H1 2018 Singapore Retail Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Palm Name Tag.Pdf

Citibank Flexible Payment Plan Search by Name. Please click on the menu button to access the table of contents. Search Results : List by Name (A-E) AGi Technology Pte Ltd Tenure: 12-months Address: 109 North Bridge Road #03-18 Funan The IT Mall Singapore 179097 Tel: 6332 5809 Aibi Tenure: 12-months Address: 1 Park Road #01-186 People's Park Complex Singapore 059108 Tel: 6535 9505 Aibi Tenure: 12-months Address: 3 Temasek Boulevard #02-089 Suntec City Mall Singapore 038983 Tel: 6334 0322 Aibi Tenure: 12-months Address: 133 New Bridge Road #03-03/04 Chinatown Point Singapore 059413 Tel: 6534 0266 Aibi Tenure: 12-months Address: 80 Marine Parade Road #B1-106/107/108/108A Parkway Parade Singapore 449269 Tel: 6440 9989 Aibi Tenure: 12-months Address: 930 Yishun Avenue 2 #B2-14 Northpoint Singapore 769098 Tel: 6758 8211 Aibi Tenure: 12-months Address: 1 Woodlands Square #B1-34 Causeway PointSingapore 738099 Tel: 6894 5655 Aibi Tenure: 12-months Address: 200 Turf Club Road #01- 13 Turf City Singapore 287994 Tel: 6469 5123 Aibi Tenure: 12-months Address: 4 Jurong West Central 2 #B1-24 Jurong Point Singapore 648886 Tel: 6792 2833 Aibi Tenure: 12-months Address: 1 Maritime Centre #01- 01/02 HarbourFront CentreSingapore 099253 Tel: 6271 5655 Aibi Tenure: 12-months Address: 68 Orchard Road #03- 06 Plaza Singapura Singapore 238839 Tel: 6238 0002 Alessi Tenure: 12-months Address: 9 Penang Road #01- 01A Park Mall Singapore 238459 Tel: 6337 4013 All About Massage Urban Spa Retreat Tenure: 12-months Address: 442 Orchard Road #02- 12 Orchard Hotel Shopping -

List of Participating Employment Agencies Under Eldercarer FDW Scheme

List of participating employment agencies under Eldercarer FDW Scheme EA on the EA able to Advanced Provide Live- Contact Contact S/N Employment Agency (EA) Placement Branch Addresses Email Address In Nurse Person (s) Number(s) Scheme Caregivers (APS)? 1 1.Care Employment APS Yes 213 Jalan Besar #03- Ms Janice Tan/ 8448 0820 [email protected] Agency 00 Singapore 208897 Ms Mary Yeo / 8778 7002 2 21st Century Caregivers Non-APS Yes 304 Orchard Road Farah 6737 1277 [email protected] Pte Ltd #04-04 Lucky Plaza Singapore 238863 3 21st Century Employment Non-APS Yes 304 Orchard Road Amy Chia 6737 1022 [email protected] Pte Ltd #02-15 Lucky Plaza Singapore 238863 4 1 Assist Agency Non-APS No 170 Upper Bukit Dylan 6463 0419 [email protected] Timah Road #03-63K Bukit Timah Shopping Centre Singapore 588179 5 A4 Employment Agency APS No 170 Upper Bukit Ms Maureen / 6465 0014 [email protected] Timah Road, Mr George / Bukit Timah Shopping 6465 0054 Centre, #04-09, Singapore 588179. 6 AA Celest Employment Non-APS No 158 East Coast Road, Ms Tay Mei Mei 8798 3478 [email protected] Singapore 428866 7 Achieve Employment LLP APS No 545 Orchard Road Ms Lynn Ng 6733 6678/ [email protected] #06-02 Far East 8588 0371 Shopping Centre Singapore 238852 8 Active Global Specialised APS Yes 51 Goldhill Plaza #12- Mr Teo Koon 6536 0086 [email protected] Caregivers Pte Ltd 11 S308900 Cho 9 Anisya LLP Non-APS No 304 Orchard Road Kevin Teo NIL [email protected] #06-22 Singapore 238863 Updated as -

Cathay Cinema Acquisition Last Traded Price ( 1 Nov 2017): S$0.58 (STI : 3,391.61) Setting the Stage for Sustainable Growth

Singapore Company Guide mm2 Asia Version 13 | Bloomberg: MM2 SP | Reuters: MM2A.SI Refer to important disclosures at the end of this report DBS Group Research . Equity 2 Nov 2017 BUY Cathay cinema acquisition Last Traded Price ( 1 Nov 2017): S$0.58 (STI : 3,391.61) Setting the stage for sustainable growth. mm2 would have a Price Target 12-mth: S$0.73 (25% upside) (Prev S$0.60) stronger presence in the entire value chain of content creation and distribution, upon the completion of the proposed Analyst acquisition of Cathay cinema chain, which is expected to be Lee Keng LING +65 6682 3703 [email protected] completed by end-November 2017. This acquisition will complement its current cinema operations in Malaysia, and What’s New further cement mm2's status as the leader in the Acquiring 100% stake in Cathay Singapore for S$230m media/entertainment industry. With a much larger and stronger or 13.8x EBITDA scale, mm2 can now enjoy the synergistic benefits from the entire value chain. Cathay is the second largest cinema chain in Singapore, Growth supported by core business and UnUsUal; cinemas to with a market share of 27% build recurring income. We continue to project mm2's EPS to Raised earnings for FY18F by 22% and 20% for FY19F grow at a CAGR of 65% from FY16-FY19, underpinned by growth in productions, expansion into the China market, and Reiterate BUY with higher TP of S$0.73 contribution from UnUsUal. The cinema arm, on the other hand, helps the group build a recurring income base. -

HYPE-34-Genesis.Pdf

Exclusive benefits for Students and NSFs FREE Campus/Camp Calls Unlimited SMS Incoming Calls Data Bundle Visit www.singtel.com/youth for details. Copyright © 2012 SingTel Mobile Singapore Pte. Ltd. (CRN : 201012456C) and Telecom Equipment Pte. Ltd. (CRN: 198904636G). Standard SingTel Mobile terms and conditions apply. WHERE TO FIND HYPE COMPLIMENTARY COPIES OF HYPE ARE AVAILABLE AT THE FOLLOWING PLACES Timbre @ The Arts House Island Creamery Swirl Art 1 Old Parliament Lane #01-04 11 King Albert Park #01-02 417 River Valley Road Timbre @ The Substation Serene Centre #01-03 1 Liang Seah Street #01-13/14 45 Armenian Street Holland Village Shopping Mall #01-02 Timbre @ Old School The Reckless Shop 11A Mount Sophia #01-05 Sogurt Orchard Central #02-08/09 617 Bukit Timah Road VivoCity #02-201 Cold Rock Blk 87 Marine Parade Central #01-503 24A Lorong Mambong DEPRESSION 313 Somerset #02-50 Leftfoot Orchard Cineleisure #03-05A 2 Bayfront Avenue #B1-60 Far East Plaza #04-108 Millenia Walk Parco #P2-21 Orchard Cineleisure #02-07A BooksActually The Cathay #01-19 Beer Market No. 9 Yong Siak Street, Tiong Bahru 3B River Valley Road #01-17/02-02 Once Upon a Milkshake St Games Cafe 32 Maxwell Road #01-08 Strictly Pancakes The Cathay #04-18 120 Pasir Ris Central #01-09 44A Prinsep Street Frolick Victoria Jomo Ice Cream Chefs Lot One #B1-23 9 Haji Lane Ocean Park Building, #01-06 Hougang Mall #B1-K11 47 Haji Lane 12 Jalan Kuras (Upper Thomson) 4 Kensington Park Road Tampines 1 #B1-32 VOL.TA Marble Slab 241 Holland Avenue #01-02 The Cathay #02-09 Iluma -

Annex a Open Clusters

Annex A Open Clusters Epidemiological investigations and contact tracing have uncovered links between cases. i. 6 of the confirmed cases (Cases 63131, 63184, 63185, 63186, 63187 and 63188) are linked to the Case 63131 cluster, with the most recent cases (Cases 63184, 63185, 63186, 63187 and 63188) linked to the cluster on 13 May. Case 63131 is a 50 year-old female Singaporean who works as a tutor at Learning Point. She was confirmed to have COVID-19 infection on 12 May. Cases 63184, 63185, 63186, 63187 and 63188 are students at Learning Point. ii. 3 of the confirmed cases (Cases 63096, 63122 and 63221) are linked to the Case 63096 cluster, with the most recent case (Case 63221) linked to the cluster on 14 May. Case 63096 is a 33 year-old male Philippines national who works as an operating theatre nurse at Sengkang General Hospital. He was confirmed to have COVID-19 infection on 11 May. Cases 63122 and 63221 are household contacts of Case 63096. iii. 59 of the confirmed cases (Cases 62873, 62940, 62941, 62942, 62945, 62971, 62972, 63005, 63015, 63026, 63047, 63055, 63059, 63060, 63061, 63070, 63071, 63072, 63074, 63084, 63091, 63094, 63095, 63097, 63098, 63100, 63109, 63115, 63117, 63118, 63119, 63125, 63126, 63128, 63129, 63132, 63135, 63136, 63138, 63139, 63140, 63141, 63146, 63148, 63149, 63150, 63165, 63167, 63169, 63177, 63178, 63179, 63180, 63181, 63191, 63192, 63194, 63195 and 63219) are linked to the Case 62873 cluster, with the most recent cases (Case 63177) linked to the cluster on 12 May, Cases 63165, 63167, 63169, 63178, 63179, 63180, 63181, 63191, 63194 and 63195 linked to the cluster on 13 May, and Cases 63192 and 63219 linked to the cluster on 14 May. -

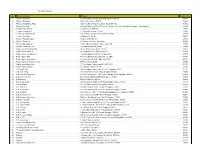

Participating Merchants

PARTICIPATING MERCHANTS PARTICIPATING POSTAL ADDRESS MERCHANTS CODE 460 ALEXANDRA ROAD, #01-17 AND #01-20 119963 53 ANG MO KIO AVENUE 3, #01-40 AMK HUB 569933 241/243 VICTORIA STREET, BUGIS VILLAGE 188030 BUKIT PANJANG PLAZA, #01-28 1 JELEBU ROAD 677743 175 BENCOOLEN STREET, #01-01 BURLINGTON SQUARE 189649 THE CENTRAL 6 EU TONG SEN STREET, #01-23 TO 26 059817 2 CHANGI BUSINESS PARK AVENUE 1, #01-05 486015 1 SENG KANG SQUARE, #B1-14/14A COMPASS ONE 545078 FAIRPRICE HUB 1 JOO KOON CIRCLE, #01-51 629117 FUCHUN COMMUNITY CLUB, #01-01 NO 1 WOODLANDS STREET 31 738581 11 BEDOK NORTH STREET 1, #01-33 469662 4 HILLVIEW RISE, #01-06 #01-07 HILLV2 667979 INCOME AT RAFFLES 16 COLLYER QUAY, #01-01/02 049318 2 JURONG EAST STREET 21, #01-51 609601 50 JURONG GATEWAY ROAD JEM, #B1-02 608549 78 AIRPORT BOULEVARD, #B2-235-236 JEWEL CHANGI AIRPORT 819666 63 JURONG WEST CENTRAL 3, #B1-54/55 JURONG POINT SHOPPING CENTRE 648331 KALLANG LEISURE PARK 5 STADIUM WALK, #01-43 397693 216 ANG MO KIO AVE 4, #01-01 569897 1 LOWER KENT RIDGE ROAD, #03-11 ONE KENT RIDGE 119082 BLK 809 FRENCH ROAD, #01-31 KITCHENER COMPLEX 200809 Burger King BLK 258 PASIR RIS STREET 21, #01-23 510258 8A MARINA BOULEVARD, #B2-03 MARINA BAY LINK MALL 018984 BLK 4 WOODLANDS STREET 12, #02-01 738623 23 SERANGOON CENTRAL NEX, #B1-30/31 556083 80 MARINE PARADE ROAD, #01-11 PARKWAY PARADE 449269 120 PASIR RIS CENTRAL, #01-11 PASIR RIS SPORTS CENTRE 519640 60 PAYA LEBAR ROAD, #01-40/41/42/43 409051 PLAZA SINGAPURA 68 ORCHARD ROAD, #B1-11 238839 33 SENGKANG WEST AVENUE, #01-09/10/11/12/13/14 THE -

Annex a Summary of Local COVID-19 Situation

Annex A Summary of Local COVID-19 Situation Figure 1: 7 Day Moving Average Number of Community Unlinked and Linked Cases1 Figure 2: Number of Community Unlinked Cases, and Linked Cases by Already Quarantined/ Detected through Surveillance1 1 Incorporates re-classifications of earlier reported cases. 1 Figure 3: Number of Active Cases in Intensive Care Unit or Requiring Oxygen Supplementation Figure 4: Breakdown of Local Cases Since 28 April by Vaccination Status and Severity of Condition2 2 Fully vaccinated – more than 14 days after completing vaccination regimen. Partially vaccinated – received 1 dose only of 2-dose vaccine or COVID-19 positive within 14 days of completing vaccination regimen. 2 Annex B Open Clusters Epidemiological investigations and contact tracing have uncovered links between cases. i. 73 of the confirmed cases (Cases 64132, 64158, 64187, 64193, 64195, 64196, 64199, 64201, 64202, 64204, 64205, 64212, 64213, 64216, 64217, 64218, 64221, 64223, 64224, 64225, 64226, 64229, 64231, 64232, 64234, 64239, 64240, 64241, 64242, 64243, 64244, 64246, 64248, 64252, 64257, 64258, 64260, 64261, 64262, 64266, 64267, 64269, 64270, 64271, 64272, 64273, 64274, 64278, 64279, 64280, 64281, 64283, 64284, 64285, 64288, 64296, 64298, 64299, 64300, 64303, 64304, 64305, 64307, 64315, 64316, 64319, 64321, 64322, 64329, 64334, 64348, 64350 and 64351) are linked to the 115 Bukit Merah View Market & Food Centre cluster with the most recent cases (Case 64348) linked to the cluster on 19 June, and Cases 64350 and 64351 linked to the cluster on 20 June. Case 64132 is a 74 year-old male Singaporean who works at a sundry store at 115 Bukit Merah View Market & Food Centre. -

Penang Rd Somerset Rd

Stevens Rd Draycott Dr OR1 : 24 Lampposts (48 banner spaces) Claymore Hill OR2 : 29 Lampposts (54 banner spaces) Goodwood No banner are allowed on LP# 41 as has no existing bar Park Hotel No banner are allowed on LP#20 (Obstructed by tree) American LP#20 (one banner space) Orange Grove Rd Club Scotts Road OR3 : 28 Lampposts (52 banner spaces) 29 30 No banner are allowed on LP#40 27 28 LP#32 and 9 (one banner space) T Galleria by 25 DFS Singapore 26 23 OR4 : 24 Lampposts (46 banner spaces) 24 Far East Plaza Del Orchard 21 LP#3 and 5 (one banner space) 19 Scotts Road 2 1 Orchard 22 3 Royal Plaza N 4 Towers assi Orchard Rd5 m Rd 6 7 20 MAD Museum 1 9 Tanglin Rd 2 9 Claymore Rd of Art & Design 8 3 4 Claymore Hill Grand Hyatt 5 6 11 Palais 10 13 Renaissance Mall Singapore 7 8 15 12 Orchard 11 Seton Cl Parade 10 17 Royal Thai 9 19 14 Hotel 12 Embassy 9 11 Cuscaded Rd Orchard Rd 21 16 Forum 14 23 Scotts 13 16 7 12 Nassim Hill 25 18 Tanglin Shopping International Square 18 27 Building 15 Hilton Singapore 10 20 Tanglin Road Centre 20 29 Shaw House St Martin’s Dr 17 22 31 22 8 Myanmar 24 33 Embassy 24 19 Cuscaden Rd Far East 26 Post Oce Shopping 35 26 28 Napier Rd Tanglin 21 Center 37 30 28 30 34 32 39 40 36 23 32 Orchard Rd 38 Tang Plaza Tanglin Road 25 The St Regis 34 29 27 36 33 31 Singapore 41 35 Tomlinson 38 37 Wheelock Place Tudor Court Angullia Park 40 41 39 43 Tanglin Mall Liat Towers 45 42 ad Orchard 44 o R Paterson Rd MRT 46 n Grange Rd li g n a T Orchard Blvd Cuscaden Road ION Orchard Singapore Tourism Board LEGEND : One Sided Decorative -

List-Of-Bin-Locations-1-1.Pdf

List of publicly accessible locations where E-Bins are deployed* *This is a working list, more locations will be added every week* Name Location Type of Bin Placed Ace The Place CC • 120 Woodlands Ave 1 3-in-1 Bin (ICT, Bulb, Battery) Apple • 2 Bayfront Avenue, B2-06, MBS • 270 Orchard Rd Battery and Bulb Bin • 78 Airport Blvd, Jewel Airport Ang Mo Kio CC • Ang Mo Kio Avenue 1 3-in-1 Bin (ICT, Bulb, Battery) Best Denki • 1 Harbourfront Walk, Vivocity, #2-07 • 3155 Commonwealth Avenue West, The Clementi Mall, #04- 46/47/48/49 • 68 Orchard Road, Plaza Singapura, #3-39 • 2 Jurong East Street 21, IMM, #3-33 • 63 Jurong West Central 3, Jurong Point, #B1-92 • 109 North Bridge Road, Funan, #3-16 3-in-1 Bin • 1 Kim Seng Promenade, Great World City, #07-01 (ICT, Bulb, Battery) • 391A Orchard Road, Ngee Ann City Tower A • 9 Bishan Place, Junction 8 Shopping Centre, #03-02 • 17 Petir Road, Hillion Mall, #B1-65 • 83 Punggol Central, Waterway Point • 311 New Upper Changi Road, Bedok Mall • 80 Marine Parade Road #03 - 29 / 30 Parkway Parade Complex Bugis Junction • 230 Victoria Street 3-in-1 Bin Towers (ICT, Bulb, Battery) Bukit Merah CC • 4000 Jalan Bukit Merah 3-in-1 Bin (ICT, Bulb, Battery) Bukit Panjang CC • 8 Pending Rd 3-in-1 Bin (ICT, Bulb, Battery) Bukit Timah Plaza • 1 Jalan Anak Bukit 3-in-1 Bin (ICT, Bulb, Battery) Cash Converters • 135 Jurong Gateway Road • 510 Tampines Central 1 3-in-1 Bin • Lor 4 Toa Payoh, Blk 192, #01-674 (ICT, Bulb, Battery) • Ang Mo Kio Ave 8, Blk 710A, #01-2625 Causeway Point • 1 Woodlands Square 3-in-1 Bin (ICT, -

Participating Outlets

Participating Outlets No Name of customer Address Postal Code 1 4Fingers Terminal 3 65 Airport Boulevard, #B2-02 Changi Airport Terminal 3 819663 2 4Fingers Northpoint 930 Yishun Avenue 2, #01-15 769098 3 4Fingers Tiong Bahru Plaza 302 Tiong Bahru Road, Tiong Bahru Plaza #01-105 168732 4 4Fingers Terminal 1 80 Airport Boulevard, #03-47 Terminal 1 Departure/Transit Lounge East, Singapore Changi Airport 819642 5 4Fingers ION Orchard 2 Orchard Turn, #B4-06A 238801 6 4Fingers Jurong Point 1 Jurong West Central 2, #03-34 648886 7 4Fingers Orchard Gateway 277 Orchard Road, #01-04/05 Orchard Gateway 238858 8 4Fingers West Gate 3 Gateway Dr, #02-05 608532 9 4Fingers Plaza Singapura 68 Orchard Rd, #B1-07 238839 10 4Fingers Tampines 1 10 Tampines Central 1, #01-39/40 529536 11 4Fingers Marina Square 6 Raffles Boulevard Marian Square #02-183A 39594 12 4Fingers Causeway Point 1 Woodland Square #01-38/39 738099 13 Pepper Lunch Houganag Mall 90 Hougang Avenue 10 #B1-24/25/26 538766 14 Pepper Lunch AMK Hub 53 Ang Mo Kio Ave 3 AMK Hub #01-34 569933 15 Pepper Lunch Compass One 1 Sengkang Square, #B1-01, Compass One 545078 16 Pepper Lunch JEM 50 Jurong Gateway Road, #04-10/11/12, JEM 608549 17 Pepper Lunch Jurong Point 63 Jurong West Central 3, #B1-62/63 JP2, 648331 18 Pepper Lunch Orchard Cineileisure #05-03, 8 Grange Road 239695 19 Pepper Lunch Bedok Mall 311 New Upper Changi Road #01-05/06/07/08 467360 20 Pepper Lunch Tapines 1 10 Tampines Central 1 #B1-06 529536 21 LJS Bedok Point 799 New Upper Changi Road #01-02/03 Singapore 467351 467351 22 LJS Bugis -

List of Publicly Accessible Locations Where E-Bins Are Deployed*

List of publicly accessible locations where E-Bins are deployed* *This is a working list, more locations will be added every week* Name Location Type of Bin Placed Ang Mo Kio CC • Ang Mo Kio Avenue 1 3-in-1 Bin (ICT, Bulb, Battery) Best Denki • 1 Harbourfront Walk, Vivocity, #2-07 • 3155 Commonwealth Avenue West, The Clementi Mall, #04-46/47/48/49 • 68 Orchard Road, Plaza Singapura, #3-39 • 2 Jurong East Street 21, IMM, #3-33 • 63 Jurong West Central 3, Jurong Point, #B1-92 • 109 North Bridge Road, Funan, #3-16 3-in-1 Bin • 1 Kim Seng Promenade, Great World City, #07-01 (ICT, Bulb, Battery) • 391A Orchard Road, Ngee Ann City Tower A • 9 Bishan Place, Junction 8 Shopping Centre, #03-02 • 17 Petir Road, Hillion Mall, #B1-65 • 83 Punggol Central, Waterway Point • 311 New Upper Changi Road, Bedok Mall • 80 Marine Parade Road #03 - 29 / 30 Parkway Parade Complex Bugis Junction • 230 Victoria Street 3-in-1 Bin Towers (ICT, Bulb, Battery) Bukit Merah CC • 4000 Jalan Bukit Merah 3-in-1 Bin (ICT, Bulb, Battery) Bukit Panjang • 8 Pending Rd 3-in-1 Bin CC (ICT, Bulb, Battery) Cash • 135 Jurong Gateway Road Converters • 510 Tampines Central 1 3-in-1 Bin • Lor 4 Toa Payoh, Blk 192, #01-674 (ICT, Bulb, Battery) • Ang Mo Kio Ave 8, Blk 710A, #01-2625 Causeway Point • 1 Woodlands Square 3-in-1 Bin (ICT, Bulb, Battery) Central Plaza • 298 Tiong Bahru Rd 3-in-1 Bin (ICT, Bulb, Battery) Challenger • 302 Tiong Bahru Road, Tiong Bahru Plaza, #03-19 • 1 Jurong West Central 2, Jurong Point, #B1-94 • 200 Victoria Street, Bugis Junction, #03-10E • 5 Changi Business -

Orchard Heritage Trail Booklet

1 CONTENTS Orchard Road: From Nutmeg Orchards to Urban Jungle 2 The Origins of Orchard Road 3 Physical landscape From Orchard to Garden 6 Gambier plantations Nutmeg orchards Singapore Botanic Gardens Green spaces at Orchard Road At Home at Orchard Road 22 Early activities along Orchard Road A residential suburb Home to the diplomatic community The Istana Conserved neighbourhoods Schools and youth organisations Community service organisations Landmarks of faith Social clubs Orchard Road at War 48 Life on Orchard Road 50 Before the shopping malls MacDonald House Early entrepreneurs of Orchard Road Retail from the 1970s Screening at Orchard Road Music and nightclubs at Orchard Road Dining on the street Courting tourists to Singapore A youth hub Selected Bibliography 74 Credits 77 Suggested Short Trail Routes 78 Orchard Road’s historical gems Communities and cemeteries From orchard to garden Heritage Trail Map 81 2 3 ORCHARD ROAD: THE ORIGINS OF FROM NUTMEG ORCHARDS ORCHARD ROAD TO URBAN JUNGLE he earliest records of Orchard Road can Leng Pa Sat Koi or “Tanglin Market Street” be found in maps from the late 1820s in Hokkien after a market that once stood Twhich depicted an unnamed road that between Cuppage Road and Koek Road (near began at a point between Government Hill present-day The Centrepoint). (now Fort Canning Park) and Mount Sophia, and continued north-west towards Tanglin. Tamils used the name Vairakimadam or The name Orchard Road appeared in a map “Ascetic’s Place” for the section of Orchard drawn by John Turnbull Thomson in 1844 Road closer to Dhoby Ghaut.