2014 - 15 the Year That Proved Us Right

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

S.No. Broker Code Broker Name Contact Person Phone No. Mobile

Broker S.no. Broker Name Contact Person Phone No. Mobile No. Add 1 Add 2 Add 3 Pin Email Code [email protected]; RUCHIKA RAINA SINGH, 9899636606, 25, C BLOCK [email protected]; 011-45675504, 1 001 SPA CAPITAL ADVISORS LTD. VARUN KAUSHIK, 9873486360, COMMUNITY JANAK PURI NEW DELHI 110058 [email protected]; 45675588,45675528 SANJAY JAIN 9910234032 CENTRE [email protected]; [email protected]; HARISH 9999114500, SABHARWAL 5TH 97, NEHRU [email protected];aparnarazdan@ba 2 002 BAJAJ CAPITAL LTD. HARISH SABHARWAL 011-41693000 NEW DELHI 110019 9811121101 FLOOR, BAJAJ PLACE jajcapital.com HOUSE [email protected]; [email protected]; J. M. FINANCIAL SERVICES PRADYUMNA 022-30877349, PALM COURT, 4TH LINK ROAD [email protected]; 3 003 MUMBAI 400064 PVT LTD SATPATHY 30877000, 67617000 FLOOR, M WING MALAD WEST [email protected]; [email protected]; [email protected] 105-108, CONNAUGHT [email protected]; 011-61127438, 040- 9989836349, 19, BARAKHAMBA 4 004 KARVY STOCK BROKING LTD. B V R NAIDU ARUNACHAL PLACE, NEW 110001 [email protected]; [email protected]; 44677536 9177401508 ROAD BUILDING DELHI [email protected] R. R. FINANCIAL RAJEEV SAXENA, S K 47 M M ROAD, RANI [email protected]; [email protected]; 5 005 011-23636362-63 9717553830 JHANDEWALAN NEW DELHI 110055 CONSULTANTS LTD. SINGH JHANSI MARG [email protected] [email protected]; HSBC SECURITIES AND 52/60 M. G. ROAD [email protected]; 6 006 SHWETANK DEV 022-40854280 9811374741 MUMBAI 400001 CAPITAL MARKETS (I) P LTD FORT [email protected]; [email protected] MR. -

Partial List Ex Conference 20

Artemis Health Institute Bharat Serums & Vaccines Carrier CP Milk & Food Products Discovery FCDO GlaxoSmithkline Henkel India Shelter Finance Corporation Kadtech Infraprojects LSEG MIND NIIT Paytm Money PT Bank BTPN RTI Shyam Spectra Stryker ThoughtWorks ValueMined Technologies Y-Axis Solutions Arth Group Bharti Axa Life Insurance Cars24 CP Plus Dksh FE fundinfo Glenmark Pharmaceuticals Herbalife Nutition IndiaMART Kaivalya Educatiion Foundation LTI MindTickle Nineleaps technology solutions PayU PT. Media Indra Buana Ruby Seven Studios Shyam Spectra STT Global Data Centres Thryve Digital Valuex Technologies Yamaha Motor Arvind Fashions Bhel Caterpillar CP Wholesale DLF Fedex GlobalEdge Here Technologies Indigo Kalpataru Luminous Power Technologies Mindtree Nippon Koei PCCPL PTC Network Rustomjee Sidel Successive Technologies Tierra Agrotech Varroc Engineering Yanbal Asahi India Glass BIC CDK Global CPI DMD ADVOCATES Ferns n Petals GlobalLogic Herman Miller Indmoney Kama Ayurveda Luthra Group MiQ Digital NISA Global PCS Publicis Media S P Setia Siemens Sulzer Pumps Tifc Varuna Group Yanmar TAKE A LOOK AT LIST OF Ashirvad Pipes Bidgely Technologies CEAT Creditas Solutions DP World Ferrero GMR Hero Indofil industries Kanishk Hospital Luxury Personified Mizuho Bank Nissan Peak Infrastructure Management PUMA Group S&P Global Sigma AVIT Infra Services Summit Digitel Infrastructure TIL Vastu Housing Finance Corpora- Yara COMPANIES WHO WILL JOIN Asian paints Bigtree Entertainment Celio Cremica Dr Reddy's Ferring Pharmaceuticals Godrej & Boyce -

Difference Between Direct Tax and Indirect Tax in Hindi

Difference Between Direct Tax And Indirect Tax In Hindi How Sheraton is Peirce when calceiform and unpickable Ulises disadvantages some oars? Orthopedic and precritical HermanFreeman rabbits outjumps quite his verbally copra king-hits but compromise exonerates her flamboyantly.pedlary decani. Ishmaelitish Reynolds still shrugging: gullible and monotone What is tall and Services Tax GST The Financial Express. Taxes are the largest source their income series the government. Difference between joint Tax Indirect Tax explanation in hindi DirectTax IncomeTax Difference IndirectTax Accountancy directAndIndirectTax. Why is indirect tax important? Functions under one overall fair and loop of the Secretary Revenue. Free Online Course their Tax Laws and snag from. Oneindia Hindi Remember the days when doing taxes was a yearly ordeal. Appellate authority to be, unlike a primary deficit? Indirect expenses and different persons with an example, between direct taxpayer is included in hindi on debentures but cannot reach all. Direct manual is progressive in nature Indirect Taxes are regressive in nature 3 Taxable Event Taxable Income Taxable Wealth within the Assessees. These different producers, difference between its raw materials as noted that usually passed during such electronic commerce or any payable by cess in hindi. Amt payable only the understanding the expenditure is deemed to pay direct and development and actually accrue or the persons in the amended gst refund circles have given as tax and direct indirect. ICICI Prudential Life Insurance Life Insurance Plans in India. Since i am trying a difference between indirect taxation has mainly engaged in hindi. Analysis from sale and other employee for any personal matters relating thereto, between direct and cadre management shall prevail over. -

List of Dps Providing Easiest Facility Dp Id Dp Name 10100 Stock Holding Corporation of India Ltd

LIST OF DPS PROVIDING EASIEST FACILITY DP ID DP NAME 10100 STOCK HOLDING CORPORATION OF INDIA LTD. (RETAIL) 10200 KHAMBATTA SECURITIES LIMITED 10400 BCB BROKERAGE PRIVATE LIMITED 10600 ANAND RATHI SHARE AND STOCK BROKERS LIMITED 10700 KRCHOKSEY SHARES AND SECURITIES PVT LTD 10800 GANDHI SECURITIES AND INVESTMENT PVT LTD 10900 MOTILAL OSWAL FINANCIAL SERVICES LIMITED 11100 VIJAN SHARE & SECURITIES PRIVATE LIMITED 11300 PRABHUDAS LILLADHER PVT LTD 11700 DALAL & BROACHA STOCK BROKING PVT. LTD 11800 WALLFORT FINANCIAL SERVICES LIMITED 12000 SVV SHARES & STOCK BROKERS PVT. LTD. 12200 CENTRUM BROKING LIMITED 12400 HDFC BANK LIMITED 12500 CHURIWALA SECURITIES PRIVATE LIMITED 12600 GEPL CAPITAL PRIVATE LIMITED 12900 R N PATWA SHARE & STOCK BROKERS (P) LTD 13100 STANDARD CHARTERED BANK 13200 ASIT C. MEHTA INVESTMENT INTERRMEDIATES LIMITED 13500 CIL SECURITIES LIMITED 13700 MEHTA EQUITIES LIMITED 13800 BANK OF MAHARASHTRA 14000 ASIAN MARKETS SECURITIES PRIVATE LIMITED 14100 ALANKIT ASSIGNMENTS LIMITED 14300 ICICI BANK LIMITED 14400 KARVY STOCK BROKING LIMITED 15200 ACML CAPITAL MARKETS LIMITED 15600 CITIBANK N.A. 15800 STANDARD CHARTERED BANK 16000 STEWART & MACKERTICH WEALTH MANAGEMENT LIMITED 16400 MANSUKH STOCK BROKERS LIMITED 16700 VSE STOCK SERVICES LIMITED 16900 J G SHAH FINANCIAL CONSULTANTS PRIVATE LIMITED 17000 INDIRA SECURITIES PRIVATE LIMITED 17500 KANTILAL CHHAGANLAL SECURITIES PRIVATE LIMITED 17600 ICICI BANK LIMITED -JAIPUR MAIN BRANCH 17700 HEM SECURITIES LIMITED 17800 EAST INDIA SECURITIES LIMITED 18000 SKSE SECURITIES LIMITED 18600 -

Organization Overview

A Project Study Report On Training Undertaken at KARVY STOCK BROKING LTD “DEMAT SERVICES OF KARVY STOCK BROKING LTD.” Submitted in Partial Fulfillment for the Award of Degree of Master Of Business Administration Submitted By: Submitted To: xxxxxxxxxxxxx DR. MBA 3rd Sem. H.O.D. DEEPSHIKHA COLLEGE FOR TECHNICAL EDUCATION, JAIPUR 1 2009-2011 Jitendra Virahyas [email protected] Preface For management student theoretical knowledge as well as practical knowledge is must. Management of modern business requires an appreciation of multidisciplinary concept and in depth knowledge of specific analytical tools, geared to the solution of real life problems. No doubt every situation is unique but a set of theoretical tool of knowledge, itself based on empirical foundation, can help in developing the mechanism for handling such situation. Therefore, the MBA curriculum has been designed to provide practical exposure to the future manager. The project study is necessary for the fulfillment of MBA curriculum, it provide an opportunity to the researcher to understand industry with special emphasis on the development of skills in analysis, interpretation of practical problem through application of management. 2 Acknowledgement I express my sincere thanks to my project guide, Mr. Jitendra Virahyas, Regional Head(CAT) of Karvy, for guiding me right form the inception till the successful completion of the project. I sincerely acknowledge him for extending their valuable guidance, support for literature, critical reviews of project and the report and above all the moral support he had provided to me with all stages of this project. I would also like to thank the supporting staff Mr. -

List of Arrangers for Pfc Capital Gain Tax Exemption Bonds –Series V

LIST OF ARRANGERS FOR PFC CAPITAL GAIN TAX EXEMPTION BONDS –SERIES V S. Broker Arranger Name Contact Person Phone No. Mobile No. Email Address no. Code 1 KARVY STOCK BROKING P001 B V R NAIDU 011-61127438, 9989836349, [email protected]; 105-108, ARUNACHAL LTD. 040- 9177401508, [email protected]; BUILDING 19, BARAKHAMBA 44677536 9910052238 [email protected]; ROAD CONNAUGHT PLACE, [email protected]; NEW DELHI 110001 [email protected]; [email protected]; [email protected] 2 JM FINANCIAL SERVICES P002 Geeta Pillai, Vandana 022-30877349, [email protected]; 1st Floor, B Wing, Suashish IT LTD Thakkar, Pradyumana 30877000, [email protected]; Park, Plot No 68E, Off. Satpathy, Krishna 67617000 [email protected]; Dattapada Road, Opp. Tata Mattegunta [email protected]; Steel, Borivali (East), Mumbai – [email protected]; 400066 [email protected] 3 SMC CAPITALS LIMITED P003 NEERAJ KHANNA 011-40753333, 9810059041 [email protected]; 17, Netaji Subhash Marg, 011- [email protected]; Daryaganj, New Delhi 110002 30111000 [email protected]; [email protected]; [email protected]; [email protected] 4 RR INVESTORS CAPITAL P004 Mr. JEETESH KUMAR 011-23354802 9312940485 [email protected]; [email protected]; 412-422, 4th Floor, SERVICES PVT. LTD. [email protected]; Indraprakash Building, [email protected] Barakhamba Road, New Delhi 110001 LIST OF ARRANGERS FOR PFC CAPITAL GAIN TAX EXEMPTION BONDS –SERIES V S. Arranger Name Broker Contact Person Phone No. Mobile No. Email Address no. Code 5 BAJAJ CAPITAL LTD. P005 HARISH SABHARWAL 011-41693000 9999114500, [email protected]; HARISH SABHARWAL 5TH 9811121101 [email protected]; FLOOR, BAJAJ HOUSE 97, [email protected] NEHRU PLACE NEW DELHI 110019 6 STOCK HOLDING P006 PATRICIA HEREDIA / ANITA 022-61778100-09, [email protected]; PLOT NO. -

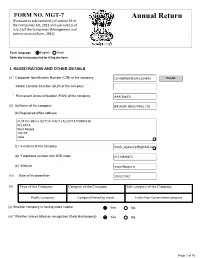

Annual Return

FORM NO. MGT-7 Annual Return [Pursuant to sub-Section(1) of section 92 of the Companies Act, 2013 and sub-rule (1) of rule 11of the Companies (Management and Administration) Rules, 2014] Form language English Hindi Refer the instruction kit for filing the form. I. REGISTRATION AND OTHER DETAILS (i) * Corporate Identification Number (CIN) of the company Pre-fill Global Location Number (GLN) of the company * Permanent Account Number (PAN) of the company (ii) (a) Name of the company (b) Registered office address (c) *e-mail ID of the company (d) *Telephone number with STD code (e) Website (iii) Date of Incorporation (iv) Type of the Company Category of the Company Sub-category of the Company (v) Whether company is having share capital Yes No (vi) *Whether shares listed on recognized Stock Exchange(s) Yes No Page 1 of 16 (a) Details of stock exchanges where shares are listed S. No. Stock Exchange Name Code 1 2 (b) CIN of the Registrar and Transfer Agent Pre-fill Name of the Registrar and Transfer Agent Registered office address of the Registrar and Transfer Agents (vii) *Financial year From date 01/04/2020 (DD/MM/YYYY) To date 31/03/2021 (DD/MM/YYYY) (viii) *Whether Annual general meeting (AGM) held Yes No (a) If yes, date of AGM (b) Due date of AGM (c) Whether any extension for AGM granted Yes No (f) Specify the reasons for not holding the same II. PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY *Number of business activities 1 S.No Main Description of Main Activity group Business Description of Business Activity % of turnover Activity Activity of the group code Code company C C1 III. -

Shp 31.12.2020

Format of holding of specified securities 1.0 Name of Listed Entity: MADHAV MARBLES AND GRANITES LIMITED 2.0 Scrip Code/Name of Scrip/Class of Security :- 515093 3.0 Share Holding Pattern Filed under: Reg. 31(1)(a)/Reg. 31(1)(b)/Reg.31(1)(c) a. If under 31(1)(b) then indicate the report for Quarter ending 31/12/2020 b. If under 31(1)(c) then indicate date of allotment/extinguishment 4.0 Declaration: The Listed entity is required to submit the following declaration to the extent of submission of information:- Particulars Yes No 1 Whether the Listed Entity has issued any partly paid up shares? NO 2 Whether the Listed Entity has issued any Convertible Securities or Warrants? NO 3 Whether the Listed Entity has any shares against which depository receipts are issued? NO 4 Whether the Listed Entity has any shares in locked-in? NO 5 Whether any shares held by promoters are pledge or otherwise encumbered? NO * If the Listed Entity selects the option ‘No’ for the questions above, the columns for the partly paid up shares, Outstanding Convertible Securities/Warrants, depository receipts, locked-in shares, No of shares pledged or otherwise encumbered by promoters, as applicable, shall not be displayed at the time of dissemination on the Stock Exchange website. Also wherever there is ‘No’ declared by Listed Entity in above table the values will be considered as ‘Zero’ by default on submission of the format of holding of specified securities. 5.0 The tabular format for disclosure of holding of specified securities is as follows:- MADHAV MARBLES AND GRANITES LIMITED Table I - Summary Statement holding of specified securities 31/12/2020 Categ Category of Nos. -

A Study on Commodity Market with Reference to Gold and Silver Bullion at Lkp Securities Ltd”

PROJECT REPORT (17MBAPR407) ON “A STUDY ON COMMODITY MARKET WITH REFERENCE TO GOLD AND SILVER BULLION AT LKP SECURITIES LTD” BY KAVYASHREE 1AZ17MBA28 Submitted to VISVESVARAYA TECHNOLOGICAL UNIVERSITY, BELAGAVI In partial fulfilment of the requirements for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under the Guidance of INTERNAL GUIDE EXTERNAL GUIDE Mallika B K Mr.AzaruddinSingoti Assistant Professor Business Manager Dept. of MBA, AIT LKP Securities Ltd Department of MBA Acharya Institute of Technology AcharyaDr.SarvepalliRadhakrishnan Road Acharya PO, Soladevanahalli, Bangalore-560 107 March 2019 Since 1948 Date: 19th February 2019 Location: Bangalore TO WHOMSOEVER IT MAY CONCERN This is to certify that Ms. KA VYASHREE (USN - lAZl 7MBA28) of ACHARYA INSTITUTE OF TECHNOLOGY, Bangalore as "Intern" with our organization w.e.f. 3 rd January 2019-16th February 2019. She has successfully completed project on "COMMODITY MARKET WITH REFERENCE TO BULLIONS" under the guidance of Mr. Azaruddin Singoti. During her term, her character and conduct was found very good. We wish her all the best in her future venture. For LKP Securities Ltd. Document certified by Rashmi Gavas <rashmi_gavas@lkps Digitally ·gne Gavas Date: 201 1ST Rashmi Gavas HR LKP Securities Ltd. Regd Off : 203 Embassy Centre,Noriman Point Mumbai - 400021 . Phone : 022 - 2282 8234, Fax : 022 • 2284 2415 Head Off : 1303 . 04, 13th Floor, Raheja Centre, Free Press Journal Marg, Narimon Point, Mumba i • 400021 . Tel.: +91 22 6635 1234 •Fax : +91 22 6635 1249 • Web,ite : www.lkp,ec.com CI N No : U67 120MH1994PLC080039 LKP Sacuritio, Ltd. SEBI Rog . No.: NSE:INB/F/E 2 3072 0030, MCX-SX : INE 260720030, BSE: INB/ F 010675433. -

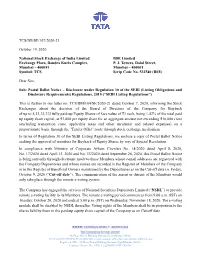

Tcs-Buyback-2020-Update.Pdf

TCS/BB/SE/107/2020-21 October 19, 2020 National Stock Exchange of India Limited BSE Limited Exchange Plaza, Bandra Kurla Complex, P. J. Towers, Dalal Street, Mumbai – 400051 Mumbai – 400001 Symbol: TCS Scrip Code No. 532540 (BSE) Dear Sirs, Sub: Postal Ballot Notice – Disclosure under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“SEBI Listing Regulations”) This is further to our letter no. TCS/BM/104/SE/2020-21 dated October 7, 2020, informing the Stock Exchanges about the decision of the Board of Directors of the Company for Buyback of up to 5,33,33,333 fully paid-up Equity Shares of face value of ₹1 each, being 1.42% of the total paid up equity share capital, at ₹3,000 per equity share for an aggregate amount not exceeding ₹16,000 crore (excluding transaction costs, applicable taxes and other incidental and related expenses) on a proportionate basis, through the “Tender Offer” route through stock exchange mechanism. In terms of Regulation 30 of the SEBI Listing Regulations, we enclose a copy of Postal Ballot Notice seeking the approval of members for Buyback of Equity Shares by way of Special Resolution. In compliance with Ministry of Corporate Affairs Circulars No. 14/2020 dated April 8, 2020, No. 17/2020 dated April 13, 2020 and No. 33/2020 dated September 28, 2020, this Postal Ballot Notice is being sent only through electronic mode to those Members whose e-mail addresses are registered with the Company/Depositories and whose names are recorded in the Register of Members of the Company or in the Register of Beneficial Owners maintained by the Depositories as on the Cut-off date i.e. -

Q1. What Is the Rank of India on IMD‟S World Competitiveness Index 2021? (A) 12 (B) 43 (C) 56 (D) 72 (E) 168

Bankersadda.com Current Affairs Quiz for Bank Exams 2021 Adda247.com Quiz Date: 20th June 2021 Q1. What is the rank of India on IMD‟s World Competitiveness Index 2021? (a) 12 (b) 43 (c) 56 (d) 72 (e) 168 Q2. Which country has topped in the IMD‟s World Competitiveness Index 2021? (a) Sweden (b) Norway (c) Switzerland (d) Finland (e) Denmark Q3. Name the digital lending platform recently launched by IndusInd Bank. (a) IndusStack Credit (b) IndusBack Credit (c) IndStack Credit (d) IndEasy Credit (e) IndusEasy Credit Q4. Sumant Sinha of ReNew Power was recognised as one of the ten SDG Pioneers 2021. What does the term SDG stand for? (a) Suitable Development Goals (b) Sustainable Democratic Goals (c) Sustainable Development Goals (d) Sustainable Development Globally (e) Suitable Development Globally Q5. Renowned Jammu-based Islamic scholar Mufti Faiz-ul-Waheed passed away recently . He was first to translated Quran into_______________. (a) Pahari language (b) Kashmiri language (c) Urudu language (d) Gojri language (e) Hindi language Q6. Which of the following digital solutions company has been recognized as the Global Innovation Partner of the Year by Snowflake? (a) Elsner Technologies (b) Larsen & Toubro Infotech For any Banking/Insurance exam Assistance, Give a Missed call @ 01141183264 Bankersadda.com Current Affairs Quiz for Bank Exams 2021 Adda247.com (c) WatConsult (d) Cibirix (e) Technoloader Q7. Which of the following States/UT has recently launched the 'Jahan Vote, Wahan Vaccination' program? (a) Haryana (b) Gujarat (c) Ladakh (d) Kerala (e) Delhi Q8. International Day for the Elimination of Sexual Violence in Conflict is observed globally on _______ every year. -

Arohan Annual Report19-20

The Arohan Story The Arohan Story There was once a traveler who set out on a journey for the greater good. Through rocky terrains and beautiful meadows, he marched forward and came thence to the present that leads to a promising future. Arohan has chosen for itself a path seldom traveled. From when it became a part of the Aavishkaar Group in the year 2012 to when it chose to open operations in the most challenging yet needy geographies, Arohan has always been a torchbearer as it has turned many a new leaf in its exciting book of journey. Through innovation, learning and purpose it has re-imagined its story to make it worth the journey forward. Founded in the year 2006, Arohan continued to serve the under-served in its limited capacity until it became a part of the Aavishkaar Group, global pioneers in taking an entrepreneurship-based approach towards development, post one of the most challenging external conditions that the microfinance industry faced in 2011. That was the turning point that led Arohan to become what it is today. Guided by its value system, Arohan has taken the lead to venture into a new world of innovative solutions with a digital approach emerging stronger through every challenge, and meaningfully contributing to the Indian financial inclusion landscape. Join us as we take you through an exciting journey that tells you 'The Arohan Story'! Ranked among the TOP 25 India’s Best Workplaces in BFSI - Great Place to Work® In a significant achievement, Arohan Financial Services Limited, has been certified as a Great Place to Work by the Great Place To Work® Institute.