BW LPG Limited and BW Group Limited (As the Selling Shareholder) and No One Else in Connection with the Offer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strong Partnerships

03 2 0 1 7 Q U A R T E R L Y A G A Z I N E O F T H E B W G R O U P MCI(P)115/11/2017 Strong Partnerships H E R I T A G E Editorial Contents 03/2017 Publisher For further information, BW Group please contact: Responsible Editor BW Group Nick Fell 10 Pasir Panjang Road #18-01 Mapletree Business City 04 CHAIRMAN’S MESSAGE 24 Being Well at Sea Managing Editor Singapore 117438 Harnessing technology Lisa Lim + 65 6434 5871 to improve the [email protected] GLOBAL BW physical, mental and Editorial Team social health of crew Alice Tsai Christina Chu Kate Langstrøm 26 BIMCO’s SHIPTERM Sonia Vaswani 10 sets sail at BW Group seminar in Singapore Contributions From Christian Hoppe 10 Another Milestone George Lim Achieved Ivy Yap 06 BW Catcher is officially FEATURE Kamilla Moestue Røstad named at Keppel Shipyard 20 Full Circle Kei Ikeda in Singapore, and the Marita Sandvoll 06 A Win-Win Deal Lives touched 37 years ago hard work continues are reunited at the Oslo office Mukesh Sharan BW, through its shareholding Venu Viswanadha in DHT Holdings Inc, is Yen Siow 16 Company Compass now one of the largest BW aspires to be Best on independent VLCC owners 10 BW Group Fleet Design & Production Water, and much work is Simple Reels Genesis Pte Ltd being done to ensure we 08 BW’s Biggest Deal in are headed that way 28 Around the World 2016 Wins Marine Money Deal of the Year Award BW Gas JuJu LNG Ltd.’s 33 Special thanks to .. -

Hafnia Prospectus (2020)

IMPORTANT NOTICE (FOR ELECTRONIC DELIVERY) THE ATTACHED PROSPECTUS IS AVAILABLE ONLY TO INVESTORS WHO ARE EITHER: (1) QIBS (AS DEFINED BELOW) UNDER RULE 144A; OR (2) OUTSIDE THE UNITED STATES IMPORTANT: You must read the following before continuing. The following applies to the attached prospectus (the “Prospectus”) relating to Hafnia Limited (the “Company”). You are advised to read this carefully before reading, accessing or making any other use of the Prospectus. In accessing the Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached Prospectus is intended for you only and you agree you will not forward this electronic transmission or the attached Prospectus to any other person. THE SHARES IN THE COMPANY HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR WITH ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE OF THE UNITED STATES, OR UNDER THE APPLICABLE SECURITIES LAWS OF AUSTRALIA, CANADA, HONG KONG OR JAPAN. SUBJECT TO CERTAIN EXCEPTIONS, THE SHARES MAY NOT BE OFFERED OR SOLD WITHIN AUSTRALIA, CANADA, HONG KONG, JAPAN OR THE UNITED STATES. THE ATTACHED PROSPECTUS MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER. ANY FORWARDING, DISTRIBUTION OR REPRODUCTION OF THIS DOCUMENT IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE SECURITIES ACT OR THE APPLICABLE LAWS OF OTHER JURISDICTIONS. -

Prospectus (Pdf)

IMPORTANT NOTICE (FOR ELECTRONIC DELIVERY) THE ATTACHED PROSPECTUS IS AVAILABLE ONLY TO INVESTORS WHO ARE EITHER: (1) QIBS (AS DEFINED BELOW) UNDER RULE 144A; OR (2) OUTSIDE THE UNITED STATES IMPORTANT: You must read the following before continuing. The following applies to the attached prospectus (the “Prospectus”) relating to BW Energy Limited (the “Company”). You are advised to read this carefully before reading, accessing or making any other use of the Prospectus. Recipients of this electronic transmission who intend to subscribe for or purchase Offer Shares are reminded that any subscription or purchase may only be made on the basis of the information contained in the Prospectus. In accessing the Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached Prospectus is intended for you only and you agree you will not forward this electronic transmission or the attached Prospectus to any other person. THE OFFER SHARES IN THE COMPANY HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR WITH ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE OF THE UNITED STATES, OR UNDER THE APPLICABLE SECURITIES LAWS OF AUSTRALIA, CANADA, HONG KONG OR JAPAN. SUBJECT TO CERTAIN EXCEPTIONS, THE OFFER SHARES MAY NOT BE OFFERED OR SOLD WITHIN AUSTRALIA, CANADA, HONG KONG, JAPAN OR THE UNITED STATES. DNB MARKETS, A PART OF DNB BANK ASA AND PARETO SECURITIES AS ARE ACTING AS JOINT GLOBAL COORDINATORS AND JOINT BOOKRUNNERS IN THE OFFERING ("THE JOINT GLOBAL COORDINATORS"). -

Bergesen Worldwide Gas ASA (BW Gas) Bond Issue Prospectus

Bergesen Worldwide Gas ASA (BW Gas) Bond Issue Prospectus Registration document Joint Book Runners Oslo, August 14, 2006 BW Gas ASA Prospectus of August 14, 2006 Table of contents: 1. Risk factors ............................................................................................................................................................. 3 2. Definitions .............................................................................................................................................................. 4 3. Persons responsible ................................................................................................................................................ 5 4. Statutory Auditors .................................................................................................................................................. 6 5. Information about the Issuer .................................................................................................................................. 7 6. Business overview.................................................................................................................................................. 9 7. Organizational structure ....................................................................................................................................... 19 8. Trend information................................................................................................................................................. 21 9. Forecasts or -

BW LPG Corporate Presentation Singapore

25 Feb 2019 Disclaimer and Forward-looking Statements This presentation is not for release, publication or distribution (directly or indirectly) in or to the United States, Canada, Australia or Japan. It is not an offer of securities for sale in or into the United States, Canada, Australia, the Hong Kong Special Administrative Region of the People's Republic of China, South Africa or Japan. • This presentation has been produced by BW LPG Limited (“BW LPG”) exclusively for information purposes. This presentation may not be reproduced or redistributed, in whole or in part, to any other person. • Matters discussed in this presentation and any materials distributed in connection with this presentation may constitute or include forward–looking statements. Forward–looking statements are statements that are not historical facts and may be identified by words such as “anticipates”, “believes”, “continues”, “estimates”, “expects”, “intends”, “may”, “should”, “will” and similar expressions, such as “going forward”. These forward–looking statements reflect BW LPG’s reasonable beliefs, intentions and current expectations concerning, among other things, BW LPG’s results of operations, financial condition, liquidity, prospects, growth and strategies. Forward–looking statements include statements regarding: objectives, goals, strategies, outlook and growth prospects; future plans, events or performance and potential for future growth; liquidity, capital resources and capital expenditures; economic outlook and industry trends; developments of BW LPG’s markets; the impact of regulatory initiatives; and the strength of BW LPG’s competitors. Forward–looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. -

Standard Chartered Closes Three Shipping Deals in Excess of USD1.6 Billion

Standard Chartered closes three shipping deals in excess of USD1.6 billion USD350 million loan to National Shipping Company of Saudi Arabia USD572 million term loan to Reliance Group of India USD684.5 million loan to BW Gas JuJu LNG Limited 17 January 2017, Dubai, UAE – Standard Chartered is pleased to announce the completion of three shipping finance deals for clients in Asia and the Middle East. These transactions highlight Standard Chartered’s strengths in advising and structuring optimal solutions for clients, its continued commitment to the shipping industry and in particular, continued commitment to clients and the shipping community in the Middle East. In November last year, the Bank leveraged its strong expertise in shipping finance and Islamic financing to structure the USD350 million senior secured Murabaha facility for National Shipping Company of Saudi Arabia (“Bahri”). This facility will be used by Bahri to finance the construction and delivery of five Very Large Crude Carriers (VLCCs), which will be delivered in early 2018. As the exclusive carrier of Saudi Aramco’s crude oil sold on a delivered basis, Bahri will use these VLCCs to transport crude oil to the Americas, South Asia and Far East. This was a landmark shipping transaction in the Middle East for 2016, where Standard Chartered led as bookrunner, mandated lead arranger, investment agent and account bank with participation from three other banks. Standard Chartered also closed a USD572 million senior secured term loan facilities to subsidiaries of Reliance Group (“Reliance”) closed in October 2016 will finance six units of Very Large Ethane Gas Carriers. -

2 0 1 9 B I a N N U

2H 2 0 1 9 BL Editorial Publisher For further information, BW Group please contact: Responsible Editor BW Group Nick Fell 10 Pasir Panjang Road #18-01 Mapletree Business City Managing Editor Singapore 117438 Lisa Lim + 65 6434 5871 [email protected] Editorial Team Christina Chu Julia Moreau Nadia van Dam Una Holmen Zachary Mahon Contributions From Abuhasan Sahibjan Alexis Wong Anders Bohm Bradley Pereira Charles Maltby Francis P. Marañon Geoff Pearson Ivy Yap Kamilla Moestue Røsted Michael Rasmussen Michael Smyth Mikael Smyth Miriam Basco Perry van Echtelt Seah Zhi Hui Thomas Andersen Uta Urbaniak Design & Production Simple Reels Genesis Pte Ltd Contents 2H/2019 02 CHAIRMAN’S MESSAGE 13 IN THE SPOTLIGHT 26 COOKING FOR LIFE World Horizon speaks with BW LPG supports the World Charles Maltby, CEO of Epic Gas LPG Association’s push to improve the lives of billions of people though use of cleaner-burning fuels such 15 as LPG for cooking 04 28 04 RINGING THE BELL Hafnia successfully lists as one of the largest shipping companies 15 NAVIGATING THE AMAZON RIVER on the Oslo Stock Exchange World Horizon explores the unique challenges of delivering energy via one of the world’s most 07 ALL OARS IN THE WATER famous rivers ENERGY DELIVERED World Horizon speaks with 28 Michael Rasmussen, BW thanks the British Navy and General Manager of Hafnia Pools, international coalition forces on fleet reorganization efforts 20 for supporting the global at Hafnia transportation of energy during troubled times 30 EVALUATING A CARBON LEVY 09 Could a carbon levy in shipping be an effective way to help reach the IMO greenhouse gas reduction 20 RUNNING THE goals? - A White Paper produced SUSTAINABILITY MARATHON by BHP, BW, DNB and DNV GL for BW takes steps across Affiliates the 2019 Global Maritime Forum to reduce our impact on the environment 38 AROUND THE WORLD 09 DIGITAL LIGHTHOUSE Taking small, cumulative steps 43 SPECIAL THANKS TO .. -

BW Offshore Limited, Prospectus of 24 August 2015

BW Offshore Limited, prospectus of 24 August 2015 Registration Document BW Offshore Limited Registration Document Bermuda, 24 August 2015 Joint Lead Managers: 1 of 42 BW Offshore Limited, prospectus of 24 August 2015 Registration Document Important information The Registration Document is based on sources such as annual reports and publicly available information and forward looking information based on current expectations, estimates and projections about global economic conditions, the economic conditions of the regions and industries that are major markets for the Company's (including subsidiaries and affiliates) lines of business. A prospective investor should consider carefully the factors set forth in chapter 1 Risk factors, and elsewhere in the Prospectus, and should consult his or her own expert advisers as to the suitability of an investment in the bonds. This Registration Document is subject to the general business terms of the Joint Lead Managers, available at their respective websites. The Joint Lead Managers and/or affiliated companies and/or officers, directors and employees may be a market maker or hold a position in any instrument or related instrument discussed in this Registration Document, and may perform or seek to perform financial advisory or banking services related to such instruments. The Joint Lead Managers’ corporate finance department may act as manager or co-manager for this Company in private and/or public placement and/or resale not publicly available or commonly known. Copies of this Registration Document are not being mailed or otherwise distributed or sent in or into or made available in the United States. Persons receiving this document (including custodians, nominees and trustees) must not distribute or send such documents or any related documents in or into the United States. -

Leading the Way Key Financial and Operational Data 2013 2012 US$’000 US$’000

BW LPG AnnuAl RepoRt 2013 leAding the WAy Key finanCial and operational data 2013 2012 US$’000 uS$’000 Revenue 449,248 377,859 tCe income 288,732 223,918 operating profit before depreciation, amortisation and impairment 136,183 96,406 operating profit/(loss) 131,173 (16,714) profit/(loss) for the financial year 125,710 (20,149) Cash and cash equivalents 110,907 22,221 Borrowings* 608,589 200,790 total assets 1,631,413 1,119,621 total liabilities 656,684 1,115,201 earnings per share 0.92 not comparable ROE 12.9% not comparable RoCe 9.2% not comparable lGC lGC 17% 15% 2013 eBITDA** 2013 tCe by segment by segment VlGC VlGC 83% 85% notes * Borrowings: Borrowings - non-current 503,362 64,751 Borrowings - current 105,227 136,039 total Borrowings 608,589 200,790 ** eBitdA excludes costs not allocated directly to segments Contents 01 the LPG Value Chain / 03 Vision, Mission, Quality / 04-05 IPO highlights / 06 Chairman’s Statement / 07 CEO’s letter / 08-09 Market and Business Report / 10-11 health, Safety, Security, environment and Quality / 12-14 Senior Management / 15-17 Shareholder information / 18-19 Corporate Social Responsibility / 20-21 Risk Management / 23-25 Board of directors’ Report / 26-29 Board of directors / 31-38 Corporate governance / 103-104 BW LPG’s Fleet list / 105-106 glossary of Shipping terms Annual Report 2013 01 tHe lpG Value chain BW LPG is the leading owner / operator of Very large gas Carriers, which are particularly well suited to high-volume long- distance upstream transportation of liquid petroleum gases (‘LPG’). -

Prospectus Rights Issue 2016

PROSPECTUS BW OFFSHORE LIMITED (An exempted company limited by shares incorporated under the laws of Bermuda) Rights Issue of 8,559,810,000 Offer Shares at a Subscription Price of NOK 0.10 per Offer Share with Subscription Rights for Existing Shareholders Subscription Period for the Rights Issue: From 1 July 2016 to 16:30 hours (CET) on 15 July 2016 Trading in Subscription Rights: From 1 July 2016 to 16:30 hours (CET) on 13 July 2016 The information in this prospectus (the "Prospectus") relates to an underwritten rights issue (the "Rights Issue") by BW Offshore Limited (the "Company" or "BW Offshore"), an exempted company limited by shares incorporated under the laws of Bermuda (together with its consolidated subsidiaries, the "Group") and the listing on Oslo Børs, a stock exchange operated by Oslo Børs ASA (the "Oslo Stock Exchange"), of 8,559,810,000 new common shares in the Company with a par value of USD 0.01 each (the "Offer Shares") issued at a subscription price of NOK 0.10 per Offer Share (the "Subscription Price"). The shareholders of the Company as of 28 June 2016 (and being registered as such in the Norwegian Central Securities Depository (the "VPS") on 30 June 2016 pursuant to the two days' settlement procedure (the "Record Date")) (the "Existing Shareholders"), will be granted transferable subscription rights (the "Subscription Rights") in the Rights Issue that, subject to certain limitations based on applicable laws and regulations, provide preferential rights to subscribe for, and be allocated, Offer Shares at the Subscription Price. The Subscription Rights will be registered on each Existing Shareholder's VPS account. -

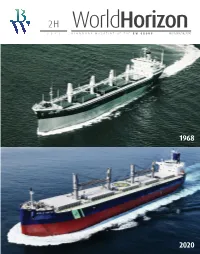

2 0 2 0 B I a N N U

2H 2 0 2 0 BIANNUAL 1968 2020 Editorial Publisher For further information, BW Group please contact: Responsible Editor BW Group Nick Fell 10 Pasir Panjang Road #18-01 Mapletree Business City Managing Editor Singapore 117438 Zachary Mahon + 65 6337 2133 [email protected] Editorial Team Julia Moreau Lisa Lim Marita Sandvoll Una Holmen Contributions From Andreas Beroutsos Billy Chiu Christian Bonfils Edmer Preter Pelagio Jon Harald Kilde Jostein Vaagland Mary Grace Mangahas Michael Smyth Mike Brugge Neeraj Bhatt Rod Macleod Tai Nguyen Design & Production Simple Reels Genesis Pte Ltd Contents 2H/2020 02 CHAIRMAN’S MESSAGE 12 19 04 12 A STIFF TAILWIND 19 DUCTOR: WASTE TO ENERGY BW invests in Cadelar, a leading BW invests in the circular economy 04 CLEAN SAILING wind turbine installation company with biogas and organic fertiliser The world’s first Very Large Gas Carrier to be powered by Liquefied Petroleum Gas is set to make waves 14 22 14 CIAO TO SÃO VICENTE 22 DEALING WITH THE GLOBAL 07 Celebrating over 40 years CREW CHANGE CRISIS of history, BW Offshore’s World Horizon speaks with 07 WEATHERING THE STORM BW Cidade de São Vicente has Captain Bhatt and Captain Pelagio BW Offshore’s FPSO BW Pioneer completed her assignment to understand how they and evades Hurricane Laura for Petrobras their crews have coped with the effects of the COVID pandemic 17 ANTI-BRIBERY & ANTI-CORRUPTION 25 IN THE SPOTLIGHT: “Don’t ask. We will not pay” TAI NGUYEN AND MIKE BRUGGE World Horizon speaks with Tai Nguyen and Mike Brugge, co-founders of BW Solar 10 28 AROUND THE WORLD 10 PATIENCE IS A VIRTUE 36 SPECIAL THANKS TO .. -

2 0 1 Quaaazineofthe Mci(P)

02 2 0 1 8 Q U A R T E R L Y A G A Z I N E O F T H E B W G R O U P MCI(P)023/11/2017 H E R I T A G E Editorial Publisher For further information, BW Group please contact: Responsible Editor BW Group Nick Fell 10 Pasir Panjang Road #18-01 Mapletree Business City Managing Editor Singapore 117438 Lisa Lim + 65 6434 5871 [email protected] Editorial Team Christina Chu Roy Por Tay Xiu Yi Una Holmen Contributions From Ivy Yap Kamilla Moestue Rostad Kasper Winroth Lin Espey Marita Sandvoll Martin Ackermann Mukesh Sharan Petrina Lau Petter Larsson Rosalinda Cruz Sarah Soon Seah Zhihui Surajit Chanda Tina Revsbech Design & Production Simple Reels Genesis Pte Ltd Contents 02/2018 04 CHAIRMAN’S MESSAGE 06 BW GROUP FLEET GLOBAL BW 06 SAILING A TREASURE TO DUSSAFU BW Adolo, or “treasure” in native Gabonese language, will sail to the Dussafu oil field 16 in Southern Gabon in 2Q 2018 16 CONTRIBUTING TO GLOBAL 10 12 FOCUSED ON DELIVERING GOALS FOR SUSTAINABILITY BEST ON WATER BW LPG delivers clean BW Tankers holds a global energy in an environmentally IN THE SPOTLIGHT meeting to ensure full alignment challenged world 10 LIN, ESPEY across departments Managing Director of BW Energy 24 AROUND THE WORLD 30 SPECIAL THANKS TO ... 20 14 20 A GOOD DAY AT SEA 14 CELEBRATING 30 YEARS BW thanks all crew for their IN THE PHILIPPINES dedication to the company BW Shipping Philippines remains a key pillar of support for crew and company 4 World Horizon Issue 02/2018 Chairman’s Message World Horizon Issue 02/2018 5 special feature of the maritime This is as it should be.