Branding and Marketing in China, Part 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Group Structure

GROUP STRUCTURE GROUP STRUCTURE The following chart sets out the Shareholders, subsidiaries and associated companies of the Company immediately following the commencement of the H Shares on Main Board, assuming no changes in shareholding after the Latest Practicable Date. Chaoyang Shanxi Beijing Beijing Tianjin Individual Auxillary Trust Gaoya Jiazeng Jinganghua Promoters Public (Note 1) (Note 2) (Note 3) (Note 4) (Note 5) (Note 6) 44.24% 6.93% 1.35% 0.82% 1.35% 5.84% 39.47% Company* 52.03% 76.42% 80.00% 100.00% Xinyang Tongli Chaopi Trading Jingkelong Langfang Jingkelong Chain (Note 7) (Note 8) (Note 9) (Note 10) 53.43% 52.63% 59.00% 100.00% 100.00% 54.23% 35.48% 45.45% 80.00% 51.10% Chaopi Chaopi Chaopi Chaopi Chaopi Chaopi Chaopi Chaopi Chaopi Chaopi Huaqing Flavourings Shuanglong Qingdao Shijiazhuang Jinglong Tianxing Ziguang Zhongde Huilong (Note 11) (Note 12) (Note 13) (Note 14) (Note 15) (Note 16) (Note 17) (Note 18) (Note 19) (Note 20) * The Company is principally engaged in the operation of hypermarkets, supermarkets and convenience stores. Notes: 1. Chaoyang Auxillary, one of the Promoters, is a state-owned enterprise. Chaoyang Auxillary’s principal business is investment holding and property management. 2. Shanxi Trust, one of the Promoters, was incorporated in the PRC as a limited liability company. It is a professional trustee company and is holding these Domestic Shares as trustee for 122 employees and officers of the Company, all of whom (save for Ms. Li Chunyan and Mr. Liu Yuejin, who are executive Directors and Ms. Wang Shuying, who is a Supervisor) are Independent Third Parties. -

Produce: Supplies to Beijing Ensured

2 | Friday, June 19, 2020 HONG KONG EDITION | CHINA DAILY PAGE TWO Vegetables are sorted at a makeshift trading area in Beijing on Monday after the Xinfadi market closed temporarily for disinfection. ZOU HONG / CHINA DAILY Produce: Supplies to Beijing ensured From page 1 and “fruit platter”. ket, which was basically a bazaar It is worthy of such labeling. Last standing on 1 hectare of land. The By Sunday, more than 8,000 peo- year, more than 17 million metric startup capital was 150,000 yuan. ple who trade or shop at the market tons of produce was traded at the During the past 32 years, many had received nucleic acid tests and market, with a turnover of 132 bil- vendors have transformed their been transferred to isolation loca- lion yuan ($18.6 million). lives by working at Xinfadi. tions for medical observation. Out of more than 4,600 domestic Prices at the market are low and Some 200,000 people are estimat- agricultural product wholesale mar- the paperwork is easy, which has ed to have visited the market since kets, Xinfadi has ranked in first place attracted a large number of vendors May 30, based on a citywide data for 17 consecutive years in terms of from nearby districts and neighbor- collection campaign conducted by trading volume and turnover. ing cities. As a result, the venue’s size communities. All of them will be giv- Founded on May 16, 1988, the and trading volume have grown en nucleic acid testing and will market has expanded rapidly in tan- annually. -

China-Private-Sector-Assessment.Pdf

China Private Sector Assessment A Preliminary Scoping Study The primary objective of the study is to provide a broad-based overview of the private sector in China as a stakeholder in combating modern slavery in the country PB The Mekong Club Thailand Private Sector Assessment The Mekong Club Thailand Private Sector Assessment 1 The Mekong Club 1. Contents 2. Objectives of the Study 4 The Mekong Club is a catalyst 8.3. Banking Industry 32 for change – engaging, inspiring and supporting the private 3. Definition of Terms 5 8.4. Tourism, Food Service & Hospitality 36 sector to eradicate slavery from their business. Given that the 8.4.1. Food Service 36 majority of modern-day slavery 4. Demographic Overview & Key Social Trends 6 8.4.2. Tourism 36 exists in the private sector, these companies are ideally placed to 4.1. Population Distribution 6 9. Construction 37 help turn the tide of this global 4.2. Social Indicators 8 epidemic. The only organisation of its kind, 4.3.1. Human Development Index (HDI) 8 10. Modern Slavery and human trafficking 38 The Mekong Club steers away 4.3.2. Poverty Rate 8 10.1. Overview 30 from the approach taken by other players in this space, which is to 10.2 Excerpts from the USA “Trafficking in Persons” ‘name and shame’ companies – 5. The Labour force 9 Report – June 2018 Update 39 ousting bad behaviour or issues 5.1. Employment and Income 9 related to this subject. Instead, 10.2.1. General 39 we believe in starting and ending 5.1.1. -

Group Structure

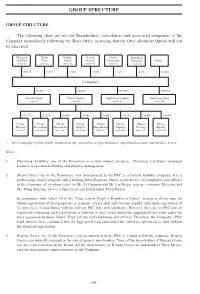

GROUP STRUCTURE GROUP STRUCTURE The following chart sets out the Shareholders, subsidiaries and associated companies of the Company immediately following the Share Offer, assuming that the Over-allotment Option will not be exercised. Chaoyang Shanxi Beijing Beijing Tianjin Individual Auxillary Trust Gaoya Jiazeng Jinganghua Promoters Public (note 1) (note 2) (note 3) (note 4) (note 5) (note 6) 46.91% 7.27% 1.42% 0.85% 1.42%6.13% 36.00% Company* 52.03% 76.42% 80.00% 100.00% Xinyang Tongli Chaopi Trading Jingkelong Langfang Jingkelong Chain (note 7) (note 8) (note 9) (note 10) 52.22% 52.63% 59.00% 59.00% 59.00% 54.23% 35.48% 45.45% Chaopi Chaopi Chaopi Chaopi Chaopi Chaopi Chaopi Chaopi Huaqing Flavourings Shuanglong Qingdao Shijiazhuang Jinglong Tianxing Ziguang (note 11) (note 12) (note 13) (note 14) (note 15) (note 16) (note 17) (note 18) * The Company is principally engaged in the operation of hypermarkets, supermarkets and convenience stores. Notes: 1. Chaoyang Auxillary, one of the Promoters, is a state-owned enterprise. Chaoyang Auxillary’s principal business is investment holding and property management. 2. Shanxi Trust, one of the Promoters, was incorporated in the PRC as a limited liability company. It is a professional trustee company and is holding these Domestic Shares as trustee for 122 employees and officers of the Company, all of whom (save for Ms. Li Chunyan and Mr. Liu Yuejin, who are executive Directors and Ms. Wang Shuying, who is a Supervisor) are Independent Third Parties. In accordance with Article 10 of the “Trust Law of People’s Republic of China”, in respect of any trust for which registration of trust properties is required, a trust shall only become legally valid upon registration of its trust assets in accordance with the relevant PRC laws and regulations. -

Parent Handbook

Guide to Beijing Table of Contents Message from the Head Master ………………………………………………………………….3 Introduction ………………………………………………………………………………………......4 Living in Hegezhuang………………………………………………………………………………..5 General Information Regarding Your Apartment………………………………………………….7 Travel & Transportation…………………………………………………………………………….10 Domestic Help...………………………………………………………………………………….....12 Expat Magazines……………..……………………………………………………………….........13 Networking…………………………………………………………………………………………...14 Sports Activities……………………………………………………………………………………..15 Weather………………………………………………………………………………………….…..16 Popular Shopping Destination…………………………………………………………………….17 The Markets…………………………………………………………………………………………20 Restaurants & Bars – Staff Picks…………………………………………………………………22 Public Parks…………………………………………………………………………………………27 Banking & Utilities………. …………………………..……………………………………………30 Hospital and Dental Service……………………………………………………………………… 32 Places of Worship…………………………………………………………………………………. 33 Family Visits to China……………………………………………………………………………. 34 Maps…………………………………………………………………………………………………35 Your Feedback ……………………………………………………………………………………..36 Life in Beijing 2 | P a g e MESSAGE FROM THE HEAD MASTER Welcome to Harrow International School Beijing. A Harrow Beijing Education embraces the challenge of pursuing academic excellence, participation and fulfillment through a broad range of extra-curricula activities, and developing strong values to help guide our students in an increasingly complex world. At the heart of our unique educational philosophy is the importance of sympathetic -

Top 100 Retail Chain Operators of 2017 in China Was Released Information Source from CCFA

Top 100 Retail Chain Operators of 2017 in China was released Information Source from CCFA (stands for China Chain Store & Franchise Association) on May 10th, 2018 In 2017, Top 100 Retail Chain Enterprises in China reached a total of 2.2 trillion CNY by sales, increasing by 8.0 % year-on-year, accounting for 6.0% of total retail sales of consumer goods. The total number of chain stores owned by Top 100 Retail Chain Enterprises is 109.8 thousand, growing by 9.1% year-on-year. The sales growth rate for the total convenience store enterprises in Top 100s in 2017 reached up to 16.9%, with the total number of stores increased by 18.1%, became the fastest commercial format in growth among all the enterprises with commercial entities. In 2017, the retail market in China was generalized by such the new words as “New Retail”, “Smart Retail” and “Unbounded Retail”, which on one hand mirrored the situations and changes of the Chinese retail market over the past year and on the other bred the capital investment boom lasting from the end of last year till the beginning of this year. The all-around cooperation between retail entities and online platforms formed a highlighted and important trend for the Chinese retail industry of 2017 while the blowout development of new commercial format and the capital-led pattern of competition for retail comprised the 2 major hot spots of the Chinese retail industry in 2017. The former referred as to the development of new commercial format was conspicuously manifested by the tidal ebbs and flows of unattended stores (& racks) as well as the upsurge of new commercial entities with He Ma as typical case; the latter referred as to the situation of retail competition redefined by capital was remarkably featured with the retail “alignments” resulted by the extensive investments respectively by Alibaba and Tencent to leading retail enterprises. -

Beijing Jingkelong Company Limited*

IMPORTANT If you are in any doubt about this prospectus, you should consult your stockbroker, bank manager, solicitor, professional accountant or other professional adviser. Beijing Jingkelong Company Limited* (a joint stock limited company incorporated in the People’s Republic of China) LISTING ON THE GROWTH ENTERPRISE MARKET OF THE STOCK EXCHANGE OF HONG KONG LIMITED BY WAY OF PLACING AND PUBLIC OFFER OF H SHARES Number of Offer Shares : 132,000,000 H Shares, comprising 120,000,000 new H Shares and 12,000,000 Sale H Shares (subject to the Over-allotment Option) Number of Placing Shares : 118,800,000 H Shares, comprising 106,800,000 new H Shares and 12,000,000 Sale H Shares (subject to the Over-allotment Option and re-allocation) Number of Public Offer Shares : 13,200,000 new H Shares (subject to re-allocation) Offer Price : Not more than HK$4.50 and expected to be not less than HK$3.90 for each Offer Share, payable in full upon application and subject to refund Nominal value : RMB1.00 per Share Stock code : 8245 Global Coordinator, Bookrunner, Lead Manager and Sponsor The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. A copy of this prospectus, having attached thereto the documents specified under the paragraph headed ‘‘Documents delivered to the Registrar of Companies and available for inspection’’ in Appendix VI to this prospectus, has been registered by the Registrar of Companies in Hong Kong as required by section 342C of the Companies Ordinance. -

物美控股集團有限公司 Wumei Holdings, Inc. and Its Subsidiary

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION This Composite Document should be read in conjunction with the accompanying Form of Acceptance, the provisions of which form part of the terms of the H Share Offer contained herein. If you are in doubt as to any aspect of this Composite Document or as to the action to be taken, you should consult a licensed securities dealer or registered institution in securities, a bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in 北京物美商業集團股份有限公司 (Wumart Stores, Inc.*), you should at once hand this Composite Document together with the accompanying Form of Acceptance to the purchaser(s) or transferee(s) or to the bank or licensed securities dealer or registered institution in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser(s) or transferee(s). Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Composite Document and the accompanying Form of Acceptance, make no representation as to their accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Composite Document and the accompanying Form of Acceptance. These materials are not an offer for sale of the Shares in the United States. The Shares have not been registered under the U.S. Securities Act of 1933, as amended, and may not be sold in the United States absent registration or an exemption from registration under the Securities Act. -

Travel Guide 2017

TRAVEL GUIDE 2017 Columbia Global Centers | Beijing 0 CONTACTS .........................................................................................................................................1 Columbia Global Centers | Beijing........................................................................................1 Contact Points: ..................................................................................................................1 Location of Columbia Global Centers | Beijing .......................................................2 Beijing Yanshan Hotel...............................................................................................................3 Brief Introduction ......................................................................................................................4 Quick Facts about China .................................................................................................4 Quick Facts about Beijing ...............................................................................................5 LIVING IN BEIJING .......................................................................................................................6 Finance ..........................................................................................................................................6 Communication ..........................................................................................................................8 Transportation......................................................................................................................... -

New JAT China Subsidiary Signs First Agreement

JAT is a specialist in Australia-China trade, focused on growth within the Australian health and wellness consumer goods export industry. ASX ANNOUNCEMENT 23 December 2020 New JAT China Subsidiary signs First Agreement Jatcorp Limited (ASX: JAT) is pleased to announce key developments in its Chinese strategy and business. Incorporation of JAT Chinese Subsidiary As announced to the ASX on a number of occasions and most recently on 16 December 2020, JAT’s strategy involves increasing the level of its operations based outside Australia and now manufactures its products in New Zealand, Japan, Korea and China. As a key part of its China business development, JAT has established a wholly owned subsidiary in China, Hangzhou JAT Food Group Co., Ltd (Hangzhou JAT). Hangzhou JAT will conduct JAT’s business operations in China to the maximum extent possible, such as the plant-based meat production and sales. In order to fund the operations of Hangzhou JAT, equity investments will be sought from Chinese-based corporate investors who wish to obtain exposure to JAT’s developing China business. Hangzhou JAT agreement with Hangzhou Xiacheng State-owned Assets Investment Holding Co., Ltd. Hangzhou JAT has entered a strategic cooperation agreement with a Chinese state-owned company, Hangzhou Xiacheng State-owned Asset Investment Holding Co.,Ltd (Hangzhou Xiacheng). Hangzhou Xiacheng was established in March 2001 and is owned by the People’s government of Xiacheng District. It is mainly engaged in industrial investment, equity investment and government -

Construction Situation and Countermeasure Analysis of Agricultural Products Logistics System in Beijing-Tianjin-Hebei Region

Economics 2016; 5(6): 89-95 http://www.sciencepublishinggroup.com/j/eco doi: 10.11648/j.eco.20160506.12 ISSN: 2376-659X (Print); ISSN: 2376-6603 (Online) Construction Situation and Countermeasure Analysis of Agricultural Products Logistics System in Beijing-Tianjin-Hebei Region Wang Keshan, Liu Xiudong School of Economics, Beijing Wuzi University, Beijing, China Email address: [email protected] (Wang Keshan), [email protected] (Liu Xiudong) To cite this article: Wang Keshan, Liu Xiudong. Construction Situation and Countermeasure Analysis of Agricultural Products Logistics System in Beijing-Tianjin-Hebei Region. Economics. Vol. 5, No. 6, 2016, pp. 89-95. doi: 10.11648/j.eco.20160506.12 Received: September 13, 2016; Accepted: November 29, 2016; Published: December 29, 2016 Abstract: Agricultural products logistics commonly refer to the supply chain system about agricultural products circulation from producing to the table. This paper analyze main agricultural products supply, consumption, production and marketing docking in Beijing-Tianjin-Hebei Region, and integration of agricultural products logistics channel construction, and emphatically summed up the state of agricultural products cold chain logistics system construction and the policies and measures of agricultural products logistics system construction in Beijing-Tianjin-Hebei Region. Keywords: Beijing-Tianjin-Hebei, Agricultural Products Logistics, Development Suggestions vegetables in Beijing and Tianjin keeps a trend of decline 1. Major Agricultural Production, while there have been an increase in Hebei (see annex 1 for Consumption and Docking of details). From the perspective of urban residents’ consumption of Production and Marketing in agricultural products in Beijing and Tianjin, Beijing urban Beijing-Tianjin-Hebei Region residents’ family per capita consumer spending on main agricultural products (food) was more than that in Tianjin, In Beijing-Tianjin-Hebei Region, Hebei province is a except eggs and aquatic products in 2007. -

Wuhan Hightech Zone Key to Hubei's Recovery

14 | Tuesday, August 4, 2020 HONG KONG EDITION | CHINA DAILY BUSINESS SIX PRIORITIES PC maker Beijing steps up efforts to boost use to ensure normal of Phytium supplies of vegetables processors By DU JUAN By YANG CHENG in Tianjin [email protected] 22,000 [email protected] tons Beijing has adopted measures to maximum daily vegetable China Greatwall Technology ensure vegetable supplies for its supply from other regions Group Co Ltd, a domestic per- residents after the Xinfadi whole- since late June in Beijing sonal computer maker, sale market suspended operations revealed an ambitious plan to due to the detection of a local clus- manufacture up to 4 million ter of COVID-19 infections in June. find supplies in other areas. units of PCs with a homegrown The major seven wholesale mar- On June 18, the first batch of independent Phytium central kets in the city raised their daily green vegetables from neighbor- processing unit and a Kylin total supply of vegetables to 15,000 ing Hebei province were put on operating system by the end of metric tons from 8,000 tons dur- shelves in Beijing’s supermarkets. this year. ing the past month, the Beijing Those vegetables were directly “The new PCs are set to aid Municipal Commerce Bureau said transported from the planting bas- the optimization of China’s on July 25. es in Hebei to Beijing by truck. Employees perform experiments using semiconductors at a hightech company’s production unit in cyberspace security,” Song Li- “Beijing has been keeping a Beijing managed to meet Wuhan, capital of Hubei province, in February.