Lydia Thomas, Producer, BBC Radio 4 – Written Evidence (GAM0004)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gambling Commission Submission to the Australian Online Gambling Review

Gambling Commission submission to the Australian online gambling review Inquiry by Joint Select Committee on Gambling Reform into Interactive Gambling – Further Review of Internet Gaming and Wagering June 2011 Contents 1 Introduction 3 2 The Gambling Commission 3 3 The Gambling Act 2005 4 4 Remote gambling 5 5 The Gambling Act 2005: Definition of gambling 5 6 The Gambling Act 2005: Definition of remote gambling 5 7 Licence Conditions and Codes of Practice 5 8 Remote technical standards 6 9 Betting exchanges 7 10 Developments in remote gambling 7 11 Betting Integrity 10 12 Conclusion 14 2 1 Introduction 1.1 This document provides information in response to questions outlined in the 17 May 2011 annoucement by the Joint Select Committee on Gambling Reform on the further review of internet gaming and wagering. 1.2 The responses to the questions in the paper are covered throughout this document and the following highlights the sections in which the answers can be found: (a) the recent growth in interactive sports betting and the changes in online wagering due to new technologies – covered in section 10 (b) the development of new technologies, including mobile phone and interactive television, that increase the risk and incidence of problem gambling – covered in section 10 (c) the relative regulatory frameworks of online and non-online gambling – covered in sections 2 – 8 (d) inducements to bet on sporting events online – covered in section 7.3 (e) The risk of match-fixing in sports as a result of the types of bets available online, and whether -

Letter to the Gambling Commission

Sarah Gardener Committee of Advertising Practice Executive Director Castle House, 37-45 Paul Street Gambling Commission London EC2A 4LS Telephone 020 7492 2200 Email [email protected] [email protected] www.cap.org.uk 22 October 2020 Dear Sarah Update on CAP and BCAP’s response to the GambleAware research I’m pleased to inform you that CAP and BCAP have today published a consultation proposing significant new restrictions on the creative content of gambling and lotteries advertising. This is an important step in meeting our commitment to respond in full to the emerging findings of the GambleAware research and ensuring that the UK Advertising Codes remain up to date with the evidence base in protecting under-18s and other vulnerable groups. The consultation will run until 22 January and we hope to announce the outcome in the first half of 2021, introducing any changes to the Codes by the end of the year. As well as introducing the consultation, this letter comments on several of the GambleAware recommendations directed at industry or where we have been carrying out policy and enforcement activity separate to the consultation. You’ll be aware that several of the recommendations have been carried over from GambleAware’s Interim Synthesis Report, published in July 2019 Restrictions on adverting volumes We address in the consultation the GambleAware question of whether to strengthen the existing policy (CAP’s ‘25% test’) on where, in non-broadcast media, it is acceptable to place a gambling ad. But, we also note the separate recommendation, directed at industry, to reduce the overall volume of gambling advertising and marketing messages reaching children, young people and vulnerable adults. -

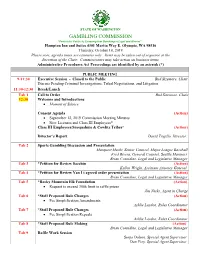

October Packet -Public.Pdf

STATE OF WASHINGTON GAMBLING COMMISSION “Protect the Public by Ensuring that Gambling is Legal and Honest” Hampton Inn and Suites 4301 Martin Way E. Olympia, WA 98516 Thursday, October 10, 2019 Please note, agenda times are estimates only. Items may be taken out of sequence at the discretion of the Chair. Commissioners may take action on business items. Administrative Procedures Act Proceedings are identified by an asterisk (*) PUBLIC MEETING 9-11:30 Executive Session - Closed to the Public Bud Sizemore, Chair Discuss Pending Criminal Investigations, Tribal Negotiations, and Litigation 11:30-12:30 Break/Lunch Tab 1 Call to Order Bud Sizemore, Chair 12:30 Welcome and Introductions • Moment of Silence Consent Agenda (Action) • September 12, 2019 Commission Meeting Minutes • New Licenses and Class III Employees* Class III Employees/Snoqualmie & Cowlitz Tribes* (Action) Director’s Report David Trujillo, Director Tab 2 Sports Gambling Discussion and Presentation Marquest Meeks, Senior Counsel, Major League Baseball Fred Rivera, General Counsel, Seattle Mariners Brian Considine, Legal and Legislative Manager Tab 3 *Petition for Review Saechin (Action) Kellen Wright, Assistant Attorney General Tab 4 *Petition for Review Yan Li agreed order presentation (Action) Brian Considine, Legal and Legislative Manager Tab 5 *Rocky Mountain Elk Foundation (Action) • Request to exceed 300k limit in raffle prizes Jim Nicks, Agent in Charge Tab 6 *Staff Proposed Rule Changes (Action) • Fee Simplification Amendments Ashlie Laydon, Rules Coordinator Tab 7 *Staff Proposed Rule Changes (Action) • Fee Simplification Repeals Ashlie Laydon, Rules Coordinator Tab 8 *Staff Proposed Rule Making (Action) Brian Considine, Legal and Legislative Manager Tab 9 Raffle Work Session Sonja Dolson, Special Agent Supervisor Dan Frey, Special Agent Supervisor Public Comment Adjourn Upon advance request, the Commission will pursue reasonable accommodations to enable persons with disabilities to attend Commission meetings. -

Convention on the Manipulation of Sports Competitions Group Of

Birmingham, 24 January 2019 T-MC(2019)3uk Convention on the Manipulation of Sports Competitions Group of Copenhagen – Network of National Platforms National Platform fact sheet UNITED KINGDOM 1. Administrative issues / State of progress State of Progress Operational. Comprises the Sports Betting Intelligence Unit (SBIU) which was formed in 2010 and the Sports betting Integrity Forum (SBIF) which was formed in 2012. Legal Status No basis in law. Actions deliverable through the UK Anti-Corruption Plan1 and Sports and Sport Betting Integrity Plan (The Plan): The Sports Betting Integrity Forum (SBIF) is responsible for delivery of The Plan. Betting Operators are obliged to report suspicious activity to the SBIU, as part of the License Conditions and Codes (condition 15.1) if it relates to or they suspect may relate to the commission of an offence under the Gambling Act (2005), may lead the Commission to take action to void a bet or is a breach of a Sports Governing Bodies betting rules. Responsible Secretariat The SBIU is part of the wider Commission Betting Integrity Programme. The Commission is an independent non-departmental public body (NDPB) sponsored by the Department for Digital, Culture, Media and Sport (DCMS). The Commission’s work is funded by fees set by DCMS and paid by the organisations and individuals we license The secretariat of the SBIF is undertaken by the Gambling Commission. Contact persons Lorraine Pearman, [email protected]; + 44 7852 429 168 Organizational form and composition of NP (bodies/entities) The Sports Betting Intelligence Unit (SBIU) is a unit within the Gambling Commission which manages reports of betting-related corruption. -

Gambling Industry Code for Socially Responsible Advertising

Gambling Industry Code for Socially Responsible Advertising 2020 September 6th Edition, GAMBLING INDUSTRY CODE FOR SOCIALLY RESPONSIBLE ADVERTISING 6th Edition October 2020 CONTENTS Introduction paras 1-5 Origins and role of the Industry Code paras 6-11 Legislative, licensing & regulatory context paras 12-18 General principles paras 19-20 Social Responsibility messaging paras 21-25 Inclusion of ‘BeGambleAware’ in advertising paras 26-30 Television advertising – watershed paras 31-40 Television advertising – responsible gambling messaging paras 41-43 Television advertising – text & subtitling para 44 Radio messaging para 45 18+ messaging para 46 Online banner advertising para 47 Sports’ sponsorship para 48 Sponsorship of television programmes paras 49-51 Social media – marketing paras 52-55 Promoting consumer awareness parags 56-57 Search activity paras 58 -60 Affiliate activity paras 61-62 Coverage of the Industry Code paras 63-66 Monitoring and review paras 67-68 Checklist para 69/Annex A and Annex B GAMBLING INDUSTRY CODE FOR SOCIALLY RESPONSIBLE ADVERTISING 6th Edition October 2020 GAMBLING INDUSTRY CODE FOR SOCIALLY ORIGINS AND ROLE OF THE INDUSTRY CODE RESPONSIBLE ADVERTISING 6. The Gambling Act 2005 amended some of 1. The Industry Code for Socially Responsible the longstanding advertising restrictions. Advertising (the ‘Industry Code’) was For example, for the first time it permitted originally introduced on 1 September 2007. television advertising for all forms of gambling. Its aim was to provide gambling operators Before that only very few types of gambling with a range of measures that would enhance such as bingo and the National Lottery the social responsibility of their advertising could be advertised in this way. -

Gambling Behaviour in England & Scotland

Gambling behaviour in England & Scotland Headline findings from the Health Survey for England 2012 and Scottish Health Survey 2012 Authors: Carla Seabury and Heather Wardle Date: 15/04/2014 Prepared for: The Gambling Commission Acknowledgements We would like to thank all those colleagues who contributed to creating the combined Health Survey for England (HSE) / Scottish Health Survey (SHeS) dataset and this report. In particular we would like to thank: • Our principal Data Manager Joan Corbett, whose hard work and advice was vital in preparing and creating the combined dataset. • Colleagues Catherine Bromley and Cathy Coshall who helped with advice and support on data issues when needed. • Statisticians, Christos Byron and Kevin Pickering who calculated and produced the weights to calibrate the data. • Other colleagues from the HSE and SHeS teams at NatCen, who provided documents and advice when requested. In addition, our thanks are due staff at the Gambling Commission, in particular that of Fiona Phillip, Marc Hannis and Rebekah Eden. Finally, we thank all the participants who took part in each survey and made this report possible. Carla Seabury, Heather Wardle Contents 1 Introduction ................................................................ 3 Purpose ..............................................................................................................3 Background ..............................................................................................................3 Report conventions .........................................................................................................4 -

Jersey Gambling Commission Annual Report and Accounts 2020

2020 Jersey Gambling Commission Annual Report and Accounts R.129/2021 CONTENTS Chairman’s Statement ................................................................................................................................................................ 2 Chief Executive’s Statement ..................................................................................................................................................... 3 The Board.......................................................................................................................................................................................4 The Executive ............................................................................................................................................................................... 5 Licensing and Regulation ......................................................................................................................................................... 6 Approach to Regulation ............................................................................................................................................................. 6 Regulatory Review 2020 ............................................................................................................................................................. 7 Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) .................................................... 8 Social Responsibility .................................................................................................................................................................. -

The Geography of Gambling Premises in Britain

THE GEOGRAPHY OF GAMBLING PREMISES IN BRITAIN Summary: Nearly three-quarters of consumers say that they would not want gambling premises on their ‘ideal’ high street, and there are concerns from those with lived experience of gambling harms that such venues “prey on those that can’t afford it and have taken over streets in rundown areas and towns”. With the UK Government’s commitment to ‘level-up’ the country, it is therefore important to understand the geography of gambling premises throughout Britain and the extent to which it matches other types of geographical inequalities between areas. The Gambling Commission reports that as of March 2020 there were still over 10,000 gambling premises in Britain – more than the number of stores (9,968) run by the eight largest supermarket chains in the country. This report introduces various academic and grey literature on the geography of gambling premises and also presents new analyses of gambling licensing data from local authorities. We find that: • A long-running trend of gambling premises being more common in deprived areas persists in Britain. As of November 2020, 21% of gambling premises were based within the most deprived decile of areas in the country, compared to just 2% in the least deprived decile. By way of comparison, just 10% of supermarkets were located in the most deprived decile and 7% were in the least deprived decile. • The relationship with deprivation is stronger for ‘family entertainment centres’ (FECs, also commonly called ‘amusement arcades’) – with 34% of such venues located in the most deprived decile. Bingo venues and adult gaming centres (AGCs) also have a strong relationship with deprivation, while it is slightly weaker (but still significant) for casinos and betting shops. -

Online Gambling Harm Inquiry

Report from the Gambling Related Harm All Party Parliamentary Group Online Gambling Harm Inquiry Final Report June 2020 This is not an official publication of the House of Commons or the House of Lords. It has not been approved by either the House or its committees. All Party Parliamentary Groups are informal groups of Members of both Houses with a common interest in particular issues. The views expressed in this report are those of the Group. The research for the report was undertaken by the members of the Group. The report was drafted by Interel the Group Secretariat, the Secretariat is funded by Derek Webb. 1 Table of Contents Introduction p3 Executive Summary p7 Levels of harm in online gambling p23 Dealing with online harm p32 Summary of Recommendations p56 Annex A – Witnesses p66 Annex B – List of Submissions Received p69 Annex C – APPG Committee Members p70 2 All Party Parliamentary Group for Gambling Related Harm Final Report into the Online Gambling Sector Introduction Over the past year, the Gambling Related Harm All Party Parliamentary Group (the APPG) has undertaken an inquiry into the online gambling industry. Our interim report was published in October 2019. This final report is based on evidence given in public inquiry sessions, closed inquiry sessions and on submissions from stakeholders ranging from people who have been harmed by online gambling to online gambling operators themselves. Since the publication of the Interim Report in October, we have continued to hear about the harmful effects that online gambling can have on people, their families and communities. We have met some very courageous women (some mothers with young children) who have come forward to talk publicly about their gambling addiction, some of who are now even facing prison as a result of crimes committed to feed their addictions. -

Report of the Gambling Commission 2006/07 HC

Annual Report and Accounts 2006|07 The Gambling Commission 1 Report of the Gambling Commission 2006/07 Presented pursuant to the Gambling Act 2005 paragraph 16 of Schedule 4 Ordered by the House of Commons to be printed 11 July 2007 HC 680 LONDON: THE STATIONERY OFFICE £18.00 SE/2005/113 (2004/05) The Gambling Commission regulates gambling in the public interest. It does so by keeping crime out of gambling, by ensuring that gambling is conducted fairly and openly, and by protecting children and vulnerable people from being harmed or exploited by gambling. The Commission also provides independent advice to government on gambling in Great Britain. Commissioners 2006/07: Peter Dean CBE Chairman Ben Gunn CBE QPM Bill Knight Rachel Lampard Andrew McIntosh Gill Milburn JP Roy Penrose OBE QPM Eve Salomon Michael Steen OBE Jenny Williams (Chief Executive) Gambling Commission Victoria Square House Victoria Square Birmingham B2 4BP Tel: 0121 230 6500 (switchboard) Tel: 0121 230 6666 (enquiries) Fax: 0121 233 6720 www.gamblingcommission.gov.uk Photography by Bill Knight www.knightsight.co.uk © Crown Copyright 2007 The text in this document (excluding any Royal Arms and departmental logos) may be reproduced free of charge in any format or medium providing that it is reproduced accurately and not used in a misleading context. The material must be acknowledged as Crown copyright and the title of the document specified. Any queries relating to the copyright in this document should be addressed to The Licensing Division, HMSO, St Clements House, 2-16 Colegate, Norwich, NR3 1BQ. Fax: 01603 723000 or e-mail: [email protected]. -

National Strategic Assessment 2020

National Strategic Assessment 2020 Making gambling fairer and safer National Strategic Assessment 2020 Contents Chief Executive’s foreword 03 Executive summary 05 The Person gambling 07 The Place where gambling is occurring 26 The Gambling product 36 The Provider of facilities for gambling 46 Measuring the effectiveness of gambling regulation 57 Covid-19 and its impact on gambling consumers 59 Annex 1: Making gambling safer – a timeline of action 64 BACK 2 NEXT National Strategic Assessment 2020 Chief Executive’s foreword The Gambling Commission was set up under the Gambling Act 2005. We license gambling operators and key personnel. We regulate gambling, by setting the rules of our licensees and ensuring they comply with them, as well as preventing illegal gambling. We advise the Secretary of State about gambling and we provide guidance to local authorities, as premises-based gambling is subject to dual licensing. We also regulate the National Lottery under the National Lottery etc. Act 1993. Our work is always guided by a determination the Person gambling (Chapter one) to make gambling safer and the licensing the Place gambling occurs (Chapter two) objectives are always at the forefront of our minds. The objectives are to: the Products available to customers (Chapter three) Protect children and other vulnerable persons from being harmed or exploited the Provider of facilities for gambling by gambling (Chapter four) Prevent gambling from being a source This assessment also takes account of of crime or disorder, being associated the unprecedented impact of the Covid-19 with crime or disorder or being used pandemic, as it has implications for all four to support crime pillars. -

Statement of Gambling Policy

Sensitivity: PROTECT Statement of Gambling Policy This Gambling Licensing Policy shall take effect from the 31st January 2019 Statement of Gambling Policy 1 (Fifth edition) Sensitivity: PROTECT STATEMENT OF GAMBLING POLICY Gambling Act 2005 (Published for consultation purposes May 2018) Contents Item Part A – General 1. The licensing objectives 2. Introduction 3. Declaration 4. Responsible Authorities 5. The Gambling Commission 6. Interested parties 7. Exchange of information 8. Enforcement 9. Licensing authority functions Part B - Premises licences 1. General Principles 2. Adult Gaming Centres 3. (Licensed) Family Entertainment Centres 4. Casinos 5. Bingo Premises 6. Betting premises 7 Tracks 8. Travelling fairs 9. Provisional Statements 10. Premises Reviews Part C - Permits / Temporary and Occasional Use Notices 1. Unlicensed Family Entertainment Centre gaming machine permits 2. (Alcohol) Licensed premises gaming machine permits 3. Prize Gaming Permits 4. Club Gaming and Club Machines Permits 5. Temporary Use Notices 6. Occasional Use Notices 7. Lotteries 8. Local Authority Lotteries Part D – Small Casino Licence General Principles Casino Application stage 1 Casino Application Stage 2 Process of evaluation Part D – Appendix 1 – Application guidelines; principles of selection General Principles Statement of Gambling Policy 2 (Fifth edition) Sensitivity: PROTECT PART A 1. The Licensing Objectives In exercising most of their functions under the Gambling Act 2005 (the Act), the Council must have regard to the licensing objectives as set out in section 1 of the Act. The licensing objectives are: • preventing gambling from being a source of crime or disorder, being associated with crime or disorder or being used to support crime • ensuring that gambling is conducted in a fair and open way • protecting children and other vulnerable persons from being harmed or exploited by gambling It should be noted that the Gambling Commission has stated: “The requirement in relation to children is explicitly to protect them from being harmed or exploited by gambling”.