the vote and publish official results. GRADUATED INCOME TAX AMENDMENT The constitutional amendment allowing the State of Illinois to implement a Graduated Income Tax failed at the ballot box with a vote of roughly 45% in favor and 55% opposed. The constitutional amendment needed a simple majority of all voters in the election to pass it or 60% of people who specifically voted on the amendment. The FY 21 budget negotiated on and passed in May was balanced, in part, on the projected revenues from the new graduated income tax. The consequences of this could be severe for higher education funding, as Gov. Pritzker has noted that there will need to be major cuts to public safety, education and human services in order to close the budget gap. -

101St General Assembly U of I Caucus

101st General Assembly U of I Caucus Senators Senator Neil Anderson (R) 36th District Biography: Raised in the Quad CIty area and helped with the family business of installing floors. He graduated from the University of Nebraska and played on the football team. After graduating, he became a firefighter in the Moline Department and a paramedic in 2006. He resides in Rock Island with his wife and two children. Senator Jason Barickman (R) 53rd District Biography: Born May 1, 1975 in Streator, Illinois; raised on family UIUC alum farm in Livingston County; Graduated Woodland High School. Veteran of his service in uniform while an infantry soldier in the Illinois Army National Guard. Graduated from Illinois State University and then the University of Illinois College of Law. Principal with law office of Meyer Capel, P.C. Selected to inaugural class of the 2012 Edgar Fellows Leadership Program. Member of Illinois House from 2011-2013. Resides in Bloomington with wife, Kristin, as well as their two sons and a daughter. Senator Scott Bennett (D) 52nd District Biography: Grew up in Gibson City; B.A. in History, Illinois State UIUC alum University; J.D. from University of Illinois College of Law; former Assistant State's Attorney for Champaign and McLean counties; Past President of the Urbana Rotary; Attorney; married (wife, Stacy), has two children. Senator Bill Cunningham (D) 18th District Biography: Served in the House from 2011-13; full-time state UIC alum legislator and lifelong resident of the southwest Chicago area; born July 21, 1967; graduate of Saint Barnabas Grammar School (1981), Mount Carmel High School (1985) and the University of Illinois Chicago (1990); former advisor to Cook County Sheriff Mike Sheahan and former chief of staff to Cook County Sheriff Tom Dart; youth soccer coach; parent representative on the Sutherland Local School Council; lives in Beverly with wife, Juliana, and two daughters, Madeline and Olivia. -

John Deere Political Action Committee

JDPAC John Deere Political Action Committee John Deere Political Action Committee Contributions Detail by State 2019-2020 Election Cycle STATE CANDIDATE NAME DISTRICT OFFICE PARTY DISBURSED ALABAMA AL Terri Sewell 07 U.S. House Democratic Party $ 5,000 AL Thomas Tuberville U.S. Senate Republican Party $ 5,000 ALASKA AK Dan Sullivan U.S. Senate Republican Party $ 5,000 ARIZONA AZ Martha McSally U.S. Senate Republican Party $ 10,000 ARKANSAS AR Rick Crawford 01 U.S. House Republican Party $ 5,000 AR Bruce Westerman 04 U.S. House Republican Party $ 10,000 CALIFORNIA CA Amerish Bera 07 U.S. House Democratic Party $ 5,000 CA Jim Costa 16 U.S. House Democratic Party $ 10,000 CA Jimmy Panetta 20 U.S. House Democratic Party $ 10,000 CA David Valadao 21 U.S. House Republican Party $ 10,000 CA Devin Nunes 22 U.S. House Republican Party $ 10,000 CA Kevin McCarthy 23 U.S. House Republican Party $ 10,000 CA Mike Garcia 25 U.S. House Republican Party $ 5,000 CA Young Kim 39 U.S. House Republican Party $ 2,500 COLORADO CO Scott Tipton 03 U.S. House Republican Party $ 5,000 CO Cory Gardner U.S. Senate Republican Party $ 7,000 DELAWARE DE Lisa Blunt Rochester At-Large U.S. House Democratic Party $ 10,000 GEORGIA GA Thomas McCall 33 State House Republican Party $ 2,000 GA Sam Watson 172 State House Republican Party $ 2,000 GA Sanford Bishop 02 U.S. House Democratic Party $ 5,000 GA Drew Ferguson 3 U.S. House Republican Party $ 10,000 GA Karen Handel 6 U.S. -

Legislative Ratings

About the Illinois Chamber of Commerce Legislative Ratings The ratings are based on legislators’ votes on the key business legislation of the 100th General Assembly as determined by staff and the Chamber’s Government Affairs Committee. The votes in the Senate and House are selected based on their impact on the business community. None of the bills used in the report are weighted, as there were an adequate number of legislation voted on during this General Assembly. Legislators were given a positive mark (+) on their scorecard for bills in which they voted in favor with the Illinois Chamber and were given a negative mark (-) on their scorecard for bills in which they voted against the Illinois Chamber. Legislators who voted present (P), were absent (A) or took a ‘no vote’ (NV) on a bill in which the Illinois Chamber supported were also given a negative mark (-) on their scorecard. Contrary, legislators who voted present, were absent or took a ‘no vote’ on a bill in which the Illinois Chamber opposed, were not counted for or against their final rating. Legislators who were either not a member at the time of the vote (NA) or were excused from their absence (E) during the vote were not counted for or against their final score. Members who did not meet the required number of votes were not given a rating (NE). In cases where more than one roll call was taken on a bill, the vote that best demonstrates support for employers’ vital interests was chosen. If employers are to change the culture in Springfield, they must educate themselves on the record of their representatives and hold them accountable for it. -

ILLINOIS COUNCIL of CONVENTION and VISITOR BUREAUS Legislative Report

ILLINOIS COUNCIL OF CONVENTION AND VISITOR BUREAUS Legislative Report Published by ICCVB March 2018. Important Upcoming Dates: March 13-15 Senate (only) in session. March 20: Illinois Primary Election. April 9-13 House in Session. April 10-13 Senate in Session April 13 Deadline for House and Senate bills out of Committee in chamber of origin. HB 66 Short Description: ROUTE 66 CENTENNIAL COMMISSION House Sponsors Rep. Tim Butler-Lawrence Walsh, Jr.-Martin J. Moylan-Avery Bourne-Juliana Stratton, Mark Batinick, Sara Wojcicki Jimenez, Keith P. Sommer, Barbara Wheeler, Daniel V. Beiser, Kelly M. Cassidy, Dan Brady, Allen Skillicorn, David S. Olsen, Jehan Gordon-Booth, Al Riley, Christian L. Mitchell, Grant Wehrli, Thomas M. Bennett, Tony McCombie and Elgie R. Sims, Jr. Senate Sponsors (Sen. Pamela J. Althoff, Michael Connelly, Linda Holmes and Andy Manar) Synopsis As Introduced Creates the Illinois Route 66 Centennial Commission Act. Sets forth the appointment of the members, duties, and meeting requirements of the Commission. Provides that the Commission shall plan and sponsor Route 66 centennial events, programs, and activities and shall encourage the development of programs to involve all citizens in Route 66 centennial events. Requires the Commission to deliver a final report of its activities to the Governor no later than June 30, 2027. Provides that the Commission shall be dissolved on June 30, 2027. House Floor Amendment No. 1 Replaces everything after the enacting clause. Reinserts the provisions of the introduced bill with the following changes. Creates the Illinois Route 66 Centennial Commission Act. Provides that the President of the Route 66 Association of Illinois and the Executive Director of the Illinois Route 66 Scenic Byway shall serve as public members (rather than ex officio members) of the Commission. -

Illinois House by Name

102nd Illinois House of Representatives Listing by Name as of 2/1/2021 Name District Party Name District Party Carol Ammons 103 D Mark Luft 91 R Jaime M. Andrade, Jr. 40 D Michael J. Madigan 22 D Dagmara Avelar 85 D Theresa Mah 2 D Mark Batinick 97 R Natalie A. Manley 98 D Thomas M. Bennett 106 R Michael T. Marron 104 R Chris Bos 51 R Joyce Mason 61 D Avery Bourne 95 R Rita Mayfield 60 D Dan Brady 105 R Deanne M. Mazzochi 47 R Kambium Buckner 26 D Tony McCombie 71 R Kelly M. Burke 36 D Martin McLaughlin 52 R Tim Butler 87 R Charles Meier 108 R Jonathan Carroll 57 D Debbie Meyers-Martin 38 D Kelly M. Cassidy 14 D Chris Miller 110 R Dan Caulkins 101 R Anna Moeller 43 D Andrew S. Chesney 89 R Bob Morgan 58 D Lakesia Collins 9 D Thomas Morrison 54 R Deb Conroy 46 D Martin J. Moylan 55 D Terra Costa Howard 48 D Mike Murphy 99 R Fred Crespo 44 D Michelle Mussman 56 D Margaret Croke 12 D Suzanne Ness 66 D John C. D'Amico 15 D Adam Niemerg 109 R C.D. Davidsmeyer 100 R Aaron M. Ortiz 1 D William Davis 30 D Tim Ozinga 37 R Eva Dina Delgado 3 D Delia C. Ramirez 4 D Anthony DeLuca 80 D Steven Reick 63 R Tom Demmer 90 R Robert Rita 28 D Daniel Didech 59 D Lamont J. Robinson, Jr. 5 D Jim Durkin 82 R Sue Scherer 96 D Amy Elik 111 R Dave Severin 117 R Marcus C. -

From Your President: Mike Reinders

TIPS Volume 46 Issue 3 ILLINOISTIPS ASSOCIATION FOR PUPIL TRANSPORTATION March 2017 Volume 45 Issue 3 In This Issue From Your President: Mike Reinders Page...................... 1 Right now it is colder than most of February here and not too far away a tornado President’s Message touched down this week, wow. Spring is just around the corner. Page ………………3 Is anyone using stop arm cameras? If so, how are they working? Let me know, or we Advertisers could send out an email to all for feedback. Conference News Page...................... 4 Does anyone else dislike early release days? We had one of the quarterly days on DOT Physical Wednesday. No matter how much communication goes out from the schools, parents Requirements Page……………….5 are not there for their little ones, 10-30 phone calls later we connected them. And we DOT Physical are a small district! On top of that we are learning new HR software, and even though I Requirements know it will get better, I am learning more by trial and error than the training provided. Page………………..7 The Seat belt issue is still a very fluid topic in Springfield, so please stay informed. IAPT Contact Info Please contact your Senator and Representatives in Springfield as well as those in Page…………………...8 Washington. No matter where you stand on this issue, become a part of the process. Roadeo News I am really looking forward to the conference less than 4 months away, talk about time Page…………… ...10 flying. Things are coming together as Barb is hard at work. We have some exciting Legislation things happening this year. -

Peoria, Born and Raised

HEARING 4/2/2021 Page 1 1 BEFORE THE 2 ILLINOIS HOUSE OF REPRESENTATIVES 3 25th DISTRICT 4 5 6 Hearing held, pursuant to Notice, on the 7 2nd day of April, 2021, between the hours of 8 11:00 a.m. and 12:15 a.m. via Zoom videoconference. 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 ALARIS LITIGATION SERVICES www.alaris.us Phone: 1.800.280.3376 Fax: 314.644.1334 HEARING 4/2/2021 Page 2 1 A P P E A R A N C E S 2 COMMITTEE MEMBERS PRESENT: 3 4 Representative Jehan Gordon-Booth, Madam Chair Representative Tim Butler, Member 5 Representative Elizabeth Hernandez, Member Representative Ryan Spain, Member 6 Representative Dave Severin, Member 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 ALARIS LITIGATION SERVICES www.alaris.us Phone: 1.800.280.3376 Fax: 314.644.1334 HEARING 4/2/2021 Page 3 1 MADAM CHAIR GORDON-BOOTH: This is the third 2 hearing for the Redistricting Committee and the 3 House Committee on Redistricting shall come to 4 order. 5 My name is Jehan Gordon-Booth and I'm the 6 State Representative from this community. I'm from 7 right here in Peoria, born and raised. I am a 8 member of the Redistricting Committee and I am 9 chairing today's hearing. 10 Myself and my colleague to the north, 11 Representative Leader Hernandez, are both 12 co-chairing the statewide Redistricting Committee 13 that would be looking to gather information from 14 communities across the state before we endeavor 15 into the redistricting process. -

HEARING 4/7/2021 Phone: 1.800.280.3376

HEARING 4/7/2021 Page 1 1 BEFORE THE ILLINOIS HOUSE OF REPRESENTATIVES 2 REDISTRICTING COMMITTEE DECATUR 3 4 5 Hearing held, pursuant to notice, on the 7th 6 day of April, 2021, between the hours of 10:00 a.m. 7 and 11:05 a.m. via Zoom teleconference. 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 ALARIS LITIGATION SERVICES www.alaris.us Phone: 1.800.280.3376 Fax: 314.644.1334 HEARING 4/7/2021 Page 2 1 A P P E A R A N C E S 2 COMMITTEE MEMBERS PRESENT: 3 Representative Jehan Gordon-Booth, Co-Chairperson Representative Jay Hoffman, Co-Chairperson 4 Representative Tim Butler, Republican Spokesperson Representative Avery Bourne, Member 5 Representative Dave Severin, Member Representative Ryan Spain, Member 6 Representative Dan Caulkins 7 Representative C.D. Davidsmeyer Representative Theresa Mah 8 Representative Michael Marron Representative Chris Miller 9 Representative Sue Scherer 10 11 12 13 14 15 16 17 18 19 20 21 Court Reporter 22 Lydia Pinkawa, CSR Illinois CSR #084-002342 23 Alaris Litigation Services 711 North Eleventh Street 24 St. Louis, Missouri 63101 ALARIS LITIGATION SERVICES www.alaris.us Phone: 1.800.280.3376 Fax: 314.644.1334 HEARING 4/7/2021 Page 3 1 CO-CHAIRPERSON GORDON-BOOTH: Good morning. 2 The hour of 10:00 having come and gone, the 3 redistricting, the House redistricting committee 4 shall come to order. It's good to be here virtually 5 with you all for this hearing in regards to what 6 folks would like to see as it relates to 7 redistricting in the Decatur area. -

2018 Scorecard

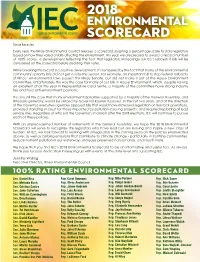

2018 ENVIRONMENTAL SCORECARD Dear Reader, Every year, the Illinois Environmental Council releases a scorecard assigning a percentage score to state legislators based on how they voted on bills affecting the environment. This year, we are pleased to award a record number of 100% scores, a development reflecting the fact that legislators increasingly ask IEC’s lobbyists if bills will be considered on the scorecard before deciding their votes. While breaking this record is a positive development, it’s tempered by the fact that many of the environmental community’s priority bills did not get a vote this session. For example, an important bill to stop federal rollbacks of Illinois’ environmental laws passed the Illinois Senate, but did not make it out of the House Environment Committee. Unfortunately this was the case for many of our bills in House Environment, which, despite having an excellent chair this year in Representative Carol Sente, a majority of the committee have strong industry ties and hold anti-environment positions. It is also still the case that many environmental priorities supported by a majority of the General Assembly, and Illinoisans generally, would be vetoed by Governor Rauner if passed. In the last two years, and at the direction of the Governor, executive agencies opposed bills that would have increased regulation on livestock operations, provided standing in court for those impacted by pollution-causing projects, and required replacing all lead service lines. Regardless of who is in the Governor’s mansion after the 2018 elections, IEC will continue to pursue each of these policies. With an unprecedented number of retirements in the General Assembly, we hope the 2018 Environmental Scorecard will serve to recognize the legislators who have lead but are leaving and inspire a new class of leaders. -

Illinois Legislative Summary 2016

ILLINOIS LEGISLATIVE SUMMARY 2016 Child Welfare and Safety HB4327 Children and Family Service HB4641 Child Care Act Amendment – Act Amendment – Power of Attorney Adoption-Only Homes on Child Custody HB4641 amends the Child Care Act of HB4327 amends the Children and Family 1969. The amendment adds Services Act. The amendment provides requirements for approval of adoption- that, during any investigation of alleged only homes by licensed child welfare child abuse or neglect that does not result agencies, such as if an adult resident has in a child being removed from the home, an arrest or conviction record, the the Department of Children and Family licensed child welfare agency shall Services shall provide information to the thoroughly investigate and withhold parent or guardian about community approval. Additionally, the amendment service programs that provide respite makes changes for the Birth Parent Rights care, voluntary guardianship, or other and Responsibilities-Private Form, support services for families in crisis. including the right to provide medical, Further, the amendment provides that a background and family information to the parent or legal custodian of a child may child's prospective adoptive parents delegate to another person certain through a voluntary Birth Parent Medical powers regarding the care and custody of Information form prior to the finalization the child (for a period not to exceed one of an adoption. year or a longer period in the case of a service member if on active duty service). Chief Sponsors Representatives: Sara Feigenholtz, Anna Chief Sponsors Moeller, Ann M. Williams Representatives: Patricia R. Bellock Senators: Kwame Raoul, Don Harmon Senators: Pamela J.