Another Record-Breaking Run for Logistics Star

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inbound E-Directory 2016

INBOUND E-DIRECTORY 2016 What is the Tourism Export Council of New Zealand? The Tourism Export Council of New Zealand is a trade association that has represented the interests of inbound tourism since 1971. Their inbound members package holidays for international visitors whether they be part of a group tour, independent traveller, conference/incentives, education or cruise visitors. What do we do & who do we represent? The Tourism Export Council’s focus is to build long term business relationships with distribution networks in New Zealand and offshore. The relationship with product suppliers in New Zealand and offshore wholesalers is integral to the country’s continued growth as a visitor destination. Member categories include: . Inbound member - inbound tour operators (ITO’s) . Allied member - attraction, activity, accommodation, transport and tourism service suppliers Examples of the allied membership include: . Attraction – Milford Sound, SkyTower, Te Papa Museum . Activities – Jetboating, Whalewatch, Maori Culture show . Accommodation – hotels, luxury lodges, backpackers . Transport – airlines, bus & coaches, sea transport, shuttles . Tourism services – Regional Tourism Organisations (RTO’s) digital & marketing companies, education & tourism agencies eg. DOC, Service IQ, Qualmark, AA Tourism, BTM Marketing, ReserveGroup Why is tourism considered an export industry? Tourism, like agriculture is one of New Zealand’s biggest income earners. Both are export industries because they bring in foreign dollars to New Zealand. With agriculture, you grow an apple, send it offshore and a foreigner eats it. A clear pathway of a New Zealand product consumed or purchased by someone overseas. Tourism works slightly differently: The product is still developed in NZ (just like the apple) It is sold offshore (like the apple) It is purchased by a foreigner (again like the apple) BUT it is experienced in NZ and therein lies the difference. -

Bringing the Future Faster

6mm hinge Bringing the future faster. Annual Report 2019 WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Bringing the future faster Spark New Zealand Annual Report 2019 Bringing the future faster Contents Build customer intimacy We need to understand BRINGING THE FUTURE FASTER and anticipate the needs of New Zealanders, and Spark performance snapshot 4 technology enables us Chair and CEO review 6 to apply these insights Our purpose and strategy 10 to every interaction, Our performance 12 helping us serve our Our customers 14 customers better. Our products and technology 18 Read more pages 7 and 14. Our people 20 Our environmental impact 22 Our community involvement 24 Our Board 26 Our Leadership Squad 30 Our governance and risk management 32 Our suppliers 33 Leadership and Board remuneration 34 FINANCIAL STATEMENTS Financial statements 38 Notes to the financial statements 44 Independent auditor’s report 90 OTHER INFORMATION Corporate governance disclosures 95 Managing risk framework roles and 106 responsibilities Materiality assessment 107 Stakeholder engagement 108 Global Reporting Initiative (GRI) content 109 index Glossary 112 Contact details 113 This report is dated 21 August 2019 and is signed on behalf of the Board of Spark New Zealand Limited by Justine Smyth, Chair and Charles Sitch, Chair, Audit and Risk Management Committee. Justine Smyth Key Dates Annual Meeting 7 November 2019 Chair FY20 half-year results announcement 19 February 2020 FY20 year-end results announcement 26 August 2020 Charles Sitch Chair Audit and Risk Management Committee WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Create New Zealand’s premier sports streaming business Spark Sport is revolutionising how New Zealanders watch their favourite sports events. -

The Climate Risk of New Zealand Equities

The Climate Risk of New Zealand Equities Hamish Kennett Ivan Diaz-Rainey Pallab Biswas Introduction/Overview ØExamine the Climate Risk exposure of New Zealand Equities, specifically NZX50 companies ØMeasuring company Transition Risk through collating firm emission data ØCompany Survey and Emission Descriptives ØPredicting Emission Disclosure ØHypothetical Carbon Liabilities 2 Measuring Transition Risk ØTransition Risk through collating firm emissions ØAimed to collate emissions for all the constituents of the NZX50. ØUnique as our dataset consists of Scope 1, Scope 2, and Scope 3 emissions, ESG scores and Emission Intensities for each firm. ØCarbon Disclosure Project (CDP) reports, Thomson Reuters Asset4, Annual reports, Sustainability reports and Certified Emissions Measurement and Reduction Scheme (CEMAR) reports. Ø86% of the market capitilisation of the NZX50. 9 ØScope 1: Classified as direct GHG emissions from sources that are owned or controlled by the company. ØScope 2: Classified as indirect emissions occurring from the generation of purchased electricity. ØScope 3: Classified as other indirect GHG emissions occurring from the activities of the company, but not from sources owned or controlled by the company. (-./01 23-./014) Ø Emission Intensity = 6789 :1;1<=1 4 Company Survey Responses Did not Email No Response to Email Responded to Email Response Company Company Company Air New Zealand Ltd. The a2 Milk Company Ltd. Arvida Group Ltd. Do not report ANZ Group Ltd. EBOS Ltd. Heartland Group Holdings Ltd. Do not report Argosy Property Ltd. Goodman Property Ltd. Metro Performance Glass Ltd. Do not report Chorus Ltd. Infratil Ltd. Pushpay Holdings Ltd. Do not report Contact Energy Ltd. Investore Property Ltd. -

May 2019 Market Update

QUAYSTREET MONTHLY MARKET UPDATE - AS AT 31 MAY 2019 - INTERNATIONAL MARKETS Geopolitics fray markets Global equity markets broadly fell in May, giving back on the rise across the continent, while at the individual some of April’s stellar performance. The MSCI World country level, Italy has made it known it is about to Index (NZD) dropped 3.6% over the month, however a flout EU fiscal rules around its budget. Across the weakening Kiwi dollar helped soften the impact in NZD channel, there are now heightened prospects of a terms. Positive returns in Brazil and India bucked the no-deal Brexit, coupled with a leadership vacuum after trend, helping emerging markets indices to outperform Prime Minister Theresa May announced she will resign developed markets, something that has not happened in June. for a while. In stark contrast to European politics, India’s Prime The weakness in markets accelerated at month-end as Minister Narendra Modi won a strong mandate for the US President made an unexpected announcement his second five-year term. The question being asked stating he would impose tariffs on Mexico if it did not by investors is to what extent he re-engages with stop the flow of illegal immigrants crossing the border the significant reforms he was planning to undertake into the US. This added further uncertainty concerning in his first term, such as overhauling the labour global trade, just as investors were evaluating the re- and agricultural sectors, that did not materialise. escalation of the US-China trade war. Notwithstanding, with its economy still among the fastest growing in the world (GDP is running at 7%), Another contributor to the renewed anxiety in markets India is likely to remain a favourite in the emerging was the deteriorating political landscape in Europe. -

FS IISNZSF 20200731 Class a Instintfi 450498

31 July 2020 Russell Investments NZ Shares Fund Fund facts Rolling 1 year performance history Inception date Fund Benchmark 14 February 2013 40% Benchmark 30% S&P/NZX 50 Index (gross) 20% and including imputation credits 10% Currency 0% 2014 2015 2016 2017 2018 2019 2020 NZD Performance review Period ending 31/07/2020 1 3 1 3 5 Since month months year years years inception % % % %p.a. %p.a. %p.a. Gross fund performance 3.5 12.3 9.4 16.1 16.2 16.4 Benchmark return* 2.5 11.4 8.8 16.2 15.9 15.9 Excess return 1.0 0.8 0.5 -0.1 0.3 0.5 Past performance is not a reliable indicator of future performance. Performance data shown is gross of fees, charges or taxes and is not in any way an indicator of the net return to you as an investor. Performance is calculated on exit price. *From 1 July 2016 this is S&P/NZX 50 Index (gross and including imputation credits). Prior to 30 June 2016 this was the Russell New Zealand Domestic Index including imputation credits (previously known as the Russell NZ Tradable Gross Index). Prior to 1 December 2014 the benchmark was the NZX50 Index including imputation credits. Fund commentary The Russell Investments NZ Shares Fund outperformed the benchmark in July. Contributing to the Fund’s outperformance was strong stock selection within the healthcare sector; notably an ex-benchmark holding in Pacific Edge and an overweight to Summerset Group. Pacific Edge jumped 168% after the company received approval to provide services under US national health insurance schemes, while Summerset Group gained after management downgraded profit guidance by less than expected. -

Market Overview Funds at a Glance

As of 31 March 2021 Market overview Global markets were again dominated by the re-opening theme last month – there For more information on our Funds, was a strong pro-risk sentiment with equities generating positive returns and, please contact: within equities, the countries most advanced in their Covid vaccine rollout (e.g. the US and the UK) offered the better performance. The MSCI All Country World index David Boyle was up 3.3%. Head of Sales & Marketing The Australian market rose 2.4% in March and the NZ market rose 2.7%. Consumer Level 25, SAP Tower Discretionary, Utilities and Real Estate were the best performing sectors in 151 Queen Street, Auckland Australia, with Materials and IT lagging. In New Zealand, it was the smaller cap New Zealand tech stocks that did the best – Vista +29%, Serko +22% and Pushpay +22%. P 0800 646 833 Laggards in NZ were Synlait, My Food Bag and Oceania Group. Synlait withdrew its E [email protected] full year guidance citing significant uncertainty and volatility. Oceania raised new www.mintasset.co.nz equity to fund acquisitions. In a case of caveat emptor, My Food Bag debuted on the market and promptly under-performed – in part, because the IPO price was set earlier in February before the market sold off. Bond rates have been rising in the US, with spill over effects to other bond markets, in part due to expectations of an economic bounce following the early success so far of the Covid vaccines. In March, this was exacerbated by the US fiscal stimulus measures – a US$1.9 trillion pandemic relief plan followed by a US$2.4 trillion infrastructure proposal. -

FS IISNZSF 20210430 Class a Instintfi 465922

30 April 2021 Russell Investments NZ Shares Fund Fund facts Rolling 1 year performance history Inception date Fund Benchmark 14 February 2013 40% Benchmark 30% S&P/NZX 50 Index (gross) 20% and including imputation credits 10% Currency 0% 2014 2015 2016 2017 2018 2019 2020 2021 NZD Performance review Period ending 30/04/2021 1 3 1 3 5 Since month months year years years inception % % % %p.a. %p.a. %p.a. Gross fund performance 1.5 -1.3 23.7 16.3 14.7 16.2 Benchmark return* 1.4 -2.8 21.6 15.6 14.4 15.6 Excess return 0.2 1.6 2.1 0.7 0.3 0.5 *From 1 July 2016 this is S&P/NZX 50 Index (gross and including imputation credits). Prior to 30 June 2016 this was the Russell New Zealand Domestic Index including imputation credits (previously known as the Russell NZ Tradable Gross Index). Prior to 1 December 2014 the benchmark was the NZX50 Index including imputation credits. Performance is calculated on exit price. Fund commentary The Russell Investments New Zealand Shares Fund outperformed the benchmark in April. Contributing to the Fund’s outperformance was strong stock selection within the industrials space; notably an underweight to Auckland International Airport (AIA) and an overweight to Mainfreight. AIA fell amid concerns over the outlook for long-haul international travel, while Mainfreight – the market’s most expensive stock and our largest overweight position – hit fresh record highs during the month. Stock selection within the information technology sector was also positive in April. -

STOXX Pacific 100 Last Updated: 01.08.2017

STOXX Pacific 100 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 98.1 1 1 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 72.3 2 2 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 58.9 3 3 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Y 56.2 4 5 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 54.3 5 4 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 38.8 6 6 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 33.0 7 7 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 31.3 8 8 AU000000WOW2 6981239 WOW.AX 698123 Woolworths Ltd. AU AUD Y 23.4 9 9 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 18.9 10 11 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 18.6 11 10 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 15.9 12 12 AU000000SCG8 BLZH0Z7 SCG.AX AU01Z4 SCENTRE GROUP AU AUD Y 14.9 13 14 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 14.4 14 13 AU000000SUN6 6585084 SUN.AX 658508 SUNCORP GROUP LTD. AU AUD Y 12.5 15 15 AU000000AMC4 6066608 AMC.AX 606660 Amcor Ltd. AU AUD Y 12.0 16 16 AU000000QBE9 6715740 QBE.AX 671574 QBE Insurance Group Ltd. -

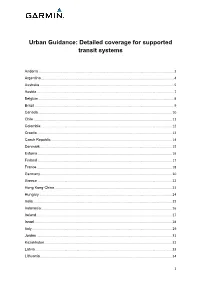

Urban Guidance: Detailed Coverage for Supported Transit Systems

Urban Guidance: Detailed coverage for supported transit systems Andorra .................................................................................................................................................. 3 Argentina ............................................................................................................................................... 4 Australia ................................................................................................................................................. 5 Austria .................................................................................................................................................... 7 Belgium .................................................................................................................................................. 8 Brazil ...................................................................................................................................................... 9 Canada ................................................................................................................................................ 10 Chile ..................................................................................................................................................... 11 Colombia .............................................................................................................................................. 12 Croatia ................................................................................................................................................. -

Monthly Business Report

MONTHLY BUSINESS REPORT October 2009 CONTRIBUTION LIST The following is a list of Business Unit Managers responsible for providing detailed monthly reports. Business Unit Name Customer Services Mark Lambert Project Delivery Allen Bufton Strategy and Planning Peter Clark Marketing and Communications Shelley Watson Corporate Services Stephen Smith TABLE OF CONTENTS 1 CUSTOMER SERVICES ............................................ ERROR! BOOKMARK NOT DEFINED. 1.1. PASSENGER TRANSPORT PATRONAGE – NETWORK WIDE ................................... ERROR! BOOKMARK NOT DEFINED. 1.2. MAJOR INFRASTRUCTURE WORKS ................................................................................................................................. 12 1.3. SPECIAL EVENT PASSENGER TRANSPORT SERVICES ................................................................................................. 12 1.4. REGISTERED SERVICE NOTIFICATIONS RECEIVED BY ARTA UNDER THE PUBLIC TRANSPORT MANAGEMENT ACT 2008 ................................................................................................................................................... 12 1.5. PUBLIC TRANSPORT CONCESSIONARY FARE SCHEME (CFS) ................................................................................... 14 1.6. AUCKLAND TOTAL MOBILITY SCHEME ........................................................................................................................ 14 1.7. TRAVEL PLANNING ........................................................................................................................................................... -

For Personal Use Only

5 May 2017 NZ Bus consolidates its Wellington bus operations NZ Bus confirms it has not been selected as a preferred tenderer for the three units of the Wellington city contracts it participated in for bus services in Wellington. There were nine units in total that were tendered by Greater Wellington Regional Council (GWRC) under the Public Transport Operating Model (PTOM). The result of the Wellington tender process is consistent with Infratil’s recent market messaging on the expected future scale of the NZ Bus business and earnings guidance. The preferred tenderers were Tranzit (NZ) who won eight of the nine units tendered and UZABUS who won one unit. GWRC has confirmed the four Directly Appointed Units (DAUs) in Wellington city that NZ Bus retains as incumbent operator, which enables NZ Bus to focus on its Go Wellington services. These units are subject to price negotiation. Under PTOM, a proportion of contracts are openly tendered while others are renewed with incumbent bus operators following direct negotiation. NZ Bus did not tender for the Hutt Valley contracts, and undertook consultation with staff before it made this decision. Zane Fulljames, CEO of NZ Bus, said the company had to make strategic decisions about which PTOM tenders to bid for, on top of the DAUs, in the context of GWRC’s PTOM guideline that specified that no one bus operator is permitted to hold more than 60% of all services in the region. “Given that NZ Bus currently holds contracts for over 80% of all bus services in the region, it was inevitable that we would hold fewer contracts at the conclusion of the PTOM tender process. -

Fare Media Transition Plan – Bus

Integrated Fares and Ticketing (IFT) Fare Media Transition Plan – Bus Bus fare products and media Amended with the fare changes to be implemented from 2018 21 February 2018 Disclaimer This document is current as at the date on its cover and may be updated from time to time jointly by GWRC and operators of Metlink services, as required. CHANGE HISTORY AND APPROVAL The following Change History log contains a record of changes made to this document. PUBLISHED/ VERSION# AUTHOR (OPTIONAL) SECTION / NATURE OF CHANGE REVISED DATE 15 June 2017 01 Reza Chalabianlou Draft for internal review Reza Chalabianlou Updated to reflect proposed fare package 7 September 2017 02 Andrew Macbeth and staggered implementation Amended with the final fare package for 25 October 2017 06 Reza Chalabianlou consideration by the Transition Group Finalised following endorsement by the 11 December 2017 07 Reza Chalabianlou Transition Board on 10/11/2017 21 February 2018 08 Reza Chalabianlou Additional change for Beneficiary pass RESPONSIBILITY ASSIGNMENT (RACI) APPROVER NAME TITLE & DEPARTMENT SIGNATURE & DATE Wayne Hastie GM, Public Transport RESPONSIBILITY TITLE & DEPARTMENT SIGNATURE & DATE Paul Kos Manager, Public Transport Planning CONSULTED (List Titles / Names) Transition board of the Public Transport Transformation Programme (PTTP) Transition Board governance INFORMED (List Titles / Names) Responsible This is the person responsible for preparing the policy, service or procedure and facilitating / coordinating the communications around it. They can also be an approver. This is the person/s accountable for approving project outcomes so they are therefore Accountable approving that this policy, service or procedure meets their requirements. This can be multiple parties from an approval perspective; however, accountability is generally a single person.