Article-7.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Country Wise List of Our Foreign Correspondents Sonali Bank Limited

Country wise list of our Foreign correspondents as on 31-12-2018. Prepared bv : Sonali Bank limited Foreign Remittance Management Division Head office.Dhaka. Courtesv : Sonali Bank limited (Product Development Team) Business Development Division Head office,Dhaka. E mail-dgmb ddp dt@s on aliban k. co m.b d Md Mizanur Rahman Md Zillur Rahman Sikder Senior Principal officer Senior ofl.icer Product Development Team. Product Der elopment Team. mob-01708159313. mob-019753621 15. Corp Bank Country dents as on 3ut2na18 Sl.No. Name ofCountry No. o No. of SI. No. Name ofCountry No. of No. of Corp. RMA Corn. RMA 01. Afganistan J I 45. Malaysia t2 12 02. Australia 8 7 46. Monaco I I 03. Algeria J 1 41. Malta 2 04. Argentina I Z I 48. Netherlands 8 7 , 05. Albenia i 49. New Zealand J J 06. Austria 7 6 50. Nepal 2 2 07. Balrain J J 51. Norway 2 I 08. Belgium 9 7 52. Nigeria I ) 09. Bhutan 2 53. Oman I q 2 10. Bulgaria 4 4 54. Pakistan 18 18 ll Brunei I 55, Poland 3 1 12. Brazrl 4 2 56. Philippines 5 5 lJ. Republic ofBelarus I 57. Portugal 4 J 14. Canada 8 7 58. Qatar 6 5 15. China 4 l3 59. Romania 1 1 16. Chile I I 60 Russia 9 8 17. Croatia I 61. SaudiArabia l6 t5 18. Cyprus I I o/.. Senegal 1 1 t 19. CzechRepublic 6 J 63. Serbia + J ,1 20. Denmark J J 64. Srilanka 5 21. -

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION of BANGLADESH (ICB) 02 BRAC BANK LIMITED 03 EASTERN BANK

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION OF BANGLADESH (ICB) 01 Head Office, Purana Paltan, Dhaka 02 Local Office, Nayapaltan, Dhaka 03 Chittagong Branch, Chittagong 04 Khulna Branch, Khulna 05 Rajshahi Branch, Rajshahi 06 Barisal Branch, Barisal 07 Sylhet Branch, Sylhet 08 Bogra Branch, Bogra 02 BRAC BANK LIMITED 01 Asad Gate Branch, Dhaka 02 Banani Branch, Dhaka 03 Bashundhara Branch, Dhaka 04 Donia Branch, Dhaka 05 Eskaton Branch, Dhaka 06 Graphics Building Branch, Motijheel, Dhaka 07 Uttara Branch, Dhaka 08 Shyamoli Branch, Dhaka 09 Gulshan Branch, Dhaka 10 Manda Branch, Dhaka 11 Mirpur Branch, , Dhaka 12 Nawabpur Branch, Dhaka 13 Rampura Branch, Dhaka 14 Narayanqani Branch, Narayanganj 15 Agrabad Branch, Chittagong 16 CDA Avenue Branch, Chittagong 17 Potia Branch, Chittagong 18 Halisohor Branch, Chittagong 19 Kazirdeuri Branch, Chittagong 20 Momin Road Branch, Chittagong 21 Bogra Branch, Bogra 22 Rajshahi Branch, Rajshahi 23 Jessore Branch, Jessore 24 Khulna Branch, Khulna 25 Barisal Branch, Barisal 26 Zindabazar Branch, Sylhet 03 EASTERN BANK LIMITED 01 Principal Branch, Dilkusha, Dhaka 02 Motijheel Branch, Dhaka 03 Mirpur Branch, Dhaka 04 Bashundhara Branch, Dhaka 05 Shyamoli Branch, Dhaka 06 Narayanganj Branch 07 Jessore Branch 08 Choumuhoni Branch 09 Agrabad Branch, Chittagong 10 Khatunganj Branch, Chittagong 11 Bogra Branch, Bogra 12 Khulna Branch, Khulna 13 Rajshahi Branch, Rajshahi 14 Savar Branch, Savar, Dhaka 15 Moulvi Bazar Branch, Sylhet Page # 1 Bank Code Br. Code Bank & Branch Name 04 BANK ASIA LIMITED 01 Principal Office , Motijheel C.A., Dhaka 02 Corporate Branch, Dhaka 03 Gulshan Branch, Dhaka 04 Uttara Branch, Dhaka 05 North South Rd. -

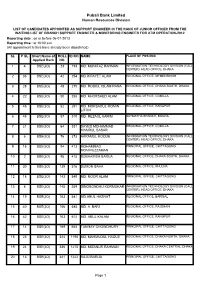

List of Candidates Appointed As Support Engineer in the Rank of Junior Officer From

Pubali Bank Limited Human Resources Division LIST OF CANDIDATES APPOINTED AS SUPPORT ENGINEER IN THE RANK OF JUNIOR OFFICER FROM THE WAITING LIST OF BRANCH SUPPORT ENGINEER & MONITORING ENGINEER FOR ATM OPERATION-2012 Reporting date : on or before 06-01-2013 Reporting time : at 10:00 a.m. (All appointment letters have already been dispatched) SL P SL Short Name of ROLL ID NO. NAME PLACE OF POSTING Applied Rank NO. 1 4 BSE(JO) 23 193 MD. MONITAZ RAHMAN INFORMATION TECHNOLOGY DIVISION (CALL CENTER), HEAD OFFICE, DHAKA 2 33 BSE(JO) 42 254 MD.RIFAYET ALAM REGIONAL OFFICE, MYMENSINGH 3 28 BSE(JO) 48 270 MD. ROBIUL ISLAM RANA REGIONAL OFFICE, DHAKA SOUTH, DHAKA 4 22 BSE(JO) 50 285 MD. KHORSHED ALAM REGIONAL OFFICE, COMILLA 5 45 BSE(JO) 52 291 MD. MOKSADUL MOMIN REGIONAL OFFICE, RANGPUR LITON 6 48 BSE(JO) 57 310 MD. REZAUL KARIM SATMATHA BRANCH, BOGRA 7 21 BSE(JO) 64 331 SAYED MOHAMMAD REGIONAL OFFICE, COMILLA KHAIRUL BASAR 8 6 BSE(JO) 76 373 AKRAMUL HOQUE INFORMATION TECHNOLOGY DIVISION (CALL CENTER), HEAD OFFICE, DHAKA 9 15 BSE(JO) 94 413 MOHAMMAD PRINCIPAL OFFICE, CHITTAGONG MONIRUZZAMAN 10 2 BSE(JO) 95 415 SUBHASISH BARUA REGIONAL OFFICE, DHAKA SOUTH, DHAKA 11 30 BSE(JO) 139 516 SUMON SAHA REGIONAL OFFICE, KHULNA 12 18 BSE(JO) 143 549 MD. NOOR ALAM PRINCIPAL OFFICE, CHITTAGONG 13 8 BSE(JO) 145 559 DINOBONDHU KORMOKAR INFORMATION TECHNOLOGY DIVISION (CALL CENTER), HEAD OFFICE, DHAKA 14 19 BSE(JO) 153 581 MD.ABUL HASNAT REGIONAL OFFICE, BARISAL 15 40 BSE(JO) 156 585 MD. -

INTERNATIONAL FINANCE INVESTMENT and COMMERCE BANK LIMITED Audited Financial Statements As at and for the Year Ended 31 December 2019

INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Audited Financial Statements as at and for the year ended 31 December 2019 INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Consolidated Balance Sheet as at 31 December 2019 Amount in BDT Particulars Note 31 December 2019 31 December 2018 PROPERTY AND ASSETS Cash 18,056,029,773 16,020,741,583 Cash in hand (including foreign currency) 3.a 2,872,338,679 2,899,030,289 Balance with Bangladesh Bank and its agent bank(s) (including foreign currency) 3.b 15,183,691,094 13,121,711,294 Balance with other banks and financial institutions 4.a 5,637,834,204 8,118,980,917 In Bangladesh 4.a(i) 4,014,719,294 6,823,590,588 Outside Bangladesh 4.a(ii) 1,623,114,910 1,295,390,329 Money at call and on short notice 5 910,000,000 3,970,000,000 Investments 47,216,443,756 32,664,400,101 Government securities 6.a 41,369,255,890 27,258,506,647 Other investments 6.b 5,847,187,866 5,405,893,454 Loans and advances 232,523,441,067 210,932,291,735 Loans, cash credit, overdrafts etc. 7.a 221,562,693,268 198,670,768,028 Bills purchased and discounted 8.a 10,960,747,799 12,261,523,707 Fixed assets including premises, furniture and fixtures 9.a 6,430,431,620 5,445,835,394 Other assets 10.a 9,606,537,605 9,003,060,522 Non-banking assets 11 373,474,800 373,474,800 Total assets 320,754,192,825 286,528,785,052 LIABILITIES AND CAPITAL Liabilities Borrowing from other banks, financial institutions and agents 12.a 8,215,860,335 9,969,432,278 Subordinated debt 13 2,800,000,000 3,500,000,000 Deposits and other -

SEBL Financial Statements As on 31

Southeast Bank Limited Report and Consolidated & Separate Financial Statements as at and for the year ended 31 December 2016 Rahman Rahman Huq Telephone +880 (2) 988 6450-2 Chartered Accountants Fax +880 (2) 988 6449 9&5Mohakhali C/A E-mail [email protected] Dtaka 1212 lnternet www.kpmg.com/bd Bangladesh independent auditoris report to the shareholders of Southeast Bank lJ■ lited Report on the financiat statements We have audited the accompanying consolidated financial statements ol Southeast Bank Limited and its subsidiaries (the "Group') as well as the separate financial statements of Southeast Bank Limited (the "Bank'), which comprise the consolidated balance sheet and the separate balance sheet as at 3l December 2016, and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash ffow statements for the year then ended, and a summary of significant accounting policies and other explanatory information. Management's responslbility for the financial statements and internal controls Management is responsible for the preparation of consolidated financial statements of the Group and also separate 'linancial statements of the Bank that give a true and lair view in accordance with Bangladesh Financial Reporting Standards as explained in note 2 and for such intemal control as management determines is necessary to enable the preparation of consolidated financial statements of the Group and also separate financial statements of the Bank that are lree from matedal mi$statement, whether due to traud or eror. The Bank Company Act, 1991 and the Bangladesh Bank Regulations require the Management to ensure etf€ctive intemal audit, intemal control and risk management functions of the Bank. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

Sl. Correspondent / Bank Name SWIFT Code Country

International Division Relationship Management Application( RMA ) Total Correspondent: 156 No. of Country: 36 Sl. Correspondent / Bank Name SWIFT Code Country 1 ISLAMIC BANK OF AFGHANISTAN IBAFAFAKA AFGHANISTAN 2 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 3 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 4 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 5 MASHREQ BANK BOMLBHBM BAHRAIN 6 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 7 AB BANK LIMITED ABBLBDDH BANGLADESH 8 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 9 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH BANGLADESH DEVELOPMENT BANK 12 BDDBBDDH BANGLADESH LIMITED (BDBL) 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BANK ASIA LIMITED BALBBDDH BANGLADESH 15 BASIC BANK LIMITED BKSIBDDH BANGLADESH 16 BRAC BANK LIMITED BRAKBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 19 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 20 EASTERN BANK LIMITED EBLDBDDH BANGLADESH EXPORT IMPORT BANK OF BANGLADESH 21 EXBKBDDH BANGLADESH LTD 22 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 23 HABIB BANK LTD HABBBDDH BANGLADESH 24 ICB ISLAMI BANK LIMITED BBSHBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT 25 IFICBDDH BANGLADESH AND COMMERCE BANK LTD (IFIC BANK) 26 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MEGHNA BANK LIMITED MGBLBDDH BANGLADESH 30 MERCANTILE -

Procedure of Open Foreign Currency Account.Pdf

Embassy of Bangladesh Washington DC Wage Earner Development Bond Foreign Currency Foreign Currency Accounts Specimern Signature Specimern Signature FC Account Opening Form and Specimen Signature Extension [email protected] Diplomatic Bag /DHL/Fedex English Version The Government of the People’s Republic of Bangladesh have introduced special saving facilities for Non Resident Bangladeshis and also foreigner’s of Bangladeshi decent. Wage Earner Development Bond : Most profitable fixed deposit investment “Wage Earner Development Bond” for Non Resident Bangladeshi’s and Foreigners of Bangladeshi decent introduced by the Government of the People’s Republic of Bangladesh. Compound rate of profit is 12.00% per annum. Tk. 25,000 become Tk. 44,750 with profit after 5 years Tk. 50,000 become Tk. 89,500 with profit after 5 years Tk. 1,00,000 become Tk. 1,79,000 with profit after 5 years Tk. 5,00,000 become Tk. 8,95,000 with profit after 5 years Profits could be withdrawn at a rate of Tk. 1000.00 per month for every Tk. 100000.00. For withdrawal of profit simple rate is applicable. Nominee is entitled to 30% to 50% of invested amount as a death risk insurance at no extra charge in case of death of the bond owner. No income tax is levied on the initial investment or profits thereof. Initial investment amount could be transferred back in foreign currency. If encashed before maturity you will get interest at following rate : a. Before six month no interest b. After six month and before 1 year : 9% c. After 1 year and before 2 years : 10% d. -

Downloadable PDF Islam and Hossain Asian Journal of Sustainability and Social Responsibility (2019) 4:3 Page 8 of 20

Islam and Hossain Asian Journal of Sustainability and Social Responsibility Asian Journal of Sustainability (2019) 4:3 https://doi.org/10.1186/s41180-019-0024-8 and Social Responsibility RESEARCH Open Access Conceptual mapping of shared value creation by the private commercial banks in Bangladesh Md. Rabiul Islam1* and Syed Zabid Hossain2 * Correspondence: [email protected]. ac.bd; [email protected] Abstract 1Department of Humanities, Rajshahi University of Engineering & Creating shared value is the opportunity driven approach of business entities to Technology (RUET), Rajshahi 6204, benefit the less addressed segment of the society through their core products and Bangladesh services. For bank financial institutions, the opportunity driven approach signifies that Full list of author information is available at the end of the article banking corporations ought to identify bankable needs that are less addressed or unaddressed and invest on purpose to benefit both society and business. The study strives to develop a conceptual model of how Private Commercial Banks (PCBs) in Bangladesh are creating shared value (a popular concept developed by ([Porter ME, Kramer MR], [The big idea: creating shared value; how to reinvent capitalism—and unleash a wave of innovation and growth], [2011])) through reviewing the products and services of PCBs in light of available literature in the field of strategic corporate social responsibility and creating shared value. The model has identified core products and services that are creating shared value for both the bank and the society concurrently. It has also identified factors that are limiting shared value creation capacity of PCBs. Thus, the model will assist the money market policy planners especially bankers to identify the products, services, markets, and value chain that could augment capacity of creating shared value and remove the road- blocks for creating upscale shared value in the developing country context. -

A Framework on Internet Banking Services for the Rationalized Generations

Asian Business Review, Volume 3, Number 2/2013 (Issue 6) ISSN 2304-2613 (Print); ISSN 2305-8730 (Online) 0 A Framework on Internet Banking Services for the Rationalized Generations Md. Rahimullah Miah Lecturer in MIS, Leading University, Sylhet, Bangladesh ABSTRACT The augmented Internet Banking Service is increasingly popular both in Bangladesh and elsewhere. This paper explores a predicted framework for global Internet Banking that emphasizes the transformative interaction among the effective customers around the regional, national and global banking indicating advanced on backend models, instructional strategies, and transaction technologies in the context on upcoming generations. We have to develop the framework on global enhanced transaction systems especially individual global account, effective online banking systems to fulfill the required method, implementing design and appraising the feedback with standard technology according to network topology for disseminating of global banking technological arena. Despite decades of development, electronic payments still need practical examples of how to use electronic payment technology within a uniqueness and rationalized way including global electronic transaction, language tools, currency converter and electronic workstation. This research focuses the major issues responsible for Internet Banking based on respondents’ perception through various internet applications. The author presents a theoretical framework for our represented method, taking into account previous models and characteristics -

District Bank Branch Location Bank Bank Branch Address DLI Office

DLI Bank Branch DLI District Bank Bank Branch Address A/C Location Office No. Bagerhat Bagerhat Agrani Bank Ltd Bagerhat, Khulna Khulna 737 Bagerhat Bagerhat Pubali Bank Ltd Bagerhat-9300 Khulna 9 Bagerhat Chakshree Bazar Bangladesh Krishi Bank Chakshree Bz. Rampal, Bagerhat Khulna 110 Bagerhat Chital Mari Bazar Bangladesh Krishi Bank Chitalmari Bz.,Bagerhat-9360 Khulna 214 Bagerhat Fakirhat Bangladesh Krishi Bank Fakirhat, Bagerhat-9370 Khulna 293 Bagerhat Mongla Pubali Bank Ltd Mongla Bazar,MadrasaRd.,Bagerhat-9351 Khulna 5 Bagerhat Morelgonj Bangladesh Krishi Bank Morelgonj, Bagerhat-9320 Khulna 281 Bagerhat Raindabazar Bangladesh Krishi Bank Raindabazar,Sarankhola, Bagerhat-9330 Khulna 263 Bagerhat Rampal Bangladesh Krishi Bank Rampal, Bagerhat-9340 Khulna 211 Bagerhat Doiboghohati Bangladesh Krishi Bank Morelgonj, Bagerhat-9320 Khulna 44 Bagerhat Foltita Bangladesh Krishi Bank Kolkolia, Fakirhat, Bagerhat Khulna 30 Bagerhat Mollahat Bangladesh Krishi Bank Mollahat, Bagerhat-9380 Khulna 243 Bagerhat Sannayashibazar Bangladesh Krishi Bank Morelgonj, Bagerhat-9321 Khulna 1 Bagerhat Town Noapara Bangladesh Krishi Bank Town Noapara, Fakirhat, Bagerhat-9370 Khulna 45 Bandarban Baishari Bangladesh Krishi Bank Baishari, Naikhagchari, Bandarban-4660 Chittagong 81 Bandarban Bandarban Pubali Bank Ltd Bandarban-4600 Chittagong 16 Bandarban Lama Bangladesh Krishi Bank Lama, Bandarban Chittagong 453 Barguna Amtoli Bangladesh Krishi Bank Amtoli, Borguna-8710 Barisal 149 Barguna Barguna Pubali Bank Ltd Barguna-8700 Barisal 9 Barguna Betagi Bangladesh -

Dutch - Bangla Bank Limited

DUTCH - BANGLA BANK LIMITED UN-AUDITED FINANCIAL STATEMENTS For the Third Quarter ended 30 September 2019 Dutch-Bangla Bank Limited Consolidated Balance Sheet As at 30 September 2019 PROPERTY AND ASSETS Notes 30-Sep-19 31-Dec-18 30-Sep-18 Taka (Un-audited) Taka (Audited) Taka (Un-audited) Cash In hand (including foreign currencies) 4 13,588,077,031 17,419,869,741 13,424,335,615 Balance with Bangladesh Bank and its agent bank (s) (including foreign currencies) 5 21,515,865,165 32,728,425,040 25,272,773,773 35,103,942,197 50,148,294,781 38,697,109,388 Balance with other banks and financial institutions 6 In Bangladesh 13,775,674,405 6,715,668,728 19,872,111,450 Outside Bangladesh 138,592,298 656,896,195 2,646,119,188 13,914,266,703 7,372,564,923 22,518,230,638 Money at call on short notice 7 13,170,000,000 - 2,670,000,000 Investments 8 Government 43,878,875,002 31,457,164,331 25,593,984,526 Others 1,411,283,434 751,283,434 251,283,434 45,290,158,436 32,208,447,765 25,845,267,960 Loans and advances 9 Loans, cash credits, overdrafts, etc. 228,437,319,738 209,463,408,465 196,168,533,474 Bills purchased and discounted 17,168,958,714 22,090,531,874 21,013,792,031 - - 245,606,278,452 231,553,940,339 217,182,325,505 Fixed assets including land, building, furniture and fixtures 10 5,483,822,895 5,737,308,593 5,129,942,207 Other assets 11 21,613,894,320 19,448,234,568 19,350,180,886 Non-banking assets - - - TOTAL ASSETS 380,182,363,003 346,468,790,969 331,393,056,584 LIABILITIES AND CAPITAL Liabilities Borrowings from other banks, financial institutions