The OFT's Decision on Reference Under Section 33(1) Given on 6 October 2011

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Cinema Media Guide 2017

Second Edition THE CINEMA MEDIA GUIDE 2017 1 WELCOME TO OUR WORLD CONTENTS. Our vision 1 ABC1 Adults 41 Foreword 2 War for the Planet of the Apes 43 Fast facts 3 Dunkirk 44 The cinema audience 5 American Made 45 The WOW factor 6 Victoria and Abdul 46 Cinema’s role in the media mix 7 Goodbye Christopher Robin 47 Building Box Office Brands 8 Blade Runner 2049 48 The return on investment 9 The Snowman 49 How to buy 11 Murder on the Orient Express 50 Buying routes 12 Suburbicon 51 Optimise your campaign 16 16-34 Men 53 Sponsorship opportunities 17 Spider-Man: Homecoming 55 The production process 19 Atomic Blonde 56 Our cinemas 21 The Dark Tower 57 Our cinema gallery 22 Kingsman: The Golden Circle 58 Cineworld 23 Thor: Ragnarok 59 ODEON 24 Justice League 60 Vue 25 16-34 Women 61 Curzon Cinemas 26 The Beguiled 63 Everyman Cinemas 27 It 64 Picturehouse Cinemas 28 Flatliners 65 Independents 29 A Bad Mom’s Christmas 66 2017 films by audience Mother! 67 Coming soon to a cinema near you 31 Pitch Perfect 3 68 Adults 33 Main Shoppers with Children 69 Valerian and the City of Cars 3 71 a Thousand Planets 35 Captain Underpants: The First Epic Movie 72 Battle of the Sexes 36 The LEGO Ninjago Movie 73 Paddington 2 37 My Little Pony: The Movie 74 Daddy’s Home 2 38 Ferdinand 75 Star Wars: The Last Jedi 39 Coming in 2018 77 Jumanji: Welcome to the Jungle 40 OUR VISION. FOREWORD. -

The Changing Meanings of the 1930S Cinema in Nottingham

FROM MODERNITY TO MEMORIAL: The Changing Meanings of the 1930s Cinema in Nottingham By Sarah Stubbings, BA, MA. Thesis submitted to the University of Nottingham for the degree of Doctor of Philosophy, August 2003 c1INGy G2ýPF 1sinr Uß CONTENTS Abstract Acknowledgements ii Introduction 1 PART ONE: CONTEMPORARY REPORTING OF THE 1930S CINEMA 1. Contested Space, Leisure and Consumption: The 1929 36 Reconstruction of the Market Place and its Impact on Cinema and the City 2. Luxury in Suburbia: The Modern, Feminised Cinemas of 73 the 1930s 3. Selling Cinema: How Advertisements and Promotional 108 Features Helped to Formulate the 1930s Cinema Discourse 4. Concerns Over Cinema: Perceptions of the Moral and 144 Physical Danger of Going to the Pictures PART TWO: RETROSPECTIVECOVERAGE OF THE 1930S CINEMA 5. The Post-war Fate of the 1930s Cinemas: Cinema Closures - 173 The 1950s and 1960s 6. Modernity and Modernisation: Cinema's Attempted 204 Transformation in the 1950s and 1960s 7. The Continued Presence of the Past: Popular Memory of 231 Cinema-going in the 'Golden Age' 8. Preserving the Past, Changing the Present? Cinema 260 Conservation: Its Context and Meanings Conclusion 292 Bibliography 298 ABSTRACT This work examines local press reporting of the 1930s cinema from 1930 up to the present day. By focusing on one particular city, Nottingham, I formulate an analysis of the place that cinema has occupied in the city's history. Utilising the local press as the primary source enables me to situate the discourses on the cinema building and the practice of cinema-going within the broader socio-cultural contexts and history of the city. -

Acquisition by Terra Firma Investments (GP) 2 Ltd of United Cinemas International (UK) Limited and Cinema International Corporation (UK) Limited

Acquisition by Terra Firma Investments (GP) 2 Ltd of United Cinemas International (UK) Limited and Cinema International Corporation (UK) Limited The OFT's decision on reference under section 22 given on 7 January 2005 PARTIES 1. Terra Firma Investments (GP) 2 Ltd (Terra Firma) manages a number of private equity funds. On 2 September 2004, Terra Firma acquired Odeon Equity Co. Limited (Odeon), the largest cinema exhibitor in the UK, with 95 cinemas. 2. United Cinemas International (UK) Limited and Cinema International Corporation (UK) Limited (collectively UCI) operate multiplex cinemas in the UK. Prior to the merger, UCI was the fourth largest cinema exhibitor in the UK, with 32 cinemas nation-wide. Its UK turnover in the year to 31 December 2003 amounted to £123 million. TRANSACTION 3. On 28 October 2004, Terra Firma acquired sole control of UCI through its wholly-owned subsidiaries. The transaction completed on 28 October 2004. The administrative deadline expires on 7 January 2005. JURISDICTION 4. As a result of this transaction, Terra Firma and UCI have ceased to be distinct. The UK turnover of UCI exceeds £70 million, so that the turnover test in section 23(1)(b) of the Enterprise Act 2002 (the Act) is satisfied. The OFT therefore believes that it is, or may be the case, that a relevant merger situation has been created. RELEVANT MARKET 1 Product market 5. The parties overlap in the supply of cinema exhibition services in the UK, in the acquisition of film exhibition rights from film distributors, and in the provision of facilities for film premieres. -

Anticipated Acquisition by Odeon Cinemas Limited and Cineworld Cinemas Limited of Carlton Screen Advertising Limited

Anticipated acquisition by Odeon Cinemas Limited and Cineworld Cinemas Limited of Carlton Screen Advertising Limited ME/3632/08 The OFT's decision on reference under section 33(1) given on 1 July 2008. Full text of decision published on 17 July 2008. Please note that square brackets indicate figures or text which have been deleted or replaced at the request of the parties for reasons of commercial confidentiality. PARTIES 1. Odeon Cinemas Limited (Odeon) is the UK's largest cinema operator with 108 cinemas (831 screens). Odeon is a subsidiary of Corleone Capital Limited (Corleone) and its ultimate parent company is TFCP Holdings Limited (formerly Terra Firma Capital Partners Holdings Limited), the private equity fund manager. 2. Cineworld Cinemas Limited (Cineworld) is the UK's second largest cinema operator with 72 cinemas (741 screens). It is a subsidiary of Cineworld Group plc whose main shareholder (with 46.8 per cent)1 is Blackstone Capital Partners (Cayman) IV LP. 3. Carlton Screen Advertising Limited (CSA) is a provider of cinema advertising services in the UK. It is a wholly owned subsidiary of ITV plc (ITV), a television broadcaster. 1 As of 5 February 2008. 51.2 per cent of its shares are publicly traded on the London Stock Exchange and two per cent are Management owned. 1 TRANSACTION 4. The proposed transaction will proceed by way of two separate steps. The first is the formation of a 50:50 joint venture (JV) between Odeon and Cineworld.2 The JV will be incorporated as Digital Cinema Media Limited (DCM). 5. The second step is that DCM will acquire CSA from ITV plc for £500,000. -

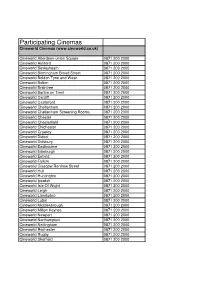

Participating Cinemas 2013 Excel

Participating Cinemas Cineworld Cinemas (www.cineworld.co.uk) Cineworld Aberdeen-union Square 0871 200 2000 Cineworld Ashford 0871 200 2000 Cineworld Bexleyheath 0871 200 2000 Cineworld Birmingham Broad Street 0871 200 2000 Cineworld Boldon Tyne and Wear 0871 200 2000 Cineworld Bolton 0871 200 2000 Cineworld Braintree 0871 200 2000 Cineworld Burton on Trent 0871 200 2000 Cineworld Cardiff 0871 200 2000 Cineworld Castleford 0871 200 2000 Cineworld Cheltenham 0871 200 2000 Cineworld Cheltenham Screening Rooms 0871 200 2000 Cineworld Chester 0871 200 2000 Cineworld Chesterfield 0871 200 2000 Cineworld Chichester 0871 200 2000 Cineworld Crawley 0871 200 2000 Cineworld Didcot 0871 200 2000 Cineworld Didsbury 0871 200 2000 Cineworld Eastbourne 0871 200 2000 Cineworld Edinburgh 0871 200 2000 Cineworld Enfield 0871 200 2000 Cineworld Falkirk 0871 200 2000 Cineworld Glasgow Renfrew Street 0871 200 2000 Cineworld Hull 0871 200 2000 Cineworld Huntington 0871 200 2000 Cineworld Ipswich 0871 200 2000 Cineworld Isle Of Wight 0871 200 2000 Cineworld Leigh 0871 200 2000 Cineworld Llandudno 0871 200 2000 Cineworld Luton 0871 200 2000 Cineworld Middlesbrough 0871 200 2000 Cineworld Milton Keynes 0871 200 2000 Cineworld Newport 0871 200 2000 Cineworld Northampton 0871 200 2000 Cineworld Nottingham 0871 200 2000 Cineworld Rochester 0871 200 2000 Cineworld Rugby 0871 200 2000 Cineworld Sheffield 0871 200 2000 Cineworld Shrewbury 0871 200 2000 Cineworld Solihull 0871 200 2000 Cineworld St Helens 0871 200 2000 Cineworld Stevenage 0871 200 2000 Cineworld Wakefield -

City Centre Audio Tour Transcript

Hiding in Plain Sight: City Centre Audio Tour Transcript Tracks Track 1 Introduction & News Theatre Track 2 The Majestic Track 3 City Cinema, Wellington Picture House & Interlude 1: Louis Le Prince Track 4 Briggate Picture House Track 5 Theatre de Luxe Track 6 The Scala Track 7 Theatre Royal Track 8 Empire Palace Theatre Track 9 Paramount Theatre Track 10 The Plaza Track 11 Grand Theatre & Opera House Track 12 Tower Cinema + Interlude 2: Two Lost Cinemas Track 13 The Coliseum & Outroduction Page | 0 Track 1: Introduction & News Theatre Welcome to the Hiding in Plain Sight Leeds City Centre Audio Tour, presented by the Hyde Park Picture House, as part of our heritage lottery funded engagement project. During the tour you will visit the sites of historic cinemas located in Leeds city centre, and we encourage you to look in detail at the buildings, as many of the cinema’s features still exist amongst Leeds’ surprising diversity of beautiful Victorian and Edwardian architecture. As you enjoy the tour, please be aware of your surroundings and of other pedestrians, and please be careful of traffic. The tour will take roughly 1 – 1 ½ hours and is at ground level throughout. As we tour around the city centre, there are many places to stop and have a break if you wish. Let’s go and visit our first cinema! You should now be standing just inside Leeds Station entrance to the south side of City Square, next to the doors at the very end of the main concourse, by the News Theatre. At one time there were over 60 different cinemas in central Leeds. -

3-6 AUGUST 2020 #Cineeurope Why

3-6 CONVENTION AUGUST TRADE SHOW 2020 CENTRE CONVENCIONS INTERNACIONAL BARCELONA (CCIB) CINEEUROPE.NET OFFICIAL CORPORATE SPONSOR Network With Worldwide Industry 2020 Leaders. The 29th Edition of CineEurope prom- ises to bring you another year with the very best in exclusive studio screenings and product presentations from Holly- wood and European studios, cinematic technologies and innovations, and edu- cational seminars to keep your business up-to-date on the latest industry trends. Network with over 3,500+ industry peers from distribution and exhibition to tech- nology and concessions, and discover . new methods of driving attendance and increasing your ROI for 2020. Produced by The Film Expo Group, CineEurope is the official convention “ of the International Union of Cinemas (UNIC), an international trade associ- ation representing cinema operators and their national associations across 38 European territories whose focus is to promote the social, cultural and eco- nomic value of cinemas in Europe and internationally. 3-6 AUGUST 2020 #cineeurope Why Over 3,500+ Industry Members in Attendance . “ JOIN EXHIBITORS FROM 50+ TERRITORIES AROUND THE GLOBE INCLUDING THESE BELOW • AMC Group • Cineworld Group • Nordisk Film Biographer • Cinamon • Empire Cinemas • Odeon Cinemas Group • Cinema City • Karo Film • Omniplex Cinema Group • Cinema Park/Formula Kino • Kinepolis Group • Pathé Cinemas • CinemaxX • Helios SA • Svenska Bio #cineeurope • Cinemaplus • Mars Entertainment • The Space Cinema • Cineplex (CJ CGV Group) • UGC • Cineplexx • Majid Al Futtaim Cinemas • Vue International • Cinépolis • Multikino • CineStar Group • Multiplex Cinemas • 3-6 August 2020 2019 A Look Back at SEMINAR CineEurope 2019 HIGHLIGHTS CineEurope continues to be at the forefront Emerging Global Markets of efforts to explore and showcase the rapid South Africa and the continent as a whole were discussed as an emerging market for the theatre changes and technologies in the industry. -

Article from the Veteran Magazine

FILM FILM TELEVISION TELEVISION HISTORY THEATRE HISTORY THEATRE RADIO RADIO PROJECT PROJECT CELEBRATING 30 YEARS OF THE HISTORY PROJECT JIM WHITTELL EXHIBITOR Interviewer: Sir Sydney Samuelson Date: 6 September 2010 James Whittell recalls his career in the film industry – in particular, working for Odeon Cinemas and becoming its managing director from 1985 to 1990. The full interview can be seen as recorded on video and as transcribed at the British Entertainment History Project website. It has been edited and re-ordered with the approval of Jim Whittell for publication in THE VETERAN. Copyright © The History Project As a trainee manager in the main foyer of the Gaumont Bradford. The Kinematograph Weekly Company of Showmen certificate issued in 1965 when Jim Whittell was at the Odeon Rotherham. y father was the opening manager of the Odeon Harrogate and but as soon as I realised what it was like to be a chemist, I thought, No – I’m Showmanship the Kinematograph Weekly showman certificate, of which I’m happy to say the Odeon Morecambe. He then became the regional manager going to follow my father into the cinema industry. Gone have the days of showmanship. There’s nothing more frustrating to I’ve got one on my wall to this day: a big, beautiful– looking certificate that Mfor Southan Morris’s large independent outfit, in charge of the I went for my interview at the Odeon in Morecambe (the very cinema my me, because I can remember key was the standards of presentation and would name a film that had been promoted in such a way as to win this. -

Odeon Cinemas Limited Held on 7 June 2013

CINEWORLD/CITY SCREEN MERGER INQUIRY Summary of hearing with Odeon Cinemas Limited held on 7 June 2013 Background 1. Odeon Cinemas Limited was primarily involved in film exhibition in the UK, the Republic of Ireland and Europe. 2. Odeon also had a joint-venture relationship with Cineworld through Digital Cinema Media (DCM), which worked with media buyers, clients and the creative community to programme advertising on screen. It had briefly had a small distribution arm in partnership with Sky but had not continued in that business. Business aims and performance measures 3. Odeon encouraged people to spend as much time in the cinema as possible on each visit and monitored spend per customer. It took many opportunities to widen and refresh its retail offer. 4. It might commit to increasing advertising or promotion in order to attract people to films or at times where demand was likely to be slacker. 5. Odeon measured its success in relation to any film in terms of share of revenues but also in terms of share of numbers attending. This was assessed against local catch- ments. Distributors expressed more interest in revenue share than audience share. 6. It was also important how customers rated their experience overall. 7. Advertising revenues normally depended on how many people saw the advertise- ments. Pricing 8. Many customers were not sensitive to ticket prices for the most popular films. For example, some people would want to see a blockbuster in its first weekend regard- less of price. Conversely some would elect not to see certain titles however they were priced. -

AMC Entertainment Holdings, Inc

AMC Entertainment Holdings, Inc. 2020 Annual Report to Stockholders On the following pages you will find our Form 10-K for the fiscal year ended December 31, 2020, but excluding Item 15(b) Exhibits, which have been filed with the Securities and Exchange Commission on March 12, 2021. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 ☒ For the fiscal year ended December 31, 2020 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 ☐ For the transition period from to Commission file number 001-33892 AMC ENTERTAINMENT HOLDINGS, INC. (Exact name of registrant as specified in its charter) Delaware 26-0303916 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) One AMC Way 11500 Ash Street, Leawood, KS 66211 (Address of principal executive offices) (Zip Code) (913) 213-2000 Registrant’s telephone number, including area code: Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Class A common stock AMC New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ☐ ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

CINEEUROPE 2021 — OCTOBER 4-7, 2021 TENTATIVE SCHEDULE of EVENTS – AS of 9/1/2021 SUNDAY, 3 OCTOBER 08.00-18.00 Trade Show

CINEEUROPE 2021 — OCTOBER 4-7, 2021 TENTATIVE SCHEDULE OF EVENTS – AS OF 9/1/2021 SUNDAY, 3 OCTOBER 08.00-18.00 Trade Show Registration 14.00-18.00 Convention Registration MONDAY, 4 OCTOBER 07.30-18.00 Convention Registration 07.30-18.00 Trade Show Registration 08.15-08.45 Coffee & Tea 09.00-11.30 CineEurope Business Sessions** BUSINESS SESSIONS It’s All About Content: The Role of Local Film In 2020, 15 European territories registered a market share for national films of above 25% - a record- as audiences returned during the summer to enjoy the sorely-missed experience of enjoying a film together, on the Big Screen. With the support of local distributors and producers, national films’ market share reached new heights, such as in Denmark (49.4%), Czech Republic (46.4%), France (44.9%), Italy (56.6%), Russia (46.9%) and Poland (50%). Can we expect this trend to last? Will we see a more diverse slate in future? Moderator - Arturo Guillen, EVP & Global Managing Director Comscore María Luisa Gutiérrez, Film Producer Santiago Segura, Film Director & Actor Anders Kjærhauge, CEO, Zentropa Daniela Elstner, Executive Director, Unifrance Olga Zinyakova CEO, KARO CineEurope’s Executive Roundtable In Association with The Boxoffice Company 2021: A different Cinema Landscape? Introductory Remarks - Charlie Rivkin, CEO & Chairman MPA Moderator – Julien Marcel,CEO, The Boxoffice Company Andrew Cripps,President Distribution, Warner Bros. Pictures International Mooky Greidinger,CEO, CineWorld Anna Marsh,CEO, Studiocanal Tim Richards, CEO, VUE International -

Leaflet About Our Theatre, Cinema and Music Hall Collections

Theatre, cinema and music hall collections Islington Local History Centre holds various materials related to local cinemas and theatres. Most photographs and illustrations are exterior views, except in the Sadler’s Wells collection. Islington reference books • Chris Draper, Islington Cinemas and Film Studios, Islington Libraries, 1991. • Eva Griffith. A Jacobean company and its playhouse: The queen's servants at the Red Bull theatre (c. 1605-1619) Cambridge University Press, 2013. • Bill Manley, Islington Entertained, Islington Libraries, 1990. General reference books (refs A786.185, N241 and L4.5) • D F Cheshire, Music Hall in Britain, David & Charles Ltd, 1974. • Robert Elkin, The Old Concert Rooms of London, Edward Arnold Ltd, 1955. • Allen Eyles. Odeon Cinemas: 1: Oscar Deutsch entertains our nation. Biddles Limited, 2002. • Allen Eyles. Odeon Cinemas 2: From J Arthur Rank to the multiplex. BFI, 2005. • S Theodore Felstead, Stars Who Made the Halls: A Hundred Years of English Humour, Harmony and Hilarity, T Werner Laurie Ltd, 1947. • Richard Gray. Cinemas in Britain, Lund Humphries, 2011. • Diana Howard, London Theatres and Music Halls 1850-1950, The Library Association, 1970. • Peter Leslie, A Hard Act to Follow: A Music Hall Review, Paddington Press, 1978. • Jack Read, Empires, Hippodromes and Palaces, The Alderman Press, 1985. • Paul Sheridan, Penny Theatres of Victorian London, Dobson Books Ltd, 1981. • David Trigg. Cinema uniforms: sartorial elegance at the picture palace, Pen2Print, 2014. • Malcolm Webb, The Amber Valley Gazetteer