India Market ‐ Trading Opportunities & Considerations (Part

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Elixir Journal

50958 Garima saxena and Rajeshwari kakkar / Elixir Inter. Law 119 (2018) 50958-50966 Available online at www.elixirpublishers.com (Elixir International Journal) International Law Elixir Inter. Law 119 (2018) 50958-50966 Performance of Stock Markets in the Last Three Decades and its Analysis Garima saxena and Rajeshwari kakkar Amity University, Noida. ARTICLE INFO ABSTRACT Article history: Stock market refers to the market where companies stocks are traded with both listed Received: 6 April 2018; and unlisted securities. Indian stock market is also called Indian equity market. Indian Received in revised form: equity market was not organized before independence due to the agricultural conditions, 25 May 2018; undeveloped industries and hampering by foreign business enterprises. It is one of the Accepted: 5 June 2018; oldest markets in India and started in 18th century when east India Company started trading in loan securities. During post-independence the capital market became more Keywords organized and RBI was nationalized. As we analyze the performance of stock markets Regulatory framework, in the last three decades, it comes near enough to a perfectly aggressive marketplace Reforms undertaken, permitting the forces of demand and delivers an inexpensive degree of freedom to Commodity, perform in comparison to other markets in particular the commodity markets. list of Deposit structure, reforms undertaken seeing the early nineteen nineties include control over problem of Net worth, investors. capital, status quo of regulator, screen primarily based buying and selling and threat management. Latest projects include the t+2 rolling settlement and the NSDL was given the obligation to assemble and preserve an important registry of securities marketplace participants and experts. -

An Observational Study on Financial Jungle with Sharekhan As Your Guide

SUMMER TRAINING PROJECT REPORT SHAREKHAN LTD. Submitted in partial fulfillment of the requirement of Bachelor of Business Administration (BBA) Guru Jambeshwar University, Hissar AN OBSERVATIONAL STUDY ON FINANCIAL JUNGLE WITH SHAREKHAN AS YOUR GUIDE Training Supervisor Submitted By: MR. RAVI VERMA ANUJ DIWAKAR (AREA ASSISTANT MANAGER) (2007-2010) ROLL NO: 07511242131 Session (2007-2010) GURU JAMBESHWAR UNIVERSITY HISSAR-125001 PREFACE No professional curriculum is considered complete without work experience. It is well evident that work experience is an indispensable part of every professional course. In the same manner practical work in any organization is must for each an every individual, who is undergoing management course. Without the practical exposure one cannot consider himself as a qualified capable manager. Entering in the organization is like stepping into altogether a new world. At first, everything seems strange and unheard but as the time passes one can understand the concept and working of the organization thereby develop professional relationship. Initially I felt that as if classroom study was irrelevant and it is useless in any working concern. But gradually I realized that all fundamental basic concepts studied are linked in one or in another way to the organization. But how and what can be done with fundamentals, depend upon the intellectual and applicability skills of an individual. During my summer training, a specific customer survey was assigned to me which helped me to have a full market exposure. This project helped me to understand and cope up with different types of people and there diversified opinions or needs. ACKNOWLEDGEMENT The completion of my summer training and project would not have been possible without the constant and timely encouragement of MR. -

CSE-BS-2016.Pdf

Corporate Information Chairman Registered Office Mr Bhaskar Sen 7, Lyons Range Public Interest Director Kolkata ‐ 700 001 Registrar & Share Transfer Agents Managing Director & CEO C B Management Services (P) Limited Mr. Subrato Das (w.e.f. 20/05/2016) P‐22, Bondel Road, Kolkata ‐ 700 019 Tel. (033) 40116726 Public Interest Directors Dr. Bhaskar Banerjee Bankers Prof. Partha Ray Axis Bank HDFC Bank Limited United Bank of India Auditors Shareholder Directors S.R. Batliboi & Co. LLP Mr. Ravi Poddar Chartered Accountants Mr. Sanjay Budhia Mr. Mohan Goenka Internal Auditors Mr. Purushoam Saraf Singhi & Co. Chartered Accountants Solicitors Victor Moses & Co. Sinha & Co. Ninety-three Annual General Meeting Day : Thursday Date : September 29th, 2016 Venue : Stock Exchange Building, 7 Lyons Range, Kolkata ‐ 700001 Time : 4.30 pm Book‐Closure : September 23rd, 2016 to September 29th, 2016 (Both days inclusive) CONTENTS Directors' Report ... 3 Management Discussion … 22 Report on Corporate Governance ... 26 Cerficate on Corporate Governance ... 34 Independent Auditors' Report ... 35 Financial Statements ... 42 Independent Auditors’ Report on consolidated financial statements ... 74 Statements relang to Subsidiary Company ... 79 Board of Directors The Calcutta Stock Exchange Limited Bhaskar Sen Chairman, Public Interest Director Dr. Bhaskar Banerjee Prof. Partha Ray Public Interest Director Public Interest Director Ravi Poddar Sanjay Budhia Mohan Goenka Purushottam Saraf Shareholder Director Shareholder Director Shareholder Director Shareholder Director Subrato Das Managing Director & CEO ANNUAL REPORT 2015-16 NOTES TO FINANCIAL STATEMENTS AS AT AND FOR THE YEAR ENDED MARCH 31, 2016 DIRECTORS’ REPORT 1. Audited Results : 1.1 Financial Highlights During the year under review : Dear Shareholders, The total income of the Exchange on a stand‐alone basis was Rs. -

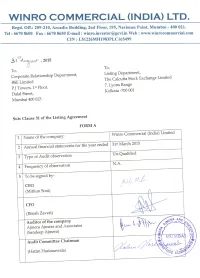

Automatically Generated PDF from Existing Images

WINRO COMMERCIAL (INDIA) LIMITED 32ND ANNUAL REPORT 2014-2015 32nd Annual Report 2014 - 2015 CORPORATE INFORMATION Key Managerial Personnel Hinal Chheda - Company Secretary BOARD OF DIRECTORS Mithun Soni - CEO Ritesh Zaveri - CFO Mr. V. V Sureshkumar Director Mr. Hatim Harianawala Independent Director BANKERS Mrs. Vaishali Dhuri Director HDFC Bank Limited Mr. Ketan Desai Independent Director Punjab National Bank Kotak Mahindra Bank Limited BOARD COMMITTEES Audit Committee REGISTRAR & SHARE TRANSFER AGENT Mr. Hatim Harianawala – Chairman TSR Darashaw Limited Mr. Ketan Desai 6-10, Haji Moosa Patrawala Industrial Mrs. Vaishali Dhuri Estate, 20 Dr. E Moses Road, Stakeholder Relationship Committee Mahalaxmi, Mumbai – 400 011 Mr. Ketan Desai - Chairman Telephone: 66568484, Fax: 66568494 Mr. V. V Sureshkumar Mrs. Vaishali Dhuri REGISTERED OFFICE Nomination & Remuneration Committee 209-210, Arcadia Building, Mr. Hatim Harianawala - Chairman 2nd Floor, Plot No. 195, Mr. Ketan Desai Nariman Point, Mumbai – 400021 Telephone: 022-66708600 Mr. V. V Sureshkumar Fax: 022-66708650 Corporate Social Responsibility Committee WEB SITE: www.winrocommercial.com Mr. Hatim Harianawala - Chairman EMAIL ID: [email protected] Mr. V. V Sureshkumar CIN: L51226MH1983PLC165499 Mrs. Vaishali Dhuri Stock Exchange’s where company’s Shares are listed Risk Management Committee BSE Limited Mr. V. V Sureshkumar- Chairman The Calcutta Stock Exchange Limited Mr. Ketan Desai CONTENTS Page No. Mrs. Vaishali Dhuri Notice 2 Asset Liability Management Committee Mr. V. V Sureshkumar – Chairman Directors’ Report 6 Mr. Ketan Desai Management Discussion Analysis Report 27 Mrs. Vaishali Dhuri Corporate Governance Report 28 Certificate on Corporate Governance 38 STATUTORY AUDITORS M/s Ajmera Ajmera and Associates Code of Conduct Declaration 38 Chartered Accountants CEO and CFO Certification 39 INTERNAL AUDITORS Auditor’s Report 40 M/s. -

Sr No Liquidity Enhancers Registered with BSE Ltd. Market Makers / General Market Participants 3 ASIT C.MEHTA INVESTMENT INTERRMEDIATES LTD

Name of the Members registered with BSE as Liquidity Enhancers as on February, 2016 Sr No Liquidity Enhancers Registered with BSE Ltd. Market Makers / General Market Participants 3 ASIT C.MEHTA INVESTMENT INTERRMEDIATES LTD. MM 6 DIMENSIONAL SECURITIES PVT.LTD. GMP 15 ACK CAPITAL MANAGEMENT PVT.LTD. GMP 18 ASHOK CHANDRAKANT SAMANI GMP 32 ANVIL SHARE & STOCK BROKING PVT.LTD. GMP 42 BCB BROKERAGE PVT.LTD. GMP 44 B.D.SHAH SECURITIES LTD. GMP 59 C.R.KOTHARI & SONS SHARES & STOCK BROKERS PVT.LTD. GMP 62 B.R.JALAN SECURITIES PVT.LTD. MM 66 HSBC Securities & Capital Mkt. Pvt. Ltd. GMP 74 BP EQUITIES PVT.LTD. GMP 84 IDBI CAPITAL MARKETS SERVICES LTD. GMP 89 JOINDRE CAPITAL SERVICES LTD. GMP 103 ICICI SECURITIES LTD. GMP 106 WELLWORTH SHARE & STOCK BROKING LTD. GMP 111 NAVKAR SHARES GMP 117 KMS Stock Broking Co. Private Limed GMP 119 ANTIQUE STOCK BROKING LTD. GMP 120 KEYNOTE CAPITAL GMP 121 EDELWEISS SECURITIES LTD. MM 122 MEHTA EQUITIES PVT. LTD. GMP 126 MAGNUM EQUITY BROKING LTD GMP 130 DSP MERRILL LYNCH LTD. GMP 132 Axis Equities Pvt. Ltd GMP 138 IKAB SECURITIES & INVESTMENT LTD. GMP 139 BALAJI EQUITIES LTD. GMP 144 GANDHI SECURITIES & INVESTMENT PVT LTD GMP 148 DILIP. C.BAGRI GMP 156 ACUMEN CAPITAL MARKET INDIA LTD. GMP 160 PRAGYA SECURITIES PVT.LTD. GMP 162 DALAL & BROACHA STOCK BROKING PVT.LTD. GMP 172 ABHIPRA CAPITAL LTD. GMP 173 DOLAT CAPITAL MARKET PVT.LTD. GMP 176 FORTUNE EQUITY BROKERS (INDIA) LTD. GMP 178 CNB FINWIZ PRIVATE LIMITED MM 179 INDIA INFOLINE LTD. GMP 182 SYSTEMATIX SHARES & STOCKS INDIA LTD. -

Calcutta Stock Exchange Limited Annual Report 2020

Chairman Registered Office Dr. Bhaskar Banerjee 7, Lyons Range, Kolkata – 700 001 Public Interest Director Website: www.cse-india.com Registrar & Share Transfer Agents Public Interest Directors C B Management Services (P) Limited Prof. Ashok Banerjee P-22, Bondel Road, Kolkata – 700 019 Mr. G.D. Gautama, IAS (Retd.) Tel. (033) 40116726 Shareholder Directors Bankers Axis Bank Mr. Purushottam Saraf HDFC Bank Limited United Bank of India Auditors S R Batliboi & Co. LLP Chartered Accountants Internal Auditors Ray & Ray Chartered Accountants Solicitors Avijit Dey, Partners, LLP Sinha & Co. 97th Annual General Meeting Day : Thursday Date : December 31st, 2020 Venue : Via Video Conference Time : 4 pm Directors’ Report ... ... 3 Management Discussion & Analysis ... ... 14 Report on Corporate Governance ... ... 17 Certificate on Corporate Governance ... ... 28 Independent Auditors’ Report ... ... 29 Financial Statements Standalone ... ... 35 Independent Auditors’ Report on Consolidated Financial Statement ... 65 Financial Statements Consolidated ... ... 70 Dr. Bhaskar Banerjee Chairman, Public Interest Director G. D. Gautama Prof. Ashok Banerjee Public Interest Director Public Interest Director Purushottam Saraf Shareholder Director The Calcutta Stock Exchange Limited Annual Report 2019-20 2 The Calcutta Stock Exchange Limited Annual Report 2019-20 DIRECTORS’ REPORT Dear Shareholders, The Board of Directors of The Calcutta Stock Exchange Limited (the ‘Exchange / Company / CSE’) take great pleasure in presenting the 97thAnnual Report for the Financial Year 2019-20 together with the Audited Financial Statements for the year ended 31st March, 2020. Consolidated performance of the Company and its subsidiaries has been referred to wherever required. 1. Audited Results: 1.1 Financial Summary and Highlights for the year under review: The total income of the Exchange on a stand-alone basis was Rs.1652.28Lacs. -

The Calcutta Stock Exchange Limited Phiroze Jeejeebhoy Towers, 7, Lyons Range, Dalhousie, Dalal Street, Murgighata, B B D Bagh, Mumbai-400 001 , Maharashtra

31 st August, 2019 To, To, The Corporate Relations Department The Listing Department BSE Limited The Calcutta Stock Exchange Limited Phiroze Jeejeebhoy Towers, 7, Lyons Range, Dalhousie, Dalal street, Murgighata, B B D Bagh, Mumbai-400 001 , Maharashtra. Kolkata-700001, West Bengal BSE Code: 539143 CSE Code: 30.010 Sub: 26th Annual Report for the financial year 2018-19 Dear Sir/Madam, Pursuant to the provisions of Regulation 34 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, we are pleased to enclose herewith the Annual Report for the 1 financial year 2018-19, along with the Notice of 26 h Annual General Meeting of Panth Infinity Limited. A copy of this Annual Report is also uploaded on the website of the Company and is being dispatched /sent to the members through permitted mode. Kindly take the same on your record. Thanking you, Encl.: As above PANTH INFINITY LIMITED I CIN: L45201MP1993PLC007647 (Formerly known as 'Synergy Bio:con Limited') 0261-2600331 -t-91-70439 99011 [email protected] www.panthinfinity.com Regi5tered Office ; 404, Navneet Plaza, 5/2, Old Palasia, lndore-452001, Madhya Pradesh. I Tel/Fax : 0731-4202337 corporate Office : S- 6, VIP Plaza, VIP Road, Near Shyam Temple. vesu, surat-395007, Gujarat 26 2018 - 19 th 26 Annual Report ǀ 2018-19 COMPANY INFORMATION BOARD OF DIRECTORS Mr. Shwet Koradiya Chairman & Non-Executive Director Ms. Surbhi Mudgal Non-Executive Independent Director Mr. Hitesh Patel Non-Executive Independent Director Mr. Zubin Raja Non-Executive Independent Director (Ceased w.e.f. 07.12.2018) Mr. Jinay Koradiya Additional Director (Appointed w.e.f. -

Bikram-Singh.Pdf

UNIVERSITY OF CALCUTTA ACADEMIC DEPARTMENT FACULTY ACADEMIC PROFILE/ CV 1. Full name of the faculty member: DR. BIKRAM SINGH 2. Designation: ASSOCIATE PROFESSOR 3. Specialisation : ACCOUNTING, FINANCE and STRATEGIC MANAGEMENT 4. Passport size photograph : 5. Contact information : Please provide contact address, email, phone number (optional), etc. 87/1 COLLEGE STREET, KOLKATA 700073: EMAIL: [email protected] 6. Academic qualifications: Please mention here the degrees (graduation onward): College/ university from which the Abbreviation of the degree degree was obtained ST. XAVIER’S COLLEGE, B.COM (H) KOLKATA under UNIVERSITY OF CALCUTTA UNIVERSITY OF CALCUTTA M.COM UNIVERSITY OF CALCUTTA M.PHIL (COMMERCE) UNIVERSITY OF CALCUTTA PH.D. (COMMERCE) 7. Positions held/ holding: Associate Editor, Business Studies, Departmental (Commerce) Journal; Member Of Editorial Review Board, Amity Journal Of Management Research 8. Research interests: Please cite briefly the areas of research interests Quality Management, Small Business, Open Innovation, Quality Circle, CSR, Entrepreneurship Training and Development, Performance Analysis of Companies, Causality, Behavioural Finance, Security Analysis, Job Stress, Dividend Policy, Financial Inclusion, Quality Management In HEIs , Leather Industry, Human Resource Development Strategies, Banking, Financial Frauds Page 1 of 5 9. Research guidance : Number of researchers awarded M.Phil/ Ph.D degrees :M.Phil = 07; Ph.D.= 02 Number of researchers pursuing M.Phil/ Ph.D : M.Phil = 02; Ph.D. = 03 10. Projects : Completed projects : Current projects : 11. Select list of publications: a) Journals: Industry 4 Readiness: Evidences from India, The Management Accountant, The Institute of Cost Accountants Of India, April, 2019, Volume 54, Issue No.4, pp 56-58 Customer’s Perception Towards Service Quality: A Study on Hotels in Kolkata, India, Vicayana, RVIM Journal Of Management Research, 11(1), January to June, 2019, pp. -

Seagate Crystal Reports Activex

Format of holding of specified securities 1.0 Name of Listed Entity: KRITI NUTRIENTS LIMITED 2.0 Scrip Code/Name of Scrip/Class of Security :- 533210 3.0 Share Holding Pattern Filed under: Reg. 31(1)(a)/Reg. 31(1)(b)/Reg.31(1)(c) a. If under 31(1)(b) then indicate the report for Quarter ending 31/03/2018 b. If under 31(1)(c) then indicate date of allotment/extinguishment 4.0 Declaration: The Listed entity is required to submit the following declaration to the extent of submission of information:- Particulars Yes No 1 Whether the Listed Entity has issued any partly paid up shares? NO 2 Whether the Listed Entity has issued any Convertible Securities or Warrants? NO 3 Whether the Listed Entity has any shares against which depository receipts are issued? NO 4 Whether the Listed Entity has any shares in locked-in? NO 5 Whether any shares held by promoters are pledge or otherwise encumbered? NO * If the Listed Entity selects the option ‘No’ for the questions above, the columns for the partly paid up shares, Outstanding Convertible Securities/Warrants, depository receipts, locked-in shares, No of shares pledged or otherwise encumbered by promoters, as applicable, shall not be displayed at the time of dissemination on the Stock Exchange website. Also wherever there is ‘No’ declared by Listed Entity in above table the values will be considered as ‘Zero’ by default on submission of the format of holding of specified securities. 5.0 The tabular format for disclosure of holding of specified securities is as follows:- KRITI NUTRIENTS LIMITED Table I - Summary Statement holding of specified securities 31/03/2018 Categ Category of Nos. -

60 1 1 Ar202021.Pdf

GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED [Corporate Identity Number (CIN) : L99999GJ1962PLC001121] BOARD OF DIRECTORS (As on 11-08-2021) 59TH ANNUAL GENERAL MEETING SHRI ANIL MUKIM Chairman PROF. RAVINDRA DHOLAKIA th Date : 27 September, 2021 SHRI TAPAN RAY Day : Monday SMT. GAURI KUMAR DR. SUDHIR KUMAR JAIN Time : 03.30 p.m. SMT. JAYABEN THAKKAR Through Video Conferencing (“VC”) / Other Audio SHRI PANKAJ JOSHI Visual Means (“OAVM”). SMT. MAMTA VERMA SHRI MUKESH PURI Managing Director EXECUTIVE DIRECTOR (FINANCE) & CFO SHRI V D NANAVATY CONTENTS Page No. EXECUTIVE DIRECTORS Notice ........................................................................02 SHRI S P YADAV SHRI B B BHAYANI Directors' Report ......................................................15 SHRI D B SHAH Business Responsibility Report .............................. 34 SR. VICE PRESIDENTS Management Discussion and Analysis Report ...... 42 SHRI A K JAUHARI SHRI D V PATHAKJEE Corporate Governance Report ................................ 50 SHRI S H PUROHIT SHRI MAYUR GARG Financial Highlights ..................................................70 SHRI S V VARMA Auditors' Report ........................................................71 COMPANY SECRETARY & SR. VICE PRESIDENT (LEGAL) CS V V VACHHRAJANI Balance Sheet ..........................................................80 VICE PRESIDENT / CHIEF Statement of Profit & Loss .......................................82 SHRI H D MEHTA Cash Flow Statement ...............................................83 SHRI J P MANDAVIA -

Balance Sheet 2019-20

Dr. Bhaskar Banerjee Chairman, Public Interest Director G. D. Gautama Prof. Ashok Banerjee Public Interest Director Public Interest Director Purushottam Saraf Shareholder Director The Calcutta Stock Exchange Limited Annual Report 2019-20 2 The Calcutta Stock Exchange Limited Annual Report 2019-20 DIRECTORS’ REPORT Dear Shareholders, The Board of Directors of The Calcutta Stock Exchange Limited (the ‘Exchange / Company / CSE’) take great pleasure in presenting the 97thAnnual Report for the Financial Year 2019-20 together with the Audited Financial Statements for the year ended 31st March, 2020. Consolidated performance of the Company and its subsidiaries has been referred to wherever required. 1. Audited Results: 1.1 Financial Summary and Highlights for the year under review: The total income of the Exchange on a stand-alone basis was Rs.1652.28Lacs. The profit before tax and contribution to Settlement Guarantee Fund and Investors’ Service Fund was Rs.134.86 Lacs. After charging the contribution to Settlement Guarantee Fund and Investors’ Service Fund the loss for the current year Rs.216.73 lacs for the financial year 2019-20. Particulars 2019-20 2018-19 Rs. In Lacs Rs. in Lacs Income: Total Revenue (I) 1652.28 2067.86 Total Expenses (II) 1517.42 1460.75 Profit before Tax (I-II) and contribution to Settlement Guarantee Fund and Investors’ Protection Fund 134.86 607.11 Total tax Expense 41.11 103.36 Profit after Tax and before contribution to Settlement Guarantee Fund and Investors’ Service Fund 93.75 505.75 Contribution to Settlement Guarantee -

June 1, 2021 National Stock Exchange of India Ltd. Exchange

June 1, 2021 National Stock Exchange of BSE Ltd. The Calcutta Stock Exchange India Ltd. Corporate Relationship Dept, Ltd., Exchange Plaza, 5th Floor, 1st Floor, New Trading Wing, 7, Lyons Range, G Block, Bandra-Kurla Complex, Rotunda Building, PJ Towers, Kolkata – 700 001 Bandra East, Mumbai – 400 051 Dalal Street, Mumbai – 400 001 Scrip Code : 10000027 (Demat) Scrip Code: TATACONSUM Scrip Code : 500800 27 (Physical) Sub: Intimation under Regulation 39(3) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 Dear Sir/Madam, Please find enclosed the intimation emails dated May 31, 2021 and June 1, 2021 received from our RTA- TSR Darashaw Consultants Private Limited, providing information regarding loss of share certificates of the Company. The information is being submitted pursuant to Regulation 39(3) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. Yours Sincerely For TATA CONSUMER PRODUCTS LIMITED Neelabja Chakrabarty Company Secretary Encl : as above 11/13 Botawala Building 1st Floor Office No 2-6 Horniman Circle Fort Mumbai 400 001 India Tel: 91-22-6121-8400 | Fax: 91-22-61218499 Registered Office: 1, Bishop Lefroy Road, Kolkata – 700 020 Corporate Identity Number (CIN): L15491WB1962PLC031425 email: [email protected] website: www.tataconsumer.com From: lossint To: Marlene Dmello; Neelabja Chakrabarty; Trevor Fernandes Cc: elvira dsilva Subject: TF-INTIMATION UNDER REGULATION 39(3) TO BE UPLOADED ON NSE/BSE Date: Monday, 31 May, 2021 10:24:05 AM Caution: External Mail - Do not click on links / enter passwords Dear Team, As per the Regulation 39(3) of SEBI (Listing obligations and disclosure requirement), Regulation 2015, we are sending herewith information pertaining to Stop Transfer which we have already noted in our database.