Results for the Fourth Quarter and Full Year 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RTR NET NEUTRALITY REPORT Report in Accordance with Art

RTR NET NEUTRALITY REPORT Report in accordance with Art. 5(1) of the TSM Regulation and Par. 182–183 of the BEREC Guidelines on the Implementation by National Regulators of European Net Neutrality Rules 2020 www.rtr.at 2020 Austrian Regulatory Authority for Broadcasting and Telecommunications (Rundfunk und Telekom Regulierungs-GmbH) Mariahilfer Straße 77–79, 1060 Vienna, Austria Tel.: +43 (0)1 58058-0; fax: +43 (0)1 58058-9191; e-mail: [email protected] www.rtr.at RTR NET NEUTRALITY REPORT 2020 Report in accordance with Art. 5(1) of the TSM Regulation and Par. 182–183 of the BEREC Guidelines on the Implementation by National Regulators of European Net Neutrality Rules Contents Contents Net Neutrality Report 2020 1 Preface and executive summary 6 2 Introduction: stakeholders and institutions in enforcement 10 3 Timeline of regulatory authority activities 14 4 Potential violations of net neutrality and associated procedures 16 4.1 Blocking of TCP/UDP ports or protocols 19 4.2 Private IP addresses and services 21 4.3 Disconnection of IP connections 22 4.4 Blocking websites due to copyright claims 22 4.5 Decisions concerning Art. 4 TSM Regulation 24 4.6 Review of R 3/16 by the BVwG 25 4.7 Overview of suspected breaches of net neutrality 28 4.8 Measures taken/applied in accordance with Art. 5(1) 29 4.9 Zero-rating monitoring activities 32 5 Other indicators and activities 38 5.1 RTR conciliation procedures 38 5.2 General requests 39 5.3 Indicators of continuous availability of non-discriminatory IAS 39 6 Focus Topic: internet during the corona crisis 48 6.1 Traffic management measures in accordance with Art. -

Sharing Knowledge Is Our Strength!

SHARING KNOWLEDGE IS OUR STRENGTH! ETIS Annual Report 2013 | 2014 CIO Executive Forum I Information Security I Enterprise Architecture I Customer Self-Service I Business Intelligence & Data Warehouse I Procurement & Vendor Management I TeBIT I Anti-Abuse I Billing & Revenue Management I CERT-SOC Telco Network ETIS Annual Report 2013 I 2014 Sharing Knowledge is our Strength! TABLE OF CONTENTS FOREWORD Table of contents Foreword As the newly elected ETIS Chairman, is it both a pleasure and a privilege to be able to introduce this year's annual report. As a long time Member of the ETIS Board and Council, I have seen the impressive work that has been done by the organisation and its Members. All of us highly appreciate the opportunities and benefits already realised from being part of the community and I look forward to further building upon ETIS’ successes and providing strategic leadership to help guide the organisation into the future. ETIS has always been a dynamic, Member driven organisation and this year is no different as we have continued to witness impressive attendance rates, new topics and activities proving a wealth of knowledge for our Members to take advantage of. We have held over 25 meetings this year as well as the ETIS During the Spring of 2013, ETIS also witnessed a passing of ETIS Council 4 Community Gathering. This equates to bringing over 600 the leadership torch with Tora Tenden stepping down as the people together to share knowledge. For an association such long-time Chairman and the election of myself as the new ETIS Management Board 6 as ours, this is a huge amount of work but the benefits for Chairman. -

A1 Group Structure.Pdf

Telekom Austria AG, Austria 100% mobilkom 100% mobilkom 100% mobilkom 100% mobilkom Belarus 100% Mobilkom 100% Telekom Fi- 100% Kroatien Be- 100% A1 Telekom Austria AG, CEE Beteiligungs- Bulgarien Beteili- Mazedonien Beteili- Beteiligungs- Beteiligungsgesellschaft nanzmanagement (TFG) teiligungsverwal- Austria verwaltung GmbH, gungsverwaltung GmbH, gungsverwaltung. GmbH, verwaltung GmbH, mbH, GmbH, Austria tung GmbH, Austria Austria Austria Austria Austria Austria 100% JetStream RO SRL, 1,5037% Wiener Börse Romania 100% A1 Towers 100% A1 TOWER 100% A1 Towers 100% SB Telecom 100% A1 Slovenija d.d., AG, Austria 100% A1now TV Bulgaria EOOD, DOOEL Skopje, d.o.o., Croatia Ltd. Cyprus, Slovenia 100% JetStream TR GmbH, Austria Bulgaria Macedonia Ticaret Ltd., Sirketi, Turkey 100% JetStream 100% Telekom 100% A1 Makedonija 100% A1 Towers Holding 100% A1 Srbija 100% A1 Bulgaria EAD, Germany GmbH, Germany Austria Personalma- DOOEL, 100% A1 Hrvatska 100% Unitary enterprise GmbH, Austria d.o.o., Serbia Bulgaria d.o.o., Croatia 90,46% TS RPL d.d., nagement GmbH, Macedonia A1, Belarus Slovenia Austria 100% JetStream Hungary Kft., Hungary 100% A1 TOWERS 100% Telemedia 100% DOSTOP 100%Jet Stream Slovakia 100% wedify GmbH 51% CABLETEL- INFRASTRUCTURE DOOEL Skopje, 100% A1 Content, KOMUNIKACIJE s.r.o., Slovakia Austria PRIMA AD Bulgaria d.o.o., Serbia Macedonia Belarus d.o.o., Slovenia 100% JetStream Switzerland mbH, CH 100% World-Direct eBusiness solutions 100% A1 Towers 100% JetStream Poland, 100% Aprimis EOOD, 100% A1 ICT 100% STUDIO GmbH, Austria Austria GmbH, Austria Poland Bulgaria services, Belarus PROTEUS d.o.o., Slovenia 100% JetStream BH d.o.o., Bosnia- Herzegovina 3,00% Eurescom GmbH, Germany 100% Unitary 100% TA CZ site Enterprise Solar 100% A1 Digital s.r.o., Czech Republic Invest, Belarus International GmbH, Austria 100% JetStream Italy S.r.l., Italy 100% MK Logistik GmbH, Austria 100% Unitary 100% A1 Digital 100% JetStream enterprise TA- Deutschland GmbH, England Ltd., England Engineering, Belarus Germany 76% CableRunner GmbH, Austria 88,83% Akenes S.A. -

Corporate Presentation 2021 Contents

Corporate Presentation 2021 Contents Company Business Areas Infrastructure Responsibility Company A1 Telekom Austria Group . Leading telecommunications provider in the CEE. 7 countries, around 25 million customers. European unit of América Móvil, one of the largest wireless services provider in the world. A1 Digital: digital transformation in the core markets as well as in Germany and Switzerland. A1 Austria is the largest company 25 mn 4,55 bn 1,58 bn 17.949 within the Group, generating 58% revenues. Customers in 7 Total revenues; EDITDA in the Employees as of core markets financial year financial year year-end 2020 2020 2020 Four strong brands . Austria’s leading communications provider. More than 5.1 million mobile customers and 2 million fixed access lines. Global package of offers from one source. Empowering Digital Life . From security, to comfort, energy and entertainment: everything is connected. A1 provides the basis for digitalisation in Austria with its networks, smart solutions and products . The Internet of Things (IoT) and 5G campus networks are steadily increasing in importance. Companies value the potential offered by IT innovations. A1 connects Austrian companies with tomorrow’s technologies, products and services. Business Areas A1 Business Areas Everything From One Single Source Consumer SME Enterprise Consumer A suitable offer for every household Combi packages, Internet, TV, mobile phones and telephony Communication and information on Smartphones, tablets, PCs and TV sets A1 Xplore TV with up to 230 channels, online video recorder, Internet apps and more than 7,500 films and series in the A1 video library Smart home: intelligent “thinking” products and services for smart connections between people, things and places M-Payment Services: A1 Mastercard and payment by mobile phone Consumer A1 Customer Service . -

Sustainability-Report-2012-13.Pdf

TELEKOM AUSTRIA GROUP SUSTAINABILITY REPORT 2012/2013 KEY FIGUres Telekom Austria Group Economy (in EUR mn) 2012 Change in % 2011 Revenues 4,329.7 -2.8 4,454.6 EBITDA comparable¹ 1,455.4 -4.7 1,527.3 EBITDA including effects from restructuring and impairment tests 1,420.8 36.0 1,044.7 Operating income 456.8 n.m. -7.6 Net result 103.8 n.m. -252.8 Equity 836.1 -5.3 8 83.1 Market capitalisation as of 31 Dec. 2012 (in EUR bn) 2.5 -37.9 4.1 ¹ Defined as EBITDA, excluding effects from restructuring and impairment tests. Products: Providing Responsible Products 2012 Customer contacts in customer service (in ’000) 45,569 Employees in Customer Service (in FTE) 3,650 E-billing share (in %) 29 Collected old mobile phones (in pcs) 73,877 1 Environment: Living Green 2012 Total CO₂ emissions (Scope 1 + 2 in tonnes) 218,296 CO₂ intensity (in tonnes per FTE) 13 Total energy consumption (in MWh) 693,284 Energy efficiency index (in Mwh/ terabyte) 2.1 Share of renewable energy (in %) 56 Paper consumption (in tonnes) 1,890 Recycling quota (in %) 55 ¹ For further KPIs as well as definitions and explanations please refer to p. 68. Employees: Empowering People 2012 Employees (in FTE) 16,446 Percentage of female employees (in %) 38 Percentage of female executives (in %)¹ 32 Percentage of local managers (in %)¹ 98 Expenses for professional training and further education per FTE (in EUR) 604 Internally hired positions 666 Result of group-wide engagement index (% share of satisfied employees) 79 ¹ In headcount Society: Creating equal opportunities 2012 Group-wide -

A1 Telekom Austria

Image: A1 Telekom Austria SUCCESS STORY A1 TELEKOM AUSTRIA „Transnational SAP process and system harmonization in the A1 Telekom Austria Group: The project was a success for many reasons, and professional data migration was one of them.“ Mag. Thomas Kloepfer, One Finance Processes, Systems & Controls, Head of Group BI & Finance Systems, One SAP Program Manager System & Client Merge Rapid Migration with SNP Methodology Meets Demanding Budget and Quality Requirements About A1 Telekom Austria The Solution A1 is Austria’s leading communications provider, serving more We migrated the data in the Macedonian SAP system to the Aus- than 5.3 million mobile customers and supplying more than 2 mil- trian SAP ERP/010 system. The 15-member team adapted all the lion landline connections. Its customers benefit from a compre- data from Macedonia to the processes in Austria. We used hensive service offering from a single provider comprising voice CrystalBridge with the SNP Analysis Suite, SNP Data Consistency telephony, Internet access, digital cable television, data and IT so- Verification, SNP System Scan and SNP Transformation Back- lutions, wholesale services, and mobile business and payment bone with SAP LT. The analysis, design and implementation solutions. The brands A1, bob, Red Bull MOBILE and Yesss! phase was followed by three test migrations, a go-live simulation stand for top quality and smart services. As a responsible compa- and finally the go-live itself. Our process enabled us to carry out ny, A1 integrates socially relevant and environmental concerns in- the project on time and the agreed budget. to its core business. The Benefits The Challenge . -

2021 Annual General Meeting

2021 Annual General Meeting Vienna, May 14, 2021 Virtual execution – 2021 Annual General Meeting Live broadcast We offer you two alternative accesses to the Internet transmission with picture and sound in German and English language. Link 1: https://www.a1.group/en/ir/annual-general-meeting-2021 Link 2: https://s3-eu-west-1.amazonaws.com/streaming.bevideo.tv/live/A1-Telekom/A1- Telekom-Austria-AG-HV-EN.html 2021 Annual General Meeting 2 Virtual execution – 2021 Annual General Meeting Questions please to : [email protected] Question form available at: https://www.a1.group/en/ir/annual-general-meeting-2021 2021 Annual General Meeting 3 Virtual execution – 2021 Annual General Meeting Voting, motions for resolutions and raising objections by special proxies: . Florian Beckermann [email protected] . Christoph Nauer [email protected] . Thomas Niss [email protected] . Sascha Schulz [email protected] 2021 Annual General Meeting 4 Procedure – Virtual Annual General Meeting . Determination of the invitation . Resolution proposals, reports . General debate . Interruption for further questions/motions for resolutions . Voting en bloc 2021 Annual General Meeting 5 Agenda Item 1 Report on the 2020 Fiscal Year 6 Members – Supervisory Board of Telekom Austria AG Shareholder representatives Carlos Garcia Edith Moreno Alejandro Karin Hlawati Peter Hagen Elizondo Cantú Jiménez Exner-Wöhrer Chair Vice Chair Thomas Carlos Peter Daniela Oscar von Schmid M. Jarque Kollmann Lecuona Torras Hauske Solís Employee representatives Gottfried Alexander Gerhard Bayer Werner Luksch Renate Richter Kehrer Sollak 2021 Annual General Meeting 7 Attendance – Supervisory Board and Committees 2020 Supervisory Board Compensation Audit meetings committee committee Edith HLAWATI 6/6 (100%) 4/4 (100%) Carlos GARCIA MORENO ELIZONDO 6/6 (100%) 4/4 (100%) 5/5 (100%) Alejandro CANTU 5/6 (83%) Karin EXNER-WÖHRER 6/6 (100%) Peter HAGEN 6/6 (100%) 5/5 (100%) Carlos M. -

Minerva Certifies ADB's Market-First IPTV Wireless and 4K/UHD Set-Top

PRESS RELEASE Minerva certifies ADB’s market-first IPTV wireless and 4K/UHD Set-Top-Box solution • Minerva iTVFusion platform fully integrated with newly launched ADB 1761 series set-top boxes • First fully integrated wireless and 4K Set-Top-Boxes (STB) for Minerva’s North American IPTV customers • Operators can access new advanced features while reducing operational costs 19 May, 2016 – Geneva, Switzerland ADB, a leading provider of solutions and services for multimedia convergence, has announced today that Minerva Networks, a leading provider of software solutions for the delivery of connected entertainment services, has certified it’s iTVFusion client on ADB’s new 1761 series of STBs. The new solution combines ADB’s deep expertise in personal TV and broadband connectivity with Minerva’s market leading IPTV platform to offer operators a wide variety of industry-first features and considerable cost savings. Advanced functionality includes next-generation wireless connectivity and 4K/UHD programming support. The new system will ensure service providers can deliver more compelling TV experiences with greater efficiency and flexibility. The 1761 STB series introduces a number of key features to the North American market: • First fully integrated 802.11ac wireless STB – allowing operators to drastically reduce installation overheads and time-to-market by using next generation wireless technology • First 4K STB – enabling TV service providers to offer Ultra High-Definition 4K quality content • Flexible deployment options – allowing operators to deliver both managed multicast and RTSP-based video as well as adaptive bit rate (ABR) streaming protocols. • Low cost/high performance STB – at under $100, the 1720w STB from the new series means considerable cost savings can be achieved, while also improving the Consumer Premises Equipment (CPE) accessibility and performance. -

A1 Telekom Austria Profile | Point Topic Subscribers

Point Topic A1 Telekom Austria Broadband Profile Austria / A1 Telekom Austria 10 Jan 2018 Telekom Austria is the incumbent telecommunications operator in Austria. It has four main business areas: fixed line, mobile communications, data communications and Internet services. Telekom Austria's subsidiary A1 Telekom Austria offers Internet services to business and residential customers. IPTV residential services were added to the offering in 2006. In 2010, the company streamlined its operations and merged their fixed line and mobile communication companies to form A1. On 3 January 2013, A1 Telekom acquired Yesss! Telecommunications Ltd. which has enabled A1 to expand its market leadership with 45 per cent of the market share in Austria. The operator continues to expand its operations further into Eastern Europe. By late 2007, the mobile segment of the Telekom Austria Group had operations in seven countries (Croatia, Slovenia, Bulgaria, Serbia, Macedonia, Liechtenstein and Austria). By early 2014, A1 Telekom Austria migrated its fixed line voice service entirely to VoIP. As of October 2014, America Movil (AM) owns a 59.7 per cent stake in Telekom Austria Group. http://www.a1.net/ Autonomous System Number 8447 Tariffs ADSL FTTH, VDSL 100 FTTx ) D FTTx, VDSL S U VDSL ( n o i t p i r c s b u S y l 50 h t n o M 10 50 100 Downstream Mb/s Financials 18/01/18 © Point Topic 2018 1 / 10 Point Topic A1 Telekom Austria Broadband Profile Financials Date Revenue EBITDA Net profit ARPU Currency 31-Mar-2015 956,000,000 338,000,000 92,700,000 30 EUR Quarter -

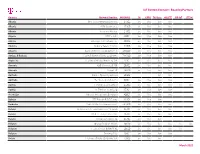

Iot Custom Connect - Roaming Partners

IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Albania One Telecommunications sh.a 27601 live live live live Albania ALBtelecom sh.a. 27603 live live live live Albania Vodafone Albania 27602 live live live live Algeria ATM Mobilis 60301 live live live live Algeria Wataniya Telecom Algerie 60303 live live live live Andorra Andorra Telecom S.A.U. 21303 live live live live Anguilla Cable and Wireless (Anguilla) Ltd 365840 live live live live Antigua & Barbuda Cable & Wireless (Antigua) Limited 344920 live live live live Argentina Telefónica Móviles Argentina S.A. 72207 live live live live Armenia VEON Armenia CJSC 28301 live live live live Armenia Ucom LLC 28310 live live live live Australia SingTel Optus Pty Limited 50502 live live Australia Telstra Corporation Ltd 50501 live live live live Austria T-Mobile Austria GmbH 23203 live live live live live live Austria A1 Telekom Austria AG 23201 live live live live Azerbaijan Bakcell Limited Liable Company 40002 live live live live Bahrain STC Bahrain B.S.C Closed 42604 live live live Barbados Cable & Wireless Barbados Ltd. 342600 live live live live Belarus Belarusian Telecommunications Network 25704 live live live live Belarus Mobile TeleSystems JLLC 25702 live live live live Belarus Unitary Enterprise A1 25701 live live live Belgium Orange Belgium NV/SA 20610 live live live live live live Belgium Telenet Group BVBA/SPRL 20620 live live live live live Belgium Proximus PLC 20601 live live live live Bolivia Telefonica Celular De Bolivia S.A. 73603 live live live March 2021 IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Bosnia and Herzegovina PUBLIC ENTERPRISE CROATIAN TELECOM Ltd. -

Most Socially Active Professionals

The World’s Most Socially Active Telecommunications Professionals – October 2020 Position Company Name LinkedIN URL Location Size No. Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) 1 WOM Colombia https://www.linkedin.com/company/64636588 Colombia 501-1000 312 197 63.14% 2 American Tower do Brasil https://www.linkedin.com/company/9257860 Brazil 201-500 300 103 34.33% 3 CityFibre https://www.linkedin.com/company/2214861 United Kingdom 501-1000 755 249 32.98% 4 NFON https://www.linkedin.com/company/934860 Germany 201-500 255 77 30.20% 5 EPOS https://www.linkedin.com/company/30739726 Denmark 1001-5000 291 87 29.90% 6 GSMA https://www.linkedin.com/company/12380 United Kingdom 501-1000 1,024 303 29.59% 7 Dialpad https://www.linkedin.com/company/3967399 United States 201-500 547 158 28.88% 8 Eurofiber Nederland https://www.linkedin.com/company/25718 Netherlands 201-500 300 86 28.67% 9 Skyline Communications https://www.linkedin.com/company/201360 Belgium 201-500 346 93 26.88% 10 Truphone https://www.linkedin.com/company/39711 United Kingdom 201-500 492 126 25.61% 11 Sigfox https://www.linkedin.com/company/2731408 France 201-500 379 96 25.33% 12 Phoenix Tower International https://www.linkedin.com/company/4989868 United States 201-500 261 66 25.29% 13 Bouygues Telecom Entreprises https://www.linkedin.com/company/2515692 France 1001-5000 995 235 23.62% 14 Monty Mobile https://www.linkedin.com/company/2423880 United Kingdom 501-1000 255 59 23.14% 15 TAWAL- Telecommunications Towershttps://www.linkedin.com/company/14784924 -

A1 Mobil Traveler

Seite 1 von 11 A1 Mobil Traveler Preis/Minute Preis/Minute im besuchten in EU Länder, Preis/Minute Preis/Minute Land Schweiz, Preis pro Land Mobilfunknetz in alle andere ankommende (national) Liechtenstein, SMS* Länder Gespräche und nach Norwegen Österreich und Island Afghanistan AWCC 4,40 4,40 4,40 1,95 0,42 Afghanistan Roshan 4,40 4,40 4,40 1,95 0,42 Ägypten Vodafone 4,10 4,10 4,10 1,95 0,42 Ägypten Etisalat 4,40 4,40 4,40 1,95 0,42 Ägypten Mobinil 4,40 4,40 4,40 1,95 0,42 Albanien Vodafone 2,00 2,20 4,10 0,95 0,32 Albanien AMC 2,30 2,50 4,40 0,95 0,32 Albanien Vodafone 2,30 2,50 4,40 0,95 0,32 Algerien Djezzy 4,40 4,40 4,40 1,95 0,42 Andorra Mobiland 2,30 2,50 4,40 0,95 0,32 Angola Unitel 4,40 4,40 4,40 1,95 0,42 Anguilla Cable & Wireless 4,40 4,40 4,40 1,95 0,42 Anguilla Digicel 4,40 4,40 4,40 1,95 0,42 Antigua & Barbuda Cable & Wireless 4,40 4,40 4,40 1,95 0,42 Antigua & Barbuda Digicel 4,40 4,40 4,40 1,95 0,42 Argentinien Claro 4,40 4,40 4,40 1,95 0,42 Argentinien Nextel 4,40 4,40 4,40 1,95 0,42 Argentinien Personal 4,40 4,40 4,40 1,95 0,42 Armenien Beeline 4,40 4,40 4,40 1,95 0,42 Armenien Karabach 4,40 4,40 4,40 1,95 0,42 Armenien VivaCell 4,40 4,40 4,40 1,95 0,42 Aruba Digicel 4,40 4,40 4,40 1,95 0,42 Aserbaidschan Azercell 4,40 4,40 4,40 1,95 0,42 Aserbaidschan Nar Mobile 4,40 4,40 4,40 1,95 0,42 Äthiopien ETC 4,40 4,40 4,40 1,95 0,42 Australien Telstra 2,10 2,30 4,10 1,95 0,42 Australien Vodafone 2,10 2,30 4,10 1,95 0,42 Australien Optus 2,40 2,60 4,40 1,95 0,42 Bahamas BTC 4,40 4,40 4,40 1,95 0,42 Bahrain Batelco 4,40 4,40 4,40 1,95 0,42 Bahrain Zain 4,40 4,40 4,40 1,95 0,42 Bangladesch Airtel 4,40 4,40 4,40 1,95 0,42 Bangladesch Grameenphone 4,40 4,40 4,40 1,95 0,42 *) ankommende SMS sind kostenlos Preise in Euro inkl.