CEO-Worker Pay Ratios in the Banking Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Iif Annual Membership Meeting Financing a Sustainable Economy: Crisis Recovery and Drivers of Future Growth

OCTOBER 12-16, 2020 2020 IIF ANNUAL MEMBERSHIP MEETING FINANCING A SUSTAINABLE ECONOMY: CRISIS RECOVERY AND DRIVERS OF FUTURE GROWTH AGENDA * Timings for all sessions are noted in US EDT * DAY 1 MONDAY, OCTOBER 12 Timings for all sessions are noted in US EDT POLICYMAKER SERIES 7:00 am – 7:50 am IN-CONVERSATION The 2020 IIF Annual Membership Meeting (AMM) was the first fully + Haruhiko Kuroda, Governor, Bank of Japan + Tim Adams, President and Chief Executive Officer, IIF (Moderator) livestreamed AMM held from Monday, October 12 to Friday, October 8:00 am – 8:50 am IN-CONVERSATION 16 and focused on some of the most critical issues facing the financial + Ravi Menon, Managing Director, Monetary Authority of Singapore industry as a result of the COVID-19 pandemic. + Tim Adams, President and Chief Executive Officer, IIF (Moderator) 9:00 am – 9:50 am KEYNOTE/IN-CONVERSATION + Ryozo Himino, Commissioner, Financial Services Agency, Japan The 5-day program included the IIF's hallmark Views from the C-Suite + Andrés Portilla, Managing Director, Regulatory Affairs, IIF (Moderator) series and the new Policymaker series along with discussions on 10:00 am – 10:50 am IN-CONVERSATION + Jörg Kukies, State Secretary, Financial Market Policy and European sustainable finance, digital finance and innovation, the global regulatory Policy, Federal Ministry of Finance, Germany + Clay Lowery, Executive Vice President, Research and Policy, IIF outlook, and the economic outlook in developed and emerging (Moderator) markets. Attendees had the opportunity to hear from many influential 11:00 am – 11:50 am IN-CONVERSATION + Luis de Guindos, Vice President, European Central Bank voices, including CEO/Chairs, Policymakers, Innovators and Regulators + Clay Lowery, Executive Vice President, Research and Policy, IIF who offered perspectives on the global economy and the future of the (Moderator) 12:00 pm – 12:50 pm BIG THINK financial services industry in a post-COVID world. -

Top News Before the Bell Stocks to Watch

TOP NEWS • Wells Fargo names BNY Mellon's Charles Scharf as CEO Wells Fargo & Co named Charles Scharf, the chief executive officer of Bank of New York Mellon, to its top job. • Democrats appeal for more witnesses to come forward about Trump-Ukraine matter Democrats are urging people who might have more information about President Donald Trump's effort to persuade Ukraine to investigate political rival Joe Biden to come forward as Trump struggles to contain the fallout from the scandal. • China's top diplomat says Beijing willing to buy more U.S. products China's top diplomat said on Thursday that China was willing to buy more U.S. products, and said trade talks would yield results if both sides "take more enthusiastic measures" to show goodwill and reduce "pessimistic language" in their trade dispute. • 'Roller coaster' of politics and trade threaten economy -Fed's Barkin The U.S. economy and labor market continue to be strong but there are "several headwinds," particularly uncertainty around trade and politics that affect business confidence, the president of the Richmond Federal Reserve said on Thursday. • JPMorgan managers agreed to help prosecutors in Australian cartel case to avoid charges, court told Two former executives of JPMorgan Chase & Co in Australia agreed to co-operate with regulators on condition of immunity in a criminal cartel case by the state against Citigroup and Deutsche Bank, a Sydney court heard. BEFORE THE BELL Futures for major Wall Street’s stock indexes were higher on optimism about an easing of U.S.-China trade tensions. European shares were up, helped by gains in mining stocks. -

Big Banks and the Executives Who Run Them Posted Huge Profits

Big Banks And The Executives Who Run Them Posted Huge Profits Even During The Pandemic-Influenced Economy of 2020, Will Washington Have The Guts To Make Them Pay Their Fair Share? SUMMARY: President Biden’s Infrastructure and American Families Plans would increase taxes on the wealthiest Americans and large mega-corporations in order to pay for crucial infrastructure and to help rebuild the American economy to succeed in the 21st Century. Together, the plans would nearly double the tax millionaires pay on stock profits while increasing the corporate tax rate to a proposed 28%, still well under the corporate tax rate prior to President Trump’s 2017 Tax Bill. The largest banks in the country are a case study into just how reasonable these plans are. These banks made tens of billions of dollars in profits during the pandemic-influenced year of 2020, and their CEOs made out handsomely as well: • JPMorgan Chase reported over $50 billion in net income for 2020 and paid its CEO, Jamie Dimon, $31,664,554 in total compensation. • Citigroup reported $11 billion in net income for 2020 and paid its CEO, Michael Corbat, $22,984,090 in total compensation. • Morgan Stanley reported nearly $11 billion in net income for 2020 and paid its CEO, James Gorman, $29,558,524 in total compensation. • Bank of America reported over $17 billion in net income for 2020 and paid its CEO, Bryan Moynihan, $25,940,571 in total compensation. • Wells Fargo reported over $3.3 billion in net income for 2020 and paid its CEO, Charles Scharf, $20,392,046 in total compensation. -

Wells Fargo 2021 Proxy Statement

Notice of Annual Meeting and Proxy Statement Wells Fargo & Company 2021 Annual Meeting of Shareholders Letter to our Shareholders from our Chief Executive Officer March 16, 2021 Dear Fellow Shareholders, We are pleased to invite you to attend Wells Fargo’s 2021 Annual Meeting of Shareholders to be held on April 27, 2021, at 10 a.m. Eastern time, via live webcast at www.virtualshareholdermeeting.com/WFC2021. The annual meeting provides our shareholders with the opportunity to ask questions about matters to be voted on at the meeting and the Company’s business, to consider matters described in the proxy statement, and to receive an update on the Company’s performance and activities. The matters to be considered at the annual meeting include the election of directors, an advisory vote to approve the 2020 compensation of named executive officers, the ratification of the appointment of the Company’s independent registered public accounting firm for 2021, and shareholder proposals. Your vote is important to us. Please vote as soon as possible by one of the methods described in your proxy materials, even if you plan to attend the virtual annual meeting. The notice and proxy statement provide you with information about how you can attend the virtual annual meeting and vote your shares. Please read the proxy statement for more information. Thank you for your continued investment in and support of Wells Fargo. Sincerely, Charles W. Scharf CEO 1 Letter to our Shareholders from our Chairman of the Board March 16, 2021 Dear Fellow Shareholders, I became Chairman of the Wells Fargo Board of Directors in March 2020, just days before the world began to recognize the severity of the COVID-19 pandemic. -

Visa's Annual Report for 2016

49373.indd 1 11/29/16 3:30 PM 49373.indd 2 11/29/16 3:30 PM 49373.indd 3 11/29/16 3:30 PM Financial Highlights GAAP In millions (except for per share data) FY 2014 FY 2015 FY 2016 Operating revenues $12,702 $13,880 $15,082 Operating expenses $5,005 $4,816 $7,199 Operating income $7,697 $9,064 $7,883 Net income $5,438 $6,328 $5,991 Stockholders' equity $27,413 $29,842 $32,912 Diluted class A common stock earnings per share $2.16 $2.58 $2.48 Financial Highlights ADJUSTED1 In millions (except for per share data) FY 2014 FY 2015 FY 2016 Operating revenues $12,702 $13,880 $15,082 Operating expenses $4,555 $4,816 $5,060 Operating income $8,147 $9,064 $10,022 Net income $5,721 $6,438 $6,862 Diluted class A common stock earnings per share $2.27 $2.62 $2.84 Operational Highlights4 12 months ended September 30 (except where noted) 2014 2015 2016 Total volume, including payments and cash volume2 $7.3 trillion $7.4 trillion $8.2 trillion Payments volume2 $4.7 trillion $4.9 trillion $5.8 trillion Transactions processed on Visa's networks 65.0 billion 71.0 billion 83.2 billion Cards3 2.3 billion 2.4 billion 2.5 billion Stock Performance The accompanying graph and chart compares the cumulative total return on $400 Visa’s common stock with the cumulative total return on Standard & Poor’s 500 Index and the Standard & Poor’s 500 Data Processing Index from September 30, $350 2012 through September 30, 2016. -

FEIGEN ADVISORS NEW CEO REPORT® January - December 2019

FEIGEN ADVISORS NEW CEO REPORT® January - December 2019 th 6 Edition JUNE 2020 © 2020 Feigen Advisors LLC © 2020 Feigen Advisors LLC Contents Introduction to The Feigen Advisors 2019 New CEO Report 2 I. New CEO Profiles 5 The S&P 250 New CEO Class of 2019 5 The FTSE 30 New CEO Class of 2019 36 II. Data & Insights 41 S&P 250 New CEO Succession: 2014 to 2019, A Six-Year View 41 The S&P 250 New CEO Class of 2019 48 III. Sources 52 IV. About Feigen Advisors 53 1 © 2020 Feigen Advisors LLC The Feigen Advisors New CEO Report The Feigen Advisors 2019 New CEO Report We are pleased to share our sixth annual New CEO Report, profiling the 30 new CEOs in the S&P 250 and the five new CEOs in the FTSE 30. At this moment, we can all take pride in the private sector. Companies are placing employees, customers, and communities first. The Business Roundtable Purpose Statement (recently signed by 181 CEOs) has passed its toughest test. The thirty new chief executives in the S&P 250 run companies with a combined $1.3 trillion in revenue (2019 numbers) and nearly 3 million employees. 87% were promoted from within, and insiders averaged more than two decades of service at their companies. Their average age is 54. 70% led a region or a business unit prior to becoming CEO. Their work matters to the world. I am hopeful that, as our nation observes the collective response of the private sector, we can over time rebuild both trust in and support for the effectiveness and the values of the market economy. -

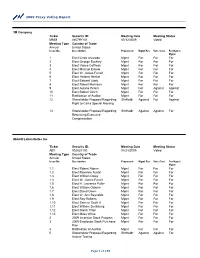

2009 Proxy Voting Report 3M Company Ticker Security ID: MMM

2009 Proxy Voting Report 3M Company Ticker Security ID: Meeting Date Meeting Status MMM 88579Y101 05/12/2009 Voted Meeting Type Country of Trade Annual United States Issue No. Description Proponent Mgmt Rec Vote Cast For/Agnst Mgmt 1 Elect Linda Alvarado Mgmt For For For 2 Elect George Buckley Mgmt For For For 3 Elect Vance Coffman Mgmt For For For 4 Elect Michael Eskew Mgmt For For For 5 Elect W. James Farrell Mgmt For For For 6 Elect Herbert Henkel Mgmt For For For 7 Elect Edward Liddy Mgmt For For For 8 Elect Robert Morrison Mgmt For For For 9 Elect Aulana Peters Mgmt For Against Against 10 Elect Robert Ulrich Mgmt For For For 11 Ratification of Auditor Mgmt For For For 12 Shareholder Proposal Regarding ShrHoldr Against For Against Right to Call a Special Meeting 13 Shareholder Proposal Regarding ShrHoldr Against Against For Restricting Executive Compensation Abbott Laboratories Inc Ticker Security ID: Meeting Date Meeting Status ABT 002824100 04/24/2009 Voted Meeting Type Country of Trade Annual United States Issue No. Description Proponent Mgmt Rec Vote Cast For/Agnst Mgmt 1.1 Elect Robert Alpern Mgmt For For For 1.2 Elect Roxanne Austin Mgmt For For For 1.3 Elect William Daley Mgmt For For For 1.4 Elect W. James Farrell Mgmt For For For 1.5 Elect H. Laurance Fuller Mgmt For For For 1.6 Elect William Osborn Mgmt For For For 1.7 Elect David Owen Mgmt For For For 1.8 Elect W. Ann Reynolds Mgmt For For For 1.9 Elect Roy Roberts Mgmt For For For 1.10 Elect Samuel Scott III Mgmt For For For 1.11 Elect William Smithburg Mgmt For For For -

Jpmorgan Chase & Co. 270 Park Avenue New York, New York 10017

JPMorgan Chase & Co. 270 Park Avenue New York, New York 10017-2070 April 7, 2011 Dear fellow shareholders: We are pleased to invite you to the annual meeting of shareholders to be held on May 17, 2011, at our offices at McCoy Center in Columbus, Ohio. As we have done in the past, in addition to considering the matters described in the proxy statement, we will review major developments since our last shareholders’ meeting. We hope that you will attend the meeting in person. We strongly encourage you to designate the proxies named on the proxy card to vote your shares even if you are planning to come. This will ensure that your common stock is represented at the meeting. The proxy statement explains more about proxy voting. Please read it carefully. We look forward to your participation. Sincerely, James Dimon Chairman and Chief Executive Officer Notice of 2011 Annual Meeting of Shareholders and Proxy Statement Date: Tuesday, May 17, 2011 Time: 10:00 a.m. Place: JPMorgan Chase McCoy Center 1111 Polaris Parkway Columbus, Ohio 43240 Matters to be voted on: • Election of directors • Ratification of appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2011 • Advisory vote on executive compensation • Advisory vote on frequency of advisory vote on executive compensation • Approval of Amendment to Long-Term Incentive Plan • Shareholder proposals, if they are introduced at the meeting • Any other matters that may properly be brought before the meeting By order of the Board of Directors Anthony J. Horan Secretary April 7, 2011 Please vote promptly. -

1 This Week in Wall Street Reform

THIS WEEK IN WALL STREET REFORM TABLE OF CONTENTS Consumer Financial Protection Bureau (CFPB) Nomination/Appointment ...................................................... 4 Political battle threatens centerpiece of financial reform ............................................................................ 4 Top Dems Believe Warren Warming To Senate Recruitment .................................................................... 4 No consumer chief? No problem ................................................................................................................ 4 New US Consumer Bureau Likely To Be Hobbled On Day One ................................................................ 4 Editorials and op-eds .............................................................................................................................................. 4 Op-ed - No regulators, no regulation .......................................................................................................... 4 Op-ed - Blocking Elizabeth Warren ............................................................................................................ 5 Editorial - Nearly a Year After Dodd-Frank ................................................................................................. 5 Op-ed - GOP Lawmakers Finally Settle on Who They Want to Lead the CFPB: Nobody ......................... 5 Op-ed - Small Banks, Big Banks, Giant Differences .................................................................................. 5 Capitol Hill